Karvy

This is a collection of articles archived for the excellence of their content. |

Brokerage

2019/ Sebi bans brokerage for suspected ₹2k-cr fraud

Nov 23, 2019: The Times of India

From: Nov 23, 2019: The Times of India

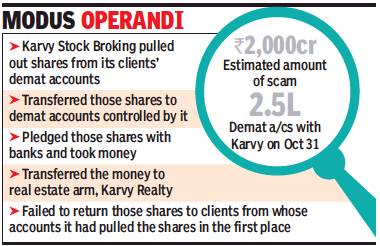

Markets regulator Sebi banned Karvy Stock Broking from accepting new investors over alleged misappropriation of shares and funds of its clients — worth about Rs 2,000 crore, which is one of the largest amounts by a broker in India.

In a rare move by the regulator, Sebi passed the ex-parte, ad-interim order against Karvy “to protect market integrity and save investors from any further loss”. Karvy Stock Broking is one of the largest brokers in the country in terms of client accounts. As of October 31, it had nearly 2.5 lakh clients, data released by NSE showed.

Sebi also asked NSDL and CDSL, the two depositories, not to act upon any instruction given by Karvy Stock Broking in “pursuance of power of attorney given by its clients”. NSE has already started a forensic audit of Karvy Stock Broking’s books to look into the extent of misuse of clients’ demat accounts for the broker’s own purposes.

Earlier this year, the NSE had received complaints from investors about irregularities by the broker relating to their demat accounts. The exchange’s inspection report showed that in 2019 itself, Karvy Stock Broking had transferred shares from 156 of its clients, all of which had shares in their demat accounts with Karvy Stock Broking but did not trade during the year.

Karvy’s modus operandi was simple: The broking house transferred shares from the demat accounts of its clients, which were inactive, to demat accounts controlled by the broking house. It then pledged those shares with banks and raised funds. These funds were transferred to Karvy Realty, its real estate arm.

NSE’s preliminary report was prepared after its ‘limited purpose inspection’ of Karvy Stock Broking conducted by it on August 19, covering a period from January 1, 2019 onward, Sebi said in its order. The ban was because there was a “need for urgent regulatory intervention to prevent further misuse of clients’ securities”.

Sebi also asked the depositories and stock exchanges to start disciplinary proceedings against Karvy Stock Broking “for misuse of clients’ funds and securities”.

Karvy Stock Broking has been given 21 days to file its objections or responses to Sebi. Market players said that since the period of inspection is limited only to 2019, the size of the scam is expected to jump manifold.

2018-19: The SEBI investigation

Partha Sinha, Nov 27, 2019: The Times of India

From: Partha Sinha, Nov 27, 2019: The Times of India

Key Highlights

In December last year, Sebi first standardised books and records maintained by brokers so that inspection and comparison of data could become easier

The move came after investor complaints that some brokers were not transferring shares and money to the designated demat and bank accounts of investors

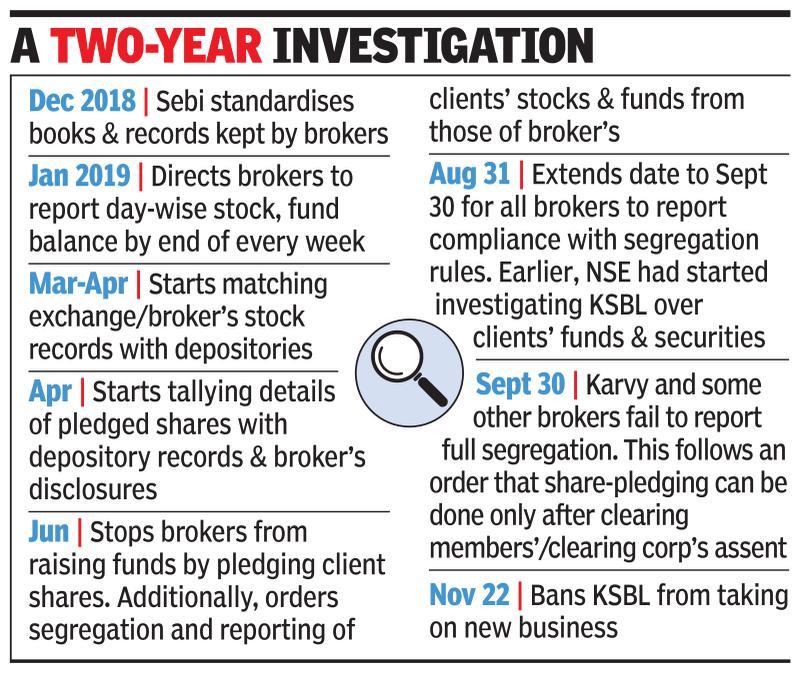

MUMBAI: Sebi's late Friday order against Karvy Stock Broking (KSBL) is a result of a nearly year-long investigation by the markets regulator. The probe was launched after investor complaints about brokers misusing clients' stocks and funds. Starting December 2018, Sebi had been changing rules and ordering new reports from stakeholders in the market, which was making it increasingly difficult for brokers to use clients' stocks and securities for their own use, sources said.

"All these steps (by the regulator and the exchanges) are aimed at investor protection," a top exchange official said. The way the investigation is progressing, sources said, more names are set to tumble out in the open and some well-known broking houses could face a similar heat like KSBL is facing now.

In December last year, Sebi first standardised books and records maintained by brokers so that inspection and comparison of data could become easier. The move came after investor complaints that some brokers were not transferring shares and money to the designated demat and bank accounts of investors.

Then, in January 2019, Sebi directed all brokers to report day-wise stock and fund balance with them, segregated according to their clients. This was to be reported at the end of every week.

Between March and April, Sebi also started matching records of ownership of stocks that's with the exchanges, with the brokers and that with the two depositories NSDL and CDSL.

Around the same time, the regulator also started tallying details of pledged shares with depository records and what the brokers disclosed.

Then in a June 20 order, Sebi stopped all brokers from raising funds by pledging clients' shares, and also ordered segregation and reporting of clients stocks and funds from those owned by the broker.

This was one of the main moves that many market players said would, over time, expose those brokers who were having a field day by using clients' stocks for their own use.

All the brokers were asked to report compliance with Sebi's June 20 order about segregation rules by August 31. However, after requests from brokers, the date was extended to September 30.