Start-ups: India

This is a collection of articles archived for the excellence of their content. the Facebook community, Indpaedia.com. All information used will be acknowledged in your name. |

Countries that have invested in Indian start-ups

2017: USA, Japan...

Over 50% foreign funding in Indian startups from non-US investors, July 16, 2018: The Times of India

The lower strip is: Amount invested.

From: Over 50% foreign funding in Indian startups from non-US investors, July 16, 2018: The Times of India

More than 220 foreign investors put $1.2 billion into Indian startups in the first half of 2017. Japanese investors were fewer in number, but the amount of funding they brought was second only to the US, which had the most investors.

Cities that funded the most Startups

2019: Delhi, Bengaluru, Mumbai, Hyderabad

Shubhra Pant, Sep 11, 2019: The Times of India

From: Shubhra Pant, Sep 11, 2019: The Times of India

From: Shubhra Pant, Sep 11, 2019: The Times of India

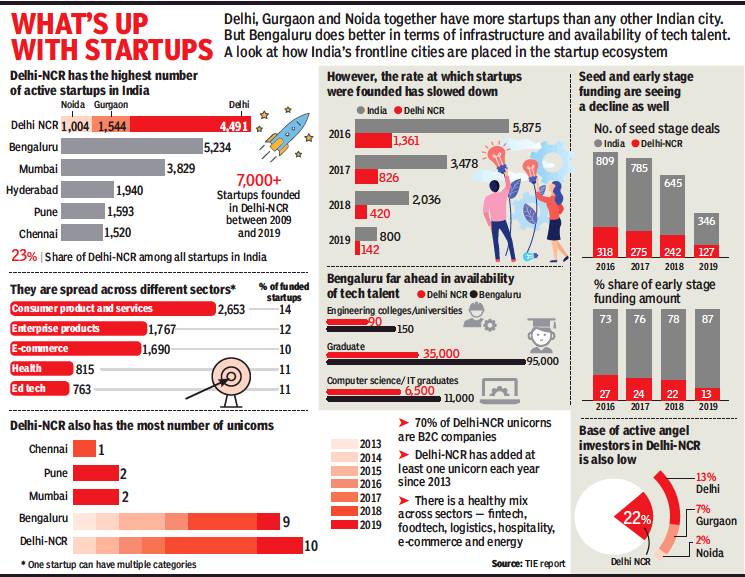

Bengaluru is India’s Silicon Valley, but here’s the surprise: Delhi, Gurgaon and Noida — collectively, Delhi-NCR — together are far ahead in the number of startups they are home to. Another reason to call the National Capital Region India’s startup capital region is that it is home to the highest number of unicorns — companies valued at over $1bn — which underlines the economic might it possesses.

The numbers were revealed in a report launched by Niti Aayog CEO Amitabh Kant in Delhi on Tuesday; at 7,039, Delhi-NCR is a runaway leader in the number of startups, followed by Bengaluru (5,234), Mumbai (3,829), Hyderabad (1,940), Pune (1,593) and Chennai (1,520).

Delhi alone, with 4,491 startups, is well ahead of Mumbai while Gurgaon (1,544), the magnet around which Delhi-NCR’s corporate world revolves, has more startups than Chennai and is almost equal to Pune. Noida, where mobile payment firm Paytm is based, has over 1,000 startups and is catching up with the others fast. In terms of the total startup valuation in India, Delhi-NCR’s contribution is almost 50%.

The report, titled ‘Turbocharging the Delhi-NCR Start-up Ecosystem’, has been prepared by The India Entrepreneur (TIE) network along with Zinnov, a Gurgaon-based management consulting firm.

Commenting on the findings, Rajan Anandan, MD of Sequoia Capital, India and TIE’s Delhi-NCR president, said the numbers had come as a surprise to them as well. “NCR is the strongest in consumer tech and services startups with real potential to make it to the top five globally in terms of the startup ecosystem and activity,” said Anandan.

According to the report, NCR — home to the likes of Zomato, OYO and Rivigo — has 10 unicorns, followed by Bengaluru with nine. Mumbai has only two.

The numbers were revealed in a report launched by Niti Aayog CEO Amitabh Kant in Delhi on Tuesday; at 7,039, Delhi-NCR is a runaway leader in the number of startups, followed by Bengaluru (5,234), Mumbai (3,829), Hyderabad (1,940), Pune (1,593) and Chennai (1,520).

Delhi alone, with 4,491 startups, is well ahead of Mumbai while Gurgaon (1,544), the magnet around which Delhi-NCR’s corporate world revolves, has more startups than Chennai and is almost equal to Pune. Noida, where mobile payment firm Paytm is based, has over 1,000 startups and is catching up with the others fast. In terms of the total startup valuation in India, Delhi-NCR’s contribution is almost 50%.

The report, titled ‘Turbocharging the Delhi-NCR Start-up Ecosystem’, has been prepared by The India Entrepreneur (TIE) network along with Zinnov, a Gurgaon-based management consulting firm.

Commenting on the findings, Rajan Anandan, MD of Sequoia Capital, India and TIE’s Delhi-NCR president, said the numbers had come as a surprise to them as well. “NCR is the strongest in consumer tech and services startups with real potential to make it to the top five globally in terms of the startup ecosystem and activity,” said Anandan.

According to the report, NCR — home to the likes of Zomato, OYO and Rivigo — has 10 unicorns, followed by Bengaluru with nine. Mumbai has only two.

Delhi beckons entrepreneurs, but still has no govt-backed startup hub

The interesting part is that beyond these 10 unicorns, NCR has another 10 soon-to-be unicorns and once they touch the $1-billion mark, it will be very difficult for any other city to beat NCR in this area,” Kant said while launching the report.

Delhi-NCR also has three of India’s four most valuable listed internet companies — Info Edge, MakeMyTrip and indiaMART. “It is quite motivating for budding entrepreneurs like me to know that Delhi has such a strong startup ecosystem. When you see so many companies touching the unicorn mark, you also get inspired and motivated to reach there,” said Meghna Saraogi, founder of Styledotme, a Gurgaon-based startup.

The report also pointed out that Delhi-NCR also has a diverse mix of startups with maximum activity in consumer products and services (14% of the total), followed by e-commerce, health, and education tech. Reacting to the findings, Sakshi Vij, founder of MylesCar said, “I think Bangalore has always been marketed better than Delhi probably because they started early. But Bangalore is now saturating as a market.”

But on the flipside, the success story of Delhi-NCR hasn’t quite led to organic growth in its support system where Bangalore is still the best-placed city in India. For a region that plays host to 23% of the country’s total startups, there is not a single government-backed startup hub in Delhi-NCR. Besides, only 10% of all incubators in India are located in Delhi-NCR and only 8.5% of all accelerators are based here. The report, highlighting this, called for a robust infrastructure setup in and around Delhi to sustain this growth rate. “When it comes to government initiatives to boost startup activity, assistance must also be provided in NCR,” said Anandan.

Meanwhile, Kant assured industry members that, “We are willing to open up to 25 incubation centres in NCR as long as we get viable business models. We will also speak with the Haryana and UP government and push for the development of startup hubs in Noida and Gurgaon.”

2020, 2021

From: Oct 25, 2021: The Times of India

See graphic:

Cities that funded the most Indian Startups in 2020, 2021

2021-22

February 1, 2022: The Times of India

From: February 1, 2022: The Times of India

New Delhi/Bengaluru: Delhi NCR has dethroned Bengaluru as the startup capital of India, the Economic Survey for 2021-22 showed, highlighting the rise of the national capital on the startup ecosystem.

Delhi added more than 5,000 recognised startups between April 2019 and December 2021 compared to 4,514 added to the total tally of the Silicon Valley of India. Maharashtra, with 11,308 recognised startups, tops the charts among states.

Last year, India’s booming startup ecosystem, too, set new records. While 44 startups became unicorns (valued at more than $1 billion), India overtook the UK to emerge as the country with the third-highest number of unicorns after the US and China that added 487 and 301 unicorns respectively in 2021. In addition, at least 14,000 new startups were recognised in India last year, up around 20 times in five years.

Only 733 startups were registered during 2016-17. Similarly, 555 districts had at least one new startup in 2021compared to only 121 districts in 2016-17, according to the survey.

For the rapid progress, stalwarts in the startup sector lauded the government’s Startup India initiative launched in 2016. Government recognition offers several benefits to a startup, including exemptions on income tax and capital gains. Under the digital initiative, other than having access to alternative investment funds, startups enjoy the benefit of an easier winding down process, as well. India boasts over 80 unicorns with an overall valuation of around $278 billion, while the total number of recognised startups in the country currently stands at 61,400.

The department for promotion of industry and internal trade (DPIIT), which earlier said government-recognised startups have created around 6. 5 lakh jobs in the country, wants to register around 50,000 new startups in the four years. The survey also pointed to the growth of startups in the space sector that shot up from 11 in 2019 to 47 last year. The domestic space sector, which currently accounts for 2% of the $447 billion global space economy, is expected to capture a much larger share going forward.

2023

From: Dec 13, 2024: The Times of India

See graphic:

Startups in India in 2023, city- wise

Demographics of startup founders

2015

See graphic, 'Demography of startup founders'

Funding

2014, 2015: Funding deals

The Times of India, November 14, 2015

Though there's much hullabaloo about some startups retrenching employees and struggling to raise fresh rounds, data shows that many more funding deals are happening now than earlier in 2015 or, indeed in 2014. However, the cheque sizes are shrinking, indicating that investors want their firms to be more careful about their spends.

In August- Oct 2015, there was an average of 53 funding deals a month, compared to 43 transactions in the first three months of 2015. In the first 10 months of 2014, there was an average of 24 deals a month, shows data from Tracxn, a startup data collection and analysis firm. The deals include startups that have been funded for the first time and funded companies getting subsequent rounds of investments. The overall number of deals this year, till October, stands at 494, compared to just 237 during the same period last year.

GSF, one of the country's most successful accelerators, said that seed rounds and Series A deals were flowing thick and fast. It saw three startups from its current batch getting Series A funding last month. It expects to announce another four to five deals by the end of this year for which term sheets have already signed. “I don't see any slowdown at seed stage or Series A stage for quality companies. Despite all the noise about a slowdown, I will go by data which shows the ecosystem is robust,“ said Rajesh Sawhney , founder of GSF. He, however, said there were valuation concerns that were resulting in slowdown in funding at later stages. For the startup ecosystem, Sawhney sees the base of the pyramid as being more important and the numbers indicate it is only getting stronger.

Vani Kola, founder and of Kalaari Capital, too, said Kalaari was continuing to see the same pace of investments as previously .

However, Aashish Bhinde, executive director (digital media and technology) at Avendus Capital, a leading investment bank in India, said the number of deals at the angel, seed or even Series A do not matter if the venture cannot raise subsequent rounds of funding. But he noted that markets have a tendency to overdo bullishness and bearishness and compared the situation to that in 2012-13 when investments came down after a big year in 2011.

One sign of growing cautiousness even in early stage funding can be seen in the deal sizes. The average value of a deal has dropped from $8 million in the first quarter of this year to $6 million in the latest quarter (excluding deals above $100 million). “Venture capital investors are becoming wary of the cash burn rate of startups,“ said Sawhney .

The MD of a major venture capital firm, who did not want to be named, said VCs were putting more effort into trying to understand every startup's business.

2014 to 2016

See graphic, ' Top 10 funded start-ups (2014 to 2016) '

2014-18: Bengaluru, New Delhi nos. 6, 8 in world

Shilpa Phadnis, B’luru, Delhi top in startup funding, July 10, 2018: The Times of India

From: Shilpa Phadnis, B’luru, Delhi top in startup funding, July 10, 2018: The Times of India

New Delhi and Bengaluru had among the highest number of startup investment rounds greater than $100 million since 2014. Bengaluru had 21 and New Delhi 18, according to a report by US venture capital and startup database CB Insights.

The report shows that each of the Indian cities had about the same number as London (19), and significantly higher numbers than Boston

(13) and Tel Aviv (2), cities that are often regarded as strong startup hubs. Mega rounds are reflective of the opportunity that the startup holds.

Silicon Valley (158), Beijing (128), Shanghai (58) and New York (40) dominated these mega-rounds. Some of the big-ticket deals in India included those to Flipkart, Ola and Paytm, and to those like online grocer Bigbasket ($300 million in series-E funding led by Alibaba) and Swiggy’s $100-million fund-raise led by South African internet and media giant Naspers. The big acceleration for Indian companies came from Japanese internet giant SoftBank that has invested more than $7 billion in the Indian ecosystem, including in Flipkart and Ola.

The report said the Japanese company’s portfolio includes more than 65 companies in the Asian hubs, showing how a single investor has propelled the rise of tech in Asia, particularly China and South Korea.

Ravi Gururaj, president of startup association TiE Bangalore, said, “Bengaluru is well positioned on many dimensions — the number of unicorns, mega rounds, aggregate funding, early-stage startups raising rounds, foreign investor interest, even Soft-Bank portfolio growth. The primary remaining hurdle is the exit or liquidity dimension, which we will hopefully crack in the next couple of years with the recent Flipkart-Walmart mega deal providing the necessary impetus and confidence to dealmakers.”

The number of exits in India have been few. In contrast, the CB Insights report said tech companies in Beijing and Shanghai tend to raise a lot of money and end up highly valued at exit. Since 2012, Beijing has seen over 30 large (over $100-million) exits, with logistics tech giant JD.com seeing an IPO valued at about $26 billion. Shanghai has clocked nearly 20 such exits.

2015: Alumni of prestigious institutes get more funding

Anand J &ShilpaPhadnis

How the new caste system - FILTERS FUNDING CHOICES

Startup research firm Tracxn finds that 37% of the 3,373 startups founded in 2015 has been founded by alumni of at least one of the following prestigious institutes -IIT, IIM, BITS, and NIT (National Institutes of Technology). But as much as 67% of the $7 billion of funding raised in 2015 has gone to these startups.

Similarly, only 13% of the registered startups on online deal-making platform LetsVentureis founded by what it calls Ivy League founders -those from IIT, IIM, BITS, Indian School of Business (ISB), Oxford, Cambridge, and US Ivy League colleges. But these ventures ac count for 27% of the funded ventures, and 34% of total funding. Sutanu Banerjee did a degree in Chinese language from the Jawaharlal Nehru University (JNU) and has been running the New Delhi-based travel organizer Prakriti Inbound profitably for the past 15 years. He recently decided to raise some private funds to expand.

2016: Funding drops 50% from levels of 2015

Funding for startups almost halved this year, down to $3.8 billion compared to $7.6 billion in 2015, as risk investor pushed back with caution after two years of unprecedented exuberance.

The funding crunch impacted the overall ecosystem with the number of startups founded this year going down dramatically , data from startup tracking firm Tracxn showed.More than 9,462 startups (including non-technology startups) were founded in 2015, compared to 3,029 in 2016, according to Tracxn data.

Sluggishness in funding has been felt globally with some of the high-flying startups seeing their valuation being cut as sentiments around technology financing took a hit last year.

The number of startups that shut shop rose to 212 from 144 last year. However, the number of funding deals stood almost the same at 1,031compared to 1,024 last year.

Padmaja Ruparel, president at Indian Angel Network (IAN) attributed the decline this year to the lack of big fund raising by the unicorns. IAN was the most active investor this year with 36 funding rounds. “There was a lot of hype, last year, which has subsided a bit. We have seen a lot more committed entrepreneurs this year,“ Ruparel said.

The big startups that raised multiple rounds of funding last year like Flipkart, Quikr, and Grofers did not raise fresh capital in 2016. Among the top ten technology deals were the Ibibo Group and Makemytrip merger, Yatra (acquired by Nasdaqlisted Terrapin for $218 million), and fund raising by Bookmyshow and Hike.

While overall funding was weak, flow of early-stage deals did not see a slowdown. For IAN, the average funding round in 2016 has remained the same as 2015 at around Rs 2.5 crore, Ruparel said. While last year, they received 6,000 applications, this year IAN received 7,500 applications. “We have seen a wider spectrum of startups coming up, with a sharper focus on top and bottom line.“

All the major venture capital funds, which are flush with dry powder, as they have together raised more than $2 billion to invest in Indian startups, took selective bets this year.New York-based Tiger Global, which was one of the most active funds last year with more than 30 investments, has almost retreated from India as it did not make any new investments this year.

As numerous startups struggled to remain afloat, M&A activity also rose marginally indicating that companies opted for consolidation to avoid shutting down.

2016, 44% decline in Mumbai, 61% increase in Pune

Sheen Off Image As Hub, Epicentre Of Boom Powai Hit Hard

Mumbai, which spawned a bunch of high-profile startups like Housing.com and attracted millions of dollars in investor capital, registered a 44% decline in funding deals in 2016, even as Pune managed to buck the slowdown.

Mumbai struggled as its startup epi center Powai saw many shutdowns last year, including the likes of TinyOwl, taking away the sheen from the city as a prime location for young ventures to flourish. The city racked up $232 million (over Rs 1,550 crore at current exchange rate) worth of funding across 151deals last year; falling from 233 deals accounting for $419 million (about Rs 2,800 crore) in 2015, said data released by VCCEdge, a NewsCorp-owned online financial research platform.

Pune, on the other hand, received $52 million (Rs 350 crore) worth of funding last year compared to $39 million (Rs 260 crore) in 2015. It also registered a 69% annual increase in the number of financing deals compared to Mumbai.The number of funding deals in Pune went up from 35 in 2015 to 59 last year.

Investments in startups have come down dramatically after a few years of excessive capital coming into young tech startups in India. Last year, startups in Maharashtra collectively scooped up $285 million (Rs 1,910 crore) as against $496 million (Rs 3,300 crore) in 2015; a drop of about 42% in terms of deal value, the data said.

“One of the reasons is that a lot of startups have moved from Mumbai to places like Bengaluru where there is a bigger tech pool and cheaper talent, along with a lower cost of living,“ said Aseem Khare, founder of hyper-local startup Taskbob, which recently shut operations.

Despite the decline in big financing rounds, angel and seed funding of startups in Maharashtra as a percentage of the total number of deals touched a five-year high of 80% in 2016. “The rise in early-stage funding in the state is encouraging from the viewpoint of promising business ideas. However, the fall in growth capital is indicative of these startups failing to achieve scale, which highlights the need for more startup incubators in the state,“ said Nita Kapoor, head, India New Ventures, News Corp, and CEO, News Corp VCCircle.

Rehan Yar Khan, founder and partner at venture capital fund, Orios Venture Partners, said, “Mumbai does not have any big startups because as these companies grow, they move to cities like Bengaluru which have cheaper talent. Ola and Quikr originated in Mumbai but moved to Bengaluru when they needed to expand and hire more people.Cities like Bengaluru, Hyderabad and Pune are technically cheaper cities with easy access to talent.“

Financial technology received the maximum funding with $27 million (Rs 185 crore) last year.

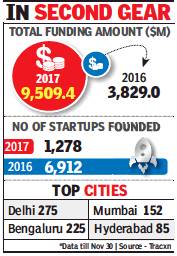

2017/ Overall funding: $9.5 billion

Shalina Pillai, Other than the big 3, startups feel the pain, December 30, 2017: The Times of India

From: Shalina Pillai, Other than the big 3, startups feel the pain, December 30, 2017: The Times of India

The year 2017 was for cautious investments and mindful entrepreneurial activity. Although it saw a huge rise in overall funding — thanks to the big three of the startup world: Flipkart, Ola, and Paytm — the funding scenario for all the others remained bleak.

According to data analytics firm Tracxn (data till 30 November), 2017 was subdued in terms of both funding and entrepreneurship. While the total funding raised by Indian startups this year was $9.5 billion, much higher than the 2016 figure of $3.8 billion, $7 billion out of it was raised by the e-commerce, ride-sharing, and mobile wallet platforms put together.

KS Vishwanathan, head of Nasscom’s 10K Program, said that unlike 2015, which saw a lot of entrepreneurs in the consumer space start their ventures, this year saw business-to-business (B2C), and enterprise-focused startups come aboard.

“India’s vibrant startup space, which has witnessed quite a few crests and troughs in its journey so far, entered a phase of maturity in 2017. It was encouraging to see enterprise and SMB-focused horizontal solutions (especially SaaS) find favour with the funders. A noteworthy trend that should catalyse many more enterprise-driven accelerator programmes,” he said.

Nasscom, too, released a report earlier this year, which noted a drop in funding activity, including a 53% drop in seed (or, the earliest stage of) funding in the first half of 2017. A major reason was the controversial angel tax, which taxed any investment raised above the fair value (as determined by the CBDT) as income in the hands of the startup.

“I would largely attribute the cautious sentiment due to macro factors like demonetisation and GST, and to the angel tax. The one sector that stood out in terms of general interest in 2017 was fintech...One could attribute this to the Bitcoin ripple effect,” said Ishan Singh, investor at Mumbai Angels, and founder of co-working space RevStart.

2018: Venture Catalysts tops angel, seed funding chart

John Sarkar, December 22, 2018: The Times of India

Early-stage investment firm Venture Catalysts has emerged as the most prolific investor in the Indian startup chart by closing 60 deals worth Rs 380 crore in 2018.

The Mumbai-headquartered incubator platform that typically invests between Rs 2 crore and Rs 7 crore in earlystage startups, has focused on the fast moving consumer goods (FMCG) segment this year rather than consumer technology, which accounts for more than 60% of all venture capital (VC) investments in India.

The next on the list of top angel and seed investors in terms of the number of deals is Axilor Ventures with 25 deals, followed by Blume Ventures and LetsVenture, according to data from startup research firm Tracxn.

“The number from last seven years shows that the FMCG sector offers huge M&A and growth opportunities,” said co-founder of Venture Catalysts, Apoorv Ranjan Sharma. “Compared to tech startups, FMCG startups earn high gross margins and therefore don’t bleed.”

Some of the FMCG startups in Venture Catalysts’ portfolio, include PeeSafe, which makes personal hygiene products for women, ecofriendly diaper company Superbottoms and organic lingerie brand Inner Sense. It had also invested in men’s grooming company Beardo, in which FMCG major Marico picked up a 45% stake.

“With disposable incomes of Indians on the rise, segments such as personal care, wellness and food & beverage have high growth potential,” said Sharma, who is looking at a few exits next year. With increasing maturity of the India start-up ecosystem, exits are expected to increase with around 80% start-up founders expecting investor exits by 2024, revealed a study by Bain & Co. India is among one of the top startup ecosystems in the world, housing more than 3,500 funded start-ups growing rapidly at 30%. VC deal value in India grew five times in last 10 years with the total number of deals in 2017 valued at $3.4 billlion.

2017-21

John Sarkar, Dec 28, 2021: The Times of India

From: John Sarkar, Dec 28, 2021: The Times of India

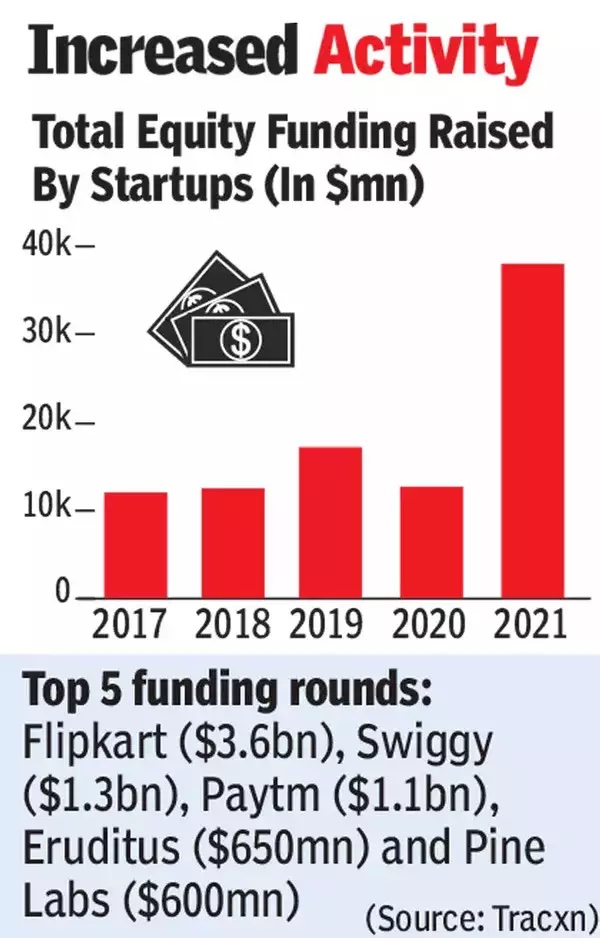

NEW DELHI: Total funding in Indian startups grew three times over last year to touch $39 billion in 2021.

While the total number of startups founded during the period stood at 3,476, around 1,700 companies witnessed 2,055 funding rounds, showed the latest data from Tracxn, a company which tracks startups and private companies.

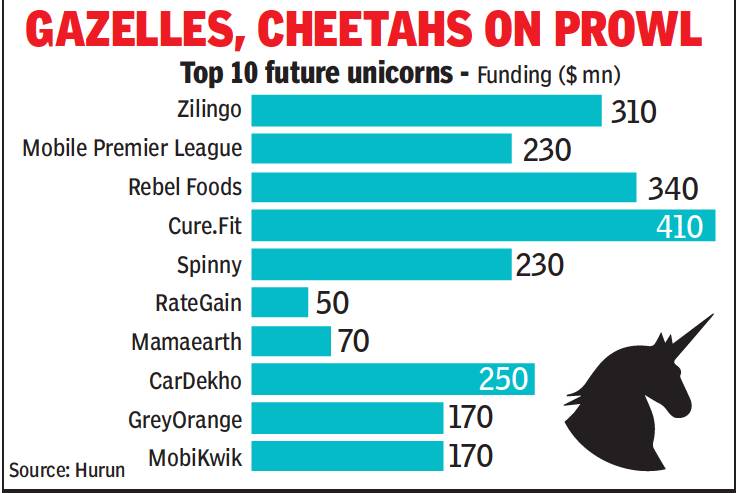

Out of 76 unicorns (valued at over $1 billion each)( created in India so far, 40 joined the club this year. Around 40% (85) of the overall number of ‘soonicorns’ (companies with potential to become a unicorn in the near future) were created in 2021.

Some of the largest rounds, excluding debt funding, were raised by companies such as Flipkart ($3.6 billion), Swiggy ($1.3 billion), Paytm ($1.1 billion), Eruditus ($650 million and Pine Labs ($600 million). Among the top 15 business models that attracted the most capital from investors, social platforms ($1.4 billion), foodtech ($1.3 billion) and K-12 edtech ($1.1 billion) topped the charts.

Sportstech, healthcare IT and social commerce brought up the rear with a funding of $0.5 billion each. Sequoia Capital, Tiger Global Management and Accel are the top three venture capital companies in 2021, while Temasek, Westbridge and Lightrock stood at the top of the list of private equity firms.

“Ten years ago, we had less than a billion dollars of funding going into startups every year. This year, we will have over $30 billion. And I credit a large part of it to the extraordinary focus that our honourable PM and the government have had on startups. The real startup India movement started accelerating in 2015,” Rajan Anandan, MD at Sequoia India, said earlier.

2019; 2014-19

Madhav Chanchani, Dec 30, 2019: The Times of India

Startups and venture capital-backed companies raised more than Rs 1 lakh crore during calendar 2019 — 26% more than the over Rs 81,000 crore raised by companies in equity capital markets, as the gap with money flowing into India’s digital economy widens. In 2018, startups had raised 18% more capital than Indian equity markets. That was the first year when the gap emerged in favour of startups.

The continuing expansion of the difference underlines the slowdown in the overall economy, hitting sectors like fast moving consumers goods (FMCG), even as technology startups have been able to mostly buck the trend till now. Back in 2017, which was the last time when total capital flows into startups had set a record high, equity markets were able to mop up double that amount (see graphic).

The Indian startup ecosystem saw a 35% increase in capital invested this year compared to 2018, setting a fresh record. But the number of startups that attracted funding fell by 17% as more money flowed into fewer companies, according to data intelligence platform Tracxn. Global investor interest in local tech startups has been high in the backdrop of growing proliferation of smartphones and internet, the China-US trade war making India more attractive, and the large exit from Flipkart last year (where Walmart acquired 77% stake for $16 billion) proving money can be made.

The capital market mobilisation of Rs 81,174 crore — which includes IPOs, offers for sales (OFS), qualified institutional placements (QIPs) and investment trusts — fell 49% short of the all-time high Rs 1,60,032 crore raised in 2017, according to data analytics major Prime Database. For India Inc, 2019 was plagued with a debt crisis along with the slowdown in economic growth even as capex over the last few years has shrunk. The fall in money raised from capital markets was also driven by a lower number of IPOs and QIPs, despite the market reaching a new high in 2019 as global liquidity continued to push up investor interest.

For Indian startups, raising more capital is necessary as they have to build fullstack business models, which requires more funding, according to venture capital investors. “Startups are not merely an aggregation layer but also building a supply by creating an infrastructure around their set of services, all of which is capital-intensive and not apparent to us,” said Anand Lunia, founding partner at early stage investment firm India Quotient.

Late- stage deals

2016-2024

February 25, 2025: The Times of India

From: February 25, 2025: The Times of India

Mumbai: The share of late-stage deals in total startup funding has dropped to under 60% through 2024 and 2023, inching closer to levels seen in 2016 when the contribution of big-sized cheques--typically over $50 million, stood at 54%. This is a far cry from the past few years when large deals easily made over 70% of total investments into startups—in 2021 when funding hit a peak amid the Covid-led surge, touching close to $40 billion, the share of late-stage deals stood at 76%, a report by Blume Ventures showed. Funding rounds with a size of over $50 million comprised the bulk of the share of late-stage investments for more than five years now.

Following the global tech downturn and a broader market correction, late stage funding into US startups have seen a sharp revival, thanks to the AI boom. AI funding alone made up about $97 billion of total large deals worth $120 billion in the market. In India, the flow of large-deals have been rather tepid except a few outlier funding rounds like that of quick commerce startup Zepto which bagged a little over $1 billion in capital from investors in 2024. “A thriving venture market like US has about 70%-75% late stage funding as more companies keep growing and require more growth capital,” analysts at the VC firm said.

In all, Indian startups garnered $11.2 billion in funding in 2024 of which late stage deals accounted for $6.6 billion, a steep drop from $28.6 billion seen at its 2021 peak. Global investment giants like SoftBank and Tiger Global have been going slow on new big India deals, leading to a drop in late-stage funding, TOI had reported. Even the time taken to close early stage funding rounds is getting longer.

Seed- stage investments

2016-18: a decline

From: https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F11%2F28&entity=Ar02814&sk=9CDE8165&mode=text Sindhu Hariharan, Early-stage deals hit as unicorns reap benefits, November 28, 2018: The Times of India]

Is India’s unicorn companies having a funding economy of their own? As the Indian startup ecosystem records successive years of record-making investment activity, more particularly chasing unicorns, research shows that the activity is terribly skewed against early stage funding.

Investment tracker, CB Insights noted that India closed just $206 million of angel- and seed-stage deals in 2017- a decline from the $283 million raised in 2016, and just 2% of the total amount raised. The number of deals at this stage also saw a steep drop from 710 in 2016 to just 462 in 2017. The research found that every surge in India’s funding has been driven by companies valued at over $1 billion, stating that “it’s almost as if India’s unicorn companies have a funding economy of their own.”

Investment data accessed by TOI from research platform Tracxn showed that the trend continued in 2018 as well. As per Tracxn’s analysis, the number of deals at the seed stage has seen a steady decline from 2016 onwards - 2016 saw 756 deals valuing $289 million in the seed stage, 2017 recorded 581 deals at $272 million, and there were only 364 seed investments in 2018 at $215 million (till Nov 23). However, Series E and F rounds - typically fuelling growth of unicorns - grew 330% and 113% in terms of value, with deal counts growing at 33% and 150% respectively.

KS Viswanathan, VP industry initiative, NASSCOM, attributed this to a priority mismatch.

“The investor community continues to be fond of investing in consumer tech space, but there has been a shift in the interest of emerging entrepreneurs to start up in deep tech areas,” he told TOI.

Padmaja Ruparel, co-founder & president, Indian Angel Network (IAN) said the regulatory climate may have a role to play.

Government-recognised startups

2016-21

John Sarkar, June 4, 2021: The Times of India

From: John Sarkar, June 4, 2021: The Times of India

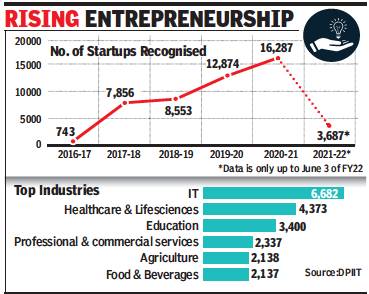

The government has recognised 50,000 startups across the country — helping them avail of benefits across a range of laws and regulations — with as many as 10,000 getting a seal of approval over the last six months.

The pace of recognising startups has picked up after the department for promotion of industry and internal trade (DPIIT) tweaked the norms a few years ago, which also enable them to get fiscal and infrastructural support. A startup registered with DPIIT, for instance, enjoys a simplified compliance structure, 80% reduction in the cost of filing patents, tax exemptions and can wind up its business within 90 days of its application to do so.

While many more startups would have been set up, the recognition by the government is part of a special programme to incentivise entrepreneurs. In fact, the Covid-19 pandemic does not seem to have dampened the spirit in any way with record recognitions given last year (see graphic).

Separate data available with the ministry of corporate affairs had shown a 27% jump in the number of new companies during 2020-21, which added up to over 1.5 lakh, with another 42,000 limited liability partnership firms also being registered during the year.

“As on June 3, 2021, 50,000 startups across have been recognised as startups by DPIIT, of which 19,896 have been recognised since April 1, 2020,” DPIIT said in a statement.

These startups are present across 623 districts with at least one startup in each state and union territory (UT). While Maharashtra, Karnataka, New Delhi, Uttar Pradesh and Gujarat have the highest number of startups, 30 states and UTs have announced specific policies to support them.

To be eligible for registration under Startup India, a government initiative launched in 2016 to bolster the domestic startup ecosystem, a company needs to fulfill several criteria, including being incorporated and registered in India up to 10 years from the date of incorporation and having annual turnover of not more than Rs 100 crore for the financial years since registration.

“Recognized startups have contributed significantly to job creation, with 5,49,842 jobs reported by 48,093 startups with an average number of 11 employees per startup,” the department said.

Management

Founders vis-à-vis outside leaders/ 2018

From: October 7, 2018: The Times of India

See graphic:

As in 2018, India was still bucking the trend of founders vis-à-vis outside leaders

Number of start-ups in India

2005-17

From: March 1, 2021: The Times of India

See graphic:

Start-ups: India, 2005-17

2010-15

See graphic:

Number of start-ups found in Indian tech space, 2010-15

2015-16: 36% increase

The Times of India, May 13 2016

Startup rush: No. of new pvt cos up 36% in 2015-16

Lubna Kably

The burgeoning startup ecosystem seems to have boosted growth of non-government or private companies. During the year 2015-16, as many as 60,414 private companies with an aggregate authorized capital of Rs 10,845 crore were registered (statistics are up to December 31) -a hike of 36% over the previous corresponding period (see table). Experts say that a private company is the best legal entity form for incorporation of a startup, especially one which is growth-oriented.

At the same time, traditional businessmen functioning as solo proprietors continued to show their preference for one-person companies (OPCs), with registrations almost doubling to 2,761during the financial year 2015-16 (up to December 31), according to the latest annual report released by the Ministry of Corporate Affairs (MCA). The collective authorized capital of the newly regis tered OPCs was nearly Rs 67 crore. The business services sector dominated, with 58% of OPCs falling in this category .While OPCs enable a single proprietor to corporatize his business, it isn't an ideal entity for startups claim experts.

Lionel Charles, CEO of Indiafilings.com, says, “Venture capitalists (VCs) do not recommend OPCs as the shares can be held by one person only and equity funding by VCs isn't feasible. An OPC is also required to mandatorily convert into a private company once its turnover exceeds Rs 2 crore or share capital exceeds Rs 50 lakh.“

Harish H V , partner at Grant Thornton, says, “Typically, startups have more than one founder. They also aim at equity infusion from angel investors and VCs. Esops are also granted to employees who ultimately hold a stake in the startup. This makes a private company form more suitable. Moreover, a minimum share capital of Rs 1 lakh is no longer required for incorporation, adding to their popularity .“

Government officials are of the view that the current year will see a further increase in the number of registrations of private companies in the backdrop of the `Startup India' programme. Recently , the govern ment carved out a separate definition for startups and offered various sops, including a tax holiday .

Eligible startups, subject to meeting certain conditions, are entitled to a tax holiday for a block of three out of the initial five years. To claim eligibility, the company must be incorporated between April 1, 2016 up to March 31, 2019, its total turnover must not exceed Rs 25 crore in any financial year and it must have obtained a certificate of eligible business from the Inter-Ministerial Board.

An amendment to the Finance Bill added limited liability partnership (LLP) in the definition of the term `startup'. LLPs are a hybrid model which provides personal immunity to the partners and offers a corporate structure. In India, professional services companies have largely adopted the LLP structure. However, for startups, especially those looking at VC funding, an LLP structure in not ideal in the long run.

2017

From: December 24, 2017: The Times of India

See graphic: Total startup base in India, 2017

2018

Tax clarity on angel funding soon, April 6, 2018: The Times of India

Key sectors among recognised startups

Top states for recognised startups

From: Tax clarity on angel funding soon, April 6, 2018: The Times of India

The government is set to clear the air on taxing angel investor funding of startups and is expected to specify a threshold up to which investment in identified companies will not face tax scrutiny, even if it is above the fair market value, a senior government official said. The issue will address concerns as tax authorities have been issuing notices on investments above the market value, since a premium can be added to the income of a company.

The move is part of the latest policy boost for startups and a notification specifying the details will be issued soon, industrial policy and promotion secretary Ramesh Abhishek told reporters. Experts, however, suggested that a comprehensive solution is needed. “The issue of taxing the excess premium received by companies needs a complete solution. Carving one exception at a time, and that too with several riders, only adds to complexity and creates a further non-level playing field between Indian and foreign investors,” said Abhishek Goenka, a partner at consulting firm PricewaterhouseCoopers.

The industry secretary said the government was keen to address all concerns and was pushing states to put in place a favourable regime for startups. Several initiatives, including a ranking of states on various parameters, were being undertaken.

The government has recognised 8,765 startups, with 88 eligible for benefits, such as tax exemption on profits made during three of seven years of operations. Abhishek said initial estimates from around 7,000 startups indicate that over 81,000 jobs will be generated with a bulk of them being in the IT services space. Among the startups recognised by the government for various incentives, Maharashtra has seen maximum number, followed by Karnataka and Delhi. He said state rankings would be on the basis of initiatives taken to develop startup ecosystem. The ranking framework covers seven areas of intervention and 38 action points, including policy support, incubation centres, seed funding, angel and venture funding.

2020

Dec: Total rises to 11 new unicorns

Digbijay Mishra & Sujit John, December 23, 2020: The Times of India

India has seen a record number of unicorns (startups valued at $1 billion or more) being created in 2020. On Tuesday, two companies Glance and Dailyhunt turned unicorns, taking the year’s total to 11. In 2019, nine ventures became unicorns, and in the year before, it was eight.

The year began on a cautionary note, with marquee venture capital firm Sequoia Capital warning of the possibility of a ‘black swan’ like event due to the pandemic. But the large amounts of money that central banks globally have been releasing to revive their economies have ensured the opposite.

InMobi Group’s Glance, which provides dynamic content on the lock screens of Android phones, on Tuesday announced it has raised $145 million from Google and existing investor Mithril Capital, an investment fund of Peter Thiel, who co-founded PayPal and Palantir Technologies. A source close to the company told TOI that the funding values Glance at over $1 billion. This also puts Naveen Tewari, who founded InMobi in 2007 and Glance in 2019, among the few who have created more than one unicorn. InMobi, a mobile advertising platform, turned a unicorn when SoftBank invested $200 million in the company in 2011.

Dailyhunt, a local languagebased news and content platform, on Tuesday said it has raised $100 million in new capital from Microsoft, Google, Falcon Edge’s investment unit Alpha Wave, and other investors, at a valuation of over $1 billion.

Mohan Kumar, founder and managing partner at softwarefocused Avatar Ventures, said companies that have managed to capture the positive side of the pandemic have seen good investor interest and raised capital at a high valuation.

“Companies that are enabling digitisation of business operations and have captured (market) and grown this year are the ones which investors are pleasantly surprised by, and they are rewarding those companies,” said Kumar. “Glance is on a tear,” Tewari told TOI. “We own the lock screen content place, just as Facebook, WhatsApp and others own their spaces. There’s no one in the rear-view mirror for us.”

Dailyhunt’s parent firm Verse Innovation said it will use the new capital to scale up its recently launched short-video app Josh, implement AI and ML solutions, and grow its content creator ecosystem. It competes with platforms like MX Takatak, and Instagram Reels. MX Takatak is owned by Times Internet, an arm of BCCL, which publishes this newspaper.

Profile of founders

Age profile of startup founders

June 16, 2018: The Times of India

From: June 16, 2018: The Times of India

More than 70 per cent of startup founders in India are under 35 years — that’s the most in the world. Millennials account for over half the country’s population. By 2020, millennials will form 50% of the global workforce...

Education and gender

July 5, 2018: The Times of India

From: July 5, 2018: The Times of India

See graphic:

The Education and gender of Start-up founders in India, presumably as in 2017

An analysis of the educational qualifications of startup founders in India shows that most tend to be engineers -- and 91% of them are male.

Relocating headquarters to India

As of 2025 Feb

Asmita Dey, March 7, 2025: The Times of India

From: Asmita Dey, March 7, 2025: The Times of India

For years, many Indian startups chose to register their companies abroad — often in the US, Singapore, or even the Cayman Islands — to access global investors and funding. But now, a wave of reverse migration is sweeping through India’s startup ecosystem. Companies that once set up their legal headquarters overseas are moving back to India, a trend known as “reverse flipping”.

The list includes big names like Razorpay, Udaan, Pine Labs, and Meesho, with some, like Zepto, having already completed the process. The shift isn’t simple — firms have to secure multiple legal and regulatory approvals and make hefty tax payments. Yet, many are taking the leap, driven by the promise of better IPO prospects, streamlined compliance, and India’s booming economy.

Notwithstanding the current state of the secondary market, the Indian capital market has matured significantly for IPOs, offering an attractive alternative to global markets. According to Alok Bathija, Partner at Accel, a software company with $50-$60 million in revenue and stable growth can now list in India, whereas a similar listing in the US would require nearly $500 million in revenue. With Indian markets offering higher valuations and greater accessibility, more startups are seeing the advantage of returning home.

Rise Of Reverse Flipping

Beyond IPO aspirations, shifting back also simplifies compliance, especially for startups in highly regulated sectors like fintech. Many of these companies generate the majority of their revenue in India and operate primarily within its financial system, making it logical for them to align with Indian laws. Amit Nawka, Partner at PwC, explains that fintech startups, as they grow larger and play a bigger role in India’s financial landscape, naturally fit better within the local regulatory framework. “As far as fintechs are concerned, as they get larger and contribute to India’s financial system, it is appropriate for them to be headquartered here, and it also gives regulators a sense of comfort,” he said. The trend is also being fuelled by the expansion of domestic funding options. Previously, Indian startups headquartered abroad had easier access to global investors, particularly US-based venture capital firms, which preferred to invest in companies domiciled within their jurisdiction. But that is no longer the case. According to Siddarth Pai, co-chair at the Indian Venture and Alternate Capital Association (IVCA), the rise of family offices and domestic venture capital funds has changed the game. “Not just the IPO-bound startups, but a whole host of other startups are looking to flip back to India, especially those in regulated areas. It becomes easier for a company to plan its expansion and get approvals for setting up new businesses if its parent company is regulated by RBI or Sebi,” he said. The abolition of the angel tax has further encouraged many startups to make the shift.

Impact On Indian Startup Ecosystem

Industry estimates suggest that more than 70 startups are currently in the process of reversing their domiciles, and at least 20 of them are major ecosystem players. However, around 500 Indian startups are still headquartered abroad, mostly in the US and Singapore. Among the most prominent companies to move back was PhonePe, which paid a staggering Rs 8,000 crore in taxes to shift its registration from Singapore to India. Sameer Nigam, co-founder & CEO of PhonePe, emphasised that for a highly regulated company like theirs, being based in India was the most logical decision. “India is where we started, India is where we are focused, and India is where we will stay for decades,” he said.

The Indian govt has taken steps to reduce bureaucratic hurdles and speed up the process for startups looking to shift back. Previously, an overseas startup merging with its Indian arm required National Company Law Tribunal (NCLT) clearance, a time-consuming procedure. Now, only govt and RBI approvals are needed, making the transition faster and more efficient. The rally in Indian tech stocks has also dispelled the longheld myth that startups must list on NASDAQ to achieve significant valuations. “India is one of the most robust IPO markets globally. In the last year alone, India had the highest number of IPOs globally, and second in value to the US,” said Varun Malhotra, Partner at Quona Capital. In 2024, India had 327 companies listing on the market, versus 183 in the US and 125 in Europe and 98 in China.

The Future of Indian Startups

For startups like Razorpay, moving back to India was an obvious choice. The company is paying over $100 million in taxes to make the transition, but CEO and co-founder Harshil Mathur believes it’s worth it. “The process of going public in India is much more streamlined today, making it a natural choice for startups like ours to grow and thrive in one of the world’s most dynamic economies. For Razorpay, reverse flipping aligns us closer to our primary market. India understands what Razorpay does, and it just makes logical sense for us to list on the market where people know us,” Mathur said.

With India rapidly emerging as a global startup powerhouse, this trend is only expected to accelerate. Sunil Khaitan, head of the financing group at Goldman Sachs India, predicts the “trend (will) accelerate in 2025, further positioning India as a key hub for entrepreneurial activity and leading to increased capital market access.” As regulatory reforms continue and the domestic investment ecosystem strengthens, the era of Indian startups incorporating overseas may soon be a thing of the past.

Start-up Ecosystem

2017: employees prefer small companies (total strength of 10)

Startups with lesser workers preferred more in 2017, March 29, 2018: The Times of India

From: Startups with lesser workers preferred more in 2017, March 29, 2018: The Times of India

A new set of data released by Nasscom Indian Startup Ecosystem 2017 shows that around 86 per cent workers were interested in working at small companies (with a total strength of 10) in 2017 compared to mere 17 per cent in 2012. In companies whose employee strength was between 50 and 100, only 1 per cent workforce showed interest in 2017 compared to 16 per cent in 2012.

2023

Shilpa Phadnis, June 20, 2023: The Times of India

Bengaluru : Bengaluru has clinched the 20th spot, moving up two places, in Startup Genome’s the ‘Global Startup Ecosystems Report (GSER) 2023’. While Silicon Valley remained on top, New York City and London were tied at the second spot. With this, the top three ecosystems have all held on to their positions from 2020.

Among the emerging ecosystems, Pune has moved into the 31-40 range in 2023, from 51–60 in 2022. New Delhi and Mumbai were ranked 24th and 31st, respectively. GSER is a comprehensive analysis of startup ecosystems around the world. The report, now in its 11th year, offers a detailed look into the world’s top startup ecosystems, while tracking emerging trends and challenges faced by entrepreneurs.

Several Indian cities have moved up several notches in the rankings, thanks to India’s growing digital public infrastructure that has proved to be a game changer. “The Covid-led growth in tech impacted countries to very different degrees and this is reflected in movements in the global rankings,” wrote J F Gauthier, founder and CEO, Startup Genome. “India is up due to its world-leading growth in 2021 and 2022 and this trajectory may well continue. ,” Gauthier added.

Meanwhile, all major Chinese ecosystems dropped in the overall rankings.

States where start-ups flourish the most

2023

January 17, 2024: The Times of India

From: January 17, 2024: The Times of India

Guj, K’taka, Kerala & TN best for startups

DPIIT Assessment Done On 25 Action Points From Funding Support To Market Access

TIMES NEWS NETWORK

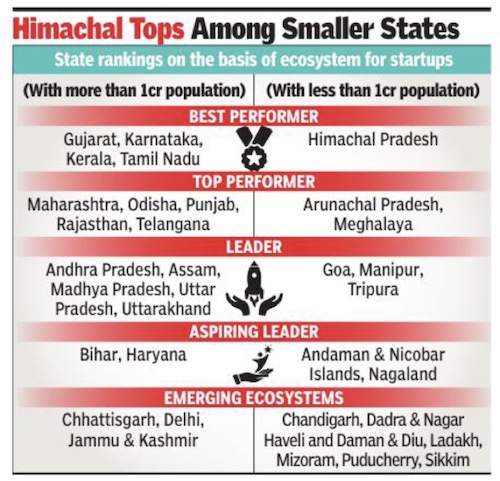

New Delhi : Gujarat, Karnataka, Kerala and Tamil Nadu ranked best states in providing a strong ecosystem for startups, according to the latest rankings. Among Union territories and smaller states, Himachal topped the list.

The rankings put together by the department for promotion of industry and internal trade (DPIIT) keep Bihar and Haryana in the same bracket of “aspiring leaders”. Although the former is considered a laggard on several economic parameters, it is seen to have undertaken several steps to support startups, just like Haryana where Gurugram is home to several MNCs and startups.

Each state was ranked which was then converted into percentiles and similar placed states were put in one segment. States in the 90-100 percentile were classified as “best performers”, while those with 30-49 were “aspiring leaders”. Delhi, Chhattisgarh and Jammu & Kashmir — which managed under 30 percentile — were put in the “emerging startups ecosystem” group.

Government officials, however, said that too much should not be read into it as the idea was to encourage states to compete and per form better and almost all states and UTs were working to develop a good ecosystem.

Apart from assessment on 25 action points ranging from institutional support to funding support and access to market, 33 states and UTs, were also gauged on the basis of feedback, both qualitative and quantitative.

In the initial years, DPIIT used to rank states based on the assessment, but for the last few years it has done away with that and instead clubs them based on the score.

Addressing an event whe re the rankings were released and startups were awarded, commerce and industry minister Piyush Goyal said that once a novelty has now become an integral part of the national mainstream.

He identified tourism as a sector with untapped function and encouraged them to explore innovative ideas around sustainable tourism. Artificial intelligence was another focus area, he said, adding that startups had made a substantial contribution in fintech, medtech, agriculture and drones.

Steps to encourage start-ups

2016: National Student Start-up Policy

The Hindu Business Line, November 25, 2016

To create 1,00,000 start-ups and one million new jobs by 2025, President Pranab Mukherjee has released a National Student Start-up Policy at Rashtrapati Bhavan, an official release said.

The policy, formulated by All India Council for Technical Education (AICTE) and which aims to make start-ups a mainstream career choice for students of all AICTE-approved colleges, was approved by the Executive Committee of AICTE in its 100th meeting held on June 28, 2016.

According to a release, the policy lays thrust on developing an “ideal entrepreneurial ecosystem and promoting strong inter-institutional partnerships among technical institutions” with the aim of guiding and grooming students to take up entrepreneurial careers and successfully launch start-ups.

The policy will also work towards re-orienting academic curriculum and pedagogy .

Government incentives, 2016

See graphic:

Government incentives for start-ups and some limitations

Startup India Action Plan

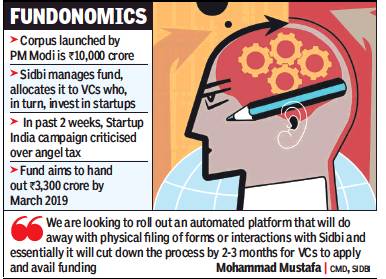

Fund allocates 19% to VCs in 3 years

From: Digbijay Mishra, Startup India fund allocates just 19% to VCs in 3 years, December 31, 2018: The Times of India

Aims For 33% In FY19, Eyes Automation For Faster Disbursals

The Startup India initiative has allocated just under 20% of its Rs 10,000-crore corpus to venture capital (VC) funds.

Mohammad Mustafa, chairman and managing director of the Small Industries Development Bank of India (Sidbi), which manages the fund-of-funds for the Startup India Action Plan, said Rs 1,900 crore had been committed to VC firms by the end of December 2018. According to figures available publicly, the allocation had stood at close to Rs 1,500 crore by the end of September 2018. Mustafa said the fund-of-funds will close the financial year with a Rs 3,300-crore allocation to VCs.

The government launched the initiative to help startups get funding in early stages. The fund doesn’t directly invest in startups. Instead, it allocates money to VCs, which are required to invest at least twice the amount of contribution received from the government.

Over the past two weeks, the Startup India initiative has come under criticism after hundreds of entrepreneurs complained of harassment by I-T authorities who sent them ‘angel tax’ notices. For now, the government has assured them there won’t be any coercive action to demand taxes from startups. The government had made similar promises a year ago when the issue first came to the fore.

Mustafa also said the Startup India fund, leveraging on technology, will bring in ‘automation’ by next fiscal, which will ensure faster disbursals to VC firms looking to raise capital from the government’s initiative. “There is a lot of demand, and VC firms are reaching out for capital. We are looking to roll out an automated platform that will do away with physical filing of forms or interactions with Sidbi. Essentially, it will cut down the process by two-three months for VCs to apply and avail of funding,” said Mustafa.

It currently takes four-five months for a VC to apply for and get fund approval. According to official records, Kae Capital, Orios Venture Partners, Stellaris Venture Partners and Alteria Capital, among others, received capital from the government’s fund-of-funds.

The Startup India fund is supposed to be deployed during the 14th and 15th Finance Commission cycles. Over the past few years, the government has been showing interest in focusing on startups since they play an important role in creation of jobs. Startup India was one of the initiatives highlighted in the G20 summit in Argentina this year.

Unicorns: India

See Unicorns: India

Women

Employees, 2018; founders: 2015-17

Women employees, presumably as in 2018;

2015-17: Women founders

From: September 30, 2018: The Times of India

See graphic:

Indian Start-ups:

Women employees, presumably as in 2018;

2015-17: Women founders

Women-led startups

2014-2023

Nov 20, 2023: The Times of India

From: Nov 20, 2023: The Times of India

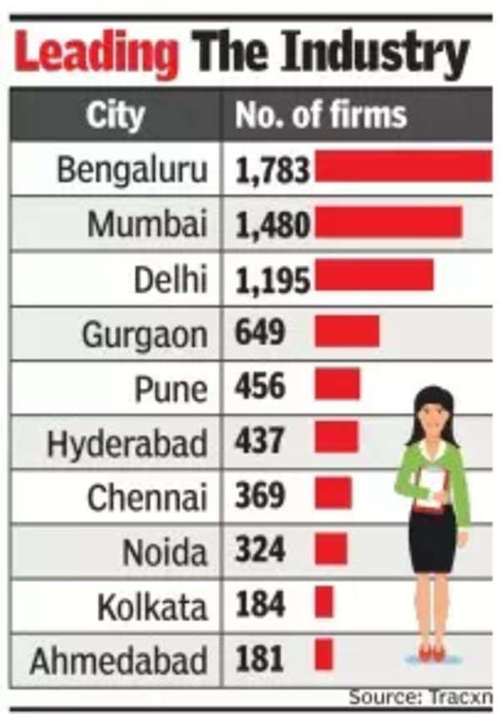

BENGALURU: The Karnataka capital is home to 1,783 women-led startups, followed by Mumbai and Delhi at 1,480 and 1,195 respectively, showed data from startup data platform Tracxn. Noida, Kolkata, and Ahmedabad took the eighth, ninth and tenth spots with 324, 184 and 181 women-led startups respectively.

With more than 61,400 startups, India’s startup ecosystem has added more firepower to become the third-largest hub globally after the US and China.Bengaluru has been one of the top startup ecosystems in India that has catalysed risk-taking among entrepreneurs with a conducive policy framework. But the gender divide is still stark. A slew of initiatives from incubation programmes, grants and fellowships offered to women-founded startups are trying to address the gender gap.

Karnataka, for instance, is the first state in the country to provide grant-in-aid of Rs 50 lakh to encourage innovators who need early-stage funding to startups without taking equity in return. This programme has put the spotlight on women entrepreneurs, resulting in 30% winners being women founders.

Tracxn counts Zomato, Byju’s, Ofbusiness, Upstox, Lenskart and Open among the top 10 women-led startups in the country. The funding landscape for women-led companies showed a significant surge in the number of rounds, rising from 171 in 2014 to 460 in 2022. However, in 2023, the number of rounds dropped to 185. The funding into women-led startups has decreased from 183 startups in 2014 to a mere 7 this year.

The number of women-led unicorns from 2008 to 2018 was 14, the data showed. Bengaluru-based neobank Open, which became the 100th unicorn, has two women co-founders — also its COO Mabel Chacko and CFO Deena Jacob. Nykaa, Mamaearth, Hasura, Pristyn Care, OfBusiness, Mobikwik, The Good Glamm Group, and Livspace are the other Indian unicorns with at least one women co-founder.

Rank/ position of Indian start-ups in the world

2015

ii) In terms of the number of startups in a city, Bangalore is followed by Mumbai and Delhi.

iii) Delhi, Mumbai and Bangalore lead the whole world in the number companies focussed on business through mobile phones.

The Times of India

2015: Bengaluru has youngest entrepreneurs in world

The Times of India, Jul 29 2015

Shalina Pillai & Anand J

At average 28.5 yrs, Bengaluru has youngest entrepreneurs in world

Bangalore has the youngest startup ecosystem in the world, with the average founder's age at 28.5 years, according to a survey of the top 20 global startup ecosystems. In Silicon Valley , the world's largest startup hub, the average age is eight years older than in Bengaluru at 36.2 years. Kuala Lumpur comes closest to Bengaluru, at 30.5 years, followed by Sao Paulo, 31.7 years, and Berlin, 31.8%. Sydney has the highest average age among startup founders, at 40.3 years, according to The Startup Ecosystem report by San Francisco-based Compass, a research firm that provides global benchmarking tools.

Compass also finds that Bengaluru moved up four positions to rank 15 in 2015 among the top 20 startup ecosystems, advancing from rank 19 in the 2012 ranking. It was amongst those who made the biggest leaps. Others who made similar leaps were New York, Austin, Singapore, Berlin and Chicago. Silicon Valley retains the top spot in the survey that looks at performance, funding, market reach, talent, and startup experience.

There were only three cities Bengaluru, Singapore, and Sydney from Asia Pacific in the top 20. Many of the cities in the top 20 were US ones. New Delhi was not in the top 20, but was among the runners up, together with Kuala Lumpur, Hong Kong, and Jakarta in Asia Pacific.

Bengaluru saw the most growth in seed fund rounds over the last three years, with an annual average growth of 53%. It was followed by Sydney (33%) and Austin (30%). According to the report, which was compiled with the help of global startup database CrunchBase, Bengaluru has done well in the funding parameter with a rank of 6, just below Chicago.

2015: Number of Indian startup No. 3 in world

The Times of India, Oct 14 2015

India bags No. 3 spot in world's startup ecosystem

Fuelled by $100 million flowing into the country's startups every week, the number of startups founded in the country has grown by 40% in 2015 over the previous year, said Nasscom's latest report on the Indian startup ecosystem. India is the third biggest startup ecosystem with more than 4,200 founded and it is expected that the country will receive $6.5 billion in funding in 2015. The largest startup ecosystems are the US (47,000-48,000 startups) and UK (4,500-5,000). Israel and China follow India.

India saw 1,200 startups being born in 2015. Currently, three-four startups are born each day . The number of startups is projected to grow to around 12,000 by 2020. The startups now employ around 85,000 people directly .

The report, launched in partnership with consulting firm Zinnov and Google, finds that 72% of the founders are less than 35 years old. The number of female entrepreneurs still constitutes only 9% of the entrepreneurs in the country , but the absolute number grew by 50% over the past year.

R Chandrashekhar, president, Nasscom, said, “The emergence of unicorns (startups with a valuation of $1 billion or more) and the big exits have created a lot of confidence in the ecosystem. Startups are now creating innovative technology solutions that are addressing social problems.“

2016

India, 3rd highest number of startup incubators and accelerators

Anand J, India has more startup incubators than Israel, May 06 2017: The Times of India

The government's initiative to establish 30 incubators in educational institutions in 2016 under the Startup India programme has enabled India to surpass Israel as the country with the third highest number of startup incubators and accelerators.

India now has 140 such institutions, ahead of Israel's 130, says a report by IT industry body Nasscom and consulting firm Zinnov. India added 40 new incubatorsaccelerators in 2016.China and the US have the highest numbers.

Incubators and accelerators perform the critical function of giving founders clear direction and advice on what is working and what is not. Some accelerators also help startups to find custo mers and funding. The US has more than 1,500 incubatorsaccelerators.

“Our aim was not to create billion-dollar valuations, but build remarkable companies that solve problems,“ Sangeeta Gupta, senior vice-president at Nasscom, told TOI.Nasscom too incubates startups through its Startup Warehouses in different cities. “The Indian startup ecosystem is at a growing stage, where accelerators and incubators are also maturing along with the ecosystem,“ Gupta said.

The report said that more than 50% of the institutions were outside the metro cities, thus helping startups to be created and nurtured across the country . The report contrasted this with the UK, where 60% of the institutions were in London. “Some 66% of the incubators established in 2016 were in tier 2 and 3 towns,“ Gupta said.

Around 50% of the incubators are in academic institutions, like IIT-Madras' Rural Technology and Business Incubator (RTBI) or IIM-Ahmedabad's Centre for Innovation Incubation and Entrepreneurship (CIIE). Around 10% of the incubators and accelerators are supported by corporates like PayPal, Target, SAP Labs, Cisco, Microsoft and Airbus. Government supported institutions include Kochi's SmartCity , T-Hub of Telangana and Nasscom's Warehouses.

2018

From: December 31, 2018: The Times of India

See graphic:

Indian startups in 2018

India costliest to generate startup business

From: March 25, 2018: The Times of India

See graphic:

Inflation and currency exchange rates make the cost of generating startup business far higher in India than other countries

2019

The 25 'most-disruptive' Indian startups

These are the 25 companies which stood out as the most disruptive in their respective fields according to The Economic Times' 2019's Top 25 Startups list. These ventures range from large consumer internet firms to biotechnology upstarts. Read on to know the names.

Chennai-based Kaleidofin, founded in 2017

Kaleidofin is a wealth management platform that offers customised, goal-based financial products to the under-banked in partnership with banks, mutual funds and insurance companies. It uses technology to customise products by looking at data on demographic profiles, income sources, asset ownership, among other things. Kaleidofin has raised close to $8 million from Okiocredit, Flourish, Omidyar Network India, Blume Ventures and Bharat Inclusion Seed Fund.

New Delhi-based SocialCops, founded in 2013

SocialCops is a data intelligence startup that works with governments, businesses, philanthropies, and nonprofits to help them make better decisions using data-based insights. The company’s strength lies in collecting data from public sources, analysing it and creating visualisations for easy understanding of insights. SocialCops has raised $370,000 in funding from Google Launchpad Accelerator, Rajan Anandan and 500 Startups.

Bengaluru-based Project Mudra, founded in 2016

Thinkerbell Labs (Project Mudra) makes braille intuitive through a mobile app, which acts as an interface between visually impaired users and braille hardware using speech recognition. The company is addressing the problem of low Braille literacy and aims to digitise the entire course material for Braille teaching. The company has raised $252,000 in funding from investors such as Greycell Ventures, Anand Mahindra, Village Capital.

Hyderabad-based Docturnal, founded in 2016

Docturnal is an artificial intelligence-based medical technology startup that sells solutions to private and government hospital chains. The startup is attempting to make detection of diseases easier and affordable using the power of a mobile phone. It’s flagship product, TimBre, can detect pulmonary tuberculosis by having patients cough into a microphone.

New Delhi-based Sirona, founded in 2015

Sirona started off as a company that made products for intimate and menstrual hygiene of women. Its first product was Pee-Buddy, but has now diversified and has introduced a series of anti-pollution and anti-mosquito products. The startup has raised Rs 2.96 crore in pre-series A funding from Indian Angel Network and also an undisclosed bridge round from the same investor earlier this year.

Sirona sells its products on Flipkart, Amazon, 1mg, BigBasket and Firstcry as well as offline stores like HyperCity, Religare and Mom&Me. It has also started selling these products in the United States and Germany through Amazon.

Mumbai-based Atomberg Technology, founded in 2012

Atomberg manufactures energy efficient home appliances and has a range of premium ceiling and tabletop fans under the Gorilla brand. The company has developed its own DC motor technology for which it has received provisional patents. Atomberg has raised around $12.5 million in funding so far from A91 Partners, Whiteboard Capital Fund, Suman Kant Munjal and IDFC Parampara.

Bengaluru-based TapChief, founded in 2016

TapChief is building a platform to offer part-time jobs on a consultation and per project basis to freelance professionals. It claims to have more than 75,000 professionals on its platform and acts as a marketplace aggregating talent for companies that are looking for highly skilled part-time workers. TapChief has so far raised around $2.3 million from investors such as Blume Ventures, 500 Startups, AngelList India, Paytm and Kunal Shah, among others.

Bengaluru-based PathShodh Healthcare, founded in 2015

PathShodh designs and develops hand-held medical diagnostic devices that replace expensive ones in laboratories. By measuring biomarkers, these devices can diagnose conditions such as diabetes, kidney disease and liver-related ailments. The startup is currently in the process of applying for certifications to sell devices in India and Europe and is looking to become the first device maker to be able to test for Glycated Albumin.

New Delhi-based Paracosmic Innovation Studios, founded in 2018

Paracosmic Innovation Studios has built a solution for game developers to facilitate secondary item transactions within their games, opening up a new revenue stream for game developers and giving users a way to trade their past purchases. The company leverages blockchain technology to facilitate these transactions.

IIT Roorkee-based Fermentech Labs, founded in 2017

Fermentech Labs has built a solid-state fermentation bioreactor that is capable of reducing crop stubble and other farm-based organic waste into useful enzymes that can be used in the animal feed and food packaging industry. While the company is still in the pre-revenue phase, it plans to start operations by selling the enzymes it synthesises.

Boston and Bengaluru-based Zumutor Biologics, founded in 2013

Zumutor is an immuno-oncology company that is developing a first-in-class antibody to treat prostate cancer. The novel drug is expected to go into phase 1 trials by the end of 2020. It also has two antibody engineering platforms that are used for discovery and development of immunotherapies. So far Zumutor has raised $20 million in funding from Accel, Bharat Innovation Fund and Chiratae Ventures.

London/Mumbai-based Carbon Clean Solutions, founded in 2011

Carbon Clean Solutions develops, sells and operates one of the most low-cost technologies to capture carbon emissions. The company claims it is able to capture carbon dioxide emissions at a cost of $40 per tonne, which is half the cost of other existing technologies. CCS’ technology is deployed at 38 sites globally and the company has received grants from the US Department of Energy.

Bengaluru-based Tricog, founded in 2014

Tricog has built a technology to speed up cardiac diagnosis and treatment, using artificial intelligence in conjunction with a cloud-based solution where an expert can remotely diagnose an ECG. The company has a wearable that continuously monitors a patient’s heart rate and is selling directly to patients, through insurance providers and is also partnering with state governments and hospitals across the world through a SaaS model.

Bengaluru-based Stellapps, founded in 2011

Stellapps is a dairy technology company that has built technology to monitor all aspects of milk production - right from milking cows, chilling the collected milk, providing storage, and distribution. The company has so far raised a little over $18 million from investors such as Omnivore Ventures, Blume Ventures, Binny Bansal, Stride and 500 Startups.

Bengaluru-based Niramai, founded in 2016

Niramai has developed technology for non-touch, non-invasive breast cancer screening for women. The solution uses artificial intelligence to scan thermal images of the breasts and Niramai claims it can detect tumors five years before it can be detected using mammography. The company has so far raised around $7 million from investors such as Dream Incubator, Beenext, pi Ventures, Axilor Ventures, Ankur Capital and Binny Bansal.

Bhopal-based Appointy, founded in 2007

Appointy offers a cloud-based scheduling software to businesses to help them automate the process of customers booking appointments. The company caters to businesses across more than 150 verticals in developed countries including spa, salon,fitness studios, colleges and universities, government offices and professional services like driving schools and tax consultants, among others. It claims to have 160,000 customers across 140 countries, including Fortune 500 firms such as Google and Telefonica. Appointy is bootstrapped.

Irvine, California/Chennai-based Happyfox Technologies, founded in 2012

Happyfox Technologies is a cloud-based customer service and support company, with its flagship products including helpdesk ticketing, live chat and chatbots. It says it has over 12,000 customers across 120 countries, from industries such as e-commerce, retail, IT, manufacturing, governments and many others. Happyfox, which was spun out of Tenmiles, is bootstrapped.

Chennai-based M2P Solutions, founded in 2014

M2P’s flagship product YAP helps businesses roll out their own branded payment products, working with banks, payment networks, financial institutions, businesses and merchants. Some of the solutions it offers are white label card programme management, card issuance application programming Interface (API), virtual or physical prepaid-cards and QR payments.

Vadodara-based Indusface, founded in 2012

Indusface is an application security firm that offers website security services across verticals like banking, financial services, insurance and telecom. It has developed an integrated solution to detect, protect and monitor web and mobile apps against cyber-attacks. Over 80% of the company’s revenues are driven from the US market. It works with clients such as Land Rover, Jaguar, Tata Motors, EY and ICICI Bank.

Fit & Glow Healthcare, founded in 2014

Fit & Glow Healthcare is a cosmetics and beauty products brand with four brands under it - WOW, Nutrava, Body Cupid, and Shaving Station. Between these, the company has over 150 products in the market. The company sells its products through Amazon, Flipkart, Nykaa and BigBasket. It also retails its products in the US through Amazon and Walmart.

Bengaluru-based Curefit, founded in 2016

Curefit is an integrated health, wellness and fitness platform. Its flagship product Cult.fit workout centres are now present in 19 cities in India and Dubai, its first overseas location. The company also has a cloud kitchen service Eat.fit, a mental wellness product Mind.fit and is in the process of opening up medical clinics through its Care.fit brand. The company has raised around $280 million in funding and is valued at close to $575 million, with its backers including Chiratae Ventures, Accel, Kalaari Capital, Oaktree Capital Management and others.

Mumbai-based Nykaa, founded in 2012

Nykaa is a marketplace for beauty and cosmetic products and has built a strong portfolio of private labels, has opened offline stores and has used social networks exceptionally well to reach out to customers. The company has raised $78 million in funding so far and is valued at around $730 million.

Gurugram-based Delhivery, founded in 2011

Delhivery is a supply chain management company that evolved from an e-commerce delivery firm. It today offers cross-border shipping, B2B logistics and integrated distribution solutions to enterprise customers, processing and handling over 500,000 parcels a day. The company has raised $680 million in funding from SoftBank Vision Fund, Tiger Global Management and others, and is valued at over $1.5 billion.

Delhi-based Lenskart, founded in 2010

Lenskart is a leading brand in the eyewear retailing category and competes with the likes of Tata Group-owned Titan EyePlus. The company calls itself the Amazon for eyewear, but has adopted an omnichannel approach with hundreds of stores across all major cities. It's currently expanding into tier-3 and tier-4 towns and plans to have 2,000 stores in the next five years.

Lenskart has raised over $380 million from investors like SoftBank Vision Fund, Kedaara Capital, TPG Growth, IFC, PremjiInvest and is valued at around $1.5 billion.

Bengaluru-based Zerodha, founded in 2010

Zerodha pioneered the tech-backed discount broking model in India and edged past rivals Sharekhan, ICICI Securities, HDFC Securities and Motilal Oswal to emerge as the largest brokerage platform in the country.

THe company is bootstrapped and profitable, unlike most other large startups in the country.

2021: India no.3

John Sarkar, Sep 3, 2021: The Times of India

From: John Sarkar, Sep 3, 2021: The Times of India