Hindustan Unilever Ltd.

| Line 8: | Line 8: | ||

[[Category:India |H ]] | [[Category:India |H ]] | ||

[[Category:Economy-Industry-Resources |H ]] | [[Category:Economy-Industry-Resources |H ]] | ||

| + | |||

| + | =Acquisitions= | ||

| + | ==2018: GlaxoSmithKline, Boost, Horlicks== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F12%2F04&entity=Ar01911&sk=51F2FF2A&mode=text Unilever gets Boost with Horlicks, December 4, 2018: ''The Times of India''] | ||

| + | |||

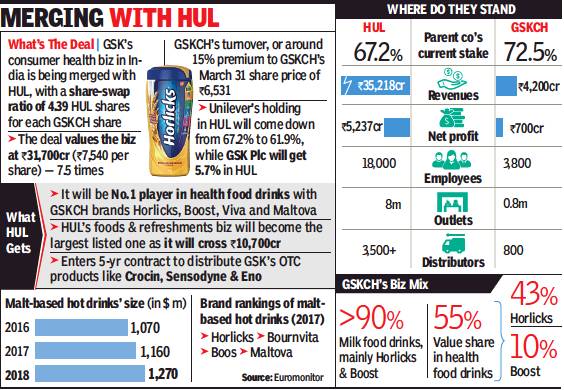

| + | [[File: HUL’s 2018 acquisitions- GlaxoSmithKline, Boost, Horlicks; Malt-based hot drinks, 2016-18.jpg|HUL’s 2018 acquisitions- GlaxoSmithKline, Boost, Horlicks <br/> Malt-based hot drinks, 2016-18 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F12%2F04&entity=Ar01911&sk=51F2FF2A&mode=text Unilever gets Boost with Horlicks, December 4, 2018: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | ''Buys GSK’s India Consumer Biz In All-Share Deal That Values It At ₹31.7K Cr'' | ||

| + | |||

| + | Unilever has agreed to acquire British healthcare company GlaxoSmithKline’s India consumer business, which includes the prized health food drinks brand Horlicks, ending months of speculation over who would bag the business. GSK has a large play in India, the Anglo-Dutch consumer product major’s second-largest market. | ||

| + | |||

| + | Horlicks, a 140-year old brand, which came to Indian shores with the British army during World War I as a “dietary supplement”, thus retains its British legacy. Swiss foods giant Nestle, too, was in a close race to acquire the business, which includes other strong brands — Boost (once endorsed by Kapil Dev and Sachin Tendulkar), Viva and Maltova. The scale of Unilever’s India business — which is also its fastest growing — appears to have dimmed the chances of other suitors in the fray. It is also touted as the largest deal under outgoing Unilever CEO Paul Polman. | ||

| + | |||

| + | In India, the merger values GSK’s subsidiary — GSK Consumer Healthcare (GSKCH) — at Rs 31,700 crore, which is 7.5 times the turnover of the firm, making it the biggest deal in the consumer space yet. Under the all-share deal, GSKCH will be merged with Unilever’s subsidiary Hindustan Unilever (HUL) in such a way that a GSKCH shareholder would get 4.39 shares of HUL for each share of GSKCH that he/she holds. It values GSKCH at Rs 7,540 per share, which is around 15% premium to the firm’s share price of Rs 6,531as on March 31, 2018. | ||

| + | |||

| + | The share price of GSKCH jumped by about Rs 273 or 3.8% to close at Rs 7,543 on the BSE on Monday. HUL’s share price was up Rs 72 or 4.1% to close at Rs 1,826. | ||

| + | |||

| + | The merger, which has been approved by the boards of the respective Indian subsidiaries but is subject to regulatory and shareholder approvals, will boost HUL’s revenues to around Rs 40,000 crore, while catapulting its food and refreshments (F&R) business to around Rs 10,700 crore (28% of HUL’s revenues), making it the largest listed F&R business in the country. | ||

| + | |||

| + | Given that Horlicks is the leading brand in the Rs 7,000-crore health food drinks market, with a combined share of 55% (along with Boost, Maltova and Viva), HUL gets a direct entry into a new category with leadership position. With penetration of health food drinks still low at around 24%, Horlicks would benefit from HUL’s distribution muscle and its 8-million outlet reach to grow under a new parent. HUL chairman and CEO Sanjiv Mehta said, “It will add huge amount of lustre to the great brands we already have in our portfolio.” | ||

| + | |||

| + | The merger will result in a single legal entity with GSKCH being housed as a division in HUL. There will be no change of company name or board constitution. | ||

| + | |||

| + | HUL’s top management said it will unlock significant synergies from the merger, both from revenue and costs. This will come about from a combination of supply chain efficiencies, operational improvements, go-to-market and distribution network optimisation and streamlining of overlapping infrastructure. It could, however, lead to certain redundancies. | ||

| + | |||

| + | When asked what would be the fate of the 3,800-odd employees of GSKCH after the merger, the management of India’s leading fast-moving consumer goods company said it is a growing business and always in need of talent. However, the first focus will be the integration of the two businesses. The maker of Lipton tea and Kwality Walls ice cream employs around 18,000 people. | ||

| + | |||

=Annual income= | =Annual income= | ||

==2010-17== | ==2010-17== | ||

| + | [[File: Annual income of Hindustan Unilever Ltd., 2010-17.jpg|Annual income of Hindustan Unilever Ltd., 2010-17; [http://epaperbeta.timesofindia.com//Gallery.aspx?id=11_09_2017_017_025_013&type=P&artUrl=TOI-EXCLUSIVE-Well-double-biz-here-in-7-11092017017025&eid=31808 The Times of India], September 11, 2017|frame|500px]] | ||

| + | |||

''' See graphic: ''' | ''' See graphic: ''' | ||

''Annual income of Hindustan Unilever Ltd., 2010-17'' | ''Annual income of Hindustan Unilever Ltd., 2010-17'' | ||

| − | |||

| − | |||

Revision as of 13:18, 22 December 2018

This is a collection of articles archived for the excellence of their content. |

Contents |

Acquisitions

2018: GlaxoSmithKline, Boost, Horlicks

Unilever gets Boost with Horlicks, December 4, 2018: The Times of India

Malt-based hot drinks, 2016-18

From: Unilever gets Boost with Horlicks, December 4, 2018: The Times of India

Buys GSK’s India Consumer Biz In All-Share Deal That Values It At ₹31.7K Cr

Unilever has agreed to acquire British healthcare company GlaxoSmithKline’s India consumer business, which includes the prized health food drinks brand Horlicks, ending months of speculation over who would bag the business. GSK has a large play in India, the Anglo-Dutch consumer product major’s second-largest market.

Horlicks, a 140-year old brand, which came to Indian shores with the British army during World War I as a “dietary supplement”, thus retains its British legacy. Swiss foods giant Nestle, too, was in a close race to acquire the business, which includes other strong brands — Boost (once endorsed by Kapil Dev and Sachin Tendulkar), Viva and Maltova. The scale of Unilever’s India business — which is also its fastest growing — appears to have dimmed the chances of other suitors in the fray. It is also touted as the largest deal under outgoing Unilever CEO Paul Polman.

In India, the merger values GSK’s subsidiary — GSK Consumer Healthcare (GSKCH) — at Rs 31,700 crore, which is 7.5 times the turnover of the firm, making it the biggest deal in the consumer space yet. Under the all-share deal, GSKCH will be merged with Unilever’s subsidiary Hindustan Unilever (HUL) in such a way that a GSKCH shareholder would get 4.39 shares of HUL for each share of GSKCH that he/she holds. It values GSKCH at Rs 7,540 per share, which is around 15% premium to the firm’s share price of Rs 6,531as on March 31, 2018.

The share price of GSKCH jumped by about Rs 273 or 3.8% to close at Rs 7,543 on the BSE on Monday. HUL’s share price was up Rs 72 or 4.1% to close at Rs 1,826.

The merger, which has been approved by the boards of the respective Indian subsidiaries but is subject to regulatory and shareholder approvals, will boost HUL’s revenues to around Rs 40,000 crore, while catapulting its food and refreshments (F&R) business to around Rs 10,700 crore (28% of HUL’s revenues), making it the largest listed F&R business in the country.

Given that Horlicks is the leading brand in the Rs 7,000-crore health food drinks market, with a combined share of 55% (along with Boost, Maltova and Viva), HUL gets a direct entry into a new category with leadership position. With penetration of health food drinks still low at around 24%, Horlicks would benefit from HUL’s distribution muscle and its 8-million outlet reach to grow under a new parent. HUL chairman and CEO Sanjiv Mehta said, “It will add huge amount of lustre to the great brands we already have in our portfolio.”

The merger will result in a single legal entity with GSKCH being housed as a division in HUL. There will be no change of company name or board constitution.

HUL’s top management said it will unlock significant synergies from the merger, both from revenue and costs. This will come about from a combination of supply chain efficiencies, operational improvements, go-to-market and distribution network optimisation and streamlining of overlapping infrastructure. It could, however, lead to certain redundancies.

When asked what would be the fate of the 3,800-odd employees of GSKCH after the merger, the management of India’s leading fast-moving consumer goods company said it is a growing business and always in need of talent. However, the first focus will be the integration of the two businesses. The maker of Lipton tea and Kwality Walls ice cream employs around 18,000 people.

Annual income

2010-17

See graphic:

Annual income of Hindustan Unilever Ltd., 2010-17