Wipro

This is a collection of articles archived for the excellence of their content. |

Contents |

Administrative structure

2020-21: Transformation under CEO Thierry Delaporte

Shilpa Phadnis & Sujit John, Oct 18, 2021: The Times of India

BENGALURU: Wipro was the top, or maybe the No. 2, revenue growth performer among the big four Indian IT services companies in the quarter ended September.

Acquisitions make these conclusions a little complicated, and companies are not often forthcoming about their organic growth numbers.

But, considering previous revenues of Wipro’s two major acquisitions this year – of Capco and Ampion – and considering Infosys also made acquisitions over the past year, it is safe to say that both these companies had dollar revenue organic growth rates of 19-20%. That’s much better than that of TCS and HCL Technologies.

It’s a remarkable turnaround for Wipro under Thierry Delaporte, the former Capgemini executive who took over in July last year. After a decade or more of underperforming its peers, during which it saw Cognizant and HCL overtaking it in total revenue, the company seems to have found a direction.

The stock prices too reflect that – Wipro’s share in the past year has risen 107%, as against Infosys’s 52%, HCL’s 48%, and TCS’s 33%. In an interaction with TOI on his first visit to India since taking over, Delaporte said he de-complicated Wipro’s complex structure, reduced hierarchies, empowered employees, and transformed the culture from one of being order-takers to being problem-solvers.

Simpler structure

The structure, he said, was “so complicated that after two months, even I was unclear about how this would work, to the point where I felt I would not even try to understand how it works, because I’m going to break it anyway.”

There were seven sectors, broken down into 31 industries, and nine geographies. The sectors and geographies, Delaporte said, were disconnected from each other. There were, in addition, 12 business lines. What Delaporte found particularly difficult to understand was that there were “27 P&Ls (profit & loss units) reporting to me at my level.”

Every P&L tends to be a silo. “Every time you create a different P&L, you are adding walls in an organisation. People are spending more time negotiating with one another, fighting about who will pick up the cost and who will get the revenue credit, as opposed to working with the client,” he said.

Delaporte broke this entire structure down into just two global business lines, and four strategic market units (geographies), and in a manner that the business units and market units had to work with one another. He shrunk the P&Ls reporting to him from 27 to a mere 4.

All of these, he said, reduced the silos internally, so that “it is no longer an obstacle for employees to dedicate their time to their markets.”

Another practice that Delaporte could not fathom was the number of KPIs (key performance indicators) used to assess executives and employees.

“We had over 800 KPIs. Can you imagine how many people we need to just build those KPIs, and track them! I have simple KPIs. If you are not growing, you are not going to be in this organisation anyway. That’s a simple KPI. And there are some others. So, simplicity, over perfection. The more KPIs you have, the more precise you are, but it is not working that way in an organisation of 220,000 people,” he said. The restructuring also involved establishing a team that would focus only on constructing and contracting large deals worth several 100 million dollars.

“We were counting on our sales teams to sell big deals. That cannot work because if you don’t define specific themes and specific profiles for that, no one will take the risk of going after big deals,” Delaporte said. Large deals can take upto 18 months to close. A sales person whose performance is assessed based on monthly and yearly signings will prefer to go after small deals. Large deals require a very different mindset to shape, structure and negotiate them. “Now, not one single executive committee meeting starts with anything other than big deals. It’s driving an obsessive focus on deals,” Delaporte said.

Another element of the restructuring was to reduce the number of layers in the organisation. An important part of that was to bring account executives – those who have the primary responsibility for an ongoing business relationship with a client – closer to the CEO.

“Before the reorganisation, we had account executives 6-7 layers below the CEO. I remember some of my first meetings with clients. There would be 4-5 people (from Wipro) in the meeting and account executives were at the bottom. It’s very silly. Now, they are just three levels below. It means a lot to the level of speed and escalation. And it’s about empowerment,” Delaporte said.

Transforming employees

The other big transformation was around people. About 30% of his time, Delaporte said, was dedicated to building a great team. This focused on two issues – getting employees to work with each other, and getting them to work with customers to identify their pain points and suggest solutions instead of waiting for the customer to tell them what to do.

“We are not here to just sell what we have, that time is gone. Every company I talk to wants to know how to transform to better connect with their clients, open new markets, or be more efficient. So you need to come proactively with ideas, leveraging your expertise and technology,” he said.

Delaporte felt many in the leadership did not have the personality and mindset he was looking for. “We replaced a third of the top 300. You haven't heard any noise and bad press around it. I think we handled it very well,” he said.

The other element of this was a culture change movement, spearheaded by chairman Rishad Premji. “We had to mature the organisation so that people would be able to work together, to understand what it means to be One Wipro. We needed a culture of accountability, a focus on outcome as opposed to a focus on effort, which was very much the culture of Wipro before,” he said. Premji dedicated a lot of time on a programme they call “5 habits.” These five were around being respectful, being responsive, communication, trust, and showing stewardship.

“A lot of colleagues have told me they are now attracting talent they were struggling to attract in the past. It’s a recognition of the fact that we are a more confident and aggressive company,” Delaporte said.

It’s still too early to say whether Delaporte’s first-year success will sustain. If it does, it would be a case study in how a new CEO transformed a mammoth company of 2.2 lakh employees, sitting remotely in Paris, and never visiting the company’s headquarters, and its biggest base, in his first 15 months.

CEOs

Delaporte, 2020-24

Shilpa Phadnis & Veena Mani, April 8, 2024: The Times of India

Bengaluru: Going by major financial metrics, one could say that Thierry Delaporte did not make things worse for Wipro than his predecessors had already done. In one significant respect, the outgoing CEO actually did better — share price. Wipro’s share price since Delaporte took over has risen 116%, compared to 81% for TCS, 94% for Infosys, and 27% for Cognizant. The same holds true if one were to look at the past one year or sixmonth share price changes. Only HCLTech has done better among large Indian-heritage IT companies.

In revenue growth and operating margin, Wipro continues to lag its peers, like under Delaporte’s immediate predecessors — which is what allowed even HCLTech to cross Wipro in revenue in 2018, two years before Delaporte took over. In 2021-22, the year after Covid struck and Delaporte’s first full year, Wipro’s revenue surged by almost 27%, way higher than its peers, partly on account of a huge acquisition (of Capco), but also because of a stronger deal flow. But after that, Delaporte could not sustain the momentum, and revenue growth slipped below that of peers.The company’s operating margin too has dropped significantly in the past couple of years, like that of its peers, with IT services demand globally falling. Only TCS has managed to keep the margin reasonably stable.

So, what would have precipitated Delaporte’s premature departure? There are plenty of senior executives – many of whom quit during Delaporte’s tenure – who have not been happy with his restructuring efforts. Few would have questioned the need for a restructuring, given Wipro’s performance before Delaporte stepped in. And, from all accounts, the steps Delaporte took in trying to simplify the structure – drastically reducing P&L (profit & loss) units reporting to him, breaking down walls between units, sharply cut- ting the number of KPIs (key performance indicators) used to assess executives and employees – had chairman Rishad Premji’s buy-in. But in its implementation, there looks to have been plenty of problems. Phil Fersht, CEO of IT analyst firm HfS Research, says in a blogpost: “Delaporte rarely left his Paris base, while his CEO counterparts have been regularly rallying the troops across India and the US. You can’t run an Indian-heritage business during tough economic times when you’re not physically present to boost morale and represent the firm.”

Many top executives, including at the SVP and VP levels, quit. The prominent ones include Jatin Dalal, the CFO, Rajan Kohli, who was president of Wipro's integrated digital, engineering and application services business line, Angan Guha, who oversaw a portfolio spanning financial services, manufacturing, energy & utilities, hi-tech and Canada operations, Sanjeev Singh, who was COO at Wipro, Mohd Haque, SVP and head of healthcare and medical devices for the Americas, and Ashish Saxena, SVP and head of the manufacturing and hi-tech business unit.Delaporte also brought in many executives from outside of Wipro. Fersht says in the process, Delaporte neglected the loyal Wipro-ites.

And many of those he brought in to head regions did not stay long. These included Tomoaki Takeuchi, country head for Japan, Sarah Adam-Gedge, MD of Australia and New Zealand, Douglas Silva, country head for Brazil, and Mohammed Areff, country head of the Middle East region. Maybe they could not fit into the culture of an Indian company. Stephanie Trautman, who was brought in from Accenture as chief growth officer in 2021, resigned in January. This, and the integration of the strategic pursuits team into strategic market units, distracted Wipro’s large deals team.

Ramkumar Ramamoorthy, partner at Catalincs and former chairman and MD of Cognizant India, says CEOs of large companies need to be rainmakers and pied pipers.

Facebook projects

Autonomous photo recognition

May 7, 2019: The Times of India

Who's checking your Facebook photos? Wipro and its workers

NEW DELHI: We got news for you. A team of over 250 overworked techies in Hyderabad have been parsing through your Facebook photos, categorising them into five "dimensions" and trying to figure out why you posted those pictures — was it a celebration, a joke or a major event in your life? These contract workers have been going through Facebook photos posted since 2014, and over the past one year have been labelling them — the first step towards an autonomous photo recognition.

Details of the project were revealed by a Reuters report, which gleaned the information from multiple employees at Wipro, the outsourcing firm that is working on behalf of Facebook.

The report says Facebook later confirmed many details of the project. Wipro declined to comment and referred all questions to Facebook. The Wipro work is among about 200 content labelling projects that Facebook has at any time, employing thousands of people globally, Facebook says. The Wipro workers said they gain a window into the lives of people as they view a vacation photo or a post memorialising a deceased family member.

Though content labelling projects such as these are often anonymised — photos are stripped of identifying information of the owner — Facebook acknowledged that some posts, including screenshots and those with comments, may include user names.

So why does Facebook need to do this? Well, the first step to creating an artificial intelligence capable of recognising photos is labelling them — the machine first needs a collection of cat photos labelled cat to recognise future cat photos. But Facebook (and also Google and others) have AI capable of doing this.

But the Wipro project suggests Facebook could be working on an AI that could recognise the "context" of a photo, not just the person or object in it — a happy photo, a sad photo and such. To train the software on this, it first needs tranches of photos with correct labelling.

Thankfully, you have uploaded all those photos on Facebook. And, contract workers are available to sit through and stare at all those random photos.

Facebook confirmed labellers in Timisoara, Romania and Manila, the Philippines are involved in the same project. It said its analysis is ongoing and thus could not provide resulting product decisions. Now go on and post an angry selfie on Facebook!

Revenue

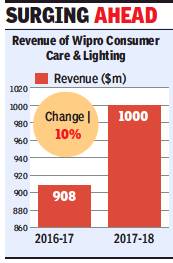

2017>2018: consumer business revenue is $1bn

Wipro consumer biz hits $1bn in revenue, May 4, 2018: The Times of India

From: Wipro consumer biz hits $1bn in revenue, May 4, 2018: The Times of India

SE Asia, Domestic Portfolio Boost Numbers

Wipro Consumer Care and Lighting (WCCL), part of the unlisted entity Wipro Enterprises, has entered the $1-billion-dollar revenue club. The company did Rs 6,630 crore, or just about $1 billion, in 2017-18. That’s a growth of 10% from last year, when it did $908 million.

WCCL CEO Vineet Agrawal had told TOI in February that a stronger foothold in Malaysia, Vietnam and Indonesia, and the continued gains of the Indian portfolio led by the Santoor and Chandrika brands have fuelled growth for the division. WCCL gets 50% of its revenue from international markets. Malaysia contributes a little over $145 million, and China $120 million. Indonesia, which had a sluggish first half, bounced back with a double-digit growth in the second half of last year, the company said in a statement on Thursday.

Rival Hindustan Unilever does a revenue of about $5 billion in India alone. ITC does $9.4 billion, but a lot of that still comes from cigarettes. Patanjali, which is just over ten years old, did a revenue of almost $1.5 billion in 2016-17 and was looking at doing $3 billion in 2017-18. Wipro’s consumer business was founded by the Premji family in 1945, when it sold vegetable oils. But in the 1980s, the focus became IT hardware and software. The consumer business was given renewed focus in the past two decades.

WCCL has over the years spent around $650 million on acquisitions, including $250 million that it spent on buying Singapore’s personal care products maker Unza Holdings in 2007. Two years ago, it bought Zhongshan Ma Er to get a strong foothold in the Guangdong (China) market.

Agrawal said the key driver of growth this year was the company’s ability to handle the GST transition in India. “We proactively engaged with our distributors and partners and clarified their doubts about GST. This gave us momentum in June-July 2017, leading to 18% growth in the India business in FY18. Distribution also improved especially post-GST implementation. Santoor and Garnet LED brands did particularly well,” he said.

Among its brands, Santoor is the biggest with a turnover of about $300 million, followed by female toiletry brand Enchanteur at $150 million. It has several $50-million plus brands including premium toiletry brand Yardley, male toiletry brand Romano, skincare brand Bio Essence, Halal skincare brand Safi and Garnett LEDs.

Last year, WCCL invested close to Rs 50 crore in New Delhi-based online consumer product firm Happily Unmarried to pick up about 20% stake.

To build the homecare portfolio, the company has test-marketed the Giffy brand of dish wash liquid in select states in India. In India, Safewash Liquid detergent intends to create newer consumption opportunities in the household laundry segment.

YEAR-WISE DEVELOPMENTS

2021

Wipro buys UK’s Capco for $1.5bn

March 5, 2021: The Times of India

Wipro buys UK firm Capco in $1.5bn deal

Banking Consultancy Will Help Indian Tech Major To Strengthen Fin Services Segment

Bengaluru:

Wipro will acquire London-based global management and tech consultancy Capco for $1.5 billion to bolster its presence in the banking, financial services & insurance (BFSI) space. The deal, which is Wipro’s largest acquisition ever, will also give the Indian tech services giant a strong consulting footprint.

The deal comes under CEO Thierry Delaporte, who took over in July last year, and demonstrates a desire to regain the momentum the company has lost to rivals over the past several years. Wipro’s other big acquisitions include those of US-based cloud consultancy firm Appirio for $500 million in 2016, and of UK-based Infocrossing for $600 million in 2007.

Capco clocked $700 million in revenue in the 2020 calendar year. Wipro said the acquisition creates a global financial services business of $3.2 billion, up from the current $2.5 billion, with a strong consulting and business transformation footprint. Capco, founded in 1998, gives Wipro access to 30 new large BFSI clients. It has over 5,000 consultants based in more than 30 global locations across 16 countries. It works with more than 100 clients and has many long-standing relationships with leading financial institutions.

The all-cash transaction is expected to be completed during the June quarter, subject to regulatory approvals and customary closing conditions. The transaction will be financed through internal cash and debt. Wipro has some $6 billion of cash reserves.

BFSI is a big spender on technology and is the largest industry vertical for the major IT services companies, accounting for almost a third of the revenue for many of them. Compared to TCS, Cognizant and Infosys, Wipro is weak in BFSI. The Capco acquisition seems to be an effort to address this gap.

Wipro believes there are significant synergies to be realised through cross-selling opportunities. Capco is said to be highly complementary to Wipro’s capabilities in building digital technology and operations solutions for helping clients achieve their transformation objectives. Delaporte said, “Together, we can deliver high-end consulting and technology transformations, and operations offerings to our clients. Wipro and Capco share complementary business models and core guiding values, and I am certain that our new Capco colleagues will be proud to call Wipro home.”

Lance Levy, CEO of Capco, said, “We are incredibly excited to join our new colleagues at Wipro. Together, we will offer bespoke transformational end-to-end solutions, now powered by innovative technology at scale, to create a new leading partner to the financial services industry.”

In its investor presentation, Wipro said the acquisition will dilute Wipro IT services ebit (earnings before interest and taxes) margins by 2% in the first year, a large component of which will be a non-cash charge. It said margins will improve in the future based on revenue and cost synergies.

Although revenue synergies and growth acceleration are the primary objectives of the acquisition, there are identified cost synergies to be realised post-integration, Wipro said.