Income Tax India: Laws

This is a collection of articles archived for the excellence of their content.

|

Basic tenets

Adapted from EconomicTimes March 2014

1) The interest earned on a bank fixed deposit is...Interest on FDs is fully taxable as income at the rate applicable to the taxpayer.

2) Travel insurance policies are not tax deductible for salaried individuals.

3) An individual won't get tax deduction for... employer's contribution to PF.

4) Gifts worth over Rs 50,000 in a year are taxed as income of recipient.

5) Any income of a minor child will be clubbed with that of the parent. HRA is not tax-exempt if you pay rent to... Your minor child.

6) A disabled dependant gets you a deduction under Section 80DD. This is an additional tax benefit

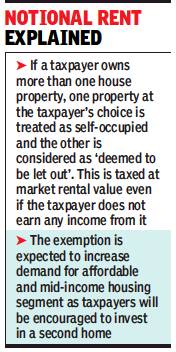

7) f you have a second house lying vacant, you have to...

a. Pay tax on rent not received. b. Include in wealth tax. c. Pay property tax on it. All the three conditions apply on a second house lying vacant.

8) If one earns rent on property, how much of it is taxable? Rental income is eligible for 30% standard deduction.

9) Only those with income below the basic exemption are exempt from filing tax returns.

10) The RGESS deduction is available only to first-time investors in equities.

Section 80C

December 12, 2017: The Times of India

To boost the habit of savings and investments, the government has allowed every individual taxpayer to invest and buy certain financial products which will allow them to avail of tax deductions. Under section 80C of Income Tax Act 1961, a taxpayer could invest a total of Rs 1.5 lakh per annum in ELSS of mutual fund houses, EPF, PPF, tax-saving FDs, NPS, life insurance products and some other approved financial products, which will reduce the person’s total tax liability. Payment of home loan principal and tuition fee of children also come under this section for tax deductions.

Section 80 D

January 23, 2018: The Times of India

WHAT ARE SECTION 80D TAX BENEFITS?

Section 80D under the Income Tax Act provides for tax deductions for buying health insurance policies, popularly called mediclaim plans. In an era of increasing healthcare costs, the government, to encourage people to take mediclaim policies, allows taxpayers some sops for these policies. A taxpayer can get claim deductions of up to Rs 25,000 per year for payment towards premium for health insurance plans for the taxpayer, spouse and dependent children. The limit is enhanced up to Rs 30,000 even if either the taxpayer or the spouse is a senior citizen. Within these limits one can also claim deductions of up to Rs 5,000 per year as a cost for preventive health check up. The government also allows mediclaim premium of up to Rs 30,000 for policies taken for parents.

Rates of income tax in India

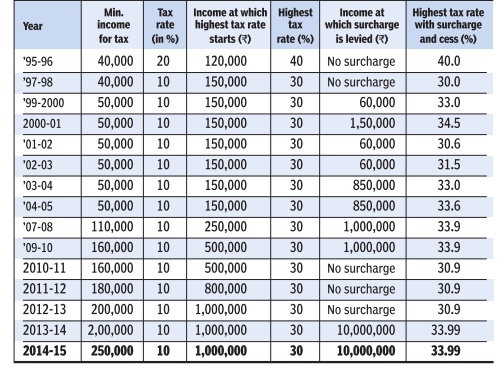

1995-2015

See the chart on this page

See graphic:

Income tax rates in India: 1995-2015

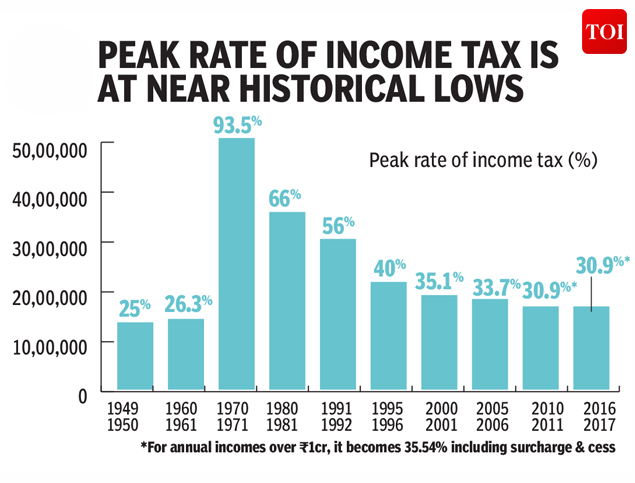

1949-2017: peak rate of Income Tax

January 15, 2018: The Times of India

From: January 15, 2018: The Times of India

See graphic:

1949-2017: peak rate of Income Tax

Highlights

We know you absolutely hate a part of your annual income going into to the government's kitty in the form of taxes. After all, you worked hard the whole year and wish the exemption limit would be set higher. Whether that would be done or not will be known till Budget 2018 is presented, but you should take heart from the fact that you pay much less tax than what your grandfather did during his time.

While exemption limit today stands at Rs 2.5 lakh annually, it was Rs 1,500 way back in 1949-50. Though this may seem a meagre amount to you, a back of the envelope calculation shows this works out to be Rs 80,000 in today's terms. So your grandfather started paying tax at annual income of Rs 80,000, while you enjoy tax-free income that is nearly three times more than it.

Tax rates are another reason for you to cheer about. The peak tax rate today stands at 30.9%. But during 1970-71 it was a staggering 93.5%, a massive increase from the 25% Indians paid in 1949-50.

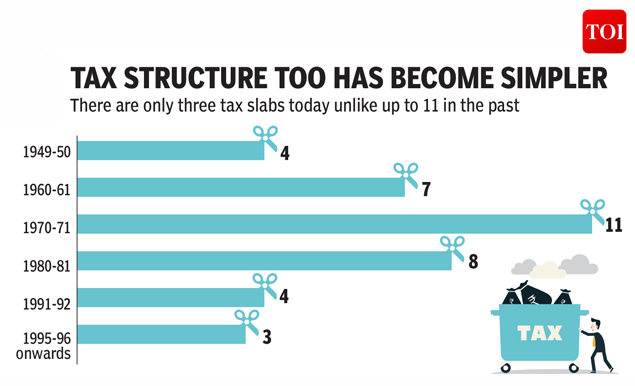

You may find three tax slabs cumbersome for tax calculation, but thank your stars, your parents or grandparents had to deal with as many as 11 tax slabs.

1949, and since 1995: The number of tax slabs

From January 15, 2018: The Times of India

See graphic:

The number of tax slabs in 1949, and since 1995

Appeals

2015: Appeals only for Rs 10 lakh +

Sources:

1. The Times of India, Dec 13 2015

2. The Times of India, Dec 13 2015, Rubna Kably

I-T appeals only for Rs 10L and above

In a bid to reduce litigation and spare taxpayers harassment, the Central Board of Direct Taxes has increased from Rs 4 lakh to Rs 10 lakh the threshold for filing an appeal before the Income Tax Appellate Tribunal, reports Rubna Kably.

The threshold limit for an appeal by the I-T department before the high courts has been doubled to Rs 20 lakh. The threshold for I-T department appeals before SC remains at Rs 25 lakh.

To rein in frivolous appeals, CBDT ties I-T hands by raising `tax effect' limit

The Central Board of Direct Taxes (CBDT) continues with its plan to reduce litigation and be more taxpayer-friendly. By significantly increasing the threshold limits for filing of appeals, at various judicial levels, by the Income-tax (I-T) department, the CBDT hopes to mitigate taxpayer harassment and create efficacy in the functioning of the I-T department.

At times, the I-T department files appeals with higher courts, with an eye on revenue, when the decision in the lower court is in favour of the taxpayer. Such frivolous litigation adds to the costs for both parties and results in taxpayer harassment.

The threshold limit for filing an appeal before the Income-Tax Appellate Tribunal (ITAT) by the I-T department has now been raised from Rs 4 lakh to Rs 10 lakh. Similarly , the limit for an appeal before the high courts has been doubled to Rs 20 lakh. While such revisions are an annual affair, the recently announced upward revisions are significant.

However, no change has been made in the threshold for appeals filed before the Supreme Court, which remains at Rs 25 lakh. Appeals before the ITAT and courts can now be filed by the I-T department only if the `tax effect' exceeds the threshold limits (see table). This move will help not only corporates, but also high net-worth individuals who find themselves embroiled in I-T litigation.

The CBDT has also clarified, in its circular dated December 10, that the revised limits will apply retrospectively and pending appeals below the specified threshold limits should be withdrawn or not pressed.

The `tax effect', as defined in CBDT's circular, means the difference between the tax on the total income assessed by the I-T department and the tax that would have been charged if the total income of the taxpayer was reduced by the income relating to disputed issues.

The CBDT has also instructed that merit must be the guiding factor while filing an appeal with higher judicial bodies -both the ITATs and courts. “It is clarified that an appeal should not be filed merely because the tax effect in a case exceeds the monetary limits (ie: threshold limits for appeals) prescribed,“ states the circular.

Tax experts view that the increase in threshold limits and withdrawal of pending appeals falling below the revised thresholds will ease litigation. The impact will be more favourable at the ITAT level, which is the first level of appeal. It is learnt that pan-India, 1.06 lakh cases were pending across various ITAT benches as of June 1. The maximum pendency was in Mumbai and Delhi, with 25,039 and 20,499 pending cases. Howev er, the exact number of pend ng cases, which will now fall below the revised threshold imits and be withdrawn, was not available.

However, to safeguard the nterests of the I-T department, certain caveats have been built into the instruc ions. For instance, just because on a particular disputed ssue, the I-T department has not appealed as the tax effect is ow, it does not preclude it from iling an appeal on the same issue for another taxpayer where the tax effect is beyond he prescribed threshold).

Further, the instructions on not filing an appeal if the ax effect is below the prescribed monetary limit will not apply in certain instances. These instances include: where the constitutional val dity of a tax provision is challenged; where the CBDT's circular has been held illegal or even when the audit objection has been accepted by the I-T department.

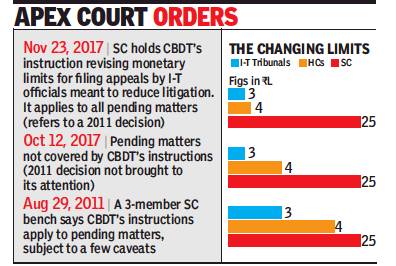

2017: ‘Higher appeals limit applies to pending cases,’ SC

From: Higher I-T appeals limit also applies to pending cases, says SC, November 28, 2017: The Times of India

The Supreme Court has held that the higher monetary threshold limits prescribed for filing of appeals by the income-tax authorities would apply both to appeals filed after the date of the instruction revising the limits and also to all pending matters. This brings respite to taxpayers who feared matters pending on the date of the instruction would be revived and lead to a tiring bout of litigation.

On November 23, the SC upheld the retrospective nature of the Central Board of Direct Taxes (CBDT) instruction setting down the thresholds for I-T appeals.

This order departs from an October order of the apex court which had taken a contrary view. After this decision, individual taxpayers and businessmen facing low denomination disputes had feared that I-T officials would rake up old matters discarded after upward revision of the threshold.

From time to time, CBDT, responsible for tax administration, enhances the monetary limits for filing of I-T appeals. Officials are not permitted to file appeals where the “tax effect” is low (as defined by the monetary limit), except for the few exceptions carved out. It helps cut down litigation, including pending litigation, and saves costs. “Tax effect” denotes the difference between the tax on income determined by I-T officials and the I-T chargeable on the income of the taxpayer after excluding the disputed income.

CBDT’s instruction, the subject matter of litigation before the SC, was dated February 9, 2011. It had provided that appeals cannot to be filed by I-T officials before high courts is the “tax effect” was less than Rs 10 lakh (the earlier circular on March 27, 2000, had pegged it at Rs 4 lakh). It did not change the monetary threshold for appeals before I-T tribunals and the SC, which remained at Rs 3 lakh and Rs 25 lakh, respectively.

Since then, another set of instructions have been issued, which provides that if the tax effect is Rs 10 lakh or less, an appeal cannot be filed even with the tax tribunals. For high courts, the limit is set at Rs 20 lakh and for the SC, it is Rs 25 lakh. Before the SC, the I-T department contended that the CBDT instruction had a prospective effect only. Thus cases pending in high courts on February 9, 2011, could not be dismissed merely based on the instruction. But the SC decided in favour of the taxpayer, SRMB Dairy Farming, a private limited company, by holding that CBDT’s instructions will also apply to all pending matters.

“The SC has rightly pointed out that the interpretation of CBDT’s instruction had to be done in the context of the purpose for which it was issued, which is to reduce litigation that had choked the legal system. Thus the apex court held that the instructions applied to pending matters also, as such an interpretation would facilitate achievement of the objectives of the National Litigation Policy aimed at bringing down the pendency of litigation cases,” said Gautam Nayak, tax partner, CNK & Associates, a firm of chartered accountants.

Interestingly, the latest instruction issued by the CBDT on December 11, 2015, not only significantly hiked the monetary threshold limits but categorically mentioned that: “This instruction will apply retrospectively to pending appeals and appeals to be filed henceforth in courts and tribunals. Pending appeals below the specified tax limits may be withdrawn.”

Nayak said: “This showcases the intent of the instructions and the SC has rightly acted on it.”

Artists

Fashion designers

‘Fashion designers are artists, eligible for I-T exemption’ Shibu Thomas

Mumbai: A fashion designer is an artist, the Bombay High Court has said and ruled that they are eligible for incometax exemptions available under the category. Ten years after the income-tax department first objected to tax benefits claimed by one of India’s leading fashion designers, Tarun Tahiliani, a division bench of Justice Dhananjay Chandrachud and Justice J P Devadhar on Monday said the designer should get tax privileges extended to the artists.

Tahiliani opened the country’s first fashion boutique, Ensemble, and is credited with being one of the designers who have brought high couture to India. Tahiliani’s IT woes began in October 2000 when he sought tax exemption for his income of Rs 83.90 lakh. Under Section 80 RR of the Income-Tax Act, a resident of India, who is an an author, playwright, artist, musician, actor or sports person can claim exemption of 75% of his income earned from foreign assignments. Tahiliani said that applying the exemptions, his taxable income for that year would be Rs 53.24 lakh.

The tax department, however, refused to accept that the fashion designer was an artist. It also contested deductions sought by sought by Tahiliani on his taxable income for 1999-2000 and 2001-2002. The income-tax appellate tribunal ruled in Tahiliani’s favour, upholding his claim that he was a creative artist. The IT department challenged the order before the high court.

The department’s lawyer contended that a fashion designer didn’t belong to the creative profession as the vocation was classified under applied arts and not fine arts. The IT department said that the benefit of exemption was granted to aid the artists, who represent Indian culture abroad.

The HC dismissed the IT department’s petition and held that fashion designers were entitled to tax exemptions meant for artists.

Capital gains

Corporates’ promotional activities

Pharmaceutical companies’ junkets for doctors

Lubna Kably, I-T trips pharma cos on doc junkets, Sep 20 2016 : The Times of India

Tribunal Disallows Expenses

The Mumbai bench of the Income-Tax Apellate Tribunal (ITAT) has nipped the `unholy' doctor-pharma nexus whereby medical practitioners are offered various incentives, like overseas trips, to encourage them to prescribe specific medicines or lines of treatment.

It has done so by upholding a disallowance of Rs 76.55 lakh, made by an I-T officer at the assessment stage. The expenditure was incurred by Liva Healthcare (a pharma company specialising in skincare formulations) to wards overseas trips for doctors and their spouses.

The immediate impact of the order is a higher I-T liability for the pharma company for financial year 2008-09, to which this case pertains, as the disallowed expenditure will be added back to the taxable component of income. In addition, the order will act as a reminder to pharma compa nies to adopt practices that are above board. The maximum rate of income tax on companies currently is 30% plus applicable surcharge and cess.

The ITAT's September 12 order observes, “The payment of overseas trips of doctors and their spouses for entertainment, by the pharma company , in lieu of expectation of getting patient re ferrals from doctors for its products so as to generate more business and profits, by any stretch of imagination cannot be accepted as legal.Undoubtedly it is not a fair practice and has to be termed as against the public policy.“

Section 37 of the I-T Act, which is a residual section, permits a business entity to claim as a deduction revenue expenditure incurred by it, `wholly and exclusively for the purpose of the business'.However, an explanation to this section provides that expenses incurred for any purpose which is an offence or is prohibited by law shall not be deemed to have incurred for the purpose of the business.Consequently , such expenditure cannot be allowed as a deduction from taxable income.

The code of conduct prescribed by the MCI debars doctors from receiving favours in return for referring, recommending or procuring of patients for medical, surgical or any other treatment.

Depreciation

iPad is communication device, not computer/ 2021

August 31, 2021: The Times of India

To you, your trusted iPad may be a handy computer. After all, in this work-from-home era, you use it to attend video-call meetings or even to draft a detailed email to a client, or to quickly look up your Powerpoint file before an important (albeit virtual) presentation. In short, this device packs a punch.

But when it comes to claiming tax depreciation, things can get complicated as the rate for a computer is 60%, against the general 15%. Recently, the Amritsar bench of the Income Tax Appellate Tribunal (ITAT) held that an iPad is a communication device and not a computer. Thus, it restricted the depreciation that Kohinoor Indian, a Jalandhar-based private company, could claim to 15% (further reducing it to 7.5% based on the date of purchase of the asset).

This order, which was uploaded on a niche tax portal, has sparked a debate among tax professionals. Globeview Advisors founder Ameya Kunte said, “To avoid future litigation, the depreciation rates should be revised considering the reality of the post-Covid world.”

The term computer is not defined under Income Tax (I-T) Act. However, under Information Technology (IT) Act, the function of composing and sending an email and receiving a reply qualifies an Apple iPad as a computer. TheITAT bench concluded an iPad is not a substitute for a computer or laptop. Apple stores also do not sell iPads as a computer device but as a communication/entertainment device, observed the ITAT bench.

Donations to NGOs’ projects

Halved in 2017

Share of donations to projects under Sec 35AC halved in FY16, March 4, 2017: The Times of India

Sec 35AC Sunset Clause Will Expire On March 31

Donations made to hundreds of projects carried out by NGOs across the country will no longer be eligible for a 100% income tax (I-T) deduction in the hands of the donor from April 1. While tax savings are not the main purpose, if donations are made in March towards eligible projects, then donors comprising salaried employees could reap an I-T benefit.

At present, donations made for specific projects run by NGOs that have been certified under section 35AC entitle the donor to a 100% I-T deduction under section 80GGA in respect of the donated amount.

However, section 35AC has a sunset clause which expires this March. Section 80GGA is not as widely known as section 80G, which permits a 100% I-T deduction in respect of certain donations (such as PM's National Relief Fund) and a 50% I-T deduction in most other cases (see table).

“Taxpayers who do not earn income under the head `profits and gains of business and profession', such as salaried employees, can claim the benefit of section 80GGA. While the employer cannot consider the donations made, while computing tax to be deducted at source against salary income, the employee can claim the benefit of the same in his I-T return and claim an I-T refund, if applicable,“ says Pradeep Mahtani, director, HelpYourNGO Foundation. A chartered accountant says, “In fact, if there has been a short deduction of tax at source and advance tax has not been paid by the salaried employee, by making donations eligible for I-T deduction up to March 31, the salaried taxpayer could mitigate his I-T penalty . Donors should ensure that they get the appropriate receipt.“

Notifications are issued by the finance ministry from time to time, certifying the projects that are eligible under section 35AC, the period of eligibility and also the total cost of the eligible project. For instance, as regards NGOs registered in Ma harashtra, these include projects by Magic Bus (skill development and livelihood programme), Association of Palliative Care (for a palliative care centre), Foundation of Promotion for Sports and Games (Olympic Gold Quest project) and Mesco (educational scholarships).

HelpYourNGO, an online donation platform, has on its portal 45 NGOs that run 90 projects eligible under section 35AC, These include some well known names such as Akshaya Patra's midday meals, projects by Childline and People for Animals.

In view of the sunset clause, a government-appointed national committee -which approves projects that would be eligible under section 35AC -had ceased to accept requests after December last year. “Donation stems from fundamental reasons, which are deep-rooted among each donor whether that's joy , guilt, remembrance or duty . However, everyone does think of saving I-T after having donated. Just like the insurance and the investment industry , which makes people aware of I-T savings available to them, for donations it is incumbent upon NGOs to make people aware of taxes they can save as a result of the donation they have made,“ says Dhaval Udani, founder of Danamojo, a payments platform for NGOs.

Perhaps awareness of a 100% I-T deduction for donations made to section 35AC-eligible projects has been low. HelpYourNGO did a dipstick sample survey of 12 NGOs, for which data was readily available. It showed that the percenta ge of donations towards 35ACeligible projects as compared to total donations received by NGOs has declined from 14.7% in fiscal 2014-15 to 7.9% in the next fiscal.

Deval Sanghavi, partner and co-founder at Dasra, a strategic philanthropy foundation, points out, “Our experience has shown that donors see the I-T deduction more as a government certification, which in essence states the organisation is compliant with laws and adheres to missiondriven principles vis-à-vis a giver donating more because of the I-T deduction.“

The number of individuals who donate money to charity has shown a rise in India.As many as 203 million Indians donated money during 2015, opposed to just 183 million in 2014, according to the World Giving Index 2016.

Educational institutions

Profits not taxable: SC

Mar 19 2015

Amit Choudhary

The Supreme Court has ruled that surplus income earned by educational institutions cannot be taxed, and imparting education not termed a for-profit activity simply because it yielded high returns. Dismissing the revenue department's submission that an educational institution ceased to be a solely scholastic endevaour if it generated high profits, the court noted that their income was exempt from tax under the Income Tax Act.

“Where an educational institution carries on the activity of education primarily for educating persons, the fact that it makes a surplus does not lead to the conclusion that it ceases to exist solely for educational purposes and becomes an institution for the purpose of making profit,“ a bench of Justice T S Thakur and Justice Rohinton F Nariman said.

“A distinction must be drawn between the making of a surplus and an institution being carried on `for profit'. If, after meeting expenditure, a surplus arises incidentally... it will not cease to be one existing solely for educational purposes,“ the bench added.

The court, however, said the government must examine activities of such institutions to ensure that the purpose of education is not taken over by a profit-making motive. “If they are not genuine, or are not being carried out in accordance with all or any of the conditions subject to which approval has been given, such exemption must be withdrawn,“ it said.

The court passed the order on a bunch of petitions filed by Queen Educational Society challenging an Uttarakhand High Court order allowing I-T authorities to tax its surplus income of around Rs 7 lakh for the assessment year 2000-01.

Exemptions

1950: residential palace of erstwhile ruler exempted from IT

AmitAnand Choudhary, Can't tax income from palace rent: SC, Dec 6, 2016: The Times of India

Court Raps I-T Dept For Pursuing Case Against Erstwhile Ruler Of Kota

The Supreme Court held that the income earned by erstwhile rulers of a princely state or their heirs by renting out a portion of the residential palace was not taxable and rapped the Income Tax department for pursuing a case despite their income being exempted under IT law.

A bench of Justices Ranjan Gogoi and Abhay Manohar Sapre allowed a plea of the ruler of the former princely state of Kota, now a part of Rajasthan, challenging the high court order for bringing his income from rent in the Income Tax net. The ruler owns extensive properties, including two residential pa laces known as Umed Bhawan Palace and the City Palace. The ruler is using Umed Bhawan Palace for his residence and a portion of it was rented out to the ministry of defence way back in 1976.

Although the Centre had in 1950 declared residential palace of an erstwhile ruler, situated within the state, as his inalienable ancestral property to be exempted from payment of income-tax, the I-T department had in 1984 initiated proceedings for assessment of income earned from renting out a portion of the palace. The Centre had incorporated Section 10(19A) in the IT Act to give exemption to former rulers.

The department contended that IT exemption was given for personal use and income earned from the rent was taxable. Commissioner of Income Tax and Income Tax Appellate Tribunal, however, turned down the plea of the IT department which had moved the Rajasthan HC.

The HC had ruled that as so long as the ruler continued to remain in occupation of his official palace for his own use, he would be entitled to claim exemption but if he let out any part of his palace, he became disentitled to claim benefit of exemption available under Section 10(19A) for the entire palace.

“In such circumstances, he is required to pay income-tax on the income derived by him from the portion let out in accordance with the provisions of the I T Act and the benefit of exemption remains available only to the extent of portion which is in his occupation as residence,“ the HC had said.

Quashing the HC order, the Supreme Court held that Section 10(19A) has used the term “palace“ for considering the grant of exemption to the ruler and income earned from renting out a portion of the palace was also exempted.

“We cannot ignore this distinction while interpreting Section 10(19A) which, in our view, is significant. In our considered opinion, if the Legislature intended to spilt the Palace in part(s), alike houses for taxing the subject, it would have said so by employing appropriate language in Section 10(19A) of the IT Act.We, however, do not find such language employed in the section,“ the bench said.. “Once the assessee is able to fulfil the conditions specified in section for claiming exemption under the Act then provisions dealing with grant of exemption should be construed liberally because the exemptions are for the benefit of the assessee,“ it said.

Scheduled tribes, Sikkimese, agriculture, institutions, hospitals, trusts

HIGHLIGHTS

I-T laws allow exemptions for various categories of incomes or individuals

Among those are members of ST communities in Nagaland, Manipur, Tripura, Arunachal and Mizoram

A similar exemption is available to all those defined as "Sikkimese"

Among those exempt from paying income tax are members of scheduled tribe communities in Nagaland, Manipur, Tripura, Arunachal Pradesh and Mizoram. Scheduled tribes in North Cachar Hills and Mikir Hills in Assam, the Khasi Hills, Garo Hills and Jaintia Hills in Meghalaya and Ladakh in Jammu & Kashmir also don't have to pay income tax. The exemption applies to income arising from any source in these areas or from dividends or interest on securities from anywhere.

A similar exemption is available to all those defined as "Sikkimese" in the I-T Act. This again is for any income generated from Sikkim itself and for income from dividend or interest on securities generated anywhere. The intent behind these exemptions is to provide fiscal concessions to backward areas and communities. In times like now, it becomes a useful route for people looking to turn undisclosed incomes legitimate.

Apart from these geographically restricted exemptions, there is of course the exemption for agricultural income. That includes any rent or revenue derived from agricultural land.

There are several institutions that are tax exempt under the IT Act. Again, it is not difficult to see why the lawmakers would have decided not to tax them. For instance, income of a public charitable trust or not for profit society established for development of khadi and village industries is exempt from tax. Educational institutions including universities existing solely for educational purposes and not for profit are exempt from paying tax on their incomes under various sub-sections of the IT Act.

Similarly, not for profit hospitals too are exempt, different kinds being covered by different sub-sections.

Income of a charitable institution or fund approved by the prescribed authority is not required to pay taxes on its income either. Nor are public religious or public charitable trusts approved by the prescribed authority. Political parties and electoral trusts are also exempt from tax on their incomes. It is another matter that a major chunk of the money flowing to parties never enters any books anyway.

Yoga

`Medical relief,' `imparting education' are charitable purposes

Lubna Kably, Ramdev trust wins I-T war on tax-exempt tag for yoga, Feb 18, 2017: The Times of India

Baba Ramdev's Patanjali Yogpeeth (a public charitable trust) has succeeded in its appeal before the Income-tax Appellate Tribunal (ITAT), which has accepted its tax exempt status.

The ITAT (Delhi bench) held that Yoga entails providing medical relief and camps also provide education, and that both `medical relief ' and `imparting education' fall within the meaning of charitable purpose, entitling the trust to claim I-T exempt status under sections 11 and 12 of the Income Tax Act.

“The finding of I-T authorities that propagation of yoga by Patanjali Yogpeeth does not qualify as medical relief or imparting of education is not justified,“ stated the ITAT in its order dated Feburary 9.Even as the litigation settled by the ITAT, relates to the 200809, the ITAT has also referred to subsequent amendment in the I-T Act, which came into effect from April 1, 2016. This amendment specifically inserted `yoga' within the definition of `charitable purpose'. If the exempt status not been upheld by the ITAT, Patanjali Yogpeeth would have been liable to pay income tax. The total income of this trust is not brought out in the ITAT order.

The ITAT also held that corpus donations aggregating to Rs 43.98 crore received by Patanjali Yogpeeth, predominantly for construction of cottages under its Vanprasth Ashram Scheme (which provides accommodation to those attending residential yoga courses), were capital receipts not liable to I-T. Such donations included land donated, whose market value was pegged by I-T authorities at Rs 65 lakh. In its order, the ITAT pointed out that “Corpus donations are not taxable, even in circumstances where the trust is not eligible for I-T exemption“.

Various additions to the trust's income made by the I-T authorities, including a Rs 96 lakh addition made for services made by the trust to Vedic Broadcasting in which Acharya Balkrishnan, a trustee and close aide of Baba Ramdev holds substantial interest were deleted by the ITAT, on the ground that the I-T authorities had not understood the facts.

The ITAT also agreed with the submissions made by the trust and observed that certain inferences by the I-T authorities such as provision of benefits to certain persons or receipt of anonymous donations were made without fully appreciating the facts.

Expatriates

Salary paid in India won’t face tax, if Non-resident

From: Lubna Kably, Non-resident expats’ salary paid in India won’t face tax, February 15, 2018: The Times of India

The Authority of Advance Rulings (AAR) has held that the salary income of a nonresident individual for services rendered overseas cannot be taxed in India, even when such salary is paid into a bank account in India.

The ruling stands out because apart from providing relief from double taxation under the Indo-US tax treaty, the AAR additionally held that the sums received in India would not be taxable here under the domestic tax laws.

Unlike a tribunal or court order, a ruling by AAR, a quasi-judicial body, does not set a precedent. But it does have persuasive value and is well-considered. Thus, the ruling may benefit expat workers, in particular the over one lakh Indian workers who work in the US, largely on H1B visas.

Typically, when white-collared workers are ‘seconded’ on an overseas assignment by an Indian company, a split salary arrangement is worked out. Under ‘secondment’, the employee is transferred on the payroll of the overseas parent or group company, which pays the basic salary and certain allowances, in the overseas country. However, the Indian company deposits a part of the salary in the employee’s bank account in India. This enables the employee to meet certain obligations in India—such as repayment of housing loan or household expenses (as the family could be in India).

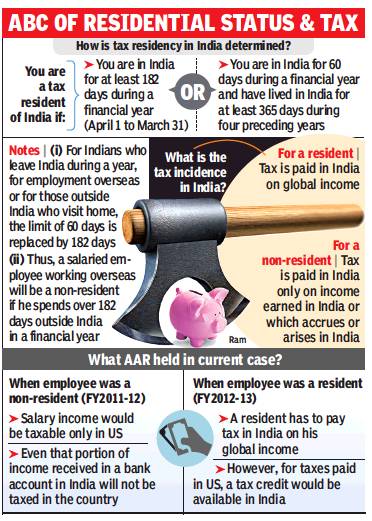

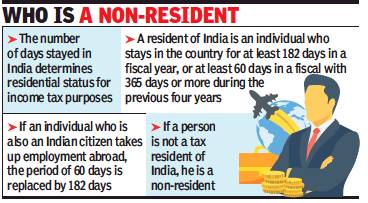

While an Indian residing abroad is popularly referred to as a non-resident Indian (NRI), the nomenclature is different under tax laws. It is not the country of origin, but the number of days’ stay in India, which determine whether a person will be a resident or non-resident for tax purposes.

Resident individuals are taxable in India on their global income, irrespective of where it was earned. In the case of non-residents, only income that accrues or arises in India (say, bank interest from a savings account in India or rental income from a house in Mumbai) is treated as taxable in India (see table). There is a third category, that is, resident but not ordinarily resident (RNOR), for whom the tax incidence is the same as for non-residents.

“Thus, salary received by non-residents in a bank account overseas for services performed outside India is not subject to tax in India. However, salary received in India is considered as taxable under the Indian domestic tax laws (along with being taxed in the country where they are working as most countries adopt the source method of taxation). Typically, a split salary mechanism results in litigation, as income-tax (I-T) authorities seek to bring to tax the income received in India. In such cases, employees claim relief under a tax treaty, which ensures that the same income is not taxed twice,” says Maulik Doshi, tax partner, SKP Group, a consultancy firm.

In this case, the employee, T N Santhosh Kumar, was seconded by Texas Instruments to Texas Inc, a US company, for a period of two years. As is typically the case, a split salary mechanism was adopted. Kumar was paid monthly a part of the salary and certain bonuses in India by Texas India.

A communique by EY India states: “Based on the India-US tax treaty, the AAR held that the place where the employee performs their duties is what is considered and not where the income is received or where the company providing the remuneration is based. As the salary is paid for work performed in the US, the income would be taxable in the US alone and no tax would be required to be withheld in India.”

“It is interesting to note that the AAR also held that such salary payments received in India by the non-resident would not be taxable in India even under its domestic tax laws,” says Doshi and adds, “in cases where there is no tax treaty (such as with Hong Kong) or in peculiar situations where the taxpayer is unable to access a tax treaty owing to lack of certain documents, this ruling will be very helpful.” In simple terms, the word accrue in India refers to something that is due in India.

Kumar was deputed for a two-year term. In the second year, in which he returned to India (that is, 2012-13) he was a resident of India and liable to tax on his global income. The US would also tax his US source salary income. Here, the AAR held he would be entitled to a tax credit in India for US taxes.

Family trusts

No `gift' tax on property received from individual

No levy on transfer of assets to family trust, March 24, 2017: The Times of India

`Gift' tax provisions will not apply to property received from an individual by a family trust, according to an amendment made in the Finance Bill passed by the Lok Sabha.

High net worth individuals (HNWI) commonly use family trusts as a tool for succession planning, as it provides an upfront solution to any possible future disputes that may arise, including any challenges to a will by relatives at a later date. Family trusts also ring fence assets from any future liabilities.Shares, immovable property et al are settled (transferred) to the trust for the benefit of spouse, children and other relatives. The trust dis tributes income to the beneficiaries.

The Finance Bill had introduced clause (x) in section 56(2). It provided that receipt of money or property by `any person' (which includes individuals and other entities such as private trusts and companies) without consideration or for inadequate consideration in excess of Rs 50,000 shall be subject to Income-tax (I-T) in the hands of the recipient, under the head `Income from other sources'.“The budget proposals had created uncertainty around family trusts receiving such gifts. The enacted change will bring relief to families intending to create trusts for legitimate succession planning,“ says Pranav Sayta, family business services leader at EY India.

Film actors

Promotion of film: actor not expected to incur expenditure

Money spent by Hrithik to promote film `taxable', Nov 30, 2016: The Times of India

It is not an actor's responsibility or obligation to incur expenditure on promotion of his film, the Mumbai bench of the Income Tax Appellate Tribunal (ITAT) ruled recently . It disallowed an expenditure of Rs 5.6 lakh, incurred for promotion of `Gujarish', which was claimed by the lead actor, Hrithik Roshan, as deduction from his income in 2010-11.

While verifying Hrithik's income-tax (I-T) returns, the officer noticed that Hrithik had shown an expenditure of Rs 7 lakh for promotion of his film.The actor said it was paid to seven contestants of `Saregama', a TV show, for promotion his brand image, as he was the lead actor in the film. `Guzaarish' was a 2010 release, composed and directed by Sanjay Leela Bhansali, which also had Aishwarya Rai in the lead role. The officer held that expenditure relating to the film's making, its promotion et all was the producer's responsibility . He disallowed the expenditure claimed by the actor in his I-T computation as a business deduction.

Flat ownership

Joint ownership of one flat won’t bar tax benefit on another: ITAT

Lubna Kably, April 9, 2024: The Times of India

Mumbai: It is quite common to include the name of a spouse in the ownership of a flat. A recent decision of the Mumbai bench of Incometax Appellate Tribunal (ITAT) will prove useful to many. ITAT has held that such joint ownership will not impact the spouse’s eligibility to claim tax benefits under Section 54-F of Income Tax (I-T) Act, relating to long-term capital gains, when he or she sells another asset (say land, shares, etc) and reinvests the sale proceeds in another flat.

When a taxpayer earns long-term capital gains from sale of any asset (other than a house property), the tax arising on the gains can be saved by investing the net sale proceeds in a residential property. The quantum of exemption depends on the amount invested in the new house. If the amount invested is less than the net sale consideration then the exemption is proportional.

To claim this exemption certain conditions need to be met. One of which is that the taxpayer must not own more than one residential house (other than the new house in which the investment is being made), on the date of sale of the original asset.

Recently in the case of S Singh, ITAT held: “Joint ownership in two residential properties at the time of sale of the original asset does not disentitle the taxpayer to claim a deduction under section 54F of Income Tax Act.”

In this case the taxpayer had sold agricultural land (the original asset) in Bhopal and earned long-term capital gains of Rs 61.6 lakh during the financial year 2012-13. Ow- ing to investment in a new house within the prescribed time frame, she claimed an exemption under Section 54F. Her case came up for scrutiny and details submitted by her showed that she held two residential properties as on the date of sale of this land. Both properties were jointly held, one with her husband and other with her father’s HUF. As she held more than one house, the I-T officer denied the deduction of Rs 61.6 lakh claimed by her.

Singh submitted that the residential property in which she was residing with her husband, was jointly owned with the loan being repaid by her husband. As regards the ownership in the HUF-held property, she explained she was again just the joint owner and at the time of sale of the agricultural land.

While divergent high court decisions existed, ITAT held that Supreme Court had laid down a principle that if two views are possible, one more favourable to taxpayer must be adopted. Accordingly, it was held that Singh could claim this tax benefit.

Flats, twin: Treated as a single unit

Lubna Kably, Oct 21, 2024: The Times of India

Mumbai: Ina significant judgment, the income tax appellate tribunal (ITAT), Mumbai bench, ruled in favour of N Aggarwal, a taxpayer, granting him full tax benefit for investment made in two adjoining flats, which were treated as a single unit.

Aggarwal had claimed a tax deduction of several crores under Section 54-F of Income Tax (I-T) Act, following his investment in two adjoining flats in a gated estate in Andheri. Under this section, if a taxpayer sells long-term assets (other than house property) and invests the entire net sales consideration in ‘one’ residential house, within the specified period, the entire long-term capital gain arising from the sale of the original assets is exempt from tax. In case the entire net sale consideration is not invested and only a part of it is invested in a residential house, tax exemption is allowed proportionately. Post an amendment in 2015, Section 54-F allows exemption only when the taxpayer purchases or constructs one residential house.

In this case, the issue raised by I-T department was that the taxpayer had purchased two flats under two separate agreements and, thus, the intention to treat it as one single house was not met.

On the other hand, Aggarwal maintained that these two flats were always meant to be used as a single residential unit. Since the builder originally obtained approval in the form of two independent units, the agreement was entered separately for each flat. Subsequently, the plan was amended — treating both flats as a single unit — and approved by Maharashtra Housing and Area Development Authority (Mhada).

“As long as the house is used by the taxpayer as one single unit, though by conversion, in our view, the exemption cannot be denied under Section 54F,” said the ITAT bench. The bench took the fact pattern into consideration. It noted that the builder originally got the plan approved as two separate units and the plan was subsequently revised in order to suit the requirement of the buyer to use it as one single unit. The revised plan very categorically identifies one kitchen and other necessary structures to be used as a single dwelling unit. The revised plan was not opposed by I-T authorities with anycontrary evidence.

Foreign accounts

No tax if Indian not beneficial owner

July 9, 2021: The Times of India

Mere mention of a person’s name in the account-opening form of an overseas bank does not mean that such an individual is the beneficial owner of the bank account, according to a recent order passed by the Delhi bench of the Income Tax Appellate Tribunal (ITAT).

An I-T officer had held that Jatinder Mehra, who had ‘opened’ this bank account, had not disclosed this overseas asset in his tax returns and the stringent provisions of the Black Money Act would apply. Thus, he sought to tax the Rs 5.7 crore (being the funds in this account) in Mehra’s hands.

However, the ITAT observed that Mehra had filed an affidavit disclosing complete details of the ownership of the bank account. Based on the solitary fact of his name mentioned in the bank account-opening form and lack of any other evidence relating to ownership or beneficial ownership over such an account, the sum could not be taxed in India in the hands of Mehra, ruled the ITAT.

In this case, an intricate set of facts were involved. Mehra’s name together with his passport details were on the account-opening form of a Singapore bank.

However, this account belonged to a foreign company — Watergate Advisors, incorporated in the tax haven of British Virgin Islands. Mehra’s son, a non-resident Indian since 1998, was the director and sole shareholder of this company. Under tax laws, overseas income held by a non-resident cannot be taxed in India.

It all began when a search was conducted in the case of Rakesh Agarwal Group, Baroda, and details of six trust companies came to light, one of which relates to this case heard by the ITAT.

At the first level of appeal, the Commissioner Appeals had ruled in favour of the taxpayer. But the I-T department filed an appeal with the tax tribunal.

Foreign exchange gains

In personal loans

May 19, 2021: The Times of India

Forex gains in the hands of an individual arising from the repayment of an interest-free loan by his relative are not taxable, according to a recent order of the Mumbai bench of the Income Tax Appellate Tribunal (ITAT). Tax experts said that this order will be useful in many cases.

The order was given by the ITAT in an appeal filed by Aditya Shroff. In this case, he had extended a personal interest-free loan of $200,000 to his Singaporebased cousin under the Liberalised Remittance Scheme of the Reserve Bank of India (RBI). Given the exchange rate of Rs 45.14, the loan transaction amounted to more than Rs 90 lakh. Two years later, when the loan was repaid in May 2012, the exchange rate was Rs 56.18. Thus, Shroff received back a higher amount. The I-T officer sought to bring to tax the surplus, which aggregated to over Rs 22 lakh.

The commissioner (appeals) had upheld this course of action. It was the view of the appellate commissioner that if the giving and taking of loans is not the business of the taxpayer, then the income arising out of the loan is to be treated as interest income, or income from other sources.

This led to Shroff filing an appeal with the ITAT. A single-member bench of vice-president Pramod Kumar observed that the benefit or gain that arose was owing to foreign exchange fluctuations, with respect to a transaction that was capital in nature (that is, a loan transaction). The order concluded that the forex gains were a non-taxable capital receipt.

A single-member bench observed the gain that arose was due to forex fluctuations, with respect to a transaction that was capital in nature

Foreign tax credit (FTC)

The Times of India, Jul 01, 2016

Lubna Kably

In a bid to reduce litigation, the Central Board of Direct Taxes (CBDT) has made it easier for Indian-resident taxpayers, including large Indian companies having overseas operations, to claim credit for the taxes borne by them abroad. Credit of foreign taxes (referred to as foreign tax credit, or FTC) were allowed under tax treaties with other countries and the Income Tax Act, but the absence of specific rules often led to litigation.Denial of FTC by tax authorities also resulted in double taxation on the same income in the hands of Indian-resident taxpayers.

FTC rules issued by the CBDT provide that credit for foreign taxes can be claimed against taxes paid in India, like income tax (be it personal or corporate), cess and surcharge. Further, Indian companies can also claim FTC against Minimum Alternate Tax (MAT). Taxpayers have to submit proof of the tax paid or deducted at source in the foreign country to claim FTC.

The earlier draft rules, issued in April, had excluded disputed foreign taxes from the ambit of FTC. Now credit can be claimed in respect of disputed foreign taxes, subject to meeting compliance requirements.

Indian-resident taxpayers pay taxes on their global income in India, including on foreign source income which has already been subject to tax overseas (see graphic). FTC eliminates double taxation on the same income. To illustrate: A parent company headquartered in India earns interest on debt given to its Sri Lankan (SL) subsidiary and is subject to a 10% withholding tax. The Indian company will pay tax in India on its global income (including the foreign source interest income). The new rules will make it easier for it to claim an FTC for the 10% tax with held in Sri Lanka.

According to RBI data, India Inc's overseas investments by way of debt and equity amounted to $750 million in May . FTC rules will help Indian companies with global operations get benefit of credits for foreign taxes. The rules will also help high net worth individuals who make overseas investments and bear foreign taxes on their dividend or interest income. “Clarity on grant of FTC against the MAT liability is a big positive as is the move to provide credit for `disputed foreign taxes' upon final settlement of dispute. However, the modus operandi for allowing such credit -especially when the assessments are time-barred -needs to be prescribed,“ says Girish Vanvari, tax leader at KPMG India.

Some hiccups remain.Gautam Nayak, tax partner, CNK & Associates, says, “The rules provide clarity about the extent of FTC available and documents to be submitted for that. However, difficulties faced by certain taxpayers have not been addressed.FTC would not be available for taxes not covered by the relevant tax treaty , such as state taxes paid in the US or branch profits' taxes paid overseas.Besides, the tax credit would be restricted to the rate of tax payable under the tax treaty , even if the actual tax paid as well as the Indian tax payable is higher. So, if excess taxes have been withheld by the foreign payer out of abundant precaution, or on account of their local laws, tax credit would be available only for tax payable under the treaty terms. For example, the US levies a higher rate of withholding of 30% if a foreign entity (say an Indian company) does not have a tax identification number. In such cases, credit in India would be available only to the extent of applicable rate prescribed under the tax treaty.“

Gifts

Brand name gifting cannot be taxed

Lubna Kably, Dec 10, 2021: The Times of India

MUMBAI: The Mumbai bench of the Income Tax Appellate Tribunal (ITAT) has held that the voluntary gift of the 'Essar brand' (comprising the brand name, trademarks and copyrights) by Essar Investments Limited to Balaji Trust, set up for the sole and exclusive benefit of the Ruia family members, is not taxable in the hands of the trust. The income tax (I-T) officer, in the course of assessment for the financial year 2012-13, had held this gift to be a taxable transaction and had raised a demand of Rs 719 crore.

Balaji Trust, a private discretionary trust, was settled (set up) on March 29, 2012 by Shashikant Ruia, with an initial sum of Rs 10,000. On the same date, Essar Investments, that was holding the Essar brand, contributed the brand, trademarks and copyrights to the corpus of the trust as a voluntary gift. The trust became the registered owner of the Essar brand.

Subsequently, the trust entered into brand-licensing agreements with Essar Group entities and earned a licence fee for use of the intellectual property. This income was accounted for in the years of receipt under the cash system of accounting.

However, the I-T officer held that the value of the Essar brand would be taxable in the hands of the trust in the financial year 2012-13 (the year in which it was gifted to the trust). He was of the view that the definition of income under the I-T Act is very wide. Thus, the receipt of the brand, trademarks and copyrights by the trust was an income, taxable under section 56 (1) as 'Income from other sources'.

The I-T officer proceeded to apply the discounted cash flow method and valued the Essar brand at Rs 1,668 crore. He raised a tax demand of Rs 719 crore on Balaji Trust. The trust succeeded in its first level of appeal before the commissioner (appeals) who held that the receipt of the Essar brand was on capital account and could not be characterised as a taxable income.

Taking the litigation forward, the tax department submitted additional grounds of appeal to the ITAT. In appeal, the I-T official sought to question whether Essar Investments was the genuine owner of the brand and whether settlement in favour of the trust was a bona fide transaction. The ITAT bench, composed of judicial member Ravish Sood and accountant member S Rifaur Rahman, dismissed this as it was a "complete volte face”.

…from NRI brother not taxable

Lubna Kably, August 20, 2024: The Times of India

Mumbai : In a significant ruling, Income-tax Appellate Tribunal’s (ITAT) Mumbai bench has held that a gift of Rs 20 lakh received by a taxpayer from his non-resident Indian brother, based in the UAE, is not subject to tax. This judgment underscores that Indian tax laws exempt certain gifts from being taxed, particularly those received from close relatives. Under Income Tax (I-T) Act, gifts exceeding Rs 50,000 are generally taxed as ‘income from other sources’ at the applicable slab rate, in hands of the recipient. However, exemptions exist: “Gifts received from relatives, on the occasion of marriage, or through a will or inheritance are not taxed. Under Section 56 (2)(x) of I-T Act, gifts from a brother fall under the exempted category.”

The case involved A Salam, who received the substantial gift from his brother. However, I-T officers initially classified the gift as taxable income. Commissioner of appeals supported this decision, arguing on grounds that the taxpayer failed to convincingly prove the donor’s creditworthiness and genuineness of the gift. Consequently, Salam filed an appeal with ITAT.

In his defence, he provided evidence that his brother, a long-term resident of Dubai who was engaged in business there for over 25 years, made the gift out of “natural love and affection”. The amount was transferred through three cheques from Bank of Baroda and ICICI Bank. He also submitted his brother’s bank statements, passport, and investor-class visa to establish his identity and financial capacity. A gift deed dated Aug 26, 2022, was also provided to support legitimacy of the gift.

ITAT member Prashant Maharishi, who presided over the case, in addition to taking cognisance of the evidence produced, also noted that parental names of the donor and recipient matched. This clearly established that the two men are real brothers. He concluded that the Rs 20 lakh received should not be classified as taxable income and directed I-T officials to delete the addition made.

Need not be camouflaged remuneration

Lubna Kably, `SRK's RS15cr Dubai villa can't be taxed', August 24, 2017: The Times of India

The income-tax appellate tribunal (ITAT) has rejected the tax department's view that a villa in Dubai gifted to Bollywood actor Shah Rukh Khan a decade ago was a camouflage to evade income tax. The tribunal has held that the value of the villa cannot be treated as the actor's taxable income.

The villa had been gifted to Khan under a formal gift deed in 2007, after he obtained the RBI's approval.

I-T authorities were of the view that the donor, Nakheel PJSC, a Dubai-based company known for the famous Palm Projects, had gifted the villa as it was keen on using the actor's image and brand.The actor is a globally known figure and has endorsed various foreign brands for remuneration running into a few crores. Thus, the gift was seen as remuneration to Khan for utilising his brand image and in lieu of his stage performance at the company's annual day event. In light of this, the I-T authorities sought to tax the value of the villa as income in SRK's hands.

During the assessment for the financial year 200708, I-T officials added the value of the villa -Rs 17.85 crore -to the income of Rs 126.3 crore declared by Khan in his I-T return. The actor would have had to pay I-T on this additional sum. At the first stage of appeal, the commissioner (appeals), agreed with the I-T authorities. Based on a valuation report, though, he reduced the addition to Rs 14.7 crore.

Appealing before ITAT, Khan, through his counsel, said the chairman of the company, Sultan Ahmed Bin Sulayem, was his friend and thus wished to make the gift. He admitted to attending the annual day event, but said he merely addressed the employees and did not perform on stage, which would have amounted to brand endorsement. On taxation of a gift in kind, ITAT pointed out that for the relevant financial year, gifts of immovable property made without any consideration were out of the tax ambit.

Gratuity

Payment of Gratuity(Amendment) Bill 2017

March 22, 2018: The Times of India

HIGHLIGHTS

Parliament has passed Payment of Gratuity(Amendment) Bill 2017 paving the way for doubling the limit of tax free gratuity to Rs 20 lakh

The Bill also notifies period of maternity leave as part of continuous service

Parliament passed Payment of Gratuity(Amendment) Bill 2017 paving the way for doubling the limit of tax free gratuity to Rs 20 lakh and empowering the government to fix the ceiling of the retirement benefit through an executive order.

The Rajya Sabha passed the bill, which was approved by the Lok Sabha on March 15. Besides enabling the central government to fix the ceiling of tax free gratuity, the bill will also empower it to fix the period of maternity leave through executive order.

It also notifies the period of maternity leave as part of continuous service and proposes to empower the central government to notify the gratuity ceiling from time to time without amending the law.

Rajya Sabha Chairman M Venkaiah Naidu said in the Upper House that he had met leaders of various parties in the morning and it was decided that the House would take up the crucial Payment of Gratuity (Amendment) Bill as it was of importance to the employees.

Labour Minister Santosh Kumar Gangwar then moved the bill for consideration and passage. It was passed by a voice vote without a debate.

The labour ministry later said in a statement that the Bill also envisages amending the provisions relating to calculation of continuous service for the purpose of gratuity in case of female employees who are on maternity leave from "twelve weeks" to such period as may be notified by the central government from time to time.

Prime Minister Narendra Modi tweeted: "A significant pro-people measure passed in Parliament. Will benefit lakhs of Indians."

After implementation of the 7th Central Pay Commission, the ceiling of tax free gratuity amount for central government employees was increased from Rs 10 lakh to Rs 20 lakh. The unions have been demanding for inclusion of the change in the Act.

At present, formal sector workers with five or more years of service are eligible for Rs 10 lakh tax-free gratuity after leaving job or at time of superannuation. A senior government official had earlier said that the government wants to provide tax-free gratuity of Rs 20 lakh to organised sector workers at par with the central government.

The Payment of Gratuity Act, 1972, was enacted to provide for gratuity payment to employees engaged in factories, mines, oilfields, plantations, ports, railway companies, shops or other establishments. The law is applicable to employees, who have completed at least five years of continuous service in an establishment that has 10 or more persons.

The amendment will also allow the central government to notify the maternity leave period for "female employees as deemed to be in continuous service in place of existing twelve weeks". The proposal comes against the backdrop of the Maternity Benefit (Amendment) Act, 2017 enhancing the maximum maternity leave period to 26 weeks.

House rent allowance

Proof needed of rent paid to kin

Lubna Kably, For tax relief, you need proof of rent paid to kin, April 11, 2017: The Times of India

The Mumbai income tax appellate tribunal (ITAT) denied a claim on house rent allowance (HRA) by a taxpayer.

She had paid rent in cash to her mother, but was unable to substantiate it. On the other hand, the Ahmedabad ITAT allowed the HRA exemption claimed by a taxpayer who had paid rent to his spouse.

Given that the avenues available to save tax are limited for the salaried class, some employees try and take the `fullest' advantage of the income tax exemption available for HRA by paying rent to a family member with whom they are residing. It is another matter if the rent is actually paid to the relative, or if the rent receipts are genuine.

Where do these seemingly contrary ITAT decisions leave the taxpayer? The bottom line is it isn't illegal to pay rent to a close relative, but it carries a risk of a deeper probe by I-T officials and if genuineness cannot be proved, the claim would be denied, with attendant consequences.

The bottom line is precautions are necessary when paying rent to a relative. For instance, it is better to enter into a leave and licence agreement and make payments via banking channels. Under section 10 (13A) of the I-T Act, a salaried taxpayer can claim exemption on HRA for an accommodation occupied by him, if the property is not owned by him and he has actually incurred rent expenditure on it.

Amarpal S Chadha, partner, people advisory services at EY-India, says: “Payment of rent to a parent or spouse will not impact the eligibility to claim HRA exemption as long as the above mentioned conditions are met and the transaction is genuine.“ “The transaction should not be a mechanism to avoid tax,“ he stresses.

So decisions by the Mumbai and Ahmedabad ITATs -one accepting the tax exemption claim on payment of rent to a relative and the other denying it -may seem contrary , but the orders were based on specific facts in each case.

Rent paid to spouse, HRA claim allowed: In 2013, the Ahmedabad ITAT bench in Bajrang Prasad Ramdharani's case, allowed an HRA exemption claim by the taxpayer, even though rent was paid by him to his spouse. He was living with his wife but paid her rent via bank transfers. The ITAT held that the taxpayer had fulfilled the twin requirement of occupying a house not owned by him and payment of rent.

Rent paid to mother, HRA claim disallowed: But more recently , the Mumbai bench disallowed the HRA claim by Meena Vaswani who had contended that she lived with her aging mother to take care of her and paid rent to her mother in cash. While rent receipts were obtained by her, as the transaction was with her mother, she had not entered into any formal contract. Vaswani was not able to produce proof of cash withdrawals from her bank to substantiate the rental payments. Moreover, the authorities were able to prove that she was not residing with her mother, but in another apart ment nearby with her husband and daughter. The ITAT agreed with I-T authorities that the transaction was a sham to obtain a tax benefit.

The fine print: “There is nothing in the I-T Act to prevent a salaried person from claiming exemption under section 10(13A) on the basis of rent paid to a close relative. However, section 143(2) empowers the I-T officer to examine the genuineness of such expense,“ says Ameet Patel, tax partner at Manohar Chowdhry & Associates, a CA firm. “In the normal course, a taxpayer would not pay rent to his spouse or parent. I personally would never advise any client to enter into such a transaction. It is but natural for the I-T officer to look upon such arrangements with suspicion,“ adds Patel.

The Mumbai ITAT placed reliance on the Indian Evidence Act, 1872, and took the position that the onus of proving that the rental transaction was real lay with the taxpayer.

Income Tax Appellate Tribunals

’Stay orders’ can exceed 365 days: SC

April 9, 2021: The Times of India

Can stay tax demand over 365 days: SC

TIMES NEWS NETWORK

Mumbai:

The Supreme Court has struck down a proviso in the Income Tax Act that curtailed the powers of the Income Tax Appellate Tribunal (ITAT) to grant stay of a tax demand for a period exceeding 365 days, even if the delay in disposing of the appeal was not owing to any fault of the taxpayer.

This recent landmark judgment, passed by a three-member bench of the SC, provides a much-needed relief to taxpayers, including India Inc, whose cases are pending in litigation at the ITAT level. The basis for the favourable verdict by the apex court is that taxpayers whose cases have not been disposed of by the ITAT, for no fault of theirs, should not be discriminated against.

The I-T demands, especially in cases involving mergers and acquisitions or cross-border taxations, run into several lakhs. With this order, taxpayers will no longer have to cough up the tax demand, pending disposal of their case by the ITAT merely because the time period of 365 days has run out. However, such delay in disposal of the matter should not be attributable to any actions by the taxpayer.

This third proviso to section 254(2A) was introduced with effect from October 1, 2008. The SC bench has held this proviso to be “arbitrary, discriminatory and in gross violation of the principles enshrined in Article 14 of the Constitution of India”.

In this case, PepsiCo India Holdings (earlier known as Pepsi Foods), which was aggrieved by an assessment order for the financial year 2007-08, filed an appeal with the ITAT. On May 31, 2013, the ITAT granted a stay on the assessment order, which was further extended till May 28, 2014.

No further extension of stay could be granted beyond the period of 365 days in view of third proviso to section 254(2A) of the Act. Then Pepsico India filed a writ petition before the Delhi high court, challenging the constitutional validity of the third proviso. Subsequently, the I-T authorities challenged the Delhi HC’s order that had struck down this proviso.

The SC has now upheld the Delhi HC’s order. It observed that though the apparent object of section 254(2A) seems to provide for expeditious disposal of appeals, no differentiation is made by the third proviso between the taxpayers who are responsible for delaying the proceedings and those who are not so responsible, thereby treating “unequals also equally”.

The apex court stated that the object of the provisions itself cannot be discriminatory. It held that any order of stay of demand shall stand vacated after the expiry of the period or periods mentioned in this section, only if the delay in disposing off the appeal is attributable to the taxpayer. Tax professionals have hailed this judgment.

Income Tax returns

Who has to file income tax returns

Salaried persons earning up to Rs 5 lakh annually

Salaried persons earning up to Rs 5 lakh annually will have to file income tax returns: Central Board of Direct Taxes

PTI | Jul 22, 2013

The CBDT had exempted salaried employees having a total income of up to Rs 5 lakh including income from other sources up to Rs 10,000 from the requirement of filing income tax return for assessment year 2011-12 and 2012-13, respectively.

However, for the assessment year 2013-14 and thereafter, salaried persons earning up to Rs 5 lakh annually will have to file income tax returns, Central Board of Direct Taxes (CBDT) said on Monday.

Earlier in May 2013, the CBDT had made E-filing of income tax return compulsory for the assessment year 2013-14 for persons having total assessable income exceeding Rs 5 lakh.

The CBDT said that the exemption has been not been extended as the facility for online filing of returns has been made "user-friendly with the advantage of pre-filled return forms".

These e-filed forms also get electronically processed at the central processing centre in a speedy manner, it said.

For filing returns, an assessee can transmit the data in the return electronically by downloading ITRs, or by online filing.

Thereafter the assessee had to submit the verification of the return from ITR-V for acknowledgement after signature to Central Processing Centre.

Not filing I-T returns?Imprisonment,fine

Not filed I-T returns? You face jail & fine

TNN | Aug 17, 2013-

MUMBAI: Those defaulting in filing income tax returns are liable to prosecution, the I-T department has said.

If the tax evaded exceeds Rs 25 lakh, the defaulter can be sentenced to a minimum imprisonment of six months and maximum of seven years, besides being asked to pay a fine. If the tax evasion amount is less than Rs 25 lakh, the imprisonment could range between three months to two years in addition to fine.

Recently, the additional chief metropolitan magistrate, New Delhi, sentenced a taxpayer to six months' imprisonment in one assessment year and one year imprisonment in subsequent assessment year for repeating the offence of not filing income tax returns.

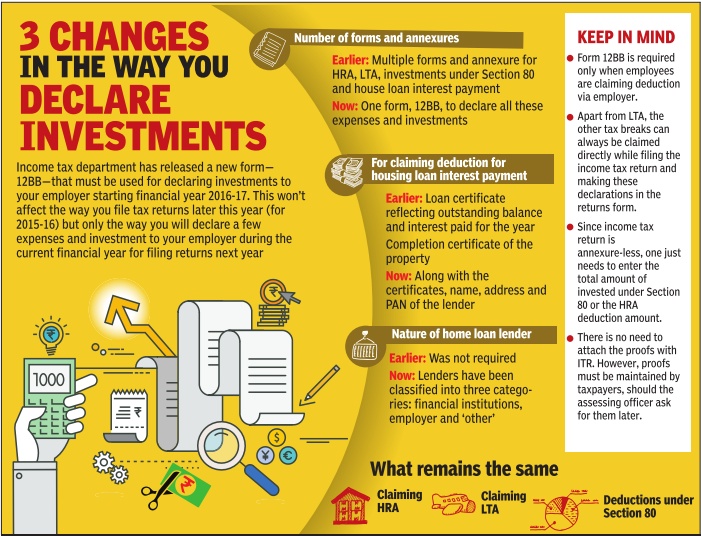

2018: Changed format

Changes you need to know for I-T returns, April 7, 2018: The Times of India

From: Changes you need to know for I-T returns, April 7, 2018: The Times of India

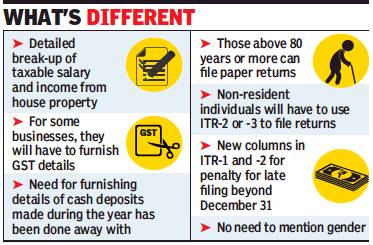

When you file your income tax (I-T) returns in July, you will have to fill details such as allowances that are not exempt, value of perks, and profits in lieu of salary in the new I-T return forms notified for the assessment year 2018-19.

A one-page simplified ITR Form-1 (Sahaj) can be filed by an individual who is a resident having income up to Rs 50 lakh and who is receiving income from salary, one house property and other income (interest, etc), the I-T department said. The detailed break-up of salary was not part of ITR forms last year but has been added this year.

Similar details have to provided for income from house property. Gender mention requirement has been removed from ITR-1. Non-resident individuals cannot use ITR-1 to file returns and will have to use ITR-2 or -3, depending on their nature of income in India. Tax experts said this could raise their compliance costs.

The ITR-1form is similar to the one for the previous assessment year, which had been used by 3 crore taxpayers who filed their returns using this form. You will also have to provide details of all bank accounts held in the country at any time during the previous year, except dormant accounts.

The requirement of furnishing details of cash deposit made during a specified period as provided in the ITR form for the assessment year 2017-18 has been done away. This provision was added in the aftermath of the demonetisation drive.

ITR Form-2 has also been rationalised by providing that Individuals and HUFs (Hindu Undivided Families), having income under any head other than business or profession, shall be eligible to file returns under this form. The Individuals and HUFs, having income under the head business or profession, shall file either ITR Form-3 or ITR Form-4, the department said.

“There are more than 25 key changes in current year ITR forms in comparison to last year. Some of these changes suggest that the focus of new ITR forms is to get more information from unlisted companies, trusts and taxpayers, who have opted for presumptive taxation scheme,” said Naveen Wadhwa, deputy general manager at Taxman.

“Further, the ITR forms also require the business entities to report the GST transaction, which would help the department to independently reconcile the transactions reported by them in income-tax returns and GST returns,” he said.

In case of non-residents, the requirement of furnishing details of any one foreign bank account has been provided for credit of refund. “There is no change in the manner of filing of ITR forms as compared to last year. All these ITR forms are to be filed electronically,” the department said.

Any individual who is 80-year-old or more has the option to file paper returns as well as an Individual or HUF whose income does not exceed Rs 5 lakh and who has not claimed any refund in the return of income.

Tax experts said additional fields for penalty due to delayed filing have been added in ITR-1 and ITR-2.

“The new Form ITR-1 (Sahaj) for assessment year 2018-19 does not request for the residential status of the individual and it is neither applicable to individuals qualifying as Not Ordinarily resident (NOR) nor to non-residents (NR). So Indian employees who have left India for overseas employment in the first half of the year and qualifying as non-resident would be required to file their India tax returns in ITR-2, even though they have annual taxable income up to Rs 50 lakh,” said Alok Agarwal, senior director at Deloitte.

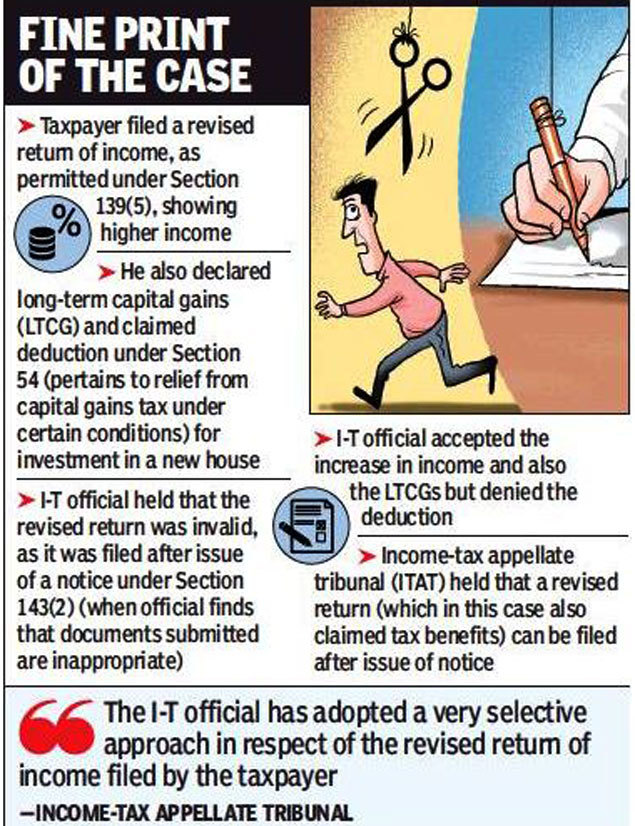

'Returns can be filed after I-T notice is issued'

From: Lubna Kably, ITAT: Can file revised return after notice issued by I-T, June 22, 2018: The Times of India

HIGHLIGHTS

Tax benefit claimed by taxpayers in revised income-tax returns cannot be denied byI-T officers because the revised return has been filed after issue of notice

Currently, the time limit for filing a revised return is before the expiry of twelve months from the last day of the financial year or before the completion of I-T assessment, whichever is earlier

A tax benefit claimed by a taxpayer in his revised income-tax return cannot be denied outright by an income-tax (I-T) officer merely because the revised return has been filed after issue of notice, income-tax appellate tribunal (ITAT) has said.

However, the revised return needs to be filed within the time limits set out in the I-T Act. This order of the Mumbai bench of the ITAT, passed on June 20, will provide relief to several taxpayers. When a mistake is made in the original I-T return, such as not disclosing an income correctly or not claiming a tax deduction, section 139 (5) the I-T Act permits a revised return to be filed to correct the errors.

Currently, the time limit for filing a revised return is before the expiry of twelve months from the last day of the financial year or before the completion of I-T assessment, whichever is earlier.

In this case before the ITAT, Mahesh Hinduja had declared a total income of Rs 4.91 lakh in his original return for the financial year 2010-11. He later filed a revised return declaring a total income of Rs 6.24 lakh. In this revised return he also disclosed long-term capital gains (LTCG) of nearly Rs 50 lakh. However, as he had invested 1.15 crore in a new residential house, he claimed a deduction under Section 54 of the I-T Act. Thus, capital gains were not offered for tax.

Under the Act, if an investment is made in another house in India, within the stipulated period of time, then the 'cost of the new house' is deducted and only the balance component of the LTCG is taxable. Thus, if the amount of capital gains is equal to or less than the cost of the new house, the entire sum of LTCG is not taxable.

To ensure that the taxpayer has not underreported his income or paid less tax, the I-T Act empowers I-T officials to issue a notice asking for further evidence. As the revised return was filed by Hinduja after he had received a notice under section 143(2), the I-T official rejected his claim for deduction. The litigation finally reached the level of the ITAT.

The ITAT noted that the I-T official had rejected the revised return of income as invalid but at the same time had accepted the higher income offered in the revised return, including the LTCGs. Only the claim of deduction under Section 54 had been rejected. "The I-T official has adopted a very selective approach in respect of the revised return of income filed by the taxpayer," remarked the ITAT.

The ITAT held that the I-T Act does not bar a taxpayer from filing a revised I-T return after issue of notice under Section 143 (2). Hinduja's case was sent back to the I-T official for examining and allowing the deduction, subject to the fulfilment of conditions prescribed for such claim.

Wrong information in I-T returns

April 19, 2018: The Times of India

HIGHLIGHTS

I-T department has said those who file wrong ITR will be prosecuted and their employers will be intimated to take action

The advsiory comes in the backdrop of the investigation wing of the department, in January, unearthing a racket of extracting fraudulent tax refunds by employees

The Central Processing Centre (CPC) of the department in Bengaluru, that receives and processes the Income Tax Returns (ITRs), has issued an advisory specifying such taxpayers should not "fall prey" to unscrupulous tax advisors or planners who help them in preparing wrong claims to get tax benefits.

Calling it a "cautionary advisory" on reports of tax evasion by under-reporting of income or inflating deductions or exemptions by salaried taxpayers, the department said such attempts "aided and abetted by unscrupulous intermediaries have been noted with concern".

"Such offences are punishable under various penal and prosecution provisions of the Income Tax Act," it said.

The advsiory comes in the backdrop of the investigation wing of the department, in January, unearthing a racket of extracting fraudulent tax refunds by employees of bellwether information technology companies based in Bengaluru, in alleged connivance with a tax advisor.

The CBI recently registered a criminal case to probe this nexus.

The tax filing season for salaried class taxpayers has just begun with the Central Board of Direct Taxes (CBDT), that frames policy for the department, recently notifying the new ITRs.