Vishal Mega Mart

This is a collection of articles archived for the excellence of their content. |

2017/ Sale at Rs 1500 cr

Vishal Mega Mart was founded by Ram Chandra Agrawal in 2001 and it initially sold ready-made apparels.Over time, it diversified into non-apparels. Agarwal was credited with creating a value-retail chain in India. The company ran into financial trouble with lenders forcing a sale. At that time, Vishal Mega Mart operated 172 outlets in the country.

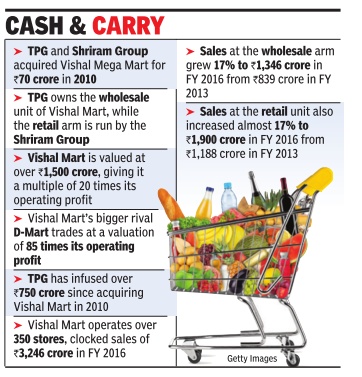

Storied American private equity investor TPG has kicked off a process to sell India's sixth-largest wholesale and retail chain, Vishal Mega Mart, in a deal that could value the company at over Rs 1,500 crore, a person directly aware of the matter said. TPG has appointed Kotak Mahindra Capital as a financial adviser to help in the sale of the asset it acquired seven years ago.

TPG owns the wholesale unit of Vishal Mega Mart, while the front-end stores are run by the Chennai-based Shriram Group. Vishal Mega Mart operates over 350 stores in the country and had clocked consolidated sales of Rs 3,000 crore in fiscal 2016.

The potential Vishal Mega Mart sale could be one of the rare cases of foreign investors looking to book a profit on a troubled Indian asset they acquired. TPG and Shriram Group had bought the distressed Vishal Mega Mart from SBI-led lenders for Rs 70 crore in 2010. The proposed sale move also follows the blockbuster stock market debut of Avenue Supermarts, the parent of another value retailer D-Mart.

Vishal Mega Mart has annual earnings before ebitda (a measurement of a company's operating profitability) of Rs 70 crore, another person with knowledge of the value retailer's financials said. TPG is expecting Vishal Mega Mart to be valued at about Rs 1,500 crore, giving it a multiple of 20 times its ebidta, the person added. Avenue Supermarts, currently, trades at a valuation of 85 times its fiscal 2017 ebidta. But Vishal Mega Mart, which has struggled on the profitability front, is unlikely to attract similar valuation multiples. “The Vishal Mega Mart deal could fetch between 20-25 times of ebitda putting it in a Rs 1,500-2,000crore valuation bracket,“ one of the people cited in the report said.

TPG declined to comment on the story.

The wholesale and retail segment in India has been witnessing consolidation as players look to ramp up scale and efficiency. Last week, Future Retail announced the buyout of HyperCity, a chain of 19 big-format stores, for Rs 655 crore, to increase its presence in the country. Some time ago, Radhakishan Damani, founder of D-Mart super markets, took control of Bombay Stores, a chain of department outlets.

Since TPG's acquisition of Vishal Mega Mart in 2010, the American firm has infused over Rs 750 crore to improve operations and strengthen balance sheet. As a result, the wholesale unit has pared losses significantly.Sales at the wholesale arm grew 17% to Rs 1,346 crore in fiscal 2016 from Rs 839 crore in fiscal 2013. Sales at the retail business also increased almost 17% to Rs 1,900 crore during the same period.