Urjit Patel

(→Clash with FM on insolvency norms) |

(→Views on "Goods and Services Tax") |

||

| (2 intermediate revisions by one user not shown) | |||

| Line 17: | Line 17: | ||

Urjit Patel's entry into the Reserve Bank of India as deputy governor had marked a number of firsts. He was the only deputy governor to have worked for a corporate. Also he was born in Kenya, did much of his education outside India and acquired an Indian passport only later in life. | Urjit Patel's entry into the Reserve Bank of India as deputy governor had marked a number of firsts. He was the only deputy governor to have worked for a corporate. Also he was born in Kenya, did much of his education outside India and acquired an Indian passport only later in life. | ||

| + | |||

However, these items in his dossier were addressed first by the UPA government in 2013, when he was appointed the deputy governor, and later by the Narendra Modi government, which appointed him for a fresh three-year term in January . The consensus has been that his was an appointment based on merit given his track record. | However, these items in his dossier were addressed first by the UPA government in 2013, when he was appointed the deputy governor, and later by the Narendra Modi government, which appointed him for a fresh three-year term in January . The consensus has been that his was an appointment based on merit given his track record. | ||

| Line 28: | Line 29: | ||

Between 2000 and 2004, Urjit worked closely with several central and state government high-level committees, such as task force on direct taxes, ministry of finance, government of India; advisory committee (on research projects and market studies), Competition Commission of India; secretariat for the Prime Minister's task force on infrastructure; group of ministers on telecom matters; committee on civil aviation reforms; ministry of power's expert group on state electricity boards and high-level expert group for reviewing the civil & defence services pension system, government of India. | Between 2000 and 2004, Urjit worked closely with several central and state government high-level committees, such as task force on direct taxes, ministry of finance, government of India; advisory committee (on research projects and market studies), Competition Commission of India; secretariat for the Prime Minister's task force on infrastructure; group of ministers on telecom matters; committee on civil aviation reforms; ministry of power's expert group on state electricity boards and high-level expert group for reviewing the civil & defence services pension system, government of India. | ||

| + | |||

| + | =A backgrounder= | ||

| + | [https://indianexpress.com/article/explained/explained-sci-tech/mangalyaan-mars-orbiter-mission-8954001/ Arjun Sengupta, Sep 25, 2023: ''The Indian Express''] | ||

| + | |||

| + | '' On September 24, ISRO’s Mars Orbiter Mission, informally known as Mangalyaan, entered into orbit around the Red Planet. This was India’s first — and successful — interplanetary mission. '' | ||

| + | |||

| + | |||

| + | On September 24, 2014, the Mars Orbiter Mission (MOM), informally referred to as Mangalyaan, successfully entered into orbit around the Red Planet. | ||

| + | |||

| + | This was India’s first tryst with interplanetary travel and a somewhat unlikely success — prior to ISRO, no other space agency had successfully managed to orbit the Red Planet in its first attempt. Moreover, ISRO became just the fourth space agency — after the US’s NASA, Russia’s ROSCOSMOS, and the European Space Agency — to accomplish this feat. And it did so in a record low cost of Rs 450 crore (approx $73 million), $25 million less than the budget the Matt Damon starrer The Martian (2015). | ||

| + | |||

| + | While the orbiter had a planned mission duration of just six months, it stayed in touch with Earth till April 2022, when communications were finally lost, possibly due to an exhaustion of fuel resources. | ||

| + | |||

| + | We look back at the historic mission. | ||

| + | |||

| + | ''' Looking ahead after Chandrayaan-1 ''' | ||

| + | |||

| + | Chandrayaan-1, India’s first (and successful) attempt at sending a spacecraft to the moon, was launched at Sriharikota on October 22, 2008, entering lunar orbit on November 8 that year. The orbiter also dropped a Moon Impact Probe (MIP) on the lunar surface, making it the first Indian-made object to touch the moon. For ISRO, Chandrayaan-1 was a massive success. | ||

| + | |||

| + | “The Indian flag on the MIP inscribed India’s presence on the Moon forever, heralding the nation’s entry into the elite club of the countries that had earlier placed national flags on the Moon (the USA, Russia and China),” G Madhavan Nair, then ISRO director, wrote in his autobiographical book Rocketing Through the Skies: An Eventful Life at ISRO (2023). | ||

| + | |||

| + | But bigger, more difficult things would soon be in play. Mars has always been an object of interest for scientists and astronomers across the world. For people working at ISRO, things were no different. But with the success of Chandrayaan-1, there was a new energy and vigour with which this task was approached. ISRO had proved itself as one of the most capable space agencies on the planet. Now it was time for it to stretch its limits. | ||

| + | |||

| + | ''' A mission blueprint is prepared ''' | ||

| + | |||

| + | A Mars Mission Study Team was constituted under Chairman K Radhakrishnan in August 2010 to provide a feasible blueprint on what a mission to the Red Planet would actually look like. Various kinds of Mars missions were discussed, including fly-by, orbiter, lander-rover, and even balloons, airplanes, sub-surface explorers, sample return missions. | ||

| + | |||

| + | “It turned out that a fly-by, which gives only a short time for scientific study [was] not really attractive. On the other hand, an orbiter or a lander would require larger transportation capability that may not be met by the established and reliable launch systems [available at the time],” V Adimurthy, the Mission Concept Designer for MOM, wrote in From Fishing Hamlet to Red Planet (2015). | ||

| + | |||

| + | Never afraid of a challenge, ISRO decided upon an orbiter mission, to be launched aboard its tried-and-tested workhorse — the PSLV. “We discovered that we can have a highly elliptic orbit mission around Mars using our proven PSLV launch system,” Adimurthy wrote. | ||

| + | |||

| + | The study team submitted its report, with all details of a potential Mars Mission in June 2011, which was followed by a series of reviews at various levels. Finally, the mission was announced by then Prime Minister Manmohan Singh on August 15, 2012, during his independence day speech. | ||

| + | |||

| + | ''' An extremely tight deadline ''' | ||

| + | |||

| + | But this left an extremely tight window within which ISRO had to launch the orbiter. The launch had to be made by November 2013-January 2014, failing which, the next launch opportunities for a fuel-saving Hohmann transfer orbit would be in 2016 and 2018. In fact, the 2013 opportunity was by far the best option available. | ||

| + | |||

| + | “Among the next two minimum-energy Earth departure opportunities, Mars missions in November 2013 and January 2016, the first opportunity of 2013 was found to be the better one requiring about 380 m/s less velocity. This is very significant with respect to the utilisation of PSLV as the launch system. We could do a reasonably good Mars Orbiter Mission with PSLV in 2013 but not in 2016,” Adimurthy wrote. | ||

| + | |||

| + | Moreover, this was a challenge unlike anything ISRO had thus far encountered. The travel time for MOM to reach Mars orbit would be around 300 days. Moreover, given the distance that the craft would cover, real-time interventions from ISRO scientists would be impossible. Hence, as Adimurthy explained: “on-board autonomy had to be provided for all critical operations.” | ||

| + | |||

| + | But the biggest challenge would be inserting the orbiter into Mars orbit. “Restart of the propulsion system, after nearly a year of travel in space, for Mars orbit capture manoeuvre was a major technical challenge,” Admurthy explained. | ||

| + | |||

| + | ''' A successful launch and a pioneering mission ''' | ||

| + | |||

| + | Despite a multitude of challenges, Mangalyaan was prepared in a record 15 months — partly due to using a reconfigured lunar orbiter prepared for the Chandrayaan mission. After a brief delay as ISRO’s tracking ships were unable to take up their pre-determined position near Fiji due to inclement weather, MOM was launched aboard a PSLV-XL on November 5, 2013. And after a 298-day transit, it was put into Mars orbit on September 24 2014. | ||

| + | |||

| + | Just by entering into orbit, MOM had succeeded. Afterall, the mission was envisioned to be a “technology demonstrator” — to test “capability [of the craft] to survive and perform Earth-bound manoeuvres; a cruise phase of 300 days of travel; Mars orbit insertion/capture and on-orbit phase around Mars,” as well as technology pertaining to “deep space communication, navigation, mission planning and management,” S Arunan, director of Mars Orbiter Mission, wrote in From Fishing Hamlet to Red Planet. | ||

| + | |||

| + | But the mission also achieved its many scientific objectives, studying the martian surface and atmosphere, as well as other planetary and solar phenomena. It also took some of the most stunning pictures of the Red Planet till date. | ||

| + | |||

| + | The Mars Orbiter Mission caught the imagination of the nation — and the world. ISRO was hailed world over, from the United States to China, for its monumental effort. But, as S Arunan put it in 2015: “MOM is a precursor to more complex and ambitious interplanetary missions of ISRO.” | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|P URJIT PATELURJIT PATEL | ||

| + | URJIT PATEL]] | ||

| + | [[Category:Government|P URJIT PATELURJIT PATEL | ||

| + | URJIT PATEL]] | ||

| + | [[Category:India|P URJIT PATELURJIT PATEL | ||

| + | URJIT PATEL]] | ||

=2016: Appointment as the RBI governor= | =2016: Appointment as the RBI governor= | ||

| Line 53: | Line 113: | ||

Those who have been expecting the new RBI appointee to overturn outgoing governor Raghuram Rajan's policies on interest rates or banking reforms will be in for a disappointment. Urjit Patel's colleagues say that he is as much of a monetarist and inflation hawk as Rajan. | Those who have been expecting the new RBI appointee to overturn outgoing governor Raghuram Rajan's policies on interest rates or banking reforms will be in for a disappointment. Urjit Patel's colleagues say that he is as much of a monetarist and inflation hawk as Rajan. | ||

| + | |||

According to deputy governor S S Mundra, Patel is focused, detail-oriented and independent-minded. He is cut from the same cloth as Rajan as far as ideology goes, though he is far more low-key than his `rockstar' predecessor. Like Rajan, he has an IMF background and is a strong supporter of banking reforms. Unlike economists such as Arvind Panagariya, Patel is not one to support boost in government capital spending at the risk of higher fiscal deficit. | According to deputy governor S S Mundra, Patel is focused, detail-oriented and independent-minded. He is cut from the same cloth as Rajan as far as ideology goes, though he is far more low-key than his `rockstar' predecessor. Like Rajan, he has an IMF background and is a strong supporter of banking reforms. Unlike economists such as Arvind Panagariya, Patel is not one to support boost in government capital spending at the risk of higher fiscal deficit. | ||

| Line 68: | Line 129: | ||

Bankers have not had much of an opportunity to interact with Patel but they too can expect continuity . As governor, Rajan held the view that by lending chunky loans, banks were engaging in lazy banking when they should be developing skills in reaching out to the thousands of small businesses. Echoing these views, Patel had said banks would be encouraged to extend a much larger number of small loans rather than extend a few very large loans.Also banks should review their large exposure limits in future for better practices of risk management. | Bankers have not had much of an opportunity to interact with Patel but they too can expect continuity . As governor, Rajan held the view that by lending chunky loans, banks were engaging in lazy banking when they should be developing skills in reaching out to the thousands of small businesses. Echoing these views, Patel had said banks would be encouraged to extend a much larger number of small loans rather than extend a few very large loans.Also banks should review their large exposure limits in future for better practices of risk management. | ||

| + | |||

| + | =Finance Secretary Garg’s version= | ||

| + | [https://www.hindustantimes.com/india-news/pm-modi-compared-ex-rbi-governor-urjit-patel-to-a-snake-claims-ex-finance-secretary-in-his-book-101695542331881.html Sep 25, 2023: ''Hindustan Times''] | ||

| + | |||

| + | |||

| + | Prime Minister Narendra Modi compared the then Reserve Bank of India governor Urjit Patel as a ‘snake who sits over a hoard of money’, former finance secretary Subhash Chandra Garg has claimed in his book ‘We Also Make Policy’. In his book, the excerpts of which were carried out by a news website , Garg said that the Narendra Modi government's ‘frustration’ with the then central bank chief had grown as early as February 2018 and escalated a month later when he accused the government of its inability to shed regulatory authority over nationalised banks, which according to him left the RBI with inadequate regulatory authority over the public sector banks compared to private-sector banks. | ||

| + | |||

| + |

In his book, Garg accused Urjit Patel of allegedly trying to scuttle the Centre's electoral bonds scheme by insisting that they should only be issued by the RBI and that too in digital mode. In June that year, the then RBI boss raised repo rate to 6.25 per cent citing a potential rise in inflationary pressures to the government’s decision to hike minimum support prices. Three months later, he raised the repo rate by 25 per cent. As a result, pressure grew on the government to put additional capital in banks worth lakhs of crores. | ||

| + | |||

| + | ''' Jaitley called Urjit Patel's solutions impractical, undesirable’ ''' | ||

| + | |||

| + | According to Garg, then finance minister Arun Jaitely felt bad by the way Patel was conducting. There was a perception that the latter wanted to go down in history as the most independent RBI governor. During a meeting convened by PM Modi on September 14, 2018, Patel gave a presentation in which he gave some solutions including the scrapping of long-term capital gains tax, scaling up disinvestment targets, approaching multilateral institutions asking them to invest in government of India bonds and paying up the pending bills of several companies.

In his book, Garg claimed that Jaitley out of frustration called Urjit Patel's solutions as ‘totally impractical and generally undesirable’. | ||

| + | |||

| + | ''' ‘Snake who sits over a hoard of money’ ''' | ||

| + | |||

| + | In his book, Garg said the tension between the Centre and RBI had weighed on the mind of PM Modi, who had picked Patel as the governor and defended him. The ex-finance secretary claimed Patel's communication lines with Jaitley and then officiating finance minister had broken down, and the only communication took place through then additional principal secretary PK Mishra in the Prime Minister's Office (PMO). | ||

| + | |||

| + | Stating that the prime minister was ‘sick of the situation’ as he had listened to Patel's presentations carefully and patiently. | ||

| + | |||

| + | “He (PM Modi) assessed that the RBI was not on top of the situation and was unwilling to do anything meaningful to address the economic situation and resolve its differences with the government”, Garg wrote, adding that the PM lost his cool and took on Patel. | ||

| + | |||

| + | An angry Modi attacked Patel on RBI's stand on the resolution of non-performing assets and its “intransigent, impractical and inflexible attitude to finding solutions”. He slammed the governor for proposing the withdrawal of the LTCG tax, which had since stabilized with hardly anyone objecting to it, and asking for fiscal deficits to be cut down further in the middle of the financial year. The prime minister, Garg added, compared Urjit Patel to the “snake who sits over a hoard of money, for being unreceptive to putting RBI’s accumulated reserves to any use”. | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|P URJIT PATELURJIT PATELURJIT PATEL | ||

| + | URJIT PATEL]] | ||

| + | [[Category:Government|P URJIT PATELURJIT PATELURJIT PATEL | ||

| + | URJIT PATEL]] | ||

| + | [[Category:India|P URJIT PATELURJIT PATELURJIT PATEL | ||

| + | URJIT PATEL]] | ||

= Clash with FM on insolvency norms= | = Clash with FM on insolvency norms= | ||

| Line 90: | Line 180: | ||

Patel minces no words while cautioning against the flexible approach taken by the government (in his words “extend and pretend”) to address chronic problems. He describes the past approach of getting PSU banks to subscribe in each other’s tier-II bonds as akin to “rearranging the deck chairs on the Titanic”. He is critical of LIC’s purchase of IDBI Bank (announced in August 2018). | Patel minces no words while cautioning against the flexible approach taken by the government (in his words “extend and pretend”) to address chronic problems. He describes the past approach of getting PSU banks to subscribe in each other’s tier-II bonds as akin to “rearranging the deck chairs on the Titanic”. He is critical of LIC’s purchase of IDBI Bank (announced in August 2018). | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | [[Category:Economy-Industry-Resources|P URJIT PATEL | + | [[Category:Economy-Industry-Resources|P URJIT PATELURJIT PATEL |

URJIT PATEL]] | URJIT PATEL]] | ||

| − | [[Category:Government|P URJIT PATEL | + | [[Category:Government|P URJIT PATELURJIT PATEL |

URJIT PATEL]] | URJIT PATEL]] | ||

| − | [[Category:India|P URJIT PATEL | + | [[Category:India|P URJIT PATELURJIT PATEL |

URJIT PATEL]] | URJIT PATEL]] | ||

=See also= | =See also= | ||

[[The Reserve Bank of India]] | [[The Reserve Bank of India]] | ||

Latest revision as of 16:51, 15 October 2023

This is a collection of articles archived for the excellence of their content. |

Contents |

[edit] A profile

The Times of India, Aug 21 2016

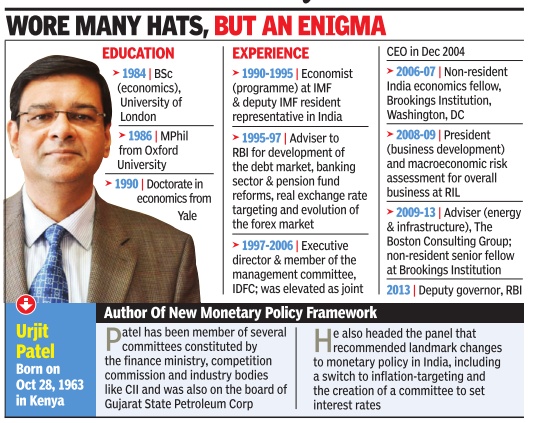

Urjit Patel's entry into the Reserve Bank of India as deputy governor had marked a number of firsts. He was the only deputy governor to have worked for a corporate. Also he was born in Kenya, did much of his education outside India and acquired an Indian passport only later in life.

However, these items in his dossier were addressed first by the UPA government in 2013, when he was appointed the deputy governor, and later by the Narendra Modi government, which appointed him for a fresh three-year term in January . The consensus has been that his was an appointment based on merit given his track record.

Patel will also be among the youngest governors in RBI.The others to take charge at an early age include Raghuram Rajan and Chintamani Deskhmukh.

RBI governors in the past have been a combination of bureaucrats and economists.But no one has experience as well-rounded as Patel. He has worked with multilateral institutions, he has played a senior role in a domestic commercial finance institution and has been a consultant. Although he was never a bureaucrat, he has worked closely with the government having been part of several committees.

One area where Patel is completely different from his predecessor is his personality .Unlike Rajan, Patel is an introvert and rarely speaks in public or participates in public debates. Although he has been deputy governor since January 2013, he has delivered very few speeches.

Born on October 28, 1963, Patel is a PhD (economics) from Yale University (1990) and MPhil from Oxford (1986).Outside academia, Patel has had a long stint in the financial sector at IDFC where he worked between 1997 and 2006, first as an executive director and part of the startup team and subsequently as a joint CEO of the company . He was also with Reliance Industries between 2008 and 2009 as president-business development.His role at Reliance involved assessing macroeconomic risk for the overall business, strategizing commercial approaches for hydrocarbon energy companies of climate change mitigation policies.

Between 2000 and 2004, Urjit worked closely with several central and state government high-level committees, such as task force on direct taxes, ministry of finance, government of India; advisory committee (on research projects and market studies), Competition Commission of India; secretariat for the Prime Minister's task force on infrastructure; group of ministers on telecom matters; committee on civil aviation reforms; ministry of power's expert group on state electricity boards and high-level expert group for reviewing the civil & defence services pension system, government of India.

[edit] A backgrounder

Arjun Sengupta, Sep 25, 2023: The Indian Express

On September 24, ISRO’s Mars Orbiter Mission, informally known as Mangalyaan, entered into orbit around the Red Planet. This was India’s first — and successful — interplanetary mission.

On September 24, 2014, the Mars Orbiter Mission (MOM), informally referred to as Mangalyaan, successfully entered into orbit around the Red Planet.

This was India’s first tryst with interplanetary travel and a somewhat unlikely success — prior to ISRO, no other space agency had successfully managed to orbit the Red Planet in its first attempt. Moreover, ISRO became just the fourth space agency — after the US’s NASA, Russia’s ROSCOSMOS, and the European Space Agency — to accomplish this feat. And it did so in a record low cost of Rs 450 crore (approx $73 million), $25 million less than the budget the Matt Damon starrer The Martian (2015).

While the orbiter had a planned mission duration of just six months, it stayed in touch with Earth till April 2022, when communications were finally lost, possibly due to an exhaustion of fuel resources.

We look back at the historic mission.

Looking ahead after Chandrayaan-1

Chandrayaan-1, India’s first (and successful) attempt at sending a spacecraft to the moon, was launched at Sriharikota on October 22, 2008, entering lunar orbit on November 8 that year. The orbiter also dropped a Moon Impact Probe (MIP) on the lunar surface, making it the first Indian-made object to touch the moon. For ISRO, Chandrayaan-1 was a massive success.

“The Indian flag on the MIP inscribed India’s presence on the Moon forever, heralding the nation’s entry into the elite club of the countries that had earlier placed national flags on the Moon (the USA, Russia and China),” G Madhavan Nair, then ISRO director, wrote in his autobiographical book Rocketing Through the Skies: An Eventful Life at ISRO (2023).

But bigger, more difficult things would soon be in play. Mars has always been an object of interest for scientists and astronomers across the world. For people working at ISRO, things were no different. But with the success of Chandrayaan-1, there was a new energy and vigour with which this task was approached. ISRO had proved itself as one of the most capable space agencies on the planet. Now it was time for it to stretch its limits.

A mission blueprint is prepared

A Mars Mission Study Team was constituted under Chairman K Radhakrishnan in August 2010 to provide a feasible blueprint on what a mission to the Red Planet would actually look like. Various kinds of Mars missions were discussed, including fly-by, orbiter, lander-rover, and even balloons, airplanes, sub-surface explorers, sample return missions.

“It turned out that a fly-by, which gives only a short time for scientific study [was] not really attractive. On the other hand, an orbiter or a lander would require larger transportation capability that may not be met by the established and reliable launch systems [available at the time],” V Adimurthy, the Mission Concept Designer for MOM, wrote in From Fishing Hamlet to Red Planet (2015).

Never afraid of a challenge, ISRO decided upon an orbiter mission, to be launched aboard its tried-and-tested workhorse — the PSLV. “We discovered that we can have a highly elliptic orbit mission around Mars using our proven PSLV launch system,” Adimurthy wrote.

The study team submitted its report, with all details of a potential Mars Mission in June 2011, which was followed by a series of reviews at various levels. Finally, the mission was announced by then Prime Minister Manmohan Singh on August 15, 2012, during his independence day speech.

An extremely tight deadline

But this left an extremely tight window within which ISRO had to launch the orbiter. The launch had to be made by November 2013-January 2014, failing which, the next launch opportunities for a fuel-saving Hohmann transfer orbit would be in 2016 and 2018. In fact, the 2013 opportunity was by far the best option available.

“Among the next two minimum-energy Earth departure opportunities, Mars missions in November 2013 and January 2016, the first opportunity of 2013 was found to be the better one requiring about 380 m/s less velocity. This is very significant with respect to the utilisation of PSLV as the launch system. We could do a reasonably good Mars Orbiter Mission with PSLV in 2013 but not in 2016,” Adimurthy wrote.

Moreover, this was a challenge unlike anything ISRO had thus far encountered. The travel time for MOM to reach Mars orbit would be around 300 days. Moreover, given the distance that the craft would cover, real-time interventions from ISRO scientists would be impossible. Hence, as Adimurthy explained: “on-board autonomy had to be provided for all critical operations.”

But the biggest challenge would be inserting the orbiter into Mars orbit. “Restart of the propulsion system, after nearly a year of travel in space, for Mars orbit capture manoeuvre was a major technical challenge,” Admurthy explained.

A successful launch and a pioneering mission

Despite a multitude of challenges, Mangalyaan was prepared in a record 15 months — partly due to using a reconfigured lunar orbiter prepared for the Chandrayaan mission. After a brief delay as ISRO’s tracking ships were unable to take up their pre-determined position near Fiji due to inclement weather, MOM was launched aboard a PSLV-XL on November 5, 2013. And after a 298-day transit, it was put into Mars orbit on September 24 2014.

Just by entering into orbit, MOM had succeeded. Afterall, the mission was envisioned to be a “technology demonstrator” — to test “capability [of the craft] to survive and perform Earth-bound manoeuvres; a cruise phase of 300 days of travel; Mars orbit insertion/capture and on-orbit phase around Mars,” as well as technology pertaining to “deep space communication, navigation, mission planning and management,” S Arunan, director of Mars Orbiter Mission, wrote in From Fishing Hamlet to Red Planet.

But the mission also achieved its many scientific objectives, studying the martian surface and atmosphere, as well as other planetary and solar phenomena. It also took some of the most stunning pictures of the Red Planet till date.

The Mars Orbiter Mission caught the imagination of the nation — and the world. ISRO was hailed world over, from the United States to China, for its monumental effort. But, as S Arunan put it in 2015: “MOM is a precursor to more complex and ambitious interplanetary missions of ISRO.”

[edit] 2016: Appointment as the RBI governor

The Times of India, Aug 21 2016

Govt opts for continuity, elevates Rajan's No 2, Urjit Patel, as RBI guv

The announcement through a press note marks an end to weeks of fevered speculation over the replacement for Rajan, who will return to academia in the US once his term ends on September 4, 2016, bringing the curtain down on an incr easingly rocky relationship with the Centre. The government unveiled the appointment on a day markets were closed, just as Rajan did in June to announce his decision not to seek a second term.

Patel -who has been given a three-year tenure -was selected from a field of five contenders with his predecessor, Subir Gokarn, being the other strong candidate. Also in the fray were chief economic adviser Arvind Subramanian, economic affairs secretary Shaktikanta Das and former World Bank chief economist Kaus hik Basu, TOI was told by people with knowledge of the deliberations. Rakesh Mohan, another former RBI deputy governor, was on the original shortlist as well but opted out citing other commitments.

The race for the coveted job finally narrowed down to Patel and Gokarn -both monetary economists with experience at RBI. While Patel, a PhD from Yale, has been at RBI since 2013, Gokarn had spent three years from November 2009 before the UPA government said no to a second term.

“Gokarn was a very strong contender but the PM felt that since he has just moved to the IMF as executive director, he should not be disturbed so soon,“ said a high-level source in the government.

While a selection panel was tasked with shortlisting candidates, the final decision was taken by Modi in consultation with finance minister Arun Jaitley over two meetings on Thursday . “Congratulations to @UrjitPatel... I'm sure he will successfully lead the Reserve Bank & contribute to India's economic development,“ Jaitley tweeted. Patel has been involved with all crucial decisions at the central bank -from reworking the way key policy rates are decided to modernising the way RBI functions. He is also a member of the panel to review the Fiscal Responsibility and Budget Management Act.

Despite his onerous fiscal responsibilities, Patel does have a lighter side. In his days at Oxford, he is said to have enjoyed leafing through the satirical magazine, Private Eye, and the bumbling Mr Bean was one of his favourite characters.

[edit] Views on "Goods and Services Tax"

The Times of India, Aug 21 2016

Patel a strong supporter of GST, but a critic of fisc deficit

Those who have been expecting the new RBI appointee to overturn outgoing governor Raghuram Rajan's policies on interest rates or banking reforms will be in for a disappointment. Urjit Patel's colleagues say that he is as much of a monetarist and inflation hawk as Rajan.

According to deputy governor S S Mundra, Patel is focused, detail-oriented and independent-minded. He is cut from the same cloth as Rajan as far as ideology goes, though he is far more low-key than his `rockstar' predecessor. Like Rajan, he has an IMF background and is a strong supporter of banking reforms. Unlike economists such as Arvind Panagariya, Patel is not one to support boost in government capital spending at the risk of higher fiscal deficit.

The view in RBI is the Centre was not completely opposed to any of Rajan's policies or reform measures which makes Patel a sound choice. “He's the best choice if the reforms undertaken by Rajan have to be taken forward. As Rajan said, there are a lot of unfinished tasks in these challenging times,“ said former RBI deputy governor K C Chakrabarty . The push for bank reforms is also likely to continue under Patel.This means that RBI is likely to go ahead with Rajan's decisions to allow banking licences on-tap and open up banking for new segments like wholesale banks and custodian banks. As an academic, Patel had argued for more transparency in bank balance sheets which is again carrying forward Rajan's legacy .

The new governor is also unlikely to let the RBI's reserves be used for supporting recapitalization of banks.In 2008, Patel had argued against the government's move to get RBI to swap dollars with oil companies for government bonds.

While Patel has been a critic of fiscal deficits, he has been a strong supporter of the Goods and Services Tax and has been quite bullish about the new tax not being inflationary .“About 55% of the Consumer Price Index (CPI) basket will not be impacted by GST...one benefit of the GST is that the cascading disappears so you might actually get effective tax rates on many goods and services to come down. And usually as a base expands, you do not need to have a tax rate which is as high as would be required. So the inflationary impact, firstly, it could just be one time; secondly, to the extent that such a large part of the CPI basket is already out of it, I think the durable impact on it is likely to be limited,“ Patel had said earlier this month.

Bankers can also expect more tweaking of benchmark rates and liquidity . Like his predecessor Rajan, Patel feels that interest rate changes should be transmitted immediately and across all tenures.

Another area of continuity will be that of financial inclusion and moving large borrowers to the bond market.

Universal bank accounts were first proposed by the Nachiket Mor committee constituted by Rajan and later accelerated by the Narendra Modi government under the Pradhan Mantri Jan Dhan Yojana. In a speech, Patel described the scheme as is unequivocally a “game-changer“.“It provides an unprecedented scaffolding and a springboard for meaningful financial inclusion and, concomitantly , substantial financial deepening of our economy ,“ Patel had said.

Bankers have not had much of an opportunity to interact with Patel but they too can expect continuity . As governor, Rajan held the view that by lending chunky loans, banks were engaging in lazy banking when they should be developing skills in reaching out to the thousands of small businesses. Echoing these views, Patel had said banks would be encouraged to extend a much larger number of small loans rather than extend a few very large loans.Also banks should review their large exposure limits in future for better practices of risk management.

[edit] Finance Secretary Garg’s version

Prime Minister Narendra Modi compared the then Reserve Bank of India governor Urjit Patel as a ‘snake who sits over a hoard of money’, former finance secretary Subhash Chandra Garg has claimed in his book ‘We Also Make Policy’. In his book, the excerpts of which were carried out by a news website , Garg said that the Narendra Modi government's ‘frustration’ with the then central bank chief had grown as early as February 2018 and escalated a month later when he accused the government of its inability to shed regulatory authority over nationalised banks, which according to him left the RBI with inadequate regulatory authority over the public sector banks compared to private-sector banks.

In his book, Garg accused Urjit Patel of allegedly trying to scuttle the Centre's electoral bonds scheme by insisting that they should only be issued by the RBI and that too in digital mode. In June that year, the then RBI boss raised repo rate to 6.25 per cent citing a potential rise in inflationary pressures to the government’s decision to hike minimum support prices. Three months later, he raised the repo rate by 25 per cent. As a result, pressure grew on the government to put additional capital in banks worth lakhs of crores.

Jaitley called Urjit Patel's solutions impractical, undesirable’

According to Garg, then finance minister Arun Jaitely felt bad by the way Patel was conducting. There was a perception that the latter wanted to go down in history as the most independent RBI governor. During a meeting convened by PM Modi on September 14, 2018, Patel gave a presentation in which he gave some solutions including the scrapping of long-term capital gains tax, scaling up disinvestment targets, approaching multilateral institutions asking them to invest in government of India bonds and paying up the pending bills of several companies. In his book, Garg claimed that Jaitley out of frustration called Urjit Patel's solutions as ‘totally impractical and generally undesirable’.

‘Snake who sits over a hoard of money’

In his book, Garg said the tension between the Centre and RBI had weighed on the mind of PM Modi, who had picked Patel as the governor and defended him. The ex-finance secretary claimed Patel's communication lines with Jaitley and then officiating finance minister had broken down, and the only communication took place through then additional principal secretary PK Mishra in the Prime Minister's Office (PMO).

Stating that the prime minister was ‘sick of the situation’ as he had listened to Patel's presentations carefully and patiently.

“He (PM Modi) assessed that the RBI was not on top of the situation and was unwilling to do anything meaningful to address the economic situation and resolve its differences with the government”, Garg wrote, adding that the PM lost his cool and took on Patel.

An angry Modi attacked Patel on RBI's stand on the resolution of non-performing assets and its “intransigent, impractical and inflexible attitude to finding solutions”. He slammed the governor for proposing the withdrawal of the LTCG tax, which had since stabilized with hardly anyone objecting to it, and asking for fiscal deficits to be cut down further in the middle of the financial year. The prime minister, Garg added, compared Urjit Patel to the “snake who sits over a hoard of money, for being unreceptive to putting RBI’s accumulated reserves to any use”.

[edit] Clash with FM on insolvency norms

MUMBAI: Former Reserve Bank of India (RBI) governor Urjit Patel has said that differences with the then finance minister began with the government’s decision to softpedal the approach toward insolvency cases.

While Patel has not mentioned any names in his new book, the mid-2018 period that he refers to is the time when Piyush Goyal held temporary charge of the Union finance ministry between May and August 2018. “In mid-2018, instead of buttressing and future-proofing the gains so far, an atmosphere to go easy on the pe dal ensued…Until then, for the most part, the finance minister and I were on the same page with frequent conversation on enhancing the landmark legislation’s operational efficiency,” writes Patel in his book.

In May 2018, Arun Jaitley who as finance minister spearheaded the insolvency law was recuperating from an ailment and Goyal, then power minister, was given additional charge. In media interactions in 2018 Goyal had called for the circular’s dilution stating that “loans cannot be arithmetically classified as NPA after 90 days”.

Patel, who resigned eight months before the end of his term, faced the rare threat of the government invoking a never-used provision to issue a directive to RBI. During his stint on Mint Street there was a breakdown of communication with the finance ministry even after Jaitley returned to office. There is, however, no reference to the relationship between the RBI and its board or the finance ministry in Patel’s book.

‘Overdraft — saving the Indian saver’ is not a tell-all book and demonetisation, which was cleared by the RBI’s board under Patel’s watch, does not find a mention anywhere.

Patel, whose clean-up of bank books resulted in the unearthing of over Rs 10 lakh crore of bad loans, has called for continued vigilance pointing out that “restructured standard assets” are an oxymoron.

In his book, the RBI’s 24th governor has identified the financial sector’s problem as the preponderance of government in ownership, resource mobilization and directed lending. He has warned against reducing the “length of arm” between the government and public sector banks as this would greatly increase the government’s debt burden.

Describing the government initiated SBI-LIC fund to bail out stressed real estate projects as a scheme in the “smoke and mirrors” genre, Patel expresses worry that the Centre’s quick-disbursing Mudra credit scheme has been more akin to transfers.

Patel minces no words while cautioning against the flexible approach taken by the government (in his words “extend and pretend”) to address chronic problems. He describes the past approach of getting PSU banks to subscribe in each other’s tier-II bonds as akin to “rearranging the deck chairs on the Titanic”. He is critical of LIC’s purchase of IDBI Bank (announced in August 2018).