Muhammad Yunus

This is a collection of articles archived for the excellence of their content. Readers will be able to edit existing articles and post new articles directly |

Contents |

Muhammad Yunus

A

Microloan Pioneer and His Bank Win Nobel Peace Prize

By ANAND GIRIDHARADAS and KEITH BRADSHER

The 2006 Nobel Peace Prize was awarded today to the Grameen Bank of Bangladesh and its founder, Muhammad Yunus, for pioneering microcredit — using loans of tiny amounts to transform destitute women into entrepreneurs.

The Norwegian Nobel Committee praised Dr. Yunus and Grameen for their “efforts to create economic and social development from below.”

Though it is not the first time the committee has chosen to honor economic development as a contribution to world peace, rather than the more usual diplomacy, rights advocacy or philanthropy, it is the first time the prize has been awarded to a profit-making business.

The selection seemed to embody two connected ideas that are gaining ground among development experts: that attacking poverty is essential to peace, and that private enterprise is essential to attacking poverty. Dr. Yunus founded the bank in his native Bangladesh to lend small amounts of cash — often as little as $20 — to local people, almost always women, who could use it to found or sustain a small business by, say, buying a cow to sell milk or a simple sewing machine to make clothing.

Traditional banks considered such people too risky to lend to, and the amounts they needed too small to bother with. Dr. Yunus’s simple but revolutionary idea was that the poor could be as creditworthy as the rich, if the rules of lending were tailored to their circumstances and were founded on principles of trust rather than financial capacity. He found that they could achieve lasting improvements to their living standards with a little bit of capital.

Since its creation in 1983, Grameen has made a total of $5.72 billion in such small loans, and has turned a profit in all but three years, including $15 million in 2005.

“Across cultures and civilizations, Yunus and Grameen Bank have shown that even the poorest of the poor can work to bring about their own development,” the Nobel citation said.

The success of the Grameen Bank has inspired many imitators, and encouraged commercial banks in many developing countries to take up microcredit lending as well.

The Peace Prize “looks like a fitting acknowledgment that the ways of the market are not necessarily evil, that markets can be harnessed as forces of good if done properly,” said Nachiket Mor, executive director of Icici Bank, India’s largest privately owned bank, which now has about $550 million in microcredit loans outstanding.

James D. Wolfensohn, the former president of the World Bank president, said by telephone Friday that the award testified to “the power of entrepreneurialism.”

“What it has to do with peace,” he added, “is that it gives dignity to families and hope to families. And it’s the lack of hope that is the greatest cause of bloodshed and intolerance.”

Dr. Yunus reacted joyously to the news of the prize, The Associated Press reported. “I am so, so happy,” he said in a telephone interview from Dhaka, the capital of Bangladesh, shortly after the prize was announced. “It’s really great news for the whole nation.” The son of a prosperous goldsmith, Dr. Yunus has said that his mother’s generosity to the poor instilled in him from a young age a sense of duty to the poor.

M. Morshed Khan, Bangladesh’s foreign minister, said that he and Dr. Yunus grew up in villages less than a mile apart in southern Bangladesh and attended the same government high school in nearby Chittagong. “I could feel from that time, he was a great achiever, and that one day he would do something important,” Mr. Khan said in a telephone interview from his home.

As a boy, he said, Dr. Yunus was the most studious pupil in the school, with little interest in sports. “He would pull out a book and read at the playground” during recess, Mr. Khan recalled.

The inspiration for Grameen Bank came to Dr. Yunus during a trip to the village of Jobra in Bangladesh during the devastating famine of 1976. He met a woman who was struggling to make ends meet as a weaver of bamboo stools. She needed to borrow to buy materials, but because she was poor and had no assets, conventional banks shunned her, and she had to turn instead to local moneylenders whose extortionate rates of interest consumed nearly all her profits.

Dr. Yunus, then a professor of rural economics at Chittagong University, gave the woman and several of her neighbors loans totalling $27 from his own pocket. To his surprise, the borrowers paid him back in full and on time. So he started traveling from village to village, offering more tiny loans and cutting out the middlemen. Dr. Yunus was determined to prove that lending to the poor was not an “impossible proposition,” as he put it.

When he later formalized the loan-making arrangement as the Grameen Bank in 1983, the bank adopted its signature innovation: making borrowers take out loans in groups of five, with each borrower guaranteeing the others’ debts. Thus, in place of the hold banks have on wealthier borrowers who do not pay their debts — foreclosure and a low credit rating — Grameen depends on an incentive at least as powerful for poor villagers, the threat of being shamed before neighbors and relatives. The bank’s 6.6 million borrowers so far have paid back 98.5 percent of their loans.

“We have no guarantee, no references, no legal instrument, and still it works — it defies all the conventional wisdom,” Dr. Yunus told Fortune magazine in a recent interview.

By contrast, acccording to Mustafizur Rahman, the research director at the nonpartisan Center for Policy Dialogue in Dhaka, traditional banks in Bangladesh, which lend mainly to businesses and affluent families with collateral, have recovery rates of just 45 to 50 percent, and most of them survive only because they are owned by the government and receive large subsidies.

The Grameen Bank has also transformed attitudes toward women in Bangladesh, a heavily Muslim country, Mr. Rahman said. The Nobel citation described microcredit as a “liberating force in societies where women in particular have to struggle against repressive social and economic conditions.”From the start, profit-making was central to Dr. Yunus’s philosophy.

“Grameen believes that charity is not an answer to poverty,” he wrote in an introduction to microcredit posted on the organization’s Web site in August. “It only helps poverty to continue. It creates dependency and takes away individual’s initiative to break through the wall of poverty. Unleashing of energy and creativity in each human being is the answer to poverty.”

In the late 1990’s Dr. Yunus diversified to create a number of companies, with the same aim of empowering the poor. Grameen Telecom sells mobile phones to rural inhabitants, to help with their business projects.

Mr. Khan, the foreign minister, said the Nobel Peace Prize was an honor for all of Bangladesh. “Grameen will remain as a landmark,” he said. As for Dr. Yunus, the prestige of the Nobel and the $1.4 million prize money, divided equally between him personally and his bank, may propel him closer to a distant goal: “One day,” he has often said, “our grandchildren will go to museums to see what poverty was like.” Amelia Gentleman and Walter Gibbs contributed reporting.

October 13, 2006

Excerpts From Nobel Peace Prize Citation

By THE ASSOCIATED PRESS

Filed at 5:29 a.m. ET

OSLO, Norway (AP) -- Excerpts from the citation awarding the 2006 Nobel Peace Prize to Bangladeshi Muhammad Yunus, and his Grameen Bank, for efforts to help create economic and social development from below by using innovative economic programs such as micro-credit lending.

Muhammad Yunus has shown himself to be a leader who has managed to translate visions into practical action for the benefit of millions of people, not only in Bangladesh, but also in many other countries. Loans to poor people without any financial security had appeared to be an impossible idea. From modest beginnings three decades ago, Yunus has, first and foremost through Grameen Bank, developed micro-credit into an ever more important instrument in the struggle against poverty. Grameen Bank has been a source of ideas and models for the many institutions in the field of micro-credit that have sprung up around the world.

Every single individual on earth has both the potential and the right to live a decent life. Across cultures and civilizations, Yunus and Grameen Bank have shown that even the poorest of the poor can work to bring about their own development. Micro-credit has proved to be an important liberating force in societies where women in particular have to struggle against repressive social and economic conditions. Economic growth and political democracy cannot achieve their full potential unless the female half of humanity participates on an equal footing with the male.

Yunus's long-term vision is to eliminate poverty in the world. That vision cannot be realized by means of micro-credit alone. But Muhammad Yunus and Grameen Bank have shown that, in the continuing efforts to achieve it, micro-credit must play a major part.

Newsmaker

By S. Salman Younus

Name: Muhammad Yunus Age: 56 Nationality: Bangladeshi Claim to fame: The banker to the poor jointly wins the Nobel Peace Prize

THIS year’s choice of the Nobel Peace Prize winner is a truly inspiring one. Muhammad Yunus has the rare quality of translating vision into practical action and his brain-child, Grameen Bank, has transformed millions of lives for the poorest of Bangladesh.

The Nobel Peace Prize, jointly awarded to Professor Muhammad Yunus and the Grameen Bank, for their work in lending small amounts of money to poor people, specially women, to set up businesses. They were the surprise winners among the 191 nominees for the most prestigious of the Nobel awards, and officials who brokered last years’ Aceh peace accord, ending 29 years of fighting in the Indonesian province, were considered as strong contenders. Often referred to as the banker to the poor, Yunus’ work has helped prove that the poor are credit-worthy.

Voted among the ten most famous living Bengali personalities, Yunus’ fight to eradicate poverty started back in 1974 when a famine hit Bangladesh. He realised that a small amount of loan can make a big difference in the lives of the poor. Out of his own pocket he lent US$27 to women in a village near Chittagong University, where he worked. The scheme proved successful in making these women independent and after a few other schemes to help the poor, Yunus founded the Grameen Bank in 1976. As it has grown, Grameen — meaning “of rural area”, “of village” — Bank has developed various alternate credit systems to serve the poor and the Grameen model of micro financing has been emulated in 23 countries.

But Professor Yunus’ impact has been far-reaching — in 2000 Mr Yunus had helped the Clintons introduce micro-credit schemes to some of the poorest communities in Arkansas. In fact, Bill Clinton has been campaigning for this Bangladeshi to win this prestigious prize for years now and in his autobiography, My Life, he as expressed these views.

Yunus, after doing his Masters in Economics from Dhaka University in 1961, joined Chittagong College as a lecturer in economics. On winning a Fulbright scholarship he obtained his Ph. D in economics from Vanderbilt University, US, in 1969. After a stint as an assistant professor in the US, Yunus retuned home and joined Chittagong University.

Professor Yunus has been awarded 27 honorary doctorate degrees (all but one a doctorate), and 15 special awards, including World Food Prize and the Indira Gandhi prize for peace, disarmament and development.

The economist has said that he will use part of his share of the $1.4 million award to create a company to make low-cost, high-nutrition food for the poor and part of it for an eye hospital for the poor.

B

June 24, 2007

In brief

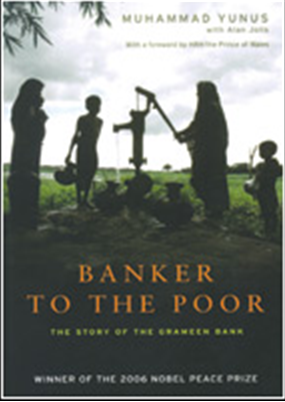

Banker to the Poor: The Story of the Grameen Bank

By Muhammad Yunus with Alan Jolis

Aurum Press Ltd

Available with Liberty Books. Next to Bar B.Q. Tonight, Shop No. G-1, Plot # GP-5, Block 5, Clifton, Karachi

Tel: 021-5374153

www.libertybooks.com

ISBN 1 85410 924 3 313pp. Rs625

Banker to the Poor is the autobiography of Muhammad Yunus, founder of the Grameen Bank and the person who has transformed the theories of dealing with the complex societal problem of poverty by offering the simple and innovative solution of micro credit. Professor Yunus’s narrative is in fact an appeal for universal action: nations should concentrate on promoting the will to survive and the courage to build the very first and the most essential element of economic cycle — man.

Eloquently, forcefully and passionately Dr Yunus shows the reader how, by extending micro credit to the poor, poverty can be eliminated. The book is a fascinating read, a time-travel through the past six decades, telling the tale of a dream of ending poverty form its emergence to its fulfillment. His narrative is simple in style but full of insights.

He writes, “The year 1974 was the year which shook me to the core of my being. Bangladesh fell into the grips of a famine…I used to get excited teaching my students how economics theories provided answers to economic problems of all type. I got carried away by the beauty and elegance of these theories. Now all of sudden I started having an empty feeling. What good were all these elegant theories when people died of starvation on pavements and on doorsteps?”

He recounts his meeting with Sufia Begum, a village resident who borrowed money to make bamboo stools to earn a living to feed her family. He discovered that Sufia Begum was so poor that she had to borrow the equivalent of 22 US cents to buy bamboo. After paying her debt at a very high finance charge she was left with only two cents of profit to take care of her daily family needs. His work in Jobra village further revealed that 42 families in the village were living in poverty because they did not have $27 to sustain themselves. He was agonised by what he discovered. He writes, “My God, my God, all this misery in all these forty-two families, all because of the lack of $27!

Professor Yunus gave the $27 from his own pocket to the forty-two families, and thus Jobra became the test bed for his micro credit experiment to take people out of the shackles of poverty. And the rest is Noble Peace Prize-winning history. — Dr Ahmed S. Khan

Timeline

1969- 2024 Aug

August 7, 2024: The Times of India

A Scholar And Academic...

In 1969, Muhammad Yunus earned his PhD in economics from Vanderbilt University in the US, where he went to study as a Fulbright scholar. He was 29 then. After that, he started teaching at Middle Tennessee State University but was back by 1972 to the land of his birth, which was Bangladesh now and Sheikh Mujibur Rahman — Hasina’s father — was the man in charge.

Yunus joined the department of Economics at the University of Chittagong, the province where he was born in 1940. In 1974 came the Bangladesh famine and it was around this time that Yunus thought of using the microcredit model to help out impoverished Bangladeshis, especially women.

...Who Became ‘Banker To The Poor’...

According to Grameen Bank, the institution synonymous with Yunus, the microcredit project took off in 1976 from Jobra village in Chittagong — or Chattogram — district. By 1983, the pilot project had led to the creation of the bank. Upending the premise of banks giving loans against collateral, Yunus championed a scheme of extending small loans without any requirement of collateral.

The bank says it is now present in 94% of Bangladesh’s villages and touches nearly 45 million people — more than a fourth of the population — through its 10.6 million borrower members. It says that 97% of its borrowers are women and that, till June 2024, it had given out loans worth $38 billion and “has ensured a lucrative recovery rate of 96.3%... higher than any other banking systems”. In 2006, the bank and Yunus were awarded the Nobel Peace Prize.

...But Fell Foul Of PM Hasina...

Soon after the Nobel came an episode that Yunus says is the cause of troubles that he’s had to face with Hasina’s now dismantled govt. In 2007, he was linked with a move to launch a new political party. There was a caretaker military govt in charge and Hasina and most other political leaders were under house arrest or in jail.

“So, people kept coming to me, that you should join politics... And they put pressure and finally I said ‘okay, I’ll join politics and I’ll create a party’... Within two months I announced that ‘no I’m not going to create a party’. That’s all — I never created a party,” Yunus told The New York Times in 2012.

But he believes Hasina misread his intentions. Asked about his equation with Hasina, he told NYT, “She never explained so I don’t understand what went on, just speculation in the press. One is that she feels I’m a political threat... This is again speculation. She never said that I’m a political threat... We’ve never had a faceto-face meeting, although I’ve tried to seek her appointment so I could see her, but it never happened.”

...And Ran Into Rough Weather, Though His Popularity Is Largely Intact

In 2011, the Hasina-led govt announced that Yunus had been removed from the position of managing director of Grameen Bank. That came after she reportedly alleged that the bank was “sucking blood of the poor” and Yunus was treating it as his “personal property”.

“They removed me and still they couldn’t find a replacement... after all this bank is owned by poor people. The borrowers own 97% of the bank and the govt owns only 3%,” he had told NYT. His troubles, though, didn’t end there. He faced trial in 2013 on charges of violating foreign currency rules and was also prosecuted in connection with the companies he created.

In Jan this year, Yunus was sentenced to six months in jail for violating labour laws before getting bail in March. Yunus’s lawyers were reported to have said he’s facing more than 100 other charges over labour law violations and alleged graft. But the man who’s received multiple international honours enjoys a solid reputation at home and abroad. In August last year, over 170 global figures, including the likes of former US Secretary of State Hillary Clinton, signed a petition asking Hasina to stop the “persecution” of Yunus. And, now, leaders of the protest movement that removed Hasina have urged him to become the chief adviser of the interim govt. Source: Media reports

Controversies

Graft case, as in 2024

March 4, 2024: The Times of India

Dhaka : A court in Bangladesh granted bail to Nobel laureate Muhammad Yunus in a $2.3 million embezzlement case.

Yunus, who was awarded the Nobel Peace Prize in 2006 for pioneering the use of microcredit to help impoverished people, was sentenced to six months in prison in January on a separate charge of violating labour laws. He was granted bail in that case too and has appealed.

Prosecutor Mir Ahmmad Ali Salam said the embezzlement case involves a workers welfare fund of Grameen Telecom, which owns 34.2% of the country’s largest mobile phone company, Grameenphone, a subsidiary of Norway’s telecom giant Telenor.

“The charges involve the embezzlement of over 250 million takas and money laundering. The accused gave the money to trade union leaders instead of the workers. This way they deprived the ordinary workers of their right- ful earnings,” Salam said.

Yunus and seven other defendants appeared in court Sunday and six others were absent. Defence counsel Abdullah Al Mamun told the court that Yunus, 83, and the others were innocent.

Last year, more than 170 global leaders and Nobel laureates urged Bangladesh’s Prime Minister Sheikh Hasina to suspend legal proceedings against Yunus. His supporters say he has been targeted because of his frosty relations with Hasina. The government has denied the allegations. AP