Urjit Patel

(→See also) |

|||

| Line 44: | Line 44: | ||

Despite his onerous fiscal responsibilities, Patel does have a lighter side. In his days at Oxford, he is said to have enjoyed leafing through the satirical magazine, Private Eye, and the bumbling Mr Bean was one of his favourite characters. | Despite his onerous fiscal responsibilities, Patel does have a lighter side. In his days at Oxford, he is said to have enjoyed leafing through the satirical magazine, Private Eye, and the bumbling Mr Bean was one of his favourite characters. | ||

| + | |||

| + | =Views on "Goods and Services Tax"= | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Patel-a-strong-supporter-of-GST-but-a-21082016016005 ''The Times of India''], Aug 21 2016 | ||

| + | |||

| + | '''Patel a strong supporter of GST, but a critic of fisc deficit''' | ||

| + | | ||

| + | Those who have been expecting the new RBI appointee to overturn outgoing governor Raghuram Rajan's policies on interest rates or banking reforms will be in for a disappointment. Urjit Patel's colleagues say that he is as much of a monetarist and inflation hawk as Rajan. | ||

| + | According to deputy governor S S Mundra, Patel is focused, detail-oriented and independent-minded. He is cut from the same cloth as Rajan as far as ideology goes, though he is far more low-key than his `rockstar' predecessor. Like Rajan, he has an IMF background and is a strong supporter of banking reforms. Unlike economists such as Arvind Panagariya, Patel is not one to support boost in government capital spending at the risk of higher fiscal deficit. | ||

| + | |||

| + | The view in RBI is the Centre was not completely opposed to any of Rajan's policies or reform measures which makes Patel a sound choice. “He's the best choice if the reforms undertaken by Rajan have to be taken forward. As Rajan said, there are a lot of unfinished tasks in these challenging times,“ said former RBI deputy governor K C Chakrabarty . The push for bank reforms is also likely to continue under Patel.This means that RBI is likely to go ahead with Rajan's decisions to allow banking licences on-tap and open up banking for new segments like wholesale banks and custodian banks. As an academic, Patel had argued for more transparency in bank balance sheets which is again carrying forward Rajan's legacy . | ||

| + | |||

| + | The new governor is also unlikely to let the RBI's reserves be used for supporting recapitalization of banks.In 2008, Patel had argued against the government's move to get RBI to swap dollars with oil companies for government bonds. | ||

| + | |||

| + | While Patel has been a critic of fiscal deficits, he has been a strong supporter of the Goods and Services Tax and has been quite bullish about the new tax not being inflationary .“About 55% of the Consumer Price Index (CPI) basket will not be impacted by GST...one benefit of the GST is that the cascading disappears so you might actually get effective tax rates on many goods and services to come down. And usually as a base expands, you do not need to have a tax rate which is as high as would be required. So the inflationary impact, firstly, it could just be one time; secondly, to the extent that such a large part of the CPI basket is already out of it, I think the durable impact on it is likely to be limited,“ Patel had said earlier this month. | ||

| + | |||

| + | Bankers can also expect more tweaking of benchmark rates and liquidity . Like his predecessor Rajan, Patel feels that interest rate changes should be transmitted immediately and across all tenures. | ||

| + | |||

| + | Another area of continuity will be that of financial inclusion and moving large borrowers to the bond market. | ||

| + | |||

| + | Universal bank accounts were first proposed by the Nachiket Mor committee constituted by Rajan and later accelerated by the Narendra Modi government under the Pradhan Mantri Jan Dhan Yojana. In a speech, Patel described the scheme as is unequivocally a “game-changer“.“It provides an unprecedented scaffolding and a springboard for meaningful financial inclusion and, concomitantly , substantial financial deepening of our economy ,“ Patel had said. | ||

| + | |||

| + | Bankers have not had much of an opportunity to interact with Patel but they too can expect continuity . As governor, Rajan held the view that by lending chunky loans, banks were engaging in lazy banking when they should be developing skills in reaching out to the thousands of small businesses. Echoing these views, Patel had said banks would be encouraged to extend a much larger number of small loans rather than extend a few very large loans.Also banks should review their large exposure limits in future for better practices of risk management. | ||

=See also= | =See also= | ||

[[The Reserve Bank of India]] | [[The Reserve Bank of India]] | ||

Revision as of 20:34, 5 September 2016

This is a collection of articles archived for the excellence of their content. |

Contents |

A profile

The Times of India, Aug 21 2016

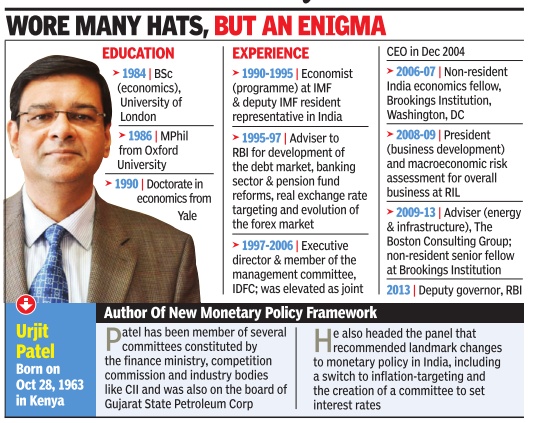

Urjit Patel's entry into the Reserve Bank of India as deputy governor had marked a number of firsts. He was the only deputy governor to have worked for a corporate. Also he was born in Kenya, did much of his education outside India and acquired an Indian passport only later in life. However, these items in his dossier were addressed first by the UPA government in 2013, when he was appointed the deputy governor, and later by the Narendra Modi government, which appointed him for a fresh three-year term in January . The consensus has been that his was an appointment based on merit given his track record.

Patel will also be among the youngest governors in RBI.The others to take charge at an early age include Raghuram Rajan and Chintamani Deskhmukh.

RBI governors in the past have been a combination of bureaucrats and economists.But no one has experience as well-rounded as Patel. He has worked with multilateral institutions, he has played a senior role in a domestic commercial finance institution and has been a consultant. Although he was never a bureaucrat, he has worked closely with the government having been part of several committees.

One area where Patel is completely different from his predecessor is his personality .Unlike Rajan, Patel is an introvert and rarely speaks in public or participates in public debates. Although he has been deputy governor since January 2013, he has delivered very few speeches.

Born on October 28, 1963, Patel is a PhD (economics) from Yale University (1990) and MPhil from Oxford (1986).Outside academia, Patel has had a long stint in the financial sector at IDFC where he worked between 1997 and 2006, first as an executive director and part of the startup team and subsequently as a joint CEO of the company . He was also with Reliance Industries between 2008 and 2009 as president-business development.His role at Reliance involved assessing macroeconomic risk for the overall business, strategizing commercial approaches for hydrocarbon energy companies of climate change mitigation policies.

Between 2000 and 2004, Urjit worked closely with several central and state government high-level committees, such as task force on direct taxes, ministry of finance, government of India; advisory committee (on research projects and market studies), Competition Commission of India; secretariat for the Prime Minister's task force on infrastructure; group of ministers on telecom matters; committee on civil aviation reforms; ministry of power's expert group on state electricity boards and high-level expert group for reviewing the civil & defence services pension system, government of India.

2016: Appointment as the RBI governor

The Times of India, Aug 21 2016

Govt opts for continuity, elevates Rajan's No 2, Urjit Patel, as RBI guv

The announcement through a press note marks an end to weeks of fevered speculation over the replacement for Rajan, who will return to academia in the US once his term ends on September 4, 2016, bringing the curtain down on an incr easingly rocky relationship with the Centre. The government unveiled the appointment on a day markets were closed, just as Rajan did in June to announce his decision not to seek a second term.

Patel -who has been given a three-year tenure -was selected from a field of five contenders with his predecessor, Subir Gokarn, being the other strong candidate. Also in the fray were chief economic adviser Arvind Subramanian, economic affairs secretary Shaktikanta Das and former World Bank chief economist Kaus hik Basu, TOI was told by people with knowledge of the deliberations. Rakesh Mohan, another former RBI deputy governor, was on the original shortlist as well but opted out citing other commitments.

The race for the coveted job finally narrowed down to Patel and Gokarn -both monetary economists with experience at RBI. While Patel, a PhD from Yale, has been at RBI since 2013, Gokarn had spent three years from November 2009 before the UPA government said no to a second term.

“Gokarn was a very strong contender but the PM felt that since he has just moved to the IMF as executive director, he should not be disturbed so soon,“ said a high-level source in the government.

While a selection panel was tasked with shortlisting candidates, the final decision was taken by Modi in consultation with finance minister Arun Jaitley over two meetings on Thursday . “Congratulations to @UrjitPatel... I'm sure he will successfully lead the Reserve Bank & contribute to India's economic development,“ Jaitley tweeted. Patel has been involved with all crucial decisions at the central bank -from reworking the way key policy rates are decided to modernising the way RBI functions. He is also a member of the panel to review the Fiscal Responsibility and Budget Management Act.

Despite his onerous fiscal responsibilities, Patel does have a lighter side. In his days at Oxford, he is said to have enjoyed leafing through the satirical magazine, Private Eye, and the bumbling Mr Bean was one of his favourite characters.

Views on "Goods and Services Tax"

The Times of India, Aug 21 2016

Patel a strong supporter of GST, but a critic of fisc deficit Those who have been expecting the new RBI appointee to overturn outgoing governor Raghuram Rajan's policies on interest rates or banking reforms will be in for a disappointment. Urjit Patel's colleagues say that he is as much of a monetarist and inflation hawk as Rajan. According to deputy governor S S Mundra, Patel is focused, detail-oriented and independent-minded. He is cut from the same cloth as Rajan as far as ideology goes, though he is far more low-key than his `rockstar' predecessor. Like Rajan, he has an IMF background and is a strong supporter of banking reforms. Unlike economists such as Arvind Panagariya, Patel is not one to support boost in government capital spending at the risk of higher fiscal deficit.

The view in RBI is the Centre was not completely opposed to any of Rajan's policies or reform measures which makes Patel a sound choice. “He's the best choice if the reforms undertaken by Rajan have to be taken forward. As Rajan said, there are a lot of unfinished tasks in these challenging times,“ said former RBI deputy governor K C Chakrabarty . The push for bank reforms is also likely to continue under Patel.This means that RBI is likely to go ahead with Rajan's decisions to allow banking licences on-tap and open up banking for new segments like wholesale banks and custodian banks. As an academic, Patel had argued for more transparency in bank balance sheets which is again carrying forward Rajan's legacy .

The new governor is also unlikely to let the RBI's reserves be used for supporting recapitalization of banks.In 2008, Patel had argued against the government's move to get RBI to swap dollars with oil companies for government bonds.

While Patel has been a critic of fiscal deficits, he has been a strong supporter of the Goods and Services Tax and has been quite bullish about the new tax not being inflationary .“About 55% of the Consumer Price Index (CPI) basket will not be impacted by GST...one benefit of the GST is that the cascading disappears so you might actually get effective tax rates on many goods and services to come down. And usually as a base expands, you do not need to have a tax rate which is as high as would be required. So the inflationary impact, firstly, it could just be one time; secondly, to the extent that such a large part of the CPI basket is already out of it, I think the durable impact on it is likely to be limited,“ Patel had said earlier this month.

Bankers can also expect more tweaking of benchmark rates and liquidity . Like his predecessor Rajan, Patel feels that interest rate changes should be transmitted immediately and across all tenures.

Another area of continuity will be that of financial inclusion and moving large borrowers to the bond market.

Universal bank accounts were first proposed by the Nachiket Mor committee constituted by Rajan and later accelerated by the Narendra Modi government under the Pradhan Mantri Jan Dhan Yojana. In a speech, Patel described the scheme as is unequivocally a “game-changer“.“It provides an unprecedented scaffolding and a springboard for meaningful financial inclusion and, concomitantly , substantial financial deepening of our economy ,“ Patel had said.

Bankers have not had much of an opportunity to interact with Patel but they too can expect continuity . As governor, Rajan held the view that by lending chunky loans, banks were engaging in lazy banking when they should be developing skills in reaching out to the thousands of small businesses. Echoing these views, Patel had said banks would be encouraged to extend a much larger number of small loans rather than extend a few very large loans.Also banks should review their large exposure limits in future for better practices of risk management.