Shipping, India: II (government data)

This article has been sourced from an authoritative, official readers who wish to update or add further details can do so on a ‘Part II’ of this article. |

The source of this article

INDIA 2012

A REFERENCE ANNUAL

Compiled by

RESEARCH, REFERENCE AND TRAINING DIVISION

PUBLICATIONS DIVISION

MINISTRY OF INFORMATION AND BROADCASTING

GOVERNMENT OF INDIA

Shipping: India

Shipping plays an important role in the transport sector of India’s economy. Approximately 95% of the country’s trade volume (68% in terms of value) is moved by sea. India has one of the largest merchant shipping fleet among the developing countries and ranks 16th amongst the countries with the largest cargo carrying fleet with 10.67 million G.T. as on 31.5.2011 and average age of the fleet being 18.03 years. Indian maritime sector facilitates not only transportation of national and international cargoes but also provides a variety of other services such as cargo handling services, shipbuilding and ship repairing, freight forwarding, light house facilities and training of marine personnel, etc.

The salient features of India’s shipping policy are the promotion of national shipping to increase self-reliance in the carriage of the country’s overseas trade and protection of stakeholders’ interest in EXIM trade. India’s national flagships provide an essential means of transport for crude oil and petroleum product imports. National shipping makes significant contribution to the foreign exchange earnings of the country. The vision of the Ministry of Shipping is to ensure vibrant, efficient and safe ports and shipping services, shipping and shipbuilding industry, promote development the Major Ports to attain global standards and promote increased inland water transportation in India.

NATIONAL MARITIME DEVELOPMENT PROGRAMME

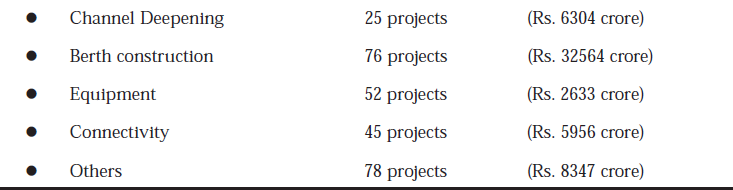

The National Maritime Development Programme has been formulated envisaging an investment of l 1,00,390 crore, comprising 276 projects covering all major ports entailing activities like construction/upgradation of berths, deepening of channels, rail/road connectivity projects, etc. at a cost of Rs.55,804 crore and 111 projects covering tonnage acquisition, maritime training, coastal shipping, aids to navigation, shipbuilding and building up of IWT infrastructure at a cost of Rs.44,535 crore.

The share of the private sector investment in the ports sector would be around Rs.34,505 crore mainly consisting of commercially viable projects like development and operation of berths, terminals, etc. Public funded projects would cover the activities like creation of common user infrastructure facilities. The objective is to upgrade and modernize the infrastructure in India considering global standards as the benchmark. The break up of the projects to be taken up under NMDP is given below :

As per the latest statistics, sixty four projects in the Port Sector have been completed and 71 projects are under progress.

Maritime Agenda for the decade 2010-2020

Ministry of Shippling has prepared a Maritime agenda for the decade 2010-20 to give a vision and road map for comprehensive development of shipping. The agenda envisages to create, build and sustain the maritime infrastructural needs of the country of the next decade. The overall vision of the Ministry as per the Maritime agenda aims towards navigating and steering the Indian Maritime sector realistically into the premier maritime nations of the world. This ten year period agenda of the Ministry of Shipping covers the last two years of the 11th Five Year Plan, the entire period of 12th Five Year Plan and the first three years of the 13th Five Year Plan. This document basically presents an agenda in the Shipping sector for consideration within overall objective to increase efficiency of the delivery system and overall pace of growth in the sector. Indeed, this is a pathbreaking document which will serve as road map for all ports (major as well as non-major ports) and shipping sector during the decade 2010-2020, which includes maritime sector development by maritime states.

INDIAN TONNAGE

Government nationalized the fiscal regime for Indian Shipping Industry by introducing Tonnage Tax system from the financial year 2004-05 in order to provide Indian Shipping Industry a level playing field vis-a-vis international shipping companies and also facilitate the growth of Indian tonnage. Indian Tonnage has steadily grown over last four years. Indian tonnage as on 1.6.2004 was 7.05 million Gross Tonnage (GT) which has increased to 10.76 million GT as on 30.6.2011. India has allowed 100% FDI in the Shipping sector.

COASTAL SHIPPING

Coastal Shipping is an energy efficient, environmental friendly and economical mode of transport in the Indian transport network and a crucial component for the development of domestic industry and trade. (India, with her 7,517 km. and a hinterland of about 380,000 sq kms, covering 9 maritime states; 5 states on the Western Coast and 4 on the Eastern Coast apart from Puducherry, Lakshadweep in the Arabian Sea and the Andaman and Nicobar Islands in the Bay of Bengal, also form

part of the coastal hinterland. These islands, covering an area of morethan 8,300 sq. km., are dependent on coastal shipping for the transportation of cargo and passengers to the mainland as well as for inter-island movement. The Exclusive Economic zone of India has also seen a huge growth in exploitation of subsea assets and a spurt of activity in this region and the proposed policy also encompasses activities within this zone. It has also a long coastline studded with 13 major ports and 200 non-major ports providing congenial and favourable conditions for the development of this alternate mode of transport.

India’s Coastal Shipping Tonnage as on 30.6. 2011 is 732 vessels with 10,35,821 GRT and 10,24718 DWT. Action plan for the development of coastal shipping is already on the anvil with Central Government. With a view to promot coastal shipping and sailing vessel industry, the home trade vessels and sailing vessels have been exempted from the payment of Lighthouse dues under the provisions of the Lighthouse Act, 1927. Berth related charges have been reduced by 30% of what is charged from other (foreign going) vessels. Besides, vessel related charges for coastal vessels and cargo related charges for coastal cargoes have also been reduced and are now charged at 60% of the rate charged from other (foreign going) vessels. Tonnage tax is available to coastal ships registered under the Merchant Shipping Act. Efforts are being made to develop minor ports, which would, in turn, develop.

AIDS TO NAVIGATION

Since Independence, India has made rapid growth in Aids to Marine Navigation. From 17 Lighthouses at the time of Independence, the present strength of Aids to Navigation consists of 180 Lighthouses, 01 Lightship, 64 Racons, 21 Deep Sea Lighted Buoys, 02 Wreck Marking Buoys and 23 Differential Global Positioning Systems (DGPS). To cater to the offshore lights and for maintaining the buoys, the Directorate General of Lighthouses & Lightships is maintaining 02 large ocean going vessels, M.V. Sagardeep-II and M.V. Pradeep. In the 11th Five Year Plan, VTS Gulf of Kachchh, 12 new Lighthouses and a National Automatic Identification System (AIS) Network is proposed to be set up. The Directorate is also in the process to establishing Navtex Chain for broadcast of safety and weather related information to local mariners. The scheme of VTSGulf of Kachchh is likely to be made operational by October, 2011.

TRAINING

India has had long maritime tradition. She is the 17th largest maritime country in the world. The single largest contributing to this glorious tradition is the presence of strong dedicated, efficient and revival reservoirs of officers and rating to Merchant Navy in India. The safety and efficiency of ships are crucially dependent upon professional ability and dedication of well trained seafarers. Great importance has always been attached to the maintenance of high quality training imparted to maritime personnel in India which has facilitated India emerging as a major manpower supply nation to a worldwide Shipping. The ever increasing demand of Indian Seafarers world-wide is a statement of the quality of education and training received in India.

INDIAN MARITIME UNIVERSITY

The Ministry of Shipping have set up an Indian Maritime Universiity (IMU) on 14.11. 2008 in Chennai with campuses at Chennai, Kolkata, Mumbai and Visakhapatnam as a Central University through IMU Act, 2008 (22 of 2008). The existing seven Government and Government-aided maritime training and research institutes, viz., Marine Engineering & Research Institute, Kolkata, Marine Engineering and Research Institute, Mumbai, Lal Bahadur Shastri College of Advanced Maritime Studies and Research, Mumbai, T.S. Chanakya, Navi Mumbai, National Maritime Academy, Chennai, Indian Institute of Port Management, Kolkata as well as National Ship Design and Research Centre, Visakhapatnam have been merged with the IMU.

Ojective

a. To facilitate and promote maritime studies.

b. To promote advanced knowledge by providing institutional and research facilities.

c. To take appropriate measures for promoting innovations in the teaching learning process in inter-disciplinary studies and research.

Expected Outcomes

a. Quality manpower: IMU will ensure not only quality manpower but also make a shift from training to education to concentrate on high end academic programmes in areas like Management, Law, Policy, Environment, Maritime Administration, etc.

b. Service export and Foreign Exchange: The IMU will help meet the expected global shortage of manpower besides generating employment as well as earning foreign exchange.

c. Research and Development: At present, the R&D efforts are almost negligible which renders the country dependent on others for skills and knowledge upgradation. The IMU will focus on Research and Development in the sector.

d. Enhanced status: It will enhance the image of India as a maritime nation.

SHIPPING CORPORATION OF INDIA LTD

The Shipping Corporation of India Ltd. (SCI) was formed on 02.10.1961. Presently, the authorised capital of the company is Rs.1000.00 crore and the Paid Up Capital is Rs.465.79 crore. The status of SCI has been changed from a Private Limited Company to Public Limited Company from 18.09.1992. The SCI was conferred the “Navratna” status by the Government of India in August 2009. Presently, the Government is holding 63.75% of the Share Capital and the balance is held by Financial Institutions, Public and others (NRIs, Corporate Bodies etc.). SCI has been signing the Memorandum of Understanding (MoU) with the Ministry of Shipping, Government of India, and has received “Excellent” rating consistently for 19 years, upto the year 2009-10. The SCI has signed the MoU for the financial year 2011-12 with the Ministry of Shipping on 24.3.2011.

Presently, the SCI's fleet stands at 79 vessels aggregating about 3.26 million GT (5.73 Million DWT) comprising of Cellular Container Vessels, Crude Oil Tankers (including a Combination Carrier), Product Tankers, Bulk Carriers, LPG/ammonia Carriers, Phosphoric Acid Carriers, Passenger-cum-Cargo Vessels and Offshore Supply Vessels. The SCI provides Liner and Passenger Services, Bulk Carrier and

Tanker Services, Offshore Services and Specialized Services. As on 1.6.2011, the share of SCI in terms of GT is around one-third of the total Indian tonnage. Additionally, the SCI also manages 46 vessels aggregating to 0.30 million GT (0.20 Million DWT) on behalf of two JVCs, viz., India LNG Transport Company No.1 and India LNG Transport Company No. 2, Andaman and Nicobar Administration, Union Territory of Lakshadweep Administration, Geological Survey of India (Ministry of Mines), Ministry of Earth Sciences (Department of Ocean Development), and Oil and Natural Gas Corporation (PSU). SCI’s managed fleet includes LNG Tankes, Passenger Vessels, Passenger-cum-Cargo Vessels, Bunker Barge, Research Vessels, Ocean Research Vessel, Fishing and Oceanographic Research Vessel, Offshore Supply Vessels, Seismic Survey Vessel, Well Stimulation Vessel, Diving Support Vessel. Unlike conventional cargo carrying vessels, these managed vessels perform specialized functions and require expert skills for their operations. Further, SCI also mans an LNG Tanker of its third JVC, viz. India LNG Transport.

The highly diversified fleet of the SCI includes modern and fuel-efficient ships giving it a qualitative status as also a distinct competitive edge over other fleet owners. SCI's acquisition, programme for the 11th Five Year Plan (2007-2012) envisages acquisition of 62 vessels of order 2.6 million GT (4.5 MT DWT). Presently, SCI has 31 vessels on order aggregating 1.18 million GT (about 2.02 MT DWT). The SCI has maintained a consistent track record of profitability and dividend. Its total income for the financial year 2010-11 was Rs.4,019.77 crore and net profit after Tax Rs.567.35 Crore. The company proposed a final divided of 25% on the paid up share capital in addition to the interim dividend of 30% paid during financial Year 2010-11.

COCHIN SHIPYARD LIMITED, KOCHI

Situated in the south western coast of India in the city of Kochi, State of Kerala, Cochin Shipyard is the largest shipyard in the country. Incorporated in the year 1972, Cochin Shipyard can build ships upto 1,10,000 DWT and repair ships upto 1,25,000 DWT. The yard has built varied types of ships including tankes, bulk carriers, port crafts, offshore vessels, tugs and passenger vessels. The orders executed by CSL in recent past includes bulk carriers for M/s Clipper Group, Bahamas; Firefighting tugs for M/s ATCO, Saudi Arabia and Platform Supply vessels for M/s Deep Sea Supplies, Norway; M/s Tidewater, USA and M/s Varoon Offshore AS, Netherlands.

The yard’s ship building order book position as on 01.06.2010 includes 10 nos. of Platform Supply Vessels for Shipping Companies of Norway, Cyprus and India, 4 Nos. of Anchor Handling Tugs for Shipping Corporation of India and 20 Nos. of Fast Patrol Vessels for Coast Guard. The Indigenous Aircraft Carrier for the Indian Navy is also presently under construction in the shipyard. This will be the biggest warship ever built in India.

The yard is also a leading ship-repairer of the country and has repaired more than 1200 ships of all types. These include up-gradation of vessels and Jack Up Rigs belonging to ONCG, periodical lay up repairs and life extension of ships including Aircract Carrier of Navy and Cost Guard. The yard has been consistently achieving profits for the last several years. Considering its achievement, the Government granted it the Miniratna status on 21-7-2008.

HOOGHLY DOCK AND PORT ENGINEERS LTD.

Hooghly Dock and Port Engineers Limited (HDPEL), Kolkata is one of the oldesh shipyards in India, specializing in small/medium shipbuilding. It was established in 1819 in private sector and was nationalized in 1984. The Company has two units in Howrah District of West Bengal, one at Salkia and another at Nazirgunge. The installed capacity in shipbuilding is 1,100 tonnes per annum and in ship-repairs, 125 ships per annum. Apart from a dry dock and a jetty, it has six slipways. The yard is capable of constructing various types of ships (including passenger ships) and other vessels such as dredgers, tugs, floating dry docks, fishing trawlers, supplycum- support vessels, multipurpose harbour vessels, light house tender vessels, barges, mooring launches, etc. and undertaking repairs of different types of vessels. The Shipbuilding orders include 6 nos. of Workboats, 1 no. of Hydraulic Surface Dredger, 1 no, of Self loading Cargo Vessels and 1 No. of Floating Dry Dock for Inland Waterways Authority of India (IWAI). HDPEL has also secured order from Indian Navy for construction of 4 nos. 1000 T Fuel Barges with an option for construction of 2 more Barges.

SHIPBUILDING AND SHIPREPAIR

There are 27 well known shipyards in the country, 8 in the public sector and the remaining 19 in the private sector. The maximum size of vessels, which can be built in India in the public sector, is 1,10,000 DWT at Cochin Shipyard Ltd. and 80,000 DWT at Hindustan Shipyard Ltd. These sizes of vessels are relatively small compared to the current trend of building large size vessles worldwide. The current capacity of all the yards is 5,00,000 DWT approximately. The Indian Shipbuilding Industry, which had only about 0.1% share of the world shipbuilding in 2002, expanded over tenfold to claim 1% share by 2007/2008 riding on the global boom and supported by a subsidy scheme.

Shipbuilding turnover for private and public sector shipyards excluding Defence Shipyards has grown about 14 fold in the last nine years from about Rs.440 crores in 2001-2002 to an estimated r 6200 crores in 2010-2011. As much as 40% of Indian ships, will need to be replaced over the next 5 years owing to age (above 20 years) and mandatory IMO regulations for phasing out single hull tankers, which, in the absence of sufficient acquisition, may result in further erosion. At present domestic shipping companies rely heavily on foreign yards for acquisition or repairs.

Policies encouraging greater participation from Indian shipping and incentivizing acquisition from local yards would facilitate in retaining a higher share of the expanding seaborne trade within the domestic economy.

Government of India extended the Shipbuilding Subsidy Scheme, for both export and domestic orders also to private sector Indian shipyards on 25.10.2002. Earlier, the scheme was open only to the Central public sector shipyards. The share of Indian Shipbuilding industry in the global order book expanded rapidly from less than 0.1% share in 2002, to 1.3% till March, 2011. The above subsidy scheme was applicable for contracts signed upto 14th August 2007. In the face of global recession and in the absence of Government support in the form of a subsidy scheme post August, 2007, Indian shipyards have been languishing for want of new orders. The momentum created by a combination of boom conditions and subsidy support has been arrested by the discontinuation of the subsidy scheme and recession, post 2007. Lapsing of the subsidy scheme has also resulted in a progressive attrition in the share of Indian yards in global order

book.

While during 2002 and 2007, orderbook increased fourfold from 0.3 million

DWT to nearly 1.3 million DWT accompanied by an impressive increase in global

market share, after 2007, the share in the new orders has progressively declined

from 0.67% in 2007 to 0.22% in 2009 and 0.13% in 2010 (Source-Clarksons)

The National Manufacturing Competitive Council (NMCC) has been

emphasizing the need for a shipbuilding policy to enable Indian Yards to compete

effectively in both the domestic and export markets to help build a strong

shipbuilding sector in the country, given its potential for employment generation

as well as its stragetic importance. In a meeting held on 7th January, 2010, NMCC

recommended that the Shipbuilding Industry in India needs to be granted

Infrastructure status and be also declared as a Strategic Sector.

Ship Repair activity in India is largly concentrated around 18 small sized

commercial dry docks, equally divided between the public and private sectors.

This

is supplemented by 'wet berths' in major ports and captive repair facilities for the

Navy.

The ship repair businesses worldwide are estimated to be around 12 billion $

(appox k 55,000 crs.). India as a whole gets a revenue of not more than 100 million

$ per annum (r 463 crs) which is less than 1% of world ship repair share. It is

estimated that the total potential of the ship repair market available in the Indian

region is of the order of r 2440 to r 2790.

The ship repair activities in India are regulated through designated Ship Repair

Units (SRUs) registered and licensed by the DG Shipping. The SRUs are a mixed lot

where except few shipyards (CSL and HSL) that have comprehensive facilities for

major repairs and dry docking, most other are small to medium size firms that can

carry out limited repairs to machinery and equipment only. Only designated SRUs

are allowed to avail of the custom duty and excise concessions.

There are a total of about 30 SRUs registered with DG Shipping in the entire

country and only 4-5 shipyards out of a total of 27 in the country carry out any

significant repair jobs.

CRUISE SHIPPING

Please see:

CENTRAL INLAND WATER TRANSPORT CORPORATION LTD (CIWTC)KOLKATA

Central Inland Water Transport Corporation Ltd. (CIWTC) was incorporated on 22nd February 1967 by taking over all the assets of the erstwhile River Steam Navigation Co. Ltd. The Principal Activity of the Corporation is the transportation of cargo through inland waterways in the country and through the routes identified in the Protocol on inland water transport between India and Bangladesh. Both the Registered office and Corporate office of CIWTC are located in Kolkata and various branches are at Guwahati, Karimganj, Badarpur, Dhubri, Patna, etc. The existing fleet strength of the CIWTC is about 101 vessels comprising 21 Pusher Tugs, 15 Self Propelled Carriers, 58 Dumb Barges, 3 Oil Tankers and 4 Over Dimensional Cargo Carriers, During 2010-11. CIWTC transported 42,882 metric tonnes of cargo.

PORT DEVELOPMENT

Private Sector Participation in Port Projects Upon the entry of private sector in the Ports sector as a sequel to the opening up of the Indian economy, a Model Concession Agreement (MCA) has been finalized to ensure transparency in the selection process for award of contracts with the scope of making project/commodity specific alterations to suit the specific requirements of the project. The objective is to give a fillip to private investment in the port sector.

In the year 2010-11, 9 projects under PPP mode relating to berth construction/ mechanization etc. were awarded under the Public Partnership mode by the Ministry of Shipping.

SETHUSAMUDRAM SHIP CHANNEL PROJECT

There are 27 well known shipyards in the country, 8 in the public sector and the remaining 19 in the private sector. The maximum size of vessels, which can be built in India in the public sector, is 1,10,000 DWT at Cochin Shipyard Ltd. and 80,000 DWT at Hindustan Shipyard Ltd. These sizes of vessels are relatively small compared to the current trend of building large size vessles worldwide. The current capacity of all the yards is 5,00,000 DWT approximately. The Indian Shipbuilding Industry, which had only about 0.1% share of the world shipbuilding in 2002, expanded over tenfold to claim 1% share by 2007/2008 riding on the global boom and supported by a subsidy scheme.

Shipbuilding turnover for private and public sector shipyards excluding Defence Shipyards has grown about 14 fold in the last nine years from about Rs.440 crores in 2001-2002 to an estimated r 6200 crores in 2010-2011. As much as 40% of Indian ships, will need to be replaced over the next 5 years owing to age (above 20 years) and mandatory IMO regulations for phasing out single hull tankers, which, in the absence of sufficient acquisition, may result in further erosion. At present domestic shipping companies rely heavily on foreign yards for acquisition or repairs. Policies encouraging greater participation from Indian shipping and incentivizing acquisition from local yards would facilitate in retaining a higher share of the expanding seaborne trade within the domestic economy.

Government of India extended the Shipbuilding Subsidy Scheme, for both export and domestic orders also to private sector Indian shipyards on 25.10.2002. Earlier, the scheme was open only to the Central public sector shipyards. The share of Indian Shipbuilding industry in the global order book expanded rapidly from less than 0.1% share in 2002, to 1.3% till March, 2011. The above subsidy scheme was applicable for contracts signed upto 14th August 2007.

In the face of global recession and in the absence of Government support in the form of a subsidy scheme post August, 2007, Indian shipyards have been languishing for want of new orders. The momentum created by a combination of boom conditions and subsidy support has been arrested by the discontinuation of the subsidy scheme and recession, post 2007. Lapsing of the subsidy scheme has also resulted in a progressive attrition in the share of Indian yards in global order

book.

While during 2002 and 2007, orderbook increased fourfold from 0.3 million DWT to nearly 1.3 million DWT accompanied by an impressive increase in global market share, after 2007, the share in the new orders has progressively declined from 0.67% in 2007 to 0.22% in 2009 and 0.13% in 2010 (Source-Clarksons) The National Manufacturing Competitive Council (NMCC) has been emphasizing the need for a shipbuilding policy to enable Indian Yards to compete effectively in both the domestic and export markets to help build a strong shipbuilding sector in the country, given its potential for employment generation as well as its stragetic importance. In a meeting held on 7th January, 2010, NMCC recommended that the Shipbuilding Industry in India needs to be granted Infrastructure status and be also declared as a Strategic Sector.

Ship Repair activity in India is largly concentrated around 18 small sized commercial dry docks, equally divided between the public and private sectors. This is supplemented by 'wet berths' in major ports and captive repair facilities for the Navy.

The ship repair businesses worldwide are estimated to be around 12 billion $ (appox k 55,000 crs.). India as a whole gets a revenue of not more than 100 million $ per annum (r 463 crs) which is less than 1% of world ship repair share. It is estimated that the total potential of the ship repair market available in the Indian region is of the order of r 2440 to r 2790.

The ship repair activities in India are regulated through designated Ship Repair Units (SRUs) registered and licensed by the DG Shipping. The SRUs are a mixed lot where except few shipyards (CSL and HSL) that have comprehensive facilities for major repairs and dry docking, most other are small to medium size firms that can carry out limited repairs to machinery and equipment only. Only designated SRUs are allowed to avail of the custom duty and excise concessions. There are a total of about 30 SRUs registered with DG Shipping in the entire country and only 4-5 shipyards out of a total of 27 in the country carry out any significant repair jobs.

CARGO TRAFFIC

The cargo handling capacity of Major Ports as on 31st March, 2011 is 670.13 million tonnes. The Ministry of Shipping has formulated the Maritime Agenda 2020 which is a perspective plan of the Ministry for the decade. This identifies priority areas for development of Port & Shipping sector in the country and is a road map to guide the agencies to develop the India Maritime sector.

During the year 2010-11, the following Port Project for capacity augmentation have been completed and commissioned. 1. Development of Coal Terminal with a capacity of 8.00 MMTA at Ennor Port. 2. Development of Iron Ore Terminal with a capacity of 12.00 MMTA at Ennore Port Ltd. 3. International Container Trans-shipment Terminal (ICTT) - Phase-I with a capacity of 12.50 MMTA at Cochin Port. 4. General Cargo Berth 1.0 MMTA at Ennore Port.

Ennore Port Limited

Ennore Port Limited (EPL), the twelfth Major Port, is the first Corporate Major Port of India. The Ennore Port Limited has been registered under the Companies Act 1956 on 11 October 1999. The Port commenced commercial operations on 22.06.2001. The first phase of development of Ennore Port from a Greenfield situation was made with an investment of about Rs.10.58 crores.

The Ennore Port Ltd is making profit since 2005-06. Having regard to its continuous profit making record, Mini Ratna Category I status was conferred on Ennore Port by the Government of India. Ennore Port has signed MOU with the Department of Shipping for the first time in the financial year 2006-07. The company achieved “Excellent” MOU score during three consequetive years. Even for the year 2010-11, the provisional MOU rating is "Excellent"

Financial Performance

During the financial year ended 31 March, 2011, Ennore Port Limited has reported a pre-tax and post tax profit of Rs.69.86 crores and Rs.55.58 crores respectively as against Rs.59.46 crores and Rs.48.66 crores reported in the previous year ended 31 March 2010 and it has declared a dividend of 20% on PAT.

Development Projects

The Port has taken implementation of Projects identified in NMDP as Phase II development and successful in attracting an investment of Rs.2600 crores on development of various cargo terminals-liquid bulk (Rs.250 cr) common user coal - (Rs.400 cr.) and Iron Ore - (Rs.480 cr.) and 1.5 MTEU Container Terminal (Rs.1400 cr.) on PPP-BOT model. EPL has also planned an ambition Capex programme of Rs.1852 crores during the next five years under NMDP/12th Five year Plan as common infrastructure facilities to facilitate the commissioning of PPP projects and for other capacity expansion projects mainly Coal Berths for handling TNEB coal. The projects also include deepening of the Port's approach channel to 20 meters for handing cape size bulk carries and augmenting rail/road connectivity. Recently, Government of Tamil Nadu has signed a MOU with IOCL for setting up a LNG Terminal of 5 MTPA at Ennore Port.

DREDGING CORPORATION OF INDIA LIMITED VESAKHAPATAM

Dredging Corporation of India Limited (DCI) was established in 1976 to provide integrated dredging service to the major ports of the country. DCI is a Mini Ratna Category - 1 Public Sector Undertaking under the administrative control of Ministry of Shipping, Government of India. The company is a Schedule “B” Company. Clients include Major Ports, Non-Major Ports, Indian Navy, State Government, etc. The Company, as on date, has 10 Trailer Suction hopper Dredgers (TSHDs) and 3 Cutter Suction Dredgers. Order for three more TSHDs of 5500 expected to join fleet in November 2011.

The paid-up capital of the company is Rs.28.0 crores divided into 2,80,00,000 equity shares of Rs.10/- each, of which 78.56 per cent, i.e. 2,19,97,700 shares are held by President of India. For the year 2010-11, the Company achieved a total income of Rs.523 crore and profit after tax of Rs.40 crore. The EPS for the year 2010-11 is Rs.14.11. The total number 1096 India 2012 of employees is 693. The company has achieved a MOU rating of "Good" for the year 2010-11.

The company is listed in Mumbai, National, Delhi and Kolkata stock exchanges. The number of shareholders is about 54000. The company has adopted a Corporate Social Responsibility Policy for fulfilling its obligation to the society at large. The company would be undertaking development activities in consultation with the Government administration and other specialist agencies.

See also

Shipping, India: II (government data)