Zee Entertainment

This is a collection of articles archived for the excellence of their content. |

Contents |

Briefly

From: Zee promoters eye convergence, ready to sell half their 42% stake, November 14, 2018: The Times of India

From: Zee promoters eye convergence, ready to sell half their 42% stake, November 14, 2018: The Times of India

Could Attract Reliance, Global Media-Tech Cos

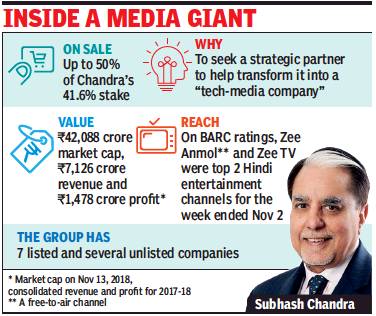

Months after Disney closed a deal to acquire Rupert Murdoch-controlled 21st Century Fox’s major global assets — including Star India — for over $71 billion, the promoters of Zee Entertainment on Monday unveiled a share sale plan that could lead to a blockbuster merger and acquisition deal in the Indian media industry.

Zee said that “Subhash Chandra and family along with its advisors met in Mumbai over the Diwali weekend” and decided to offload up to half of its promoter holding of about 42% in flagship Zee Entertainment Enterprises Ltd (ZEEL), as part of a “strategic review of its businesses in the changing global media landscape”.

Storied investment banker Goldman Sachs has been appointed to scout for suitors. The outcome of the strategic review is expected to be concluded by March-April 2019.

Among the names that are already doing the rounds as potential buyers are Mukesh Ambani’s Reliance Industries, which is on the hunt for content to feed Jio, US cable giant Comcast, Alibaba, Apple and Google.

While Zee’s communication to the stock exchanges said it was seeking a “partner” for up to 50% of promoter holdings, investment bankers and media insiders believe it might be persuaded to sell its entire stake. “If you want a global player or even Reliance, they’ll want control if they’re going to pay a strategic premium,” said one of them.

By his reckoning, Zee could command a 30% premium over its current market valuation of about Rs 42,000 crore, or about Rs 55,000 crore. The promoter stake of 41.6% (as of September 30) – of which 59% is pledged – would then be worth about Rs 23,000 crore.

“The company has been doing well in its domestic business but given our global ambitions, we are looking for a partner with expertise in technology,” Chandra’s son Punit Goenka, ZEEL’s managing director & CEO, told TOI. “Gone is the time when we could do it on our own. From a content company, we want to become a content and technology company.”

Zee’s consolidated revenues were Rs 7,126 crore in 2017-18 and profit after tax was Rs 1,478 crore.

Asked if the promoters would be willing to sell their entire stake given the right valuation, Goenka said no. But, he added, the company would be open to multi-level deals that could see the new partner pick up higher stakes in subsidiaries, for instance, Zee5.

Chandra may be emulating Murdoch

Brushing aside threats to traditional broadcasting businesses from new-age over-the-top (OTT) players, including Amazon Prime Video and Netflix, ZEEL’s managing director & CEO Punit Goenka said he expected Zee’s portfolio play to change dramatically in the next five years.

Murdoch’s Indian general entertainment and OTT platform Hotstar were said to be key to Disney’s takeover interest — and while there was no geography-wise break-up of valuations, a few media observers placed Star India’s as high as $10-15 billion. In fact, analysts said Chandra, who wants to retain control over Zee’s news broadcasting assets, could be emulating Murdoch. “The Zee Entertainment stock hasn’t done well recently. But the fundamental value is higher. The promoters want to realise that value,” said an analyst.

“There is informed recognition that the world is convergent today and the lines across media, telecom, manufacturing and technology are thinner than ever. The review showed that the family needs to accelerate efforts to stay ahead of fastchanging trends,” Zee said.

“Zee is likely to elicit high interest from global players and valuations are likely to reflect the inherent scarcity premium since there isn't any comparable asset left in the Indian media space after this,” said Sanjay Jain of Taj Capital, a New Delhi-based investment advisory firm. “With the transformational changes happening in media globally with OTT platforms, Zee offers a serious content platform including films and studio strengths, which can be built upon to shape it for evolving technologies in the internet space,” he added.

Zee Network has assets in Hindi and a swathe of vernacular markets, giving it a national footprint. The OTT business under Zee5 has become the largest after Hotstar. Advertising revenues (63%) and subscription revenues (30%) contributed a major chunk of topline, according to company officials. Essel, which is promoted by Chandra and which has a stake in Zee, also has distribution assets in Dish TV and Siticable.

YEAR-WISE PERFORMANCE

2018: a bad year

In reprieve for Zee, lenders agree not to use ‘default’ tag, January 28, 2019: The Times of India

From: In reprieve for Zee, lenders agree not to use ‘default’ tag, January 28, 2019: The Times of India

Meeting Held Over Weekend After Stocks Crashed

Zee and Essel Group chairman Subhash Chandra has reached an agreement with lenders, under which the latter wouldn’t declare an event of default due to the steep fall in share prices. This follows last Friday’s stock market rout of Zee and Essel Group stocks, in which investors lost $2 billion, or around Rs 14,000 crore. A prolonged meeting between the lenders and the promoters took place over the weekend after the steep fall in the shares of Zee Entertainment Enterprises and Dish TV triggered a panic.

Some of the lenders, who have a pledge on the promoter family stock, had sold about 6.5 million shares in the Friday carnage. This prompted Chandra to issue an unprecedented open letter, apologising to the lenders and seeking their patience. On Sunday evening, Essel said the lenders have agreed not to trigger “any event of default declared due to the steep fall in price”. “As a result, there will be synergy and cooperation among lenders, leading to a unified approach,” the statement added.

Lenders drew comfort from reiteration by the promoters for a speedy resolution through a strategic sale in a time-bound manner, the statement said. “We have always believed in the intrinsic value of Zee Entertainment and, most above, the sheer value system with which its promoters function,” Aditya Birla Sun Life AMC’s CEO A Balasubramanian said.

Speaking on the development, Chandra said, “I am pleased to share that we have achieved an understanding with lenders. We have always valued their immense trust and faith. I am very positive, that we will continue to take such positive steps in rising up from the current challenging times, with support of all stakeholders.”

Zee Entertainment further reiterated that Nityank Infrapower & Multiventures, which was being investigated for money laundering during the postdemonetisation weeks, was an independent company and did not belong to Zee Group.

It also said that queries from the Serious Fraud Investigation Office (SFIO) were directed to Nityank Infra. “Information and documents relating to certain transactions were sought by SFIO from certain group entities and these were provided,” Zee Entertainment said in a letter to the exchanges. “In view of the above, since all information sought by SFIO has been provided and no further information has been subsequently sought, the matter stands closed for the group entities.”

2019

Change of management

REEBA ZACHARIAH, Nov 26, 2019: The Times of India

Subhash Chandra, founder of Zee Entertainment Enterprises and pioneer of India’s private satellite television, has stepped down from the chairman’s position, four days after his stake in the company fell to 5%.

Chandra’s resignation brings an end to his role as the head of Zee, a company he founded in 1992 after economic liberalisation kicked off. The 67-year-old, however, will continue to be on the board of Zee as a non-executive director. Last Thursday, Chandra sold 16.5% in Zee to a clutch of financial investors, raising Rs 4,770 crore to pare debt. As a result of the sharesale, his stake in Zee came down to 5%.

“In light of the changes in shareholding, Chandra has expressed his intention to resign as chairman of the board with immediate effect,” the company said in a regulatory filing. He also expressed his desire to step aside as a board member, but the rest of the board requested him to continue as a non-executive director, the company said.

Chandra’s oldest son, Punit Goenka, 44, also a director, continues to manage the show at Zee. Chandra has two seats on the Zee board as against three before he sold 16.5% in the company. Nominee director Subodh Kumar has also stepped down from the board of Zee. Chandra’s 5% holding makes Zee vulnerable to hostile takeovers in the future, said corporate governance experts. US-based investment manager Invesco Oppenheimer is the largest shareholder of Zee with a stake of 18.7%. Other large institutional investors are GIC (8.4%) and BlackRock (5%).

Zee reconstituted the board by inducting three new independent directors — R Gopalan, Surendra Singh and Aparajita Jain — who replaced two independent directors and one nominee director of the promoters. The reconstituted Zee board has six independent directors and two members from the promoters.

Though the company didn’t reveal who will be the new chairman, Monday’s board meet was chaired by Gopalan, former finance secretary. “The reconstitution of the board was to provide a strong signal to existing and new institutional investors who have reposed their faith by investing Rs 4,770 crore,” the company said.

2 ex-directors of Zee Ent had flagged issues

Nov 28, 2019: The Times of India

Two former board members of Zee Entertainment Enterprises had raised concerns over multiple issues, including a Rs 2,200-crore film advance given in fiscal 2019, the company said in a regulatory filing. The duo, Subodh Kumar and Neharika Vohra, had also flagged issues about “no action” on a bank that appropriated Rs 200 crore in deposits towards promoter loans and on large outstanding from Essel Group companies, Dish TV and SitiCable, for content supplied by Zee, the filing said.

The company, however, said its board had noted the issues raised by the two directors before they resigned on November 22, and those have been “discussed and acted upon from time to time in board meetings in which they were also present”.

Kumar was a nominee director of the Essel Group, which sold its 16.5% stake in Zee on November 22 and Vohra was an independent director. Another independent director Sunil Kumar resigned on November 24, a day before Essel’s Subhash Chandra stepped down as chairman of Zee. The company said that Kumar had informed that his resignation followed the sale of Essel’s stake in Zee and reconstitution of the board.

Zee said information with regard to the Rs 2,200-crore film advance was “disclosed in its annual report and clarified in various investor interactions”. It also said that the issue pertaining to the wrongful revocation of the bank guarantee was resolved with the company having being secured by the promoter firms and legal notices were sent to the bank at the relevant time.

On outstanding loan to Dish TV and SitiCable, Zee said that those have been secured by a definitive plan and the situation is being “strictly monitored”.

2021: merger with Sony proposed

Reeba Zachariah, Sep 23, 2021: The Times of India

From: Reeba Zachariah, Sep 23, 2021: The Times of India

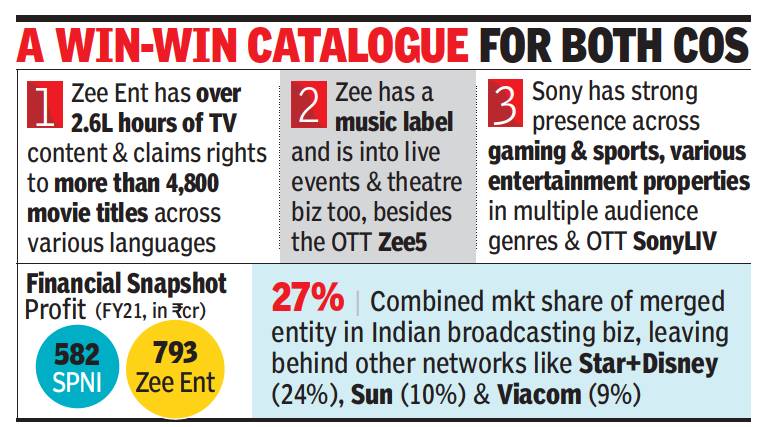

Ten days after two of its largest shareholders sought the removal of Zee Entertainment Enterprises MD Punit Goenka, the latter has struck a merger deal with Sony Pictures Networks India that keeps him in the driver’s seat. Zee will merge with Sony Pictures in an agreement that gives the former 47% in the combined entity.

The local unit of the $85-billion Sony Corp, Japan, will own 53%. Goenka and his family, who own 3.99% in Zee, will retain their stake in the merged entity even as other Zee shareholders including Invesco Oppenheimer Developing Markets Fund and OFI Global China Fund—which sought Goenka’s ouster—will see their stakes diluted.

INVESCO VIEW NOT KNOWN

Deal will need assent of 75% of Zee shareholders

The Goenkas can also raise their holding to 20% in the combined entity according to the terms of the deal. The Zee-Sony merger will make the combined entity the largest entertainment player in the country, overtaking current leader Walt Disney & Star.

In a regulatory filing, Zee said: “In consideration of the existing promoters of Zee agreeing not to compete with the merged company, promoters of Sony Pictures will transfer such number of shares of the merged entity such that the (Zee) promoters will own 3.99% of the combined entity.”

It further said that the promoter family is free to increase its shareholding to 20% from 3.99% in the merged company, which will be listed on the Indian bourses. The term sheet gives a period of 90 days, during which both the parties will conduct mutual diligence and finalize definitive agreements. The proposal will then be presented to Zee shareholders. For the deal to go through, it will need approval from 75% of Zee shareholders. It is not known what Invesco’s view is on the Zee-Sony merger.

Ten days ago, Invesco, which owns 18% in Zee, sought a special shareholder meet to oust Goenka from the board as well as appoint six nominee directors. The proposal was seen as a move to end the control of Goenka over the company, which was founded by his father Subhash Chandra in1992.

Wednesday’s development sent Zee shares soaring. The stock closed at Rs 337, up 32% on the BSE. “The corporate governance overhang of Zee should fade away with this merger and enhance investor confidence,” said NV Capital co-founder Vivek Menon. InGovern Research Services founder Shriram Subramanian said: “With Sony as a majority shareholder and a revamped board, the combined entity would be the best solution Invesco could have hoped for. As an asset manager, it would be interested in financial returns and better governance.” InGovern had raised corporate governance concerns at Zee.

The merger will create a combined entity with revenues of Rs 13,452 crore and an employee strength of 4,600 people. The Japanese giant will infuse capital into Sony Pictures as part of the merger such that the local arm will have $1.6billion funds at closing, and will nominate the majority of the directors on the board of the combined entity.

Sony MD N P Singh will “hold a leadership role on the board” of the merged entity. Couple of years ago, Sony was looking to buy Zee but the deal fell through over valuation differences. Subsequently, it looked at a deal with Mukesh Ambani-controlled Viacom18 but this too didn’t work out.

Lawyers said though the transaction will result in a change in control, Sony will not have to make an open offer as rules exempt it for deals done via a merger. “Obtaining Zee shareholders’ approval for the merger and for the continuation of its MD at the merged entity for the next five years may entail challenges considering the current stressed relationship between certain institutional shareholders of the company and the board,” said RBSA Advisors MD Ravishu Shah.