Hikal Ltd

This is a collection of articles archived for the excellence of their content. |

YEAR-WISE DEVELOPMENTS

1988-2023: Intra-family issues

Reeba Zachariah, April 20, 2023: The Times of India

From: Reeba Zachariah, April 20, 2023: The Times of India

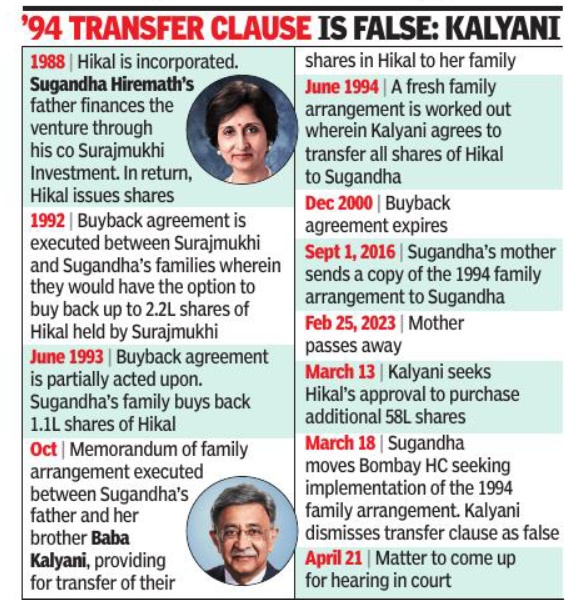

Mumbai: Pharmaceuticals and chemicals company Hikal’s non-executive director Sugandha Hiremath has accused her brother, Bharat Forge CMD Baba Kalyani, of trying to “marginalise and oust” her and her husband from the firm. The Hiremaths own about 35% in Hikal, which has amarket cap of Rs 3,578 crore, while Kalyani holds 34%.

Sugandha (71) has said Kalyani sought to buy additional shares of Hikal a fortnight after their mother’s death instead of honouring a family arrangement of transferring his entire stake in the company to her. Kalyani (74), however, has disputed her claim of the stake transfer.

Sugandha has moved the Bombay high court for the enforcement of a family settlement of 1994, under which Kalyani is bound to sell his entire stake in Hikal to the Hiremaths. She has alleged that Kalyani’s move to buy an additional 58 lakh shares shows his intention to consolidate his holding in Hikal.

Based on Hikal’s current trading price, the 58 lakh shares will cost Kalyani around Rs 169 crore. “It is obvious that Kalyani’s sole intention is to marginalise and oust the Hiremaths from Hikal in contravention of the 1994 family arrangement,” said Sugandha in her petition.

According to Sugandha, the June 19, 1994 family arrangement superseded the pact prepared on October 30, 1993 —both provided for transfer of Hikal shares from the Kalyanis to the Hiremaths. Her petition states that the 1994 arrangement was arrived upon between her parents and Kalyani in the presence of former ICICI Bank chairman N Vaghul and former Sebi chairman S S Nadkarni at Taj Mahal Hotel in Mumbai. She claimed that her father listed the family arrangement “in the form of a note” and handed it to Vaghul. She later received a copy of the note from her mother.

Kalyani, however, dismissed the transfer clause in the 1994 family arrangement as “a false claim” by Sugandha, though he acknowledged that the October 1993 deal stated that Hikal will go to the Hire- maths. Sugandha claims that the 1993 document was superseded, and hence, she doesn’t seek its enforcement, Kalyani said in his reply. Refusing to acknowledge any Hikal agreement in 1994, Kalyani said that the Taj meeting was related to resolving ownership issues at Bharat Forge and Kalyani Forge.

As far as Hikal is concerned, Kalyani submitted that there was a buyback agreement between him and the Hiremaths under which the latter would have the option to buy 2. 2 lakh shares of the company held by him between April 1, 1992, and December 31, 2000. But this agreement doesn’t speak of any family arrangement or transfer of his entire stake in Hikal to the Hiremaths, said Kalyani.

Sugandha argued that Kalyani had intentionally allowed the buyback agreement to expire. The agreement was partially acted upon in June 1993. But after that whenever the Hiremaths sought to exercise their option to buy the remaining shares back, Kalyani failed to comply, she claimed. The case dates back to 1988 when Hikal was set up by Sugandha’s husband Jaidev Hiremath. Sugandha’s father, through Surajmukhi Investment, offered seed capital to Hikal for a manufacturing facility in Raigad, Maharashtra. In return, Hikal shares were issued to Surajmukhi, with the understanding that these shares would be transferred back to the Hiremaths.

Sugandha said despite her and Kalyani holding a proportional stake in Hikal, it has been accepted and acknowledged by the latter that the Hiremaths will always be in exclusive management and control of Hikal. Contesting this, Kalyani said Hikal was to remain under joint control of both.