Hindustan Unilever Ltd.

This is a collection of articles archived for the excellence of their content. |

Contents[hide] |

Acquisitions

2018: GlaxoSmithKline, Boost, Horlicks

Unilever gets Boost with Horlicks, December 4, 2018: The Times of India

Malt-based hot drinks, 2016-18

From: Unilever gets Boost with Horlicks, December 4, 2018: The Times of India

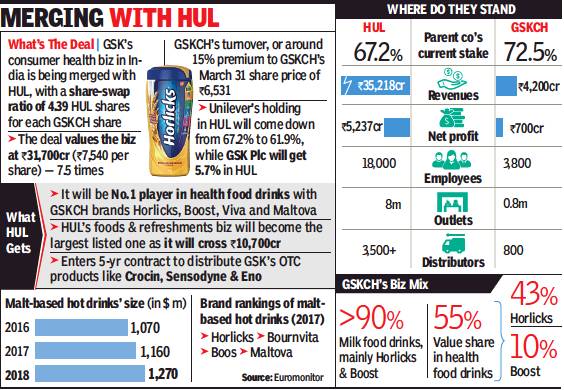

Buys GSK’s India Consumer Biz In All-Share Deal That Values It At ₹31.7K Cr

Unilever has agreed to acquire British healthcare company GlaxoSmithKline’s India consumer business, which includes the prized health food drinks brand Horlicks, ending months of speculation over who would bag the business. GSK has a large play in India, the Anglo-Dutch consumer product major’s second-largest market.

Horlicks, a 140-year old brand, which came to Indian shores with the British army during World War I as a “dietary supplement”, thus retains its British legacy. Swiss foods giant Nestle, too, was in a close race to acquire the business, which includes other strong brands — Boost (once endorsed by Kapil Dev and Sachin Tendulkar), Viva and Maltova. The scale of Unilever’s India business — which is also its fastest growing — appears to have dimmed the chances of other suitors in the fray. It is also touted as the largest deal under outgoing Unilever CEO Paul Polman.

In India, the merger values GSK’s subsidiary — GSK Consumer Healthcare (GSKCH) — at Rs 31,700 crore, which is 7.5 times the turnover of the firm, making it the biggest deal in the consumer space yet. Under the all-share deal, GSKCH will be merged with Unilever’s subsidiary Hindustan Unilever (HUL) in such a way that a GSKCH shareholder would get 4.39 shares of HUL for each share of GSKCH that he/she holds. It values GSKCH at Rs 7,540 per share, which is around 15% premium to the firm’s share price of Rs 6,531as on March 31, 2018.

The share price of GSKCH jumped by about Rs 273 or 3.8% to close at Rs 7,543 on the BSE on Monday. HUL’s share price was up Rs 72 or 4.1% to close at Rs 1,826.

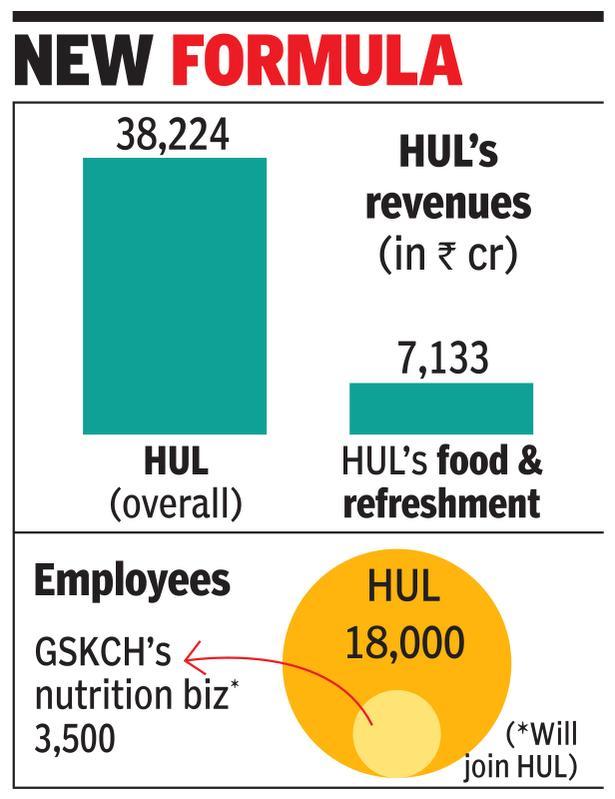

The merger, which has been approved by the boards of the respective Indian subsidiaries but is subject to regulatory and shareholder approvals, will boost HUL’s revenues to around Rs 40,000 crore, while catapulting its food and refreshments (F&R) business to around Rs 10,700 crore (28% of HUL’s revenues), making it the largest listed F&R business in the country.

Given that Horlicks is the leading brand in the Rs 7,000-crore health food drinks market, with a combined share of 55% (along with Boost, Maltova and Viva), HUL gets a direct entry into a new category with leadership position. With penetration of health food drinks still low at around 24%, Horlicks would benefit from HUL’s distribution muscle and its 8-million outlet reach to grow under a new parent. HUL chairman and CEO Sanjiv Mehta said, “It will add huge amount of lustre to the great brands we already have in our portfolio.”

The merger will result in a single legal entity with GSKCH being housed as a division in HUL. There will be no change of company name or board constitution.

HUL’s top management said it will unlock significant synergies from the merger, both from revenue and costs. This will come about from a combination of supply chain efficiencies, operational improvements, go-to-market and distribution network optimisation and streamlining of overlapping infrastructure. It could, however, lead to certain redundancies.

When asked what would be the fate of the 3,800-odd employees of GSKCH after the merger, the management of India’s leading fast-moving consumer goods company said it is a growing business and always in need of talent. However, the first focus will be the integration of the two businesses. The maker of Lipton tea and Kwality Walls ice cream employs around 18,000 people.

Annual income

2010-17

See graphic:

Annual income of Hindustan Unilever Ltd., 2010-17

COOs of Unilever from India

2019/ Paranjpe named COO of Unilever

Paranjpe is named COO of Unilever, March 15, 2019: The Times of India

From: Paranjpe is named COO of Unilever, March 15, 2019: The Times of India

HUL CMD Mehta Gets Extra Charge Of S Asia

Nitin Paranjpe has become the second Indian to be appointed as COO of Unilever. The first Indian who made it to the global post was Harish Manwani, who retired five years ago.

The Anglo-Dutch consumer products major has also elevated Hindustan Unilever (HUL) CMD Sanjiv Mehta as president, South Asia, Unilever and member of Unilever Leadership Executive (ULE), from May 1. Mehta will continue to helm HUL as CMD.

The move demonstrates the strategic importance of India to Unilever. India grew 2.5 times in the last 10 years. It also became the second-largest country for the $60-billion Unilever, after the US, ahead of Brazil.

Paranjpe, 56, is president, foods & refreshments, Unilever, a post he has held since January 1, 2018, and will be filled in by Hanneke Faber. In his new role, Paranjpe will be responsible for Unilever’s goto-market organisations, driving and co-ordinating in-year performance across countries in line with the organization’s divisional strategies.

In a statement, Unilever CEO Alan Jope said: “Today’s increasingly fragmented consumer, channel and media environment requires us to operate with more speed and agility than ever before. With his deep knowledge and experience of our markets, Nitin is ideally placed to work with me and the Unilever Leadership Executive to drive our performance and help deliver our growth ambitions.”

He is largely credited to have brought back profitable growth focus back to HUL. Paranjpe, whose personal belief in setting stretched targets is well known, had told TOI in an interview, “As a leader, I think we must constantly raise the bar and not be satisfied with what we’ve been doing. There is always a scope to get better. Improvement will happen when you have a healthy dissatisfaction and there’s a healthy goal.”

Mehta, 58, has delivered on the ‘4-G’ growth model embracing consistent, competitive, profitable and responsible growth. There have been several ticks on the M&A front as well, with HUL acquiring brands like Indulekha and Adityaa Milk. The proposed merger of GSK Consumer Healthcare (Horlicks, Boost) with HUL, is an added feather in Mehta’s cap.

History, till 2019

March 16, 2019: The Times of India

Hindustan Unilever's parent company, the Anglo-Dutch conglomerate, Unilever, is taking on hues of Hindustani with the recent announcement elevating two senior Indian executives into global leadership roles — while Nitin Paranjpe becomes only the second Indian after Harish Manwani to be named as the company’s COO, Sanjeev Mehta has been named as the Unilever’s South Asia president. Incidentally, all three — Manwani, Paranjpe and Mehta headed Unilever’s Indian subsidiary, HUL.

Global Indians: Mehta in fact joins compatriots Paranjpe and Unilever CHRO Leena Nair as one of the three Indians on Unilever’s leadership executive team — a first in the company's history. However, they aren't by any means the only Indians working across Unilever's geographical spread — Samir Singh, former vice president and executive director (personal care) at HUL is Unilever's global executive vice president of skin cleansing while B V Pradeep, who was director-consumer and markets insight, Asia at HUL, is currently global vice president - consumer & market insight - market clusters at Unilever.

Opening the floodgates: While Indian managerial talent from HUL has regularly been tapped by the parent company Unilever for positions overseas — former HUL (then Hindustan Lever) head Keki Dadiseth served as director-home and personal care (HPC) products division as did M S Banga, who headed Unilever's food as well as its HPC division — it was Manwani's elevation as Unilever's first ever COO and the subsequent reorganisation of the company into 8 geographical clusters that opened the floodgates for expatriation of Indian managers to Unilever's overseas subsidiaries.

Indianisation of Unilever: Ever since Hindustan Lever, which was what HUL was known as before being renamed in 2005 — though the formal name change happened in 2007 — appointed Prakash Tandon as the first Indian chairman of the company, it has had only one non-Indian as HUL's head. Given that India is the second largest market for Unilever after the US, contributing 10% to its global sales, it has been leveraging the managerial experience of its Indian executives to shore up its operational strength in other geographies. Only thing that remains now — if an Indian executive can crack the glass ceiling at the company's HQ to become its CEO.

Top management from India

As in 2023

Oct 27, 2023: The Times of India

From: Oct 27, 2023: The Times of India

Mumbai : Another Indian executive has found a place in the top leadership team of Unilever. India-born Priya Nair has been elevated as president of beauty & wellbeing to the Unilever Leadership Executive (ULE) — a team of international C-level executives who lead the British multinational.

Nair’s appointment takes the tally of Indian executives on the ULE to three, the other two being Nitin Paranjpe, chief people and transformation officer, and Rohit Jawa, who took over as CEO & MD of the Indian subsidiary Hindustan Unilever (HUL) in June-end this year. Nair, who is chief marketing officer of beauty and wellbeing at the company, will join the ULE from January 1, 2024. Moreover, she has become the second Indiaborn woman to be appointed to ULE after Leena Nair, who left Unilever to become the global CEO of Chanel. Nair, who was also reportedly in the running to succeed Sanjiv Mehta at the helm of HUL, is replacing Fernando Fernandez, who will take over as the CFO of Unilever. Other changes to the ULE include the appointment of Peter ter Kulve, currently president home care, as the new president ice cream, and Eduardo Campanella’s appointment as the new president home care. Esi Eggleston Bracey, GM personal care North America and head of country (US), has been appointed to the new role of chief growth and marketing officer.

Unilever’s CEO Hein Schumacher said: “Fernando has had a very impressive track record throughout his Unilever career, in a variety of financial, marketing and general management roles… Priya, Esi and Edu represent part of an exceptional generation of Unilever leaders who combine world class marketing skills with frontline experience. I am delighted they will join the ULE.”

YEAR-WISE DEVELOPMENTS

2020

GlaxoSmithKline Consumer Healthcare merges with HUL

HUL now owns Horlicks, Boost, April 2, 2020: The Times of India

From: HUL now owns Horlicks, Boost, April 2, 2020: The Times of India

MUMBAI: The merger of GlaxoSmithKline Consumer Healthcare (GSKCH) with Hindustan Unilever (HUL) — one of the largest FMCG deals — is complete. Now, the board of HUL has also approved the takeover of brand Horlicks from GSK global.

This option was available to HUL in the original agreement between Unilever and GSK, which was signed in December 2018. HUL will pay a consideration of Rs 3,045 crore (376 million euros) to GSK through its internal accruals. Since HUL is buying the brand, it will not pay any brand royalties. Brands Boost, Maltova and Viva, which were owned by GSKCH, would be automatically transferred to HUL.

The merger, for which all necessary approvals have been obtained, has been done on the basis of an exchange ratio of 4.39 HUL shares for each one of GSKCH. Following the issue of new HUL shares, Unilever’s holding in HUL will be diluted from 67.2% to 61.9%. GSK, on the other hand, gets an ownership of 5.7% in HUL after the merger.

In a conference call with media persons, HUL’s CFO Srinivas Phatak said GSKCH’s nutrition team of 3,500 employees will join HUL. GSKCH brands will form part of HUL’s food and refreshment (F&R) portfolio. HUL said the merger will bring a market development opportunity to drive premiumisation through the high sciences portfolio.

The merger is effective April 1. HUL, with the number one health food drinks portfolio in its kitty, emerges as one of the largest foods companies in India, in addition to it being the numero uno home and personal care company. Horlicks has a volume share of close to 50%. It was introduced to India in the 1930s and has been an everyday nutrition staple in households across generations.

In a statement, HUL CMD Sanjiv Mehta said, “Brands such as Horlicks and Boost are iconic, and we are excited to have them in the Hindustan Unilever fold. The merger gives us a unique opportunity to live our purpose and serve India where nutrition-related challenges form the largest causes of disease — malnutrition and micronutrient deficiency — and aligns well with the government’s ambitious Swasth Bharat and Poshan Abhiyaan programmes.” After the merger, HUL’s F&R business (Rs 7,133 crore in 2018-19) would near its home care portfolio (Rs 12,876 crore) in sales. “Given the potential of the business, it could grow in double digits in the medium term. One opportunity is to expand the portfolio to rural markets,” said Phatak.

Phatak said the firm will now begin work on integrating IT, SAP systems and processes, and the cultural integration, all of which will take 9-12 months to accomplish. “We will look into synergy aspects and execute and implement it in a seamless manner,” said Phatak.

The nutrition and health drinks category remains under-penetrated in India and HUL is well positioned to further develop the market, given the extent of its reach and capabilities. As part of the deal, HUL will be partnering with GSK (via a consignment-selling arrangement) to distribute GSKCH brands like Eno, Crocin and Sensodyne in India.

Mehta said, “In the current context, the focus of the company has been to ensure that all our people remain safe and we do our best to keep supply lines running for essential products. In these difficult times, we are joining hands with the government in the fight against Covid-19.”