Automobile industry: India

This is a collection of articles archived for the excellence of their content. |

After-sales service ranks

2014-2015, company-wise

- Honda and Maruti Suzuki rank highest after-sales customer service

- Maruti Suzuki holds this position for the 17th consecutive year

- Hyundai and Tata rank third in a tie at 888

CHENNAI: Even as automotive manufacturers collectively improve their after-sales service satisfaction for the eighth consecutive year in India, satisfaction levels and service consistency vary greatly across the regions of the country, according to the JD Power 2016 India Customer Service Index (CSI) Study for the mass market segment released on Friday.

Honda and Maruti Suzuki rank highest in satisfaction, in a tie, with after-sales customer service among mass market brands, each with a score of 901. Maruti Suzuki holds this position for the 17th consecutive year, while Honda ranks highest for the first time. Maruti Suzuki performs well across all factors and Honda shows strong improvement across all factors, with the greatest improvements in service initiation and service quality. Hyundai and Tata rank third in a tie at 888, and are the most improved nameplates in the study.

Overall service satisfaction in the mass market segment in India improved by 14 points to 880 on a 1,000-point scale in 2016 from 866 in 2015. Overall satisfaction in the West region is 900, while overall satisfaction in the North region is 857.

Strong differences in customer behavior, preferences and expectations of their after-sales experiences contribute to the substantial disparity in the regional scores. For example, 82% of vehicle owners in the West region schedule an appointment for their service visit, while only 55% of customers in the North region schedule their appointment, affecting dealers' ability to effectively manage unscheduled workload and maximize throughput. Additionally, owners in the North region drive their vehicles an average of 11% more than those in the other three regions in the first 12-24 months of ownership, indicating that dealers in the North region have to account for more wear and tear issues when customers bring their cars in for service.

"In an astoundingly diverse market like India where every region and state has its own unique characteristics and needs, dealers need to capitalize on every customer interaction opportunity to develop points of differentiation and deliver on those expectations," said Mohit Arora, executive director at J.D. Power. "By being attuned to the differing customer needs across the country, dealerships can continuously adapt their service processes to consistently deliver a superior customer experience."

The study finds that dealers are improving in their communication activities with their customers at every service juncture, and that is having a positive impact on overall satisfaction. Nearly nine in 10 (89%) customers say they were reminded by the dealership about their vehicle service, an increase from 86% in 2015. Additionally, 93% of customers say their service advisor ensured that they fully understood the scope of work being performed on their vehicle, up from 90% in 2015. Following their service, 89% of customers say they were informed about when to schedule the next visit, up from 83% in 2015. Overall satisfaction among customers who receive all three of these communications is 899, compared with 818 among those who do not receive such communications from their dealers.

"Dealers are at the frontline of interacting with customers and hence represent the automotive brand that they carry," said Kaustav Roy, director at J.D. Power. "It's critical that every communication milestone is handled properly. Any gap in communication may have the unintended effect of lowering satisfaction, as well as customer loyalty, and the negative impact may be magnified when it gets passed on through word of mouth."

Among customers who are highly satisfied with their dealer service (overall satisfaction scores of 980 and above), 92% say they "definitely would" revisit their service dealer for post-warranty service, compared with only 44% of dissatisfied customers (818 or lower). Furthermore, 93% of highly satisfied service customers say they "definitely would" recommend their service dealer to family and friends. In contrast, only 50% of dissatisfied customers intend to recommend their dealer.

Now in its 20th year, the study measures new-vehicle owner satisfaction with the after-sales service process by examining dealership performance in five factors (listed in order of importance): service quality; vehicle pick-up; service advisor; service facility; and service initiation. The study examines service satisfaction in the mass market segment. Satisfaction is calculated on a 1,000-point scale.

The 2016 India Customer Service Index (CSI) Study is based on responses from 7,843 new-vehicle owners who purchased their vehicle between May 2014 and August 2015. The study was fielded from May through August 2016

Automobile manufacturing hubs in India, state-wise

2016

The Times of India, September 11, 2016

Swaminathan S AnklesAria Aiyar

Tata shifted its Nano plant from Singur to Sanand, Gujarat. Can acquisition of land at Sanand be struck down as not serving a public purpose? Many states competed to attract the plant. Gujarat won by offering cheap land, tax breaks and concessional finance. Can all these be struck down too? Gujarat has long been highly industrialised but dominated by oil and chemical industries creating few jobs. Narendra Modi as chief minister visualized the Sanand plant as not just a Tata factory but an incubator of auto ancillaries and skills that would make Gujarat a major auto hub with lakhs of jobs, like Delhi, Maharashtra and Tamil Nadu.

Events have vindicated him. The Nano itself was a giant flop, and Tata will have to shift to other models.But the project created many auto ancillaries and skills that have indeed attracted several other auto majors, and converted Gujarat into an auto hub. Tata may have failed but Gujarat has succeeded.

Ford built its first plant in Tamil Nadu but moved to Gujarat in 2015 for its second plant. Honda and MarutiSuzuki, both of which began with car factories near Delhi, are now building new plants in Gujarat.Maruti-Suzuki will be by far the biggest investor, with an initial capacity of 250,000 carsyear rising to 1.5 millionyear with an outlay of a whopping Rs 18,500 crore. AMW Motors has built a heavy truck plant with a capacity of 50,000 heavy trucks per year. Atul Auto, a producer of commercial three wheelers, is planning a second plant near Sanand.

Honda Motorcycle and Scooters India has set up a plant producing 1.2 million Activa scooters per year.Hero MotoCorp is constructing a plant with an initial capacity of 1.2 million two-wheelers, to be raised to 1.8 million. Gujarat will span the full range from two-wheelers to cars to trucks.

The Nano factory initially spawned 41 auto ancillary plants. The number is projected to rise to 350, mostly in the Sanand-Mandal-Becharaji region. The big names include Canada's Magna International, Germany's Bosch and Switzerland's Oerlikon. Old-time tyre-makers Apollo and Ceat have been joined by newcomers like Taiwan's Maxxis Tire, Yokohama Tyres and MRF.

These successes more than compensates for the failure and likely closure of the state's first auto plant of General Motors at Halol. This was in any case too small to spark an auto hub. Sanand has the requisite scale.

In sum, forced acquisition is usually wrong, and Gujarat has rightly shifted mainly to negotiated land purchases. But there can be exceptions that justify acquisition, and the auto hub in Gujarat is one such example.

Automobile sales

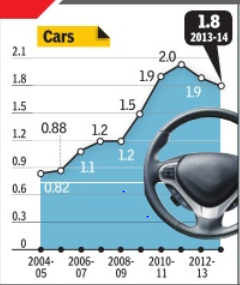

2004-13: Sales of cars in India

See graphic:

Sales of cars in India, 2004-13

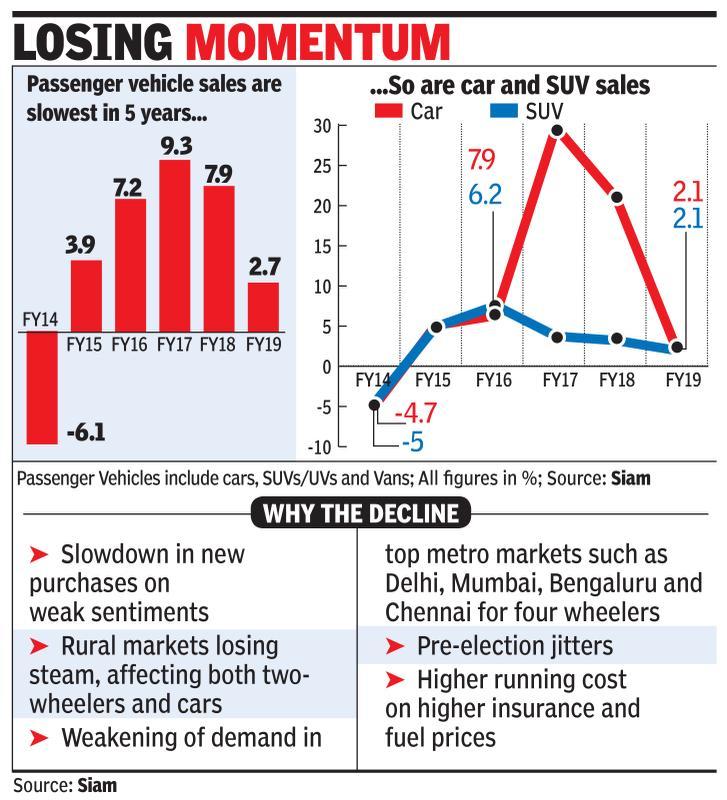

2014-19

Both 2014 and 2019 were election years.

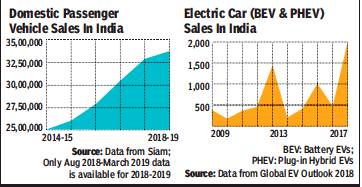

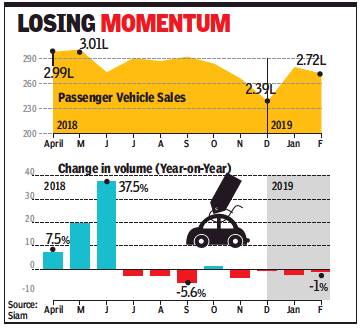

From: Pankaj Doval, April 9, 2019: The Times of India

See graphic:

Passenger vehicle sales in India, 2014-19;

Both 2014 and 2019 were election years.

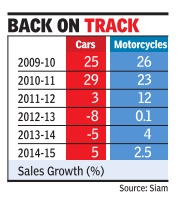

2009-15: 5% growth

Apr 11 2015

Pankaj Doval

Car sales up after 2 yrs of decline

After two successive years of decline, car sales registered a 5% growth in the financial year (2014-15). But the revival may not be sustained in the current financial year due to an adverse impact on the rural economy after unseasonal rains.

Car sales fell 5% in 2013-14 and 8% in 2012-13 as high interest rates and growing fuel prices had dampened buyer sentiment.

The car industry has started showing some positive traction after entry of the Narendra Modi government in May last year. Modi's entry , which revived hopes of an economic turnaround, also coincided with a cut in fuel prices and a marginal reduction in interest rates. These positive factors, coupled with a low base year, led to a growth in sales numbers.

But a weak rural economy may play spoilsport. The difficult journey of the rural economy started last year with a deficient monsoon. This year also, unseasonal rains have damaged rabi crops.

The impact of an affected rural economy is already visible on the sales of motorcy cles, which grew only 2.5% in 2014-15, lagging a 25% growth witnessed by scooters. Sales of bikes fell 6% during the last quarter of 2014-15. Analysts said with rural economy playing an increasingly bigger role in the sales of small cars and motorcycles, an adverse demand impact here could hit the overall sales momentum.

“We are already feeling the pressure of a slowdown in the rural economy ,“ Vishnu Mathur, DG of industry body Society of Indian Automobile Manufacturers (Siam), told TOI.“Sales in the rural regions are critical for growth in some of the important categories, especially motorcycles.“

According to some estimates, rural economy accounts for around 30% to total sales of car makers -especially in case of mass-market manufactur ers like Maruti and Hyundai, while in motorcycles, the share has reached nearly half.

“Market sentiment in some rural areas has been impacted due to various factors, including the curtailment of national rural employment guarantee act (NREGA) spends, poor crop realisation and moderating wages,“ an official at top twowheeler maker Hero MotoCorp said. “The industry has, therefore, felt some impact in retail off-take in markets such as Bihar and Madhya Pradesh and sugar cane-growing areas in Uttar Pradesh and Maharashtra.“

The scooter category , however, is somewhat insulated from the agri pressure as it has abig share of the urban market.

The weak trends in rural India are worrisome for car manufacturers, which had turned their focus on agri-led regions.

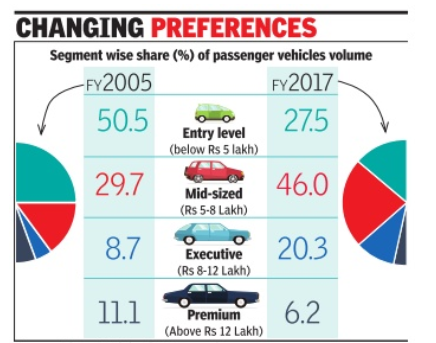

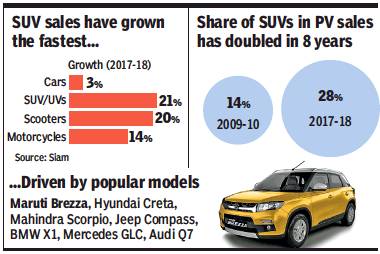

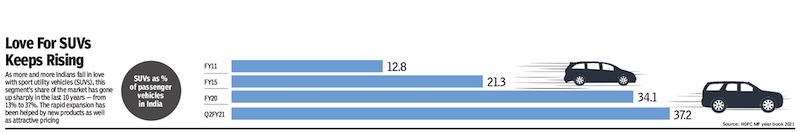

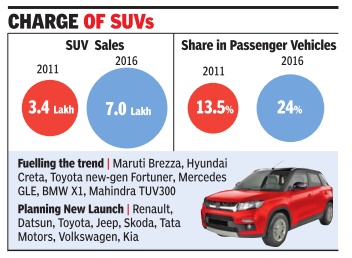

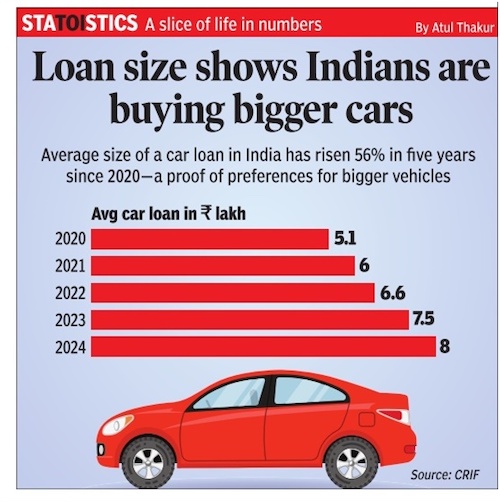

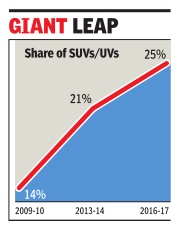

2009-18: SUV sales grow 7x faster than cars

Pankaj Doval, SUV sales grow 7x faster than cars, April 14, 2018: The Times of India

See graphic:

i) Passenger vehicle sales, 2009-18: Share of SUV sales;

ii) Growth of sales of SUVs and cars, 2017-18.

ii) Growth of sales of SUVs and cars, 2017-18.

From: Pankaj Doval, SUV sales grow 7x faster than cars, April 14, 2018: The Times of India

If you thought that small cars and sedans are where the heart of the Indian buyer is, think again. Sale of SUVs grew seven times faster than that of passenger cars in 2017-18, the trend being fuelled by new models and changing lifestyles. While small cars and sedans managed a growth of 3% in the last financial year, the sales of off-roaders grew 21%, the fastest in the personal commuter segment, which also includes scooters (20% growth) and motorcycles (14%). And, the share of SUVs in overall passenger vehicle sales rose to nearly 30% in 2017-18, compared to 14% recorded at the end of March 2010.

According to numbers released by the Society of Indian Automobile Manufacturers (Siam), 9.2 lakh SUVs were sold in 2017-18 against 7.6 lakh units in the previous year. The non-SUV segment (compact cars and sedans), while accounting for larger volumes, has been nearstagnant in terms of growth — sales stood at 21.7 lakh units in 2017-18 against 21 lakh units in 2016-17.

Market analysts said the trend is only going to get stronger as SUVs will continue to remain favourite with Indian buyers and companies will drive in new models. “SUVs are the order of the day, in line with global trends, and will continue to remain strong,” Rakesh Srivastava, director (sales & marketing) at Hyundai India, told.

For Hyundai, share of SUVs in total sales has grown to a little over 20% now, against less than 10% before 2015. The company’s entry SUV Creta (price starts from under Rs 10 lakh), has driven this change. “SUVs are naturally suited for the Indian geography with a large road network. Their strong body architecture, higher seating position and relatively-larger cabin space make them highly desirable with buyers,” Srivastava added.

Affordability has helped SUV sales too

Affordability has also led to the rise in sales of SUVs. Models such as Maruti’s Brezza and Ford’s Eco Sport are priced under Rs 10 lakh, enabling many people to fulfil their desire to own an off-roader.

“SUVs have always been highly aspirational. Earlier they were very expensive. With the entry of affordable options, people have really fallen for them. For many, SUV is a lifestyle statement and an extension of their personality,” said a senior industry official, requesting anonymity.

But while affordability is driving in volumes, the trend is equally strong in premium and luxury categories. Jeep Compass (starting from Rs 15 lakh), the first locally-built SUV from Fiat Chrysler India, has seen a strong response.

“The Compass took consumer aspiration to the next level. We have already sold over 20,000 units in just eight

months, and are working on new orders,” a senior official at Jeep’s parent Fiat Chrysler said. “This kind of demand demonstrates Indian market’s appetite for SUVs.”

The company is now working on another SUV Renegade, to be priced lower than Compass.

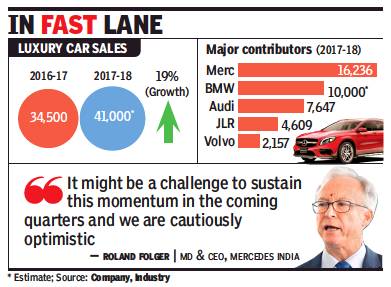

Mercedes-Benz, that leads the luxury market in India, gets nearly 35% of its sales from SUVs, including models such as GLC and GLE. “Indian customers have a penchant for SUVs and they are preferred for better road presence, proven off-road capabilities, practicality, and also for travelling with families,” Roland Folger, MD & CEO of Mercedes-Benz India, said.

Folger said even women buyers are taking a higher interest in owning and driving SUVs. “They find SUVs to be practical, comfortable, and safer.” Industry officials estimate that the share of SUVs in overall passenger vehicle sales may further move up beyond 30%, on the back of strong demand and new models.

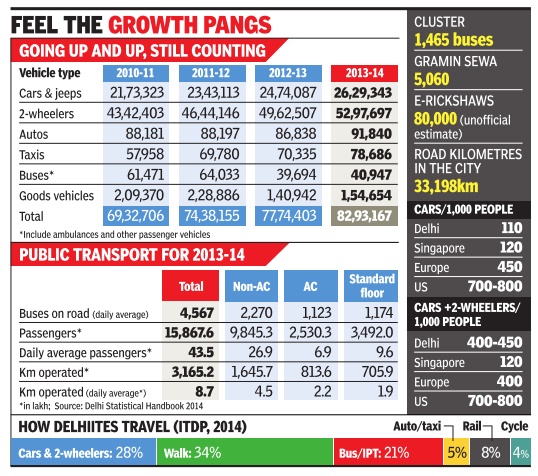

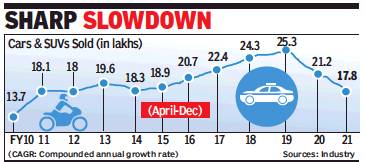

2010- 2021 Jan

Nandini Sengupta, January 22, 2021: The Times of India

From: Nandini Sengupta, January 22, 2021: The Times of India

Increased cost of ownership, high base effect and lower disposable incomes pushed car sales growth to just 1.3% during 2015-20, a dip from 6% in the preceding five-year period. Compounded sales growth of cars and sports utility vehicles between 2005-10 was 13%, which slowed to 6% in the next five-year block, and further slowing to just 1.3% now.

But one of the big reasons for the drop is the slowdown in economic growth. “The pace of growth for the passenger vehicle segment was high in the 2000-2010 period due to strong economic growth, new model launches and reduction in excise duty in 2005-06. After that, growth slowed due to moderation in economic growth and increase in cost of ownership due to high fuel cost in 2012-13. Since 2015, sales have been impacted due to regulatory norms and demonetisation, among other factors,” said Crisil director Research Hetal Gandhi.

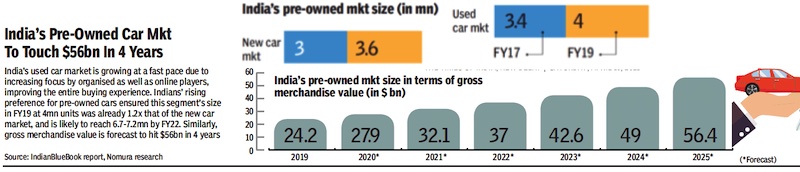

Of course, a sharp slowdown in previous year and the pandemic this year has slowed down momentum. “The growth pace tapered off from 2012 onwards and has since then stayed range-bound because it is a reflection of the performance of the economy and the resultant consumer sentiment,” said ICRA VP Ashish Modani. “A significant growth in the pre-owned car market has offered a new value proposition. As the car park grows and consumer buying behaviour changes, there is bound to be an impact on overall growth,” said E&Y head (auto sector) Vinnay Raghunath. Some feel that increasing cost of ownership has spooked sales growth. “Cost of ownership has been going up sharply due to regulatory changes (BS4, BS6 emission norms), taxes, insurance, road tax and increase in material costs. In the last 10 years, there has been a 60% increase in on-road price of cars and SUVs due to this cost pile-up,” said Maruti Suzuki India executive director (marketing & sales) Shashank Srivastava. A premium hatchback car with an ex-showroom price tag of just over Rs 5 lakh in 2010 and below Rs 6 lakh after road tax and insurance now costs Rs 9.55 lakh on road.

“The base effect is of course one reason why the CAGR has slowed down, but the good news is apart from last year (slowdown) and this year (pandemic),” said BMW Group CEO Vikram Pawah.

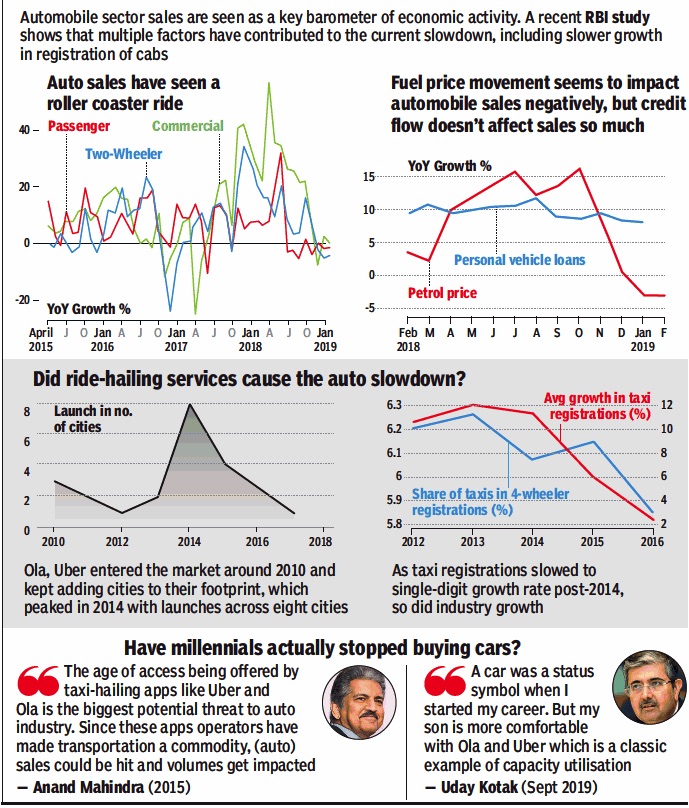

2010-18: Impact of Ola/ Uber on sales

From: Sep 12, 2019: The Times of India

See graphic :

2010-18: The impact of Ola/ Uber on Automobile sales

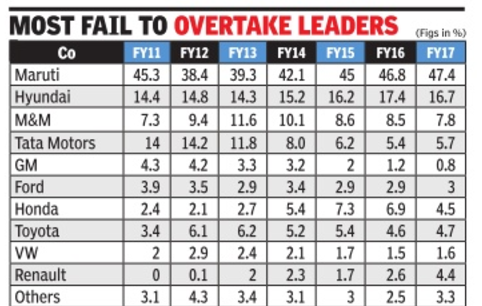

Nandini Sengupta|Top car cos maintain mkt share growth|Jul 15 2017: The Times of India (Delhi)

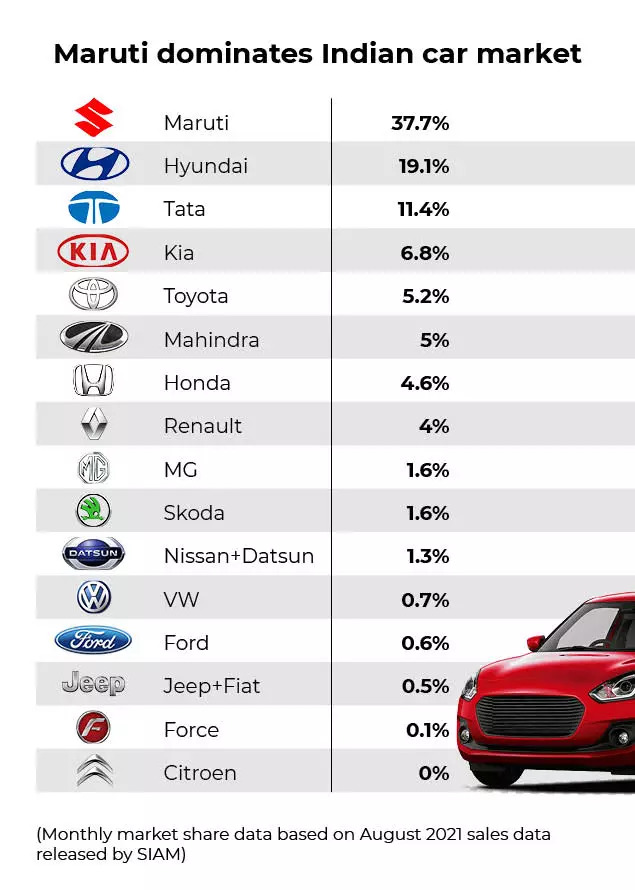

Big gets bigger, small becomes smaller: The Indian passenger vehicle market has become a losing market share game for the vast majority of players apart from the top 3 and the rare exception of Renault.According to SIAM data, market leader Maruti has seen a steady upswing in market share since FY12. Arch rival Hyundai too has remained on the upward curve, though it did slip a little in FY17. M&M has been up since FY11, but has gone flat negative in the last three fiscals. As for the rest, even big MNC names like Toyota and Ford have remained flat market share-wise, even as Honda and Volkswagen have slipped.Tata Motors has been one of the biggest losers, seeing its market share come down to less than half (see table). Maruti's market share climb -up to 50.4% by June 2017 -is on the back of its product pipeline. Between February 2014 and March 2017, it has rolled out seven new products -Celerio, Ciaz, S-Cross, Baleno, Vitara Brezza, Ignis and Baleno RS. In FY 17-18, too, it plans to bring two new models and two upgrades. Unsurprisingly , Maruti has outpaced the industry in growth for five years.

Said K Ayukawa, MD & CEO, Maruti Suzuki, “There are over 18 players in the market. Our target is to focus on our business and achieve our target of 2 million unit sales in 2020. Our endeavour will be to study our customers' demands and offer them a range of products. If we listen to them carefully, market share will follow.“

Top officials say that's because Hyundai has not had any mass-market launches in FY17.Its only launch Tucson is a high-end niche SUV . Said Rakesh Srivastava, senior VP (sales & marketing), Hyundai Motor India, “Building processes and services to consistently gain customer confidence, building an aspirational premium brand, product launches in the volume segment with high price-value proposition and strong, extensive channel partners -this is the recipe to gain market share in India.“ Brands that are floundering are doing so because they don't tick one or more of these four boxes.

Indeed, Renault's jump from 1.7% in FY15 to 4.4% in FY17 has been driven by the success of the Kwid.

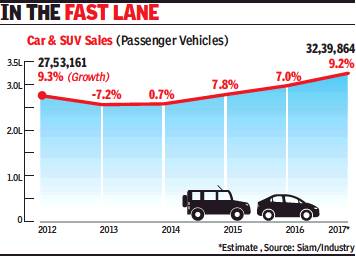

2012-17: Car and SUV sales

From: Pankaj Doval, Car sales grow highest in 4 years to cross 3m in 2017, January 2, 2018: The Times of India

As We Enter 2018, Industry Shrugs Off DeMon, GST Impact

A ‘double Diwali’ in 2017 — on the back of advancement of purchases due to the GST rollout — ensured that car and SUV sales rose the fastest since 2013 and crossed the 3-million mark for the first time ever. Even the demonetisation blues could not curb spirits as new models — especially SUVs — and attractive discounts aided the near 10% surge in volumes.

According to initial industry estimates, passenger vehicle sales in 2017 grew by 9.2% to nearly 3.2 million against 2.9 million units in 2016. “These are initial estimates, and the final numbers could be even higher,” an industry source said.

The growth comes despite doubts at the beginning of the year over where the industry had been heading. The start of the year was nearly at the peak of demonetisation (announced on November 8, 2016) and buyers — short of cash — were keeping off showrooms and new purchases.

“The industry has done well, and we are looking forward to the new year now,” Maruti chairman RC Bhargava told TOI. The company sold a record 1.6 million cars in 2017 at a growth of 15%, and this meant selling one in every two cars.

After the initial fears around demonetisation, things started turning around as pent-up demand was unleashed on fears of a duty hike in the GST regime that was rolled out from July. Rakesh Srivastava, director (sales & marketing) at Hyundai India, said, “The GST implementation had led to uncertainty and fear in the minds of people who thought that prices will go up. This led to strong growth in April-June period.”

Another factor that aided the demand was good monsoon that saw good uptake in rural and semi-urban areas. Sugato Sen, deputy DG at industry body Society of Indian Automobile Manufacturers (Siam), said, “On an average, rains were much better than the last two-three years. This helped in realising higher rural demand.”

Company executives said that the festive season also remained “fruitful”, which helped in the continuation of the momentum. “Even as we have crossed an all-time high, we expect 2018 also to be good. The economy should do well, and help the market respond positively,” Sen said.

SUVs have been a big driver in boosting the demand for passenger vehicles, and much has been riding on models such as Maruti’s Brezza, Hyundai’s Creta and the newly-launched Jeep’s Compass.

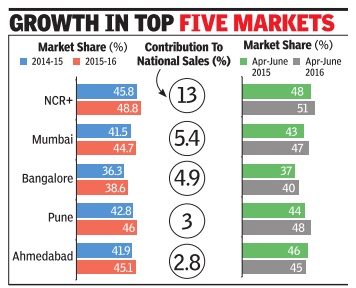

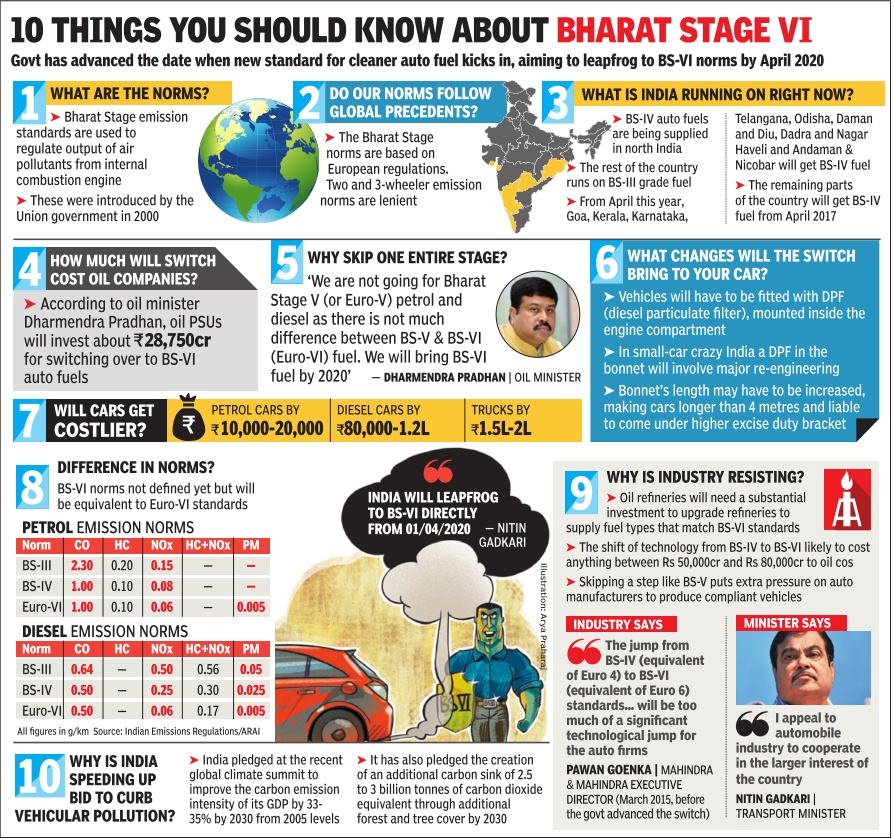

The Times of India, Sep 10 2016

Nandini Sengupta

A new focus on utility vehicles, a premium channel in Nexa and marketing aggression has helped Maruti Suzuki increase its marketshare in all the top 11 cities that form the creamy layer of the passenger vehicle market in India. The company has gained between 1-3% across the top car cities in India --DelhiNCR region, Mumbai, Bengaluru, Chennai, Pune, Ahmedabad, Hyderabad, Kolkata, Kochi, Jaipur and Lucknow.Collectively these top 11 cities comprise 40% of Maruti's total domestic sales.

“Enhancing market share in the top cities has been one of Maruti Suzuki's major achievements in the recent past. Our network is these markets is much stronger. Nexa has redefined the purchase and ownership experience. But it is our products that have played a key role: the design, features, safety and technologies like mild hybrid and AMT have made our vehicles much more appealing for urban customers,“ said R S Kalsi, executive director, marketing & sales, Maruti Suzuki.

The highest gain has been in the Delhi-NCR region whe re the company's marketshare has risen from 45.8% in FY15 to 48.8% in FY16 and 51% in Q1 of FY17 (see table). In Mumbai, Maruti's marketshare has increased from 41.5% in FY15 to 44.7% in FY16 and 47% in Q1 of this fisccal.Marketshare in Bengaluru is up from 36.3% fiscal before last to 38.6% last financial year to 40% this Q1. Collectively, these three cities comprise over 23% of Maruti's national sales. There are 17 auto companies jostling for a footprint in the passenger vehicle market.

The urban focus has helped Maruti gain marketshare at a time when poor rainfall caused rural markets to shrink. The Nexa network not only strengthened the urban focus but also helped aggressively sell vehicles to suit the changing taste of these markets.

2011-20

From: February 24, 2021: The Times of India

See graphic:

SUVs as % of passenger vehicles in India, FY11- Q2 FY21

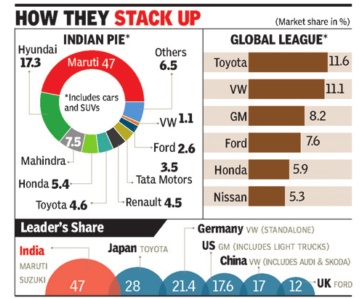

2012-15: Three manufacturers dominate

The Times of India, January 28, 2016

Nandini Sengupta

Top 3 auto cos hold 70% mkt share'

India is the only country in the world where the top three auto manufacturers increased their market share to 70% for April-December 2015 compared to 67% in 2012, as per industry data. The pecking order has largely remained unchanged in the last five years. Also, the share of the top 10 models in the total sales has remained more than 50% for the last three years. The only change in the pecking order has been Mahindra & Mahindra moving into the third slot in 2013-14, ousting Tata Motors. Auto marketers say this overwhelming dominance of a few players in a market, which has 18 car and SUV manufacturers, is something peculiar to India alone. R S Kalsi, ED (marketing & sales), Maruti Suzuki India, said, “There is no other example of this trend anywhere else and the highest marketshare by a single company , apart from Maruti in India, is Toyota in Japan with around 30%.“

The top two's dominance of the market becomes obvious when one considers that their incremental volumes are more than what some of their competitors sell in a year. Rakesh Srivastava, senior VP (sales and marketing), Hyundai Motor India, said, “Last year, our sales went up 16% to 4.76 lakh units in the domestic market and this incremental increase is higher than the annual sales volume of 10 auto companies in India.“

Experts say part of this is due to the early mover advantage and the ability to focus on a solid distribution channel. Maruti Suzuki, for instance, has 1,750 showrooms and 3,000 workshops, while No. 2 player Hyundai has 1,070 showrooms, 370 used car outlets and 335 rural sales outlets.

But part of it also has to do with the existing car pool and the Indian customer's comfort level with a productbrand that has strong resale value. Indeed the three years of slowdown has reinforced the customer's tendency to go with what's tried and tested. “Typically Indian customers are willing to experiment during an economic growth phase, but in a slowdown they stick to tested and trusted products,“ Srivastava said.

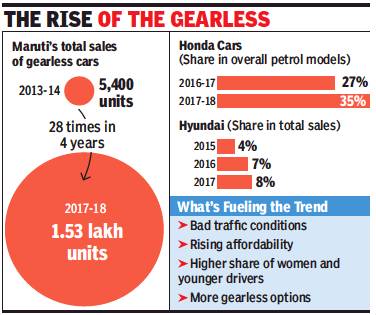

2013-17: rise in the sales of gearless cars

Pankaj Doval, Automatic car sales in top gear, June 11, 2018: The Times of India

From: Pankaj Doval, Automatic car sales in top gear, June 11, 2018: The Times of India

Blame it on the stress of driving in choked cities, or simply the ease and rising affordability that automatic cars offer, Indians are increasingly going in for these vehicles that give you the comfort of driving without having to worry about gear-shift and clutch.

While being bought only by a few just some years back, gearless cars have seen a substantial growth over the last three to four years, especially as their prices have become more affordable and their performance has gone up manifold — the mileage is equal, or even a little more than the conventional manual variants.

The introduction of lowcost gearless technologies such as AMT (automated manual transmission) by top carmaker Maruti in mass models, such as the Alto, has only strengthened the trend, prompting others to also work towards the cheaper technology. Hyundai will be launching an AMT version in its all-new small car (Santro replacement) that it drives in towards the end of this year.

The numbers are telling: Maruti, which sold just around 5,400 gearless cars four years back, has seen its sales jump to over 1.5 lakh cars in 2017-18. This is now nearly 10% of the company’s annual sales. The company clearly expects more sales of the gearless cars. Maruti Suzuki director (marketing and sales) R S Kalsi says, “With enhanced awareness and deeper penetration, we aim to sell over two lakh cars with AMT in 2018-19.”

Expectedly, the demand is being generated in metro cities and top towns — where there are higher disposable incomes, but also increasing burden on drivers due to heavy traffic conditions. Cars being used by more than one family member, especially the lady in the house, is also leading to higher sales of gearless cars — which are easier to drive.

Hyundai India sales and marketing director Rakesh Srivastava says, “The percentage of auto is far higher in bigger cities such as Delhi, Mumbai, Kolkata and Bengaluru due to traffic challenges. People associate gearless with stress-free driving.”

Honda Cars India director of sales & marketing Rajesh Goel says, “Mostly, our gearless CVTs (continuously variable transmission) offer better fuel efficiency than manual versions.”

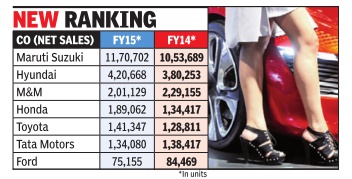

2014, 2015: Car sales, company-wise

The Times of India, Jun 23 2015

Nandini Sengupta

Toyota Replaces Tata Motors As Fifth Largest Car Maker

M&M lone Indian auto co in top 5

There has been a shift in the pecking order of car and SUV companies in India with the fourth, fifth and sixth spots showing significant changes. According to statistics from the Society of Indian Automobile Manufacturers (SIAM), the top five passenger vehicle companies in India by sale are Maruti, Hyundai, Mahindra & Mahindra, Honda and Toyota. Tata Motors, which was in fourth place in fiscal 2014, slipped to sixth place in FY2015. Ford India is the seventh company in the top sellers' list. As a result of this rejig, M&M is now the only Indian brand among the top five passenger vehicle companies in India.

Indeed, Maruti, Hyundai and M&M have retained their earlier positions in FY2015 as well. Maruti, with 11,70,702 units in sales, remains top seller in FY2015 as well, increasing its tally from 10,53,689 units the year before.

Hyundai, in second position with 4,20,668 units, has also increased its tally from 3,80,253 units in FY14. M&M in third position, though, is lower in terms of sales at 2,01,129 units, down from 2,29,155 units in FY14.

The real change though is in the fourth, fifth and sixth slots. Honda, with 1,89,062 units, is the biggest gainer in the fourth position. It was in the fifth position with 1,34,417 units in FY14. Toyota, at fifth position with 1,41,347 units, has also jumped a slot in FY15. The year before it was sixth with 1,28,811 units.

Tata Motors lost two slots in FY15. With 1,34,080 units, it is now in sixth place whereas in FY14 it was fourth with a nearly similar tally of 1,38,417 units. Ford has remained number seventh, though with a reduced tally -75,155 units in FY15 compared to 84,469 units in FY15.

Industry experts say the change in pecking order is part of a larger churn in the industry as India readies for new emission and safety regulations in two years. N Raja, senior VP & director sales & marketing, Toyota Kirloskar Motor, said, “Customers have started to appreciate and demand safety features in cars, which becomes an important buying parameter. At Toyota, we are happy to contribute to the globalization of the automobile products sold in the country rather than merely chase numbers.“

Others say that individual performances depend more upon the value proposition of the vehicle models and technology will not be market barrier for companies. Vishnu Mathur, director general, SIAM, said, “Once the mandatory regulations come in, the higher technology will be a benchmark for everybody with price-increase a possible small differentiator.“

2014-19: passenger vehicles, electric vehicles

From: July 5, 2019: The Times of India

See graphic, 'Automobile sales in India, 2014-19: passenger vehicles, electric vehicles '

Purchasing patterns

25% cars sold are off-roaders

Pankaj Doval, 1 of every 4 cars sold is off-roader, Jan 12, 2017: The Times of India

The love of Indians for SUVs is getting stronger by the day and one out of every four cars sold in the country is now an off-roader.

The lure of off-roaders -with high ground clearance, macho looks and relatively-powerful engines -is so strong that their sales volumes have more than doubled over the last five years, outpacing the growth of other segments in the car market, such as compact cars and mini sedans.

Rapidly changing lifestyles, increased inter-city travel and proliferation of newer, and budget-friendly models have fuelled the surge, say companies. “It is a disruptive segment, and it is only going to grow bigger and stronger,“ sa id Rakesh Srivastava, senior VP (sales & marketing) at Hyundai India. The company has tasted success with Creta that now accounts for sale of nearly 8,000 units on a monthly ba sis. “The SUV category is attracting buyers even from sedans and MPVs,“ he added.

Officials say that a higher stance, and patchy road conditions prompt many to opt for SUVs. “Even the prices of the vehicles have been coming down over the years, and they have entered the mainstream of the car industry,“ an official with a leading company said.

Maruti's Brezza, which was launched in March last year, is a case in point. The model has quickly raced on to become one of the fastest-growing cars in the market. It has seen sales of 80,000 units in the nine months of its launch, and boasts of a waiting period, that runs into a few months.

N Raja, director of sales & marketing at Toyota Kirloskar, said that people are “bored“ of hatchbacks and mini sedans.

Mercedes Benz's GLE (priced upwards of Rs 50 lakh) and BMW's X1 (starts around Rs 30 lakh) have seen strong demand in the market too.

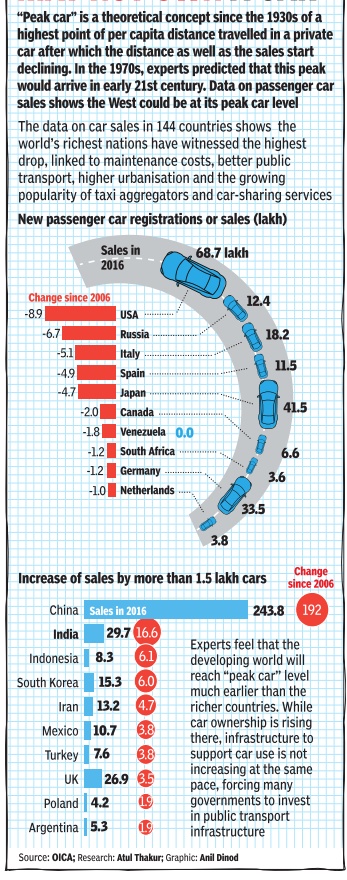

2016: car sales

See graphic.

Passenger car sales in 2016 compared with 2006

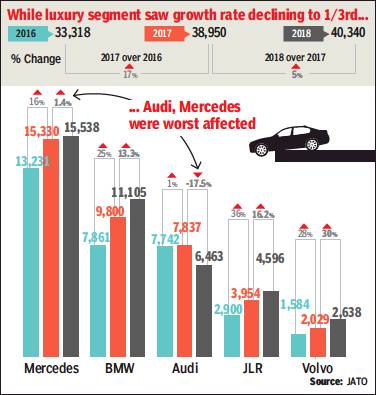

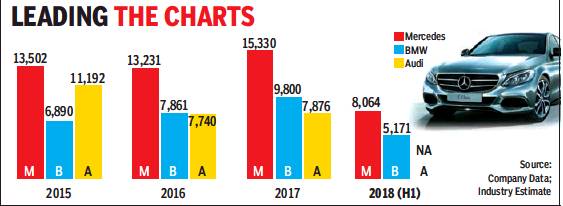

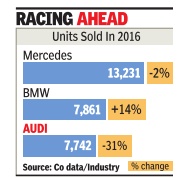

2016>2018: Luxury cars sales slow down

Pankaj Doval, January 17, 2019: The Times of India

From: Pankaj Doval, January 17, 2019: The Times of India

Luxury car sales have decelerated. With the stock market remaining volatile through most of last year and liquidity pressure growing, reluctant buyers stayed away from new purchases or upgrades, leading to 5% growth in volumes in 2018 against a 17% surge in the previous year. Luxury car makers like Mercedes-Benz and Audi are a worried lot, especially as the liquidity crunch is impacting operations of many of their customers. “A large number of our buyers are from the SME sector. When they cannot even procure working capital comfortably, how can we expect them to buy new cars?” one leading luxury dealer said.

Martin Schwenk, newlyappointed MD & CEO of Mercedes India, said there is nervousness in the market. “I am here since last two months, and I have met our dealers, investors and customers. Honestly, I saw a lot of hesitation based on the overall economic development… (the) hesitation is based on volatility in markets, and the credit situation specifically.”

Rahil Ansari, the head of Audi in India, feels that the pain may be there for some more time. “Luxury car purchase is not the biggest necessity that people have currently.” Ansari attributed Audi’s poor showing to the closure of two dealerships in the Delhi-NCR region after the promoter was found to be indulging in unlawful activities.

Rohit Suri, MD of JLR India, said the second half of 2018 was particularly tough due to tight liquidity condition, higher upfront insurance costs and increased lending rates. A low-key third quarter (July-September) impacted the industry as demand was tight on weaker rupee and high fuel prices. Ravi G Bhatia, India president for global automotive data and consultancy firm JATO, said he expects growth to be difficult in the short term. “The segment is weighed down by the burden of excessive duty and lack of aggressiveness from stakeholders to grow the market. We need strong local strategies.”

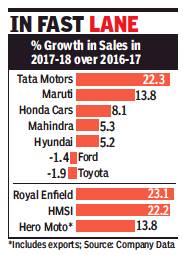

2017-18

Pankaj Doval, High fuel prices can hit momentum, say car cos, April 3, 2018: The Times of India

From: Pankaj Doval, High fuel prices can hit momentum, say car cos, April 3, 2018: The Times of India

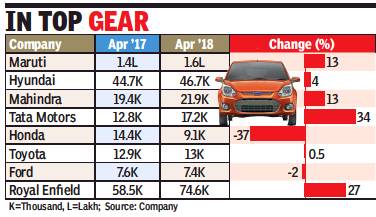

New models and strong demand helped car and SUV sales shrug off the post-GST blues and close 2017-18 with healthy numbers, though high fuel prices and fears of rise in interest rates may dampen the momentum in the current financial year.

Top car makers such as Maruti Suzuki, Hyundai, Mahindras and Tata Motors reported a growth in sales in 2016-17, even though Toyota and Ford failed to keep pace and slipped by around 2%. Models such as Maruti’s new Swift and Brezza mini SUV, Hyundai’s Verna and Tata Motor’s Nexon fuelled demand.

However, companies say 2018-19 may be challenging as some negative factors have been building up over the past few months.

“The industry is on a positive on the strength of macro-economic factors, backed by stability in policies,” Rakesh Srivastava, director (sales & marketing) at Hyundai India said. “Hardening of interest rates and increase in fuel prices could challenge the growth rate, especially in the entry segment, where cost of acquisition and cost of operations are key factors for buyers.” Companies have also been complaining about GST rates on cars, and say these should be reduced to push demand.

“There are headwinds in terms of impending increase in interest rates, crude prices, and inflation,” Ford India MD Anurag Mehrotra said.

Maruti has been growing strongly and has increased share as it expands model lineup and retail presence. The company is getting new vehicles as parent Suzuki is ramping up Gujarat factory premises and investing in additional production lines.

Sales of Tata Motors have grown 22% in 2017-18, led by new models as well as a low base. New cars such as Nexon, Hexa and Tigor have combined well with the Tiago compact.

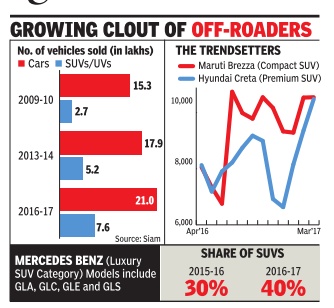

2017-2019: the decline in sales

Atul Mathur, August 15, 2019: The Times of India

From: Atul Mathur, August 15, 2019: The Times of India

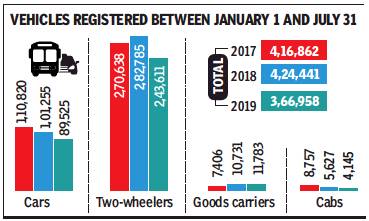

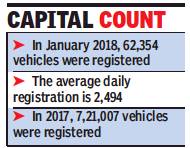

The current slowdown in the automobile industry is reflected in the Delhi market too, with fewer passenger cars and two-wheelers getting registered in the first seven months in 2019 compared with the same period in the last two years.

Except for goods carriers like trucks, tempos and e-rickshaw carts, the capital registered 13.5% fewer vehicles than in 2018. Delhi is known to be the biggest automobile market in the country with the total registered vehicles higher than the combined figures of Mumbai, Chennai and Kolkata.

Data accessed by TOI shows that the sale of motorcycles and scooters, which regularly registered year-onyear growth of 8-9% over the past several years, has for the first time slipped to a negative 13.8% in the first seven months this year. The fall is around 10% when compared with 2017 figures.

The sale of cars, which usually registers an annual growth in Delhi of 5-6%, too has dived 11.6% between January and July this year compared with same period in 2018. The fall is steeper at 19% against the figures in 2017.

Transport department officials said the revenue collection through road tax and registration fees accordingly decreased 2.9% in 2018-19 against 2017-18, collecting as it did, Rs 2,054.8 crore this year, Rs 61 crore less than last year. In 2017-18, the transport department had recorded a growth of 17% in collection of road tax and registration charges, which had totalled Rs 1,808.8 crore in 2016-17. While the transport department officials said the negative growth in the registration of new cars and vehicles could even be attributed to better public transport with the Delhi Metro opening new corridors and its daily ridership going up by almost 2.5 lakh passengers, experts actually link the falling registration numbers with the increase in the on-road price of two-wheelers and people having less disposable income to spend on new automobiles.

“Earlier, a new two-wheeler came with comprehensive insurance of one year. Now, the buyer has to mandatorily purchase five-year insurance with a new scooter or motorcycle,” noted Vishnu Mathur, director-general, Society of Indian Automobile Manufacturers (SIAM). “Also, the vehicle prices have gone up due to the new safety regulations. My estimate is that the on-road price of a two-wheeler has gone up almost 15%. This is a big burden for a middle-class buyer.”

Mathur added that the consumers were also wary of spending money on new vehicles due to financial issues such as the flux in the job market and lack of salary increments. “The banks too are cautious about giving auto loans,” he said.

2017, 2018: cars sold

Pankaj Doval, Driving new models, car cos start FY19 on a high, May 2, 2018: The Times of India

From: Pankaj Doval, Driving new models, car cos start FY19 on a high, May 2, 2018: The Times of India

Car makers started the new fiscal on a strong note even as higher fuel prices and chances of a hike in interest rates may play a spoiler in the coming months. But, forecast of a normal monsoon by the Met department is the silver lining companies are banking on.

Top makers such as Maruti, Mahindra and Tata Motors opened the fiscal 2018-19 with double-digit growth in April as new models and attractive schemes helped sales.

Maruti, which recently drove in the new-gen version of its Swift hatchback, sold a total of 1.6 lakh units in April, a growth of 13% over the 1.4 lakh units sold in the same month last year. Company chairman R C Bhargava has said that Maruti, which will invest Rs 5,000 crore over the next twelve months, expects to grow by double-digit this fiscal after realising a 14% growth last year.

Tata Motors, which has been witnessing a turnaround after encouraging numbers for the Tiago hatchback and the Nexon mini SUV, reported a 34% growth in April volumes at 17,235 units against 12,827 units in the same month last year. “While there were challenges in the market, strong demand for new products led the growth for us,” Mayank Pareek, president of the company’s Passenger Vehicles Business Unit, said. Mahindra and Mahindra, which launched a new version of its XUV5OO SUV, said numbers are higher by 13% at 21,927 units. The company, facing stiff competition from Maruti, Hyundai and Renault, has been working on a revival strategy.

Companies, however, are worried about the impact of higher fuel prices and possible inflationary trends emanating from it. “Increasing inflation trajectory which might weigh on customer’s access and cost to credit, coupled with increasing crude prices, could lead to passenger vehicle industry growing at low single digits,” Anurag Mehrotra, president and MD of Ford India, said. Honda Cars had a 37% decline in volumes, but this is because the company did not deliver the older-generation Amaze to dealerships. The new Amaze is hitting the roads soon, a company official said.

Fuel prices are at record levels at this moment, which companies fear may dampen customer demand. Another point of worry for carmakers is the slowdown in top metros such as Bangalore, Mumbai and even Delhi where generating demand is getting tougher.

The sales in these volume heavy cities have been impacted due to rising acceptance of shared mobility (through companies such as Ola and Uber) and rapidly-improving metro train network. As the infrastructure gets choked, many people prefer to move by cabs rather than driving on their own and getting stuck in traffic jams. Online shopping and the ease of ordering from home is also making people re-think when they consider a new car.

Car sales starting to fall in big cities

From: Pankaj Doval, Jams, app-based cabs, e-shopping drive down car sales in big cities, April 29, 2018: The Times of India

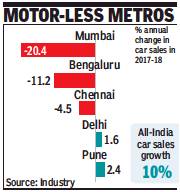

Traffic jams, parking problems, app-based cabs, online shopping and fast-spreading Metro rail networks have resulted in car sales starting to fall in big cities, something many hoped for but few expected to become a reality.

City-specific numbers accessed by TOI from industry sources show car sales dropped 20% in Mumbai in 2017-18 — 97,274 cars sold during the year versus 1.22 lakh in the previous year. Bengaluru, with its choked infrastructure but younger and tech-savvy population, saw car sales fall 11%. The Karnataka capital is India’s second-largest car market after Delhi.

Delhi car mkt sees marginal growth of 1.6%

India’s largest car market, Delhi, recorded a marginal growth of 1.6%, and that too because of the lower base of 2016-17 when diesel car sales were banned for a few months.

Falling or flat metro markets in a year when all-India sales grew by 10% is seen as an evolutionary trend. “Metro cities are seeing challenges in volume growth on account of rising trend of shared mobility through platforms such as Ola and Uber,” says Rakesh Srivastava, director (Sales & Marketing) with Hyundai India. “The other key factor is rapidly growing Metro transportation, especially to key employment hubs such as Gurgaon and Delhi. People prefer to take Metro than driving and getting stuck in jams.”

Industry officials also point to a growing trend of people not planning to buy or sell a second car. “If the woman... of the house earlier had a car for household chores, she now either orders online or calls for an app-based cab. There is no hassle of driving, looking for a parking spot, or getting stuck in traffic,” says an industry veteran. N Raja, deputy MD at Toyota Kirloskar, says fewer purchases by drivers of fleet operators and shared mobility platforms have also contributed to the decline. This has happened because firms such as Ola and Uber have brought down driver incentives.

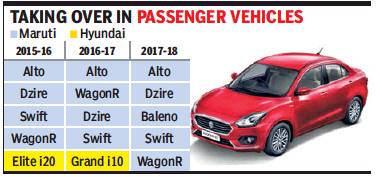

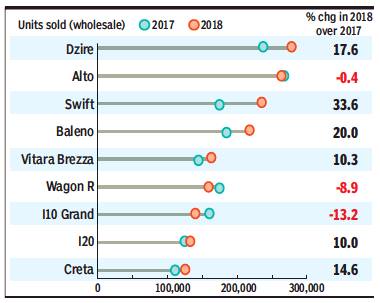

Maruti Suzuki made the top- 5 passenger vehicle models

Nandini Sengupta, Maruti owns road to top-5 seller list, April 12, 2018: The Times of India

From: Nandini Sengupta, Maruti owns road to top-5 seller list, April 12, 2018: The Times of India

Dzire Sales Accelerate, Close Gap With Leader Alto In FY18

Maruti Suzuki has ended fiscal 2017-18 with a clean sweep of the top five selling passenger vehicle models in India. The company’s Alto has topped the all-India sales tally for the fiscal with 2.5 lakh units, followed by Dzire (2.4 lakh), Baleno (1.9 lakh), Swift (1.7 lakh) and WagonR (1.68 lakh).

While Maruti’s dominance in the top-10 best-selling models list is not new, this year the difference between sales numbers of the mass market entry-level Alto and the compact sedan Dzire has come down from more than 40,000 units in FY16-17 to a mere 18,415 units. While Alto, too, has grown by 7%, the reason for the reduction in sales gap is due to Dzire’s much higher growth at 20%. Indeed, the only model that did not grow in the top-5 list is Maruti’s WagonR, which saw sales dipping from 1.72 lakh units in FY16-17 to 1.68 lakh this time round.

A look at the sales tally comparison between FY16-17 and FY17-18 tells the story: Maruti Suzuki clocked the highest growth in the top-5 list in the Baleno, which grew a staggering 58% year-on-year. The second-highest growth was in Dzire sales. In comparison, older models like Swift and Alto showed modest growth. While Swift grew just 5.4%, WagonR actually contracted by 2%.

Maruti also has two more models in the top-10 list — Vitara Brezza at No. 7 and Celerio at No. 10. While Vitara Brezza sales grew nearly 37% to 1.5 lakh units, Celerio sales actually contracted by almost 3% to 94,721 units.

The growth patterns show the trend: Although the entry segment is still growing on the back of the Alto’s popularity, the growth spurt is much lower than what’s being totted up by the SUV and sedan brigade. Even a not-so-new Dzire has clocked a significant double-digit growth rate, showing the increasing preference for ‘bigger’ vehicles. Clearly, India still loves the hatch, but is beginning to aspire for other vehicle types like sedans and SUVs.

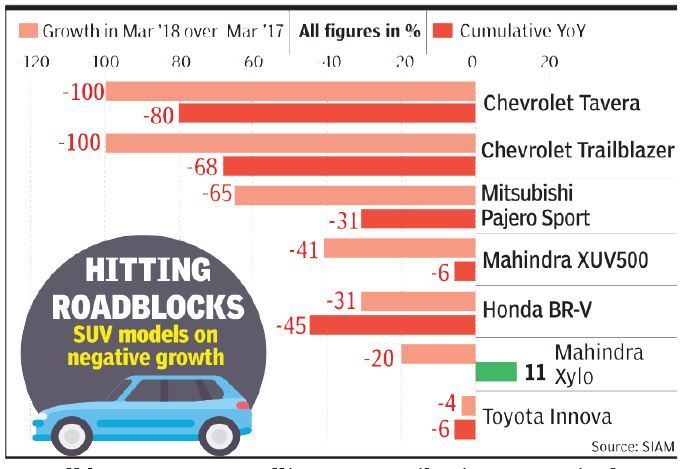

2017> 2018: SUV models that sold well/ badly

Nandini Sen Gupta, Not all SUV models are hot selling, June 25, 2018: The Times of India

From: Nandini Sen Gupta, Not all SUV models are hot selling, June 25, 2018: The Times of India

The SUV/UV segment may be burning serious rubber on Indian roads but not all products are hitting top gear.

According to Society of Indian Automobile Manufactures (SIAM) data, a good half a dozen well-known models is languishing both month-on month and year-on-year (YoY). This includes the likes of Mahindra XUV500, Toyota Innova, Honda BR-V, Chevrolet Trailblazer, Chevrolet Tavera and Mitsubishi Pajero Sport. The stats also show not all segments in the SUV spectrum are growing. The 4.4-4.7m segment under the Rs 15-lakh price band is degrowing in double digits. While Chevrolet models Tavera and Trailblazer are languishing after parent GM India decided to pull out of India, the other three on the list are well-known, strong selling products. Take the Toyota Innova, whose numbers dropped 6% in FY18 compared to FY17.

Toyota officials say this dip is usual once the launch spur wears out. Toyota Kirloskar Motor deputy MD N Raja said, “The Innova Crysta was launched during May 2016. The initial new product launch period contributing to spur in the customer buying patterns plays a lead role. Innova Crysta remains a segment leader YoY capturing an average of 40% market share. We witnessed a sales jump of 34% with around 17,800 units during this financial year, starting April-June 2018 (as on date), reflecting a further increased market share of 4% in its segment.”

In the case of the Mahindra XUV500, the dip is due to the stock getting over before the launch of a refreshed version, said company officials. M&M chief of sales and marketing (automotive division) Veejay Nakra said, “In FY18,we had taken conscious steps to phase out the old model with planned lower wholesale in Q4 (especially for March). This resulted in a slight degrowth for the brand in FY18.

Car marketers say the SUV market is getting fragmented and hence sub-segments are performing differently. Nakra said, “The sub-segment, such as compact SUVs, has seen higher growth as compared to a full-sized UV segment. Additionally, external challenges such as GST and cess increase in September have impacted volumes of full-sized SUVs in H1 FY18,” he added.

2017, 2018: sales in metros decline

Growing traffic congestion and the rising popularity of shared mobility players such as Uber and Ola have lowered the demand for new cars in the top metros of the country, Maruti Suzuki said.

Demand has further been squeezed as fuel prices continue to remain high and insurance premiums and vehicle financing rates get dearer, the company — which accounts for one out of every two cars sold in the country — said. “The metro markets are currently under pressure in terms of growth. There are concerns,” RS Kalsi, senior director (sales & marketing) at Maruti Suzuki, told TOI here. “Traffic congestion, (and) shared mobility are some of the factors that are impacting the generation of demand,” he said while spelling out what had impacted the sales numbers of car makers in the metro cities.

Urban markets lag rural in car sales for 2nd year

If a customer decides not to buy, we can’t do anything in that situation.” New vehicle sales have been under pressure and Maruti has witnessed flat growth over the past two months (year-onyear). The weak numbers have been particularly alarming as they have come during the festive period which normally is a bumper period for carmakers.

Kalsi said that urban markets, which provide a larger share to the sales of carmakers, are feeling the pinch. They lag the rural markets which are growing at a faster pace. “The rural markets have grown by 12-14%, while the urban markets are moving slower. The urban growth is estimated at 2-3%.”

This will be second year when the urban markets — which provide the bulk of sales in India — are proving to be laggards. In 2017-18, sales had fallen by 20% in Mumbai, 11% in Bengaluru, and 4.5% in Chennai. Delhi and Pune, also heavy-volume markets, could manage only a 2% growth.

Speaking about the sales pressure on the retail front, Kalsi said the festive season has “not been on expected lines” this year on account of the slowdown pangs. “The sales were not on expected lines, and the growth was on expected projections. We grew 6%, which was not very good. We were expecting to move up by doubt-digits, and could only grow by around half.”

Discounts have been high in the industry as companies try and lure buyers to showrooms. Maruti has already said that discounts were higher by nearly 20% in the second quarter of this fiscal against the same in the previous year. “The average discount was around Rs 15,500 in the second quarter of last fiscal, and the same was around Rs 18,500 in the same period of 2018-19,” Kalsi said.

Pressure due to low demand has been felt across vehicles categories, but has been particularly strong for first-time buyers. “When the sentiments are down, every category witnesses pressure.” Kalsi said it is “difficult to provide a forecast” on how the market would behave in the new fiscal, considering the variety of factors that have been pulling down the numbers currently. However, he pointed out that there were certain positives that were also building up in the market. These include the growth in GDP, the slight softening in fuel prices and the crop support prices announced for the farmers. “But at the end of the day, the sentiment is determined by the sum total of all the factors.”

Maruti drives in the new-gen Ertiga

Maruti Suzuki drove in an all-new version of its MPV Ertiga with an entry price of Rs 7.44 lakh. While the petrol variants of the new Ertiga are costlier by up to Rs 71,000 from the outgoing version, the diesel versions are costlier by up to Rs 20,000. The petrol variants, including two automatic transmission trims, are powered by an all-new 1.5 litre engine and are priced between Rs 7.4 lakh and Rs 9.9 lakh. The diesel variants carry the same 1.3 litre engine as the earlier version and are priced between Rs 8.8 lakh and Rs 10.9 lakh (all prices ex-showroom Delhi).

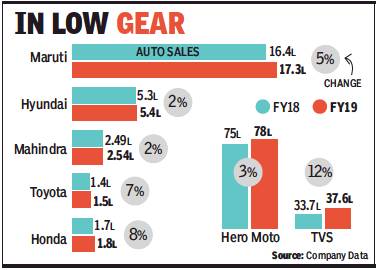

2017> 2018: slowing demand

Pankaj Doval, Auto cos see tough times ahead on slowing demand, April 2, 2019: The Times of India

From: Pankaj Doval, Auto cos see tough times ahead on slowing demand, April 2, 2019: The Times of India

Weak Rural Mkts, Rising Shared Mobility Play Spoilsport

Lower demand in rural markets slowed down the auto industry towards the end of 2018-19 as car, SUV and two-wheeler makers faced tough times, with the outlook looking more challenging over the coming months.

Top companies such as Maruti, Hyundai, Mahindra & Mahindra, Toyota and Honda managed a single-digit growth for the entire financial year, and sales for some of them have been in the negative zone in the last few months.

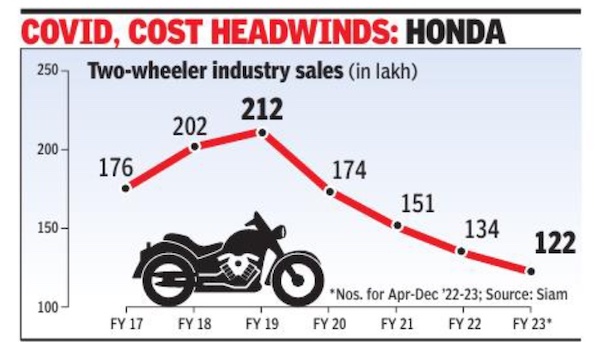

Two-wheeler makers have seen an equally challenging period as top player Hero Moto’s volumes have been in the red for the past four months (decline was 20% in March), even though sales for full financial year were up 3%. Things have been equally challenging for other manufacturers, such as Honda Motorcycle and Scooter India (HMSI), Bajaj Auto and TVS, which have also been under slowdown pressure.

On the passenger vehicle front, the growth is expected at 3% this fiscal, a far cry from initial forecast of 8-10% at the beginning of financial year. Higher cost of insurance, dearer and tougher financing scenario, and relatively stronger fuel prices have dampened the sentiments in the car and SUV space. Also, with the top metro markets such as Delhi, Mumbai, Bangalore and Chennai witnessing a pressure on new demand generation on a variety of factors — including due to increasing population of shared-mobility players such as Ola and Uber — things are expected to remain tough.

A bigger worry for the passenger vehicle industry has been market conditions remaining tough, despite companies driving in new models and offering attractive discounts and freebies. Except for October last year, year-on-year sales growth has been in the negative territory since July. New models such as Hyundai’s Santro mini, Mahindra’s Marazzo MPV and Maruti WagonR hatch have not been able to bail out the industry.

Market analysts said with general elections around the corner, buyers are “in a negative mode as poll-related political mud-slinging gets harsher, creating an uncertain economic and political situation.” Vishnu Mathur, director general of industry body Siam, said he expected a turnaround only after elections. “The problem is that even retail sales are in the negative zone now. People are generally hesitant during election times.”

N Raja, deputy MD of Toyota Kirloskar Motor said that consumer spending has weakened in the pre-election phase and business sentiments have dampened temporarily.

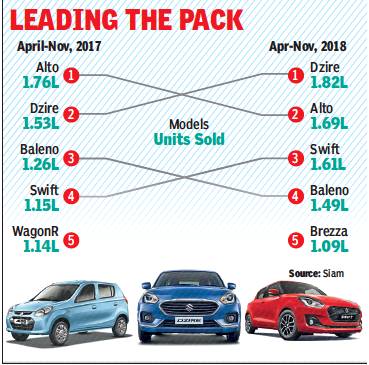

2017> 2018: Dzire replaces Alto as no.1

Dzire overtakes Alto as top-selling car, December 26, 2018: The Times of India

From: Dzire overtakes Alto as top-selling car, December 26, 2018: The Times of India

Rides On Buyers’ Growing Aspirations And Desire For A Better Status Symbol

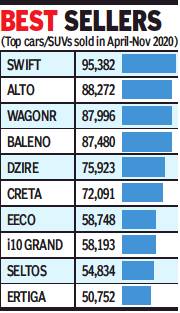

Indian car buyers are upgrading, and Maruti’s Alto — the country’s largest selling hatchback — is no more the Number 1 seller. Bigger sibling Dzire has emerged as the top-seller in April-November 2018, riding on growing aspirations of Indians for a car-with-theboot and a new design.

While Alto sold 1.69 lakh units in first eight months of the current financial year, Dzire surged ahead with 1.82 lakh units. For Alto, numbers declined by 4%, but higher-priced Dzire saw volumes go up by 19%, according to industry body Siam.

The change indicates desire of Indians for a better status symbol, say market watchers. It also shows growing fatigue that has set in for Alto, one of the most-prominent cars after (now phased out) Maruti 800. While Dzire has been upgraded, a fresh version of Alto is in the works and may see a new life only next year.

Ravi G Bhatia, India president for global automotive data and consultancy firm JATO, said the trend is here to stay. Also, more features in relatively bigger vehicles, and their growing affordability, are attracting a lot of buyers. “Income has gone up for customers, but car prices have not increased in the same proportion. So, bigger cars are more comfortable,” Bhatia said. “Smaller car models are more concerned about giving an attractive entry price, and compromise in certain features such as infotainment and safety. So, a lot of convenience is seen in the mid-size models.”

Maruti will not be very worried at the outcome as its models command a major share in the top-selling passenger vehicle segment in the country. Other models to break into the fat-volume brigade are from Hyundai (not in the top 5), though the gap between rivals is large.

Hyundai’s premium hatchback Elite i20 sold 92,817 units in April-November to be the seventh best-selling passenger vehicle model. It was in the eighth position in the year-ago period, clocking 89,988 units.

WagonR, yet another model from Maruti, is in the sixth position with 1.07 lakh units, down from fifth last year when it registered sales of 1.14 lakh units.

Hyundai’s compact car Grand i10 is at the eight position this year, posting sales of 88,016 units, down from sixth position in the same period last year when it clocked 1.03 lakh units. Hyundai’s SUV Creta sold 84,701 units, retaining the ninth spot. It had sold 71,808 units in the year-ago period.

Completing the top-10 best-selling passenger vehicle model is Maruti’s compact car Celerio with 70,079 units. It was at the same rank in the year-ago period with 66,682 units, according to SIAM data.

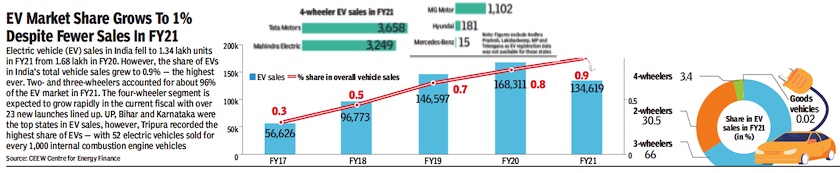

Sales, 2017-21

From: April 19, 2021: The Times of India

See graphic:

Electric vehicles sales in India, 2017-21

2018: After decades, a sedan is the bestselling car

Pankaj Doval, January 22, 2019: The Times of India

From: Pankaj Doval, January 22, 2019: The Times of India

Buyers’ Desire Goes Beyond Small Vehicles

India’s love for its smallest cars seems to be waning. In 2018, Alto, which was the number 1 car for 14 straight years, lost its crown to Dzire, Maruti’s compact sedan. Not only was it beaten by the bigger car, it sold around a thousand fewer units over the year. In rival Hyundai’s stable, too, sales of Grand i10 fell by about 13%, while its bigger siblings, i20 and Creta, saw robust sales growth of about 10% and 15%, respectively.

Although Dzire and its hatchback version, Swift, have outsold Alto for a few months in past years, this is the first time a sedan has been India’s biggest-selling car for a whole year since the Ambassador ruled the roost decades ago, before the rise of the Maruti 800. With disposable incomes and aspirations rising, is this a sign of the times?

“The Indian car buyer is upgrading, and he wants the best for what he can afford,” said industry analyst Jnaneswar Sen. The trend also shows that first-time buyers are not increasing as quickly as those who are upgrading, or buying another car, he added. “So, the upper segment is growing, but the entry car market is shrinking.”

Social scientist and advertising professional Santosh Desai said the trend is here to stay. “This shift has been in the making for a while… Incomes are rising, and you have gone through the cycles of the first car,” Desai said, adding, “The Indian customer has begun to value comfort and some higher-order needs, and is willing to pay for them.”

Industry officials said buyers now value safety and comfort as much as design. “Features like airbags and ABS are turning out to be very important as buyers get more safety-conscious. In terms of comfort, features like power windows, and touch-screen controls for in-car entertainment, have a strong pull,” a top official with a leading carmaker said.

Sales of Dzire grew by 18%, Alto fell 0.5%

Dzire, a sub-4-metre sedan launched in 2008, has been one of the strongest models for Maruti from the very beginning. It is priced Rs 5.7 lakh onwards, as against Alto’s Rs 2.6-lakh starting price. While Dzire’s sales grew by 18% in a year when overall passenger vehicle sales grew by 5%, demand for Alto — the so-called “people’s car” — fell by 0.5%, numbers accessed by TOI show.

Desai said people desire a car with a boot not only as a status symbol but also as a practical need. “We carry enormous amounts of luggage when travel, thus option of adding a boot is legitimate. It is a significant factor.” Easy access to finance may also explain the robust demand for bigger vehicles, experts said. Dzire’s more expensive stablemate Brezza took fifth position, ahead of WagonR. It had finished seventh in 2017. Hyundai Creta, which retails upwards of Rs 9.5 lakh, was the ninth-largest selling model.

2018> 19: sales lose steam

Pankaj Doval, Car, SUV sales lose steam as sentiment weakens, March 9, 2019: The Times of India

From: Pankaj Doval, Car, SUV sales lose steam as sentiment weakens, March 9, 2019: The Times of India

New models and attractive discounts have failed to enthuse car and SUV buyers, who are staying away from the market as negative sentiments continue to strengthen.

Sales of passenger vehicles have been negative (year-on-year) in seven of the past eight months, reflecting the nervousness among buyers. Overall, car and SUV sales have grown by 3% in eleven months of 2018-19, a far cry from the 8-10% growth forecast made at the beginning of the year.

Market analysts say with general elections around the corner, buyers are “in a negative mode as pollrelated political mud-slinging gets harsher, creating an uncertain economic and political situation”.

No registration for taxis in the past one month — due to problems with insurance requirement — has also hit demand.

“Many RTOs are asking for a three-year insurance. while insurance companies do not have such a product. Taxi sales are 10% of overall sales and chip in with nearly 27,000-30,000 units every month.” Any credible revival is expected only after the poll results.

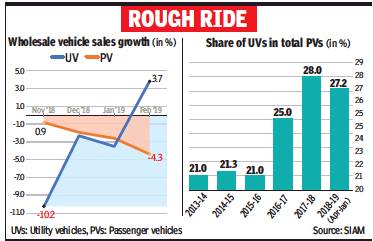

2013-19: SUV sales drop in 18-19

Nandini Sengupta, After 5 yrs of growth, SUV sales hit a bump, March 11, 2019: The Times of India

From: Nandini Sengupta, After 5 yrs of growth, SUV sales hit a bump, March 11, 2019: The Times of India

Sharp Fall Since Nov | MPVs Rebound In Feb

Is the SUV craze fading? After rising steadily for five years, sales of utility and crossover vehicles have fallen sharply since November. And though overall utility vehicle (UV) wholesales have rebounded in February, it is on the back of improved MPV sales rather than SUV volumes, which remain negative. The UV share in overall passenger vehicle sales this financial year is also down marginally. In fact, segment leaders Suzuki Vitara Brezza and Hyundai Creta were among the hardest hit in December.

In 2013-14, only 1-in-5 passenger vehicles sold in India was a utility vehicle. By 2016-17, their share had increased to 1-in-4. And last fiscal, it peaked at 28%. However, figures for the April-January period of this financial year show their share is down to 27.2% (see graphic). While car sales have also slowed since November, the dip in SUV sales is more marked. In January, SUV sales were down 3.5% compared to 2.6% for cars. In December, 2.3% fewer SUVs sold compared to 2% fewer cars. And in November, when car sales fell 1%, SUV sales were down 10.2%.

In February, however, total UV (including SUV and MPV) wholesales rebounded on the back of aggressive billing by companies before the year-end and good performance by the MPV segment. SIAM data shows total UV sales were up 3.7% in February, while cars were down 4.3%. For April-February, cars were up nearly 3%, while total UVs (including MPVs) were up 2%.

Suzuki Vitara Brezza, the best-selling compact SUV, saw sales crash from 14,378 units in November to 9,667 in December, although it rebounded to 13,172 units in January. Second placed Hyundai Creta sold 9,677 units in November; 7,631 in December and 10,314 in January.

Industry experts say both the compact and the mid-sized SUV segments are affected. These have the maximum models and account for the bulk of sales. In the compact SUV segment, sales were down by 5% — to 1,44,203 from 1,51,141 units — in the November-February period. In the mid-sized segment (Hyundai Tucson, Jeep Compass, etc), sales fell 19% to 10,105 units from 12,618 in the period. Sales of medium premium SUVs (Toyota Fortuner, Ford Endeavour, etc) were down 9%, to 10,580 units from 11,656 units. However, premium SUVs, such as Land Cruiser and Prado, sold 37 units as against 30 earlier.

Sales have fallen due to the overall subdued consumer sentiment, said Mahindra & Mahindra president (automotive sector) Rajan Wadhera. “In December, a call was taken to focus on retail to bring dealer stocks to normal, and this has resulted in low performance. The availability of finance is an issue.” He said buyers are avoiding highpriced SUVs.

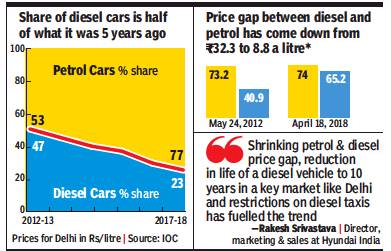

Other experts said people may be delaying buying to wait for BS-6-compliant vehicles. Also, SUVs, which mostly have diesel engines, may be looking less attractive because fuel prices are again rising and diesel is inching closer to petrol.

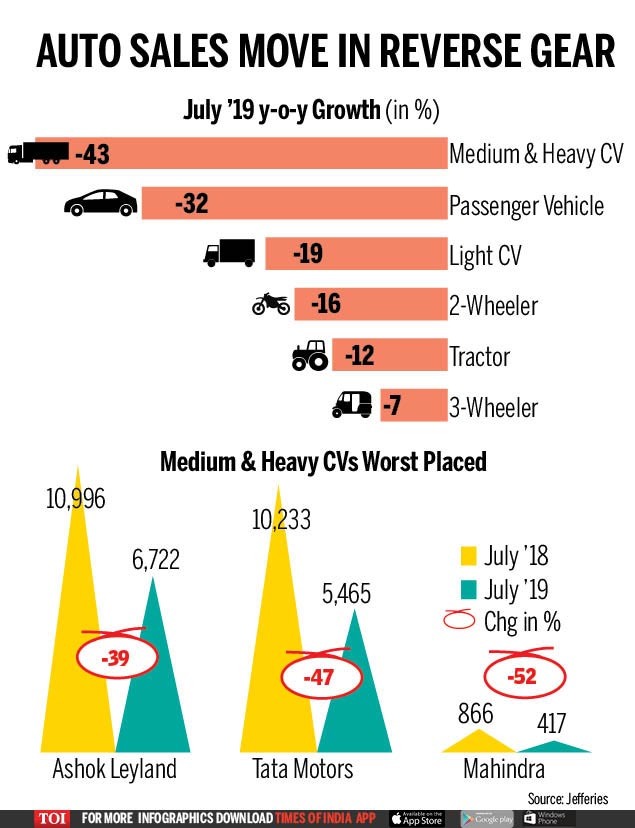

All sales weak; weakest in CVs

August 9, 2019: The Times of India

From: August 9, 2019: The Times of India

Weak sales stall auto growth, decline most severe in commercial vehicles

Continued weak retails, high inventory & reducing BS-6 related pre-buying prospects have led to some of the sharpest declines of ongoing downcycle across auto segments. Medium & heavy commercial vehicle (MHCV) saw a 43% y-o-y decline, the sharpest across auto segments. Light commercial vehicle (LCV) volumes have been holding up better than other segments, however, sales were down 19% y-o-y in July.

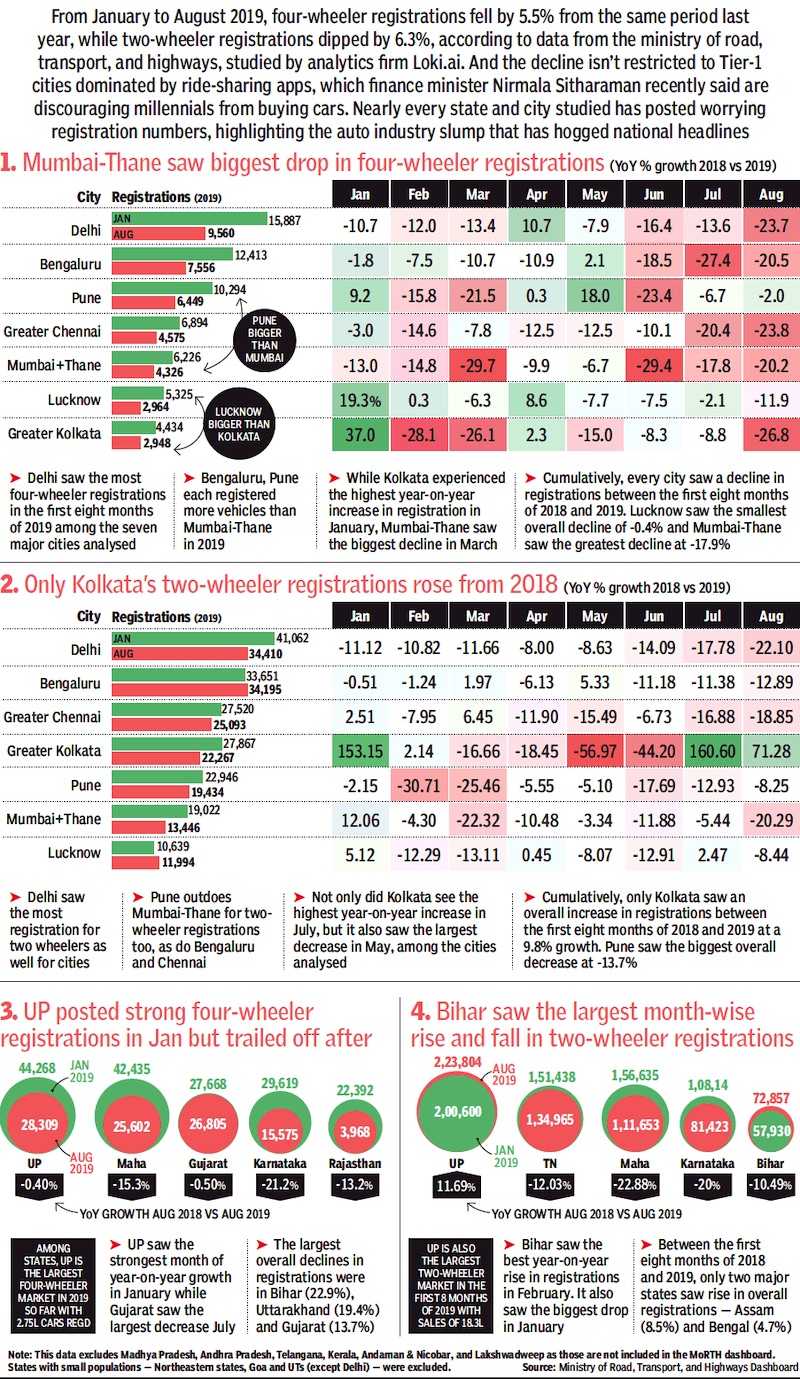

Jan to Aug sales, state-wise

From: Sep 21, 2019: The Times of India

See graphic:

Jan to Aug 2019 automobile sales, state-wise

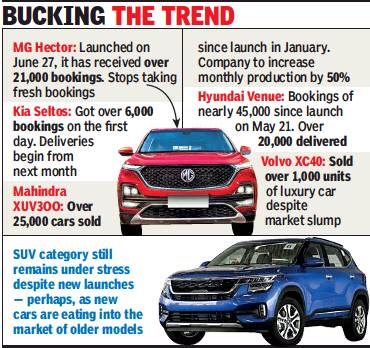

2019: new SUV models defied the slowdown

Pankaj Doval, July 20, 2019: The Times of India

From: Pankaj Doval, July 20, 2019: The Times of India

Amid a slowdown in the auto industry, a new set of products has been able to buck the trend, witnessing strong booking and sales numbers. And, in line with preference of Indian buyers for offroaders, these products happen to be SUVs — ranging from the sub-Rs 10-lakh mini Hyundai Venue to the Rs 40-lakh-plus Volvo XC40.

Take for example the Hector premium SUV (priced upwards of Rs 12 lakh) from British brand Morris Garages (MG) Motor. Hector, which touts itself as ‘India’s first internet car’, has managed to get bookings of over 21,000 units since its launch on June 27. Overwhelmed by the number, which far exceeds internal estimates, the company has stopped taking bookings. “This is a happy, but completely unexpected response. We are sold out for this year, and that too so soon,” Rajeev Chaba, MD of MG Motor India, told TOI.

Korea’s Kia Motors is also witnessing strong numbers. The company got over 6,000 bookings on the first day for SUV Seltos. Kia is working overtime to ensure that the waiting list will be minimum when deliveries begin, said Manohar Bhat, head of sales and marketing. “We are elated with an overwhelming response… and are fully prepared to make on-time deliveries.”

For Mahindra & Mahindra, new mini SUV XUV3OO has been a success story. “We have managed to sell over 25,000 units since the launch in January. We are still having a waiting list, at a time when we are also opening export bookings,” Pawan Goenka, MD, said. To meet demand, the company has decided to increase production of the model from 5,000 units to 7,500.” Hyundai’s Venue has witnessed 45,000 bookings since its launch on May 21. “We are taking steps to boost deliveries to cut the backlog. So far, 20,000 have been delivered,” Vikas Jain, head of sales, said.

Volvo sold 2,700 cars (across models) last year and has managed to sell 1,000 units of XC40 that is imported at present. “There has been a constant demand for this car and, going forward, we will ensure that more units of the model are allocated for India,” Volvo Car India MD Charles Frump said.

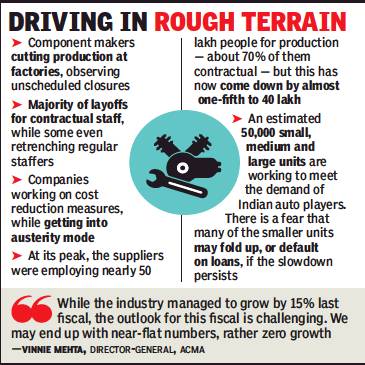

The slowdown hits 10 lakh auto parts jobs

Pankaj Doval, July 25, 2019: The Times of India

From: Pankaj Doval, July 25, 2019: The Times of India

Slowdown hits 10L jobs in auto parts cos

Demand For Cars, CVs, Bikes At Historic Lows

New Delhi:

Nearly 10 lakh jobs have been shaved off from the auto component industry, following a prolonged and painful slowdown that has seen the demand for cars, commercial vehicles (CVs), and twowheelers slip to historic lows, a top official from the industry association as well as company officials have said.

The component players are the backbone of the domestic automobile industry and contribute nearly 2.3% to the country’s GDP. “It is a crisis, and we have been under intense pressure over the past one year, which has resulted in significant production cuts at factories. Our estimates show that job losses are between 8 lakh and 10 lakh, and are across key automobile manufacturing locations such as the Haryana belt, Pune region, Chennai, Nashik, Uttarakhand, and Jamshedpur,” Vinnie Mehta, director-general of Automotive Component Manufacturers Association (ACMA) told TOI.

Mehta said the impact has been “unprecedented” and is being felt across the spectrum of the auto component industry. “I have never seen such a scenario when a top supplier such as Bosch completely shuts down its factories for as many as five straight days. This is scary, and alarming.”

Speaking about the nature of job losses, he said a majority of them are contractual staff hired by companies for routine production work. “Many of them are working at the shop-floor, or engaged in logistics and other allied/support activities at factories.”

Speaking about the size of the component industry, ACMA said in 2018-19, nearly Rs 4 lakh crore worth of parts were made in India, of which components worth roughly Rs 2.3 lakh crore were sold to domestic auto makers, while exports amounted to Rs 1lakh crore. After-market sales accounted for around Rs 67,500 crore.

The industry is also calling it a “never-seen-before crisis”, considering that the slump is coming at a time when they have made heavy investments for migration to new BS6 norms. “Add to this the movement towards electric mobility where there is still no clarity on timelines for a mandated shift. Things are getting tougher,” Ram Venkataramani, president of ACMA, who is also MD of component maker Indian Piston Rings, said.

Industry players said a faster shift to electrics will not give them much time to recover investments made towards upgrading to new emission and safety standards. Also, there is a need to grasp the complexities related to the new clean mobility systems, which will require technology upgradation as well as new investments.

“Almost every company in the industry is right-sizing, while putting a freeze on new hiring, except when they are moving to a new location. The focus has shifted from business growth to working towards remaining viable,” Ashok Taneja, MD & CEO of Shriram Pistons & Rings, said. “We have adjusted and moderated production in line with sales realities. Also, companies are directing investments towards automation and robotisation to drive in quality and right-size manpower.”

The industry is now demanding that GST on components should be brought down to 18% to drive in affordability.

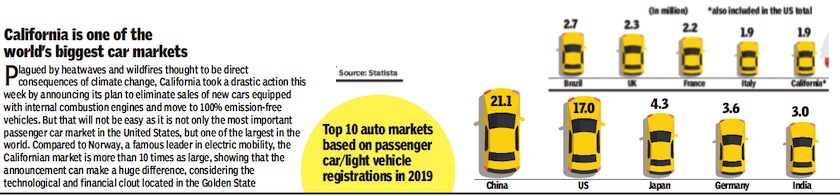

2019

From: September 26, 2020: The Times of India

See graphic:

Top 10 auto markets based on passenger car- light vehicle registrations in 2019

2019-21

Pankaj Doval, Oct 15, 2021: The Times of India

From: Pankaj Doval, Oct 15, 2021: The Times of India

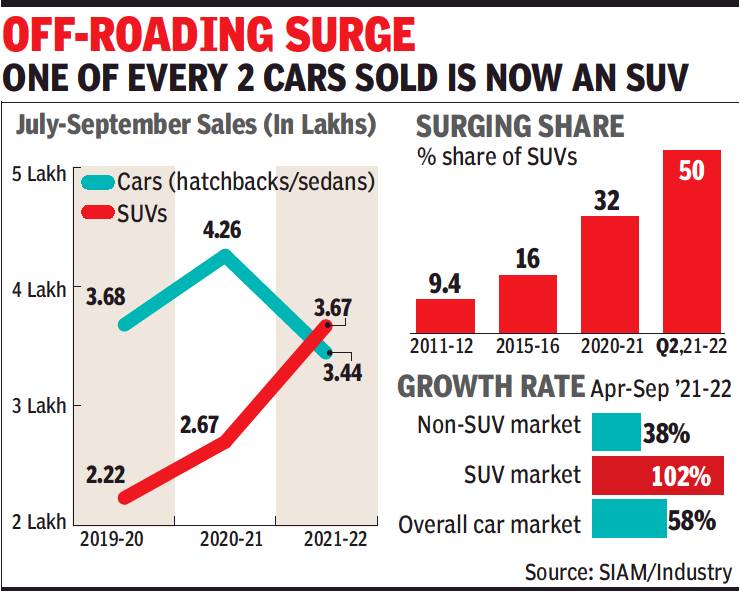

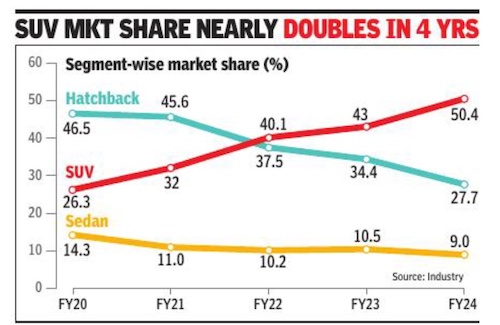

It’s official — India is no longer a small car market, and the country is in love with SUVs. More than half the passenger vehicles sold in September, as well as the July-September quarter, were SUVs that commanded more volumes than the cumulative might of hatchbacks and sedans.

The strong showing — perhaps for the first time ever in India’s automotive history — displays the growing fondness and craze of Indian buyers for SUVs, which are available across price points and brands, and have one of the strongest line-ups in the broader car market.

With sales of 87,720 units in September 2021, SUVs outnumbered the passenger cars category –– comprising hatchbacks and sedans — by a large distance as the latter could only sell 64,235 units in the same month.

And the trend was equally strong during the second quarter of 2021-22 — SUVs sold 3,67,457 units while passenger cars added up to 3,43,939 units, according to data sourced by TOI from SIAM, the industry lobby group.

So what’s fuelling the trend? The fall in prices of SUVs over the past few years — as companies adopted the body style even when it came to small cars (which attract lower GST rates) — and the broadening road and highway network across are pushing demand for the vehicles that have better ground clearance and relatively modern and robust design cues. Prices of mini SUVs such as Nissan Magnite and Renault Kiger begin at under Rs 6 lakh, while the sub-Rs 10 lakh category has strong models such as Maruti Brezza, Kia Sonet, Hyundai Venue and Tata Nexon.

2020: the best- selling models

Nandini Sengupta, December 28, 2020: The Times of India

From: Nandini Sengupta, December 28, 2020: The Times of India

Two consecutive years of low sales, first due to an economic slowdown and then the pandemic, has created a ‘winner takes it all’ situation in the car and SUV market. The top 20 models sold between April and November comprise 74.1% of all passenger vehicle sales in India, up from 70% in 2015-16 and 69% in 2016-17.

In 2017-18, the top 20 passenger vehicles commanded 69.4% of the market, which increased to 72% in 2018-19 and hit 73% in 2019-20.

“When consumption is under pressure, customers tend to experiment less and go with established brands and models, which explains this phenomenon,” said Maruti Suzuki executive director Shashank Srivastava.

Hyundai Motor India director (sales, marketing & service) Tarun Garg said: “Last couple of years have been very challenging and during uncertain times customers’ affinity is more towards tried, tested and strong brands as they give confidence to customers.” Interestingly, the contribution of the top 10 models has not varied much, remaining between 48-49%. It was 49% in 2019-20 and dipped to 48.7% in the April-November period this year.

Maruti Suzuki’s Swift, which ousted stablemate Alto 800 to become India’s largest selling passenger vehicle in 2019-20 has continued to hold its position even as due to market contraction actual volumes of this model too has come down from a peak of 2.2 lakh units in 2018-19 to 1.9 lakh units last year and 95,500 units in April-No- vember 2020. Swift’s contribution to the total industry sales has gone up from 5.7% in 2016-17 to 5.8% in 2017-18, 6.6% in 2018-19, 6.8% in 2019 and 6.6% in April-November 2020. The Swift’s race to the top of the pile has been powered by first-time car owners, who now comprise 46% of its buyers, up from 36% five years ago. But Alto 800 still commands more first-timers with 58%.

Auto consultants say the winner-takes-all trend has been visible in many consumer sectors as well. “Over the last decade, there has been a proliferation in variants and brands but a deep understanding of consumer preferences, buyer attributes and ability to consistently develop relevant product value propositions have benefited larger brands. A more recent phenomenon is for consumers to go back to trusted products which is true across other industries like consumer goods too,” said Vinay Raghunath, head (auto sector), EY.

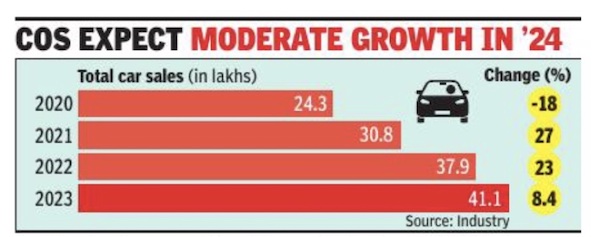

2020 – 23

See graphic:

Total car sales, 2020-23

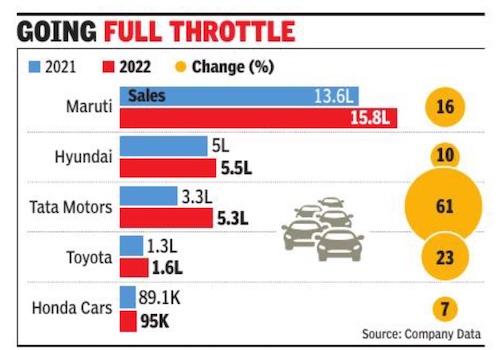

2021- 22

From: Pankaj Doval, January 2, 2023: The Times of India

See graphic:

Car sales in India in 2021 and 2022

2022

Pankaj Doval, Dec 31, 2022: The Times of India

From: Pankaj Doval, Dec 31, 2022: The Times of India

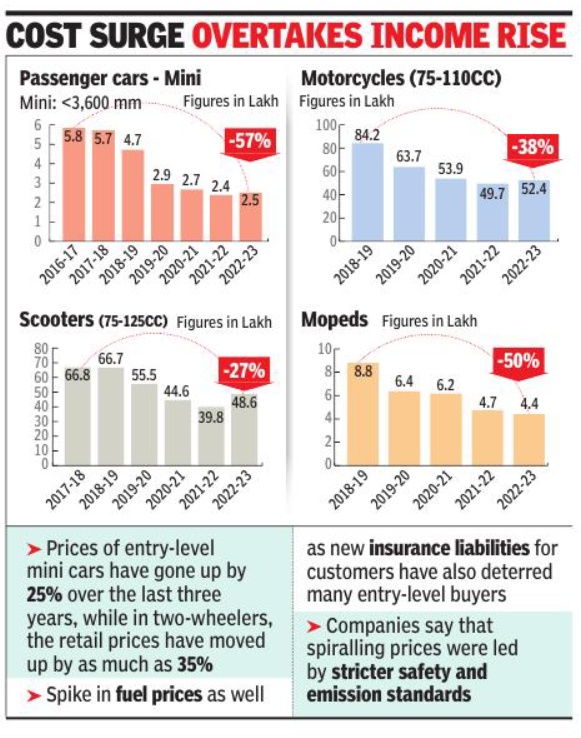

New Delhi : ‘Cheap and best’ is no longer the favourite mantra of Indian car buyers.

Panoramic sunroof, driver assist systems, 360-degree camera, giant infotainment screens, cruise control, six airbags – these are just some of the ‘must-haves’ that an Indian car buyer is demanding today.

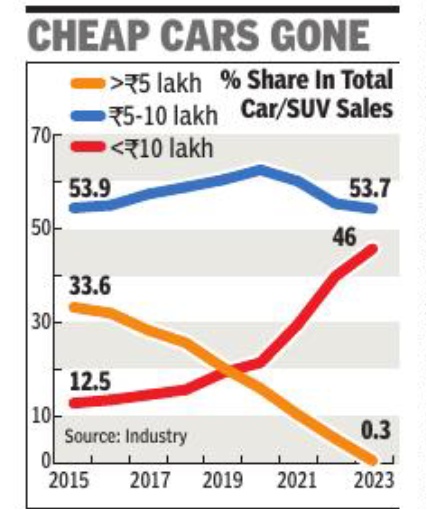

The Indian buyer is going premium, and how. Sales of vehicles costing upwards of Rs 10 lakh climbed to a record 41% of total volumes that were sold in 2022. This was a significant jump from 2018 when 5. 4 lakh cars sold in this price bracket accounted for 16% of the pie.

Now, the volume of premium cars is estimated at 15. 5 lakh units when industry sales are pegged at around 38 lakh units.

All this while the bottom end of the market, comprising entry-level models such as theMaruti Alto and the Renault Kwid, shrank as inflation and rising interest rates kept firsttime buyers away. In fact, many buyers have opted for an aspirational buy, preferring a more feature-loaded second-hand vehicle instead of a new entry-level brand.