Credit/ Debit cards: India

| Line 1: | Line 1: | ||

| − | [[File: Debit cards, 2011- | + | [[File: Debit cards, 2011-16a.jpg|Debit cards, 2011-16 <br/>GOODBYE CASH, BUY BUY DEBIT CARDS <br/> In five years between 2011 and 2016, the number of debit cards saw a threefold spiral that shows that more and more people are comfortable using debit cards <br/> [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=STATOISTICS-GOODBYE-CASH-BUY-BUY-DEBIT-CARDS-01112016009014 ''The Times of India'']|frame|500px]] |

{| class="wikitable" | {| class="wikitable" | ||

|- | |- | ||

Revision as of 15:55, 1 November 2016

GOODBYE CASH, BUY BUY DEBIT CARDS

In five years between 2011 and 2016, the number of debit cards saw a threefold spiral that shows that more and more people are comfortable using debit cards

The Times of India

This is a collection of articles archived for the excellence of their content. Readers will be able to edit existing articles and post new articles directly |

Credit card spend rises

Average credit card spend up 42% in 2 years

Big Driver: 0% EMI On Phones And Durables

Mayur Shetty TNN

The Times of India 2013/07/23

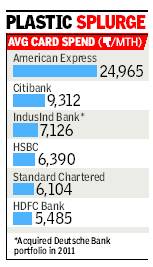

If there is one business that has defied the slowdown, it is credit cards. Average monthly spend per card has jumped 42% (2013) to Rs 6,322 from Rs 4,462 (in 2011). Banks attribute the rise primarily to a payment innovation termed ‘EMI at POS’, which enables manufacturers and retailers to sell smartphones and consumer durables under monthly installment schemes without their taking any credit risk or the buyer bearing any interest cost.

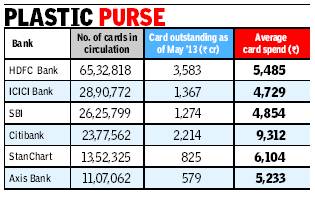

Total spending on credit cards increased 57% to Rs 12,380 crore in May 2013 from Rs 7,880 crore in May 2011. Part of this is due to the card industry returning to growth after four years and the number of credit cards rising to 1.95 crore from 1.76 crore.

Manufacturers target young people through EMI plans

Manufacturers are targeting young people with relatively lower incomes through EMI schemes to expand the market as well as clear inventories, particularly for expensive products such as smartphones. While manufacturers are prepared to get their payments in instalments, they do not have the wherewithal to assess credit worthiness or recover payments. “In the case of EMI at POS, the merchant or the manufacturer bears the interest burden but if the cardholder defaults, the risk is borne by the credit card issuer,” said banker Mohapatra.

Card companies have been offering customers the option to convert some of the large purchases into consumer loans which can be repaid in instalments over some years. But the response has been lukewarm as Indian consumers are interest-averse with almost 80% choosing to repay their entire bill by the month-end instead of rolling over.

“In recent years, several new entities have started accepting card payments. This includes insurance companies and government utilities. But the biggest driver for increase in size of transactions has been the zero-interest EMI option,” said Visa’s country manager Uttam Nayak. Visa has been aggregating hundreds of high value billers across the country, from LIC to electricity, gas, telecom, and water utilities where bills can be viewed and paid online.

Another driver is that banks are getting innovative with their rewards programmes. For instance, the Citibank PremierMiles credit card, which targets air travellers, offers reward points which work as a virtual currency as they can be used for airline tickets, hotels and car rental services. “Providing such an innovative proposition drives card preference among engaged customers, thereby increasing the value of spends. Cardholders can now choose what they want to buy using their reward points – be it a big purchase such as an airline ticket or smaller expenses like fuel, apparel or books. With over 65,000 Instant Redemptions per month, this has become the most popular way for redeeming reward points among Citibank customers” said Muge Yuzuak, Head of Cards and Personal Loans, Citi India.

Card companies are in 2013 in a much better position to extend credit than they were in 2008. First, there has been a dramatic fall in wilful defaults. Secondly, banks have learnt their lessons after 2007 when defaults in personal loans peaked; instead, they now issue cards largely to their own customer base.