Toothpastes: India

This is a collection of articles archived for the excellence of their content. |

Contents |

Herbal toothpastes

The Times of India, Aug 11 2016

John Sarkar

Herbal toothpaste robs MNCs' shine

In a development that may prove India's growing penchant for herbal and ayurvedic products, homegrown companies such as Dabur and Patanjali have robbed market share from top MNCs such as Colgate and Hindustan Unilever (HUL) in the toothpaste category. This has prompted some of the larger players to launch `natural' products and price them competitively . Till now, it was only Haridwar-based company Patanjali, which had been playing the low-price card to disrupt the country's FMCG market.

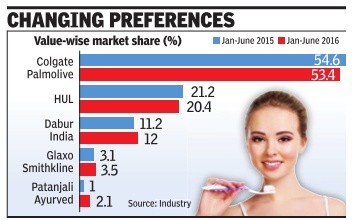

Quoting data from research firm Nielsen, senior FMCG executives said Patanjali has gained market share at the fastest pace by cornering 2.1% of the pie in January-June 2016, compared to 0.5% in 2015. Dabur managed to increase its share to 12% during the first six months of 2016, as against 11.2% in the same period last year.

In comparison, market le ader Colgate-Palmolive and HUL saw a decline in their shares (see table).

“Baba Ramdev deserves credit for the explosion in the ayurvedic FMCG space. The amount of viral marketing that has happened over the last one year over Patanjali products is every marketer's dream,“ said Arvind Singhal, founder of retail consultancy Technopak.“Also, Indian consumers have a lingering mindset that products made by Western companies may have harmful chemicals, although scientifically it may not be true.“

The herbal and ayurvedic toothpaste market in India is pegged at around Rs 800 crore, which is nearly 10% of the Rs 7,500-crore toothpaste market in India.

Colgate-Palmolive launched two new toothpastes with natural ingredients.

2013-16

Namrata Singh, Patanjali toothpaste makes Dabur smile, May 17, 2017: The Times of India

Patanjali Ayurved's Dant Kanti toothpaste has drilled holes into market shares of multinationals Colgate-Palmolive (India) and Hindustan Unilever.

But the wave of `naturals' -that appears to have engaged consumers -has actually been beneficial to homegrown company Dabur India, whose toothpaste market share has grown by a little over 1% in 2016.

In a presentation to investors, Colgate-Palmolive revealed a decline in its combined toothpaste volume market share from 57.4% in 2015 to 55.6% in 2016. HUL's combined share in toothpastes, with brands Pepsodent and CloseUp, has also eroded by 0.5% to 19.1%. However, Dabur's combined share has grown from 13.9% in 2015 to 15.3%.

Dant Kanti has emerged as the fastest growing brand, albeit on a small base, gaining 1.5% share in one year to about 3%. Industry experts said this is indicative of the fact that consumers are increasingly adopting natural or ayurvedic products. They added that the growth for Dant Kanti could have also come from new users adopting toothpastes for teeth cleansing as also multibrand users. Industry estimates show that 250 million in India still do not use a toothpaste.While the urban penetration of toothpastes is at a mature 92.3%, rural penetration stands at 74%.

Sunil Duggal, CEO of Dabur, recently told analysts, “The preference for herbal and ayurvedic toothpaste continues to gain traction, as a result of which our mar ket share in the toothpaste category went up by over 100 basis points (1percentage point) in 2016-17.“

In fiscal year 2017, Dabur's flagship brand `Dabur Red Paste', with a volume share of 8.5%, has emerged as the No. 3 toothpaste brand in the country by overtaking Cibaca Top (7.5% share). The top two brands of toothpaste are Colgate Dental Cream, with a share of around 29%, and CloseUp, with a share of about 13%.

Recently, Patanjali Ayurved announced that its annual turnover had crossed Rs 10,000 crore in the fiscal year 2017. Of this, Rs 940 crore came from Dant Kanti alone.

Following Dant Kanti's success, Colgate went into an overdrive and launched a new ayurvedic variant under Cibaca. An Edelweiss Research report on ColgatePalmolive said the natural segment is there to stay in the market.

2017-19, ‘20

Rupali Mukherjee, December 1, 2020: The Times of India

From: Rupali Mukherjee, December 1, 2020: The Times of India

Niche play gives teeth to toothpaste sales

Mumbai:

Specialisation, which has been driving growth for consumer goods, is now showing a marked increase for one of the most mundane products in the market — toothpaste. Need-based offerings are showing a sharp uptick. These include addressing tooth sensitivity, whitening or with herbal and ‘natural’ flavours.

As a result, the market is fast moving from generic all-inone toothpastes to more need-based offerings such as whitening, mint & herbal flavours, and those that address sensitivity. This is in line with global trends where specialty toothpastes are being developed, while some have been repositioned in the beauty/lifestyle category. Toothpaste, with a market size of around Rs 10,000 crore, is one of the most highly penetrated products and is growing at 2-3%. A case in point for specialisation is the sensitivity category, growing five to six times faster than the overall oral health category.

Tapping this potential, GSK Consumer Healthcare is expanding its flagship brand Sensodyne with a specialised oral health care product Polident — a denture care fixative. “Across categories, consumers today are looking for products that cater to their specific needs vs offering all-in-one benefits. The same is true for the oral health category with toothpastes as well. Over time, preference has shifted to toothpastes with a sharply defined benefit proposition — sensitivity relief, freshness and so on. Sensodyne has tapped into this trend to define the sensitivity segment over the last 10 years,” GSK Consumer Healthcare area marketing lead (OH) Anurita Chopra told TOI. Similarly, the ‘natural and ayurvedic’ sub-segment of the toothpaste market is growing at a faster clip. As against this, the overall oral care category grew by around 5% in Q2 of 2020-21. “We are seeing a marked shift in consumer demand for ayurvedic and herbal toothpastes with consumers increasingly seeking natural valueadded remedies for their oral hygiene needs. During Q22021, Dabur reported a growth of 24% in our toothpaste business with our flagship brand Dabur Red Paste seeing strong doubledigit growth. Our Babool and Meswak brands also reported double-digit growths. We have now expanded our oral care portfolio with the launch of Dabur Dant Rakshak Ayurvedic toothpaste,” Dabur India CEO Mohit Malhotra said.

The need-based or functional categories in oral care are growth drivers for a while now. “These toothpaste categories — gel-based, ‘natural or herbal’ and those addressing sensitivity — have been outperforming the market, and will corner a larger share over the next few years,” said ICICI Securities research head Manoj Menon.