Payment systems: India

This is a collection of articles archived for the excellence of their content. |

Contents |

What is a payment bank?

Introduction

Source:

1. The Hindu, August 20, 2015, Pooja Mehra

2. The Hindu, August 20, 2015

They are the new stripped-down type of banks, which are expected to reach customers mainly through their mobile phones rather than traditional bank branches. Payments banks will take deposits and remittances, but will not advance loans. In its previous bi-monthly monetary policy, the RBI had said it would announce the names of the entities in August 2015. An external advisory committee, which submitted its report on July 6, 2015, selected them.

The Reserve Bank of India gave approval in principle for 11 entities to set up payments banks. “It has selected entities with experience in different sectors and with different capabilities so that different models could be tried,” the RBI said in a press release.

However, as this is the first time, the central bank said: “It would be difficult at this stage to forecast the most successful likely model in the emerging business of payments.”

Telecom Minister Ravi Shankar Prasad said the Postal Department should gear up to become a vehicle of financial inclusion.

How will they function?

1. Payments banks will largely depend on mobile and ATM infrastructure to provide banking services.

2. Opening an account is expected to be like acquiring a pre-paid mobile number.

3. Analysts expect tough competition to drive down charges for fund transfers and other transactions.

The Airtel Payments Bank case, 2016

The Hindu Business Line, November 25, 2016

Radhika Merwin

Telecom major’s payments arm may incur a loss of close to 1.25% on each deposit

Ever since the RBI doled out payments bank licenses to various entities — from mobile operators and niche NBFCs to deep-pocketed corporates — the industry has been keenly awaiting the interest rate that these players would offer on their deposits.

The speculation was put to rest, when Airtel Payments Bank (subsidiary of Bharti Airtel) — the first to commence operations — set the rate on its savings deposits at 7.25 per cent, far higher than what most banks offer as in November 2016. The payments space hitherto consisting of prepaid cards and mobile wallets, has also been shaken up as the money you load in these wallets, does not earn you any interest.

But Airtel Payments Bank will have to pay a price for such disruption. A back-of-the-envelope calculation shows that Airtel may incur a loss of close to 1.25 per cent on each deposit.

No lending

As per the RBI guidelines, payments banks are allowed to take deposits up to Rs. 1 lakh per account. Such niche banks can provide payment and remittance services through various channels and can issue debit cards. But these banks cannot lend money or issue credit cards.

The income of these banks will mostly consist of interest from its investments in safe government securities and fee income that it can earn by distributing simple financial products such as mutual funds and insurance. These niche banks need to invest 75 per cent of their deposits in government securities with maturity up to one year and the balance 25 per cent can be parked with commercial banks.

Currently, yield on one-year G-Sec is quoting at about 6 per cent. This means that for every say Rs. 2,000 deposit, on which Airtel Payments Bank pays 7.25 per cent interest, it will incur a loss of about Rs. 25 per annum or Rs. 2 per month. This is a ball park figure and the actual loss can vary depending on other factors. But it is evident that the bank will be paying some price to rope in customers in the initial period.

Why?

Entities that provide payment services through prepaid cards, mobile wallets and online platforms have been infringing on banks’ turf. The RBI paving the way for new format banks has intensified the competitive landscape. To take on competition many large banks, particularly private ones, have been making significant leaps into the digital arena.

The one advantage that new payments bank have over traditional banks, is their far lower operating cost structure, giving them leeway to offer higher interest rate on their deposits. This can help them garner a pie of low-cost deposits. Following the deregulation of interest on savings account from Oct 2011, YES Bank and Kotak Bank, being late entrants, chose a similar strategy to build their deposit base — offering higher rates on savings deposit to catch up with the biggies. The strategy has paid off to a lot extent.

For payments bank, a much higher capital adequacy ratio of 15 per cent against the 9-odd per cent that traditional banks have to adhere to, also works to their advantage. While payments bank do not carry any lending risk, the extra capital can help absorb losses, if any, in the initial phase of ramping up distribution network and business.

Retaining customers

While the payments bank operations may incur a loss in the initial period, for Bharti Airtel, the promoter of Airtel Payments Bank, the value-add that it can offer its customers through this differentiated banking services, can help lower its churn of customers.

The cost of acquiring a customer is high and incurring a Rs. 2 loss per month to retain a customer may not seem like such a bad proposition. Telecom is a near 40 per cent EBITDA margin business for Airtel. The operating guidelines for the new format banks that was released recently by the RBI, has also offered more flexibility. In case of payments banks promoted by a telecom company, the RBI has allowed a seamless transition of mobile users into bank customers, if the KYC norms are already met.

Authority and powers

Source:

1. The Hindu, August 20, 2015

2. The Hindu, August 20, 2015

3. The Times of India, August 20, 2015

- Payments banks have differentiated licences with limitations on what they can do.

- RBI norms limit demand deposits to a maximum of Rs 1 lakh.

- The deposits raised by them will have to be invested in government bonds and a maximum of 25% can be invested in an account with another bank.

- Payments banks can sell insurance and mutual funds.

-They can’t offer loans but can raise deposits of upto Rs. 1 lakh, and pay interest on these balances just like a savings bank account does.

-They can enable transfers and remittances through a mobile phone.

-They can offer services such as automatic payments of bills, and purchases in cashless, chequeless transactions through a phone.

-They can issue debit cards and ATM cards usable on ATM networks of all banks.

-They can transfer money directly to bank accounts at nearly no cost being a part of the gateway that connects banks.

-They can provide forex cards to travellers, usable again as a debit or ATM card all over India.

-They can offer forex services at charges lower than banks.

-They can also offer card acceptance mechanisms to third parties such as the ‘Apple Pay.’

How they came into existence

11 entities authorised to set up payment banks by RBI

-Aditya Birla Nuvo Ltd

-Airtel M Commerce Services Ltd

-Cholamandalam Distribution Services Ltd

-Department of Posts

-Fino PayTech Ltd

-National Securities Depository Ltd

-Reliance Industries Ltd

-Dilip Shantilal Shanghvi

-Vijay Shekhar Sharma

-Tech Mahindra Ltd

-Vodafone m-pesa Ltd

”In-principle” nod for payments banks valid for 18 months

The RBI said all selected applicants had “the reach and the technological and financial strength to service hitherto-excluded customers across the country.”

The “in-principle” approval will be valid for 18 months, when the applicants have to comply with the requirements under the guidelines and fulfil the other conditions so that the central bank would consider granting them licence for starting business.

After issuing the final guidelines for licensing of payments banks on November 27, 2014, the RBI received 41 applications for payment banks.

Going forward, the RBI said, it intends to use the learning from this licensing round to revise the guidelines and move to giving licences more regularly, virtually “on tap”.

Impact

On banking sector

This is for the first time in the history of India's banking sector that RBI is giving out differentiated licences for specific activities. RBI is expected to come out with a second set of such licences — for small finance banks — and the process for those is in its final stage. The move is seen as a major step in pushing financial inclusion in the country.

It’s a step to redefine banking in India. The Reserve Bank expects payment banks to target India’s migrant labourers, low-income households and small businesses, offering savings accounts and remittance services with a low transaction cost. It hopes payments banks will enable poorer citizens who transact only in cash to take their first step into formal banking. It could be uneconomical for traditional banks to open branches in every village but the mobile phones coverage is a promising low-cost platform for quickly taking basic banking services to every rural citizen. The innovation is also expected to accelerate India’s journey into a cashless economy.

India’s domestic remittance market is estimated to be about Rs. 800-900 billion and growing. With money transfers made possible through mobile phones, a big chunk of it, especially that of the migrant labour, could shift to this new platform. Payment banks can also play a crucial role in implementing the government’s direct benefit transfer scheme, where subsidies on healthcare, education and gas are paid directly to beneficiaries’ accounts.

Also, this is the first time since banks were nationalized, that private sector business groups have bagged the RBI’s nod for banking services.

On customers

1. Service charges will come down.

2. The requirement of minimum monthly/quarterly balance is unlikely to be applied.

3. Competition from these new entities will force existing banks to offer low-cost (or low balance) basic accounts.

4. Payments banks will spread the reach of banking to rural areas.

5. The payment banks will cater to the needs of small savings accounts, remittance services, low income households, small businesses and other unorganized sector entities.

6. The payments bank licence will enable the network of 1,54,000 post offices (including 1,30,000 rural post offices) to offer banking services to the masses in the country.

Experience in other countries

Payment technologies have proved hugely popular in other developing countries. In Kenya, the most cited success story, Vodafone’s M-Pesa is used by two in three of adults to store money, make purchases and transfer funds to friends and relatives.

Performance

2017-19

August 7, 2019: The Times of India

Their status in 2019.

From: August 7, 2019: The Times of India

Payment banks cannot extend any kind of loan, neither can they take deposits of more than `1 lakh. They were expected to make money from transactions, but PE-funded fintechs are providing free payment options. Also, being banks, they are subject to a high level of compliance requirements unlike digital wallets. In the absence of an assured revenue stream, many feel that a business case for payments banks may not be feasible.

2019: losses swell to ₹626 crore

Dec 25, 2019 The Times of India

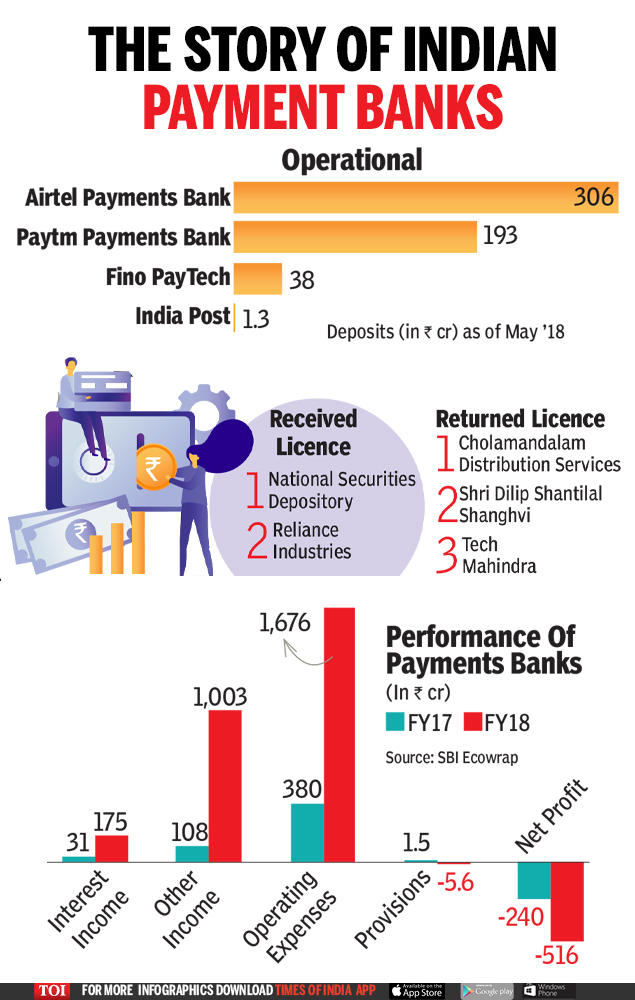

Payments banks — including those floated by Paytm, Reliance Jio, Airtel and Fino — saw their aggregate losses mount 21% to Rs 626 crore during fiscal 2019 from Rs 516 crore in the previous year. “The limited operational space available to them and the large initial costs involved in setting up of the infrastructure imply that it may take time for payments banks to break even as they expand their customer base,” the RBI’s report on ‘Trend and Progress of Banking in India’ said.

Interest income of payments banks increased 45% to Rs 255 crore from the previous year, while other income (including commission on transactions) doubled to Rs 2,093 crore this year from earlier. There are seven payment banks currently operational in India, up from five in the previous year.

Another positive was that remittances through payment banks increased 23% to Rs 1.10 lakh crore in fiscal 2019 from Rs 89,653 crore in fiscal 2018. An interesting trend was “UPI taking over from e-wallets as the most prominent channel for inward and outward remittances in terms of both value and volume for payment banks”, the report noted. The number of UPI transactions increased to 499 million, worth Rs 57,219 crore that accounted for 70% of total transactions. E-wallets had only 18.6% of the total transaction pie.

Payments banks saw their deposit base double in FY19 to Rs 883 crore from Rs 438 crore in FY18. These banks are not allowed to collect more than Rs 1 lakh as deposit from customers. They also saw liabilities and provisions nearly double to Rs 4,363 crore year-over-year. This pushed up total liabilities including deposits by 45% to Rs 7,114 crore from the year-ago period, the report said.

YEAR-WISE DEVELOPMENTS

2020-21

July 16, 2021: The Times of India

From: July 16, 2021: The Times of India

RBI governor Shaktikanta Das said that 91% of prepaid instruments were in the form of e-wallets and the rest in the form of cards. He said the shift to digital has also been accelerated by fast payment systems, such as Immediate Payment Service (IMPS) and Unified Payments Interface (UPI), which provide immediate credit to beneficiaries and are available round the clock.

Das pointed out that during June 2021, the payment systems in India processed on an average more than 15 crore transactions each day, amounting to nearly Rs 4.5 lakh crore daily. Of this, UPI alone witnessed over 280 crore transactions.

On UPI, Das said that globally, there has been a lot of interest in the locally developed platform. Another innovation was the Aadhaar-enabled Payment System (AePS) that facilitates fund transfers/payments and cash withdrawals through micro-ATMs and banking correspondents (BCs) using Aadhaar authentication, he said. During the pandemic, cash transactions at BC outlets through micro-ATMs witnessed significant surge with more than 94 crore transactions accounting for Rs 2.25 lakh crore during 2020-21.