OnePlus and India

This is a collection of articles archived for the excellence of their content. |

Contents |

Premium segment

2019

Madhav Chanchani, February 4, 2020: The Times of India

From: Madhav Chanchani, February 4, 2020: The Times of India

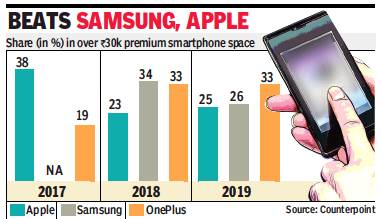

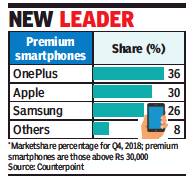

Chinese smartphone player OnePlus has emerged as the leader in the overall premium smartphone category (handsets of over Rs 30,000), taking over the market dominated by US major Apple and Korea’s Samsung for the last two years. OnePlus had 33% market share in 2019, while Samsung trailed with 26% and Apple with 25%, according to data from Counterpoint.

Chinese smartphone marker Xiaomi (28% share), along with three brands owned by BBK Electronics — Vivo, Realme and Oppo (combined share of 35%) — already rule the overall smartphone market as they focus on the budget segment competing with the likes of Samsung (21%). OnePlus is also part of BBK Electronics, which lets its brands operate independently with separate teams.

“Given that a large share of the consumer segment in India still remains heavily offline based, we are working towards extending OnePlus’ unique premium brand experience to retail customers through OnePlus Experience Centers, which have played a crucial role in the brand’s growth,” OnePlus founder Pete Lau told TOI. The company plans to expand the total number of OnePlus stores from 30 to 100 by end of the year, as it looks at the offline segment to drive further growth. It also has a presence in another 2,000 stores through retail partners. While India’s overall smartphone market has seen its growth slow from 10% in 2018 to 7% in 2019, the premium smartphone segment is growing faster. While the ultrapremium segment, smartphones over Rs 45,000, grew at a record pace of 63% partly because of increasing iPhone shipments the premium segment also saw a 29% growth. This comes at a time when India has emerged as the second-largest smartphone market in the world, next to China. It overtook the US in 2019. At around 158 million smartphone units shipped in 2019, India beat US’ shipments of 153 million by a margin of 5 million even as China is experiencing declined in shipments, according to Counterpoint.

OnePlus said that it shipped over 2 million smartphones in 2019 in India, helped by increasing new launches and entry in the ultra-premium segment. According to its India head Vikas Agarwal, 20% of the demand for its products came from users shifting from iPhones to Android OS. The country accounts for a third of the revenues for the brand, which has also made India an R&D hub, which it plans to scale up from 250 employees to 1000 in the next 2-3 years.

Sales in India

2018: no. 1

Avik Das1, How OnePlus won smartphone mkt, February 5, 2019: The Times of India

From: Avik Das1, How OnePlus won smartphone mkt, February 5, 2019: The Times of India

When OnePlus launched its first mobile phone nearly five years ago, its main target market was the US and Europe. India was nowhere on its radar. The Chinese company wanted to be an online brand and operate in the premium smartphone market. But in India at the time, e-commerce was in a nascent stage, and the premium phone pie was small.

What happened soon after surprised company executives. “Within five months, we noticed that a lot of users from India were buying the phone on Amazon’s global website using a US address, and then auto-forwarding it to India through Aramex, a Dubai-based logistics company. They were undeterred by the customs duty, which could increase the cost by Rs 5,000,” recalls Vikas Agarwal, general manager for OnePlus in India.

A closer monitoring of website traffic trends showed that India was among the top seven countries in sales, though the company was not selling in India. “That’s when we decided to launch here,” says Agarwal, who was the first employee for OnePlus in India when he joined in October 2014. The first set of phones were introduced in December that year.

Four years hence, India is OnePlus’s single largest market, accounting for 33%, or $466 million, of the company’s total revenue of $1.4 billion in 2017. China is the second biggest market, while Europe and America make up the rest. In the last few quarters, OnePlus has also become the biggest premium smartphone (those above Rs 30,000) player in India, overtaking Samsung and Apple. And all of this has come from just one new product that it launches every year.

“What has clicked is the positioning, the focus on the premium segment. They were at the right place at the right time. When they entered, the premium market was just 1-2%, which has now grown to 5-6%. With their strategy of one device per year and attractive pricing, they positioned the brand really well,” Tarun Pathak, associate director at Counterpoint Research, said.

What has worked most for the company is the pricing. In this extremely price-sensitive market, OnePlus is seen as great value for money. Its 6T model sells for about Rs 38,000 on Amazon, significantly lower than Samsung’s Galaxy S9 at Rs 61,000 and Apple’s iPhone X at about Rs 85,000.

Another strategy that has worked well for the Shenzenbased company is the word of mouth it gets, and its social media strategy to target a new consumer base. Not only are loyal OnePlus consumers upgrading, but the company is also attracting customers who previously used an Apple or a Samsung phone. “Out of the new purchases, we have seen about 20% people from Samsung and close to 17% from Apple. This movement has started to scale now,” says Agarwal.

Pete Lau, founder and chief executive of OnePlus, says the secret sauce to the company’s success in India is “our total focus on products”.

See also

OnePlus and India