Indian film industry: statistics, economics

This is a collection of articles archived for the excellence of their content. |

The Indian film industry's place in the world

2012 (and 13): Vis-à-vis USA, China and Japan

Niall McCarthy| Bollywood: India's Film Industry By The Numbers| SEP 3, 2014| Forbes.com

Niall McCarthy is a data journalist covering technological, societal and media topics

Opinions expressed by Forbes Contributors are their own.

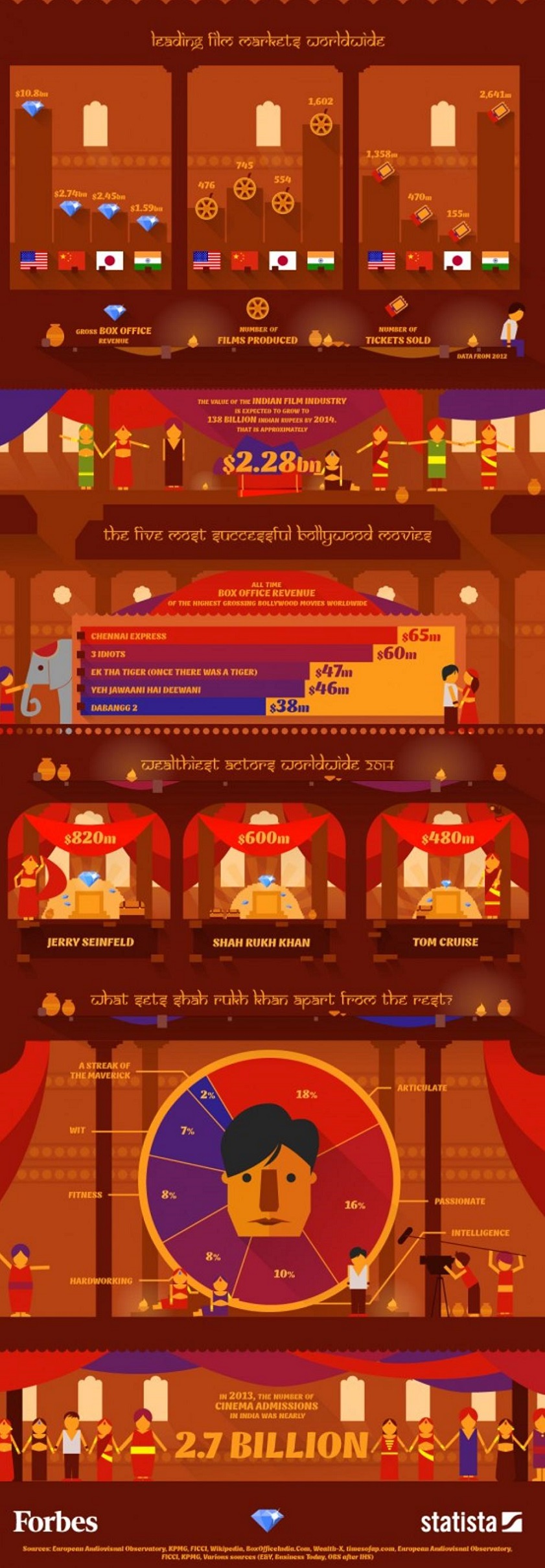

Amidst all the glamor and dazzle of Hollywood, people often forget about the world's other movie capital - India. Firmly established in Mumbai, which was formerly known as Bombay (hence the Bollywood nickname), the Indian film industry is expected to grow to 138 billion Rupees by 2014 - that's $2.28 billion.

Number of films produced The numbers are certainly impressive - in terms of the number of films produced each year, Bollywood is firmly on top of the pile with 1,602 in 2012 alone. The U.S. churned out 476 films that year while the Chinese managed 745.

Tickets sold In the same year, Hollywood sold 1.36 billion tickets compared to Bollywood's whopping 2.6 billion (and nearly 2.7 billion cinema admissions in 2013).

Revenues Indian films can't match Hollywood in box office revenue, however. U.S. films grossed nearly $10.8 billion in 2012 compared to India's meager $1.6 billion.

ii) The three wealthiest actors in the world in 2014.

iii) The number of cinema admissions in India in 2013.

From Niall McCarthy, Bollywood: India's Film Industry By The Numbers, SEP 3, 2014, Forbes.com

People in India don't tend to mind all those numbers though, they just want to watch films, something that can't be disputed with!

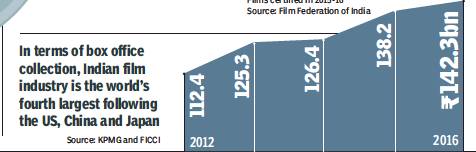

2012-16: Vis-à-vis USA, China and Japan

From: November 27, 2017: The Times of India

See graphic:

In terms of box office collection, Indian film industry is the world’s fourth largest following the US, China and Japan, 2012-16

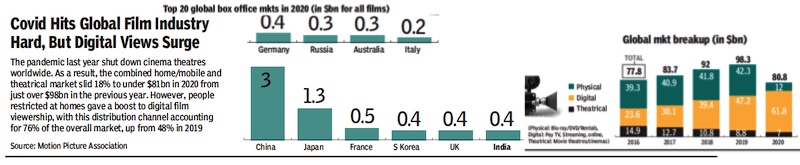

2020: India no.7

From: April 26, 2021: The Times of India

See graphic:

The Indian film industry’s rank in the world in 2020 (The USA is missing from this graphic)

Number of films made: Hindi-Urdu, Telugu, Tamil, other Indian languages

1994: Telugu, Tamil, ‘Bombay’ are nos.1, 2, 3

The number of films released

Ajith Pillai, Sudha G. Telak | March 15, 1995 | India Today

Telugu:153 films;

Tamil: 135 films;

Bombay 119 films (language not stated; mostly Hindi-Urdu)

Malayalam:69 films

Kannada:62 films

2003

Telugu film industries outshine Bollywood | January 25, 2006 | Business Standard

In 2003, the country's film industry produced 877 films, of which the majority were made in South Indian languages.

Hindi 246 films

Telugu 155 films

Tamil 151 films

Kannada 109 films

Malayalam 64 films

Other language films 152.

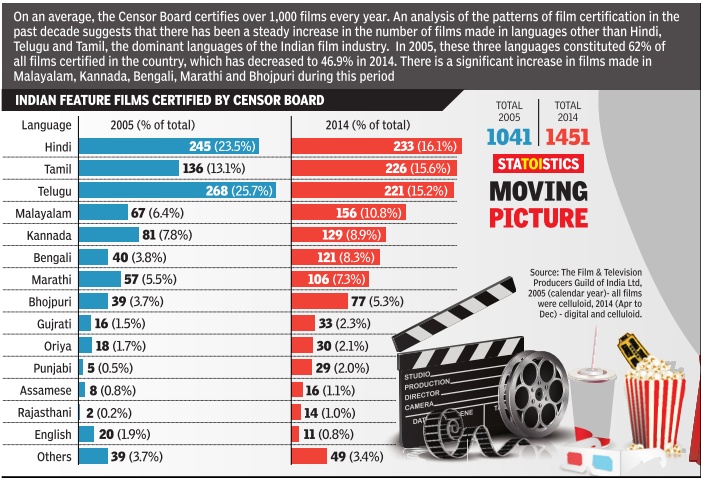

2005, 2014: the 14 main languages

See graphic, 'Indian cinema, number of feature films in major Indian languages certified in 2005, 2014 '

2005- 2009: normally more Telugu films produced than Hindi-Urdu

Tollywood loses to Bollywood on numbers |TNN | Oct 2, 2010 | IndiaTimes/ The Times of India

The Indian film industry produces the most number of films in the world and with Telugu films playing a dominant role in getting that honour for India, it was a matter of pride for the Telugu film industry.

Yet it has always been a see-saw battle between Telugu and Hindi films.

2005 Telugu films ruled the roost with 268 films as against 245 Hindi films. Tamil:136 films in 2005

2006 Telugu films were one up over Bollywood. While 245 Telugu films were produced during that period, in contrast there were 223 Hindi films. Tamil:162 films in 2006

2007 according to the Central Board of Film Certification (CBFC) figures, 257 Hindi films were produced as against 241 Telugu films which occupied the second place. Tamil:149 films in 2007

2008 the Telugu film industry had climbed the peak by producing 286 films, a huge number by any standard. Tamil: 175 films in 2008

2009 as many as 235 Hindi films were produced as against 218 Telugu films. Tamil: 190 films in 2009 Tamil films have always occupied the third place

The number of Telugu films had increased in the last few years largely because of the entry of several newcomers, flush with money made from the real estate boom, as producers in the Telugu film industry.

"One of the main reasons why the Telugu film industry has been producing a high number of films is because of the time discipline here. A day's shoot could start as early as 7 am or 8 am and continue till evening with only a lunch break," said Film Federation of India executive committee member from Andhra Pradesh, V V Balakrishna Rao. In Mumbai, because of the distances that the film crew or actors have to travel, at the most a day's shoot can last only three hours to four hours. Another reason why the Telugu film industry produces more films is the lucrative overseas market. Telugu films are being released in the US, UK, Japan, France, and Australia and their success has brought in money for producers.

However the number fell to 218 in 2009 due to several factors. Telugu film industry watchers pointed out that quite a few stars did not act in many movies as they feared that a flop might make their stock nose dive.

2010, 2011: Telugu is no.3, no.2

Suresh Krishnamoorthy | Telugu movies overtake Tamil films in number | APRIL 23, 2012 | The Hindu

In 2011, Bollywood churned out 206 films, while Telugu films stood at 192, with Tamil following with 185

Ever since the days of the movies, the Telugu film industry has generally been considered as second only to the Hindi industry. After Bollywood, tinsel town here has always been in the forefront, not just in the number of films produced, but in its technical excellence too.

On an average, an estimated 150 films are produced annually [in Telugu], with about a 100 more thrown in with films ‘dubbed' from Tamil, Hindi and English predominantly, year after year.

In its latest report, the Central Board of Film Certification certified that the Tamil film industry that was number two in the country after Bollywood, during the year 2008 and 2010 was overtaken by Telugu films.

2010 the Tamil industry saw 202 films hitting screens, while only 181 Telugu movies were made

2011 while [Filmistan] churned out 206 films, the number of Telugu films stood at 192, with Tamil following at 185.

This being the case as far as the numbers go, the trends of ‘hits' keep changing and while big budget films loaded with the routine commercial elements mostly attract attention at the box office, their smaller, lesser-privileged counterparts draw the spotlight on themselves every now and then solely on the strength of their story and screenplay.

2012 started with the Mahesh ‘Prince' Babu-starrer ‘Businessman' turning out to be a runaway hit, closely followed by ‘Victory' Venkatesh in ‘Bodyguard'. Of the about dozen films to hit the screens this year, these two big budget movies can easily be termed the biggest grosser. On the other end of the spectrum is ‘Ee Rojullo', a small film that was recently released and virtually re-wrote history. Patronised by movie-goers the way it was, it had the makers laughing all the way to the bank.

‘Lovely', that falls under the ‘small film' category did have a more-than-modest budget but went on to do fairly well, as did films like ‘SMS', ‘Love Failure' and ‘Ishq' in what is typically termed ‘more than average', in the industry. An enormous ‘disappointment' though, was Ramcharan Tej's ‘Racha' that failed to elicit the desired response.

The summer has a slew of really big films lined up including ‘Damarukam', ‘Adhinayakudu', ‘Gabbar Singh', ‘Dharuvu' and ‘Dammu', all with big cast and crew names and of course, ones where the producers has not spared any expense and has gone along with the directors in toto.

2011, 2012: the top 9 industries

2011:

1255 films were made in India

Hindi (206),

Telugu (192),

Tamil (185),

Kannada (138),

Bengali (122),

Marathi (107),

Malayalam (95),

Bhojpuri (74)

Gujarati (59).

2012:

1602 films were produced -

Tamil 262 films,

Telugu 256 films

Hindi films 221 films.

Malayalam (185),

Kannada (128),

Bengali (123),

Marathi (123),

Bhojpuri (87),

Gujarati (72).

Film Federation of India (FFI) secretary general Supran Sen is both proud about the fact and also unhappy. Only 10 per cent of the films produced can be described as real hits bringing in revenue. The others sink without a trace, Supran Sen said. Sen pointed out that through a large number of films are made, quite a few of them do not even get released. That means, though the Central Board of Film Certification (CBFC) has certified 1602 films in 35 languages, it could be that several of them would not even have had a theatrical release.

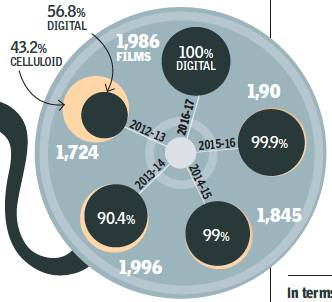

2012-17: films certified in India

See graphic:

Films certified in India, 2012-17, year-wise, share of celluloid and digital

From: November 27, 2017: The Times of India

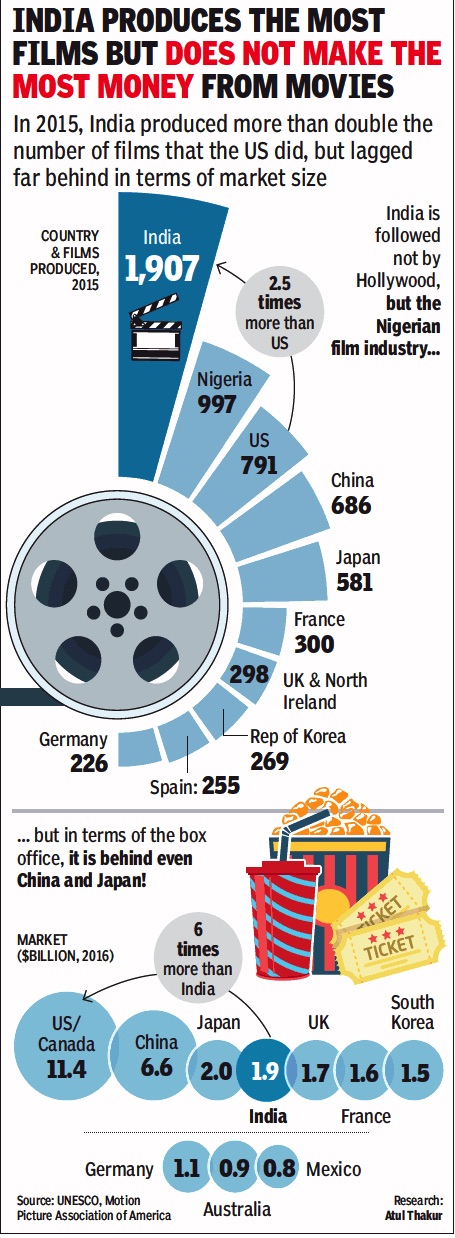

2015: Indian film industry, size and number of films

i) The size of the market, and ii) the number of films produced

From: December 5, 2017: The Times of India

See graphic:

The Indian film industry vis-à-vis other major film industries in 2015:

i) The size of the market, and ii) the number of films produced

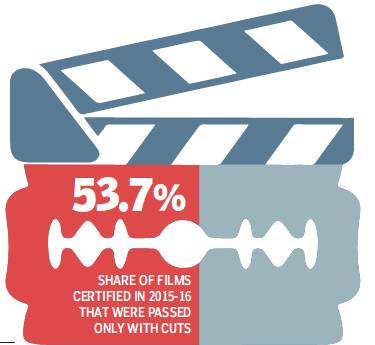

2015-16: number of films passed with only cuts

See graphic:

Share of films certified in 2015-16 that were passed only with cuts

From: November 27, 2017: The Times of India

2015-16, number of films passed with only cuts, language-wise

From: November 27, 2017: The Times of India

See graphic:

Films certified in 2015-16, with-without cuts, language-wise

2016

Domestic box office has remained stagnant at about $1.5bn

India produces 1,900 films a year on average

Hindi language 340 films

Tamil 291 films

Telugu 275 films

Kannada 204 films

Box office receipts

Right now [end of 2016], the Indian film industry has an annual revenue of around INR 138 Billion (13,800 Crores)

Hindi Film Industry- Annual Turnover

Hindi film industry alone contributes [? receives] a major 43% of the total [box office] revenue. That makes it INR 5,934 Crore for the year 2015.

Tamil Film Industry- Annual Turnover

Tamil It contributes [? receives] 19% of the total annual revenue of Indian Film Industry, which means in the year 2015 it had a turnover of INR 2,622 Crores.

Telugu Film Industry- Annual Turnover

The Telugu Film Industry earns 17% of total annual revenue of the Indian Film Industry. In the year 2015 it had an annual revenue of INR 2,346 Crores.

Malayalam Film Industry- Annual Turnover

Witnessing a growth and stability, the Malayalam film industry is going strong each year. Over 140 films were released during the year 2015 in Malayalam, making over INR 500 Million [crore?] at the box office over movie budgets of INR 120–150 million [crore?].

Kannada Film Industry- Annual Turnover

Kannada Film Industry is the smallest regional industry in the south. According to sources in the Karnataka Film Chamber of Commerce (KFCC), the annual turnover, which was in the range of INR 250-300 Crores till 2014, crossed INR 400 Crores in the year 2015.

Bengali Film Industry- Annual Turnover

Its annual turnover in the year 2014 was INR 150 Crores, which is equivalent of a budget for one star studded Hindi film.

2017: Hindi-Urdu 43%; Telugu + Tamil: 36%

Shuffle off, Bollywood: it’s time for Tollywood and Kollywood | May 18th 2017 | The Economist

India puts out around 1,500-2,000 films a year, according to industry estimates, more than anywhere else in the world.

Hindi fare of the sort Bollywood cranks out from Mumbai makes up less than a fifth of that, but accounts for 43% of national box-office takings, which are worth around $2bn.

That leaves a long tail of regional films, which must split around $1bn across 1,000-plus releases shot in 20 different languages. With an average take of well below $1m, few emerge from obscurity.

Kollywood (the Tamil-language industry in Tamil Nadu, which is based in a neighbourhood of Chennai called Kodambakkam) and Tollywood (which makes Telugu films in nearby Telangana)… “The[se] two south Indian film industries will soon overtake Bollywood,” says Shibasish Sarkar of Reliance Entertainment, a big non-Hindi producer. They already have a combined 36% at the box office.

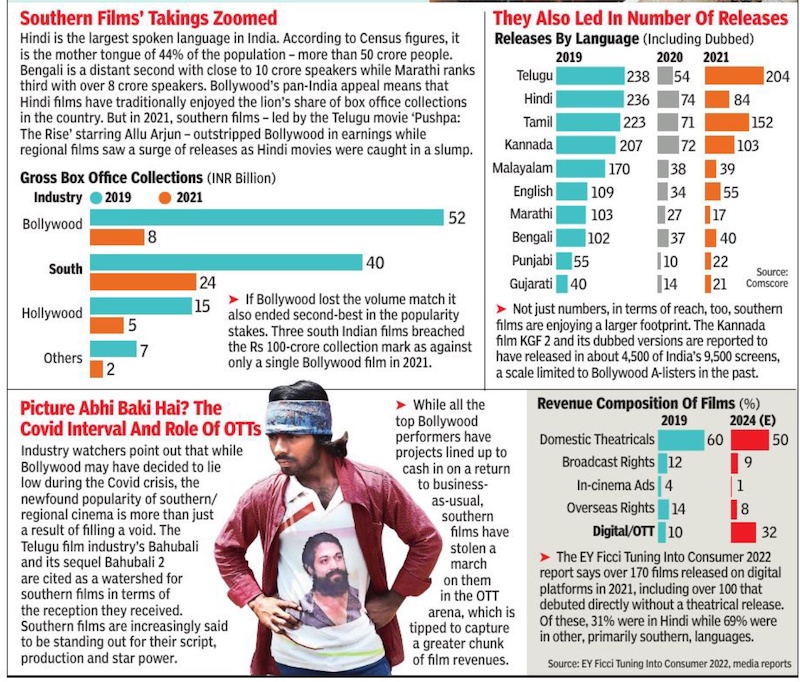

2020, 2021: affected by Covid lockdowns

Kaveree Bamzai/ Why Bollywood is losing out to films from South India/ - Times of India/ 16 Feb 19

From: May 22, 2022: The Times of India

See graphic:

Box office collections of the various film industries of India in 2020 and 2021.

2020

By 2020, the combined revenue of all the South Indian film industries (Telugu, Tamil, Kannada and Malayalam) had surpassed that of the Hindi film industry.

2021

Telugu film industry box-office collections ₹1,070 crore, from 180 films

Hindi film industry, ₹760 crore from 55 movies (stricter lockdowns)

Tamil film industry ₹700 crore.

The South Indian Film Industry

A FICCI and Ernst & Young overview, 2009

Overview of the South Indian Film Industry | November 28, 2009 | Box Office India

The South Indian region comprises of four states – Andhra Pradesh [later divided into AP n Telangana], Karnataka, Kerala and Tamil Nadu. [There is also the Tamil- speaking UT of Puducherry.] Together these states account for 21 per cent (240 million) of the Indian population and 24 per cent (INR 7405 billion) of the country’s gross domestic product (GDP). The region has high income levels as well. The per capita GDP of the four states is more than or marginally below the country’s per capita GDP.

The people of South India have unique cultures, tastes and media consumption habits which are quite different from those in the other parts of the country. Films and television are popular means of entertainment here. Films especially have an important place in the mind and the heart of South Indians. Leading actors enjoy a demi-god status and have large and fiercely loyal fan following.

The South Indian film industry has a long and rich history. It is a key contributor to the overall Indian film industry, in terms of number of films produced, revenues earned and employment generated. It has, by far, the largest share in the total number of films released per year.

Highlights from Indian entertainment down South, a report released by

FICCI and Ernst & Young

Market Size

The aggregate market size of the Tamil, Telugu and Malayalam film industry segments in FY09 in terms of total revenues generated by films is estimated to be around INR 17.3 billion.

Market Size by language Segments

Of the aggregate market size, the Telugu segment contributes around INR 7.7 billion, the Tamil segment INR 7.7 billion, the Malayalam segment INR 1.4 billion and the Kannada segment INR 0.5 billion.

In terms of overall share, the Telugu and Tamil segments account for approximately 45 per cent each. While the Malayalam segment accounts for 8 per cent and Kannada segment for 2 per cent.

Market Size by revenue streams

Among the various revenue streams, domestic theatrical revenue is, by far, the most dominant, accounting for nearly three-fourth (around INR 12.6 billion) of the total revenues earned. Revenues from cable and satellite (C&S) television rights come next in the list, contributing around INR 3 billion (17 per cent of the total revenue pie), followed by international theatrical rights, which contribute around INR 0.9 billion or 5 per cent of the total revenue pie. Other revenue streams namely, music rights, domestic home video rights, internet and mobile rights, etc contribute an aggregate around INR 0.8 billion or 5 per cent of the total revenues earned.

Key Strengths of the South Indian film industry

Large theatrical market:

A large number of people in South India watch movies on theatre screens. Domestic theatrical revenues are the most important source of revenue for the South Indian film industry. Despite a small geographic area, the theatrical collections from South Indian movies are high. The region houses 5,000 theatre screens, which is almost 50 per cent of the total number of operational theatre screens in India. In other words the proportion of people watching films to the overall population is much higher in Tamil Nadu and Andhra Pradesh than other parts of the country.

High levels of discipline

The South Indian film industry works in a disciplined manner. The movies have a well defined script. The actors, directors and crews adhere to the schedule. Producers and support staff stick to the production plan and the actors report to shooting on time and comply to their call sheets. The productivity levels are also high in the industry. Proper planning is done before the commencement of the shooting, which helps in monitoring and effective cost controls. The producers are generally more cost conscious and aim to reduce the avoidable costs incurred.

Technologically advanced

The technical professionals have been at the forefront of technological advancements in all areas – production, postproduction, distribution and exhibition. Presently most films incorporate digital intermediate (DI) and several of them have used computer graphics interface (CGI) for special effects or animation. The south film industry is ahead on its digitization curve with up to 40 per cent of the film prints released for the South Indian films are digital. Many players are adopting digital technology to combat piracy and improve transparency in revenue reporting.

THE KANNADA FILM INDUSTRY, 2007

T.V. Mahalingam | Business Today adds:

Films produced in 2006: 67

Number of hits (2006): 12

Number of distribution territories: Seven

Top grosser last year (2006): My Autograph, Rs 6 crore

Other major hits: Jothe Jotheyali, Huballi and Sevanthi Sevanthi

Major movie-going towns: Hubli, Belguam, Dharwad, Mysore, Bellary and Mandya

Number of multiplexes in state capital: Five; total theatres in major cities, 1,200

Average size of big budget movie: Rs 3.5 crore

Average size of medium budget movie: Rs 75 lakh

Average time taken for movie making: 7 months

Top stars and their fee per film: Shivaraj Kumar, Puneet, Ravichandran, Sudeep, Upendra. All charge upwards of Rs 30 lakh

Such steep prices have forced producers and directors to look beyond predictable star casts and run-of-the-mill plots. Take the case of the Kannada industry, popularly referred to as Sandalwood. While the industry was driven for decades by pairing popular (and ageing) heroes such as Rajkumar, Vishnuvardhan and (former mp) Ambareesh with a crop of lesser paid (and often much younger) actresses, producers and directors seem to have taken a reality check recently. "There was a wave of poorly-made remakes for many years, but that has changed recently with movies such as c/o Footpath, Nenapirali, Mungarina Malle and Jothe Jotheyali all providing some fresh ideas and that too from first-time producers," says H.R. Srikanth, who produced his 11-old-year-son Kishen's directorial debut c/o Footpath. Moviemakers such as Srikanth also say the industry is getting more professional, with over-the-counter payments, bound scripts and new ideas all slowly, but surely, becoming the norm.

End of the Business Today data for 2007. The FICCI and Ernst & Young overview, 2009| Box Office India, resumes below.

The Kannada film industry, 2009

Introduction

The cinema of Karnataka, sometimes colloquially referred to as Sandalwood, encompasses movies made in the Indian state of Karnataka. Kannada industry completed 75 years. The Kannada film industry, on an average produces 120 to 150 films a year. According to Karnataka Film Chamber of Commerce, only a handful of these recover costs, while most of the others incur losses.

Market Size

The market size of the Kannada film industry segment is estimated to be around INR 500 million, in terms of total revenues generated by films in FY09. However the total cost of making films is much higher and hence the industry is making losses at present. The Kannada film industry depends mainly on domestic theatrical revenues, like its Tamil, Telugu and Malayalam counterparts. Domestic theatrical revenues contribute half of the total revenues earned by films (INR 250 million). The other major revenue stream is C&S television rights (INR 125 million), while other revenues streams such as home video rights, music rights and international theatrical form the balance. International rights are a miniscule portion as compared to the other two.

The Malayalam film industry, 2009

Introduction

The Malayalam film industry is smaller than its Tamil and Telugu counterparts. However, the industry is unique in the sense that the Malayalam films are based on more artistic values and the content is natural and realistic. Not all films are made for commercial value, many are made for aesthetic and cultural values. As a result, Malayalam films have won numerous national awards. Many successful Malayalam films have also been remade into films into other South Indian languages and Hindi. The industry has also contributed excellent technicians to the Hindi film industry and some of its directors are highly reputed for their skills. On an average, the Malayalam film industry produces around 70 -90 films per year. However, similar to Tamil and Telugu segments, many films are not released in the theatrical market owing to lack of market interest and a large percentage of films released fail to perform. The number of Malayalam films released from 2004 to 2008 has been declined from 69 in 2004 to 63 in 2008. The time taken to make a film depends on several factors – the budget of the film and its production values, the theme of the film, the availability of actors, the quantum of computer graphics usage, etc. In comparison to the Tamil and Telugu segments, the Malayalam industry is largely disciplined and completes films in a shorter time period with smaller budgets. The time taken to make a film varies from 90 days to 150 days, while the period of shooting is typically 45 to 50 days.

Market Size

The market size of the Malayalam film industry segment is estimated to be around INR 1.4 billion FY09, in terms of total revenue generated by films. This market is shared between the key players in the industry, namely the producers, distributors and exhibitors.

THE TAMIL FILM INDUSTRY, 2007

T.V. Mahalingam | Business Today adds:

Films produced in 2006: 162

Number of hits (2006): 25, five were mega hits

Top grosser last year: Varalaaru, Rs 55 crore

Other major hits: Vettaiyadu Valaiyadu, Rs 50 crore; Tiruttu Payale, Rs 40 crore; Imsai Arasan 23am Pulikesi, Rs 15 crore

Major movie-going towns: Madurai, Coimbatore, Salem, Tirunelveli and Tiruchirappalli

Number of multiplexes in state capital: 18 screens that can be termed as multiplex; number likely to go up to 80 by 2010

Average size of big budget movie: Rs 22 crore

Average size of medium budget movie: Rs 7 crore

Top stars and their fee per film: Rs 5 crore or 30 per cent of movie budget. Super stars Kamal Hassan and Rajinikanth charge anything upwards of Rs 9 crore

Tamil New Year's day (April 14) will witness the clash of celluloid titans- Rajinikanth and Kamal Hassan-with the release of their mega-budget movies, Sivaji and Dasavatharam. Both movies have been made at budgets exceeding Rs 30 crore. Even though both movies are likely to open to packed houses, things have changed substantially since the 90's when the duo ruled the box office. A new breed of actors including Vikram, Surya, Ajith and Vijay has emerged as dependable box office stars.

That has resulted in two things. One, the budgets and returns of movies have got bigger. For example, Kamal Hassan's previous movie, Vettaiyadu Vilaiyadu (2006), was made at a cost of Rs 24 crore and grossed Rs 50 crore. Two, a lot more medium-sized and small-budget 'experimental' movies are being produced and becoming successful. Tamil industry watchers believe that in the first half of 2006, 35 per cent of the movies that came out were made within the budget of Rs 1.5 crore to Rs 3 crore. Similarly in the Telugu industry, almost half of the movies produced are mid-budget ventures (Rs 3-5 crore). The boom in budget movies can be partly attributed to the burgeoning costs of the stars of the South Indian film industry. Industry insiders say that Tamil 'superstar' Rajinikanth charges upwards of Rs 9 crore, while Telugu 'megastar' Chiranjeevi demands anything above Rs 3.5 crore.

End of the Business Today data for 2007. The FICCI and Ernst & Young overview, 2009| Box Office India, resumes below.

The Tamil Film Industry, 2009

Introduction

The Tamil film industry, on an average produces around 130 to 150 films per year. A significant number of films produced however are not released in the theatrical market owing to lack of market interest. Even among the films that are released, a large percentage fails to recover their costs. In fact these days flop films barely recover their print and publicity costs. The entire money invested in their production is lost. The number of films certified has increased over 2004-08 period, from 120 in 2004 to 173 in 2008. The time taken to make a film depends on several factors – the budget of the film and production values, the theme of the film, the availability of actors, the quantum of computer graphics usage, etc. On an average the industry takes about 8-12 months for a small budget film, 10-14 months for a medium budget film and 12-18 months for a large budget film. The number of days of shooting varies from 60-90 days for a small budget film to 90-120 days for a medium budget film to 140 -200 days for a large budget film.

Market Size

In FY09, the market size of the Tamil film industry segment is estimated to be around INR 7.7 billion, in terms of total revenues generated by films. This market is shared between the key players in the industry, namely the producers, distributors and exhibitors.

Key territories

The key territories in the international theatrical market for Tamil films are Malaysia, Singapore, Sri Lanka, the Middle East, the U.S and Canada, and the U.K, Europe and Australia-New Zealand. For a big budget film with a well known star cast, the U.S and Canada territory contributes 20 per cent of the international revenues. While the U.K, Europe and Australia-New Zealand territory contributes another 20 per cent. For a medium budget film, these two territories together contribute only 10 per cent of international revenues. Small budget films are not released at all in theatres in these markets.

THE TELUGU FILM INDUSTRY, 2007

T.V. Mahalingam | Business Today adds:

Films produced in 2006: 245

Number of hits (2006): 10

Number of distribution territories: 3

Top grosser last year (2006): Pokkiri with close to Rs 40 crore (the highest ever in the industry's 75-year history)

Other major hits: Stalin (Rs 33 crore), and Bommarillu (Rs 20 crore)

Major movie-going towns: Nellore, Tenali, Miryalguda and Nandiyal

Number of multiplexes in state capital: Two

Average size of big budget movie: Rs 12-15 crore

Average size of medium budget movie: Rs 5-8 crore

Average time taken for movie making: 2.5 months

Top stars and their fee per film: Chiranjeevi, Rs 3.5 crore; Balakrishna, Rs 2 crore; Nagarjuna, Rs 2 crore; Venkatesh, Rs 1 crore to Rs 1.5 crore; Ravi Teja, Rs 1 crore-plus

Reel rush: Filmgoers at Prasads IMax, Hyderabad. 245 films were made in Telugu last year; Telugu actor Chiranjeevi (bottom)

Here's a quick quiz. In which language were the most films produced in India in 2006? No, it's not Hindi. The answer-Telugu. "Of the 1,091 movies produced in India last year, 245 were made in Telugu, 223 in Hindi and 162 in Tamil," reveals Sen. Basically, only one in every five movies made in India is churned out by Bollywood. And it's just not the volume of regional movies being made that's astonishing. The Telugu industry registered its biggest hit ever with Pokkiri, which raked in close to Rs 40 crore in box office collections. In fact, industry association FICCI had valued the Indian film industry at Rs 6,800 crore in 2005. The industry is projected to grow at CAGR of 18 per cent to Rs 15,300 crore by 2010. "It would be safe to assume that the size of the regional film industry today would be about 55-60 per cent of the total Indian film industry," says a leading film analyst. That means regional film industry revenues of Rs 4,400 crore in 2006.

That's why we are now seeing NRIs, real estate brokers getting into this. Nearly 70 per cent of new crop of film promoters today are such people," says Ramanaidu, who points out that only 10 per cent of the movies go on to become hits.

Other film industry watchers in Hyderabad support this view. "Every month, at least a couple of people with no film background and as diverse as being into brick and sand business come to me for a signature to join the producers council," says D. Suresh Babu, President, Suresh Productions, and elder son of Ramanaidu and elder brother of well known Tollywood star Venkatesh.

Packed house: With box office collections close to Rs 40 crore, Pokkiri was a Telugu blockbuster that was remade in Tamil as well

End of the Business Today data for 2007. The FICCI and Ernst & Young overview, 2009| Box Office India, resumes below.

The Telugu Film Industry, 2009

Introduction

The Telugu film industry is the most prolific producer of films in the overall south Indian film industry. On an average, the industry produces around 250 to 270 films per year. Like the Tamil industry a significant number of films do not make it to the theatrical market. The success ratio, similarly, is low and a large percentage of films fail to recover the investment made in them.

The time taken to make a film depends on several factors – the budget of the film and its production values (represented by the shooting location, costumes, sets, action, scenes etc.), the genre and the theme of the film, the availability of the dates of the character actors, extent of usage of special effects and computer graphics etc. On an average the industry takes about eight to ten months for a small budget film, 10-12 for a medium budget film and 12-15 months for a large budget film. The number of days of shooting varies from 60-80 days for a small budget film to 80-100 days for a medium budget film to 150-200 days for a large budget film.

Market Size

The market size of the Telugu film industry segment is estimated to be around INR 7.7 billion for FY09, in terms of total revenues generated by films. This market is shared between the key players in the industry, namely the producers, distributors and exhibitors.

Key territories

For the purpose of distribution, the domestic theatrical market for Telugu films is divided into several territories. Those territories have varying venue potential. More than 80 per cent of theatrical revenues come from the AP market. Nizam, which earlier used to account for around 25 per cent of AP theatrical revenues, has increased its share to 35-40 per cent at present, primarily on account of development of multiplexes in Hyderabad. Ceeded, too, has increased its share marginally, from around 16 per cent earlier to around 20 per cent at present. Other than AP, Telugu films have a significant market in the states of Tamil Nadu and Karnataka. Around, 20-25 per cent Telugu films are released in Tamil Nadu. Earlier these films used to be dubbed or remade into Tamil films but of late, with increase in Telugu speaking population in Tamil Nadu, they are being released as straight films. Telugu films are also released as straight films in Karnataka, which contributes around 3 per cent of AP theatrical revenues. A few Telugu films (around 8-10 per year) are dubbed into Malayalam and released in Kerala. Some highly successful Telugu films are also remade in Hindi and other Indian languages.

Other Indian cinemas

2007

T.V. Mahalingam | The Boom In Regional Films | April 8, 2007| Business Today, with additional reporting by Ritwik Mukherjee, Rahul Sachitanand, E. Kumar Sharma, Pallavi Srivastava and Nitya Varadarajan

India's economic prosperity is scripting an unlikely story: The market for regional films has come roaring back, with Bhojpuri to Tamil to Punjabi to Telugu movies raking in record moolah at the box office.

Reel rush: Filmgoers at Prasads IMax, Hyderabad. 245 films were made in Telugu last yearIn January last year, something queer happened in Mumbai. The Amitabh Bachchan-starrer Family was released simultaneously with the über-cool, ultra dark Sanjay Dutt thriller Zinda. Both movies had tepid openings and flopped subsequently. But that's hardly strange. Flops, especially costly ones, are more the norm than the exception in Bollywood. What was bizarre was the fact that the competition for Big-B and Deadly-D came from unlikely quarters-Manoj Tiwari, the Jerry Lewis of Bhojpuri cinema, who sang, danced and, of course, emoted his way to box office glory. The movie, Dehati Babu, went on to become the biggest Bhojpuri hit of 2006.

The boom in regional movies has also resulted in more and more films being shot in studios down south. "In the last one year, there has been a 50 per cent increase in the number of movies being shot here," says G. Sudhakar, General Manager (Film Marketing), Ramoji Film City. However, Mumbai continues to remain the major hub for film production, thanks to the spurt in Bhojpuri, Marathi and Punjabi movies. According to the Film Federation of India, Mumbai was the biggest centre for film production, accounting for 403 of the 1,091 films produced. Hyderabad accounted for 220 films followed by Chennai at 205 films.

Starting young: Kishen made his directorial debut at 10. The story is similar in other regional industries, too. Ask 70-year-old D. Ramanaidu, the man who holds a Guinness Book record for most movies made under one banner, on what's driving people to make more Telugu movies, and he'll tell you as it is. "There are no entry barriers here. If you have the money, you can get to promote a film.

Ready to roll: Director Prabhat Roy says low budget Bengali films are a thing of yoreRegional producers are also beginning to focus on non-theatrical revenues like music rights, VCD rights sales and international rights sales. Even laggards like the Punjabi film industry have learnt to tap non-theatrical revenues. Manmohan Singh, a cinematographer-turned-director, has made blockbuster movies such as Jee Aayan Nu, Asa Nu Maan Watna Da and Yaaran Naal Baharan. His last movie, Dil Apna Punjabi (2006), was the first movie in the state to cross the magical Rs 10-crore mark in revenues.

This tips-produced movie had a 12-week run at the box office and did business worth Rs 4 crore in the country. Singh also released the movie in Australia, Norway, New Zealand, France, Spain, Italy and Germany, apart from usual markets like the UK, the us and Canada. "Even DVD, VCD distribution is a huge revenue-earner. For Dil Apna Punjabi, we did something between Rs 1.25-Rs 1.5 crore from both domestic and overseas market," says Singh.

Audio, DVD, VCD and theatrical rights for Rajinikanth's yet to be released Sivaji are being negotiated by Chennai-based AVM studios for a release in Europe, Singapore, Sri Lanka, and West Asia. The movie is also slated to hit theaters in the US, Malaysia, Australia, New Zealand, South Africa, and Mauritius. Bhojpuri movie producers too have started seriously selling VCD and music rights. "Music rights are sold at Rs 7-15 lakh per movie, while hit VCD rights can sell between Rs 15 lakh and Rs 22 lakh. There is a huge audience for Bhojpuri movies in countries like Fiji, Nepal, West Indies and Indonesia," says Bhojpuri director Rajkumar R. Pandey.

With audiences like these, it won't be long before a Ravi Kishen or a Balakrishna becomes the face of Indian cinema across the world. Cooking roast chicken on Big Brother (think Shilpa Shetty) may not be the only way.

THE BENGALI FILM INDUSTRY, 2007

T.V. Mahalingam | Business Today adds:

Films produced in 2006: 35

Number of hits in 2006: Four

Number of distribution territories: Six major territories, plus 1 overseas

Top grosser last year (2006): MLA Fata Kesto, Rs 80 lakh-Rs 1 crore

Major movie-going towns: Haldia, Behrampur, Siliguri, Burdwan and Malda

Number of multiplexes in state capital: Four

Average size of big budget movie: Rs 1.5-1.6 crore

Average size of medium budget movie: Rs 70-80 lakh

Average time taken for movie making: Six months

Top stars and their fee per film: Mithun Chakraborty, Rs 15 lakh-Rs 50 lakh; Prosenjit, Rs 10 lakh-Rs 35 lakh; Jeet, Rs 10-30 lakh

The Bengali film industry, renowned for its brand of arty and sedate cinema, is also witnessing a turnaround. "The industry, seven-eight years ago, was plagued by the maladies of low budgets, poor production values and zilch marketing effort. That's passé now," says Prabhat Roy, one of the best-known film directors. The turnaround started in 2002 and since then, budgets have increased and production standards have improved. The Bengali film industry now churns out 50 movies a year with the market estimated to be worth around Rs 150 crore.

As a result, big Bollywood banners are foraying into the industry and "Ideas", a local film production company floated by Bengali superstar Prosenjit, is working on producing Bengali films. "If you make a good vernacular film, production costs are much lower and you tend to make more profits, says Shrikant Mohta, Director, Shri Venkatesh Films, a leading production house. As a result, Bengali actresses such as Rituparna Sengupta, Roopa Ganguly and Indrani Halder have floated production houses.

THE BHOJPURI FILM INDUSTRY, 2007

T.V. Mahalingam | Business Today adds:

Films produced in 2006: 77

Number of hits (2006): Five

Number of distribution territories: Bihar, UP, Mumbai, and parts of Punjab and West Bengal

Top grosser last year (2006): Dehati Babu, Rs 1.45 crore

Average size of big budget movie: Rs 55 lakh (recently movies have been made for Rs 1-1.5 crore)

Average size of medium budget movie: Rs 35 lakh

Average time taken for movie making: 2-4 months

Top stars and their fee per film: Manoj Tiwari, Rs 30-45 lakh; Ravi Kishen, Rs 15-25 lakh; Nagma, Rs 8-12 lakh; Rambha, Rs 5-10 lakh

The success of Dehati Babu is no flash in the pan. The once down-in-the-dumps industry has been on a roll for the last three years. Today, Bhojwood has its own Oscars, cheekily christened, BFA-the Bhojpuri Film Awards. Star rates have more than tripled over the last year, with Manoj Tiwari charging as much as Rs 50 lakh per film. "The number of Bhojpuri movies being produced almost doubled from 39 in 2005 to 76 last year. That makes it the fastest growing film industry in India," says Supran Sen, Secretary, Film Federation of India.

Evidently, regional Indian cinema has achieved in the past three years what every corporate in India also has on its wish list-attract funds, hire and retain fresh talent and go global. But things weren't always this good. For Bhojpuri cinema, for instance, the 90's were a horrific period. Less than 20 movies were being made a year, and most of them flopped. 2004 was a watershed year with superhit movies like Panditji Bataai Na Biyah Kab Hoyee and Sasura Bada Paisewala. The success of these films opened up a market, which led to a spate of first-time producers thronging to make Bhojpuri movies. Like Sudhakar Pandey, who has produced hit Bhojpuri movies such as Sasura Bada Paisewala, and Daroga Babu I Love You. "I had a shaukh (hobby) for music. And I used to produce Bhojpuri music albums with popular singers like Manoj Tiwari. These albums used to cost Rs 10-15 lakh to make. And then, I realised that it was possible to make a Bhojpuri film for Rs 30-35 lakh. That's how I got into movies," says Pandey, who used to be in the 'clearing and forwarding business' before making a plunge into movie production in 2002. According to industry watchers, in 2006 alone, Rs 90 crore worth of Bhojpuri movies were produced-up from about Rs 55 crore in 2005. In fact, liquor baron Vijay Mallya is said to be bankrolling a Bhojpuri movie, even as Balaji Telefilms is remaking Hindi blockbuster Sholay in Bhojpuri with yesteryear matinee idol Jeetendra playing Thakur.

THE PUNJABI FILM INDUSTRY, 2007

T.V. Mahalingam | Business Today adds:

Films produced in 2006: 12

Number of hits (2006): Four

Number of distribution territories: Punjab, Haryana, parts of Delhi and Himachal Pradesh

Top grosser last year (2006): Dil Apna Punjabi, Rs 10-12 crore

Major movie-going towns: Ludhiana, Chandigarh Jalandhar, Amritsar & Patiala

Number of multiplexes in state capital: One

Average size of big budget movie: Rs 3-6 crore

Average size of medium budget movie: Rs 1.5 crore

Average time taken for movie making: 35-50 days

Top stars and their fee per film: Harbhajan Maan, Rs 60 lakh; Gurdas Maan, Rs 55 lakh; Babbu Maan, Rs 30 lakh; Neeru Bajwa, Rs 20 lakh.

Dubbed films

Dubbing: The economics, 2012

S Shyam Prasad| THE ECONOMICS OF DUBBING | Bangalore Mirror| Jul 15, 2012 | The Times of India

While the pro and anti-dubbing lobbies go hammer and tongs at each other, those in the know say it does not make business sense to dub films in Kannada, Marathi and Malayalam

shyam.prasad1@timesgroup.com

Of late, every controversy in Sandalwood is linked to the dubbing issue. A few weeks ago, producer Soorappa Babu filed a complaint against Shiva Rajkumar to get back the advance he paid for a movie. This is being linked to the actor’s regular warning against the pro-dubbing lobby — Babu is said to be in favour of dubbing.

- Every other day, rumour mills are abuzz that dubbing of 100-200 films into Kannada is underway. And everyone seems to have an opinion on the issue. After the success of Sudeep in Eega/ Naan Ee, Kannada producers Ramu and K Manju decided to release his dubbed Kannada films in Tamil and Telugu. Sudeep asked why other language films were not being dubbed in Kannada.

- However, the real decision makers on the issue say, dubbing into Kannada is uneconomical. If you buy the dubbing rights of a Rajinikanth or Shah Rukh Khan film in Kannada, you will lose money. People in the dubbing business bet their last shiny-shirt on their backs on this one simple truth. Every discussion in Sandalwood in the last few months has veered towards ‘dubbing’ in the end. The film industry has steeled itself against the onslaught of a‘consumer group’ which is demanding dubbed content in Kannada, especially films. However, the suppliers say that the demand in Kannada is not big enough to warrant an investment of time, money and effort. For years now, big Hollywood films are being dubbed in Hindi, Tamil and Telugu. However, other languages which have reasonable film industries like Marathi, Malayalam, Bengali and others do not get to see these dubbed films in their languages. The reason, say suppliers, is plain economics.

- According to the operations head of a Mumbai based production house, “Dubbing a Hindi film in Marathi does not make sense because most people watch Hindi films. Dubbing a Tamil film in Malayalam does not make sense for the same reason. So you see more Telugu films are dubbed in Malayalam while Tamil films are released in the original language in Kerala”. In Kannada, it is slightly different. The total number of film tickets sold is comparatively less than other south states and the number of people watching a Kannada film is even less. Kannada moviegoers constitute about 35 per cent of the total audience in Karnataka. Hindi, Tamil and Telugu have a minimum of 20 per cent each. So a Hollywood movie dubbed in Hindi, Tamil and Telugu will cover more than three-fourths of the audience and there is no need to dub it in Kannada. Since most top Tamil and Telugu films are dubbed or made in both these languages, they too cover about 50 per cent of the movie goers in Karnataka without having to dub in Kannada. Original producers and distributors will therefore not take a risk in these markets. If someone wants to buy the rights and dub them, rights will be sold.

- Prashanth Sambargi, who has dubbed Kannada films to Hindi, has been approached to coordinate dubbing of Telugu and Tamil films in Kannada. According to him the real problem lies with the small percentage of movie goers in Karnataka. He says, “The annual revenue for Kannada films in a year is about Rs 100 crore. There are only 380 registered theatres with an average seating capacity of 400. The average occupancy is about 50 per cent for non-Kannada and 40 per cent for Kannada films. About 9 lakh people watch Kannada films every week out of a total of about 27 lakh people for all languages. A dubbed Hindi or Telugu film in Kannada will cost about Rs 50 lakh. This has to be recovered from these 9 lakh Kannada audience where ticket rates are lower than theatres screening non-Kannada films”.

SMALLER STARS BIGGER PROFIT

There are four important cost factors to dubbing a film in Karnataka. The cost of song re-recording could be approximately Rs 10 lakh. If Sonu Nigam has sung in a Hindi film, hiring him for the Kannada version would be expensive. A local singer will come much cheaper. Second cost is translation which could be anywhere from Rs 50,000 to Rs 2 lakh and takes three days. Cost of the dubbing artistes is Rs 2 lakh. If the script of an original language has to be altered — a newspaper or a name board on celluloid— it will cost about Rs 1 lakh. Marketing costs will be about Rs 25 to Rs 30 lakh for the state. If it is a local producer who is doing the dubbing, he has to purchase the rights which will be the biggest variable input cost.

- Sambargi says it will be uneconomical to dub big films. He says, “The distribution rights of a Rajinikanth’s Tamil film in Karnataka costs many crore of rupees.If you buy the dubbing rights for his film, it would be impossible to recover the costs. Big films of other languages demand huge sum for dubbing rights. So it is mostly lesser known stars of other languages whose films are dubbed to make a profit. These films have to be purchased for about Rs 15 to Rs 20 lakh each. It would be economical to dub the films of smaller stars from Tamil or Telugu in Kannada. But original producers themselves are averse to dubbing in Kannada or Marathi.”

A top Kannada film producer and distributor says the cost of dubbing a film into Kannada can be broughtdowntoRs15lakh.He says, “Even if Amitabh Bachchan has sung the song, we can re-record it by a local singer.” Many Kannada, Tamil and Telugu films are dubbed into Hindi just for TV and not for theatrical release. This kind of dubbing costs about Rs 5 lakh apart from the rights. A couple of dubbing artistes will dub for all characters and even the song recording is done cheaply. Only this kind of compromise on quality can make dubbed films viable in Kannada, he added.

NUMBER GAME

35% constitute Kannada moviegoers out of the total movie audience in Karnataka

100 crore is the revenue for all Kannada films in a year

9 lakh people watch Kannada films every week

18 lakh people watch other language films every week

50 lakh is the cost of dubbing a Hindi or Telugu film in Kannada

10 lakh is the cost of re-recording a song in Kannada

50 thousand to 2 lakh is the cost of translating a script into Kannada

2 lakh is the cost of dubbing artiste.

30 lakh is the cost of marketing a dubbed film in Kannada in the state

The international (aka overseas) market

The traditional markets for Indian films, as in 2017

The so-called “traditional” market for Indian films is a block of 50 territories with the biggest being the US, the UAE, the UK, Singapore, Malaysia, Hong Kong, India’s south Asian neighbours, Australia and New Zealand, and North Africa, with some pockets in France, Germany and Switzerland.

Elsewhere, Indian films were popular in Russia and China in the 1950s, particularly actor/film-maker Raj Kapoor’s blockbuster Awara, while dancing action star Mithun Chakraborty enjoyed fame there with his 1982 film Disco Dancer.

However, of late, Indian studio majors have been striking out into non-traditional territories with dubbed or subtitled versions of films: Ki & Ka was released in territories as diverse as Ivory Coast, Zimbabwe and Gibraltar; Bajrangi Bhaijaan in Morocco, Tunisia and Poland; and Mary Kom in Kazakhstan, Azerbaijan, and Kyrgyzstan.

Indian producers have utilised every trick in the book to reach overseas audiences. Arka hired François Da Silva, former artistic director of Cannes’ directors’ fortnight, to sell and market the film internationally. Non-Indian behind-the-camera talent is increasingly common. Leena Yadav’s female empowerment saga Parched, in Hindi, boasts Titanic cinematographer Russell Carpenter and The Descendants editor Kevin Tent.

Accessible English-language titles are also on the rise. Pan Nalin’s Angry Indian Goddesses, billed as India’s first female buddy movie, sold to 61 territories internationally. Nalin says: “Based on my past movies and gaining some experience with international distribution one thing I realised is that it’s not enough to just have a great movie. We also need a great title which is universally appealing. Titling it in English has paid off. Across the world, the moment we utter or read Angry Indian Goddesses it puts a smile on faces.”

All the major Hollywood films are released in English and in Hindi, Telugu and Tamil dubs, demonstrating that India loves global tentpoles, provided they speak in their own tongues. (Appropriately, the highest grossing Hollywood film in India is the India-set The Jungle Book, which roared to $28m in 2016.)

Telugu films after Bãhubali / 2016

Lata Jha | Telugu films storm the US market | Fri, Feb 17 2017 | Live Mint

What has contributed to the numbers is the sizeable number of Telugu-speaking people in the US, mainly in the 35-40 age group

The trend started nearly two years ago with the phenomenal success of S.S Rajamouli’s ‘Baahubali: The Beginning’ (2015) that made around $7 million in the US.

New Delhi: Earlier this month, Telugu romantic comedy Nenu Local opened to $160,716 (Rs1.08 crore) in the US. Starring Nani and Keerthy Suresh, the multiplex film that is not high on star value, as independent trade analyst Sreedhar Pillai puts it, may have packed in $ 828,204 (Rs5.55 crore) within five days, showing 130% growth on weekdays. However, it is not the first Telugu offering to have stormed the US market.

Last month during Pongal, family drama Sathamanam Bhavati, Chiranjeevi-starrer Khaidi No.150 and epic historical action film Gautamiputra Satakarni earned $653,664 (Rs4.45 crore), $2,361,969 (Rs16.08 crore) and $1,571,487 (Rs10.70 crore), respectively, within two weeks in the US.

The trend, however, started nearly two years ago with the phenomenal success of S.S Rajamouli’s Baahubali: The Beginning (2015) that made around $7 million in the US. Allu Arjun’s action film Sarrainodu (2016) that made $678,519 at the US box office in its first weekend is another success story.

“Telugu films have consistently dominated the US market and have emerged as a major source of international revenue. They have even managed to eclipse Hindi films in some cases,” said trade analyst Taran Adarsh. “The three major Sankranti releases especially did phenomenally well.”

Ok Jaanu, the Hindi release during the Sankranti period, opened at $211,660 in comparison.

What has contributed to the numbers is the sizeable number of Telugu-speaking people in the US, mainly in the 35-40 age group, from various parts of Andhra Pradesh, including Vijayawada and Hyderabad.

“These are immigrants, both male and female, who work in the information technology sector mainly in the West Coast and are settled there with family,” said Atul Mohan, editor of trade magazine Complete Cinema. “They watch these films avidly.”

As with many Hindi films, the success of Telugu cinema in the US is driven by mainstream family entertainers and star-driven commercial potboilers. Actors like Mahesh Babu, Nithiin, Ram Charan, Pawan Kalyan and Nandamuri Taraka Rama Rao Jr. tend to be most popular and often notch up hits even with films that are commercial failures in India. For example, Kalyan’s tepidly received action film Sardaar Gabbar Singh (2016) made $1,058,000 in the US within 10 days.

Pillai said a big-ticket Telugu film can notch up the same screen count as a Hindi release—300-400 cinemas.

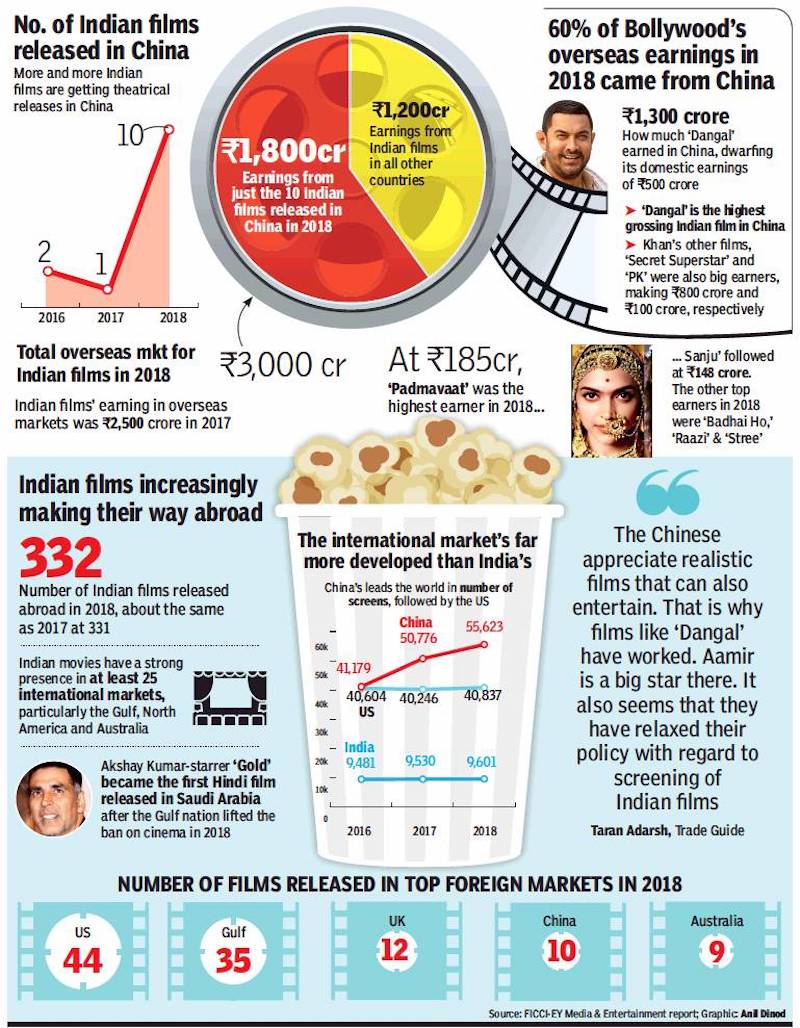

2018: China becomes the biggest foreign market

March 23, 2019: The Times of India

ii) Earnings from China vis-à-vis the rest of the world, 2018;

iii) The number of screens in China, the USA and India, 2016-18;

iv) The number of Indian films released in India’s main international (hitherto called ‘overseas’) markets in 2018.

From: March 23, 2019: The Times of India

See graphic:

i) Indian films released in China, 2016-18;

ii) Earnings from China vis-à-vis the rest of the world, 2018;

iii) The number of screens in China, the USA and India, 2016-18;

iv) The number of Indian films released in India’s main international (hitherto called ‘overseas’) markets in 2018.

HOW CHINA’S BECOME THE BIGGEST FOREIGN MARKET FOR BOLLYWOOD

India’s film industry is a global powerhouse. In 2018, Indians made and watched 1,776 films across several languages, garnering more than Rs 7 lakh crore in revenues. And while India is an increasingly important market for international releases, Indian movies are also becoming a valuable export. The Indian diaspora across the world is an obvious market, but it’s the Chinese market that holds the most monetary promise for Indian films

Cinema Halls/ Theatres

Number of screens: 1980s- 2017

According to industry estimates, India had 11,000-12,000 cinema halls in the late 1980s. By December 2017, the numbers had dipped to less than 5,000 single-screen theatres, partly compensated by the advent of more than 3,000 multiplex screens. (Avijit Ghosh | You can’t go to the movies in this Punjab town | Feb 18, 2018 | The Times of India)

For example, take Batala (Punjab)

(Avijit Ghosh | You can’t go to the movies in this Punjab town | Feb 18, 2018 | The Times of India)

Krishna Talkies came up before Independence, is history. Along with Rose Cinema, Krishna Talkies called it curtains in 2004-05. [From 2005 to 2018], this Punjab town [Batala] has had no theatre.

Batala isn’t really an isolated case.

For Batala’s theatres, the hard times began in the early 1980s when pirated video cassettes began luring family audiences away. The rise of insurgency in Punjab made it worse. Krishna Swarup, its former co-owner, recalls: “During 1983-84, militants twice tried to set fire to Krishna Talkies. A desi bomb was also hurled once. People became too scared to visit theatres.”

With the state government imposing a fixed high entertainment tax, losses mounted. “It was difficult to pay salaries to the staff,” Swarup adds. Blockbusters such as Hum Aapke Hain Koun, Dilwale Dulhania Le Jayenge and Border ran for months in the 1990s but those were the last high notes. For a few years, the theatres survived on a diet of “sex movies” [mostly dubbed from another Indian language] before the end credits rolled.

Thanks to satellite TV, pirated CDs, and streaming sites, viewers have many more options today.

A generation of boys and girls in Batala and its surrounding villages has grown up without going to the movies. Shopkeeper Deepak Mahajan did travel once with his wife to Amritsar, about 35km away, to watch [a] Punjabi hit. But such occasions are rare as they cost money — for toll, petrol, multiplex ticket, lunch — and require planning. “We spent more than Rs 1,000, while a trip to the local theatre would have cost less than Rs 200 for the entire family,” says Mahajan.

The absence of a movie theatre is particularly hard for those who can’t afford smartphones. For some undergraduate students at R R Bawa DAV girls’ college, going to Amritsar for a movie is a once-a-year kind of thing. One of them said she borrows her brother’s smartphone to watch movies.

Krishna Talkies, located in the heart of the town, was bought by a local businessman, Harvinder Singh. “The area wasn’t enough to construct a miniplex,” he says. Part of Krishna’s compound has morphed into a food street where hawkers peddle dosa, chowmein, momos, tikki and burger. The Rose complex is overrun with wild undergrowth and dying trees. Barring the fading letters, R and S in iron, there is no evidence of its cinematic past.

Theatre staff were like celebrities because knowing them meant access to tickets for the first day, first show. “Even a gatekeeper like me was in demand. They used to refer to me respectfully as paaji (elder brother),” says Kumar. After the theatre shut down, he was unemployed for months. Now, he sells eggs for a living.

Number of screens, occupancy: 2006

Telugu film industries outshine Bollywood | January 25, 2006 | Business Standard

Hindi movie industry may be far ahead in coming out with big budget flicks, but when it comes to the occupancy rate in theatres, the number of movie theatres and the movies released in a year, Tamil and Telugu film industries fare better than Bollywood.

Deepak Asher, director, Inox Leisure, said that occupancy rates in South Indian movie theatres are about 50 to 60 per cent compared to 35 to 40 per cent in other parts of the country.

According to CII-KPMG report 2005, there are about 12,900 screens in the country, out of which, 95 per cent are single screens. Put together, Tamil Nadu and Andhra Pradesh have 5,160 theatres while Karnataka and Kerala have 2,451 theatres.

There are 73 multiplexes operating in India with the Western region having 42 multiplexes, followed by Northern region having 23 and South and East having five and three respectively.

A large number of multiplexes are concentrated in Northern and Western India as the state governments in these regions were the first ones to announce entertainment tax exemptions on multiplexes.

Entertainment tax is one of the largest costs borne by theatre owners, except in cases where the entertainment tax rebate is available. The rebate is available in certain states on fulfilment of certain conditions. In case, the rebate is available, the entire rebate adds to the profit of the multiplex operator.

Exemption from income-tax to the extent of 50 per cent of profits enjoyed by Inox on its own and operated multiplexes in Pune and Vadodara will expire in 2006-07.

Inox Leisure operates a chain of eight multiplexes in seven cities.

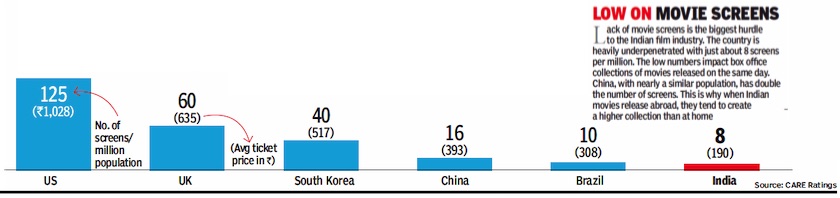

International comparisons, 2019?

From: February 20, 2020: The Times of India

See graphic:

The Number of screens in India vis-à-vis in India, Brazil, China, South Korea, the UK and the USA, presumably as in 2019.

2020, 2021

Kaveree Bamzai/ Why Bollywood is losing out to films from South India/ - Times of India/ 16 Feb 19

Source: Ernst & Young 2020 report:

India had 9,527 screens, of which 6,327 were single screens and 3,200 multiplex screens. At least 1,000 screens closed down [because of Covid lockdowns?]

Source: the Film Federation of India’s 2021 data:

Single screens in India 10,167

Andhra Pradesh undivided 2,809 single screens,

Tamil Nadu 1,546,

Kerala 1,015

Karnataka 950,

Cinema-viewing habit

2015-16

Kaveree Bamzai/ Why Bollywood is losing out to films from South India/ - Times of India/ 16 Feb 19

The cinema-viewing habit is stronger in the south.

Source: Data from the National Family Health Survey (NFHS) 2015-16

On average, 15% of respondents in the country went to a cinema hall or theatre at least once a month.

In four of the five South Indian states — Karnataka, Telangana, Andhra Pradesh and Tamil Nadu — the share of people who went to a cinema hall or theatre at least once a month was nearly double the national average, with roughly one in three people being a regular movie-goer.

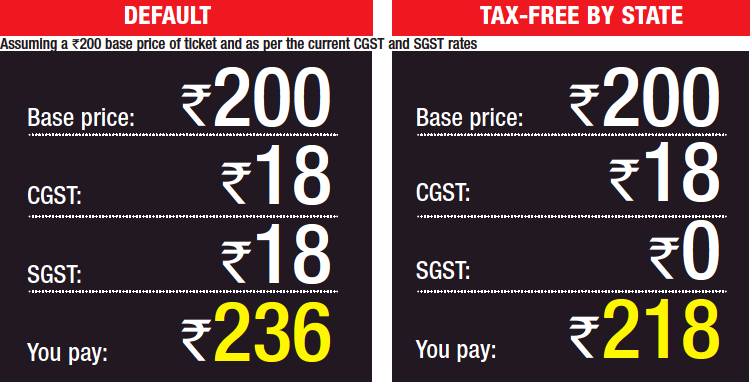

Tax exemption

How much cheaper is a tax-free film in 2020?

Niharika Lal, January 16, 2020: The Times of India

From: Niharika Lal, January 16, 2020: The Times of India

Recently, several states made Deepika Padukone's 'Chhapaak', a film on acid attack survivors, tax-free, while UP made Ajay Devgn's 'Tanhaji: The Unsung Hero', a film on Maratha warrior Tanhaji Malusare, tax-free. Maharashtra is considering making both the films tax-free, as per Revenue Minister Balasaheb Thorat, who said, "Earlier, the Revenue ministry used to take a decision on making a movie tax-free, but now the tax has been subsumed in the GST." Since GST (Goods and Services Tax) came into effect, what exactly does a film's tax-free status mean?

In December 2018, two GST slabs were announced for films – 18% for tickets above Rs 100, and 12% for tickets below Rs 100. This tax is divided between the state and central government (State GST and Central GST). When a state declares a film 'tax-free', now it exempts only half of the entertainment tax, which would be either 9% or 6%, as per the ticket price. For the multiplex audience, since there are hardly any tickets available below Rs 100, the default exemption would be 9%. Cinema hall owners say that declaring a film tax-free had a bigger impact in the pre-GST years, when every state had different entertainment tax and the state governments could exempt the whole amount. Now, a moviegoer still needs to pay Central GST even for tax-exempted films. With GST in play, now the tax-free status of a film means endorsement of a film by the state government, rather than any significant monetary benefit.