Ruia

This is a collection of articles archived for the excellence of their content. |

Contents |

Essar Oil

2016: sold to Russian consortium

A consortium comprising Russian energy giant Rosneft, commodities trader Trafigura, and Russian fund United Capital Partners (UCP) announced on Saturday the acquisition of nearly the entire stake owned by the Ruias in Essar Oil for $12.9 billion. This is the largest-ever single foreign direct investment in India.

The move would help the debt-laden Ruias, promoters of the shipping-to-steel conglomerate Essar Group, retire over half its liabilities of around Rs 90,000 crore, group director Prashant Ruia said.

Under the deal, Rosneft would acquire 49% in Essar Oil, while Trafigura, UCP and the Ruias would together hold a matching equity . The remaining 2% would be held by minority shareholders. While Trafigura and UCP would hold 49% each in the consortium -Kesani Enterprises Co Ltd -Ruias would hold a 2% stake.

Of the $12.9 billion, around $10.9 billion or Rs 72,800 crore would be the value for the refining and retail assets, which includes a debt of around $4.5 billion that Rosneft would take over. Russian state bank VTB said it would refinance $3.9 billion owed by the Essar Group. Rosneft would pay $3.5 billion and its partners, Trafigura and UCP, the same amount for an equal joint stake. The remaining $2 billion or around Rs 13,300 crore is being paid for the Vadinar port and other infrastructure, Essar said.

Ruia said the equity value worked out to around $5.8 billion and the minority share holders may get a little more than Rs 262 a share, the price at which the shares were delisted. “We will know the real value of the shares when the deal is closed,“ he said.

Bankers and policymakers said the deal would help the crucial infrastructure and banking sector ease the burden on balance sheets.

“This deal proves the attractiveness of the Indian energy market to foreign investors as India is one of the fastest growing fuel consuming economies. This deal is also a significant step in the process of deleveraging the bal ance sheets of Indian corporates,“ said ICICI Bank MD & CEO Chanda Kochhar.

Economic affairs secretary Shaktikanta Das said it would help reduce stress in the system.

While the deal had been in the pipeline for several months, the near exit of the Ruias from Essar Oil was only revealed a few days ago. In fact, the scope of the deal was also widened beyond the Vadinar oil refinery to include ports as well as the fuel retail business, which would continue to run under the Essar brand for a while.

Ruia said that the deal was expected to be closed by the end of 2016.

The group, which exited the telecom business by selling its 33% stake in Vodafone to the British telecom giant, has been financially stretched and now intends to focus on other businesses such as steel. It has been under pressure from lenders, both domestic as well as foreign, to reduce the debt by selling other assets.

How Rosneft's $13 billion Essar deal almost fell apart

Saudi state energy firm Aramco had also bid for Indian refiner Essar.

Rosneft-Essar deal was salvaged due to involvement of Putin and Modi.

The tussle for Essar shows growing battle for oil markets between Russia and Saudi Arabia.

An oil refinery of Essar Oil in Gujarat.An oil refinery of Essar Oil in Gujarat.

A multi-billion-dollar Russian deal to buy Indian refiner Essar was nearly sunk at the eleventh hour by a rival bid from Saudi Arabia as the two oil superpowers vie for supremacy across the world.

The deal between Essar and a consortium led by Kremlin oil giant Rosneft appeared dead in the water two months ago after Saudi state energy firm Aramco weighed in, according to seven Russia, India and Saudi-based industry sources familiar with or involved in the negotiations.

It was salvaged due to the involvement of Russian President Vladimir Putin and Indian Prime Minister Narendra Modi, who were keen for it go through, and after the consortium agreed to pay $13 billion — more than double what Rosneft had initially valued Essar at, sources told Reuters.

This made the refiner the biggest—ever foreign acquisition in India and Russia's largest outbound deal.

The tussle for Essar — a state—of—the—art plant in the world's fastest—growing fuel market — illustrates the growing battle for oil markets between Russia and Saudi Arabia, the world's two largest crude exporters.

It also sheds light on the challenges OPEC member Saudi Arabia and non—OPEC Russia — which are also fighting a proxy conflict in Syria's civil war — will face in trying to clinch a global agreement to limit output growth to prop up oil prices.

The full details of how the Essar deal was struck remain unclear. Two industry sources said it was rescued thanks to the involvement of Putin and Modi while three other sources said Rosneft had simply outbid Saudi Aramco.

Officials in Modi's office declined to comment while Putin's spokesman Dmitry Peskov denied there was any Kremlin intervention in the deal.

"Naturally, we defend the interests of our companies. Of course we lobby for them, especially on such large deals," said Peskov, but added that in the case of Essar "there were no orders from the Kremlin".

"It was a corporate decision by Rosneft to gain synergies via cooperation with India," he said.

Rosneft and Saudi Aramco declined to comment.

Essar said it had held discussions with several potential buyers but had gone with the Rosneft consortium because their offer was considered the most attractive. It denied there was any intervention from Putin or Modi.

Showdown

Rosneft boss Igor Sechin is keen to buy refining assets around the world to guarantee outlets for Russian oil. He had been negotiating since 2014 to buy 49 percent of Essar from its owners, Indian brothers Ravi and Shashi Ruia, and the two parties had been in exclusive talks since July 2015 when a preliminary deal was signed.

While the exact amount Rosneft was prepared to offer for the stake at that stage is unclear, Russian and Indian industry sources said it valued the whole of Essar at about $5.7 billion.

However it became apparent that there were problems with the deal in early September, when Sechin travelled to India to meet the Ruia brothers, flying from Hangzhou, China, where he had been part of Putin's G20 summit delegation.

Sechin walked into the meeting with the Ruia brothers soon after landing in India at 1am, determined to close the deal, according to sources briefed on the discussions.

As the meeting started, one of the brothers told Sechin the deal process had been going on for too long, the exclusivity period had expired in July and Essar was now talking to other parties.

Those other parties included Saudi Aramco, he said.

According to the sources familiar with how the meeting unfolded, Sechin responded by saying that if Essar walked away from the deal it risked losing Russian financial and oil—supply support.

The Ruia brothers then said the talks with Rosneft were over and called an abrupt end to the meeting.

"People started leaving the room, embarrassed," one of the sources said. Another source said the Essar management had drafted a statement to say the deal with Rosneft was off.

Rosneft and Essar declined to comment on what transpired at the meeting, or on whether such a statement had existed. Sechin and the Ruia brothers could not be reached for comment.

Three Saudi—based sources familiar with details of talks between Essar and Saudi Aramco said the firm was seriously considering buying Essar. One of the sources said Aramco was prepared to pay up to $9 billion for all or most of the refiner.

Aramco declined to comment on whether it had made a bid.

Too big to fail

In the end, however, the Rosneft—Essar deal proved to be too big to fail.

For India, a deal collapse or a delay because of talks with another party would set back Modi's drive to clean up India's $140 billion mountain of bad debt given Essar's multi—billion—dollar debts to local and foreign banks after years of rapid expansion.

For Russia, the deal in the huge Indian market represented an important milestone in building a global oil empire despite Western sanctions imposed on Russia over its actions in Ukraine.

Facing the Saudi competition, Rosneft formed a consortium that bought 98 per cent of the refiner plus a fuel terminal for $13 billion. The Kremlin oil firm bought 49 percent — below the 50 percent level that would have fallen foul of Western sanctions — with Swiss trading house Trafigura and Russian private investment group UCP buying the other 49 percent.

According to the Indian and Russian industry sources, Rosneft and Essar returned to the negotiating table within days of the spat in early September, and the deal was finally struck.

One of the sources said there was a fierce battle between Essar and Rosneft over the terms. They said the Russian—led consortium was forced to outbid the Saudi offer, which they said comprised a combination of cash, long—term low interest credit and oil supplies.

Trafigura declined to comment on how the deal came together, while UCP did not reply to a written request asking for comment. Washington said the deal did not violate sanctions.

The deal was signed in Mauritius on October 14, a day before a formal announcement on the sidelines of a BRICS summit in Goa where Putin and Modi met. The leaders also oversaw the signing of a raft of other transactions including India agreeing to pay $5 billion for Russian long—range air defence missile systems.

Two industry sources said the Essar deal had first been discussed by Putin and Modi as far back as May 2014 on the sidelines of the St. Petersburg Economic Forum, Russia's main investor show.

It was unclear what form — if any — high—level government intervention might have taken after the September dispute.

But the two sources said that without political will in Moscow and New Delhi, an agreement could not have been struck.

"Putin and Modi saved that deal," said one.

Essar Steel

2017-18: efforts to retain Essar Steel

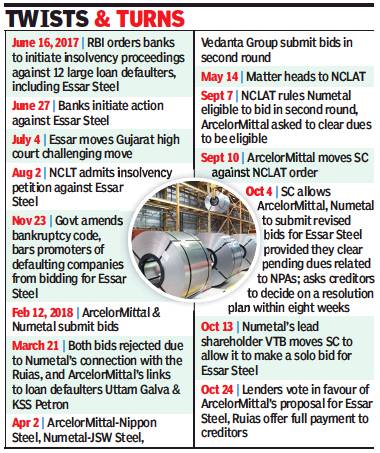

From: Reeba Zachariah, Ruias make huge last-gasp bid to retain Essar Steel, October 26, 2018: The Times of India

Offer ₹54,389Cr After Lenders Vote For Mittal

The Ruias mounted a stunning last-ditch effort to retain the flagship Essar Steel within the family. Led by brothers Shashi and Ravi, they offered Rs 54,389 crore to lenders for settling all claims and allowing the company to exit the bankruptcy process. Indications are that they might be willing to go up to Rs 60,000 crore.

The development comes even as creditors voted over Tuesday, Wednesday and Thursday in favour of ArcelorMittal’s Rs 42,000-crore bid for Essar Steel.

The latest move will shift the battle back to the courts, delaying the sale process of Essar Steel, besides putting pressure on ArcelorMittal to up its bid.

The Ruias’ offer consists of an upfront cash payment of Rs 47,507 crore to all creditors, including Rs 45,559 crore to senior secured financial creditors.

The proposal, made under section 12A of the bankruptcy rules, will lead to “full upfront recovery of loans for lenders, and maximum recovery for all other classes of creditors”, Essar Steel said in a statement.

Ruias, Arcelor spar over legitimacy of bid

Bankers Wonder Why Promoters Didn’t Make Offer To Repay All Loans Earlier

Section 12A states that a bankruptcy application can be withdrawn by the party that has filed it — SBI, in the case of Essar Steel — provided 90% of the lenders approve it. However, the recently amended rule states that such a withdrawal can only take place before the bidding process starts. The Ruias contend that the amended version came in June this year while the bankruptcy process of Essar Steel, the third largest private steel maker in the country with a capacity of 10 million tonnes per annum, started in October 2017.

ArcelorMittal, however, doesn’t agree with this. It maintained that Section 12A “doesn’t apply to the resolution process of Essar Steel”. “Any application to withdraw must be submitted prior to the issuance of the invitation for expressions of interest and must be accompanied by a bank guarantee for the specified amounts,” company said in a statement an hour after Ruias’s offer. “We expect the (auction) process to continue as per clear terms of the bankruptcy code,” it added.

The Ruias, said people close to the development, will disclose the funding arrangement to the creditors once their offer is accepted. Speculation is that Chinese bank ICBC will be a key lender to the transaction. The latest offer covers the dues of Orissa Slurry but not those of other Essar group companies such as ports, power and shipping. Sources said Essar could up the offer to Rs 60,000 crore to pay for the dues of a few other group entities as well.

Bankers appeared divided in their interpretation of the latest developments. Some argued that fresh offers should not be accepted once the entire insolvency process is completed. Others opined that the process has not been completed in the Essar case, where ArcelorMittal was the only declared preferred bidder but no letter of intent was issued. They also pointed out that legal challenges by Russia’s VTB-Numetal consortium is still pending in the SC.

A number of bankers wondered why the Ruias didn’t make this offer earlier. “If they are in a position to pay now, then why not earlier? RBI rules state that if a borrower has the ability to pay and does not pay then it can be classified as a wilful defaulter,” said a banker.

Essar sources said Arcelor-Mittal was “misrepresenting” the process. They said that section 12A was introduced in June 2018 and included the cases which were beyond EoI stage, “A reasonable view can be taken that an opportunity should be given to all ongoing cases to withdraw from CIR (corporate insolvency resolution) process by giving full recovery to secured lenders. Few lenders of Uttam Galva and related entities such as GPI Textiles and Gontermann Peipers (India) Ltd have not been paid and they are demanding from ArcelorMittal the payment of their overdues,” said a source.

Prashant Ruia, who is Essar Group’s director and son of group chairman Shashi Ruia, said, “The value and quality of the asset can be ascertained from the interest shown and value offered by all the global steel majors… Even after the onset of the insolvency resolution process, the shareholders of Essar Steel had made offers to settle the debt of the company, but the lenders did not accept them. We believe our current proposal will provide 100% recovery to secured creditors and lenders and maximum recovery for unsecured creditors,” Ruia said.

ArcelorMittal wins Essar Steel with ₹42,000cr bid/ 2018 Oct

From: Reeba Zachariah, ArcelorMittal wins Essar Steel with ₹42,000cr bid, October 27, 2018: The Times of India

ArcelorMittal said that Essar Steel creditors have voted in favour of its Rs 42,000-crore bid and have issued a letter of intent to sell the asset to the company. With the debt-ridden firm’s lenders not entertaining the lastminute, Rs 54,389-crore counter-bid of the Ruias to retain control, the original promoters are set to move court against the decision next week.

Though the creditors have approved ArcelorMittal’s proposal, the Essar Steel transaction also requires the consent of the National Company Law Tribunal (NCLT) before the world’s largest steel producer becomes the owner of India’s No. 3 private sector manufacturer, which has an annual capacity of 10 million tonnes. The $69-billion ArcelorMittal—which is controlled by Indiaborn, London billionaire Lakshmi Mittal—said it expects approval from NCLT to come before the end of the year.

Stake in Numetal blocked Ruias from bidding earlier

The sale of Essar Steel is the most keenly watched auction process under India’s still nascent bankruptcy law, where the banks are set to recover dues with the gentlest of hair-cuts.

The Ruias plan to challenge the decision by early next week, according to sources close to the family. They are awaiting a formal response from the creditors on their huge and sudden settlement offer, which was made under section 12A of the bankruptcy code in a bid to take the company out of the insolvency net.

While questions were raised about Ruias making an offer in the final stages of the bankruptcy proceedings, these sources claimed the family had only a small window to make such an offer as the Numetal case was pending before the Supreme Court till about three weeks ago.

The Ruias had a stake in Numetal—the consortium was led by Russian bank VTB—and had put in a bid for Essar Steel through it. But they had to divest their stake in Numetal as the bankruptcy code disallows promoters of insolvent companies from participating in the auction process of their own assets. Still, Numetal’s woes didn’t end. The SC directed it to clear the pending dues of Essar Steel before putting in a bid for the troubled steel maker.

“Since Rewant Ruia (son of Essar Steel co-founder Ravi Ruia) was part of Numetal, the family couldn’t make an alternate offer,” said a person close to the family. Separately, VTB also moved the apex court to allow the bank to make a solo bid for Essar Steel, which is yet to be heard.

The heightened interest in Essar Steel indicates the changing dynamics of the global alloy market with India expected to be the second largest steel-consuming nation, overtaking the current No.2, the US. The World Steel Association has predicted that India will consume 102mt of finished steel products in 2019, higher than the estimated 101mt consumption by the US in the same period.

ArcelorMittal, which has tied up with Nippon Steel & Sumitomo Metal Corporation for the Essar Steel transaction, will be infusing an additional Rs 8,000 crore in the Indian company to support operations, increase production and enhance profitability. The joint venture, which will finance the Rs 50,000-crore transaction through one-third equity and twothirds debt, will help in fulfilling Lakshmi Mittal’s more than a decade-old ambition of owning a large steel mill in India.

The Ruias, however, want the creditors to consider their proposal as it offers “full upfront recovery of loans for the lenders, and maximum recovery for all other classes of creditors”, and insist that it shouldn’t be ignored because of some procedural norms. The Rs 54,389-crore offer includes an upfront cash payment of Rs 47,507 crore to all creditors.

Section 12A allows withdrawal of a company from the bankruptcy process with 90% consent of the lenders, but it should be done before the bidding process starts.

2019: SC paves way for Ruia exit, Mittal entry

AmitAnand Choudhary, Nov 16, 2019: The Times of India

The Supreme Court set aside a ruling by the National Company Law Appellate Tribunal (NCLAT) and cleared the takeover of Essar Steel by global metals magnate LN Mittal’s ArcelorMittal after a protracted legal battle. This will pave the way for banks to recover Rs 42,000 crore in dues and oust the Ruias, once among India’s most powerful business families, from the company.

The money paid by Mittal will go to banks, mostly staterun, whose loans the Ruias had defaulted on.

This is among the biggest insolvency resolutions. The outcome, significant for banks and the government which are keen to recover NPAs, came after a tortuous journey marked by intense litigation, raising doubts about whether insolvency law can successfully recover lakhs of crores loaned to chronic defaulters.

The SC order breathes fresh hope into the process by emphasising that the Committee of Creditors will have the decisive say in resolutions, with the role of the National Company Law Tribunal and NCLAT confined to reviewing whether the process is in harmony with the Insolvency and Bankruptcy Code.

Essar Steel was among the first batch of a dozen high-profile bad debt cases referred by the Reserve Bank of India for the insolvency action in June 2017.

Though the law provides for resolution in a maximum 270 days, a series of cases in various forums resulted in the entire process stretching to nearly 28 months.

NCLAT ruling created hurdle for Mittal deal

ArcelorMittal’s proposal to take over the Indian company had been approved by Committee of Creditors (CoC), led by banks, but fresh hurdle arose following a ruling by NCLAT, which held that a financial creditor such as banks and an operational creditor such as a vendor be treated equally while settling dues.

Under IBC, it is the Committee of Creditors that is tasked with taking major decisions along with the resolution professional once proceedings have been initiated by NCLT.

The lenders moved the apex court and a bench of Justices Justice R F Nariman, Surya Kant and V Ramasubramanian set aside the NCLAT order. In a 164-page judgment, the bench demarcated the role of resolution applicants, resolution professionals, CoC and the adjudicating authorities in insolvency proceedings.

There was setback for the government too as the court struck down the provision under IBC making it “mandatory” to complete the insolvency proceedings within 330 days. However, it seemed to be pleased with the fact that the Essar case had finally gone through. Finance minister Niramala Sitharaman said the verdict reinforced the credibility and substantive nature of IBC and would help improve the process of resolution.