TCS (Tata Consultancy Services)

This is a collection of articles archived for the excellence of their content.

|

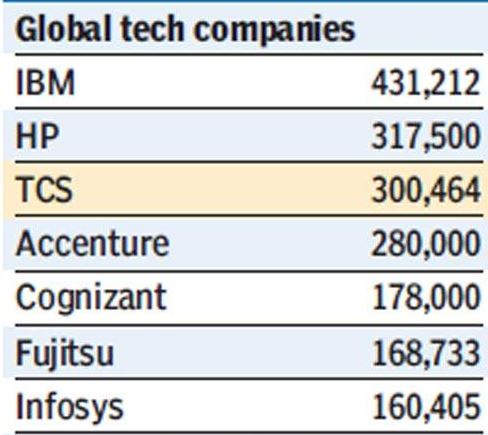

Among the world's biggest tech employers

2014: World's 3rd largest technology sector employer

TCS may soon be world's second biggest tech employer

Shilpa Phadnis & Sujit John,TNN | Jun 17, 2014 The Times of India

TCS has become the world's third largest employer of people in the technology sector, with over 3 lakh employees. And given the pace at which it is growing, it could become the second largest employer this year, crossing Hewlett-Packard, and would be fast closing in on leader IBM.

In India, it's one of the biggest creators of jobs in recent years, possibly even the biggest. Besides the Indian army, government departments like the Indian Railways and India Post, and PSU companies like Coal India, there's perhaps no other company that has more employees. And unlike the government departments, which are mostly reducing their staff strength, TCS numbers are rising each year by between 25,000 and 35,000.

In the last fiscal year, the $13.4-billion Tata Group company hired 61,200 people, with the net addition being 24,268, discounting those who left the company. The net addition in each of the past several years has been along similar lines or higher.

On the contrary, for some of the leading global tech companies, numbers are dropping given the transformations they are going through to deal with shifts in technology towards areas like cloud computing and mobility. HP had 349,600 employees in 2011, but that number is now down to 317,500. IBM, which has about 4.3 lakh employees, is also in the midst of layoffs.

TCS has said it will hire 55,000 people this year. If the net addition is half of that, it will be well ahead of HP's number by the end of this fiscal. Among Indian IT companies, Infosys is almost 50% of TCS with 1.6 lakh employees.

Chief executive officers

2016- 23

From: March 17, 2023: The Times of India

See graphic:

TCS, 2016- 23

Highest-paid executives

2017

The Times of India, Jun 1, 2017

N Chandrasekaran, former TCS CEO and current current Tata Group chairman (Rs 30 crore)

Former Tata Consultancy Services (TCS) CEO and current Tata Sons chairman N Chandrasekaran earned a little over Rs 30 crore in FY17, a majority of which was in the form of commission, the company's annual report showed. In his role as CEO of TCS, Chandrasekaran earned Rs 2.4 crore in basic salary, Rs 25 crore as commission and Rs 2.7 crore in allowances in addition to certain perquisites.

This is a hike of over 17% over FY16. In FY16, Chandrasekaran earned over Rs 25 crore and made an additional Rs 10 crore as part of a one-time special bonus.

Rajesh Gopinathan, CEO, TCS (Rs 6.2 crore)

Current CEO Rajesh Gopinathan, who took over the role in February this year, earned Rs 6.2 crore during the FY17. TCS' new CEO received Rs 4 crore as commission. His base salary during the year was Rs 66.5 lakh approximately.

Gopinathan joined TCS in 2001 and was appointed as CFO of the company in February 2013. Prior to this, he held the position of the vice president, business finance. Gopinathan has also worked with Tata Industries.

NG Subramaniam, COO, TCS (Rs 6.15 crore)

The current chief operating officer (COO) NG Subramaniam earned Rs 6.15 crore during FY17. N Ganapathy Subramaniam (NGS as he is widely called) received Rs 3.5 crore as commission and Rs 76 lakh (approximately) as basic salary.

He was earlier the president of TCS Financial Solutions, a strategic business unit of TCS. Ganapathy Subramaniam has been part of TCS and the Indian IT industry for the past 34 years. NSG is also executive director on the board of TCS.

Aarthi Subramanian, executive director, TCS (Rs 3.71 crore)

Executive director Aarthi Subramanian earned Rs 3.71 crore during the fiscal year 2016-17, as per the company's annual report. This includes Rs 89 lakh as allowances and Rs 2 crore as commission. Her basic salary during the year stood at Rs 81.5 lakh approximately.

Ramakrishnan V, CFO, TCS (Rs 2.36 crore)

Chief financial officer Ramakrishnan V received Rs 2.36 crore as remuneration during the fiscal year 2016-17. His basic salary during the period stood at Rs 43 lakh as per the company's annual report.

Suprakash Mukhopadhyay, global treasury head and company secretary, TCS (Rs 2.32 crore)

Suprakash Mukhopadhyay, the global treasury head and company secretary of TCS received Rs 2.32 crore as remuneration during the fiscal year 2016-17 as per the TCS' annual report. His basic salary during the year was Rs 35 lakh.

2019/ The 8 highest-paid

Gadgets Now Bureau, June 14, 2019: The Times of India

Tata Consultancy Services (TCS) is the crown jewel of the Indian IT industry and one of the biggest companies in India. A recent report by The Economic Times revealed that TCS now has 103 crorepati employees in 2019. The report further stated that more than a quarter of these crorepati employees started their career with TCS. Here we list out 8 highest-paid executives at TCS:

The CEO of India’s biggest tech company earned a salary of Rs 16.2 crore in the financial year 2018-19, as per the annual report of the company.

N G Subramaniam is the COO of TCS and he drew a salary of Rs 11.61 crore in 2018-19.

Serving as the head of business and tech services, Krishnan Ramanujam has an annual salary of Rs 4.1 crore

The CTO of TCS, Krishnan earned a salary of Rs 3.5 crore

K Krithivasan is the head of the banking, financial services and insurance business and made Rs 4.3 crore in 2018-19.

As the head of the company’s healthcare and life sciences business, Ghosh earned a salary of Rs 4.7 crore

Pal was the head of retail and consumer products but moved on to join Tata Sons earlier this year. He earned Rs 4.3 crore in 2018-19.

One of the oldest employees at TCS, 72-year-old Sanyal earned a salary over a crore in 2018-19.

Human resources

How TCS saves on staff costs

More new graduates help TCS save on staff costs; among lowest in industry

By Jochelle Mendonca, ET Bureau |[1] 19 Jun, 2014

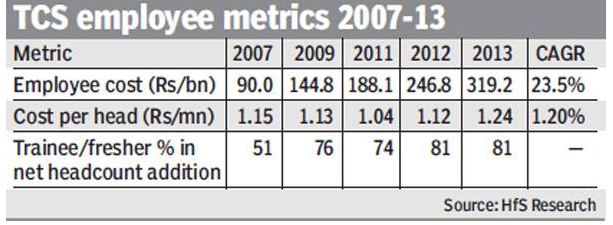

How has Tata Consultancy Services managed to keep its employee costs much lower than its peers?Tthe secret could be its higher intake of freshers and a lean middle management.

This focus on new hires has allowed India's largest IT services player to earn the fattest margins in the software industry and also have considerable flexibility on deploying its resources.

Analyst firm HfS estimated that the Mumbai-based company effectively achieved a 6.3% reduction in average employee costs every year over 2007-2013. During this period, the percentage of new graduates hired of the total rose from 50% to 80%. TCSBSE 1.00 % has over 3,00,000 employees globally.

Hiring more freshers gives TCS the flexibility to use them in lower value and transactional activities, freeing up the more experienced employees for higher value work, HfS said. Also, freshers are .. The company had a utilisation rate of 77.9%, including trainees, for the fourth quarter of 2014, when it posted an operating margin of 29.1%.

Also helping TCS, and the rest of the industry, is the fact that salaries for college graduates have not increased in the last four years at about Rs 3.15-3.50 lakh annually.

Salary hikes have also fallen to single digits from double digits before the 2008 g .. global economic meltdown.

2016: continuous appraisalsystem

The Times of India, April 20, 2016

TCS Abandons Bell-Curve Appraisal

TCS said it has abandoned bell curve-based performance appraisal and is moving to a system of continuous feedback, becoming the latest player to move away from the forced-ranking system.

Intellectual Property Rights

Defending in the US courts

The Times of India, April 17, 2016

India's TCS to appeal $940 million US court damages

India's biggest IT outsourcing firm Tata Consultancy Services (TCS) says it will challenge $940 million in damages imposed by a US court in an intellectual property theft case.

A federal grand jury in the US state of Wisconsin found TCS and its American unit guilty of using data from a US medical software firm without permission, according to Indian media reports.

The Mumbai-based company said in a statement that it plans to "defend its position vigorously in appeals to higher courts".

It also said it "did not misuse or derive any benefit" from documents downloaded from the user-web portal of US-based Epic Systems when developing its own hospital management system. "As an organization, TCS remains committed to protecting IP (intellectual property) as well as its reputation and financial interests fully," it said. The statement did not put a figure on the fine. But the Press Trust of India and other media said TCS and the American unit were ordered to pay $240 million to Epic Systems for using its software without permission and another $700 million in punitive damages.

Epic Systems filed the lawsuit in 2014, accusing TCS of taking its crucial data when it was hired by the company to install healthcare software for a US-based client, according to the Press Trust of India.

2016: Fined $940mn

The Times of India, Apr 17 2016

Chidanand Rajghatta TCS fined $940m in US for `stealing' healthcare software

A Wisconsin federal jury slapped a $940 million penalty, including $700 million in punitive damages, on Tata Consultancy Services (TCS) for allegedly stealing healthcare software from an American company , Epic Systems.

The verdict is one of the most adverse handed down to an Indian company abroad.The software giant said it would appeal against the ruling.Appeals can be filed within 30 days of the trial judgment.

TCS said it had not misused or derived any benefit from documents downloaded from Epic System's user web portal.“While TCS respects the legal process, the jury verdict on lia bility and damages was unexpected as the company believes they are unsupported by the evidence presented during trial. TCS plans to defend its position vigorously in appeals...TCS appreciates the trial judge's announcement...that he is almost certain he will reduce the damages award,“ it said. The jury verdict would not have an impact on its Q4 results due to be announced on Monday, TCS claimed.

Epic Systems, a US based electronics medical records vendor, had accused TCS of stealing documents and other confidential information tied to the software it builds for healthcare companies to manage billing, insurance benefits management and referral services.

It said a TCS employee reviewed Epic's intellectual property under the pretence of doing consulting work for Kaiser Permanente, the largest managed health care company in the U.S, and in doing so downloaded Epic's proprietary software to help build a rival system.

TCS maintained in its statement that it did not misuse or benefit from any of the said information for development of `Med Mantra' which it implemented for Apollo Hospitals in India in 2009.

According to Epic, Kaiser Permanente had contracted it to handle its patient records in 2003. In 2005, TCS employees requested access to the company's sensitive internal web under the guise of being Kaiser Permanente employ ees in need of training. Kaiser confirmed to Epic that the consultants were working for it, whereupon Epic had the workers sign a privacy contract to keep the inner workings of its software secret.

But Epic alleges that TCS contractors accessed Epic's internal network to download the entire suite to help TCS build a competing product called Med Mantra. In one instance, Epic said a TCS employee used his access to Epic UserWeb to download at least 6477 documents, 1687 unique files, from an IP address outside the US. “The vast majority of the stolen data was not required for TCS to provide consulting services,“ the complaint states. “To the contrary, much of the data , if used improperly , would provide an unfair design advantage for TCS's Med Mantra.“

Market capitalisation

2014/ Rs 5 lakh crore/ $84 billion market capitalization

TCS first Indian co to top Rs 5 lakh cr

Reeba.Zachariah @timesgroup.com Mumbai:

The Times of India Jul 24 2014]

World's Second Most Valuable IT Services Firm

Outsourcing giant Tata Consultancy Services (TCS) became the first Indian company to cross the Rs 5 lakh crore mark in market capitalization in July 2014 . In the process, TCS also became the second most valuable IT services company in the world, ahead of Accenture but behind IBM. TCS's market valuation rose to about Rs 5.1 lakh crore (about $84 billion), the highest since its listing l0 years ago, well ahead of Accentu re's $51 billion, but way behind IBM's $193.7 billion.

TCS's market cap is bigger than the combined market cap of the other four do mestic IT players in the pecking order, Infosys ($31.7 billion), Wipro ($23.3 billion), HCL Technologies ($17.9 billion) and Tech Mahindra ($8.5 billion). The software services firm's market cap is also bigger than the combined market cap of the other 31 listed Tata group companies ($57.2 billion).

Shares of TCS have risen nearly 9% since it announced robust first quarter earnings last week -$845 million net profit on $3.69 billion revenue. Several “buy“ ratings on TCS have been issued by analysts, who expect an eventful FY15 for TCS as its global customers up spending on IT services. The $13-billion TCS, established in 1948, which counts Cisco and HewlettPackard among its clients, won seven large deals in Q1 FY15.

Why TCS is ahead

Sanchit Vir Gogia, chief analyst at Greyhound Research, says TCS is ahead of many of its Indian peers in identifying new areas of growth, making investments and all the right noises. "It is betting big on the Digital Five Forces—mobility, big data, cloud, social media and robotics," he said.

Analysts also find it remarkable that it has grown its people strength so quickly, and yet created an organizational structure nimble enough to handle these numbers. Equally, it has kept its people costs under such control that it is seen as a major factor in its extremely high operating margins (over 28%), perhaps the highest among large companies in the global IT services industry.

Pradeep Mukherji, president and managing partner in global management consulting firm Avasant, said TCS is managing the huge workforce by breaking it into smaller business units that each function virtually as a smaller company. "The depth and breadth of middle management and work delegation, managing a good onshore and offshore mix are some of the key drivers in managing the employee pyramid effectively," he said.

TCS' employee cost has risen from Rs 90 billion in 2007 to Rs 319.2 billion in 2013, but the cost per employee has barely risen in these past seven years. The cost per headcount has grown from Rs 11.5 lakh in 2007, to Rs 12.4 lakh) in 2013, an annual increase of a mere 1.2%, said a report by US-based IT advisory firm HfS Research. "A conservative estimate of 8% annual wage hike in India, 2% hike in developed countries and 4% hike in developing countries will lead to about 7.5% weighted average annual wage hike for TCS' mix of employees," said HfS analyst Pareekh Jain. In other words, TCS has been able to offset its salary hikes through other measures.

One of the biggest of these looks to be a sharp increase in its fresher intake relative to the intake of experienced employees. The percentage of freshers hired (of total hiring) increased to 81% in 2013 from 51% in 2007, finds HfS.

"They have stretched the employee pyramid with an army of junior employees. TCS is aggressively hiring in tier-2 and -3 cities that offsets cost to a large extents TCS has also focused on automation and reusable software tools and frameworks to improve employee productivity," said Sudin Apte, CEO of IT advisory firm Offshore Insights.

Jain believes that hiring more freshers has given TCS the flexibility to deploy them in lower value and transactional activities, thus freeing up experienced resources for higher value work. "Secondly, training freshers for new skills is easier than retraining old resources for new skills," he said.

Ashish Chopra, IT analyst with brokerage firm Motilal Oswal, noted that TCS had also significantly reduced the proportion of employees at client sites overseas, thus reducing the salary burden.

2018, April: Nears $100Bn

From: April 21, 2018: The Times of India

See graphic:

TCS, 1969, and 2004-2018: growth

2018, April: crosses $100 billion mark

April 23, 2018: The Times of India

HIGHLIGHTS

TCS created history by becoming the first Indian company to reach the $100 billion market capitalisation (m-cap) mark

At 10.30 am, the market value of the company stood at Rs 6,79,332.81 crore ( $102.6 billion)

Tata Consultancy Services (TCS), the country's largest IT outsourcing company created history on Monday by becoming the first Indian company to reach the $100 billion market capitalisation (m-cap) mark. The shares of the IT behemoth were trading 4 per cent above previous closing mark at Rs 3,545 on the BSE at 10.30 am, thus hitting an all-time high.

By definition, market capitalisation is the value of a company that is traded on the stock market, calculated by multiplying the total number of shares by the present share price.

At 10.30 am, the market value of the company stood at Rs 6,79,332.81 crore ( $102.6 billion).

Last week, when the markets closed on Friday, the company was at the verge of the milestone as the m-cap stood at slightly above $99 billion. TCS stock had surged more than 6 per cent.

The rise in the TCS scrip's fortune came after the it posted a rise of 4.5 per cent in its Q4 net profit. In the January-March quarter, the company reported a net profit of Rs 6,925 crore, up 4.57 per cent against Rs 6,622 crore posted in the same quarter last year. On top of that, the company announced a 1:1 bonus for its shareholders. This is the third bonus share offering by the company since its listing in 2004. TCS had allotted 1:1 bonus shares in 2006 and 2009.

The Tata group flagship, which contributes around 85 per cent of the group's profit, reported a revenue growth of 8.2 per cent at Rs 32,075 crore for the three months to March. In dollar terms, the company had its highest revenue growth in 14 quarters at 11.7 per cent.

"With robust deal wins and green-shoots in banking, financial services and insurance (BFSI) sector, there is definite possibility of double-digit revenue growth. With growth acceleration, scale up in digital and support from currency, margins are ready for uptick as well, implying return of double-digit revenue/earnings growth after 3 years," Edelweiss Research said in a note.

Natarajan Chandrasekaran:a profile

He was reappointed the CEO and MD of TCS for another five years from October 6, even as the it giant touched a record revenue of $13.4 billion (more than rs 80,000 crore) in 2013-14.

In June 2014, TCS became the world's third-largest employer in the technology sector with over 300,000 employees. because in July 2014, the tcs market cap crossed rs 5 lakh crore, higher than the sum of the market capitalisation of all the other 19 listed firms in the tata group, which stood at a little over Rs.3 lakh crore.

Marathon man

With an ambition to run in all international marathons, he has participated in marathons in Mumbai, New York,Prague,Stockholm,Vienna, Chicago, Berlin and Tokyo.

Overseas operations

USA

2018: jury rejects employment bias claims

A California jury has rejected charges in an employment bias lawsuit that Indian IT major Tata Consultancy Services (TCS) discriminated against American workers, giving the Indian IT industry relief from trumped up charges of stealing American jobs.

Several American workers who brought the classaction lawsuit against TCS had accused the company of a “systematic pattern and practice of discrimination” favoring Indian ex-pats and visaready workers from India for US positions while alleging that non-South Asian workers were 13 times more likely to be fired by the company.

The plaintiffs alleged that the TCS let go of 78% of its non-South Asian workers who were taken off job assignments, or “benched” from work between 2011 and 2014, while only 22% of benched South Asians were fired, even though they made up half the company’s US workforce.

But following a trial culminating in day-long deliberations, a nine-member jury at a federal court in Oakland unanimously ruled that TCS “did not discriminate on the base of race or national origin,” according to local media and attorneys who represented TCS.

TCS executives testified at trial that the company had recently raised its year-over-year retention rate to 82% from 69% and that the company had increased the number of US residents it hires and retains, including a 400% increase in local hires since 2011.

Most of the workers who alleged they had been fired were let go for refusing to relocate for a job, TCS maintained.

The legal relief for TCS came at a time President Trump and his administration have repeatedly invoked the mantra of America First and American jobs for Americans first, despite the well-recorded shortage of STEM workers for specialty jobs in the US. “There wasn’t any preference for foreign workers,” an attorney who represented TCS in the case told the local media. “It is a model of growth, and growth in the US , and we know that there’s a STEM shortage here and that’s not a secret.”

TCS, which derives more than 60% of its nearly $20 billion revenues from the US , was chuffed over the legal victory, which comes as a relief to the broader tirade against foreign workers and outsourcing.

“We have always maintained the claims made in this case were baseless and we are gratified that the jury agreed,” a TCS spokesperson said in an email to ToI.

2019: TCS one of USA’s biggest job creators

Shilpa Phadnis, July 11, 2019: The Times of India

TCS is one of the top job creators in the US, the company’s global HR head Milind Lakkad has said. He did not disclose any numbers, but sources told TOI the company has about 40,000 people in the US — almost 10% of its total workforce, and the highest among its Indian IT peers.

Currently, the company has 872 open positions in the US, including 644 in technology. Asked whether TCS would make higher net additions on-site in the coming quarters, Lakkad said the numbers are not going to change significantly. “We already have a significant number,” he said. When TCS’s employee strength was 3.18 lakh, Amsterdam-based The Top Employer Institute had said TCS has over 30,000 people in the US working across 450 locations.

With its business improving, TCS’s overall hiring has picked up sharply in recent quarters. It made a net addition of 12,356 employees in April-June, its highest in five years, taking the total headcount to 4.36 lakh people.

US hiring has increased for most IT players as part of the effort to overcome visa hurdles and also because of the need to be closer to clients. Infosys has about 27,000 employees in the US. The number of US locals in Wipro’s US employee base stood at 63.7% as of March this year, compared to 46.2% two years prior to that.

Lakkad said TCS has given 100% of quarterly variable payout to 85% of its employees. But for the remaining 15% (senior level executives), it will vary depending on the business unit performance. The payout will be reflected in the July payroll.

Profits

2014:India’s most profitable company

Jan 20 2015

Sindhu Hariharan

After 23 years, India has a new numero uno when it comes to profitability. Information technology major Tata Consultancy Services (TCS) posted a net profit of Rs 5,328 crore for the quarter ended December, overtaking Reliance Industries Ltd. The oil-to-telecom behemoth saw its profit dip to Rs 5,256 crore -its first decline in nine quarters -as falling crude prices hurt its core business. Though these figures are only for one quarter, it is still a significant moment as it's the first time an IT company has topped the profit charts. RIL itself had overtaken the previous leader, Tata Steel, on the back of changes in the economy unleashed by the reforms.

“Being the best growth company in an industry with huge growth potential, the performance of TCS is one that is sustainable in the long run,“ Shashi Bhusan, senior research analyst at Prabhudas Lilladher said. Analysts said that though the outlook for the commodities sector in general and crude in specific is currently subdued, TCS grabbing the top spot underlines the emergence of the IT sector as force undeterred by macro-economic concerns and business cycles. Commenting on the third quarter performance, TCS CEO N Chandrasekaran said, “We have maintained our momentum in a traditionally weak quarter for the IT industry . Based on our progress this quarter, we are well on our way to post industry-leading growth for FY15.“

Reliance acknowledged that oil prices have approached the `shut-in' zone and below $40barrel, the quantity of oil would fall below production costs.

Industry experts added that global demand and currency movements are the main factors that have been deciding the fortunes of tech players and both these aspects are seeing a favourable turn.

“The inherent balance sheet strength of TCS commands a greater valuation and the sectors that it primarily caters to also hold it in good stead,“ said Mayuresh Joshi, VP, Institution at Angel Broking.

Research firm Gartner's `Worldwide IT Spending Forecast', which is a leading indicator of technology trends, has forecast a 2.4% increase in global IT spending in 2015 compared to 2014 and expects it to reach a total of $3.8 trillion. On the other hand, energy consultant, Facts Global Energy (FGE), expect a possibility of crude prices heading towards $40bbl in early 2015, as per their oil market update of January 2015.

Revenues

2018-19

Oct 12, 2019: Gadgets Now Bureau

The country's largest IT company Tata Consultancy Services (TCS) hit an unexpected bump during the second quarter of the fiscal year 2019-20. The company has reported what most analysts see as weak performance in terms of both revenue growth as well as profit margins. However, it made record hiring during the quarter and announced special dividend for investors. Here are all the big numbers you need to know and more …

1. TCS posted 1.78% increase in net profit during Q2

TCS's Q2 net profit stood at Rs 8,042 crore as against a profit of Rs 7,901 crore reported in the same period last year.

2. TCS reported 1.09% dip in profit as compared to previous quarter (Q1)

TCS reported 1.09% dip in quarter-on-quarter profit. The company reported profit of Rs 8,042 crore in Q2, down from Rs 8,131 crore reported in the quarter ended June 30, 2019.

3. TCS revenue went up by 5.76% during the quarter

TCS' revenue from operations stood at Rs 38,977 crore, up 5.76% from Rs 36,854 crore posted in the same quarter last year. In terms of quarter-on-quarter, revenue grew 2.20% from Q1 ended June 30, 2019.

4. TCS added highest-ever number of employees during the quarter

In a notification to the stock exchanges, TCS said that it has added 14,097 employees during the second quarter. As of September 30, 2019, the total headcount of the company stood at 4,50,738.

5. Declared special dividend of Rs 40 per equity share

The board of directors of TCS declared a second interim dividend of Rs 5 and a special dividend of Rs 40 per equity share of Re 1 each.

6. TCS bagged deals worth $2.2 billion in BFSI sector, 'highest-ever' in six quarters

TCS bagged deals worth $2.2 billion in banking and financial services (BFSI) sector, which the company claims is the highest ever in the last six quarters. "We ended the quarter with steady growth despite increased volatility in the financial services and retail verticals. We remain confident as the medium and longer term demand for our services continues to be very strong, as evidenced by our Q2 order book -- the highest in the last six quarters," TCS CEO and managing director Rajesh Gopinathan said.

7. Revenue hit by weakness in BFSI and retail businesses

The weakness in retail business across the US and UK coupled with continued decline in spending by banking and financial services clients hurt TCS during the quarter. Weak demand in banking and financial services as well as in the retail industry led to slower revenue growth, company executives said, In addition, business also reportedly slowed in the Middle East, Japan and Asia-Pacific.

8. Company eyeing big growth next quarter

TCS executives hope that it could potentially turn into a repeat of last year's double-digit growth, if the demand environment improves. "Last year, our turnaround came in Q3, so there is hope," TCS CEO and managing director Rajesh Gopinathan told media. "We had hoped Q2 would be strong, deals have been delayed, whether they close in Q3 or not we will have to see. But we are strongly positioned," he added.

Recruitment

2018: online test to recruit engg graduates

Shilpa Phadnis & Avik Das, September 25, 2018: The Times of India

From: Shilpa Phadnis & Avik Das, September 25, 2018: The Times of India

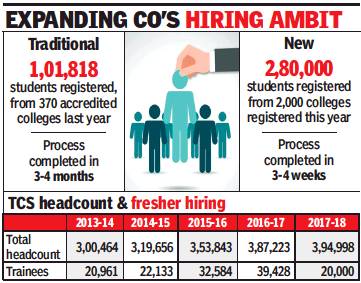

Process Faster Than Campus Visits, Reaches More Students

Tata Consultancy Services (TCS), one of India’s biggest hirers, is changing the way it has been recruiting engineering graduates over the past many years.

The tech company is digitising the recruitment system, and reducing its dependence on the traditional process of going to campuses to find candidates — which is the way much of the IT industry hires today. Starting this year, it has started a pan-India online test — called the National Qualifier Test — and is following that up with a video interview, or a face-toface interview, depending on the candidate’s location.

The company says this has enabled it to reach out to a far larger student talent base, as also complete the recruitment process in three-four weeks, compared to the three-four months it took under the traditional process. TCS traditionally had a pool of 370 accredited colleges where it visited annually for fresh hires. With the online test, the company said it could reach out to nearly 2,000 colleges, including those “in Baramulla, Kohima and other far-flung areas”.

The number of students who registered for the test on the company’s digital platform iON was 280,000 from 100 cities and 24 states. This figure is 175% higher than the number of students who registered for the traditional process last year. “The basic process of campus recruitment is not changing but the way we are doing is changing,” Ajoy Mukherjee, executive VP and head of global human resources at TCS, told TOI.

When TCS visits engineering colleges, it conducts recruitment tests for those in the fourth year (7th semester) with the help of its HR team, technical team and recruitment team in individual institutions. After the test, an interview is conducted. So 370 colleges took three to four months to cover. “We have optimised recruitment so that it can be done faster — in three to four weeks,” said Mukherjee.

This year, the tests were conducted earlier this month, and the interview process is currently on. “We could not go to colleges in far-flung areas. Now they come together in one nearby accredited college or an iON centre for the interview,” Mukherjee said. The traditional campus recruitment process, however, will continue in top institutions such as the IITs, NITs and IIMs. But the hiring numbers could be fewer.

The company declined to comment on how many graduates it would hire this fiscal, but said the number would be more than last year, when it recruited about 20,000 trainees.

Venguswamy Ramaswamy, global head of TCS’ digital assessment platform iON, said the company has “democratised talent spotting” through this novel method. The platform has algorithms that evaluate responses from candidates when they write programmes in Java, C or C++. iON has been used for other assessments, such as railway exams, CAT, GATE and CLAT. To date, it has assessed more than 115 million candidates. “Earlier, we used to give the offer letters by September and wait for the graduate to join us in June. With this platform, we engage with students on trending topics, arrange hackathons and other modes of talent development before they join. This helps us integrate them faster,” said Ramaswamy.

July 9, 2018: The Times of India

Indian IT giant Tata Consultancy Services (TCS) is one of the most-valuable companies in the country. Earlier this year, the TCS became the India's first $100 billion company. Here we look at the company's top 10 shareholders. The list based on the company's annual report for the fiscal year 2017-18 does not incude directors, promoters and holders od GDRs and ADRs.

Life Insurance Corporation of India (LIC)

As per the annual report for the fiscal year 2017-18, LIC holds 7,53,84,947 shares. This is 3.9% of the company's total shares.

First State Investment Icvc-Stewart Investors Asia Pacific Leaders Fund

First State Investment Icvc-Stewart Investors Asia Pacific Leaders Fund holds 1,50,54,489 shares as per the annual report for the fiscal year 2017-18. This is 0.8% of the company's total shares.

Lazardo Emerging Markets Equity Portfolio

The third-biggest in this list is Lazardo Emerging Markets Equity Portfolio with 98,19,005 shares. This is 0.5% of the total equity shares.

Oppenheimer Developing Markets Fund

With 79,96,009 shares, Oppenheimer Developing Markets Fund stands at No. 4. As per TCS' annual report for the fiscal year 2017-18 this is 0.4% of the company's total shares.

HDFC Trustee Company Ltd

HDFC Trustee Company Ltd is the fifth biggest shareholder in TCS with 76,45.593 shares. This is 0.4% of the company's total shares.

Vanguard Emerging Markets Stock Index Fund, A Series of

Vanguard Emerging Markets Stock Index Fund, A Series of Vanguard International Equity Index Fund hold 75,95,080 shares as per TCS's FY2017-18 report.

SBI Mutual Fund

SBI Mutual Fund ranks at No. 7 with 70,56,720 shares at the end of FY2017-18. This too is 0.4% of the company's total shares.

Government of Singapore

The Government of Singapore too is among the biggest shareholders of TCS. It held 64,97,754 shares of the company at the end of FY2017-18.

Abu Dhabi Investment Authority

Abu Dhabi Investment Authority ranks at No. 9 with 62,96,384 shares. This is 0.3% of the company's total shares.

Vanguard Total International Stock Index Fund

At No. 10 is Vanguard Total International Stock Index Fund with 61,79,273 shares.

See also

Infosys TCS (Tata Consultancy Services)