Automobile industry: India

(→2015, Jan- Aug: Types of vehicles registered in Delhi) |

(→Premium compact segment) |

||

| Line 213: | Line 213: | ||

[http://epaperbeta.timesofindia.com/Gallery.aspx?id=28_08_2015_008_055_010&type=P&artUrl=LET-DELHI-BREATHE-Delhi-govt-More-diesel-vehicles-28082015008055&eid=31808 ''The Times of India''] | [http://epaperbeta.timesofindia.com/Gallery.aspx?id=28_08_2015_008_055_010&type=P&artUrl=LET-DELHI-BREATHE-Delhi-govt-More-diesel-vehicles-28082015008055&eid=31808 ''The Times of India''] | ||

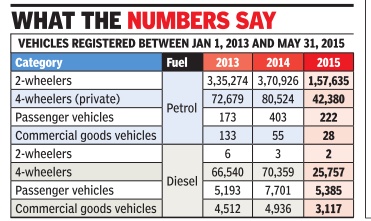

[[File: Types of vehicles registered in Delhi, Jan 2013- May 2015.jpg|Types of vehicles registered in Delhi, Jan 2013- May 2015 ; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=28_08_2015_008_055_010&type=P&artUrl=LET-DELHI-BREATHE-Delhi-govt-More-diesel-vehicles-28082015008055&eid=31808 ''The Times of India''], August 28, 2015|frame|500px]] | [[File: Types of vehicles registered in Delhi, Jan 2013- May 2015.jpg|Types of vehicles registered in Delhi, Jan 2013- May 2015 ; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=28_08_2015_008_055_010&type=P&artUrl=LET-DELHI-BREATHE-Delhi-govt-More-diesel-vehicles-28082015008055&eid=31808 ''The Times of India''], August 28, 2015|frame|500px]] | ||

| + | |||

| + | =2012-15: Three manufacturers dominate= | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Top-3-auto-cos-hold-70-mkt-share-28012016021048 ''The Times of India''], January 28, 2016 | ||

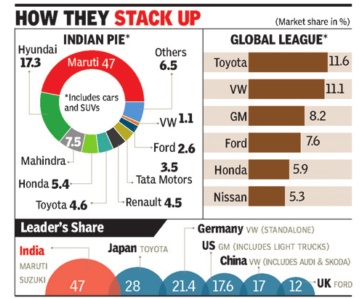

| + | [[File: The share of manufacturers in the Indian automobile market, presumably as in Dec 2015.jpg| The share of manufacturers in the Indian automobile market, presumably as in Dec 2015; Graphic courtesy: [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Top-3-auto-cos-hold-70-mkt-share-28012016021048 ''The Times of India''], January 28, 2016|frame|500px]] | ||

| + | |||

| + | Nandini Sengupta | ||

| + | |||

| + | ''Top 3 auto cos hold 70% mkt share''' | ||

| + | | ||

| + | India is the only country in the world where the top three auto manufacturers increased their market share to 70% for April-December 2015 compared to 67% in 2012, as per industry data. The pecking order has largely remained unchanged in the last five years. Also, the share of the top 10 models in the total sales has remained more than 50% for the last three years. The only change in the pecking order has been Mahindra & Mahindra moving into the third slot in 2013-14, ousting Tata Motors. | ||

| + | Auto marketers say this overwhelming dominance of a few players in a market, which has 18 car and SUV manufacturers, is something peculiar to India alone. R S Kalsi, ED (marketing & sales), Maruti Suzuki India, said, “There is no other example of this trend anywhere else and the highest marketshare by a single company , apart from Maruti in India, is Toyota in Japan with around 30%.“ | ||

| + | |||

| + | The top two's dominance of the market becomes obvious when one considers that their incremental volumes are more than what some of their competitors sell in a year. Rakesh Srivastava, senior VP (sales and marketing), Hyundai Motor India, said, “Last year, our sales went up 16% to 4.76 lakh units in the domestic market and this incremental increase is higher than the annual sales volume of 10 auto companies in India.“ | ||

| + | |||

| + | Experts say part of this is due to the early mover advantage and the ability to focus on a solid distribution channel. Maruti Suzuki, for instance, has 1,750 showrooms and 3,000 workshops, while No. 2 player Hyundai has 1,070 showrooms, 370 used car outlets and 335 rural sales outlets. | ||

| + | |||

| + | But part of it also has to do with the existing car pool and the Indian customer's comfort level with a productbrand that has strong resale value. Indeed the three years of slowdown has reinforced the customer's tendency to go with what's tried and tested. “Typically Indian customers are willing to experiment during an economic growth phase, but in a slowdown they stick to tested and trusted products,“ Srivastava said. | ||

| + | |||

=Premium compact segment= | =Premium compact segment= | ||

Revision as of 18:03, 8 February 2016

This is a collection of articles archived for the excellence of their content. |

2008: India 8th automaker in the world

From the archives of The Times of India: 2008 ‘India figures in top 15 automakers’

New Delhi: With a burgeoning auto industry to boast of, India has made it to the top 15 automakers of the world and occupies the fourth position in the leading developing countries' category of motor vehicle manufacturers, a UNIDO report has said.

According to the UNIDO International Yearbook of Industrial Statistics 2008, India ranks 12th in the list of world's top 15 automakers, which is led by Japan followed by the US and Germany. Other countries making it to list are Mexico, France, Korea, UK, Canada, Spain, Iran, Sweden, Brazil, Italy and Indonesia.

In the leading developing countries category, India ranks fourth. The list is topped by Mexico, followed by Korea, Iran. Brazil holds the fifth position followed by Indonesia, Turkey, Argentina, Thailand, Singapore, China, China (Taiwan Province), Malaysia, UAE and Columbia.

India also figures among the world's top 15 producers of chemicals and chemical products, electrical machinery and apparatus, basic metals, coke, refined petroleum products, nuclear fuel, non-metallic mineral products (glass and glass products, cement, lime and plaster, ceramic products), machinery and equipment, leather, leather products and footwear and textiles, the report said.

The country ranks fifth among the top 15 textile producers in the world. China has captured the top slot followed by the US, Italy, Japan, Mexico, Thailand, Indonesia, Pakistan, Germany, Korea, UK, Brazil, Turkey and Bangladesh.

The Yearbook is the 14th issue of UNIDO's annual publication and is based on 2006 data. It follows the International Standard for Industrial Classification that categorizes the automobile sector as manufacture of motor vehicles, bodies (coachwork) for motor vehicles, trailers and semi-trailers and manufacture of parts and accessories of motor vehicles and their engines.

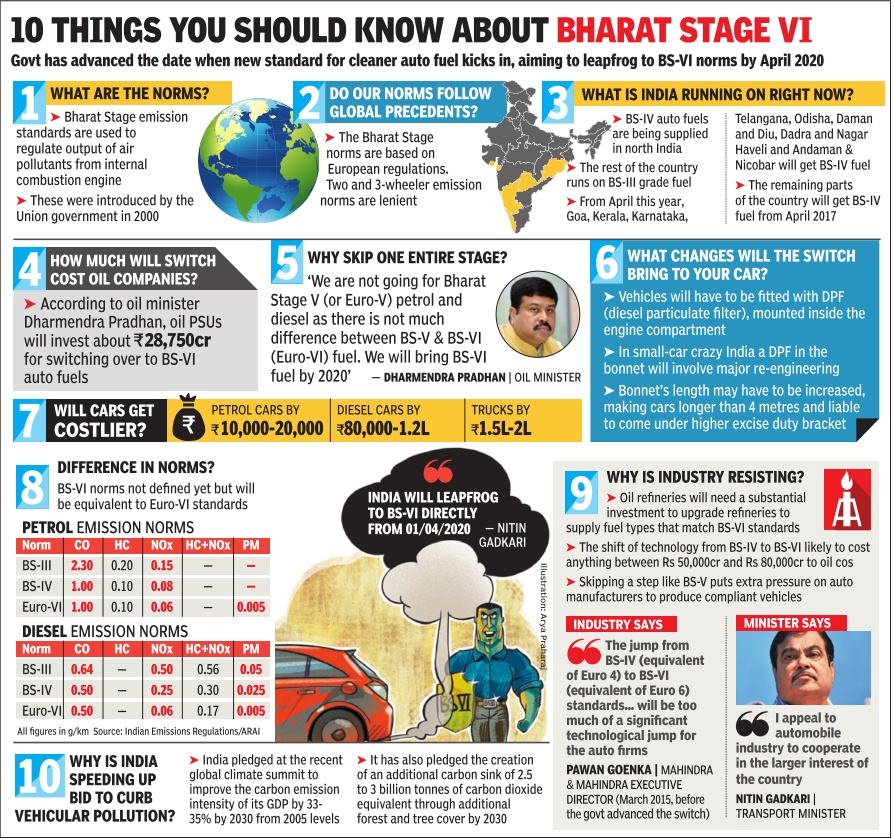

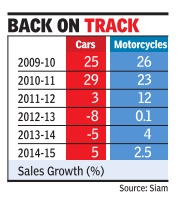

2009-15: Automobile sales

Apr 11 2015

Pankaj Doval

Car sales up after 2 yrs of decline

After two successive years of decline, car sales registered a 5% growth in the last financial year (2014-15). But the revival may not be sustained in the current financial year due to an adverse impact on the rural economy after unseasonal rains. Car sales fell 5% in 2013-14 and 8% in 2012-13 as high interest rates and growing fuel prices had dampened buyer sentiment.

The car industry has started showing some positive traction after entry of the Narendra Modi government in May last year. Modi's entry , which revived hopes of an economic turnaround, also coincided with a cut in fuel prices and a marginal reduction in interest rates. These positive factors, coupled with a low base year, led to a growth in sales numbers.

But a weak rural economy may play spoilsport. The difficult journey of the rural economy started last year with a deficient monsoon. This year also, unseasonal rains have damaged rabi crops.

The impact of an affected rural economy is already visible on the sales of motorcy cles, which grew only 2.5% in 2014-15, lagging a 25% growth witnessed by scooters. Sales of bikes fell 6% during the last quarter of 2014-15. Analysts said with rural economy playing an increasingly bigger role in the sales of small cars and motorcycles, an adverse demand impact here could hit the overall sales momentum.

“We are already feeling the pressure of a slowdown in the rural economy ,“ Vishnu Mathur, DG of industry body Society of Indian Automobile Manufacturers (Siam), told TOI.“Sales in the rural regions are critical for growth in some of the important categories, especially motorcycles.“

According to some estimates, rural economy accounts for around 30% to total sales of car makers -especially in case of mass-market manufactur ers like Maruti and Hyundai, while in motorcycles, the share has reached nearly half.

“Market sentiment in some rural areas has been impacted due to various factors, including the curtailment of national rural employment guarantee act (NREGA) spends, poor crop realisation and moderating wages,“ an official at top twowheeler maker Hero MotoCorp said. “The industry has, therefore, felt some impact in retail off-take in markets such as Bihar and Madhya Pradesh and sugar cane-growing areas in Uttar Pradesh and Maharashtra.“

The scooter category , however, is somewhat insulated from the agri pressure as it has abig share of the urban market.

The weak trends in rural India are worrisome for car manufacturers, which had turned their focus on agri-led regions.

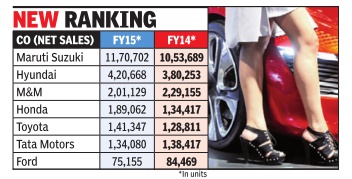

2014, 2015: Car sales

The Times of India, Jun 23 2015

Nandini Sengupta

Toyota Replaces Tata Motors As Fifth Largest Car Maker

M&M lone Indian auto co in top 5

There has been a shift in the pecking order of car and SUV companies in India with the fourth, fifth and sixth spots showing significant changes. According to statistics from the Society of Indian Automobile Manufacturers (SIAM), the top five passenger vehicle companies in India by sale are Maruti, Hyundai, Mahindra & Mahindra, Honda and Toyota. Tata Motors, which was in fourth place in fiscal 2014, slipped to sixth place in FY2015. Ford India is the seventh company in the top sellers' list. As a result of this rejig, M&M is now the only Indian brand among the top five passenger vehicle companies in India.

Indeed, Maruti, Hyundai and M&M have retained their earlier positions in FY2015 as well. Maruti, with 11,70,702 units in sales, remains top seller in FY2015 as well, increasing its tally from 10,53,689 units the year before.

Hyundai, in second position with 4,20,668 units, has also increased its tally from 3,80,253 units in FY14. M&M in third position, though, is lower in terms of sales at 2,01,129 units, down from 2,29,155 units in FY14.

The real change though is in the fourth, fifth and sixth slots. Honda, with 1,89,062 units, is the biggest gainer in the fourth position. It was in the fifth position with 1,34,417 units in FY14. Toyota, at fifth position with 1,41,347 units, has also jumped a slot in FY15. The year before it was sixth with 1,28,811 units.

Tata Motors lost two slots in FY15. With 1,34,080 units, it is now in sixth place whereas in FY14 it was fourth with a nearly similar tally of 1,38,417 units. Ford has remained number seventh, though with a reduced tally -75,155 units in FY15 compared to 84,469 units in FY15.

Industry experts say the change in pecking order is part of a larger churn in the industry as India readies for new emission and safety regulations in two years. N Raja, senior VP & director sales & marketing, Toyota Kirloskar Motor, said, “Customers have started to appreciate and demand safety features in cars, which becomes an important buying parameter. At Toyota, we are happy to contribute to the globalization of the automobile products sold in the country rather than merely chase numbers.“

Others say that individual performances depend more upon the value proposition of the vehicle models and technology will not be market barrier for companies. Vishnu Mathur, director general, SIAM, said, “Once the mandatory regulations come in, the higher technology will be a benchmark for everybody with price-increase a possible small differentiator.“

Bajaj’s small car with Renault-Nissan Alliance, unviable

The Times of India, July 16, 2011

Bajaj Auto’s ultra low-cost car plans with Renault-Nissan Alliance hit a new low as the company’s MD Rajiv Bajaj termed the project “unviable”, though the company later clarified that the troubled project was on.

Bajaj, speaking to reporters after announcing the company’s quarterly results, was quoted as saying by a news wire, “We don’t intend to get into the low-margin (passenger car) business.” He also told the news conference that from 2007 to 2009, “we had an initial plan with Renault and Nissan to develop a low-cost small car which would be like the Nano.” But sometime in November 2009, Bajaj informed Carlos Ghosn, chief executive of both Nissan and Renault, that the minicar project was “unviable”, to which Ghosn agreed, the agency reported. However,just as the statement by the Indian partner created ripples, the company issued a clarification, saying the project was still intact. “We would like to clarify the Bajaj-Renault-Nissan project is very much on,” S Ravi Kumar, Bajaj Auto’s senior V-P for business development, told another news wire in an emailed statement.

“The new four-wheeler platform, which will have commercial and passenger applications, will be showcased to Renault-Nissan in January 2012… Bajaj Auto will remain in the commercial space of the business while Renault-Nissan, if they decide to go ahead with the project, will be responsible for the personal transportation application,” he said. Bajaj and his executives did not respond to calls and text messages sent by TOI. A spokesperson for Renault refused to comment.

The conflicting statements, within hours of each other, however, did not come as a surprise as the partners have been having differences right from the time they came together. Conflicting statements, and doubts, over the viability of the project have been expressed by the partners from time to time. Things came to a boil in May when Renault India chief Marc Nassif said that the French auto major might pull out of the project if the car being developed and manufactured by Bajaj did not meet the alliance’s expectations.

Nassif followed this up in June by saying that Renault could even go solo on the project as “creating new ideas is in the DNA” of the company. This probably would have prompted Bajaj to go public with his statement on the split.

The ambitious project has been slow to take off since the very beginning. Delays, differences and constant bickering saw the partners often caught on the wrong foot in how they perceived the way forward for the development of the car. The troubles were very much visible after the partners never agreed to sign a joint venture despite the grandiose nature of the project.

HANGING IN BALANCE

2008

Bajaj does a one-up and unveils the prototype two days before the unveiling of the Tata Nano Carlos Ghosn-led Renault and Nissan join the ultra low-cost project, fix 2010 as the timeline for the model’s launch

2009

Differences surface between the partners. Colin Dodge, the global V-P for Nissan, says it is turning out to be a “very difficult’’ project Later in the year, Ghosn and Rajiv Bajaj meet on the sidelines of the World Economic Forum and try to sort out the differences. Ghosn says engineering, design and manufacturing expertise will come from Bajaj and Renault-Nissan will handle marketing and distribution

2010

Bajaj officials say early in the year that the partners are “aligned to the project and to the agreed objectives” and the “broad contours” had been agreed to Partners bury differences and sign an MoU.

2011

Tired of the slow progress and rising differences, Renault sounds non-committal to the project, saying it may pull out if the car developed by Bajaj does not meet expectations Rajiv Bajaj says he has informed Ghosn that the project is “unviable”.

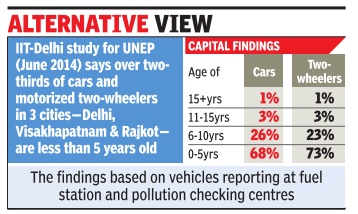

Average age of cars on road

Transport min says ban unfair on owners

Dipak Dash The Times of India Dec 03 2014

The findings of a study by IIT (Delhi) for UN Environment Programme showed that on average, less than one percent cars which are over 15 years old are plying on Delhi roads. The findings were same for two-wheelers. The findings were based on vehicles reporting at fuel stations and pollution checking centres. While the sample size for cars was 2,231, it was 1,570 in the case of two-wheelers. The survey found that the average age of cars on road was 4.4 years and the average age of two-wheelers was 4.7 years.

The study also covered two other cities Visakhapatnam and Rajkot and the findings were not much different.

Referring to a study conducted by central roads research institute (CRRI) in 2007, the report has mentioned how the vehicle registration date in Indian cities is an overestimation of the actual number of vehicles plying. This is because private vehicle owners pay a life time tax on the purchase of the vehicle and don't have to register their vehicle annually .

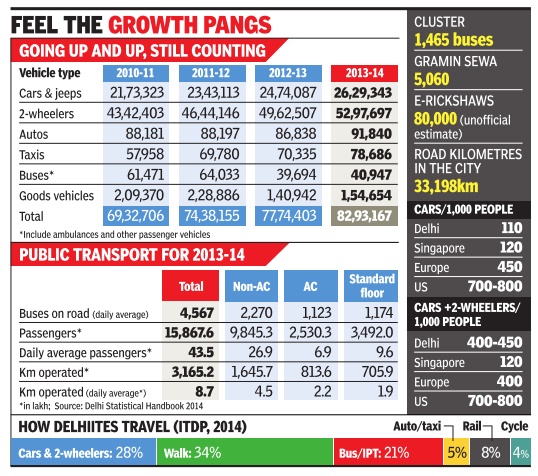

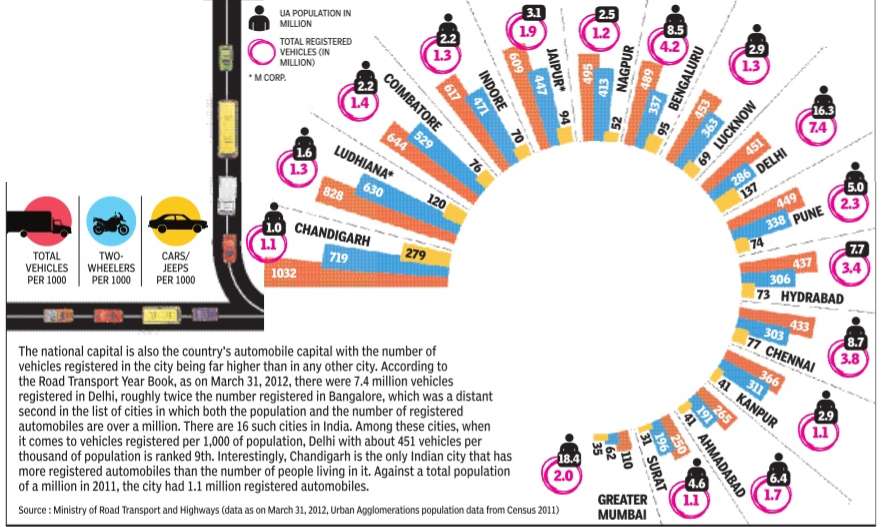

Number of vehicles, city-wise

Quadricycles

The Times of India, Jun 29 2015

Nandini Sen Gupta

Crash test must for quadricycles: Gauhati HC

In an interesting twist to the quadricycle saga, the Gauhati high court has in an interim order directed the central government not to permit auto manufacturers to release and sell small fourwheelers with a mass of up to 1,500kg and quadricycles without putting them to crash-test and emission test. The order says that since the quadricycle is “also a motor vehicle coming within the definition of M1 category,“ the emission norms applicable to the M1 category should have been made applicable to it and not the norms relating to two-wheelers and three-wheelers. The order is important because the quadricycle's crash and emission norms have been a bone of contention in the au to industry. The M1 category comprises passenger vehicles with not more than eight seats in addition to the driver's seat whereas N1 covers goods vehicles having a maximum mass of 3.5 tonnes.

Quadricycles are lightweight four-wheel vehicles meant for intra-city travel. Since the government notified this new category of vehicles on February 19, 2014, several high courts across the country have issued stay orders on their introduction which is why these vehicles have not yet hit the roads in India. However, in March 2015, the Supreme Court transferred to it self several petitions related to the launch of quadricycles and also extended a stay imposed on the orders of several high courts, including those of Delhi, Karnataka and Andhra Pradesh. Its final decision is still awaited.

The Gauhati high court order, delivered by Chief Justice (acting) K Sreedhar Rao and Justice PK Saikia, not only raises the safety and emission requirements for quadricycles but also covers all four-wheeler vehicles-both passenger and goods -with a mass up to 1,500kg. “It is the contention of the petitioners that the small passenger cars produced by the manufacturers in India do not conform to the safety standards,“ said the order.Referring to the European New Car Assessment Programme (ENCAP) test con ducted on Indian vehicles late last year, the order said: “The requirement of air bags and the sturdy frontal body are said to be primary conditions for safety of the driver and other inmates in the vehicle. However, in the test conducted by the ENCAP in November 2014, it is said that all small cars -four-wheelers in particular -of the M1 and N1 categories sold in India have not passed the crashtest and do not conform to the standard of emission test.“

The government recently made it mandatory for new models to meet the minimum frontal and side crash test as well as pedestrian protection test from October 2017 onwards. These norms mean that auto companies will have to install airbags and the anti-lock brake system in all vehicles.

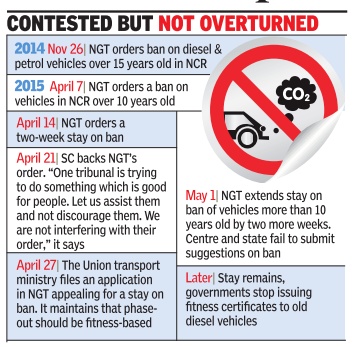

Diesel vehicles, restrictions on

The Times of India, Aug 13 2015

NGT cited apex court order upholding ban

The ban on diesel vehicles over 10 years old in NCR stays, as the National Green Tribunal declined to change its order. It said Delhi government and states that are part of NCR may decide whether to continue to take action against old vehicles. Additional solicitor general Pinky Anand, appearing for the road transport ministry , sought that the order be modified “in public interest“, saying if truckers went on strike -as they were mulling -it would impact supply of essentials to the capital. The government shouldn't be expected to challan them as long as the matter was pending, she urged.

The bench headed by NGT chair Justice Swatanter Kumar responded, “We decline to vary our earlier order. Till disposal of application... it's for the state to challan diesel vehicles or not to prevent... non-supply of essential articles to Delhi.“ ASG Anand had ap proached NGT appeal ing for a modification to NGT's earlier order: “In public interest, at least the state may not be held responsible for challaning of diesel vehicles during the pendency of the application.“ Anand said, “If the transport associations or truckers go on strike because of authorities not issuing them fitness certificates, common people will suffer. That is why we are appealing that the order be withdrawn or modified for the time being,“ Anand said.

The All India Motor Transport Congress in a meeting on August 10 had decided to abandon their commercial vehicles more than 10 years old at the entry point of Delhi at Ghaziabad, Gurgaon, Badarpur and Noida. The purpose was to protest against the nonissuance of re-registration and fitness certificates of diesel vehicles that are over 10 years old by the state govern ments of Delhi, Uttar Pradesh and Haryana, in response to NGT's order of banning these old vehicles.

The tribunal also said the ban on the vehicles over a decade old has been upheld by the Supreme Court and the tribunal cannot go against the apex court's decision.

Anand told the bench that truck operators were mulling a strike and protesting against governments of Delhi, Haryana and UP for not is suing fitness certificates to diesel vehicles more than 10 years old. A strike could mean disruption of the supply of essential services to the city.

In the weeks following NGT's order to ban, Delhi traffic police had impounded about 2,000 polluting diesel vehicles. These were released later on. No more vehicles have been impounded since.

The Centre had moved NGT seeking a stay on the ban order. The ministry has also sought a time of six months to suggest measures to address air pollution. In its application, the ministry had claimed only 7% of the vehicles in the capital are over 10 years old and that any “stringent measure of ad-hoc nature to ban vehicles on the basis of age will not provide any holistic solution to the pollution problem.“

It subsequently submitted several IIT Delhi studies and documents to argue that the transport sector is not responsible for the majority of emissions.

Insurance

No relief if owner negligent

The Times of India, Nov 14 2015

Sana Shakil

No relief if vehicle lost due to owner's fault

The owner of a vehicle cannot claim any compensation from an insurance company in case his vehicle is damaged or stolen due to his own negligence, a trial court said.

The court made the observation while denying an insurance claim to Jamun Pandey , whose truck was stolen after his driver Ram Nandan forgot the keys in the vehicle and left it unattended for some time in an unauthorised area. “The insured vehicle was stolen due to the negligence of the driver of the plaintiff. The plaintiff is guilty of breach of terms and conditions of the insurance policy . I, hereby, hold that the plaintiff is not entitled to any relief of recovery from the defendant as asked for in the plaint,“ additional district judge Kamini Lau said.

The court was hearing a suit filed by Pandey , who had claimed Rs 6.2 lakh from SBI General Insurance Company . The insurance policy was valid from December 14, 2012-December 13, 2013, and Pandey's truck went missing on October 25, 2013, from a spot near Pratap Nagar Metro station. Pandey , in his plaint, said he was entitled to get the insurance amount according to the company's policy . However, the company strongly opposed the plea, saying that Pandey was guilty of gross negli gence that led to the theft. The court agreed with the defendant's submission and pointed out several discrepancies in Pandey's plaint.

“...Therefore, in view of these four different versions regarding the details of the theft, it is clear that Pandey and Nandan are only trying to cover up their negligence in safeguarding the insured vehicle against loss or damage,“ the court said.

Discussing the facts of the case, the judge said, “The sta tement that one key had gone with the vehicle clearly establishes that Ram Nandan had left it in the vehicle, while leaving the truck unattended for at least one hour fifteen minutes as per his own admission.But from the record of the FIR, the time appears to be much longer since the information of the theft was given to police in writing at 8.30am on October 25, 2013, in spite of the distance of the police station from the place of theft being merely a kilometer away“.

2015: The big Volkswagen recall

The Times of India, Dec 02 2015

Pankaj Doval & Dipak Dash

VW recalls 3.2L cars, may halt sale of diesel models

Embattled German auto major Volkswagen Group may halt the sale of a number of its diesel engine models in India across brands like VW , Audi and Skoda over the global diesel emissions cheating scandal that saw it recall 3.24 lakh cars on Tuesday, making it the biggest-ever such exercise. Weeks after a government testing agency saw various models of the group spewing higher levels of pollutants than lab results -similar to the results in the US where the scandal first broke out in September this year -the VW Group refused to admit to fixing an emission cheating software. But soon after a meeting with government officials on Tuesday afternoon, VW announced the “voluntary recall“.

Company sources indicated that the group will fall in line, although there was no official comment on the issue. Most of the major models sold by the VW group will be covered in the recall exercise as the spiked machines carry 1.2-litre, 1.5litre, 1.6-litre and 2-litre diesel engines. The engines are derivatives of the EA189 diesel engine family where the cheating software was installed globally to buck tough emission norms and achieve higher efficiencies.

For Audi, the models where the recall will be announced included the A4 and A6 sedans and the Q3 and Q5 SUVs.For Skoda, the affected models include Fabia com pact and Rapid, Laura and Superb sedans and the Yeti SUV . The cars impacted are those that have been sold between 2008 and till the end of November this year.These are approximately 198,500 cars from VW, 88,700 cars from Skoda and 36,500 cars from Audi across the various models.

An official source said that the group was “nearly made to admit guilt“ as the government presented it with the findings of Automotive Research Association of India (ARAI).

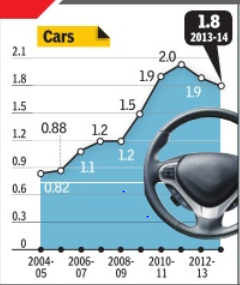

2015, Jan- Aug: Types of vehicles registered in Delhi

2012-15: Three manufacturers dominate

The Times of India, January 28, 2016

Nandini Sengupta

Top 3 auto cos hold 70% mkt share' India is the only country in the world where the top three auto manufacturers increased their market share to 70% for April-December 2015 compared to 67% in 2012, as per industry data. The pecking order has largely remained unchanged in the last five years. Also, the share of the top 10 models in the total sales has remained more than 50% for the last three years. The only change in the pecking order has been Mahindra & Mahindra moving into the third slot in 2013-14, ousting Tata Motors. Auto marketers say this overwhelming dominance of a few players in a market, which has 18 car and SUV manufacturers, is something peculiar to India alone. R S Kalsi, ED (marketing & sales), Maruti Suzuki India, said, “There is no other example of this trend anywhere else and the highest marketshare by a single company , apart from Maruti in India, is Toyota in Japan with around 30%.“

The top two's dominance of the market becomes obvious when one considers that their incremental volumes are more than what some of their competitors sell in a year. Rakesh Srivastava, senior VP (sales and marketing), Hyundai Motor India, said, “Last year, our sales went up 16% to 4.76 lakh units in the domestic market and this incremental increase is higher than the annual sales volume of 10 auto companies in India.“

Experts say part of this is due to the early mover advantage and the ability to focus on a solid distribution channel. Maruti Suzuki, for instance, has 1,750 showrooms and 3,000 workshops, while No. 2 player Hyundai has 1,070 showrooms, 370 used car outlets and 335 rural sales outlets.

But part of it also has to do with the existing car pool and the Indian customer's comfort level with a productbrand that has strong resale value. Indeed the three years of slowdown has reinforced the customer's tendency to go with what's tried and tested. “Typically Indian customers are willing to experiment during an economic growth phase, but in a slowdown they stick to tested and trusted products,“ Srivastava said.

Premium compact segment

Nov, Dec 2015: Baleno vs. i20

The Times of India, January 19, 2016

Pankaj Doval Baleno No. 1 premium compact, beats i20

The battle between Maruti Suzuki and rival Hyundai is getting intense.Maruti's premium compact `Baleno', within months of launch from a new retail format Nexa, has overtaken Hyundai's best-seller `Elite i20'.The new Baleno is one of Maruti's most ambitious products and is the mainstay for Nexa channel at present, which is aimed at premium and upmarket customers. Maruti Suzuki sold 10,572 Baleno in December compared to 10,379 Elite i20 by Hyundai, numbers released by industry body Siam showed. In November, Maruti sold 9,074 Baleno as against 10,074 Elite i20 by Hyundai.

Maruti's surge in the category comes at a time when it is set to challenge the Korean ri val in the SUV category as well. While Hyundai has been going strong with newly-launched `Creta', Maruti will un veil `Vitara Brezza' at the Delhi Auto Expo next month. It plans to commercially launch the SUV around March.

The Baleno -which carries a 1.2-litre petrol engine and a 1.3-litre diesel variant with key safety features such as dual air bags and ABS as standard -was launched by Maruti on October 26 with an aggressive entry price of Rs 4.99 lakh (ex-showroom Delhi) for the entry petrol variant (this went up to Rs 5.11 lakh after a price hike earlier this month). The base diesel variant costs Rs 6.21 lakh.The Elite i20's base petrol variant costs Rs 5.36 lakh, while the diesel version comes for Rs 6.47 lakh.

When contacted, Maruti officials said the Baleno now commands a waiting period.“The response has been strong, and we expect that the demand will remain robust in the coming months as well,“ said Partho Banerjee, senior VP at the company , who heads the Nexa channel.