Goods and services tax (GST): A history

This is a collection of articles archived for the excellence of their content. |

Contents[hide] |

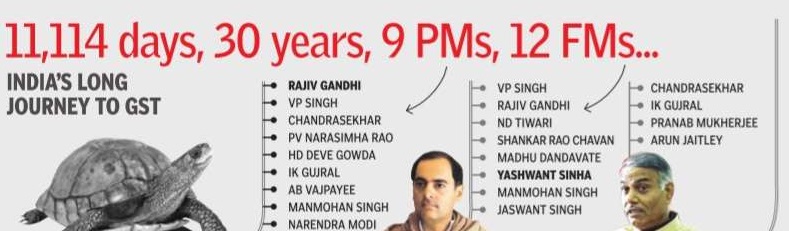

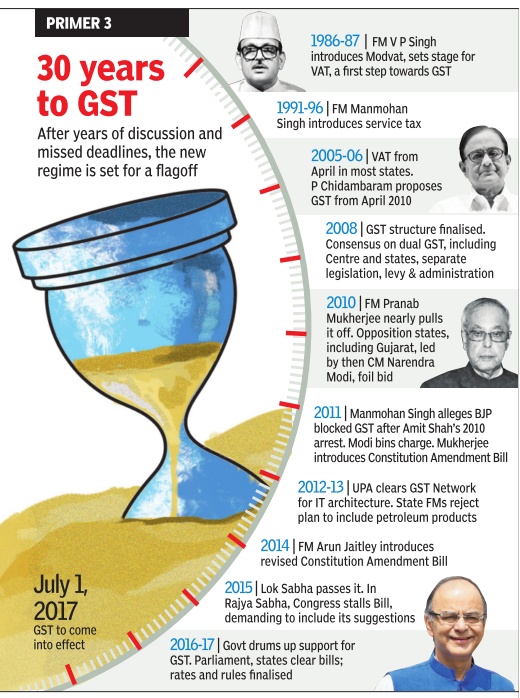

History

The broad details

The GST was conceptualised for the first time in 1999 during a meeting between the then Prime Minister Atal Bihari Vajpayee and his economic advisory panel which included three former RBI governors IG Patel, Bimal Jalan and C Rangarajan.

HIGHLIGHTS

GST was conceptualised during Vajpayee government.

2GST implementation picked up speed during UPA regime.

3Jaitley tabled four GST Bills in Lok Sabha

With the tabling of four GST Bills in the Lok Sabha, the journey of goods and services tax enters its last lap. Meeting the deadline of July 1 seems a definite possibility.

It has been a marathon journey of the most crucial tax reform in the country. The journey started in 2000 when there was an NDA government at the Centre with Atal Bihari Vajpayee as the Prime Minister.

Acting on the advice by his economic advisory panel of IG Patel, Bimal Jalan and C Rangarajan, Vajpayee set up a committee headed by the then finance minister of West Bengal Asim Dasgupta - a CPI-M leader - to design a GST model.

The Asim Dasgupta committee was also tasked with putting in place the back-end technology and logistics for rolling out a uniform taxation regime in the country.

In 2003, Vajpayee government formed a task force under Vijay Kelkar to recommend tax reforms.

THE CHIDAMBARAM YEARS

The Vajpayee government was replaced with Manmohan Singh's UPA-I government in 2004. The new government sped up the process.

In 2005, Kelkar committee recommended rolling out GST as suggested by the 12th Finance Commission. Presenting his budget, the then Finance Minister P Chidambaram echoed the sentiments for bringing in GST regime.

In February next year, Chidambaram set April 1, 2010 as the deadline for introducing GST. Meanwhile, the Asim Dasgupta committee kept working and preparing the ground work for the GST.

Chidambaram retained the April 2010 deadline for implementing the GST in his successive Budget speeches.

GST Bill: The story so far | SEPTEMBER 22, 2016 | The Hindu adds

Budget

In Budget 2006-07, P. Chidambaram, Minister of Finance of the UPA II proposed implementation of Goods and Services Tax (GST) by April 1, 2010.

Comprehensive GST

A consumption based tax, the idea was to do away with the complications afflicting the current system of taxation. In a comprehensive GST regime all the transactions would be liable to a single unified tax.

Joint Committee

A joint committee comprising adviser to Finance Minister, State Finance Ministers, finance secretaries and bureaucrats was set up in 2007. It submitted its report on the vision for GST the same year.

Report to Empowered Committee

The Empowered Committee of State Finance Ministers submitted its final report to Empowered Committee whose report in turn was the backbone for drafting the Bill.

End of The Hindu report. The India Today report resumes

PRANAB MUKHERJEE TAKES OVER

In 2009, Pranab Mukherjee became the Finance minister and announced the basic structure of the GST, as designed by Asim Dasgupta committee. Mukherjee too retained the April 2010 deadline, which, many rightly suspected, was not possible under the given circumstances.

The BJP opposed the basic structure of the GST on many counts. The BJP ruled states raised objections.

In February 2010, the finance ministry started large-scale, what it called mission-mode computerisation of commercial taxes in states. The project was to lay foundation for the GST.

On April 1 that year, the GST deadline was missed.

Asim Dasgupta committee kept working. In one of the interviews, Dasgupta said that by the end of 2010, the committee had completed 80 per cent of the GST work.

GST BILL IN PARLIAMENT

In 2011, the government tabled a Constitution Amendment Bill in the Lok Sabha to provide for the GST. The BJP opposed. It got the Left on its side. Other Opposition parties also raised objections.

The GST Bill was sent to the parliamentary standing committee headed by Yashwant Sinha, who was the Finance Minister when Asim Dasgupta committee was constituted.

GST MOVES THROUGH POLITICS

Meanwhile, Mamata Banerjee's TMC unseated the three-decade-old Left Front in West Bengal. Asim Dasgupta resigned as the chairman of the committee and was replaced by senior Congress leader and the then Finance Minister of Kerala K M Mani.

In 2012, during the deliberations in the parliamentary standing committee, the BJP and the Left objected to extra discretionary power to the Centre over GST dispute authority.

With Pranab Mukherjee moving to the Rashtrapati Bhawan in 2012, Chidambaram held a series of meetings with the state finance ministers. They set another deadline of December 31, 2012 to iron out all their differences.

In February 2013, Chidamabaram announced in his Budget speech that the government had set aside Rs 9,000 crore to compensate states for losses incurred due to GST. Meanwhile, the parliamentary standing committee submitted its report on GST. The Amendment Bill for introducing GST was ready for introduction in Parliament.

Two months later in October 2013, the then Narendra Modi government of Gujarat opposed the GST Bill. Gujarat claimed that it would have to incur over Rs 14,000 crore losses every year due to GST. This argument changed forced the BJP change its political narrative of the GST.

2014 AND AFTER

The parliamentary elections were held in 2014 and with the dissolution of the 15th Lok Sabha, the GST Bill - approved by the standing committee for reintroduction - lapsed.

Seven months after the formation of the Modi government, Finance Minister Arun Jaitley introduced the GST Bill in the Lok Sabha. It was now Congress's turn to object.

In February 2015, Jaitley set another deadline of April 1, 2016 to implement GST. In May 2015, the Lok Sabha passed the Constitution Amendment Bill paving way for GST.

Now in opposition, the Congress demanded that the GST Bill be sent to the Select Committee of the Rajya Sabha.

Over the next more than a year, the ruling and Opposition parties held back GST over several issues including those of having a capping taxation rate and according constitutional status to the GST. Finally in August 2016, the two sides agree to pass the Amendment Bill.

In next 15-20 days, 18 states ratify the GST Bill and President Pranab Mukhejee gives his assent to it. In the same month of September, President Mukherjee constitutes the GST Council, which frames five GST Bills.

THE FIVE GST BILLS

Finance Minister Arun Jaitley today tabled four GST Bills today in the Lok Sabha. The Union Cabinet cleared all the four Bills earlier last week.

The Bills are - the Central Goods and Services Tax Bill 2017 (C-GST), the Integrated Goods and Services Tax Bill 2017 (I-GST), the Union Territory Goods and Services Tax Bill 2017 (UT-GST) and the Goods and Services Tax (Compensation to the States) Bill 2017.

These Bills require to be passed by Parliament while the State Goods and Services Tax Bill 2017 will go to state Assemblies. They need to be separately passed by 29 Assemblies to have GST as the new tax regime in the country.

As per the Constitution Amendment Act, the government is bound to roll out GST by September 15 else it will lose the legal backing to collect taxes from September 16.

BJP’s opposition to GST when BJP was in the opposition

2010: BJP-ruled states opposed GST

BJP-ruled states oppose implementation of GST |AUGUST 04, 2010 PTI

Some BJP-ruled states expressed doubts over the implementation of goods and services tax (GST) from April as they are strongly opposed to the provision in the draft constitutional amendment bill that gives the Centre a veto power on the states’ taxation issues.

“It is impossible to implement GST from April 1 next year,” Madhya Pradesh Finance Minister Raghavji told reporters after state GST panel met here to discuss constitutional amendment bill to roll out the new indirect taxes regime, which will subsume the current indirect levies like excise, VAT, sales tax, and local taxes among others.

He also said the states are opposed to the provision in the draft constitutional amendment bill that grants a veto power to Union Finance Minister over the state GST.

“Everybody is opposed to the veto power of the Union Finance Minister. We need more time. States’ autonomy and federalism will be destroyed (if we accept this bill). This is against the fiscal autonomy of the states. Majority of the states - BJP ruled states and others like UP, Tamil Nadu, Orissa and some others are also against it,” the MP finance minister said.

His remarks came on a day when Finance Minister Pranab Mukherjee sought the cooperation of the states to table the constitutional amendment bill in the ongoing Monsoon session.

Gujarat finance minister Saurabh Patel also expressed similar opinion saying, “in the present form it will not come (constitutional amendment bill) in the Monsoon session. The Centre should allow the states to be empowered. If they don’t allow, GST is dead.”

Mr. Patel further said GST may affect the common man badly, that too in an environment of high inflation. “A 10 per cent CGST rate and a higher rate of SGST will force the common man to pay tax at more than 20 per cent against the present 5 per cent (VAT) on essential items like food, medicines, agricultural produce, footwear, readymade clothes, etc., and 12.5 per cent on other goods,” he pointed out.

Last month [ie in July 2010], the Centre had proposed three tier GST rate structure - combined 20 and 12 per cent for goods and 16 per cent for services with the Union and state government each imposing equal percentage of levy.

Ernst & Young tax partner Harishanker Subramaniam said if the constitutional amendment bill is not passed in the Monsoon session, it will be a challenge to implement GST from April next.

Feb 2011: ‘take states on board ‘

BJP slams govt on plan to introduce GST Bill in Parliament| Feb 20, 2011 |PTI

The BJP, whose support is crucial for roll-out of Goods and Services Tax, on Sunday slammed the UPA Government for its plan to introduce GST Constitutional Amendment bill in Parliament in the Budget Session, without taking states on board.

"They are doing a wrong thing," senior party leader and Chairman of the Parliamentary Standing Committee on Finance Yashwant Sinha told PTI.

The former Finance Minister also attacked Prime Minister Manmohan Singh for his remarks that the BJP was opposing the government's reforms agenda because it wanted some decision against a minister in Gujarat to be reversed.

"The reasons that have been given, frankly, I cannot mention it in public. They (BJP) say because you have taken some decision against a particular person, who was a minister in Gujarat, we must reverse it," Singh had said recently.

Sinha said several states, including those ruled by the BJP, were opposed to introduction of the GST because of their own interests and not due to any partisan issue.

He said it was unexpected and "unbecoming" of the Prime Minister to have made an "unparliamentary" remark about the BJP stalling the tax and other economic reforms.

He said there were differences of opinion even among the BJP-ruled states on GST.

"It is not Gujarat, it is Madhya Pradesh, which has been strongly opposing GST from day one. It happened years before Amit Shah (former Gujarat Home Minister who was arrested in Soharabuddin alleged fake encounter case)...so why Madhya Pradesh is opposing it?".

States like MP are opposing the GST because it has genuine concerns, Sinha said, adding that even the non-BJP states were also opposing it.

"UP is not a BJP-ruled state..it is opposing," Sinha said.

The government has listed GST Constitution Amendment Bill to be introduced in the forthcoming Budget session. After that, it would be referred to the Standing Committee on Finance.

The passage of the Bill would require two-third majority in both the houses of Parliament and two-third majority in states assemblies.

Sinha said that GST should first be implemented at Central level by merging the central excise and service tax.

"I am firmly of the view that the government of India should introduce GST first at the central level. At the central level you have central excise and you have the service tax. Now if you first merge the two, you have your own GST," he further said.

Sinha added, "You present an example to the states that this is how we do GST and then the states might follow."

The proposed GST has been hanging fire, with all the three drafts of GST constitutional amendment bill proposed by the Centre being opposed mainly by the BJP-ruled states.

After missing the original April 2010 deadline for GST rollout, the government proposed to introduce it in April 2011. But it is all set to miss this deadline too.

The GST will subsume indirect taxes such as excise duty and service tax at the central level and VAT on the states front, besides local levies.

2013: ‘Why is Narendra Modi opposed to GST’: Jairam Ramesh

Why is Narendra Modi opposed to GST: Jairam Ramesh | Wed, 25 Sep 2013 | DNA India

Union minister Jairam Ramesh says goods & service tax was brainchild of NDA finance minister Yashwant Sinha

Union rural development minister Jairam Ramesh lashed out at chief minister Narendra Modi for raising objections against goods and service tax (GST) that has led to its delay in implementation.

The senior minister of the UPA government said he failed to understand why Modi was opposed to GST when it was the brainchild of former finance minister Yashwant Sinha. “I have come to Modi’s city and want to ask just one question. Why is he against GST?” asked Ramesh, who was on a one-day visit to Ahmedabad on Tuesday to raise awareness about Land Acquisition Act.

The central minister said the idea was first introduced by Sinha in 2002 when he was finance minister in the Atal Bihari Vajpayee-led NDA government. He even pointed out that it was included in the manifestos of both the Congress and the BJP.

“I met Sushma Swaraj in 2011 for a consensus on the implementation of GST and told her about the problem due to the protest by Gujarat. She had then assured of support saying it was there in the BJP’s manifesto, too. But, nothing has happened till now,” said Ramesh.

The Union minister also said that he had met Modi last year and asked him about his reasons for opposing GST. But the CM had avoided giving a reply. He further stated that the central government was open to compensating any state government if it suffered a financial loss due to the implementation of GST. The UPA government, said Ramesh, does not want to pass any act without all-party consent and this is why GST has not been implemented due to the opposition from only one person.

State government spokespersons Nitin Patel and Saurabh Patel described Ramesh’s allegation as baseless and said that the UPA government had failed to set up the infrastructure for rolling GST which has led to its delay.

Gujarat opposes GST regime: 2013

Gujarat opposes GST regime| TNN | Oct 23, 2013 | The Times of India

GANDHINAGAR: Narendra Modi-led Gujarat government has opposed the UPA government's attempt to pass the 115th Constitution Amendment Bill, 2011 to forcibly enact goods and service tax (GST) regime in the country.

The opposition was aired during national empowered committee meeting on Monday at New Delhi.

Cabinet minister Saurabh Patel, who represented Gujarat at the meeting, said, "If the Union government through an ordinance enacts the GST regime, Gujarat will have to bear Rs 14,000 crore loss per annum due to the destination based taxation principle."

Patel said that Gujarat is facing a severe problem of realization of revenue due to economic slowdown. "Yet the Centre has not yet released the pending compensation of Rs 4,500 crore. This issue should be resolved instead of moving towards the constitution amendment. As suggested by the standing committee, broad consensus has not been arrived at on key issues concerning the implementation of GST," he said.

The issues listed by him were revenue neutral rate, place of supply rules for goods and services, dual control, exemption, compensation, among others.

He said the committee is of the opinion that before proceeding to enact the constitution bill 2011, broad consensus on key issues concerning the implementation of GST should be arrived at between the Centre and the state governments.

Patel added, "The adequate groundwork would thus be essential before setting upon to operationalize the proposed GST regime. Keeping in view the apprehensions expressed by states, a credible study would also be required to evaluate the impact of GST regime on the revenues of the states. All these key issues are between the centre and the state governments and not among the ruling parities in different states and the Centre."

‘India lost Rs 12 lakh crore due to BJP's opposition to GST:’ Congress

HIGHLIGHTS

The one nation, one tax concept is only a myth. What you brought today cannot be called a gamechanger but only a baby step: Moily

GST implementation will automatically encourage digitisation, bring in transparency and lower the prices: BJP MP Udit Raj

Congress leader Veerappa MoilyIndia lost Rs 12 lakh crore due to BJP's opposition to GST, says Congress leader Veerappa Moily

NEW DELHI: India lost a whopping Rs 12 lakh crore due to years of delay in implementation of the GST due to the stiff opposition by the BJP when the UPA government was in power, the opposition said on Wednesday.

Initiating a discussion on the four GST bills+ in the Lok Sabha, Congress leader Veerappa Moily said what the NDA government has brought about in the name of a "revolutionary tax reform is not a gamechanger but only a baby step".

Criticising various provisions in the proposed GST regime+ , Moily said it will be a "technological nightmare" and the anti-profiteering provisions in it are "far too draconian."

"Seven to eight years have passed after the erstwhile UPA government wanted to bring the GST bill. Some parties then felt it should be halted due to reasons best known to them," he said.

The former law minister said due to the delay caused in the roll out of GST, the country lost around Rs 1.5 lakh crore annually and put the total loss at Rs 12 lakh crore.

Asking who will compensate for this "huge loss", Moily said the country was deprived of massive financial benefits due to the "damaging political gambles".

Moily also slammed the Narendra Modi government for "high as well as too many taxes under the proposed GST system which he said does not reflect the original spirit behind the new tax regime."

"The one nation, one tax concept is only a myth. There are too many rates, cesses... What you brought today cannot be called a gamechanger but only a baby step," said Moily.

Referring to the "complexities" in the inter-state transactions proposed under under the GST, he called some of the provisions as "retrogade".

The Congress leader also took strong exception to leaving the real estate sector out of the ambit of the GST. "The real estate sector generates lot of black money. It is very unfortunate that the sector was not brought under the ambit of GST," said Moily.

Earlier, Finance Minister Arun Jaitley introduced four bills in the Lok Sabha to give effect to the Goods and Services Tax (GST).

Jaitley said the legislations will have to be passed by Parliament and one by each of the state assemblies to turn India into one market with a single tax rate.

The bills are the Central Goods and Services Tax Bill, 2017, the Integrated Goods and Services Tax Bill, 2017, the Goods and Services Tax (Compensation to States) Bill, 2017 and the Union Territory Goods and Services Tax Bill, 2017.

Moily said there will be a turf war between the tax administrations of central and state governments after the implementation of the GST.

The senior Congress leader said the GST will enhance only administrative complexity in the tax system and there will be "complete anarchy" in taxation.

"Intention may be good but this will land the country in complete tax distortion," he said.

Moily said there was no clarity how the tax benefits will be availed by the common people.

He said the GST legislation was an example of how the government is pursuing a "chalta hai" (casual) attitude as there was not enough provision to protect the common people.

Participating in the debate, BJP member Udit Raj said the GST would bring about uniformity in the tax system and be immensely beneficial to the 1.2 billion people of the country.

Raj, a former revenue officer, said the GST Bill has been brought to end the different tax slabs prevalent in different states besides abolishing the cascading effects of the current tax structure.

Under the GST, there will be same tax structure across the country, all anomalies will come to an end and extend the tax base, he claimed.

The BJP MP dismissed the suggestion that with the implementation of GST, the powers of the state legislatures to enact tax laws will be completely abrogated, saying the legislation was prepared only with the consent of all state governments.

He said the Centre will not dictate the GST Council but will act as buffer between the central and state governments.

Raj said GST implementation will automatically encourage digitisation, bring in transparency and lower the prices and the hoarding of essential commodities, besides curbing blackmoney. "The GST is a game changer.. It will lead to a corruption-free India," he said.

He also tried to counter Moily's argument that the delay in implementation of GST led to the loss of Rs 12 lakh crore and saying that the earlier Opposition was responsible for delaying implementation of the legislation.

Milestones

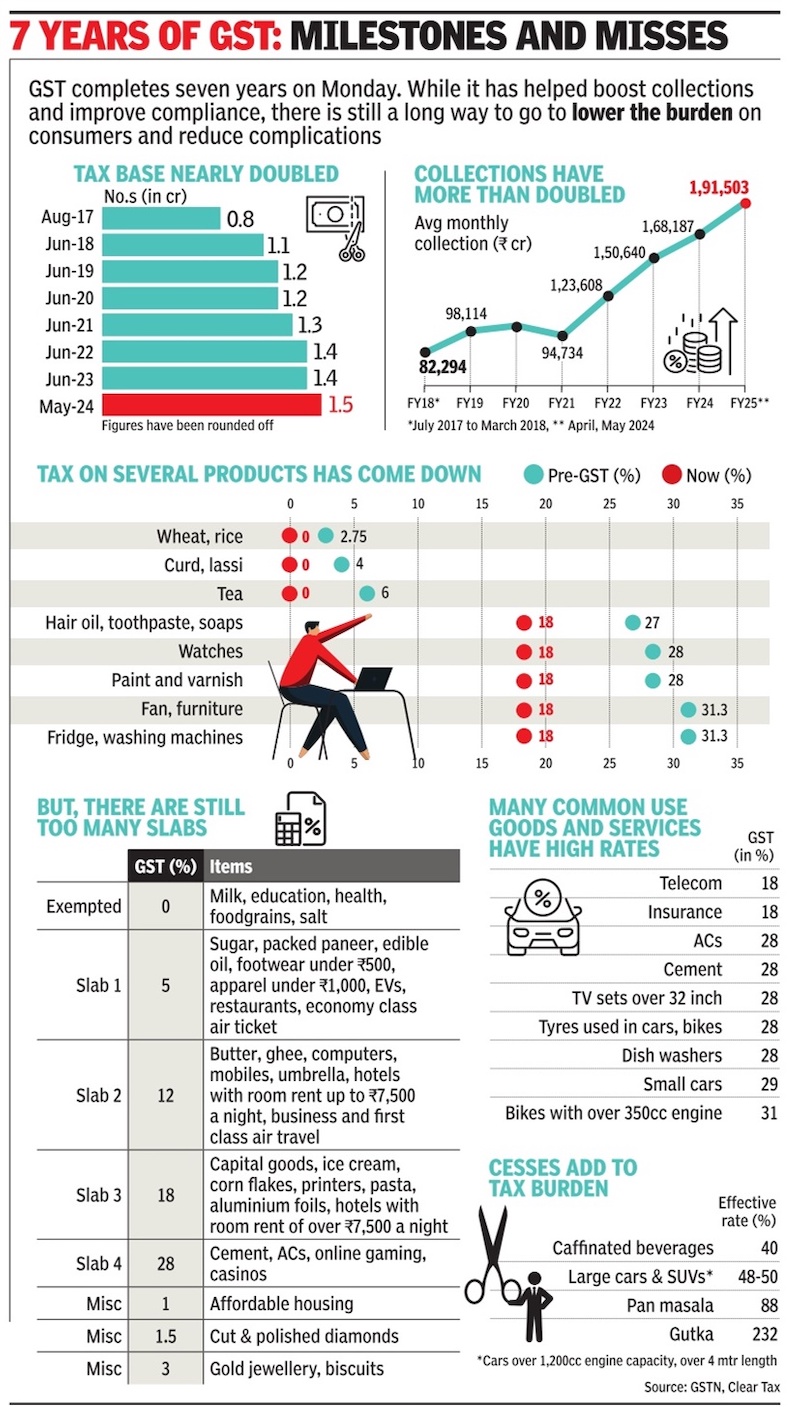

2017-24

From: July 1, 2024: The Times of India

See graphic:

GST: Milestones and misses: 2017-24

Congress’ opposition after entering the opposition

Congress’ aggressive disruption of LS

The Times of India, Aug 04 2016

The hurdles in the way of the GST law were as much political as disagreements over clauses and design of the tax reform, as the government's lack of numbers in Rajya Sabha gave Congress a stranglehold on the legislation. The passage of the Constitution amendment bill was hardly seen as a major issue when the Modi government assumed office and Congress functionaries wondered why the new dispensation was taking its time over the reform measure.

Things changed swiftly as BJP and Congress settled into a deeply hostile and suspicious relationship, souring any possibility of bipartisanship.Congress's aggressive disruption of Lok Sabha despite its reduced strength of 44 over `Lalitgate' made it clear that the main opposition was not going to be deterred by BJP's emphatic win in 2014.

Congress's tactics of disruption and delay in the Upper House centred around party vice-president Rahul Gandhi's conviction that the Modi government should not be given easy passage with legislation as an act of assertion.

BJP functionaries said the demands raised by Congress were an afterthought as issues like writing an 18% tax rate or the formulation on a dispute resolution mechanism were not part of the bill piloted even by the UPA government.

The decision to block the GST bill was also driven by Congress's calculation that delaying the reform measure would slow down the Modi government's political momentum and the frustration in the BJP camp indicated that this was a worry.

The balance began to slowly tilt towards the government as states under regional parties began to back the law and BJP launched a powerful campaign alleging that Cong ress -unable to swallow its Lok Sabha defeat -was seeking to undermine PM Narendra Modi's mandate.

It was a charge Congress vehemently denied, but BJP members found it a convenient argument that helped cover up some of the government's shortcomings in its two years in office.

The charge stung and barring success in Bihar, the strategy did not deliver any political gains in state elections, where Congress found itself on a losing wicket.

Business also played a role in convincing Congress that its opposition to the GST law, despite the party's claim that it was raising important issu es, was being seen as a negative tactic and was perceived to be hurting the economy .

In an astute move, Congress agreed to drop its insistence on writing the tax rate into the Constitution amendment as long as it was ring fenced. The government's decision to bring only the amendment now and leave the central GST bill for the winter session smoothened the path further.

The view of several state finance ministers that an 18% rate may not be adequate and the daunting process of getting parliamentary approval to alter the rate also persuaded Congress to amend its position.

Cabinet approves key changes in GST Bill

The Times of India, Jul 27, 2016

Cabinet approves key changes in GST Bill

In a bid to strengthen the chances of passage of the crucial GST Bill, the Union Cabinet here on Wednesday approved key changes in the proposed legislation, including dropping the proposed one per cent additional tax on inter-state sale, sources said.

This provision's removal has been a key demand of the opposition Congress.

The cabinet, which met under the chairmanship of Prime Minister Narendra Modi, also agreed to include the mechanism to compensate states for all loss of revenues for five years.

Minister of State for Parliamentary Affairs Mukhtar Abbas Naqvi earlier told the Rajya Sabha that the GST Bill will come up for discussion in the first week of August. It is pending in the Rajya Sabha, where the National Democratic Alliance government lacks a majority.

West Bengal Finance Minister Amit Mitra chaired the meeting of the empowered committee of state Finance ministers to form a consensus on the bill, and the states agreed to keep the GST rate out of the bill. However, there was no decision on what the rate should be as all the states did not agree on the proposed 18 per cent rate.

The Congress demands that the constitutional amendment bill sould provide for capping the GST rate at 18 per cent. Mitra said a broad consensus has been worked out on the GST and all are of the opinion that taxes on the common man need to be reduced. At the same time, there is a need to ensure that the trend of revenue collection continues, he added. "It is very important that tax on the common man is significantly reduced. At the same time we need to safeguard the taxes going to the state exchequer," he said.

The states are demanding that there should be no dual control on businesses with an annual turnover of less than Rs 1.5 crore, and this issue has to be resolved for the GST to happen, Mitra said after the panel's meeting. "We will work towards this so that small businesses do not suffer. It has to be through a consensus for the GST to happen," Mitra added. The Congress is also demanding an independent dispute resolution mechanism for the GST. The GST was first mooted by the previous Congress-led United Progressive Alliance government.

Congress’ U-turn

The Times of India, Aug 04 2016

Congress made a bold bid to deny the Centre the bragging rights for rolling out GST, stating that its demand for changes in the draft had made it “pro-people“ even as it stressed that these were not a pretext for obstruction. P Chidambaram told reporters the Centre had accepted the call for removal of 1% surcharge and reformulation of dispute redressal mechanism because the GST draft was “flawed“.

He also said Congress would continue to insist on the 18% cap while expressing confidence that the Centre would include it in the subsequent legislation. He warned that a high rate would be inflationary and hurt the common man but put the burden of convincing states in favour of a lowrate cap on the FM.

The states voiced support for around 23%.

The arguments at the Congress briefing sought to lay the ground for the party to fight back in popular perception over its dramatic change in position after it single-handedly held back GST for a year. Veterans like Anand Sharma spoke in RS in Hindi to carry the message wide in a bid to explain to voters the party's about-turn.

After sound & fury, CPM yields quietly:

Despite the noises CPM made against the bill, it was a foregone conclusion that it would support it as the party had come around in the last month or so. Two factors were at play . One, the party's changed equation with Congress. And, two, support to GST by the newly-elected CPM regime in Kerala.

Political parties’ stances on GST/ 2017

BJP cost country Rs 12L cr by blocking GST: Oppn, Mar 30, 2017: The Times of India

Congress leader M Veerappa Moily accused BJP on Wednesday of blocking passage of the GST bill when UPA was in power, causing a loss of over Rs 12 lakh crore to the country. He alleged that the government had subverted Rajya Sabha by bringing legislations to the Lower House as money bills.

Soon after finance minister Arun Jaitley introduced four bills in Lok Sabha to give effect to the goods and services tax (GST), Moily exhorted Rajya Sabha members to resign if they had any pride left.

“It is the biggest step in federal law, federal finances.You are a representative of the council of states. Finance minister, you are denying rights to yourself,“ Moily said, pointing towards Jaitley , a Rajya Sabha member.

Moily said when BJP was in opposition, it put hurdles in the way of the GST bill, leading to loss of Rs 12 lakh crore. “The country has faced around Rs 12 lakh crore loss because of delay in implementing the GST bill. More than seven to eight years have passed,“ Moily said.

BJD's Bhartruhari Mahtab aired his reservations regarding the move to bring agriculturists in the tax net.

TMC's Kalyan Banerjee said the West Bengal government had supported the “path-breaking“ GST legislation but expressed concern over the government's hurry in its implementation.

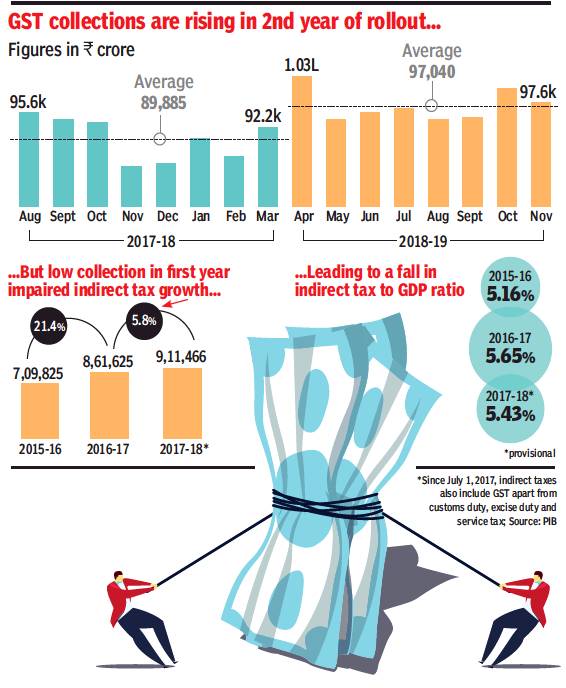

Collection of GST

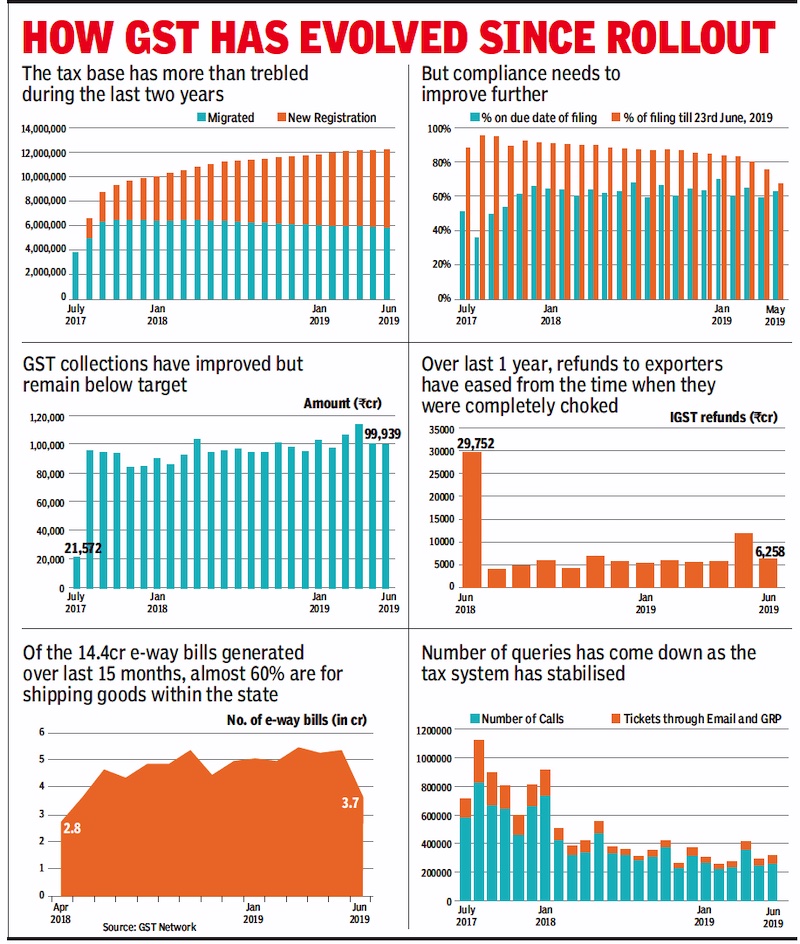

2017-19

Collection of GST, 2017-19.

From: Pratik Jain- Partner and Leader Indirect Tax, PwC India, February 12, 2019: The Times of India

See graphic:

Collection of indirect taxes, 2015-18;

Collection of GST, 2017-19.

Details

From: July 2, 2019: The Times of India

See graphic, 'The Collection of GST, 2017-19. '

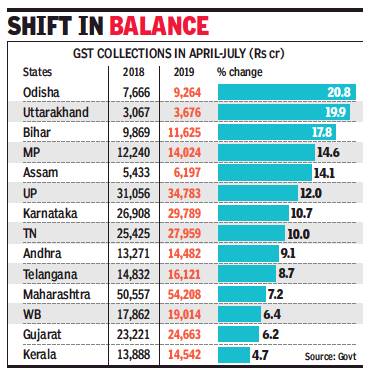

2018-19: The poorer states lead

Sidhartha, August 13, 2019: The Times of India

From: Sidhartha, August 13, 2019: The Times of India

Poorer states score big in GST mop-up

Industrialised Peers Lag On New Tax

Consuming states such as Bihar, Odisha, UP and Madhya Pradesh — many of whom may be poorer but have large populations — are faring better in goods and services tax (GST) collections than their industrialised peers such as Maharashtra, Gujarat, Karnataka and Tamil Nadu.

Data accessed by TOI showed that West Bengal is among a handful of non-industrialised consuming states, which has not fared well during the first four months of the current financial year, when overall GST collections rose 9% to Rs 3.56 lakh crore. Among the major laggards was Delhi, which saw a 2% decline in mop-up, which was estimated at Rs 12,700 crore during April-July 2019, compared to a little under Rs 13,000 crore a year ago. At the top of the heap are the states in the North East, led by Nagaland (39%), Arunachal Pradesh (35%), Sikkim (32%) and Meghalaya. But the overall collections for these states are between Rs 370 crore and Rs 680 crore.

Government officials and tax experts said the data showed the expected shift in balance towards the consuming states has started, a fear that had prompted Gujarat, Maharashtra and Tamil Nadu to demand compensation when the Narendra Modi government began negotiations for implementing GST. Later, the Centre got the BJP-ruled states to drop the demand.

“An above-average growth in collections in consuming states was expected even prior to the launch of GST as it is structured as a destination-based consumption tax. However, originating states, where the collection growth has been slower, would need to consider the fact that the compensation mechanism comes to an end in 2022, unless extended,” said M S Mani, a partner at consulting firm Deloitte.

Under the compensation mechanism, states with less than 14% annual growth are to be compensated by the Centre for five years and, going by the current trend, some of the poorer states do not need support (see graphic). To compensate states, a cess on items such as soft drinks, tobacco and automobiles is levied.

Government officials said full impact is visible this year as the settlement of Integrated GST is happening regularly, unlike last year when it was delayed. “The distribution of the kitty is much better now and is benefiting the poorer states,” said an officer. Pratik Jain, who leads the practice at Pricewaterhouse-Coopers, said the power to tax services has also benefited the states. “The not so rich states, which have higher consumption, seem to be doing better but even those such as Maharashtra will do well since they are not just producing but also have a large consumption base,” he added.

Experts, however, warned that those like Haryana and Punjab with lower populations may not do too well. In fact, Punjab could be adversely hit due to purchase tax and other cesses that it levied before they were subsumed into GST. Industry sources said Delhi has been adversely hit as the tax arbitrage on central sales tax (CST) has ended. In the past, Delhi imposed a lower CST of 1%, resulting in many companies shipping goods from the Union territory by locating their offices here. CST is now history.

See also

Goods and services tax (GST): A history