Pakistan- India economic relations

This is a collection of articles archived for the excellence of their content. |

Contents |

Backgrounders

1995- 2018

August 23, 2019: The Times of India

From: August 23, 2019: The Times of India

From: August 23, 2019: The Times of India

From: August 23, 2019: The Times of India

From: August 23, 2019: The Times of India

From: August 23, 2019: The Times of India

[[File: India's share in Pakistan's total exports {%}; Top 10 goods, as in 2019.jpg|India's share in Pakistan's total exports {%}; Top 10 goods, as in 2019

From: August 23, 2019: The Times of India|frame|500px]]

The ongoing trade war between India and Pakistan will hit Islamabad hard as it is dependent on India as far as bilateral trade is concerned

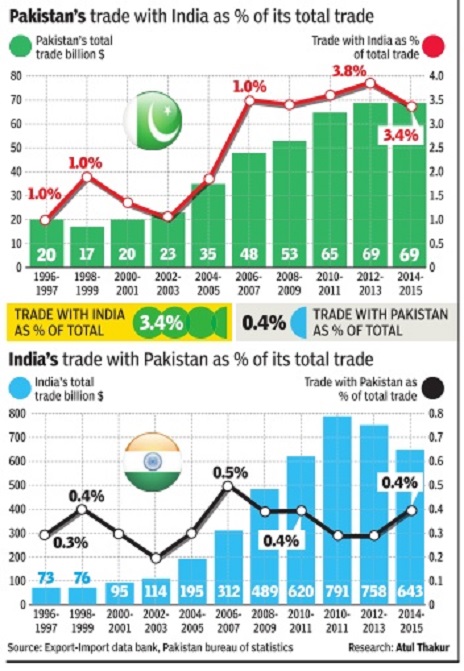

On August 9, Pakistan formally suspended trade relations with India in response to the revocation of the special status of Jammu & Kashmir. In 2018, according to data collated by United Nations Conference on Trade and Development, bilateral trade between India and Pakistan was worth $2.8 billion, of which $2.3 billion was India’s exports to and $500 million its imports from Pakistan.

1. Pakistan is more dependent on India for its exports

Pakistan’s dependence on India is slightly higher than India’s on its neighbour. India’s exports to Pakistan are 0.73% of its total exports while India accounts for 1.62% of Pakistan’s exports.

2. Pakistan’s imports from India are five times India’s imports from Pakistan

When it comes to imports, India is even less dependent on Pakistan. In 2018, Pakistan accounted for 0.09% of India’s total imports. India constitutes 3.9% of Pakistan’s total imports.

3. India, the largest importer of Pakistani cement

Cement is the only good with a significant chunk coming from Pakistan. No other commodity imported from Pakistan is more than 10% of India’s total imports.

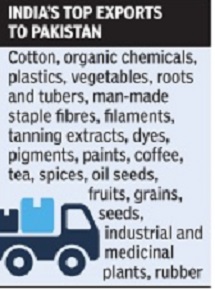

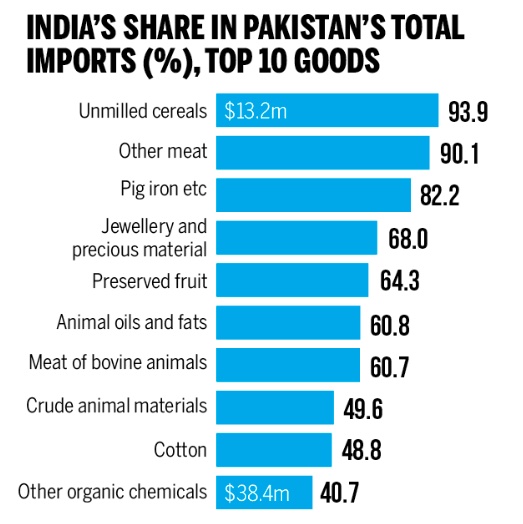

4. Pakistan is hugely reliant on India for 40 commodities For 40 commodities, Pakistan’s imports from India constitute more than 10% of its total imports. For 17 of these goods, more than one- fourth of Pakistan’s imports come from India. These commodities are likely to become costlier in Pakistan.

5. Trade ban could hit exporters in both India and Pakistan

While an import ban will push up domestic prices, an export ban can hurt domestic producers, who may struggle to find new markets. Pakistan is a big market for India’s animal oils and cotton.

6. For 26 goods, more than 10% of Pak’s exports go to India

There are 13 commodities for which more than one-fourth of Pakistan’s total exports go to India and the ban will badly impact its domestic producers.

Pakistan’s actions have backfired before

After the Pulwama terror attack in February and the Balakot strike, Pakistan closed its airspace to Indian flights in retaliation. Though the closure was meant to stifle flights to and from India, it ended up hurting Pakistan considerably.

While airlines lost time and money on rerouting flights, Pakistan lost millions in overflight fees earned when planes pass through foreign airspace. About 400 flights a day avoided Pakistani airspace, resulting in losses of $100 million since the closure, which was lifted on July 12

What is air toll?

Airlines pay civil aviation administration of the country they are flying over a certain fee based on the type of aircraft, the distance covered while overflying a country and the weight of an aircraft before it takes off. For a Boeing 737, Pakistan charges $580. The amount will rise in case of larger aircraft like the Airbus 380 or Boeing 747. The rates differ from one country to another

2015-20

April 1, 2021: The Times of India

From: April 1, 2021: The Times of India

From: April 1, 2021: The Times of India

From: April 1, 2021: The Times of India

From: April 1, 2021: The Times of India

Explained: Why India, Pakistan are talking trade again

The news

Pakistan has allowed private companies to import sugar and cotton from India. The move signals a revival of trade ties between the two neighbours. "India desires normal relations, including on trade with all countries, including Pakistan. Pakistan unilaterally suspended bilateral trade with India in August 2019. It is for Pakistan to review its unilateral measures on trade," minister of state for commerce and industry Hardeep Singh Puri had said in the Lok Sabha last month.

The freeze

After the Pulwama terror attack in February 2019, India withdrew the 'most-favoured nation' (MFN) status it had unilaterally granted to Pakistan in 1996 as a member of World Trade Organisation (a Pakistan cabinet decision of November 2, 2011 to reciprocate remains unimplemented). Withdrawing MFN status meant India could make all goods imported from Pakistan more expensive (and therefore unviable) by imposing a customs duty of 200% on them. This was followed by suspension of cross-border trade in April 2019, which India then said was being misused for funnelling in illegal weapons, narcotics, and fake currency. Pakistan announced complete suspension of all bilateral trade after the Indian government revoked the special status of Jammu and Kashmir on August 5, 2019. Pakistan made a partial relaxation in September 2019 for trade in medicines.

The thaw

There’s been a gradual thawing in ties between the two neighbours since the announcement of ceasefire along the Line of Control in February this year. This was followed by Pakistani Prime Minister Imran Khan advocating dialogue between the two countries and its army chief talking of stable ties. Prime Minister Narendra Modi had also written a letter to PM Khan extending greetings on the occasion of Pakistan Day on March 23.

The need

While it is yet to be seen if trade between the two countries will expand across all commodities, the choice of sugar and cotton to make a start wasn’t surprising. Pakistan was one of the leading buyers of Indian cotton before the trade ban two years ago (it imported over $550 million of cotton in 2018-19). But recently, there have been reports of Pakistan’s textile sector struggling to source cotton at the right price following a low yield of cotton in the country. India is not just the world's biggest producer of cotton, it can offer the commodity to its neighbour at cheaper rates than suppliers from other countries.

India is also the second biggest sugar producer and Pakistan has been facing a crisis with domestic sugar prices soaring. Its attempts to tap the international market haven’t borne fruit due to the high cost. Pakistani traders have been buying Indian sugar from their offices in Dubai or Afghanistan, according to Reuters, but with direct imports from India, the cost comes down substantially. While sugar imports will help Pakistan lower soaring prices ahead of Ramadan, it will also help India reduce surpluses that are weighing on its local markets.

The trade

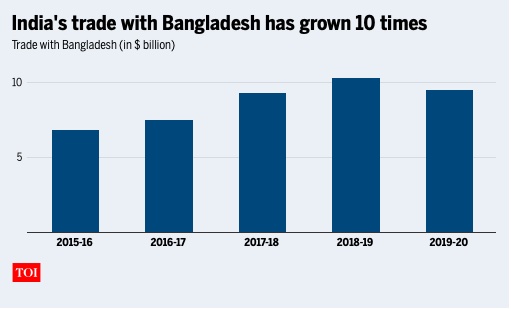

Trade relations between India and Pakistan have always mirrored the political ties between the two neighbours. And this means direct trade has remained more or less stagnant (indirect and informal trade through Dubai isn’t accounted for in the official numbers). Before the ban, trade between both nations had stood at just $2.5 billion in 2018-19, accounting for a mere 0.3% of India’s total trade with the world and just over 3% of Pakistan’s global trade. The ban dried even that up. In calendar year 2020, India’s exports to Pakistan dipped 76.3% to $283 million while imports plummeted 96.2% to just $2.5 million. In contrast, India’s trade with its eastern neighbour Bangladesh has grown in recent years.

Advantage India

Though the volume of trade between India and Pakistan has been low, the balance of trade has been heavily skewed in favour of India, which means India sells much more to Pakistan than it buys. Opening up of bilateral trade, therefore, will be more beneficial to India.

India mainly exports cotton, dyes, chemicals, plastics, vegetables and iron and steel. It imports fruits, cement, leather and spices.

The potential

What if the two largest economies in South Asia traded like normal neighbours?

According to a 2018 World Bank study (A Glass Half Full: The Promise of Regional Trade in South Asia), the trade potential between India and Pakistan stands at $37 billion. The report also highlighted how India and Pakistan maintained long, sensitive lists of items on which no tariff concessions are granted but in practice many of these items reach Pakistan via a third country like the United Arab Emirates, adding to the cost. The lack of normal bilateral trade relations also affects the formation or deepening of regional value-chains in many high-value trading sectors, the report highlighted.

E-commerce

Amazon's e-commerce 'bridge'

Indian merchants registered as sellers on Seattle-based online retail giant Amazon could soon find more buyers in Pakistan, if the company’s bid to increase its holding in a Pakistan-based fashion portal Clicky.pk proves successful, according to four people aware of the ongoing negotiations between Amazon and Clicky.pk.

Amazon already owns about 33% stake in Clicky.pk through its acquisition in 2017 of online retailer Souq, which is based in Dubai. Souq had invested in the Pakistani company in late 2016. “If a transaction (between Amazon and Cicky.pk) goes through Indian merchants can sell more goods in Pakistan, which can be routed through Dubai, where Souq is based,” said one of the people cited above.

Pakistan has a negative list of about 1,200 goods that cannot be imported from India. This has encouraged informal trade between the two countries routed largely through Dubai and occasionally Afghanistan.

According to a 2016 ICRIER paper, informal trade between the two South Asian neighbours for fiscal 2013 was pegged at $4.7 billion, dominated by exports from India. The formal trade between the two countries that year was $2.6 billion and was down to $2.3 billion in fiscal 2017.

“Several Indian FMCG products are popular in Pakistan. But a major chunk of products are raw material, unbranded food item, clothing and jewellery,” the sources told ET. Typically, most of these products are routed through Dubai and the big traders in Karachi who import these products, from where they are distributed across the country, the person added.

Amazon declined to comment for this story. Clicky.pk did not reply to email queries from ET.

For Amazon, raising its stake in Clicky.pk will also provide the American company with a firmer foothold in a market that China’s Alibaba is also eyeing keenly. Alibaba, is also in talks to pick up a stake in Rocket Internet-owned Daraz, one of the largest online commerce platforms in Pakistan, according to a Bloomberg report last month.

Clicky.pk competes with players like Daraz. Pakistan’s online commerce market was estimated to be worth $100 million in 2017.

Clicky.pk had raised nearly $1million by selling 33% stake to Souq in late 2016. In 2017 Amazon completed the acquisition of Souq for $580 million. The deal between Souq and Clicky.pk was not reported till now.

Experts are of the view that Amazon will look to consolidate its presence in the Indian subcontinent and the Middle East. “These three geographical locations — India, Dubai and Pakistan — makes sense for Amazon to scale up. Amazon will make entry into multiple Asian countries, a new strategy to increase its volume, optimise its sourcing and reduce single-country dependence for revenue flow,” said one of the sources mentioned above.

E-commerce in Pakistan is set to cross $1 billion by 2020 from $100 million last year, according to a recently published report by the Pakistan Telecommunication Authority (PTA). In comparison, India’s online retail market was pegged between $18 billion and $20 billion in 2017 with overall ecommerce market, which includes areas like online travel, estimated to be worth over $33 billion.

"Both Alibaba and Amazon will be interested in Pakistan, which has 70% mobile phone penetration in its 220 million population," said Adam Ghaznavi, a serial entrepreneur who had led Rocket Internet's Easy Taxi and ecommerce site Kaymu.pk in Pakistan. "The China Pakistan Economic Corridor is also bringing in lot of Chinese investment to the country, which will attract investors," he added.

Most-Favoured-Nation (MFN) status

MFN: a backgrounder

February 16, 2019: The Times of India

India withdrew the 'most-favoured nation' or MFN status to Pakistan after a terror attack which took lives of at least 40 CRPF (Central Reserve Police Force) personnel in Jammu and Kashmir. The country is considering punitive actions like significant hike in customs duties, port curbs and ban on goods imported from Pakistan.

This is one of the deadliest terror attacks in Jammu and Kashmir when a suicide bomber rammed a vehicle carrying over 100 kg of explosives into their bus in Pulwama district.

The move to remove MFN status would enable India to increase customs duty on goods coming from the neighbouring nation.

When was it given to Pakistan:

India granted the MFN status to Pakistan way back in in 1996, but the neighbouring country has not yet reciprocated.

In 2012, Pakistan had committed to giving the MFN status to India but retracted later. Instead of MFN, Pakistan said it was working on granting Non-Discriminatory Market Access (NDMA) status to India but that also was not announced.

The MFN status was accorded under WTO's General Agreement on Tariffs and Trade (GATT). Both India and Pakistan are signatories to this; and are members of the World Trade Organisation (WTO), which means they have to treat each other and the other WTO member countries as favoured trading partners in terms of imposing customs duties on goods.

What happens when India removes MFN status:

Removal of this status means India can now enhance customs duties to any level on goods coming from Pakistan, a trade expert said.

Withdrawal of the MFN status would significantly hit Pakistan's exports to India, which stood at $488.5 million (around Rs 3,482.3 crore) in 2017-18.

Last year in November, a senior aide to Pakistan's Prime Minister Imran Khan had said that the country has "no immediate plans" to grant MFN status to India. Pakistan allows only 137 products to be exported from India through the Wagah border land route.

Total India-Pakistan trade has increased marginally to $2.41 billion in 2017-18 as against $2.27 billion in 2016-17. India imported goods worth $488.5 million in 2017-18 and exported goods worth $1.92 billion in that fiscal.

Under MFN pact, a WTO member country is obliged to treat the other trading nation in a non-discriminatory manner, especially with regard to customs duty and other levies.

What India imports and exports:

India mainly exports cotton, dyes, chemicals, plastics, vegetables and iron and steel; while it imports fruits, cement, leather and spices.

The main items which Pakistan exports to India include fresh fruits, cement, petroleum products, bulk minerals and ores and finished leather.

The CCS meet was chaired by Prime Minister Narendra Modi to discuss the security scenario in J&K in the wake of the Pulwama terror attack.

Pros of MFN:

MFN status is helpful for the developing nations. The countries with the status have broader access to a market for trade goods, reduced cost of export items owing to highly reduced tariffs and trade barriers.

It also reduces the bureaucratic hurdles and varied kinds of other tariffs for imports. It then increases demands for the goods and giving a boost to the economy and export sector.

What commerce ministry said:

The commerce ministry would soon notify to the World Trade Organization (WTO) its decision to revoke the MFN status to Pakistan on security grounds, an official said. The ministry would work on a list of goods imported from Pakistan over which India would increase the customs duties.

2016: India considers taking Pak to WTO

The Times of India

India may drag Pak to WTO on MFN, dispute Sep 28 2016 : The Times of India

A meeting convened PM Modi explored the option of dragging Pakistan to the World Trade Organisation's (WTO) dispute resolution body for refusing to reciprocate for 20 years India's granting of the Most Favoured Nation status to Pakistan. But New Delhi might not consider withdrawal of Pakistan's status, government sources said. What is Most-Favoured-Nation (MFN) status?

Under the World Trade Organization (WTO) agreements, countries cannot normally discriminate among their trading partners. If a country grants another country a special favour (e.g. lower customs duty on imports) then it has to offer the same favour to all WTO members.

Each member treats all the other members equally as “most-favoured“ trading partners.

The benefits of MFN status is available only to WTO members.

However, countries can enter into preferential trade agreements and free trade agreements to grant access and favours over and above MFN.

India-Pakistan MFN India granted Pakistan MFN status in 1996, and Pa kistan is yet to reciprocate. Trade between the two countries never really normalized. Total annual official trade between the two countries was $2.5 billion in 2015-16, whereas annual unofficial trade is estimated to be nearly $15 billion. A section of Pakistan's industry feels Indian goods will swamp Pakistan if Islamabad grants MFN status to India. There have been talks of granting Non-Discriminatory Market Access (NDMA) to India, which experts believe is MFN in another name.

Can India withdraw MFN status to Pakistan? India can move WTO and request for withdrawal of MFN status to Pakistan, citing breach of security . Article 21(b) (III) of WTO rules says that “nothing in this agreement shall ... prevent any WTO member from taking any action it considers necessary for the protection of its...security interest taken in time of war or other emergency in international relations.“

What would happen if India withdraws MFN status?

Exports from India will be choked, hurting consumers in some sectors. Trade through the Attari Wagah border will be hurt. According to a Ficci survey , steel costs in Pakistan would go down by 55%, engineering goods by 26%, bicycles by 20% and pharmaceuticals by 35% if they are imported from India through direct trade channels. Fruits and vegetables would be cheaper by 40% and sugar by 30%. The survey had said that liberalized trade in agriculture would help generate 2.7 lakh jobs in India and 1.7 lakh in Pakistan.

Trade

1995-2018

What they export to each other.

Reliance on each other’s exports.

From: August 20, 2019: The Times of India

See graphic:

Pakistan- India trade, 1995-2018

What they export to each other.

Reliance on each other’s exports.

2011-2021

Chandrima Banerjee. February 27, 2022: The Times of India

From: Chandrima Banerjee. February 27, 2022: The Times of India

From: Chandrima Banerjee. February 27, 2022: The Times of India

From: Chandrima Banerjee. February 27, 2022: The Times of India

From: Chandrima Banerjee. February 27, 2022: The Times of India

From: Chandrima Banerjee. February 27, 2022: The Times of India

From: Chandrima Banerjee. February 27, 2022: The Times of India

From: Chandrima Banerjee. February 27, 2022: The Times of India

From: Chandrima Banerjee. February 27, 2022: The Times of India

From: Chandrima Banerjee. February 27, 2022: The Times of India

From: Chandrima Banerjee. February 27, 2022: The Times of India

From: Chandrima Banerjee. February 27, 2022: The Times of India

In August 2019, India exported goods worth $52 million (around Rs 370 crore) to Pakistan. Pakistan’s monthly exports to India were valued at a little over $2.5 million (about Rs 18 crore) then. India withdrew statehood from Jammu and Kashmir that month, Pakistan retaliated and said it was downgrading India’s trade status to that of Israel — which was that of zero business.

In 30 days, India’s exports to Pakistan had a significant 76% decline. That of Pakistan to India went down by a massive 98%. The drop in India’s imports from Pakistan (80%), meanwhile, was much higher than the dip in Pakistan’s imports from India (70%). Pakistan’s market in India shrank much more than India’s did in Pakistan.

This month, two statements coming out of Pakistan have indicated a thaw. Pakistan’s adviser to the Prime Minister on commerce, textile, industry and production, and investment Abdul Razak Dawood said this:

As far as the ministry of commerce is concerned, its position is to do trade with India. And my stance is that we should do trade with India and it should be opened now … Trade with India is very beneficial to all, especially Pakistan. And I support it.

Days before that, leading Pakistan entrepreneur Mian Muhammad Mansha, on similar lines, said this:

If things improve between the two neighbours, Indian Prime Minister Narendra Modi could visit Pakistan in a month … If the economy does not improve, the country may face disastrous consequences. Pakistan should improve trade relations with India and take a regional approach to economic development. Europe fought two great wars, but ultimately settled for peace and regional development. There is no permanent enmity.

It’s a delicate balancing act — the one between economic compulsions and political contingencies. And a lot can change in two years.

In Pakistan, Prime Minister Imran Khan has been pushing austerity measures through to meet the International Monetary Fund's terms for a bailout

Why Pakistan needs India back

Bilateral trade between India and Pakistan has long been heavily skewed in favour of India.

In terms of absolute volume, Pakistan’s exports to India have been an average 18% of India’s exports to Pakistan over the past two decades. In the same period, it has imported 414% of the volume India has from Pakistan. India’s balance of trade with Pakistan has been reasonably favourable while that of Pakistan with India has never been.

It has been quite a departure from when the countries were separated. A US Agency for International Development report from 2012 quotes the Indian commerce minister in 1949, KC Neogy, saying that it was “supremely necessary” for India and Pakistan to have a joint economic policy. The Indian government had even started looking for ways to form a customs union for the two countries. But conflict always prevented uninterrupted trade. Between 1965 and 1973, for instance, when two wars were fought by them, the countries did not trade with each other at all. In 1974, they signed a protocol to resume trade. In 1986, Pakistan allowed the import of 41 items from India. That list grew to 249 things in 1987.

A series of trade agreements followed — South Asia Preferential Trade Agreement in 1995, South Asian Free Trade Area in 2004. By 2012, Pakistan had decided to remove a positive list of things that could be imported from India to allow everything in (barring some products). They started talking about resolving non-tariff barriers (like import quotas, anti-dumping laws, import bans and so on). But while India had granted Pakistan the Most Favoured Nation status (MFN, which guarantees equal treatment in trading terms) in 1996, Pakistan refused to reciprocate and said that it wanted Kashmir to be resolved first.

In 2019, India withdrew the MFN status for Pakistan and increased customs duty on Pakistan’s goods to 200%. The backdrop was the Pulwama attack. Pakistan had not retaliated then. It did in August 2019. And all progress between the two countries was undone. But it’s difficult to say whom it’s hurting more.

The absolute numbers alone may not say much. The difference in global trade volume of the two countries itself is huge.

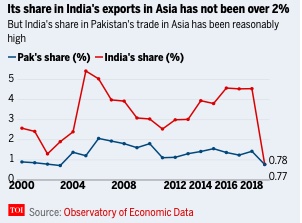

So, to understand how much each country means to the other, it is more useful to see what share each country has in the other’s trade space. Not once in 20 years has Pakistan’s share in India’s exports crossed 1% (the highest was a 0.98% share way back in 2006). India’s share in Pakistan’s exports has been higher, hovering around 2%. So, India is a relatively more important market for Pakistan than Pakistan is for India.

Both countries have at least 40% of their external trade within Asia. But even there, Pakistan’s highest share in India’s exports was 2%, back in 2006. It was, however, at its highest in a decade (1.43%) just before the embargo was imposed, in 2018. India’s share in Pakistan’s exports was also a good 4.55% then. It dropped to 0.78% the following year.

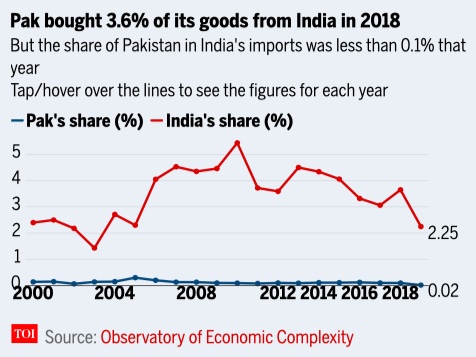

The divide is far greater in imports. Pakistan’s share as a country of origin for India’s imports has not crossed 0.1% in a decade. So, for every Rs 1,000 India spent in buying something it needed from other countries, Pakistan got Re 1 — at its highest. In the same time period, India’s highest share was 5.44% — or, by the same analogy, Rs 54 for every Rs 1,000 Pakistan spent.

And what did Pakistan buy most from India? Organic chemicals and cotton. In 2018, before Pakistan imposed the embargo, India was its largest provider of cotton and its second largest for organic chemicals. It was also its third largest sugar import source. For India, meanwhile, fruits, construction material and mineral fuels were the biggest buys from Pakistan till 2018. Pakistan was not its top supplier for any of these.

Finally, Pakistan’s economic situation itself may have compelled it to reassess the pragmatism behind an embargo. For instance, by January 2020, prices of vegetables had shot up exponentially. Tomatoes were 156% costlier than in January 2019, onions were 125% more expensive and potatoes 87%. Facing immense backlash, Pakistan started importing tomatoes from Iran and onions from Afghanistan in October 2020. Did it help? Not immediately. Tomatoes were still 16% more expensive, potatoes 9% and onions 6% in November than in October.

So palpable was the anger over this that finance minister Hammad Azhar was asked in April 2021 why Pakistan was not allowing import of these vegetables from India when prices were “skyrocketing”. He did not say much.

The economic situation, meanwhile, has been precarious. In February this year, the International Monetary Fund (IMF) revived a $6 billion-loan deal — Pakistan has gone to the IMF 22 times in six decades — with taxation conditions that have stirred a controversy within the cash-strapped country.

It’s not the best time to close off the economy.

An Indian Border Security Force personnel watches over parked supply trucks. In February this year, Pakistan allowed India to deliver wheat to Afghanistan through the Attari-Wagah border

This is not the first overture

At the end of March 2021, it was declared that Pakistan was going to partially resume trade with India. Pakistan finance minister Azhar had said the country’s economic coordination committee wanted to allow trade in two things — cotton and sugar — to start again.

The reasons were pressing. Sugar prices were high globally but low in India. A “15-20% difference” in sugar prices between India and Pakistan. Cotton, too, was bound by similar compulsions. Demand was high because Pakistan’s textile exports were up but the cotton crop had not been great. “The difference [in prices] affects the SMEs (small and medium enterprises). Big industry can buy it from Egypt or other countries,” Azhar had added.

Within a day, the announcement was withdrawn. Or denied. Finance minister Azhar said it was routine procedure — a plan was proposed and the economic coordination committee rejected it.

Except, the summaries of these recommendations were approved by Prime Minister Imran Khan. “It means that the prime minister is already in support of lifting the ban on these products’ imports from India,” the Dawn reported.

But Imran was quick to reiterate his public stance. In May 2021, a month later, he said restoring trade ties would mean “ignoring” the struggle of Kashmir: “If we normalise relations with India at this time we will be doing a major betrayal with the people of Kashmir.”

On February 22 this year, two days after his commerce adviser talked about trade with India, Imran in an interview in Russia said he wanted to resolve differences through dialogue: “I would love to debate Narendra Modi on TV.”

2018-2024

From: May 6, 2025: The Times of India

See graphic:

India – Pakistan trade, exports and imports, 2018-2024

Worker remittances and other inflows, outflows

2016

Omer Farooq Khan, Pak probes Sharif for ‘laundering’ $5bn to India, May 9, 2018: The Times of India

Dealing yet another blow to deposed Pakistan Prime Minister Nawaz Sharif, the country’s anti-graft watchdog, the National Accountability Bureau, on Tuesday ordered an inquiry against him for allegedly laundering $4.9 billion to India.

A NAB statement said bureau chairman Justice Javed Iqbal (Retd) has taken notice of a media report claiming that the incident was mentioned in World Bank’s Migration and Remittances Book 2016. The statement, however, has not mentioned details of the media report in question. The press release claimed, “The amount was laundered to the Indian finance ministry after which Indian foreign exchange reserves witnessed an increase while Pakistan had suffered as a result.”

Claims of $5bn in Pak fund flow false, says bank

However, in a press release issued on September 21, 2016, the State Bank of Pakistan (SBP) had rejected the estimates of $4.9 billion remittances from Pakistan to India and had termed it contrary to facts.

SBP said the outflow of $4.9 billion was cited in the Migration and Remittances Fact Book 2016, prepared by the Global Knowledge Partnership on Migration and Development. “It must be noted that the Fact Book data suggests estimates (not actual flows), which are based on a number of assumptions,” it said.

The SBP said the data of balance of payments showed that $116,000 worth of worker remittances flew from Pakistan to India in FY16 and inflows from India to Pakistan stood at $329,000.

The NAB probe comes as a setback to Sharif, who had to quit as PM following the SC verdict in the Panama Papers case that had disqualified him from office in July 2017. Sharif is not only facing three corruption cases, but the NAB also initiated a probe against him for alleged illegal expansion of a road leading to his estate in Lahore. Once formulated, it will be his fifth NAB case.

The accountability court on Tuesday sought more time from the Pakistan SC to end the trial on references filed by the NAB against members of the Sharif family.

See also

Pakistan- India economic relations

Pakistan- India: Cease-fire and its violations

Nuclear weapons testing: India- Pakistan

Nuclear arsenals: India, Pakistan

and many more articles, especially about the 1965 and 1971 wars, The Kargil war of 1999, 1947...