US- India economic relations

This is a collection of articles archived for the excellence of their content. the Facebook community, Indpaedia.com. All information used will be acknowledged in your name. |

Creation of jobs

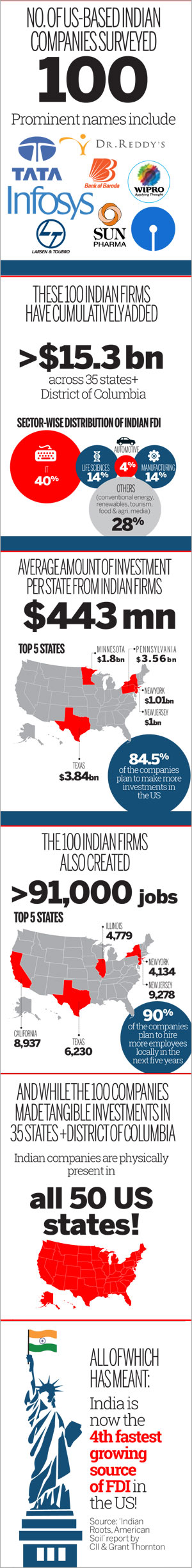

2017/ Indian companies create over 1 lakh jobs in US

The Times of India November 15, 2017

HIGHLIGHTS

Indian firms are among the fastest growing investors in the US, contributing to growth and job creation in the US economy, a lawmaker said

The top five states in which Indian companies have generated maximum employment are New Jersey, Texas, California, New York and Georgia

Indian companies have created more than 113,000 jobs in the US and invested nearly $18 billion in the country, according to an annual report which gives state-by-state breakdown of the tangible investments made and jobs created by 100 Indian firms doing business in America and Puerto Rico.

The report titled 'Indian Roots, American Soil', which was released by Confederation of Indian Industry (CII) on Tuesday, states that Indian companies have also contributed $147 million towards corporate social responsibility and $588 million as research and development expenditures in the US.

Together, 100 Indian companies employ 113,423 people across 50 states, the District of Columbia and Puerto Rico, the report said, adding that the total value of tangible investments made by these companies exceeds $17.9 billion.

The top five states in which Indian companies have generated maximum employment are New Jersey (8,572 jobs), Texas (7,271 jobs), California (6,749 jobs), New York (5,135 jobs) and Georgia (4,554 jobs).

According to the report, the top five states in which Indian companies have contributed the highest foreign direct investment are New York ($1.57 billion), New Jersey ($1.56 billion), Massachusetts ($931 million), California ($542 million) and Wyoming ($435 million).

The average amount of investment received from Indian companies per state/territory is $187 million, the report said, noting that 85 per cent of the companies plan to make more investments in the US.

As many as 87 per cent of the companies plan to hire more employees locally in the next five years. Indian industry and professionals are making significant contributions to the US economy, said Indian Ambassador to the US Navtej Sarna.

"The presence and reach of Indian companies continue to grow each year as they invest billions of dollars and create jobs across the United States," he said.

Chandrajit Banerjee, CII director general said the story of Indian investment in the US is one that showcases how intertwined the two countries are that contribute to each other's success. Indian firms are among the fastest growing investors in the US, contributing to growth and job creation in the US economy, said Senator Chris Van Hollen. As the world's oldest democracy and the world's largest democracy, a strong US-India partnership is vital for the 21st century, said Congressman Ami Bera.

The friendship between the United States and India has continued to grow under President Trump's administration, said Congressman Pete Sessions. Indian businesses have brought hundreds of millions of dollars and thousands of jobs to Texas and, at the same time, the reforms led by Prime Minister Modi have opened doors for American companies to expand their operations in India, he said.

"I am glad to see, as CII's event today proves, bonds between our nations - both commercial and strategic - continue to grow stronger," Sessions said.

"According to CII's survey, Indian companies in Virginia have invested over $37 million in my state, and I can only hope that they will continue to invest in Virginia and that our engagement with these companies will continue to grow," said Congressman David Brat. In addition to spurring economic activity, particularly in North Carolina, this type of investment serves to strengthen the bond between our two countries, said Congressman George Holding. The report shows that Indian companies have invested over $195 million in the state of Illinois, and created over 3,800 jobs, said Congressman Raja Krishnamoorthi.

"I hope that Indian companies continue to put down roots and invest in our state, as our economy and community are strengthened by their engagement with us," he said.

Earnings from the US

Data earnings: 2017

From: May 26, 2018: The Times of India

See graphic:

At $11bn, India's data earnings from the US is 20x what next 9 bring- 2017

Economic indicators

2012/ 2014- 2024

From: August 6, 2025: The Times of India

See graphic:

Select indicators showing the state of India – USA economic relations, 2012/ 2014- 2024

US prez Donald Trump has been railing against India for buying Russian oil, but away from the talk of penalties and sanctions, one of America’s closest allies stays under the radar as it continues to receive oil and gas from Russia, finds Richa Gandhi.

Government securities of the USA

2016: India the 12th largest holder

India 12th largest holder of US govt securities, Feb 20, 2017: The Times of India

India became the 12th largest holder of US government securities at the end of 2016, with exposure worth $118 billion.

With holdings worth $1.09 trillion, Japan remained the largest holder of these securities followed by neighbouring China with exposure to the tune of $1.06 trillion. After Japan and China, Ireland was at the third place with holdings worth $288 billion, followed by Cayman Islands ($264 billion), Brazil ($259 billion) and Switzerland ($229 billion). “Foreign residents decreased their holdings of long-term US securities in December; net sales were $13.9 billion. Net sales by private foreign investors were $32 billion, while net purchases by foreign official institutions were $18.1 billion,“ the Treasury Department said.

2018, July: India no.13

India's exposure was $142.6bn

2022: India number 10

From: March 30, 2023: The Times of India

See graphic:

The top 10 holders of US treasury holdings in 2022

Investments

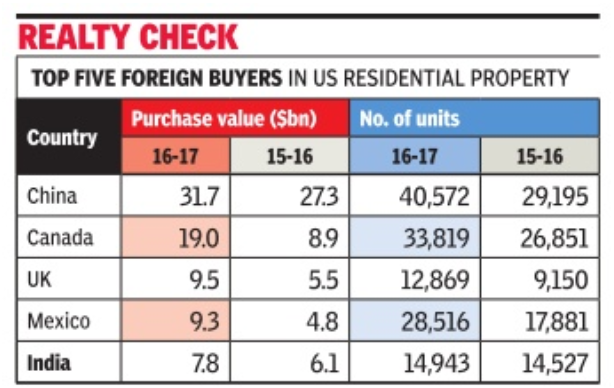

Indians no.5 investors in US residential property

Lubna Kably|Indians among top US homebuyers|Jul 21 2017 : The Times of India (Delhi)

Fifth-Largest Foreign Investors In Residential Property, Shows Study

The gloom owing to protectionist policies has not kept Indians residing in the US from investing in real estate. By purchasing residential property worth $7.8 billion during the 12-month period ending March 2017, Indians have emerged as the fifth largest foreign investors in real estate in the US.

Backed by mortgage finance, these properties were largely acquired for use as primary residence, or for a child studying in the US.

Chinese nationals were the biggest buyers, purchasing $31.7 billion worth of residential property . They are followed by Canadians, Britons, and Mexicans.

From April 2015 to March 2016, Indians invested $6.1 billion and occupied third place.However, a surge of invest ments from other nationalities led to India slipping to fifth position in 2016-17 (see table).

The bulk of buyers from China, India, and Mexico were working and residing in the US, while most buyers from Canada and the United Kingdom were non-resident buyers, adds the report “2017 -Profile of International Activity in US Residential Real Estate“, released recently by the National Association of Realtors (NAR).

More than a third of the Chinese buyers purchased residential property in California. Compared to other major foreign buyers, Indians were not as concentrated in any state and the location of their jobs largely determined the purchase. While California, New Jersey , Texas, Massachusetts, and Kentucky were top destinations, more than two in five Indian buyers purchased in other state.

In aggregate, foreign buyers purchased $153 billion worth of residential property in the US between April 2016 and March 2017, which is a 49% jump from the figure for the corresponding period between 2015 and 2016 -$102.6 billion. In terms of units, foreign buyers purchased 2.84 lakh residential properties in the US from April 2016 to March 2017, up 32% from the previous period's 2.14 lakh properties.

On an average, foreign buyers paid $536,852 for their properties, 12% more than the average for the previous 12-month period. The average purchase price as regards property purchased by Indians was $522,440. “The political and economic uncertainty both here and abroad did not deter foreigners from exponentially ramping up their purchases of US property over the past year,“ said Lawrence Yun, NAR's chief economist.“...Foreigners increasingly acted on their beliefs that the US is a safe place to live, work and invest,“ added Yun.

While a stronger dollar makes it more expensive to purchase US property , expectations of further weakening of a local currency prompts some foreign buyers to accelerate their purchases.

Referring to the value of the rupee, the report states that it depreciated modestly (by 2%) relative to the dollar over the survey period. However, after demonetisation in November 2016, the rupee reversed course and began to appreciate.

Trade issues

2018: Harley Davidson, 100% duty, Modi and Trump

US President Says ‘Fantastic’ And ‘Beautiful’ Modi Sweet-Talked Him On Motorcycle Tariffs

US President Trump lit into India again on Monday in a rambling critique on trade issues, picking on a minor dispute with New Delhi over motorcycle tariffs to highlight his grievance that other nations have taken advantage of previous US administration’s negligence on trade. For the second time this month, Trump latched on to an issue that does not even account for 0.05% of the $140 billion US-India bilateral trade, itself ranked tenth in the US commercial sweepstakes.

After lamenting how China, Canada, and Mexico — the top three American trade partners — were ripping off the US, Trump settled on the Harley Davidson dispute with India to build a case for his version of fair trade. “So we want fair trade deals. We want reciprocal trade deals. Scott Walker has a wonderful company called Harley Davidson in Wisconsin. Right? Great. So when they send a motorcycle to India, as an example, they have to pay 100 percent tax — 100 percent,” Trump began, even though he acknowledged Prime Minister Narendra Modi personally intervened to reduce it to 50%. It isn’t enough for Trump.

“Now, the Prime Minister, who I think is a fantastic man, called me the other day. He said, “We are lowering it to 50 per cent.” I said, “Okay, but so far we’re getting nothing.” So we get nothing, he gets 50 (per cent), and they think we’re doing — like they’re doing us a favour. That’s not a favour. And you know what I’m talking about,” he rambled on.

Trump then revealed that Harley itself had not asked for concessions and he was the one who was spending time on an issue that is laughably insignificant in terms of US world trade. “It’s a great company. When I spoke with your chairman or the president of Harley, they weren’t even asking for it because they’ve been ripped off with trade so long that they were surprised that I brought it up. I’m the one that’s pushing it more than they are, but it’s unfair,” he said. “And India sells us a lot of motorbike…So when they have a motorbike — a big number, by the way — they have a company that does a lot of business. So they have a motorcycle that comes into our country — We get zero. They get 100 percent, brought down to 75; brought down, now, to 50. Okay,” he said.

Then he returned to Modi. “And I wasn’t sure — he said it so beautifully. He’s a beautiful man. And he said, ‘I just want to inform you that we have reduced it to 75, but we have further reduced it to 50.’ And I said, ‘Huh.’ What do I say? Am I supposed to be thrilled? And that’s not good for you people, especially as governors. It’s just not right. And we have many deals like that,” he told a meeting of the nation’s governors, who were further gobsmacked when he told them he would have confronted the Florida shooter unarmed.

India exports less than 1,000 motorcycles to US; African and Latin-American countries buy many times more. Besides, Harley manufactures its bikes in India now, and the tariff would largely be on the few imported bikes and semi- and completely knocked down components.

The US president’s obsession with Harley and its effort to get greater traction in India is attributed to the motorbike users demographic profile — mostly white, middle-aged men in middle America who typically voted for Trump as attested by “Bikers for Trump” rallies during the election. Trump also narrowly won narrowly won Wisconsin (47.2% to Hillary’s 46.5%), where the Harley headquarters is located (in Milwaukee) and ostensibly wants to show his gratitude to the state’s working class voters who ditched Democrats, making him the first Republican candidate to carry the state since Ronald Reagan in 1984.

So despite the insignificance of the dispute and the negligible numbers, he wants to make it a signature issue on manufacturing, ignoring the fact that Harley manufactures from India. “It is an easy illustrative example for his voters because Harley is an iconic brand,” one trade expert told TOI on background. “US and India actually have much bigger trade disputes, on medical devices for example.”

What Trump also doesn’t know or prefers to ignore is Harley’s entry to India was premised on a “mangoes for motorbikes” deal in 2007 between then President George Bush and PM Manmohan Singh, an agreement that took a long time to fructify for India because mango exporters had to jump through all kinds of hoops (including irradiating mangoes to get rid of pests), making the mangoes almost unaffordable in the US (up to $36 for a box of 12).

Duty-free concessions on 50 Indian products’ import revoked

US revokes duty-free privileges, November 2, 2018: The Times of India

Imports Of 50 Indian Products Face Heat Over Trump Stand

The US on Thursday revoked duty-free concessions on import of at least 50 Indian products, mostly from handloom and agriculture sectors, reflecting the Trump administration’s tough stand on trade-related issues with New Delhi.

The federal register issued a notification, listing out 90 products that were so far subject to duty-free provisions under the Generalized System of Preferences (GSP).

US President Donald Trump issued a presidential proclamation on Tuesday, leading to the removal of these products from the privilege beginning November 1. These products “will no longer qualify for duty-free preferences under the GSP programme but may continue to be imported subject to regular Most Favored Nation duty-rates,” an official of US Trade Representative (USTR) said.

A review of the products indicates that the presidential proclamation is not country specific, but product specific. With India being the largest beneficiary of the GSP, it has been hit the most by the latest decision of the Trump administration.

The GSP, the largest and oldest US trade preference programme, is designed to promote economic development by allowing duty-free entry for thousands of products from designated beneficiary countries.

A count of these products indicated that at least 50 of them are from India. Notably, India is the largest beneficiary of the GSP. In 2017, India’s duty-free export to the US under the GSP was over $5.6 billion.

The volume of India’s export to the US impacted by the latest move of the Trump administration is not known yet, but the list of products from which duty-free import provision has been removed reflects that a large number of small and medium size business could be impacted, in particular handloom and agricultural sector.

In his presidential proclamation, Trump said that certain ‘de minimis’ waivers will no longer be granted for any product, regardless of the country source, that exceeds the GSP’s Competitive Need Limitation (CNL) thresholds. The CNL thresholds are quantitative ceilings on GSP benefits for each product and designated beneficiary country.

2019: GSP withdrawal

The US decision to withdraw duty benefits on Indian products under the Generalized System of Preferences (GSP) programme will not have a significant impact on exports to America, a top government official said.

India exports goods worth $5.6 billion under the GSP, and the duty benefit is only $190 million annually, commerce secretary Anup Wadhawan said.

India mainly exports raw materials and intermediate goods such as organic chemicals to the US, he said. The response comes after the US government said it intends to end the preferential trade status granted to India

"GSP withdrawal will not have a significant impact on India's exports to the US," the secretary told reporters here.

The US demand for relaxation in norms for exports of medical devices and dairy products are non-negotiable to India.

US President Donald Trump has said he intends to end the preferential trade status granted to India and Turkey, asserting that New Delhi has failed to assure America of "equitable and reasonable" access to its markets, an announcement that could be seen as a major setback to bilateral trade ties.

The US Trade Representative's Office has said that removing India from the GSP programme would not take effect for at least 60 days after notifications to Congress and the Indian government, and it will be enacted by a presidential proclamation.

As many as 1,900 Indian products from sectors such as chemicals and engineering get duty free access to the US market under the GSP, introduced in 1976.

Details

The Balakot drama drowned discussion of an important event at the time — the US gave notice to withdraw zero-duty entry for Indian exports under its Generalized Scheme of Preferences (GSP). The US said Indian protectionism was unfairly hurting US exports. Lengthy bilateral negotiations failed to avert this setback, which will hit $5.7 billion of Indian exports covering 5,111 tariff lines. This sad outcome reflects faulty priorities and inflexibility in India’s economic diplomacy, with losses far exceeding gains.

The commerce ministry tried to put a brave face on it by saying that US tariffs that will now be imposed are low, often below 4%, so the loss of preferences will amount to only $190 million. This grossly understates the problem. Many Indian labour-intensive exports are sold at very thin margins of 2% or less, so even small duties can render uncompetitive billions of dollars’ worth of Indian exports. Competitors like Bangladesh, Vietnam and Cambodia continue to get duty-free treatment from the US, and so will gain at India’s expense.

History shows that no country has become a miracle economy — defined as achieving 7% GDP growth for over a decade — without buoyant exports. Domestic demand alone is not enough to create a miracle economy — the harnessing of global demand is vital. India enjoyed fastgrowing exports and fast-growing GDP from 2003 to 2014. After that exports fell and stagnated, and have finally recovered past the 2013-14 level only in 2018-19. Despite stagnant exports, India probably achieved 7% growth in the Modi years (the data is disputed). But such exceptional performance cannot last, and exports must be given top priority if India is to remain a miracle economy.

This economic backdrop should have guided India’s economic diplomacy on GSP but did not. India remains instinctively protectionist despite declarations by Donald Trump that he will insist on much more reciprocity in trade. WTO rules provide ‘special and differential treatment’ for poor countries, as a form of aid. So, poor countries can erect some trade barriers even as developed ones lower theirs.

Such concessions were seen as appropriate when the West dominated the world economy. But since the 1990s, and especially since the rise of China, the US and EU view many developing countries as threats to be combated, not poor countries to be aided. Reciprocity is being demanded instead of “special and differential treatment.”

This is most evident in the case of China. But India too is being asked to change. India now claims to be the third largest economy in the world, and a member of the G-20. Such a country needs to open up substantially, not demand concessions that looked reasonable when India was dirt poor.

India is the largest user of anti-dumping suits in WTO to thwart imports. Under Modi, import duties have been raised on agricultural goods, textiles, electronic components, solar panels and “simple” manufactures like candles and clocks. The Modi government has also used price controls extensively in agriculture and medicines, affecting many foreign suppliers. Modi boasts of reducing medical and agricultural costs through price controls, but needs to realise that this opens India to retaliation. GSP withdrawal by the US illustrates this graphically.

In bilateral GSP talks, US demands were modest. India had prohibited the import of dairy products from the US, saying this would hurt Hindu sentiment since many US farmers mixed animal parts in their cattle feed. This looked a protectionist ruse: no Hindu agitations have occurred on this count. India also imposed price controls on medical stents used for heart conditions, and on devices like knee implants.

Good diplomacy would have found compromises to settle these complaints. India could have offered to allow the import of limited dairy products pending a scheme for certifying US cattle that were not fed animal parts. India could have lifted price control on high-end stents (the bio-absorbable and drug-eluting varieties) in which the US specialises, and which are used only by India’s rich, while continuing with price controls for lower-tech stents used by the masses.

But the Modi government would not budge an inch. Nor did it budge on issues like India’s import duty on solar panels, which the US has now taken to the WTO for adjudication. Donald Trump complains repeatedly and bitterly about India’s high import duty on giant Harley-Davidson mobikes. Slashing this duty would be a very low-cost gesture to mollify the US: no Indian company makes these giant bikes, and demand is less than 100 bikes per year.

Alas, Indian rigidity continued even when the US made it clear that the consequence could be a withdrawal of GSP. The rest is history.

US to scrap sops on $5.6bn Indian exports

Chidanand Rajghatta, March 6, 2019: The Times of India

President Donald Trump notified the US Congress that he intended to terminate preferential trade terms to India in 60 days, apparently dissatisfied with concessions by New Delhi in response to efforts to force open the Indian market.

India offered to open its agriculture, milk and poultry

markets in response to US warning it would terminate Generalised System of Preferences — under which $5.6 billion of Indian exports to US enjoy zero tariffs — due to lack of reciprocal market access. However, Trump told US lawmakers India “has not assured US it will provide equitable and reasonable access” to its markets and he intends to nix the preferential treatment that India has enjoyed.

Key dispute: Price cap on stents, knee implants

The Indian government reacted cautiously, saying it had sought to address the Donald Trump administration’s concerns. “The (US) department of commerce engaged with various government of India departments concerned with these issues, and India was able to offer a very meaningful way forward on almost all the US requests. In a few instances, specific US requests were not found reasonable and doable at this time by the departments concerned, in light of public welfare concerns reflective of India’s developing country status and its national interest,” it said. It added that higher import of American goods, including oil and natural gas and coal, had helped pare the US trade deficit with India during 2017 and 2018.

At the heart of the dispute is the US insistence that India should remove the price cap on knee implants and stents — which New Delhi now regulates as “essential medicine” but which is a money-spinner for western companies. India declined, saying it had commitments to make such medical devices affordable to Indian patients, but agreed to open up the Indian market for a wide variety of US farm produce – from cherries to chicken to milk products, which New Delhi had long resisted because of reservations over US farm practices.

On the US side, there were concerns about India’s e-commerce and data localisation policies which New Delhi looks at as sovereign issues but Washington sees as putting a crimp on US companies.

In the end Trump rejected the Indian offer as inadequate, surprising New Delhi, which saw him as a dealmaker who would appreciate the openings in the Indian agricultural market that would give him bragging rights in Middle American farm country.

India is the world’s largest beneficiary of the GSP, with nearly 2000 of its products worth $5.6 billion, approximately 12% of its exports to the US, eligible for zero-tariff export. The products include motor vehicle parts,

jewellery, handicrafts, carpets, marine produce and a range of raw materials such as granite (the Vietnam Memorial is built from granite imported from India).

But Indian officials maintain the GSP withdrawal will not be a crushing blow; exports will continue, except they will be subject to tariffs. The reckoning is that some day in the near future India would have had to grow out of the GSP regime (as China has done), which was devised on the 1970s to help developing world countries, and that day might as well be now.

"The trade package is now no longer in discussion. But if the US is willing to review the review, we are open for discussion," said an Indian official.

In fact, Trump despatched a separate letter to lawmakers at the same time as the India letter withdrawing GSP facility to Turkey, with the reasoning that it had reached an economic status that no longer merited preferential concessions.

Although Trump told US lawmakers in his letter that he would “continue to assess whether the Government of India is providing equitable and reasonable access to its markets,” and the withdrawal will kick in only after 60 days through a presidential proclamation, there is little chance of any deal being salvaged in the two month window.

That’s mainly because India’s election code of conduct will kick in soon and the government will be hamstrung for the next two months in offering any more concessions.

Besides, New Delhi appears to have calculated that the tariff concession loss, estimated by commerce ministry officials at between $200 million and $250 million, is not something to lose sleep over. “We just have to take it on the chin and move on,” one official who spoke on background said.

On the geo-political front through, there is some surprise that Trump has put a hex on the so-called strategic ties with India by talking up trade issues with relatively modest financial outcomes – chump change in fact.

The Harley-Davison tariff issue that he raked up several times over the past year is worth a laughably small amount of money. But he made it symbolic of the trade fight he has picked up across the world.

India to impose retaliatory tariff of $235 million on 29 American goods

Sidhartha, No action plan ready against US trade move, March 6, 2019: The Times of India

From: Sidhartha, No action plan ready against US trade move, March 6, 2019: The Times of India

Govt Caught Off-Guard, Ignored Warnings, Hoped To Clinch Deal Through Dialogue

For close to a year, India has been threatening to impose retaliatory tariff of $235 million on 29 American goods to counter the Donald Trump administration’s decision to raise import duty on steel and aluminium goods. But nine months after the plan was announced, the government is still dilly-dallying on countering US government’s assault against Indian exports and visas, even as the American authorities near a deal with China.

The deadline to impose duties on products, ranging from almonds to lentils, has been postponed half-adozen times, with April being the latest cut-off. All these months, the Narendra Modi government had hoped that Trump would go easy and a deal could be reached through a dialogue at the commerce minister level. What the Indian authorities kept ignoring was the US government’s repeated attacks on its policies — ranging from export promotion schemes and farm subsidy to import duties — as well as disputes at WTO.

“We have little choice but to keep our channels of engagement open,” an official told TOI. Several officials suggested that the coming months could see US pressure intensify as Trump readies for reelection, especially on the demand to lower import duties.

What has compounded the problem for the bureaucracy is the lack of a clear strategy to tackle trade issues and a muted response from the political leadership, which seems oblivious to the challenges being faced by exporters — from refund of GST to devising new strategies to tackle the export slowdown. In fact, there have been suggestions from some key functionaries that India should contemplate a trade agreement with the US, a proposal that has been trashed, at least for the moment.

The confusion was on display on Tuesday too as officials from the commerce department, who are usually reluctant to consult the ministry of external affairs on trade issues, opted to get the official response vetted by the foreign office. Government functionaries seemed to suggest that the withdrawal of benefits under the generalised system of preferences would not make a significant dent to India’s exports to the US. Commerce secretary Anup Wadhawan, who has been dealing with US negotiators for the last few years, suggested the hit could be as low as $190 million.

In private, officials admitted, they could do little to counter the “unilateral move” by the US. “In any case a country like India should not be seeking it, if we have ambitions to be on the global high table,” said an officer. But clearly, that was not the case during the meetings with US authorities.

Unlike China, which is America’s biggest trade partner, India is still a fringe player. In 2018, China’s bilateral trade with the US was estimated at $635 billion, compared to India-US trade of under $75 billion in 2017-18. But any action against India is seen to be providing political muscle to Trump. The current Indian government does not have a plan to counter the US offensive, with its proposals for truce rebuffed by the Americans, officials acknowledged.

In a statement, the commerce department detailed how it sought to address Trump administration’s concerns, including on issues such as pricing of stents, which the Modi administration has sought to sell as an initiative to make medicines and medical devices more affordable for the common man.

But there were issues on which there was little manoeuvring space. For instance, the demand for a tariff reduction on several products was seen to be benefiting the Chinese more than the Americans.

Trump stops special duty benefits for Indian goods

Chidanand Rajghatta, June 2, 2019: The Times of India

From: Chidanand Rajghatta, June 2, 2019: The Times of India

From: Chidanand Rajghatta, June 2, 2019: The Times of India

Trump stops special duty benefits for Indian goods

Unfortunate, Says India In Guarded Reply

Washington:

After mounting pressure on what it termed India’s restrictive trade policy, the White House announced on Friday that it was terminating the country’s special market access to the United States under the generalised system of preferences (GSP) programme on June 5. “I have determined that India has not assured the United States that India will provide equitable and reasonable access to its markets,” Trump said in a statement on Friday. In an otherwise guarded response, the Indian government said that it had sought to resolve some of the trade irritants but it was “unfortunate” that they were not accepted by the US.

“In any relationship, in particular in the area of economic ties, there are ongoing issues which get resolved mutually from time to time. We view this issue as a part of this regular process and will continue to build on our strong ties with the US, both economic and people-to-people. We are confident that the two nations will continue to work together intensively for further growing these ties in a mutually beneficial manner,” the commerce department said in a statement. Exporters, however, said that the impact of the action may not be significant.

Under GSP, India accounted for 25% of goods with duty-free access to US

Out of $6.35 billion exports under the generalised system of preferences (GSP) scheme, net benefit was only to the tune of $260 million... thus at macro level the impact of GSP withdrawal on our exports to the US would be minimal.

However, in respect of products having GSP benefits of 3% or more, exporters may find it difficult to absorb the GSP loss,” said Federation of Indian Export Organisations (FIEO) president Ganesh Kumar Gupta, adding that it may give an edge to Chinese goods.

The Trump administration has mounted a series of attacks on India’s trade policies and the government has failed to initiate retaliatory action, although it has been threatening to do so.

Conceived by Washington in 1974 to help 120 developing countries and territories advance their economy and markets, the GSP regime saw India become one of the biggest beneficiaries, most recently accounting for nearly a quarter of the goods that got duty-free access to the US.

That concession is now over as President Trump bears down on what he believes are American handouts to countries that are now trending towards middle-income or developed status, with some of them being “ungrateful” to boot.

Trump has complained repeatedly that India is a “very very high tariff nation”, highlighting in particular New Delhi’s taxes against high-end Harley-Davidson motorcycles (even after the taxes were cut in half), even though the amount involved is paltry in the overall scheme of things.

Washington and New Delhi have been scrapping over trade for several years now, but whereas previous administrations pressed their case with a combination of international litigation (mainly before the World Trade Organisation) and bilateral, behind-the-scenes coaxing and cajoling, Trump has adopted a more hardball, take-no-prisoners approach.

In fact, the US president announced imposition of graduated tariffs on neighbouring Mexico — overriding the arguments of his own advisers, including his son-in-law Jared Kushner — because of what he said is Mexico’s unhelpful attitude in stanching the flow of illegal migrants across the southern borders.

While the sums involved in the US-India spat are relatively modest (the US trade deficit with India is less than $25 billion compared to the $420 billion with China and even the $75 billion with Mexico), the GSP withdrawal casts a shadow over what are widely touted as strategic ties aimed at countering China. The question being asked in Indian circles is: Why treat India on par with China and punish it on trade issues when the disparity is so great, and the US ostensibly wants to support India’s rise as a counterweight to China?

President Trump though forgoes all such strategic visions and diplomatic niceties as he holds up trade as the principle issue before his base to claim the US has been short-changed and indeed sold short by previous administrations, while pressing countries such as China and India to import more US produce and buy more American goods. In recent years, India has been forced to open its markets to California almonds, Washington apples, and chicken legs from Middle America, but in the Trump view, all that is still chicken feed: India has to buy more to bridge the nearly $25 billion in trade deficit.

2019/ US takes India to WTO for duty hike

July 5, 2019: The Times of India

The US dragged India to the World Trade Organization (WTO) by filing a complaint against New Delhi’s move to increase customs duties on 28 American goods, alleging this is inconsistent with global trade norms.

According to a communication of the Geneva-based WTO, the US said that the additional duties imposed by India “appears to nullify or impair the benefits accruing to the US directly or indirectly” under the General Agreement on Tariffs and Trade (GATT) 1994.

GATT is a WTO pact, signed by all member countries of the multi-lateral body, aimed at promoting trade by reducing or eliminating barriers like customs duties. The US has alleged that the duties imposed by India appears to be inconsistent with two norms of GATT.

The US has stated that India does not impose these duties on like products originating in the territory of any other WTO member nation. “India also appears to be applying rates of duty to US imports greater than the rates of duty set out in India’s schedule of concessions,” the communication said.

The duties are inconsistent because “India fails to extend to products of the US an advantage, favour, privilege or immunity granted by India with respect to customs duties and charges of any kind imposed on or in connection with the importation of products originating in the territory of other members...,” the US has alleged. As part of the dispute, the US has sought consultations with India under the aegis of the WTO’s dispute settlement mechanism. “We look forward to receiving your reply and to fixing a mutually convenient date to hold consultations,” it said. AGENCIES

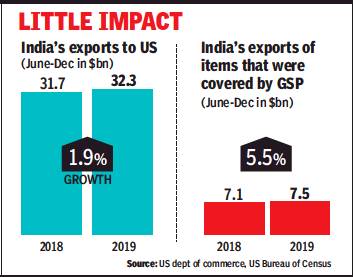

India’s exports to the USA

2018, 2019

India’s exports of items that were covered by GSP (June-Dec in $bn)- 2018-19

From: Sop withdrawal by US may not hit exports hard, February 19, 2020: The Times of India

See graphic:

India's exports to US (June-Dec in $ bn): 2018-19;

India’s exports of items that were covered by GSP (June-Dec in $bn)- 2018-19

2021-2025: General exports, engineering exports

Engineering exports, presumably 2024

From: Sidhartha, May 21, 2025: The Times of India

See graphic:

India’s exports to the USA: General exports, 2021-2025

Engineering exports, presumably 2024

Sector-wise

2024-25

From: August 14, 2025: The Times of India

See graphic:

Indian exports to the USA, Sector-wise: 2024-25

Tariffs

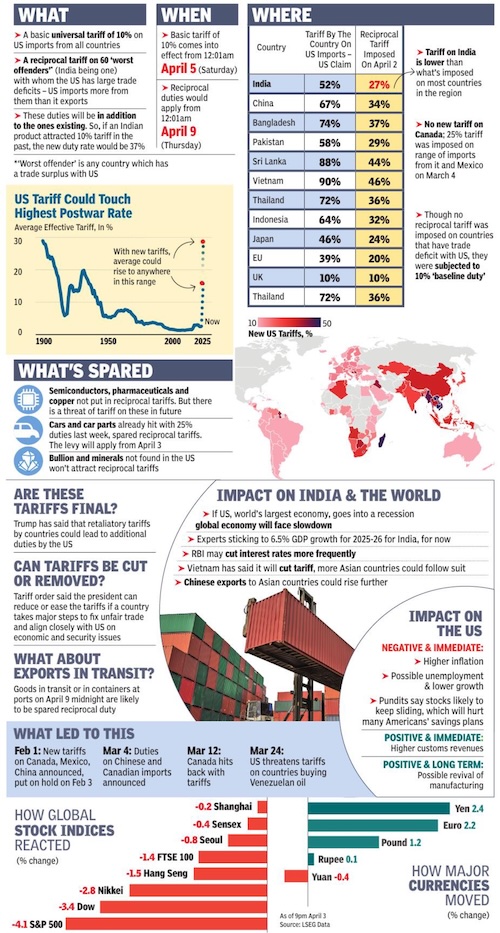

2025 April

Chidanand Rajghatta & Sidhartha, April 4, 2025: The Times of India

From: Chidanand Rajghatta & Sidhartha, April 4, 2025: The Times of India

At a White House Rose Garden event on what he called “Liberation Day” for the US, India became a middling victim in Trump’s take-no-prisoner approach that treated friend and foe alike with a two-tier tariff: a baseline tax of 10% on all countries that will go into effect on April 5, and additional tariffs on some countries that he considers to be the “worst offenders”, which will be imposed on April 9.

India, described by Trump as the ‘tariff king’, makes the US President’s ‘worst offender’ checklist because, by his calculation, New Delhi taxes US imports to the tune of 52%, a dubious figure arrived at by adding perceived non-monetary, nontariff barriers, ‘currency manipulation’ etc. China was assessed at 67%, Taiwan at 64%, and South Korea at 50%. But out of the ‘kindness of his heart’ he would impose not a ‘commonsense reciprocal tariff’ but give a 50% ‘discount,’ Trump said, thus making it 27% tariff on imports from India.

“For decades, our country has been looted, pillaged, raped and plundered by nations near and far – both friend and foe alike. Foreign cheaters have ransacked our factories, and foreign scavengers have torn apart our once beautiful American dream,” the president of the richest country on earth raged in remarks that were borderline offensive and distasteful.

Financial markets plunged in response. Some $2tn of market value was wiped out in S&P 500 stocks alone as the index fell 4%, its worst day since Sept 2022. The dollar experienced its largest single-day decline on record, dropping 2.1% against major currencies.

The ripple effect of Trump’s sweeping tariffs will reshape global trade flows, disrupt supply chains, and test longstanding diplomatic alliances. As countries scramble to respond, the economic and geopolitical fallout is likely to be deep and enduring.

INDIA’S REACTION: The govt said it would seek to “expeditiously” clinch a “mutually beneficial” bilateral trade deal with the US and reiterated its commitment to strong strategic relations.

Sources said the commerce department is consulting export councils and ministries to gauge the fallout and explore support for affected businesses.

With PM Modi and Trump agreeing to a bilateral trade agreement later this year, India and the US have finalised the broad contours of detailed discussions with technical negotiations expected to be launched this month. This, sources said, gave India a lead over others who will now begin an engagement with the US to seek tariff cuts. “India was an early mover and over the last 50 days a lot of work has been done. The idea is to settle all outstanding bilateral trade issues,” an official said. The assessment is that the Trump administration too is keen to engage and a deal can be crafted by lowering a few duties in India.

Here’s a quick look at what the tariffs mean, who’s hit hardest, and why India may feel mildly relieved – for now.

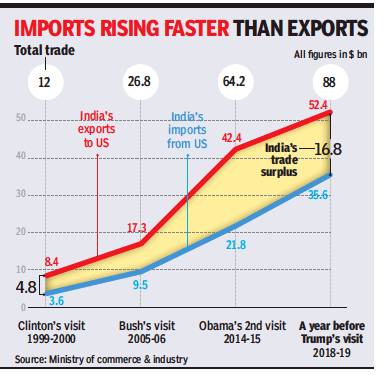

US exports to, imports from India

1999-2019

From: Sidhartha, February 23, 2020: The Times of India

See graphic:

US- India trade, exports and imports, 1999-2019

2000-15: growth, and issues

Payal Bhattacharya, India-US trade deal: The story so far, February 20, 2020: The Times of India

From: Payal Bhattacharya, India-US trade deal: The story so far, February 20, 2020: The Times of India

Growth of India-US trade

The US remains India's top trading partner in terms of goods and services, followed by China. Goods dominate the bilateral trade between the US and India -- approximately 62 per cent while it is 38 per cent in services.

According to the US-India Strategic and Partnership Forum (USISPF) report, the overall growth rate in cumulative bilateral trade for the first three quarters of 2019 (January-September) was down to 4.5 per cent from 8.4 per cent registered for the first two quarters.

In the third quarter, goods and services trade fell to -2.3 per cent as against an impressive growth of 9.6 per cent witnessed for the first two quarters of the year.

First three quarters of 2019 saw US export $45.3 billion worth of goods and services to India, up 4 per cent from the corresponding period last year. On the other hand, it imported $65.6 billion worth of goods and services from India, up 5 per cent from the previous year's $62.5 billion level.

The report projected that total bilateral trade may touch $238 billion by 2025 if the current 7.5 per cent average annual rate of growth sustains. However, higher growth rates can result in bilateral trade in the range of $283 billion and $327 billion.

Generalised system of preferences (GSP)

India was the largest beneficiary of the US GSP as it provided duty-free access to $5.6 billion worth of products exported to the US. However, the US accused India of preventing equitable and reasonable access for Americans to its markets.

Consequently, India's special trade designation that dated back to the 1970s was suspended, after Modi put price caps on medical devices like cardiac stents and knee implants. He also introduced new data localisation requirements and imposed restrictions on e-commerce.

In return, India imposed retaliatory tariffs on several American imports, including almonds, pulses, walnut and fresh apples.

Trump's visit has raised hopes that some of India's trade preferences will be restored, in exchange for reduction in tariffs and other concessions.

The Davidson story

Trump has time and again complained about high import tariffs levied by India on American motorcycles. Even as India slashed customs duty on imported motorcycles from high-end brands such as Harley Davidson to 50 per cent from 100 per cent earlier, Trump said it was too high and unacceptable.

High duties on large engine motorcycles raised their prices and made it too expensive for consumers in India. To make the bikes more affordable, an assembly plant was built in India. However, the brand has not yet been able to capture a majority portion of the Indian market.

Steel and aluminium

India is a major exporter of steel and aluminium from the United States. In March 2018, America imposed 25 per cent import duty on steel and 10 per cent on aluminium products. The move had revenue implications of about $240 million on Indian steel and aluminium products.

India had also dragged the US to the World Trade Organisation's (WTO's) dispute settlement mechanism over the imposition of import duties on steel and aluminium.

Farm and dairy market

India imposed higher import duties on 29 US products, including almonds, walnut and pulses in retaliation to US significantly hiking duties on certain steel and aluminium products.

While import duty on walnut was hiked to 120 per cent from 30 per cent, that on chickpeas, Bengal gram (chana) and masur dal was raised to 70 per cent, from 30 per cent.

Traditionally, India has always been protective of its dairy imports and imposed restrictions to protect the livelihoods of 80 million rural households involved in the industry.

However, it has offered to allow imports of US chicken legs, turkey and produce such as blueberries and cherries. It has also offered to cut tariffs on chicken legs from 100 per cent to 25 per cent. But, US negotiators want that tariff to be reduced to 10 per cent.

According to sources, the government has also offered to allow some access to its dairy market, but with 5 per cent tariff and quotas. However, a certificate would be needed stating that products have not been derived from animals that have consumed feeds that include internal organs, blood meal or tissues of ruminants.

The US also wants India to buy at least another $5-6 billion worth of American goods.

Budget 2020-21

In Union Budget 2020-21, finance minister Nirmala Sitharaman announced higher tariffs on medical devices, toys, furniture and footwear and said the government will strengthen rules to allow for additional levies to be imposed when there is a significant surge in imports.

This further angered the US side as it faces tough competition with China in the Indian market in areas such as electronics, machinery, organic chemicals and medical devices.

Modi's protectionism?

Over the years, PM Modi has voiced his support for free trade in global forums but his report back home appears to be one of rising protectionism. From raising tariffs, to opting out of the world's biggest regional trade deal (Regional Comprehensive Economic Partnership, or RCEP) and modifying rules to ban the import of any goods that is deemed harmful to domestic industries - the government has done it all.

At first, government announced curbs on non-essential imports in 2018 to rein in the current account deficit and halt a rout in the rupee at a time when investors were dumping emerging market assets.

However, government officials have denied that the nation is becoming protectionist. "After the global financial crisis the trend towards globalisation has actually sort of reversed across the world," said Krishnamurthy Subramanian, the chief economic advisor of the government.

In his keynote speech at the World Economic Forum in Davos in January 2018, Modi called on fellow leaders to embrace more open trade. Over the years, he has taken steps to reduce barriers to foreign investment and ease business regulations in India as part of his goal to attain a $5 trillion economy.

However, with economic growth falling to over six-year low and pressure on domestic inudsties, the government is strengthening its barriers again.

Way ahead

What the two sides need now is a political level meeting between US trade representative Robert Lighthizer and commerce and industry minister of India Piyush Goyal to take a final call on the tariffs. The Indian side has full mandate from Prime Minister Narendra Modi to close the deal but, the US believes the Indian government -- with its tortuous inter-agency processes -- had dragged the processes unnecessarily.

With GDP (gross domestic product) falling to over six-year low of 4.5 per cent in July-September 2019 quarter and exports contracting for the fifth straight month in January 2020, a trade deal with US could mean a big boost for the Indian economy. Exports have been under pressure for a long time due to slowdown in key markets. Experts have called for measures to accelerate shipments of goods from the country.

Rising domestic inflation has brought additional pressure and is affecting our global competitive strength.

2009-24

See graphic:

Exports to and imports from the USA to India, 2009-24

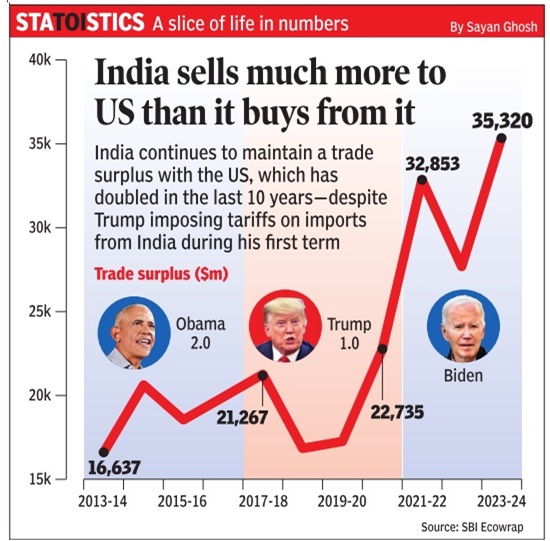

2013-24

From: Nov 13, 2024: The Times of India

See graphic:

India’s trade surplus with the USA, 2013-24

Trade deficit in 2017>18

Govt looks to address trade concerns of US, March 8, 2019: The Times of India

From: Govt looks to address trade concerns of US, March 8, 2019: The Times of India

Sources said while the duty was to be retained at 20%, the total payout was to be capped at around Rs 10,000.

The government has already said it had made it clear that pricing regime for stents and knee implants would be reviewed with a trade margin approach, instead of the current price cap. Similarly, it had moved on several other fronts to ease import rules for cherries and pork, but the US went ahead and decided to issue the notice.

While a response to the US is expected over the next few weeks, the government is keen to avoid any “knee-jerk reaction”. India was the largest beneficiary of the US GSP programme, with exports to the tune of $5.7 billion under the scheme. The government has, however, maintained that the impact will be limited to $190 million.

Sources said there is already sufficient market access for American products, with nearly 80% of the market for stents and implants controlled by US companies. In recent years, there has been a spurt in American exports to India, which shot up 29% to $33 billion in 2018, latest data showed. In fact, India is among a few countries with which US has narrowed its trade deficit.

Many believe that Trump’s move was not reasonable, especially when American companies — from Amazon and Uber to ATC and PepsiCo — were market leaders in India. The pressure on India is seen to be part of Trump’s overall pitch to restrict imports and promote local manufacturing, a strategy that does not seemed to have shown results, at least in trade numbers.

2024

From: Nov 7, 2024: The Times of India

See graphic:

Exports to and imports from the USA to India, 2024

As of 2025 March

US share in India’s major export items (%)

(Source: Ministry of Trade & Commerce, HDFC Bank – Data as of April 24, 2025)

Pharma – 37.8%

Gems & jewellery – 32.7%

Electrical & electronics – 29.7%

Textiles & apparel – 29%

Nuclear reactors & machinery – 20.1%

Iron & steel – 18.2%

Chemicals & chemical products – 13.1%

The US view of India’s trade policies

As in 2019

US slams India on data protection, April 9, 2019: The Times of India

From: US slams India on data protection, April 9, 2019: The Times of India

The US Trade Representative (USTR) has slammed the government’s draft e-commerce policy and attempts to mandate data localisation, while noting that there is enormous scope for India to reduce import duties, which have gone up in recent years. In its annual publication, USTR has also suggested that the government should not engage in “unjustified retaliation” by raising import duties on 29 products in response to the Trump administration’s decision to hike levies on steel and aluminium.

“The US has urged India to work to address the common problem of excess capacity in the global steel and aluminium sectors, rather than engage in unjustified retaliation, designed to punish American workers and companies. The US will take all necessary action to protect interests in the face of such retaliation,” the latest National Trade Estimate Report said.

After threatening to levy higher tariffs, the government has repeatedly postponed the retaliatory action, hoping that the issue can be sorted out via negotiations.

The USTR report is critical of some of the recent moves on data protection. “An only-in-India data storage requirement will hamper the ability of service suppliers to detect fraud and ensure the security of their networks... These data localisation provisions (in the draft Data Protection Bill) would damage the digital economy without supporting privacy. Additionally, the bill would authorise immense fines and criminal penalties in response to data breaches,” USTR said in the report.

Additionally, it has said the “discriminatory and trade-distortive” aspects of the draft e-commerce policy need to be reviewed, including broad-based data localisation and restriction on crossborder data flows. The criticism comes along with the recently-introduced changes to the marketplace model.

A large part of the section dealing with India in the annual publication that looks at trade and other policies across the globe, is related to India’s import tariff regime. “India’s average Most Favoured Nation (MFN) applied tariff rate of 13.8% remains the highest of any major world economy,” it said, adding that the Narendra Modi government’s ‘Make in India’ initiative has resulted in a higher customs tariff on labour-intensive and electronic goods.

It pointed out that India had agreed to maintain average tariffs of 48.5% at WTO, while the actual applied rate was much lower. “Given this large disparity between WTO-bound and applied rates, India has considerable flexibility to change tariff rates at any time, creating tremendous uncertainty for US exporters,” it argued.

Apart from trade skirmishes involving India’s export promotion schemes and farm subsidies, the US has also pointed to the tariffs applied by the government.

B

SECTORS

Garments

Indian exports, 2014-2024

Ashni Dhaor, May 14, 2025: The Times of India

From: Ashni Dhaor, May 14, 2025: The Times of India

Festive season is some distance away. But Pooja’s thoughts have moved to her savings kitty. The 27-year-old has plans — leftovers from last year, plus new ones — and this is an important time to make them happen. April and May are the tail end of peak export season that begins in Sept. But this year, it doesn’t feel like it.

“There has been no overtime for several weeks,” says Pooja, briefly pausing at her stitching station. These stretch end to end in parallel lines at garment exporter Sonu Exim’s cavernous second floor workshop in the industrial zone in Noida’s Sector 83. She’s part of the highly skilled section of the garment factory, which employs 1,500 workers in different functions across five floors. The first floor is for cutting fabric, third for finishing touches like fixing loose threads or sequins, fourth for quality checks, and fifth for chemical treatment to soften the fabric and ‘lock’ the colour. Packing, the final step, is a separate section where garments are ironed, folded, tagged and placed into cartons for shipping.

On the second, Pooja and her colleagues operate an orchestra of sewing machines that is just finishing up with brown shimmer-sequined tops for an American buyer. Not a thread should be out of place in the export-quality tops, so the stitchers work with meditative focus. The whirr of machines blocks out all other noise, keeps them in the zone. “It’s for one of our regular buyers,” a supervisor says. “We’re finishing one of the last batches of last season’s orders.”

In a normal year, work days in April would stretch till 9pm and bring in extra cash from overtime. “But this month and in March, we’ve been wrapping up by the usual 6.30pm,” says Pooja.

Threat Of A US Slowdown

For the textile clusters of Gautam Budh Nagar — one of India’s top exporters of readymade garments — the “something amiss” factor has been building up with US President Donald Trump’s constant rattling of the tariff sabre. US was the top destination of India’s textile exports in FY24, accounting for 28% of the trade. The Gautam Budh Nagar hub itself houses more than 4,000 units that make clothes for brands like GAP, Ralph Lauren, Zara, Mango, to name a few. Women’s clothing makes up the bulk of readymade exports to the US from here as well as units in Gurgaon and Faridabad. Menswear is majorly manufactured in units in the south, like Tamil Nadu’s Tiruppur.

A baseline tariff of 10% came into effect on April 5 and the possibility of an additional 26% — announced by Trump but put on hold for 90 days — looms. But what export unit owners fear will hit them before tariffs do is weakening buying sentiment in the US. They have been warily reading forecasts of America going into a recession under Trump 2.0. Workers, too, speak of “mandi” (slowdown) in America. “If that happens, it’s a scary thought for us because our jobs will get directly affected. I don’t understand tariffs, but I hope our jobs and incomes remain safe,” says Rajeev, who works in the finishing department of an exporter.

The health of the US economy is linked to the well-being of thousands of families. “I learnt some stitching from my father but this is my first job in a professional setup. I took up the job to increase my family’s income,” says 22-year-old Heeba. She has recently moved to Noida from Aligarh and began working at a loungewear exporting unit in Sector 6, making Rs 12,000 per month.

Mahesh Pal (48) is on the other end of the spectrum, stitching garments for two decades. “This is the only work I have ever done,” says Pal, who is from UP’s Mahoba. “I never got formal training, just learnt on the job,” he says.

Trump Actions Present An Opening

The churn triggered by ‘Trumponomics’ hasn’t lashed Indian shores yet. But ripples, if minor, are nonetheless visible. “Buyers are asking for a 5% discount, essentially to share the burden of the 10% tariff,” says Nikhil Thukral of Twenty Second Miles, a Noida-based apparel firm that exports garments worth Rs 3040 crore annually to the US, Europe and Dubai. “Most exporters have agreed to this to maintain long-term relationships with buyers. But new orders have slowed down. It’s a wait-and-watch situation. We hope the US reduces tariffs on India after the 90-day pause,” he adds.

The other headwind is the rise in freight costs as a fallout of the US-China trade war. “Because of the uncertainty around tariffs, freight rates have gone up by 10%. Containers were stuck in Chinese ports (because of uncertainty around port fees the US intends to charge Chinese vessels),” says an exporter. “This has hit delivery timelines. But the ships have begun moving and the backlog is slowly clearing up.”

But the turbulence is not without a hint of opportunity. While China, the world’s largest textile exporter, is locked in a tariff battle with the US, the other big textile-exporting countries — like Vietnam (46%) and Bangladesh (37%) — have much higher tariffs than India. Indian exporters are also hopeful that Delhi and Washington will thrash out a trade deal. US vice president JD Vance said earlier this month that “good negotiations” were under way with India.

Counting On ‘China Plus One’

Besides, India will continue to benefit from the ‘China plus one’ model as companies look to diversify their supply chains (evident in the huge expansion of Apple’s iPhone manufacturing in Tamil Nadu). “Global companies have been working on this model for two to three years. Irrespective of the outcome of tariffs, India will gain traction as a base for manufacturing due to the availability of cheap labour,” says Arvind Rai of Modelama Export Pvt Ltd, which manufactures and exports woven garments, outerwear, tops, dresses, kids’ wear, men’s shirts, etc. “(Political) trouble in Bangladesh had a positive impact on India’s apparel and textile industry. Our orders increased by 10-20% across the board and is likely to sustain,” he adds.

What most Indian exporters don’t have, however, is the ability to scale up to prepare for a scenario where even 5% of orders from China are diverted here. Anuj Goel of Sonu Exim, which runs three factories in Noida and exports Rs 250 crore worth of apparel annually to the US and Europe, says, “We already struggle to complete orders in peak season. Supply of raw materials from Surat, Salem, Bhiwandi and Ludhiana can’t keep up. Unless the supply chain scales up, we can’t handle additional demand.”

In fact, India would have to depend on supplies from China, which accounts for 62% of our total fabric import. Anurag Kapoor of RADNIK, an export firm, agrees that scaling up is a challenge, but says it’s doable. “If our buyers give a fiveyear commitment, we’re ready to scale up,” he says, citing Bangladesh’s example after the 2023 mass arrests of opposition workers that led to a period of turmoil. “When political instability erupted in Bangladesh, Indian exporters began scaling up production as one of our biggest competitors was facing economic turmoil. But as Bangladesh’s economy became stable again, our expansion projects had to be abandoned. So, we need a guarantee from buyers,” he explains.

Many of the American clients are catalogue buyers, wholesalers who sample stores for retailers to choose from.

Lean Season To Re-strategise?

Roshan Baid of Paragon Textiles, which exports primarily to the US, says the current lean season is a good time to prepare. “We are already past the peak and summer collections have been sent out. If there is a confirmed increase in orders, we’re ready to expand. Many of us have planned units at the new Yamuna apparel park,” he says.

India exported $10.5 billion worth of textile and apparel products to the US in 2024, accounting for 28.5% of the country’s total textile exports. Of this, readymade garments accounted for $8.7 billion, the largest share. While India holds just 3.9% of the global apparel trade, it has steadily emerged as a preferred partner for US buyers in recent years.

To capitalise on the opportunity, exporters want better govt support through subsidies for MSMEs, investment in logistics, and faster raw material supply. “We have an abundant labour force, our wages are competitive, our govt is stable and our economy is strong. These are all to India’s advantage and it is also among the top cotton producers globally, so we can support a large garments industry. With govt support, it can grow much bigger,” says an exporter. With inputs from Bagish Jha

See also

India–United States Civil Nuclear Agreement

Quad (Australia, India, Japan, USA)

US- India economic relations

US Relations with Afghanistan & Pakistan

… and many more