Municipal Bonds: India

This is a collection of articles archived for the excellence of their content. Readers will be able to edit existing articles and post new articles directly |

Contents[hide] |

Requirement of municipal bonds in India

Time Our Cities Woke Up To Municipal Bonds

Several Indian Cities Have Tried This Instrument But Financial Discipline Needed For It To Succeed

Surojit Gupta | TNN

The Times of India 2013/07/20

Most municipal corporations [in India] are in dire straits, the landscape dotted with empty coffers, fiscal mismanagement and corruption.

For instance, the finances of the Jaipur Municipal Corporation are in poor shape, the civic body mopping up only 40% to 50% of its annual revenue targets. A large chunk of its revenues goes in paying 8,000 employees. From Lucknow, to Raipur to Bangalore, the story is similar.

Among the world’s weakest urban local governments

According to the report on Indian Urban Infrastructure and Services chaired by economist Isher Judge Ahluwalia, our urban local governments are among the world’s weakest in terms of capacity to raise resources and financial autonomy. “While transfers from state governments and the Centre have increased, ULBs’ (urban local bodies) tax bases have remained narrow, inflexible and lack buoyancy. They’ve failed to levy user charges for services to cover operations, maintenance and depreciation costs,” the report says.

Several municipal corporations have tried to tap the market through municipal bonds – instruments for financing infrastructure projects.

MUNI BONDS IN INDIA

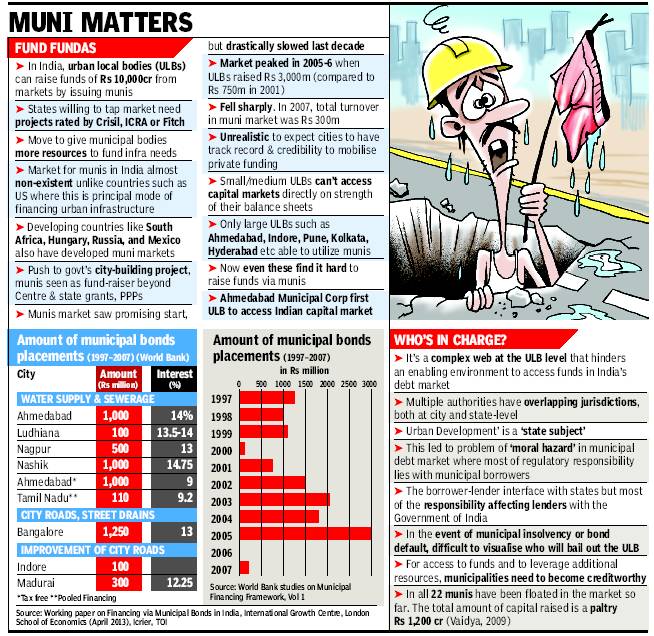

Since 1997, 25 municipal bond issues have been issued in India. These include taxable and tax-free bonds and pooled financing issues raising nearly Rs 14 billion, experts Shahana Sheikh and Mukul G Asher say.

Sheikh and Asher, in a paper on developing a municipal bond market published in the Administrative Staff College of India journal, say of the 25 municipal bond issues, a quarter has been raised by the Ahmedabad Municipal Corporation and urban bodies around Bangalore.

Of these 25, 17 have been for water supply and sewerage projects, six to fund roads. “This is possibly because user charges in such infrastructure projects are easier to enforce. The amount and frequency of expected revenues can be predicted with some certainty,” they say.

Ahmedabad

The Ahmedabad Municipal Corporation plans to issue tax-free bonds to raise Rs 150 crore, seven years after it first raised money through bonds. It was the first civic body in 2005 to issue redeemable taxfree bonds, which got an A++ rating from Crisil. Most of these are held by corporate houses and banks. Faced with a funds crunch, the Indore Municipal Corporation plans to tap the bond market.

Maharashtra CM Prithviraj Chavan has told municipal corporations to get ready for credit ratings and raise infrastructure funds through municipal bonds.

While the municipal bond market is yet to mature in India, it accounts for a big chunk for financing city projects in the US. Canada, South Africa, Hungary, Russia, Brazil and Mexico have developed municipal bond markets.

According to Care Ratings, the largest owners of municipal bonds in the US are individuals, mutual and money market funds, insurance companies and banks. Urban local entities must get a credit rating before raising funds from the market to gain investor confidence, it says. These ratings are assigned on a number of factors – economic, legal, financial, and project viability.

PAINFULLY SLOW

In India, municipal bonds have taken time to take off because of structural problems. Since most civic bodies depend on state capital, municipal bond holders want state guarantee. In most cases, state government finances are strained. This makes it difficult to provide guarantees. Experts say the accounting practices of these entities retard the development of the municipal bond market here.

Vinayak Chatterjee, Feedback Infra chairman, says municipal bonds have a potential in India, but the market won’t develop unless municipal bodies manage their finances efficiently and adopt modern accounting practices. “Accounting systems are complex and archaic,” Chatterjee said.

The absence of buoyant revenue streams for urban bodies increases their reluctance to borrow, Sheikh and Asher say. “...the current institutional arrangement of state governments constrain the capacities of the financially better-off ULBs to access the municipal bond market.”

As cities expand, India faces challenges of providing public services and the stretched finances of municipal corporations will heighten the pain. “Globally, empowered city governments are financially independent, but sadly, Indian states do not empower their cities. Indian city governments are the third tier, along with state governments and the Union government, and should demand such empowerment from state governments,” said Shailesh Pathak, president, Srei Infrastructure.

Pune Municipal bonds

2017: oversubscribed by six times

Raises Rs 200cr, Oversubscribed By Six Times

Pune municipality became the first civic body in the country to raise money by issuing bonds on Bombay Stock Exchange. The municipal body raised Rs 200 crore through BSE's bond trading platform and was oversubscribed by six times --approximately Rs 1,200 crore. This also marked the re-entry of municipal bonds after 14 years, which is being seen as the beginning of resurgence in the municipal bond market in India.

New Delhi Municipal Council (NDMC) is likely to issue bonds for raising Rs 200 crore by this month end while Ahmedabad Municipal Corporation (AMC) would hit the bond market to raise a similar amount in the next one month. About a dozen municipalities are expected to raise Rs 6,000 crore through municipal bonds during this financial year.

Pune Municipal Corpora tion (PMC) raised Rs 200 crore at 7.59% coupon for 10 years for its ambitious 24x7 water supply for the entire city, which is better than the coupon rate for government securities at 8%. “New era dawns in municipal finance.History created by Pune Municipal Corporation by launching India's largest municipal bond programme,“ Union urban development minister M Venkaiah Naidu tweeted.

“We require about Rs 3,300 crore for the round-the-clock water supply ... We will raise 2,300 crore by issuing bonds.We will go more fresh tranches as and when we require fund,“ Pune municipal com missioner Kunal Kumar told TOI. He added municipal bodies tapping the bond market will improve availability of finance for more development works and projects, particularly under government's Smart City programme.

Ashish Kumar Chauhan, CEO and MD of BSE told TOI that PMC bond offering is a pilot case and it will help municipalities to understand the servicing aspect related to such papers. Even investors will understand the risks associated with municipal bonds. “We invite all the municipalities to raise the funds and follow PMC's successful bond issuance,“ Chauhan said. He added that Indian bond markets are poised for a substantial growth and the nation can use its domestic savings to fund its infrastructure needs in a substantial manner.

Over-subscription of PMC's bonds is also being seen as a positive sign considering that only Rs 1,100 crore has been raised through bonds in the past three decades.