Two-wheeled automobiles: India

This is a collection of articles archived for the excellence of their content.

|

Contents |

India and the world

2020: state-wise

Dipak Dash, July 25, 2023: The Times of India

From: Dipak Dash, July 25, 2023: The Times of India

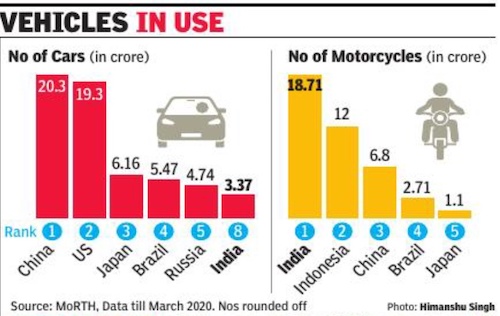

New Delhi: India, according to the latest Road Transport Year Book, has the maximum number of registered two-wheelers, followed by Indonesia. India ranks eighth in the world in number of passenger cars, while China, the United States and Japan are the top three.

The report has referred to the 2020 data of the International Road Federation, which is used as the reference across the countries.

As per the report, which has collated data from all states and UTs on registered vehicles, India had 32. 63 crore vehicles in 2020 and nearly 75% of these were two-wheelers. Meanwhile, in the past three years, little more than two crore vehicles have been registered, taking the total number to around 34. 8 crore till mid-July, data from the government’s Vahan portal show. The government data show that among all states and UTs, Maharashtra had the maximum number of registered vehicles (3. 78 crore), followed by Uttar Pradesh (3. 49 crore) and Tamil Nadu (3. 21 crore). Among the million-plus cities, Delhi topped the list with nearly 1. 18 crore registered vehicles while Bengaluru had the second maximum number of vehicles at 96. 4 lakh. Interestingly, while Delhi had the maximum number of registered private vehicles, its neighbouring city, Faridabad had the maximum number of 18. 6 registered transport or commercial vehicles among such cities.

The data also show that the 55 million-plus cities had a 34% share of all the total registered private vehicles in the country, indicating how people have continued owning private vehicles due to lack of adequate public transport. “The trend has not changed and we are adding more two-wheelers across our cities and small towns. While their share has been increasing and high number of crashes involving them, we are yet to address the need of such large number of vehicles,” said road safety expert RohitBaluja.

Some countries such as Malaysia, where 50% of the vehicles are two-wheelers, have gone for creating separate lanes for two-wheelers to prevent collisions.

Recently, at the ‘Vision Zero’ conference in Sweden where over 100 countries gathered to chalk out a plan to halve road fatalities by 2030 also agreed that motorcycles across the nations are emerging as the biggest challenge.

In India, the number of two-wheeler occupants killed has consistently increased to 69,385 in 2021 and it was 45% of all road fatalities.

Sales (of all two-wheelers)

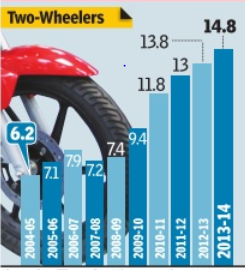

2004-14

See graphic:

Sale of two-wheelers in India, 2004-14

2017, India: World’s biggest market for two-wheelers

India is now the world’s biggest two-wheeler market , Pankaj Doval, May 7, 2017: The Times of India

HIGHLIGHTS

17.7 million two-wheelers were sold in India in 2016, while China trailed at 16.8 million units

"The massive government spending in rural programmes and large road-construction projects is leading to a pick-up in volumes in smaller towns and villages," said a top official at Hero MotoCorp

NEW DELHI: India has overtaken China to emerge as the world's biggest market for two-wheelers. A total of 17.7 million two-wheelers were sold here last year, that's over 48,000 units every day.

Neighbouring China trailed with 16.8 million units sold, according to officials from industry body Society of Indian Automobile Manufacturers (Siam) as well as data from China Association of Automobile Manufacturers.

Besides rising incomes and growing infrastructure in rural areas, one big reason for the spurt in sales has been women commuters+ who like the ease of zipping in and out of chaotic city traffic on their gearless scooters. For Honda, which leads the scooter market, the share of women is at 35%.

The market in China has been on a decline over the past few years, perhaps due to the fast-paced growth in car sales there as well as the curbs on petrol two-wheelers in top cities. "The Chinese market has been coming down from the highs of 25 million or so, reached a few years back," says Sugato Sen, Deputy DG of Siam. However, the sales of electric two-wheelers have been on an upswing in China.

Indonesia is holding steady as the third-largest two-wheeler market with annual sales estimated at 6 million units. Here too, volumes have slipped from 6.5 million units sold in 2015.

So, what clicks for India when it comes to the two-wheeler market? "The need for mobility is very large in India, and we are one of the fastest developing economies in the world," says YS Guleria, Senior VP (Sales & Marketing) at Honda Motorcycle and Scooter India (HMSI), the country's second-biggest two-wheeler company.

Easier finance options, newer and more fuel-efficient models, rising incomes have only added to the push even as new business models, such as e-commerce, also help purchases.

A top official at Hero MotoCorp, the country's biggest company, said that the growth of infrastructure in smaller towns and non-urban areas is helping demand.

"The massive government spending in rural programmes and large road-construction projects is leading to a pick-up in volumes in smaller towns and villages," said the official, who did not wish to be identified.

In metros and the larger cities, the sales are also being aided by the choked infrastructure. "People are buying two-wheelers for shorter commute and errands, even if they have a car. It is difficult to move around in congested cities, and even more difficult to get a space to park. So, two-wheelers are increasingly becoming the second vehicles in the household," the official from Hero says.

Industry officials say that the market will continue to grow over the next few years. "We will grow at around 9-11% over the coming years," Honda's Guleria says.

The growth is not only being led by commuter vehicles, but even larger and expensive two-wheelers are being sold in good numbers. Royal Enfield, which sells bikes comfortably priced upwards of Rs 1 lakh, has seen sales grow by over 30% last year, and is now preparing to boost its production capacity.

"We have seen a massive demand in the past few years and are ramping up capacity," says Siddhartha Lal, CEO of Eicher Motors that sells the bikes. "India is a market where sales are only going to go up, and there is enormous potential here."

Premium bike makers (those selling products priced upwards of Rs 5 lakh) such as UK's Triumph Motorcycles and American Harley Davidson have also been upping their product portfolio and exposure in India.

Triumph, which entered India in 2013, has already sold over 4,000 bikes and now has portfolio of over 17 vehicles. "Triumph is the fastest-growing luxury motorcycle brand in India, and we hope to maintain the pace further," Vimal Sumbly, MD of Triumph in India, says.

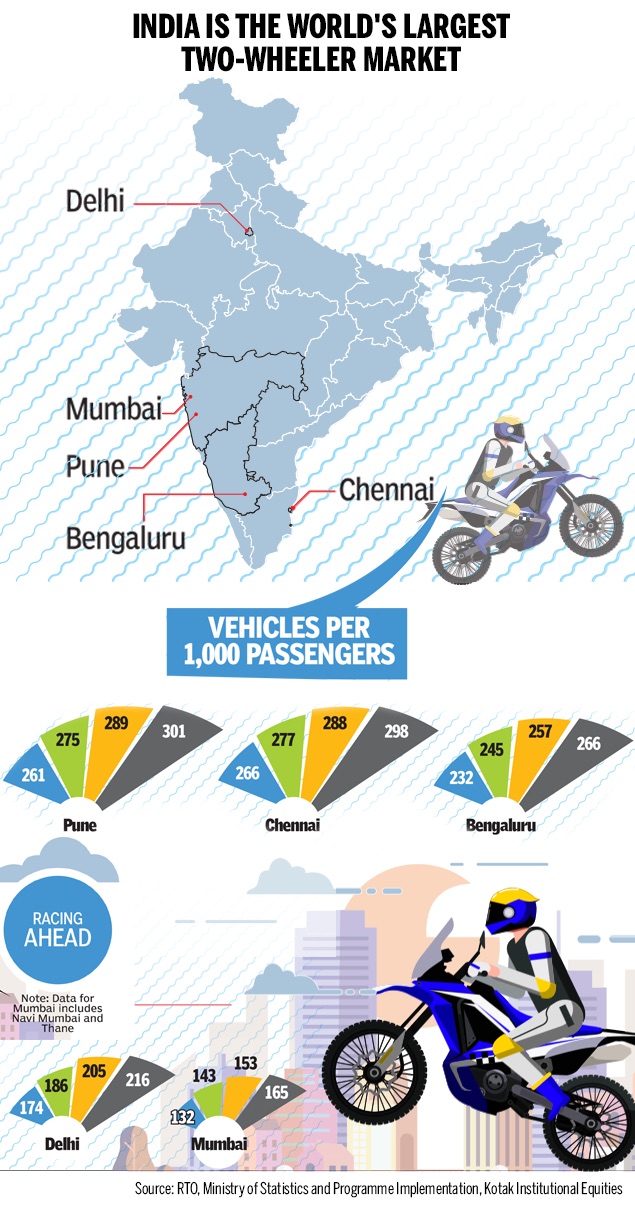

2018: ownership in the metros

From: January 10, 2019: The Times of India

See graphic:

Ownership of two-wheeled automobiles in the Indian metros, presumably as in 2018

2012-19

NANDINI SENGUPTA, May 20, 2019: The Times of India

From: NANDINI SENGUPTA, May 20, 2019: The Times of India

Call it the premium drive rub-off. When the DZire beat the Alto as the top selling model in cars, no one expected that trend to spread to other categories. But now, motorcycles are witnessing the exact same drive towards premiumisation. According to industry body SIAM’s data, from 2014 to 2019, the 75-125cc motorcycle segment shrunk from 84% to 76% of the market. That segment had commanded 84% of the total 10-million motorcycle sales in FY12-13 and 83.7% of 10.5 million in FY13-14.

Cut to the 125-250cc segment, which had a near 15% share of the total pie in FY12-13 and 14.3% in FY13-14. This category now claims 17.6% share of the motorcycle market. And the relatively higher end 250-500cc has gone from 1.2% in FY12-13 and 2% in FY13-14 to 6% now ( see graphic).

Motorcycle marketers say a combination of social and economic factors are responsible for this trend. “An increasingly younger population, enhanced household incomes, and lower fuel costs have bolstered the growth of the premium segment,” said a Hero MotoCorp spokesperson.

The ecosystem has helped too. “Improved road infrastructure and the availability of global lifestyle motorcycle brands have also helped push demand for more premium bikes,” said Honda Motorcycle & Scooter India (HMSI) senior vice-president (sales & marketing) Yadvinder Singh Guleria.

While the lifestyle angle actually kicks in for the 250cc-plus category, the rub-off is trickling downwards. “The affinity for lifestyle biking and preference for motorcycles as an extension of one’s style has given a push to the segment in both urban and rural markets,” said a TVS spokesperson.

Unsurprisingly, this has prompted more attention from the big three in the motomarket. Hero MotoCorp, which commands over 50% share of the domestic motorcycle market and close to 70% in the 100-125cc segment, is now enhancing “focus on growing presence in the higher capacity segment as well”, added the spokesperson.

HMSI has started expanding a new retail network — the Honda’s BigWing — to sell its premium products.

2018-19: decline in sales

Pankaj Doval, April 9, 2019: The Times of India

From: Pankaj Doval, April 9, 2019: The Times of India

Pressure on the jobs front and the growing pain in rural and semi-urban India has started to tell on the auto industry. Sales of scooters have slipped into the red for the first time in 13 years and the passenger vehicles segment —that includes cars and SUVs — has grown at the slowest pace in the last five years.

Scooters, that account for nearly one-third of total two-wheelers sold in the country, recorded sales of 67 lakh units in 2018-19, down 0.27% from 67.2 lakh units in the previous year. The last time that the category — which has been credited with single-handedly adding weight and buoyancy to the two-wheeler segment over the past few years — had fallen was in fiscal 2005-06 where it de-grew by 1.5%.

And while the motorcycle segment was able to duck the trend with a sales growth of nearly 8% for the full fiscal, the pain is visible here too.

‘Job scenario impacting PV sales’

Sales of motorcycles have been struggling over the last few months and have been in the negative territory since January this year. Companies such as Hero Moto, Honda Motorcycle and Scooter India (HMSI), and TVS have cut production and also dealer dispatches as they fall in line with the new reality.

Industry body Society of Indian Automobile Manufacturers (Siam) came out with a conservative, rather grim, outlook for the new fiscal. On a 2.7% growth in passenger vehicles in 2018-19, it predicted a growth between 3% and 5% for 2019-20. Two-wheelers too saw a forecast of 5-7% growth, nearly same as the 5% growth realised in 2018-19.

“The situation on the jobs front is among some of the sentiments that have affected the growth in the passenger vehicles industry,” Siam president Rajan Wadhera said.

Wadhera, who is also the president of the automotive business of Mahindra & Mahindra, said that pre-election jitters and rising cost of insurance and fuel also kept buyers away from the market.

His view was backed by industry analyst VG Ramakrishnan, MD of consultancy firm Avanteum Advisors. “The impact on the jobs front is highly under-estimated so far. After GST, quite a bit of unorganised sector folded up and the number of companies reduced. The slowdown in the IT sector and bloodbath in telecom not only saw a reduction in total employment, but also created an uncertainty in the minds of those who are still employed. You tend to postpone new purchases, even though you may have the money.”

The nervousness in the metro and semi-urban markets hit the demand for scooters badly with market leader HMSI (Honda) forced to cut production as sales fell. A top official with one of the leading two-wheeler companies said that the going remains tough even in rural markets. “When it comes to motorcycles, rural markets are nearly 50% of total sales. There is simply no traction in rural, and we are struggling to get numbers,” the official, who requested anonymity, said.

Siam’s Wadhera said the industry is saddled with excess capacity, which will limit the capacity of companies to make new investments. “There is enough capacity in all the segments. I do not expect major investments to flow in on the growth forecast that we have given.”

The problem for the auto industry is that new numbers are not coming in even though they have launched new models and have also thrown in attractive discounts and freebies.

“In the bigger metros, shared mobility is also pinching demand. Many of the younger people are in no hurry to buy a car, and are happy with Olas and Ubers. They are least interested in buying a car, even though aspirations are intact,” Jnaneswar Sen, former sales and marketing chief at Honda Cars India, said.

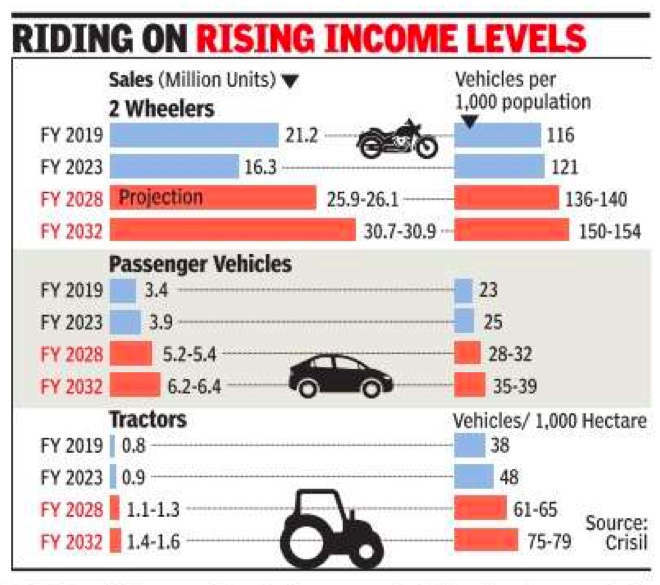

2019, 2023

See graphic:

Two wheeler sales in India in 2019, 2023

Manufacturing hubs (in the states)

2011-18

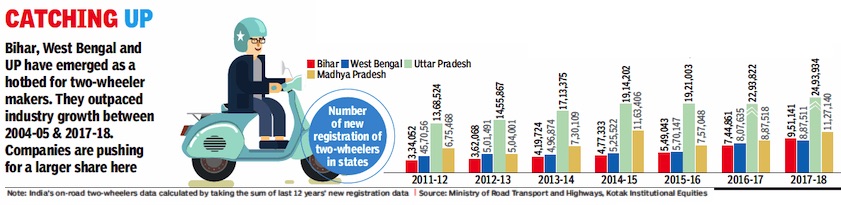

From: January 22, 2019: The Times of India

From: January 22, 2019: The Times of India

See graphics:

States that were the main manufacturing hubs of two-wheeled automobiles during the period 2011-18

Two-wheelers per 100 passengers, state-wise- 2015-18

MOPEDS

Sales

2019, 2020

Nandini Sengupta, December 15, 2020: The Times of India

From: Nandini Sengupta, December 15, 2020: The Times of India

For the first time in the moped segment, sales turned positive in July-September after falling for four quarters. Additionally, sales in October and November indicate that rural consumption is picking up, pushing moped sales. And the segment is a single-product, single-company market — commanded by TVS Motor.

Sales crashed from July-September 2019 up until April-June 2020, before the prop-up came in the second quarter of this fiscal. TVS has done well with the moped, selling over 4 lakh units of the XL100 in the April-November period so far, despite a washout first quarter. And yet, when contacted, none its competitors said there were any plans of cracking this segment.

“Traditionally, mopeds have their own market in the southern part of the country, supported significantly by the fact that states like Andhra Pradesh and Telangana give subsidy to small farmers and fishermen to buy a moped,” said rating agency Icra VP Shamsher Dewan. The reason why there has not been that much interest so far in mopeds is because the value of the market is not very big and mopeds have, for the longest time, languished at the bottom of the sales chart.

A TVS Motor spokesman did not want to comment on the moped sales.

Demand for mopeds comes from villages and small towns, where it doubles up as a rural activity vehicle priced under Rs 45,000. The reason why mopeds are suddenly back in business, said Crisil Research director Hetal Gandhi, “is because after BS6 (emission norms), the price of mopeds have increased by around 10% — lower than the average hike in other twowheeler segments”.

What has also helped the spurt is the reverse migration due to the pandemic. “Workers who have moved back to their hometowns owing to Covid-19 have been using their remittance incomes to purchase vehicles like mopeds for transportation and business sustenance needs,” said Gandhi.

MOTORCYCLES

Electric two-wheelers

As in 2020

Small Cos Have Sprung Up Across Country Producing Quick-Fix Green Rides

The last thing you would associate with electric mobility and green two-wheelers would be a company called Jitendra EV, a small-time establishment based out of Maharashtra. And if that’s not surprising enough, there are other similar ones with not-soimpressive names. By way of example there is Kabira Mobility, which is a e-bike seller that assembles its rides in Dharwad, Karnataka as also M2Go, a company headquartered in the Punjabi Bagh locality in Delhi.

These companies are part of a large group of start-ups — and their numbers are growing by the day — that have sprang up across the country over the last couple of years looking to tap into the growing push towards electric mobility in what are the tech’s early days in India. The gameplan is simple: source batteries, controllers, and body parts and stitch them all together (many of the companies proudly call it ‘local manufacturing’ though it’s not much more than just cosmetic, small-time assembly), before selling it under the ‘Make in India’ tag. The sourcing is done mostly from China (and now even from India) and is akin to what happened in the early days of the mobile phone industry in India. People (some from non-related fields) bought the some times nearly completed parts from China, assembled them here at small establishments, and Hyderabad-based Everve Motors is owned by Reddy Customs, who are high-end car modifiers. Gurugrambased Evolet India is a company run by defence veterans while Coimbatore-based Emote electric is run by young engineers.

Emote is showcasing its more sophisticated modelprototype that has gears and can go from 0-60 kms in less than 4 seconds. Most of these companies have 50 or fewer employees and sales volumes of less than 5,000 bikes annually.

M2Go is a start-up conceptualised by some students of a private university in Delhi who came together for a project. One of the promoters of the university liked the idea and decided to invest through seed funding.

then passed them off as local products under their own brand names. While the trick worked for some years, it was not sustainable in the long run without proper R&D for such sellers, who also often lacked proper corporate structure and/or long-term plans. Today, Chinese phone companies rule the roost and have over 75% share of the smartphone market, while many of the Indian ones have perished.

Ask Jitendra Shah, owner of Jitendra EV (who are traditionally auto dealers), on why he decided to have the company under his own name. Pat comes the reply, “If it’s my name that is being used, how can I compromise on quality then.” Amusing but certainly plausible enough logic for him to go for the name.

Kabira Mobility’s scooters and a ‘high-speed’ sports bike will begin commercial sales from March this year and Jaibir Singh, the project head, says the project was completed in the last two years or so.

Many of the products, which cost between Rs 45,000 to Rs 1.1 lakh, offer a mobility range of 60 km to 100 km (under different driving conditions) with a charge time of around 4 hours. Some of them also offer the convenience of portable batteries, weighing about 12 kg, that can even be carried home.

Experts believe that unlike traditional petrol automobile products that need high-tech engineering for designing engines and transmission systems, the heart of e-bike technology is its battery and motor, which is mostly imported from China. The rest of the components are either locally manufactured or are imported as kits to be assembled and sold in the Indian market.

And, while small startups are trying to find their feet in the e-bike segment, the bigger ones such as Bajaj Auto, TVS, Hero Moto-Corp and Honda 2wheelers are yet to show any serious intent with the last two not having launched any EV products yet.

Sales (of motorcycles)

2016>18: High-end bike sales slow down

Nandini Sengupta, High-end bike sales hit slow lane, March 23, 2018: The Times of India

From: Nandini Sengupta, High-end bike sales hit slow lane, March 23, 2018: The Times of India

As leisure biking picks up speed in India, more and more global motorcycle brands are flocking to this market and new products and brands are rolling in thick and fast. But despite the excitement about the highend luxury motorcycle market, the latest SIAM data shows that the 500cc-plus segment is shrinking.

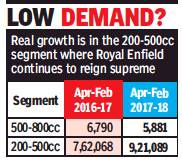

The real growth is in the 200-500cc segment where Royal Enfield continues to reign supreme. The higher end moto-market — where global brands like Harley Davidson, Triumph, Kawasaki and others play — is either flat or has turned negative.

Consider the stats: According to Siam, between April and February, sales in the 500cc-plus segment fell to 5,881 units from 6,790 a year ago. In contrast, the 200-500cc market is vrooming with sales up nearly 21% in the April-February period. This segment has gone from 7,62,068 units in the previous April-February to nearly a million units (9,21,089 units) now.

The segment immediately preceding this — the 150-200cc market — has clocked the highest growth in the motorcycle market at nearly 42% with Bajaj, Honda Motorcycle and Scooter India, Suzuki and TVS all clocking impressive growth.

Motorcycle marketers are betting big on this demand shift upwards as some of the more mass-market segments continue to shrink. The 125-150cc market, for instance, has shrunk from 11,93,426 units to 10,17,713 units this time round. “The demand shrink is happening in those commuter segments which focused on urban markets as demand there is moving towards 200cc and above,” said a senior motorcycle marketer. “But rural demand has ensured that the bottom end of the motorcycle market remains buoyant.”

Indeed, the 75-110cc entrylevel commuter segment has actually grown from 5.9 million units to 6.7 million units in the April-February period. The 110-125cc commuter segment has also grown from 1.7 million units to 2 million units in the same period. Both these segments were under pressure when rural demand was stuck in first gear due to poor rains, among other reasons.

2017-19: superbike sales

John Sarkar, Sliding superbike sales prompt offers, February 14, 2019: The Times of India

From: John Sarkar, Sliding superbike sales prompt offers, February 14, 2019: The Times of India

Two-wheeler companies in India are offering lucrative discounts on superbikes to liquidate stocks, as potential buyers are moving to smaller capacity motorcycles.

Sales of motorcycles with engine capacity between 800cc and 1600cc have taken a beating between April 2018 and January 2019. In comparison, sales of bikes with engine capacity greater than 500cc and less than/equal to 800cc increased from 2,858 units to 4,798 units during this period.

Most premium bike makers from Ducati and Harley-Davidson to Triumph are offering cash discounts and freebies on their high-end bikes to lure buyers and arrest the sales slide. These motorcycles cost upwards of Rs 10 lakh. Companies primarily attributed the reason to the widespread availability of cheaper mid-capacity motorcycles that sport price tags of Rs 3-7 lakh.

“We were selling around 15 bikes every month in the capital during this time last year, but currently we are finding it difficult to sell even five,” said an executive at a dealership at British bike maker Triumph Motorcycles.

While a Harley-Davidson India spokesperson refused to comment on discounts, executives at its dealerships said buyers can avail ‘benefits’ of up to Rs 2 lakh or around 10% of maximum retail price (MRP) on its high-end motorcycles.

“There is definitely a weakness in the market,” said the MD of a premium motorcycle company. “Factors like rising fuel costs, lack of liquidity in the system and high insurance costs have affected sales. Some companies, however, are facing slow sales due to product churn as they are phasing out older models and bringing in new ones.”

Honda Motorcycles & Scooters

2017: India the largest market

India is now the largest two wheeler market globally , by volume, for Japanese automobile major Honda. Honda Motorcycle & Scooter India's (HMSI) volume contribution globally hit 32% in the first quarter of this financial year -its highest ever so far.

According to top HMSI officials the company's two wheeler sales grew 20% in the AprilJuly period -compared to 9% growth clocked by the industry -with scooters growing 19% and motorcycles growing 20% including domestic sales and exports.

“India is also the biggest production hub now for Honda with a combined capacity of 6.4 million units compared to Indonesia which was earlier the largest at 5.8 million units,“ said YS Guleria senior VP marketing and sales HMSI.

With this India has become Honda's largest motorcycle market globally in FY16-17 dethroning Indonesia which however continues to be Hon da's biggest scooter market globally. In an effort to keep up that momentum the company is planning to enter the high growth 250 cc plus motorcycle market that is currently dominated by Royal Enfield.

“We have a strong intention to enter this segment in the near future. We have been considering how to enter it with the right product and compete from the cost and price point because competition enjoys high cost competitiveness,“ said M Kato president and CEO HMSI. Apart from the lifestyle segment Honda's also trying to expand the market for scooters to semi urban and rural segments. To that end the company on Monday launched the 110 cc Cliq at a price of Rs 44,524.

“Overall rural markets contribute around 28-30% of Honda's sales with 20% of scooter sales coming from these markets“ added Guleria.

Apart from rural markets, focus is also on the 5 southern markets which together account for 28% of two wheeler sales countrywide and 43% scooter sales.