Hinduja group

This is a collection of articles archived for the excellence of their content. Additional information may please be sent as messages to the Facebook community, Indpaedia.com. All information used will be gratefully acknowledged in your name.

This is a collection of articles archived for the excellence of their content. |

Contents |

YEAR-WISE DEVELOPMENTS

Timeline

1914- 2020

From: Bloomberg, Nov 24, 2021: The Times of India

See graphic:

Hinduja Group: A timeline, 1914- 2020

SP Hinduja

Briefly

May 18, 2023: The Times of India

From: May 18, 2023: The Times of India

When SP Hinduja entered the family business in 1952, his father had made Iran the hub of his trading business — he would export carpets and dry fruits from Iran and import textiles and tea from India. The Hinduja Group remained headquartered in Iran till 1979. But, when the Islamic revolution swept out the Shah and brought Ayatollah Khomeini to office, SP and his family members shifted base to London, which remains the conglomerate’s HQ even now.

SP helped to broaden the family’s business interests. The group established a finance company, Hinduja Bank, in Switzerland. It later acquired Gulf Oil International and Land Rover Leyland International Holdings (UK), a major shareholder of Ashok Leyland. SP, according to the Hinduja Group website, conceived of IndusInd Bank,the first of the new-generation private banks in India. Former Ashok Leyland MD R Seshasayee said, “He (SP) was a man well ahead of his time and was truly a visionary. ”

Seshasayee, who worked closely with SP for many years, said, “He was a person who had a deep commitment to India and all the ancient values that India stands for. Our civilisational values were deeply ingrained in his mind and he was a nationalist, no matter whatpassport he held. ”

Seshasayee described SP as a complete family man. “He was the binding force in the family, which includes both immediate family, extended family, and the concept of Parivar — even professionals like me were drawn into that circle. ”

SP, along with his three brothers, controlled the Hinduja Group, which employs over 1. 5 lakh people in more than 35 countries. But in June 2020, a UK court filing revealed a dispute between SP and his three brothers over the ownership of assets. SP’s descendants sought a separation of some of the family assets. However, the four brothers in 2014 had inked a pact that all the assets belong to everyone and that each one will appoint the others as their executors. In 2022, media reports from the UK emerged that the brothers had decided to halt the litigation after they agreed to tear up the pact.

Karam Hinduja

As in 2021 Nov

Bloomberg, Nov 24, 2021: The Times of India

LONDON: As a child in London, one of Karam Hinduja’s favourite pastimes was watching Bollywood movies with his grandfather Srichand Hinduja, the patriarch of a sprawling global business empire.

“He and I, without fail, once a week, whatever was new, whether it was good or bad,” Karam said in a interview in Geneva. “That’s a lot of how we bonded.”

Little did he know then that a quarter century later the two of them would be embroiled in a real-life family drama more gripping than any Bollywood plot. And unlike most of the tearjerkers they watched, this one may not have a happy ending.

His grandfather, SP as the 85-year-old is known, now suffers from a form of dementia, and Karam, his sister, mother, aunt and grandmother are locked in a battle with the rest of the Hinduja family over pieces of the $18 billion British-Indian group.

Karam’s side of the family is effectively asking for what was once unthinkable — the group’s assets to be broken up. SP’s three brothers, Gopichand, Prakash and Ashok want the group to stick to its age-old motto that “everything belongs to everyone and nothing belongs to anyone.”

As clashes pile up in courts in London and Switzerland and the SP side suggests misogyny may be driving actions against his daughters, there may be no going back. The increasingly bitter feud has raised the possibility of a messy unraveling of the 107-year-old group, putting at risk one of the world’s largest conglomerates.

With dozens of companies — including six publicly-traded entities in India — the closely-held Hinduja Group employs more than 150,000 people in 38 countries in truck-making, banking, chemicals, power, media and healthcare.

“They seem to have reached a point of no return,” said Kavil Ramachandran, a family-business expert at the Indian School of Business. “It’s most unlikely to go back to the socialistic philosophy of everything for everybody.”

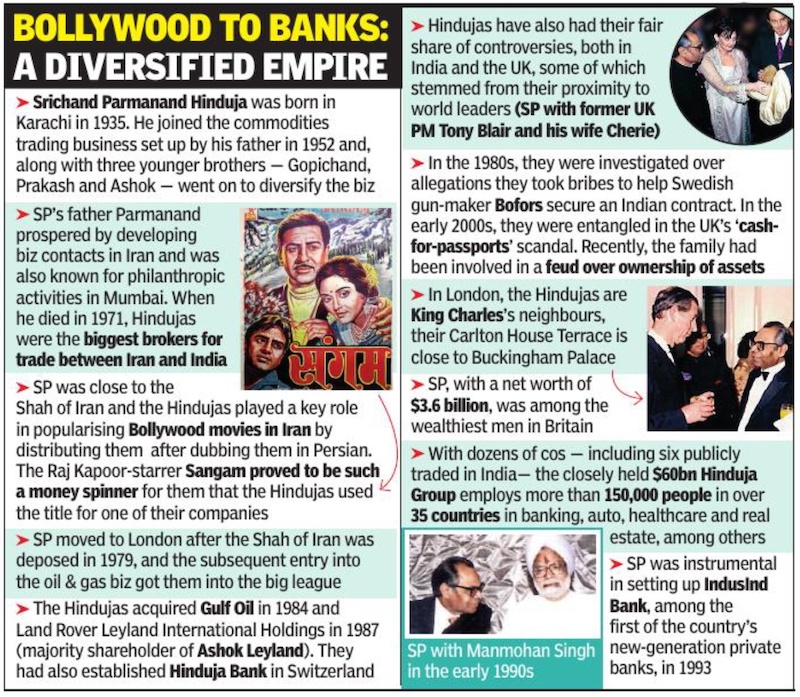

Bollywood to banks: A diversified empire

Founded by their father Parmanand Deepchand Hinduja in 1914 in the Sindh region of British India, the one-time commodities-trading firm was rapidly diversified by the brothers, with early success coming from distributing Bollywood films outside India.

The group’s heady rise let them rub shoulders with the likes of former US President George HW Bush and UK prime minister Boris Johnson.

In London, they are Queen Elizabeth’s neighbours, sharing Carlton House Terrace — four interconnected Georgian houses down the street from Buckingham Palace — where they hold their annual star-studded Diwali bash. SP and Gopichand, UK citizens, are among the wealthiest men in Britain.

With a collective net worth of about $15 billion, the four brothers always presented a united front, with little to suggest that not all was well in the House of Hinduja. Until last year. That’s when a London judgment shed light on the conflict in the family.

Gopichand, Prakash and Ashok were defending the validity of a letter signed in 2014 by the four brothers stating that assets held by one belong to all. That came as SP — represented by his daughter Vinoo — claimed sole ownership of Geneva-based Hinduja Bank.

SP wants the London court to rule that the letter has no “legal effect.” A decision on that is not due for a while yet, but if he succeeds, assets in his name could pass to his daughters Vinoo and Shanu on his death.

Meanwhile, a court in the Swiss canton of Lucerne said the case between SP and his brothers is on hold, pending a decision on who will represent his interests.

Although the Swiss bank is a tiny part of the family’s overall assets, the case raises broader ownership questions. The three brothers frame it as a power grab by SP’s daughters, who they said are using their father’s weakened state to go against his long-held wishes.

“SP had one mantra that nobody owns anything, everybody owns everything,” Radhamohun Gujadhur, an adviser to the brothers, said in an interview.

“Anyone doing differently is speaking under their own illusions or to further a selfish private agenda. The group structure has withstood the challenges of Shanu and Vinoo Hinduja who disagree with their own father’s vision of the group.”

Shanu didn’t want to comment on the dispute while Vinoo declined requests for comment. Ashok said he couldn’t comment on the record. Charles Stewart-Smith, a spokesman for the brothers, declined interview requests, referring to an earlier statement by them saying the efforts “go against our founder’s and family’s values.”

Another London lawsuit from 2018 shows how the feud could touch other family assets. That fight was over $1 billion in assets held at the Swiss bank by a company tied to Ashok Leyland Ltd., one of the group’s most high-profile listed companies and the world’s third-largest manufacturer of buses.

bb Difficult to determine ownership

Opaque holding structures — through trusts and offshore entities — make it difficult to determine ownership of the conglomerate’s companies. For instance, the brothers’ shares in IndusInd Bank Ltd in Mumbai, among the largest privately-owned banks in India, are held in an entity registered in Mauritius. Even the brothers’ domiciles complicate matters. SP and Gopichand live in London, Prakash resides in Monaco, and Ashok in Mumbai.

The group’s organization that worked for the brothers may not for third and fourth generation Hindujas now taking the reins.

“These old structures in the new world that they’re in are going to come apart,” said Nigel Nicholson, a professor at London Business School and author of ‘Family Wars.’ “The notion that one can maintain unity with woolly notions of common ownership without clear governance structures is tricky.”

For instance, SP’s 31-year-old grandson Karam, appointed the Swiss bank’s CEO last year, has a different take on the ownership of his firm.

“SP is the founder and has always been the sole shareholder and continues to be of this institution,” he said. “In the absence of an overarching agreement, members of our family have individual shareholdings.”

The brothers’ adviser disagrees.

“The Hinduja group doesn’t have any individual ownership and this includes the bank,” said Gujadhur.

Karam has renamed the bank SP Hinduja Banque Privee, although on the Hinduja Group website it is still called Hinduja Bank Switzerland. Housed in a modest building at the foot of Geneva’s old town, the bank headquarters has a simple blue door and a small brass plaque engraved with its new name.

In the interview there, Karam said he can appreciate that the timing of the bank’s re-branding may seem provocative given the ongoing legal battle. But the board endorses the move and it reflects the legal status quo, he said.

The bank is small by Swiss private banking standards, with about 1.7 billion Swiss francs ($1.8 billion) in client assets. Nevertheless it has become a lightning rod for the dispute, with Karam hinting that the fight has tinges of misogyny since the SP branch is dominated by women.

'It’s shocking’

“It’s shocking; I simply cannot understand the animosity that exists toward the SP branch of the family,” the Columbia University graduate said. “It makes you wonder how even such wealthy and somewhat westernized and powerful individuals, what their views truly are, maybe, toward women. I don’t know. It’s all I can think of.”

Karam’s mother, Shanu, who is the Swiss bank’s chairwoman, said her ascension at the firm is “instructive,” showing her father’s opposition “to the sidelining of women.”

Traditional Indian family businesses often keep daughters out of key roles, but for the brothers’ adviser, Karam’s accusations of misogyny are flat-out wrong. The sisters Vinoo and Shanu are on the boards of several of the group’s companies, and “if there was any truth to those misogyny claims I don’t think they would have been named to those boards,” he said.

What really sparked the feud remains a mystery to those not in the inner circles of the family, but some warn about its implications for the group.

“The moment you start thinking of division, that this part you look after, that part I look after, it belongs to you, it belongs to me, it belongs to my other brother, then you cannot continue for too long,” Hinduja Group general Counsel Abhijit Mukhopadhyay said in a law firm podcast last year.

Not new to controversy

The Hindujas aren’t new to controversy. In the 1980s, they were investigated on allegations they took bribes to help Swedish gun-maker Bofors secure an Indian contract. The case was later thrown out of court. In the early 2000s, they were entangled in the UK’s “cash-for-passports” scandal, having donated money for the Millenium Dome when SP was applying for British citizenship. More recently, Prakash has been investigated for suspected tax evasion by Geneva prosecutors, an allegation he denies.

But the very public fight within the family may be the biggest existential threat the group has faced, and the feuding sides are digging in for battle.

“Many of the questions at the heart of the family dispute are now a matter for the courts,” said Karam. “I don’t think people realize how tight-knit our SP branch is. The six of us, we’re very tight-knit. One of us gets cut and everyone knows about it.”

Court judgments

2024

Swiss criminal court sentences four Hindujas to prison

June 22, 2024: The Times of India

Geneva : A Swiss criminal court sentenced four members of the billionaire Hinduja family to four to four-and-a-half years in prison for exploiting their vulnerable domestic workers, but dismissed the more severe charge of human trafficking. The abuse by Indian-born tycoon Prakash Hinduja and his wife, son and daughter-in-law included seizing the passports of the workers, mostly illiterate Indians employed at their lakeside villa in Geneva. The workers were paid in rupees — not Swiss francs — in banks at home, which they couldn’t access.

The four were not in court though a fifth defendant — Najib Ziazi, the family’s busi- ness manager — was in attendance. He received an 18-month suspended sentence. The Hindujas’ lawyers said they were ‘apalled and disappointed’ by the order and had filed an appeal. AGENCIES

Have appealed ruling on abuse, this part of verdict ineffective now: Hindujas’ lawyers

Lawyers representing the defendants said they would appeal. In a statement, the Hindujas’ advocates Yael Hayat, Robert Assael and Roman Jordan said, “Our clients have been acquitted of all human trafficking charges. We are appalled and disappointed by the rest of the decision… we have filed an appeal to the higher court, thereby making this part of the judgment not effective. Under Swiss law, the presumption of innocence is paramount till a final judgment by the highest adjudicating authority is enforced.” There is no effective detention for any members of the family, they added.

The court said the four were guilty of exploiting the workers and providing unauthorised employment, such as by giving meagre if any health benefits and paying wages that were less than one tenth the pay for such jobs in Switzerland. It dismissed the trafficking charges on the grounds that the staff understood what they were getting into, at least in part. The four Hindujas also barred the domestic workers from leaving the villa and forcing them to work excruciatingly long hours, among other things.

Prakash Hinduja and his wife Kamal each received 4 1/2 year sentences, while their son Ajay and his wife, Namrata, were sentenced each to four years. The trial opened June 10.

Last week, it emerged in criminal court that the family —which has roots in India — had reached an undisclosed settlement with the plaintiffs. Geneva prosecutors opened the case for alleged illegal activity including exploitation, human trafficking and violation of Swiss labour laws.

The family set up residence in Switzerland in the late 1980s, and Prakash was already convicted in 2007 on similar, if lesser charges, though prosecutors say he persisted in employing people without proper paperwork anyway. Swiss authorities have already seized diamonds, rubies, a platinum necklace and other jewellery and assets from the family in anticipation that they could be used to pay for legal fees and possible penalties.

Prosecutors said that at times the staffers — in jobs like cooks or house help — were forced to work up to 18 hours a day with little or no vacation time off. One ailing employee got stuck with a hospital bill of over 7,000 francs (dollars), and the family only agreed to pay half, the court said. Employees worked even later hours for receptions and slept in the basement of the villa in the upscale Cologny neighbourhood — sometimes on a mattress on the floor, prosecutors said. They described a “climate of fear” instituted by Kamal Hinduja.

Some employees allegedly spoke only Hindi and were paid their wages in Indian rupees in banks back home that they couldn’t access. AP

Pet vis-à-vis help

2024

June 18, 2024: The Times of India

The billionaire Hinduja family spent more on their pet dog than they paid one of their servants, according to a Swiss prosecutor who urged jail terms of as long as five and a half years at a trial over alleged trafficking and exploitation of Indian staff at their Lake Geneva villa. Prosecutor Yves Bertossa launched a blistering attack on the family at the Swiss city’s criminal court on Monday, citing testimony from the staff and Hindujas, as well as evidence submitted during his investigation.

“They spent more for one dog than one of their servants,” he said. The woman, he said, was paid at one point as little as 7 Swiss francs ($7.84) for a working day that lasted as long as 18 hours, seven days a week. He pointed to a budget document headlined “Pets”, which he said demonstrated that the family spent 8,584 Swiss francs in a year on their family dog.

Staff contracts didn’t specify working hours or days off, but rather that they be available as needed by their employers, Bertossa continued. Given their passports had been confiscated, they had no Swiss francs to spend as wages were paid in India and couldn’t leave the house without their employer’s permission, they had little to no freedom, he argued.

But lawyers for the family immediately hit back at Bertossa’s claims, citing the servants’ testimony that they were treated with respect and dignity. The salary can’t simply be reduced to what they were paid in cash,” given their board and lodgings were covered, said Yael Hayat, a lawyer for family scion Ajay Hinduja. Eighteen hour-working days is also an exaggeration, she said. During the trial, Ajay testified that he lacked a detailed knowledge of the staff’s working conditions as their recruitment was handled by the Hinduja Group in India. BLOOMBERG