TCS (Tata Consultancy Services)

(→Rs 5 lakh crore/ $84 billion market capitalization) |

(→How TCS saves on staff costs) |

||

| Line 76: | Line 76: | ||

Salary hikes have also fallen to single digits from double digits before the 2008 g .. global economic meltdown. | Salary hikes have also fallen to single digits from double digits before the 2008 g .. global economic meltdown. | ||

| + | |||

| + | =2014:India’s most profitable company= | ||

| + | [[File: tcs.jpg|2014:TCS versus RIL|frame|500px]] | ||

| + | |||

| + | [http://epaperbeta.timesofindia.com//Article.aspx?eid=31808&articlexml=TCS-now-Indias-most-profitable-company-20012015001035 ''The Times of India''] | ||

| + | |||

| + | Jan 20 2015 | ||

| + | |||

| + | Sindhu Hariharan | ||

| + | |||

| + | After 23 years, India has a new numero uno when it comes to profitability. Information technology major Tata Consultancy Services (TCS) posted a net profit of Rs 5,328 crore for the quarter ended December, overtaking Reliance Industries Ltd. The oil-to-telecom behemoth saw its profit dip to Rs 5,256 crore -its first decline in nine quarters -as falling crude prices hurt its core business. | ||

| + | Though these figures are only for one quarter, it is still a significant moment as it's the first time an IT company has topped the profit charts. RIL itself had overtaken the previous leader, Tata Steel, on the back of changes in the economy unleashed by the reforms. | ||

| + | |||

| + | “Being the best growth company in an industry with huge growth potential, the performance of TCS is one that is sustainable in the long run,“ Shashi Bhusan, senior research analyst at Prabhudas Lilladher said. Analysts said that though the outlook for the commodities sector in general and crude in specific is currently subdued, TCS grabbing the top spot underlines the emergence of the IT sector as force undeterred by macro-economic concerns and business cycles. Commenting on the third quarter performance, TCS CEO N Chandrasekaran said, “We have maintained our momentum in a traditionally weak quarter for the IT industry . Based on our progress this quarter, we are well on our way to post industry-leading growth for FY15.“ | ||

| + | |||

| + | Reliance acknowledged that oil prices have approached the `shut-in' zone and below $40barrel, the quantity of oil would fall below production costs. | ||

| + | |||

| + | Industry experts added that global demand and currency movements are the main factors that have been deciding the fortunes of tech players and both these aspects are seeing a favourable turn. | ||

| + | |||

| + | “The inherent balance sheet strength of TCS commands a greater valuation and the sectors that it primarily caters to also hold it in good stead,“ said Mayuresh Joshi, VP, Institution at Angel Broking. | ||

| + | |||

| + | Research firm Gartner's `Worldwide IT Spending Forecast', which is a leading indicator of technology trends, has forecast a 2.4% increase in global IT spending in 2015 compared to 2014 and expects it to reach a total of $3.8 trillion. On the other hand, energy consultant, Facts Global Energy (FGE), expect a possibility of crude prices heading towards $40bbl in early 2015, as per their oil market update of January 2015. | ||

| + | |||

=See also= | =See also= | ||

[[Infosys]] | [[Infosys]] | ||

[[TCS (Tata Consultancy Services) ]] | [[TCS (Tata Consultancy Services) ]] | ||

Revision as of 17:07, 6 February 2015

This is a collection of articles archived for the excellence of their content.

|

TCS may soon be world's second biggest tech employer

Shilpa Phadnis & Sujit John,TNN | Jun 17, 2014 The Times of India

Contents |

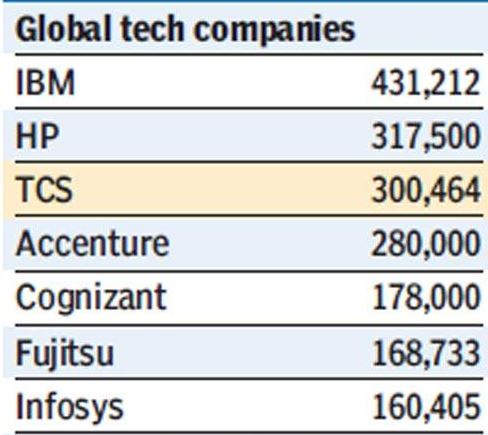

World's third largest technology sector employer

TCS has become the world's third largest employer of people in the technology sector, with over 3 lakh employees. And given the pace at which it is growing, it could become the second largest employer this year, crossing Hewlett-Packard, and would be fast closing in on leader IBM.

In India, it's one of the biggest creators of jobs in recent years, possibly even the biggest. Besides the Indian army, government departments like the Indian Railways and India Post, and PSU companies like Coal India, there's perhaps no other company that has more employees. And unlike the government departments, which are mostly reducing their staff strength, TCS numbers are rising each year by between 25,000 and 35,000.

In the last fiscal year, the $13.4-billion Tata Group company hired 61,200 people, with the net addition being 24,268, discounting those who left the company. The net addition in each of the past several years has been along similar lines or higher.

On the contrary, for some of the leading global tech companies, numbers are dropping given the transformations they are going through to deal with shifts in technology towards areas like cloud computing and mobility. HP had 349,600 employees in 2011, but that number is now down to 317,500. IBM, which has about 4.3 lakh employees, is also in the midst of layoffs.

TCS has said it will hire 55,000 people this year. If the net addition is half of that, it will be well ahead of HP's number by the end of this fiscal. Among Indian IT companies, Infosys is almost 50% of TCS with 1.6 lakh employees.

Rs 5 lakh crore/ $84 billion market capitalization

TCS first Indian co to top Rs 5 lakh cr

Reeba.Zachariah @timesgroup.com Mumbai:

The Times of India Jul 24 2014]

World's Second Most Valuable IT Services Firm

Outsourcing giant Tata Consultancy Services (TCS) became the first Indian company to cross the Rs 5 lakh crore mark in market capitalization in July 2014 . In the process, TCS also became the second most valuable IT services company in the world, ahead of Accenture but behind IBM. TCS's market valuation rose to about Rs 5.1 lakh crore (about $84 billion), the highest since its listing l0 years ago, well ahead of Accentu re's $51 billion, but way behind IBM's $193.7 billion.

TCS's market cap is bigger than the combined market cap of the other four do mestic IT players in the pecking order, Infosys ($31.7 billion), Wipro ($23.3 billion), HCL Technologies ($17.9 billion) and Tech Mahindra ($8.5 billion). The software services firm's market cap is also bigger than the combined market cap of the other 31 listed Tata group companies ($57.2 billion).

Shares of TCS have risen nearly 9% since it announced robust first quarter earnings last week -$845 million net profit on $3.69 billion revenue. Several “buy“ ratings on TCS have been issued by analysts, who expect an eventful FY15 for TCS as its global customers up spending on IT services. The $13-billion TCS, established in 1948, which counts Cisco and HewlettPackard among its clients, won seven large deals in Q1 FY15.

Why TCS is ahead

Sanchit Vir Gogia, chief analyst at Greyhound Research, says TCS is ahead of many of its Indian peers in identifying new areas of growth, making investments and all the right noises. "It is betting big on the Digital Five Forces—mobility, big data, cloud, social media and robotics," he said.

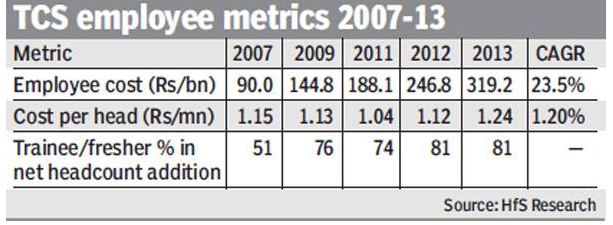

Analysts also find it remarkable that it has grown its people strength so quickly, and yet created an organizational structure nimble enough to handle these numbers. Equally, it has kept its people costs under such control that it is seen as a major factor in its extremely high operating margins (over 28%), perhaps the highest among large companies in the global IT services industry.

Pradeep Mukherji, president and managing partner in global management consulting firm Avasant, said TCS is managing the huge workforce by breaking it into smaller business units that each function virtually as a smaller company. "The depth and breadth of middle management and work delegation, managing a good onshore and offshore mix are some of the key drivers in managing the employee pyramid effectively," he said.

TCS' employee cost has risen from Rs 90 billion in 2007 to Rs 319.2 billion in 2013, but the cost per employee has barely risen in these past seven years. The cost per headcount has grown from Rs 11.5 lakh in 2007, to Rs 12.4 lakh) in 2013, an annual increase of a mere 1.2%, said a report by US-based IT advisory firm HfS Research. "A conservative estimate of 8% annual wage hike in India, 2% hike in developed countries and 4% hike in developing countries will lead to about 7.5% weighted average annual wage hike for TCS' mix of employees," said HfS analyst Pareekh Jain. In other words, TCS has been able to offset its salary hikes through other measures.

One of the biggest of these looks to be a sharp increase in its fresher intake relative to the intake of experienced employees. The percentage of freshers hired (of total hiring) increased to 81% in 2013 from 51% in 2007, finds HfS.

"They have stretched the employee pyramid with an army of junior employees. TCS is aggressively hiring in tier-2 and -3 cities that offsets cost to a large extents TCS has also focused on automation and reusable software tools and frameworks to improve employee productivity," said Sudin Apte, CEO of IT advisory firm Offshore Insights.

Jain believes that hiring more freshers has given TCS the flexibility to deploy them in lower value and transactional activities, thus freeing up experienced resources for higher value work. "Secondly, training freshers for new skills is easier than retraining old resources for new skills," he said.

Ashish Chopra, IT analyst with brokerage firm Motilal Oswal, noted that TCS had also significantly reduced the proportion of employees at client sites overseas, thus reducing the salary burden.

How TCS saves on staff costs

More new graduates help TCS save on staff costs; among lowest in industry

By Jochelle Mendonca, ET Bureau |[1] 19 Jun, 2014

How has Tata Consultancy Services managed to keep its employee costs much lower than its peers?Tthe secret could be its higher intake of freshers and a lean middle management.

This focus on new hires has allowed India's largest IT services player to earn the fattest margins in the software industry and also have considerable flexibility on deploying its resources.

Analyst firm HfS estimated that the Mumbai-based company effectively achieved a 6.3% reduction in average employee costs every year over 2007-2013. During this period, the percentage of new graduates hired of the total rose from 50% to 80%. TCSBSE 1.00 % has over 3,00,000 employees globally.

Hiring more freshers gives TCS the flexibility to use them in lower value and transactional activities, freeing up the more experienced employees for higher value work, HfS said. Also, freshers are .. The company had a utilisation rate of 77.9%, including trainees, for the fourth quarter of 2014, when it posted an operating margin of 29.1%.

Also helping TCS, and the rest of the industry, is the fact that salaries for college graduates have not increased in the last four years at about Rs 3.15-3.50 lakh annually.

Salary hikes have also fallen to single digits from double digits before the 2008 g .. global economic meltdown.

2014:India’s most profitable company

Jan 20 2015

Sindhu Hariharan

After 23 years, India has a new numero uno when it comes to profitability. Information technology major Tata Consultancy Services (TCS) posted a net profit of Rs 5,328 crore for the quarter ended December, overtaking Reliance Industries Ltd. The oil-to-telecom behemoth saw its profit dip to Rs 5,256 crore -its first decline in nine quarters -as falling crude prices hurt its core business. Though these figures are only for one quarter, it is still a significant moment as it's the first time an IT company has topped the profit charts. RIL itself had overtaken the previous leader, Tata Steel, on the back of changes in the economy unleashed by the reforms.

“Being the best growth company in an industry with huge growth potential, the performance of TCS is one that is sustainable in the long run,“ Shashi Bhusan, senior research analyst at Prabhudas Lilladher said. Analysts said that though the outlook for the commodities sector in general and crude in specific is currently subdued, TCS grabbing the top spot underlines the emergence of the IT sector as force undeterred by macro-economic concerns and business cycles. Commenting on the third quarter performance, TCS CEO N Chandrasekaran said, “We have maintained our momentum in a traditionally weak quarter for the IT industry . Based on our progress this quarter, we are well on our way to post industry-leading growth for FY15.“

Reliance acknowledged that oil prices have approached the `shut-in' zone and below $40barrel, the quantity of oil would fall below production costs.

Industry experts added that global demand and currency movements are the main factors that have been deciding the fortunes of tech players and both these aspects are seeing a favourable turn.

“The inherent balance sheet strength of TCS commands a greater valuation and the sectors that it primarily caters to also hold it in good stead,“ said Mayuresh Joshi, VP, Institution at Angel Broking.

Research firm Gartner's `Worldwide IT Spending Forecast', which is a leading indicator of technology trends, has forecast a 2.4% increase in global IT spending in 2015 compared to 2014 and expects it to reach a total of $3.8 trillion. On the other hand, energy consultant, Facts Global Energy (FGE), expect a possibility of crude prices heading towards $40bbl in early 2015, as per their oil market update of January 2015.

See also

Infosys TCS (Tata Consultancy Services)