Shopping malls: India

This is a collection of articles archived for the excellence of their content. Readers will be able to edit existing articles and post new articles directly |

Contents |

Operational mall stock

City wise

2022

From: Oct 3, 2022: The Times of India

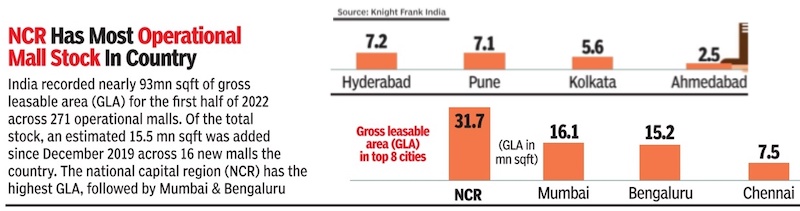

See graphic:

Gross leasable area (GLA) in top 8 cities, 2021

Shopping habits

Trends, 2014

Lakshmi Kumaraswami, Dec 25, 2014: India Today

From: Lakshmi Kumaraswami, Dec 25, 2014: India Today

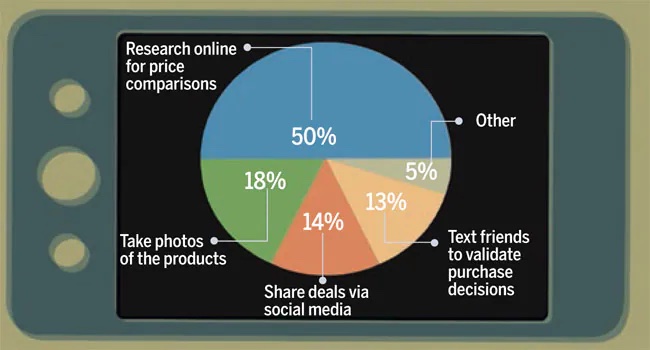

See graphic:

Shopping trends, 2014

Sixty-seven per cent people globally use their mobile phones to shop. Apart from the actual act of buying, here's how they use their smartphones to facilitate purchases.

Asia’s most impatient/ 2018

From: May 2, 2019: The Times of India

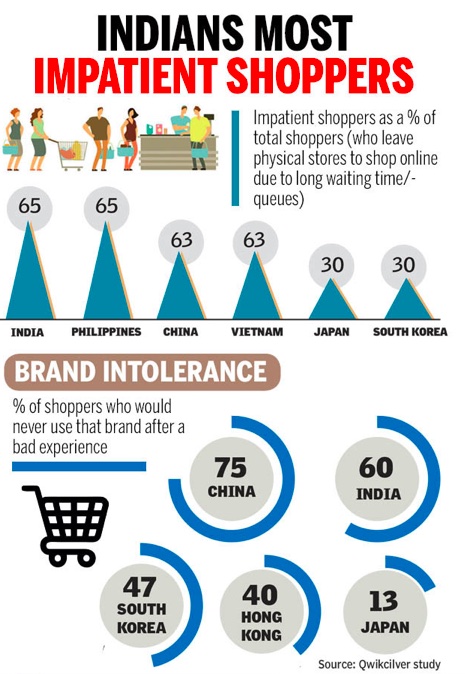

See graphic:

Indians were Asia’s most impatient, presumably in 2018

Shopping malls: India

Malls more than double in 2008-13

60 Come Up In 2012-13 Developers Build Big Despite Slowdown: Study

Samidha Sharma & Anshul Dhamija TNN

The Times of India 2013/08/08

The slowdown in the Indian realty sector has surprisingly not hampered the development of new malls across the country.

The number

India has 570 operational malls (as of May 2013) with a total area of 180 million sq ft compared to just 225 malls that were up and running five years ago, according to numbers collated by a real estate consultancy firm which were shared with TOI exclusively.

The seven metros have 190 operational malls even as more than 60 opened across India in the last one year alone, data from Bangalore-based Asipac Consulting says. And it’s not just the number of malls that has more than doubled since 2008 — the average area of the top 15 malls across the country has gone up 40% (from 6.17 lakh sq ft to 8.66 lakh sq ft) in the last three years.

The promoters

Developers such as the Rahejas (Inorbit), Phoenix (Market City), DLF and Prestige (Forum) are now building larger malls as these have a better chance of succeeding in an overcrowded marketplace, the report from Asipac says. Industry experts say consumers prefer bigger malls which offer more brands under one roof rather than visiting multiple malls, mirroring what happened in the mature retail markets years ago.

With easing of the FDI policy, international retailers coming to India are expected to occupy larger spaces thereby increasing revenues. “If the anchor tenants occupy larger spaces, it would benefit retailers as well as the consumer, who can expect prices to come down by 10-15% in these large-format stores. As a consequence, the revenue of the mall would definitely go up,” says Pushpa Bector, senior VP, head (leasing & mall management), DLF Mall of India, which opens early next year in Noida. The mall, spread across 1.9 million sq ft, will have 14 anchor tenants, including brands like Uniqlo which will make its debut in India.

Profitability and projections for the future

A dipstick done by Asipac shows around 40% of the malls in the country are performing well. Of the ones doing well, most grew by about 16% last year and 12% in financial year 2013 — not bad considering the overall macro situation in the country. Bigger malls may not succeed immediately but they eventually pull in people because of the mix of brands that they offer, says Amit Bagaria, founder, Asipac group.

between 2013 and 2016, the average area of the top 15 malls is projected to go over 10.3 lakh sq ft, based on 2013 construction, the report says, indicating the preference for building larger shopping complexes. The average daily footfall in Phoenix Marketcity, the largest mall in terms of size, is 65,789 compared to 90,803 for GIP, Noida, ranked seventh on the list.

Shashie Kumar, senior centre director at Phoenix Marketcity, Bangalore, says over the last few years the focus of consumers has evidently shifted to larger mall spaces even as there has been proliferation of micromarkets within cities. However, some developers feel currently the country does not have as much supply to fill up large malls. “The ideal mall space in India is between 6-8 lakh sq ft. India doesn’t have that many brands for mall developers to build beyond a million sq ft and be profitable,” says S Raghunandhan, CEO, retail, Prestige Estates Projects, which runs the UB City Mall in Bangalore.