Tata Steel

This is a collection of articles archived for the excellence of their content. |

Contents |

Tata Group's overseas takeovers

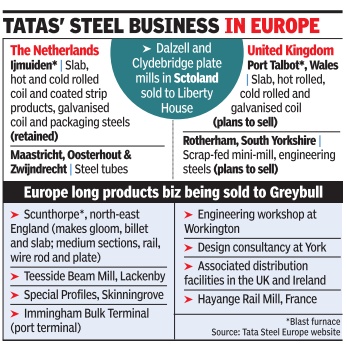

See graphic:

TATA's steel business in Europe

2017: alliance with ThyssenKrupp

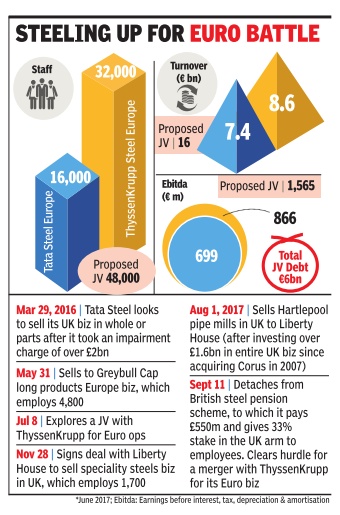

A decade after its buyout of Corus, Tata Steel is scaling down its investment in Europe. Tata Steel and German group ThyssenKrupp have signed an agreement to combine their steel businesses in Europe in a bid to create the continent's second largest steel firm, after ArcelorMittal.

The new company , to be named ThyssenKrupp Tata Steel, will have an estimated turnover of 15 billion euros and will employ 48,000 people. The merger will help Tata Steel lower its debt burden as it will knock off 2.5 billion euros (Rs 17,000 crore) from its balance sheet. Tata Steel has a debt of Rs 75,000 crore.Both Tata Steel and ThyssenKrupp will hold equal stakes in the new company , which will have a capacity of 21million tonnes. The agreement comes more than a year after Tata Steel decided to explore a JV for its loss-making European business with the $46 billion ThyssenKrupp.Last week Tata Steel hived off its British pension scheme, which was an obstacle in its talks with ThyssenKrupp. Tata group chairman N Chandrasekaran said deal will allow the steel company to focus on domestic market and grow the business, through various channels, including acquisitions of stressed assets.

Tata Steel, under Ratan Tata's leadership, had entered the European market through the $13-billion acquisition of Corus in 2007. The buyout of Corus, rechristened as Tata Steel Europe, was the biggest M&A by an Indian corporate. However, the acquisition did not turn out to be profitable for Tata Steel. In March 2016, the company , then led by Cyrus Mistry , announced its exit from the British market because of continuous losses that forced it to write down over £2 billion.The new merger agreement will mark a major reduction in exposure for Tata Steel to the European market.

To be headquartered in Amsterdam, ThyssenKrupp Tata Steel will house both the companies' assets and liabilities. Tata Steel has plants in Ijmuiden (the Netherlands) and Port Talbot (the UK), while ThyssenKrupp has a unit in Duisburg (Germany). Tata Steel will shift 2.5 billion euros of debt to the proposed JV while ThyssenKrupp will transfer pension liabilities of 3.6 billion euros.

Tata Steel and ThyssenKrupp, which see cost savings of up to 600 million euros per annum from combining their businesses, hope to complete the deal by March 2019. Heinrich Hiesinger, chairman of ThyssenKrupp, said the merged entity will be in a better position to cope with the structural challenges in the European steel industry . The industry is affected due to overcapacity and dumping by Chinese companies. Post the merger, Tata Steel's stake in the new company will be recognised as an “income from investment“.

2018: Joins Thyssenkrupp to become Europe's no.2 steelmaker

June 30, 2018: The Times of India

HIGHLIGHTS

The joint venture is the largest deal in Europe’s steel industry since the takeover of Arcelor by Mittal in 2006

To be named Thyssenkrupp Tata Steel, the JV will have about 48,000 workers and about 15 billion euros in sales

Thyssenkrupp’s supervisory board on Friday gave the green light for a steel joint venture with Tata Steel, paving the way for the European steel sector’s biggest shake-up in more than a decade.

The largest deal in Europe’s steel industry since the takeover of Arcelor by Mittal in 2006, the 50-50 joint venture - to be named Thyssenkrupp Tata Steel - will have about 48,000 workers and about 15 billion euros ($17.5 billion) in sales.

Based in the Netherlands, it will be the continent’s No 2 steelmaker after ArcelorMittal and forms the core of Thyssenkrupp CEO Heinrich Hiesinger’s plan to turn the steel-to-submarines conglomerate into a technology company.

“The joint venture with Tata Steel is an important milestone for the transformation of Thyssenkrupp to an industrials and service group and will lead to a significant improvement of the financial figures of Thyssenkrupp, effective with closing,” the group said in a statement.

The definite agreement would be signed shortly, it added.

The deal comes as European steel makers face stiff tariffs of 25 per cent on their exports to the United States, their biggest market, fuelling fears the local market might be forced to absorb more volume as a result.

DETAILS

Since tariffs were announced in late May, shares in European steelmakers ArcelorMittal, Thyssenkrupp, Salzgitter and Voestalpine have lost 8 to 17 per cent.

Hiesinger had faced pressure from activist shareholders Cevian and Elliott to extract more commitments from Tata Steel, whose European business performed worse than Thyssen’s since the deal was first announced in September, thus creating a valuation gap.

Thyssenkrupp said that in case of an initial public offering of the joint venture, which is widely expected by investors and has been flagged by both companies, it would get a bigger share of the proceeds “reflecting an economic ratio of 55-45.”

The German group also said it now expects annual synergies of 400 million to 500 million euros from the transaction, having previously communicated a maximum of 600 million.

Markus Grolms, vice chairman of Thyssenkrupp’s supervisory board, also said that Tata Steel would continue to remain liable for environmental risks in Britain, where its Port Talbot factory, the least profitable of the joint venture, is based.

He also said that Tata Steel’s Dutch unit would be part of the joint venture’s cash-pooling mechanism, which had been a key demand for German workers concerned that Tata would give its own workers better conditions in the new company.

“Yes, we do want to protect people. But we also want a company with better chances and less risks,” Grolms said.

2019: Tatas- Thyssenkrupp call off JV

Reeba Zachariah, May 11, 2019: The Times of India

Tata Steel and German conglomerate Thyssenkrupp have decided to call off their steel joint venture (JV), expecting the deal to be rejected by the European Commission over competition concerns.

The JV, announced in September 2017, was supposed to create Europe’s second-largest steel company with a turnover of 15 billion euros, behind ArcelorMittal. The deal was expected to stabilise and cut down the debt of the Tatas’ loss-making European steel business. The collapse of the JV is a setback to Tata Group chairman N Chandrasekaran’s restructuring initiatives.

The European Commission will announce its decision by June 17. Tata Steel and Thyssenkrupp had tried to offer “significant concessions” to assuage the commission’s concerns, but those didn’t help. If further commitments were made, then it would “affect the basic foundation” of the venture, making it uneconomical, Tata Steel said. The commission was expecting substantial concessions in the form of sale of assets of the JV.

With the merger now abandoned, Tata Steel said it will work towards improving the performance of Corus besides exploring other options for the unit (which is now known as Tata Steel Europe). The focus is to make the European operations cash-positive this year, said Tata Steel CEO T V Narendran.

Tata Steel acquired Corus for $13 billion in 2007, which marked its foray into Europe and which was the biggest merger & acquisition by an Indian corporate at that time. The acquisition, however, never made money for Tata Steel and it had to write off billions of dollars due to losses.

Tata Group's domestic takeovers

2018

Tatas buy Bhushan Steel

Reeba Zachariah, Leg up for IBC as Tatas buy Bhushan Steel, May 19, 2018: The Times of India

First Resolution Among 12 High-Profile Cases

Tata Steel said that it has completed the acquisition of Bhushan Steel even as it continues to fight a legal battle with the financially-troubled company’s original promoter.

The country’s second-largest private sector metal producer has paid Rs 35,200 crore to the creditors of Bhushan Steel for a 73% stake in the company, in what is seen as the conclusion of the first among a dozen high-profile cases that are being pushed for resolution under the new Insolvency & Bankruptcy Code (IBC).

The statement from Tata Steel came even as Bhushan Steel’s erstwhile owner Neeraj Singal has challenged the deal at the appellate tribunal and has sought a stay on the transfer of his 22% stake in the company. The matter is up for hearing on May 21. The completion of the acquisition puts the Singals out of the saddle from a company that had acquired the image of a perpetual loan defaulter that put up plants at a cost higher than the industry average.

The Tata-Bhushan deal drew immediate celebration from the government, which has forced banks and the RBI to use the new law that seeks time-bound resolution as part of a “clean-up drive” to rid Indian industry of loan defaulters. While cases ranging from Essar Steel and Bhushan Steel and Power to Binani Cement and Jaypee Associates are being fought across judicial forums, the government expects the successful resolution of Bhushan Steel to speed up a decision in other cases too.

“Fifty-three lenders, domestic and international, recover Rs 35,200 crores under IBC — 76% of the outstanding bad debt. The whole process completed in 270 days from admission in NCLT. Creditors to also get upside from a 12% equity stake now in strong hands,” financial services secretary Rajeev Kumar tweeted. Banks had a loan exposure of Rs 56,079 crore to Bhushan Steel.

Compared to the liquidation value of Rs 14,500 crore, the lenders had managed to realise a much higher value, said Piyush Goyal, who is officiating as finance minister while Arun Jaitley recuperates from a surgery. “For the first time, such a large loan resolution has been achieved through upfront payment received by banks through sale of a company,” he said.

Tata Steel to pay L&T ₹1,200 crore over a year

Goyal added, “This is a record step towards resolving the legacy of unprecedented amount of bad bank loans inherited by this government.” Goyal credited Prime Minister Narendra Modi and Jaitley for the insolvency resolution plan. He added that lower NPAs will make loans more affordable, especially for MSMEs.

Besides the Rs 35,200 crore, Tata Steel will be paying Rs 1,200 crore to Bhushan Steel’s operational creditors like Larsen & Toubro over a year. Recently, Larsen & Toubro had objected to the deal on the ground that Bhushan Steel owes it Rs 900 crore and wanted it to be treated on a par with financial creditors. But the court had dismissed its petition.

According to the arrangement between the financial creditors and Tata Steel, the former will hold 12% in Bhushan Steel after they convert a part of the debt into equity. Tata Steel has paid another Rs 100 crore to the financial creditors for “novation of remaining financial debt of Bhushan Steel”.

Tata Steel, which has routed the acquisition through its wholly owned subsidiary Bamnipal Steel, will finance the transaction through a mix of debt (Rs 16,500 crore) and equity (Rs 18,700 crore). Bhushan Steel is Tata Steel’s biggest acquisition since Corus in 2007.

While Electrosteel Steels was expected to be the first among the 12 bankruptcy cases to be resolved after potential buyer Vedanta got the tribunal’s nod, the unsuccessful bidder Renaissance Steel challenged Vedanta’s eligibility to take over the ailing company at the appellate tribunal and the case is listed for hearing on May 28.