JM Financial

This is a collection of articles archived for the excellence of their content. |

History

The Times of India, Aug 03 2016

Reeba Zachariah

Done deal: Nimeshbhai signs off after 43 yrs

Cricket was his first love. But Nimesh Kampani, heeding his father's advice, chose to be an investment banker. Kampani, who founded JM Financial in 1973 with a capital of Rs 5,000, emerged as one of the most storied advisers in India Inc, with his firm now having a market value of about Rs 5,300 crore.

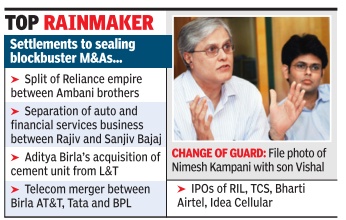

In August, 2016, after steering JM Financial for 43 years, Kampani decided to relinquish his executive role from September-end when he turns 70 and be its non-executive chairman. Thirty-nine-yearold Vishal Kampani, who shares his father's penchant for deals, will take charge as managing director, effectively heralding a new era at the Mumbai-based JM Financial.

Nimeshbhai, as he is often referred to in corporate circles, earned his spurs by offering insights to Indian industrialists on M&As, fund-raises, demergers and family settlements.Kampani, along with Hemendra Kothari of erstwhile DSP Merrill Lynch and Uday Kotak of Kotak Mahindra Bank, were the `Three Ks' who shaped up Indian investment banking in a liberalized economy . Kampani regularly scripted market moves for the country's oldest and biggest conglomerates such as the Tatas, Birlas and Bajajs -from debentures to IPOs to takeover deals. JM Financial advised the Tatas on about 45 transactions and Birlas on over 20 big deals.

Nimeshbhai played his role in family settlements, including the business restructuring at the Ambani household as the two brothers separated a decade ago. Kampani was involved with the Reliance Industries IPO that introduced the equity cult in India. He was also the point of contact for industrialists from different, opposing camps. He represented the late Reliance founder DhirubhaiAmbani and Bombay Dye ingchiefNusliWadia, who fought messy battles, on several transactions.

JM Financial, like its domestic peers, faced the heat from Wall Street biggies in the last decade, but made a comeback topping the M&A charts last calendar. The senior Kampani is exiting at a time when the spotlight has been shifting to the scion who demonstrated that the firm's deal-making gene is intact.

JM Financial exited a decade-long partnership with Morgan Stanley in 2007, preferring to stay independent. It paid $20 million to acquire Morgan's 40% stake in investment banking and received $425 million for its stake in securities firm from the US partner.