Credit/ Debit cards: India

GOODBYE CASH, BUY BUY DEBIT CARDS

In five years between 2011 and 2016, the number of debit cards saw a threefold spiral that shows that more and more people are comfortable using debit cards

The Times of India

This is a collection of articles archived for the excellence of their content. Readers will be able to edit existing articles and post new articles directly |

Contents |

Cards issued

2022

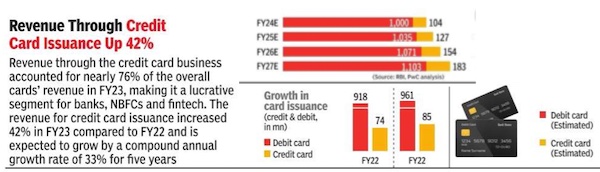

See graphic:

Growth of card issuance, FY 22-23

Credit cards issued

2020-2024

From: Oct 8, 2024: The Times of India

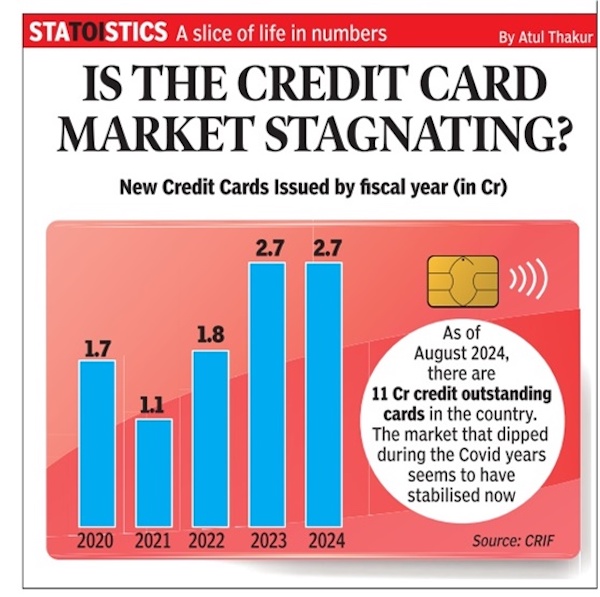

See graphic:

Growth of credit card issuance, 2020-2024

Card usage

2017: Card use rises, complaints dip

Credit card use jumps but plaints dip, December 20, 2017: The Times of India

From: Credit card use jumps but plaints dip, December 20, 2017: The Times of India

Despite a sharp jump in the number of credit cards in use, complaints regarding credit cards have dropped significantly. According to data released by the Reserve Bank of India (RBI), credit card-related complaints dropped over 5% despite a 27% jump in customer complaints in the overall banking sector.

According to the annual report of the banking ombudsman — an institution which adjudicates on consumer complaints — there is a decline in the number of credit card-related complaints as well as their percentage share of these complaints. In FY16, the ombudsman received 8,740 credit card complaints, which accounted for 8.5% of total banking complaints. In FY17, the number dropped to 8,297, or 6.5% of the total sector’s. This was despite the number of credit cards rising from 2.4 crore to 2.9 crore during the same period.

Bankers say that the number of complaints has dropped because of digitisation and measures to promote electronic bill payments. Also, security features have been improved.

However, while credit card complaints have fallen, there is a perceptible rise in the number of ATM /debit cardrelated complaints, which increased by 12.5% during the year under review. Out of a total of 24,731 card-related complaints, 16,434 complaints pertained to ATM/debit cards (12.5% of total complaints received). Card-related complaints (both debit and credit) comprised 18.9% of total complaints and accounted for the second highest number of complaints.

Total complaints stood at 1.30 lakh. Non-dispensation/ short dispensation of cash in ATM withdrawals was the major cause of complaints under this category. Complaints related to credit cards constituted 6.4% of total complaints received during 2016-17.

2008-18: growth in debit card usage

From: Rachel Chitra, India to have 1 billion debit cards soon, from just 84m 10 years ago, November 3, 2018: The Times of India

See graphic:

2008-18: growth in debit card usage

2014-19: Debit cards double, ATMs see 20% rise

Mayur Shetty, May 4, 2019: The Times of India

From: Mayur Shetty, May 4, 2019: The Times of India

Debit cards double in 5 years, but ATMs see only 20% rise

The number of debit cards in India has doubled to 94 crore in February 2019 from 42 crore in August 2014 when Jan-Dhan Yojana was launched.

However, the number of ATMs has increased only 20% from 1.70 to 2.02 lakh, and a stand-off between banks, ATM companies and cash logistics firms on sharing costs are holding back investments. While cash in circulation has jumped to Rs 21.36 lakh crore, the ATM network of banks has shrunk from 2.06 lakh a year ago to 2.02 lakh this year. At the heart of the stand-off is the question of who will bear the additional costs over the RBI’s new security guidelines for ATMs. While a large public sector bank did float a procurement process for new machines, the transaction did not materialise as there was no consensus on who will bear the increased costs.

Last year, the RBI came out with a new set of guidelines requiring banks to ensure that the cash vans they use have multiple security features including GPS and armed guards. It has also placed limits on the extent of cash that can be carried in the vans.

It has asked banks to switch to a ‘cassette swap’ system where currency notes will be transported in metal canisters, which will be loaded directly into ATMs and the cash loaders will not have access to currency notes. Banks must upgrade a third of their network every year and cover all machines by March 2021.

“We are seeing ATM deployment only in pockets. Clearly, the demand is there. It is about creating a model that is viable. If the additional costs are not covered through a higher interchange (a fee paid by the ATM-using bank to the ATMdeploying bank), banks will have to bear the costs,” said Himanshu Pujara, regional MD of Euronet Worldwide and a director in the Confederation of ATM Industry (CATMi). With banks outsourcing deployment of ATMs, management service providers who operate the networks or even rent out machines to banks have a large role to play.

Banks, which are trying to contain costs, are refusing to pay more for the same services. The cash logistics companies are seeking an additional Rs 4,900 per ATM per month because of the increased security features.

“The increased costs are a disincentive for ATM deployment. Although the RBI has issued several new bank licences, many of them are looking at riding the network of existing banks as paying the interchange is cheaper than building your own network,” said a banker. The interchange issue is being addressed by the RBI and a recent meeting was called by National Payments Corporation of India (NPCI) and the interchange is likely to be increased from Rs 15 to Rs 18 per transaction.

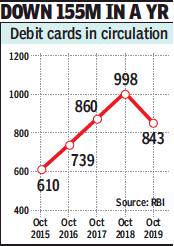

2019: a 2-year low

Rachel Chitra, Dec 23, 2019 Times of India

From: Rachel Chitra, Dec 23, 2019 Times of India

In October 2018, debit cards in India seemed well on their way to touching the one billion mark with 998 million cards in circulation (as reported by TOI on November 3, 2018). In just a year, the number plunged 15% and hit a two-year low of 843 million, as of October 2019.

Bankers say 155 million cards went out of the market because the EMV migration from magnetic-strip to chipbased cards weeded out dormant accounts and inactive cards. The Reserve Bank of India has mandated that all banks have to make this switch as EMV-chip based cards are deemed more secure. So for most of 2018, banks were engaged in reissuing all debit cards.

With over 80% of cards reissued in April 2019, most public sector and private banks had blocked magnetic stripe cards. This automatically weeded out any remaining inactive accounts.

“All banks had undertaken a major re-carding exercise during the EMV migration. For us, when we moved from the magnetic strip to EMVchip based, we also made all our cards NFC-enabled (near field communication-enabled cards) for tap-and-go payments,” said Sanjeev Moghe, executive VP and head, cards & payment at Axis Bank.

Credit card spend rises

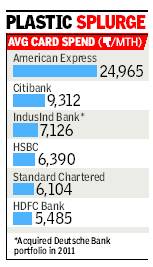

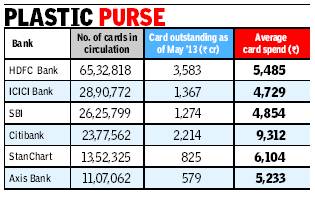

Average credit card spend up 42% in 2 years

Big Driver: 0% EMI On Phones And Durables

Mayur Shetty TNN

The Times of India 2013/07/23

If there is one business that has defied the slowdown, it is credit cards. Average monthly spend per card has jumped 42% (2013) to Rs 6,322 from Rs 4,462 (in 2011). Banks attribute the rise primarily to a payment innovation termed ‘EMI at POS’, which enables manufacturers and retailers to sell smartphones and consumer durables under monthly installment schemes without their taking any credit risk or the buyer bearing any interest cost.

Total spending on credit cards increased 57% to Rs 12,380 crore in May 2013 from Rs 7,880 crore in May 2011. Part of this is due to the card industry returning to growth after four years and the number of credit cards rising to 1.95 crore from 1.76 crore.

Manufacturers target young people through EMI plans

Manufacturers are targeting young people with relatively lower incomes through EMI schemes to expand the market as well as clear inventories, particularly for expensive products such as smartphones. While manufacturers are prepared to get their payments in instalments, they do not have the wherewithal to assess credit worthiness or recover payments. “In the case of EMI at POS, the merchant or the manufacturer bears the interest burden but if the cardholder defaults, the risk is borne by the credit card issuer,” said banker Mohapatra.

Card companies have been offering customers the option to convert some of the large purchases into consumer loans which can be repaid in instalments over some years. But the response has been lukewarm as Indian consumers are interest-averse with almost 80% choosing to repay their entire bill by the month-end instead of rolling over.

“In recent years, several new entities have started accepting card payments. This includes insurance companies and government utilities. But the biggest driver for increase in size of transactions has been the zero-interest EMI option,” said Visa’s country manager Uttam Nayak. Visa has been aggregating hundreds of high value billers across the country, from LIC to electricity, gas, telecom, and water utilities where bills can be viewed and paid online.

Another driver is that banks are getting innovative with their rewards programmes. For instance, the Citibank PremierMiles credit card, which targets air travellers, offers reward points which work as a virtual currency as they can be used for airline tickets, hotels and car rental services. “Providing such an innovative proposition drives card preference among engaged customers, thereby increasing the value of spends. Cardholders can now choose what they want to buy using their reward points – be it a big purchase such as an airline ticket or smaller expenses like fuel, apparel or books. With over 65,000 Instant Redemptions per month, this has become the most popular way for redeeming reward points among Citibank customers” said Muge Yuzuak, Head of Cards and Personal Loans, Citi India.

Card companies are in 2013 in a much better position to extend credit than they were in 2008. First, there has been a dramatic fall in wilful defaults. Secondly, banks have learnt their lessons after 2007 when defaults in personal loans peaked; instead, they now issue cards largely to their own customer base.

Credit vs. debit cards

Usage in 2018

From: June 19, 2019: The Times of India

See graphic:

The usage of credit vs. debit cards, presumably as in 2018

While debit cards dominate purchases, recording the most number of swipes for ATM & PoS machines, on the value front, customers prefer credit cards, according to the data released by Reserve Bank of India (RBI).

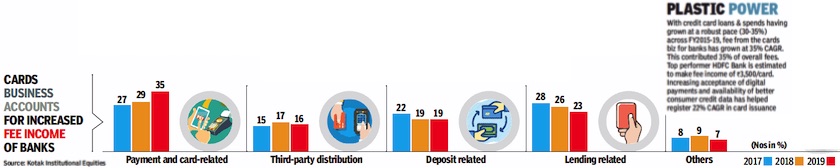

The fee income of banks

2017-19

From: Oct 21, 2019: The Times of India

See graphic:

The fee income of banks from Credit/ Debit cards, 2017-19

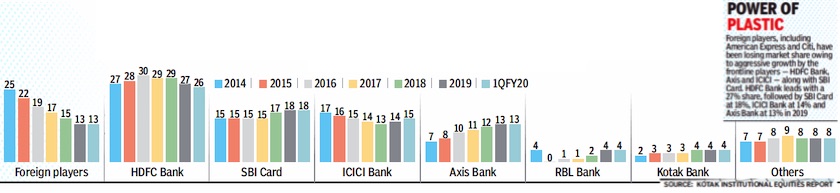

The major cards

2014-19

From: Oct 8, 2019: The Times of India

See graphic:

The major Credit/ Debit cards in India, 2014-19

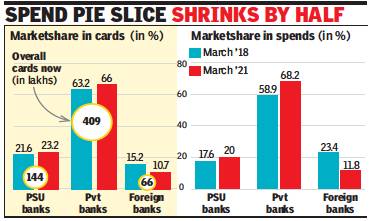

Foreign vis-à-vis Indian banks

2018> 21

Mayur Shetty , May 28, 2021: The Times of India

From: Mayur Shetty , May 28, 2021: The Times of India

Foreign banks have seen their share of credit cards come down by a third in the last three years. In terms of value of transactions, their share has halved as that of private and public sector banks have grown.

According to data released by the RBI, foreign banks had 57 lakh credit cards outstanding as of March 2018. At that time, there were 3.8 crore credit cards in India, which gave the multinationals a market share of 15%. However, despite losing market share, the foreign banks had significant clout because of the higher value of transactions by their customers who spent more than the average cardholder. In 2018, the foreign banks had monthly card spends of Rs 10,380 crore — a 23.4% share.

Fast forward to March 2021, when the total market expanded to 6.2 crore cards while the number of cards issued by foreign banks stood at 66 lakhs, reflecting a market share of nearly 11%. It is not just in the number of cards that the multinationals have been losing ground. In terms of value of transactions too, foreign banks have a market share of 11.8% in the Rs 72,372-crore monthly volume.

In global banks, four dominate the credit card space — Citi, Amex, StanChart and HSBC. These MNC banks have also played a pioneering role in the card business in India and they dominated the market in the ’90s. Citi’s decision to exit its retail business in India could further reduce share of foreign banks, should the portfolio be taken by a local player. Additionally, American Express faces a freeze on on-boarding new customers due to data-localisation norms even as more private banks are stepping in.

Rules

Non-transferable even to spouse

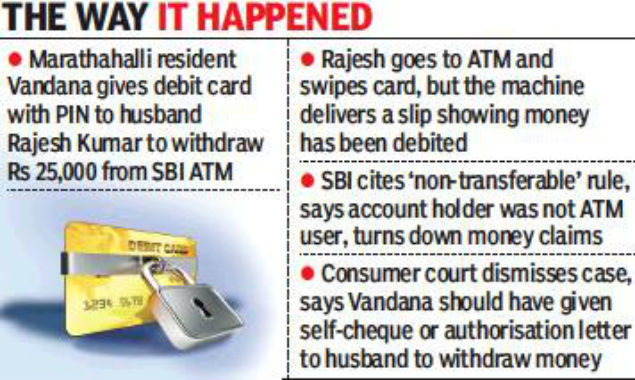

Petlee Peter, June 7, 2018: The Times of India

From: Petlee Peter, June 7, 2018: The Times of India

A casual act of letting your spouse or a close relative/friend withdraw money from an ATM using your debit card could prove costly. This is what a Benglauru woman on maternity leave learnt, albeit the hard way.

Banking rules categorically state that an ATM card is non-transferable and no other person apart from the account holder should use it.

On November 14, 2013, Marathahalli resident Vandana gave her debit card with PIN to her husband, Rajesh Kumar, to withdraw Rs 25,000 from a local SBI ATM. Rajesh went to the ATM and swiped the card; the machine delivered a slip showing the money was debited, but the amount was never released. SBI cited the ‘non-transferable’ rule and said the account holder was not the ATM user and turned down the money claims.

Vandana approached the Bangalore IVth Additional District Consumer Disputes Redressal Forum on October 21, 2014, alleging that SBI had failed to refund the Rs 25,000 she’d lost in the ATM transaction. She said she had just given birth and could not move out of home, hence had to ask her husband to draw the money on her behalf.

When the ATM did not release the money, Rajesh called the SBI call centre only to be informed that it was an ATM fault and the money would be reverted to the account within 24 hours. With no sign of the money after a day, he approached the bank’s Helicopter Division branch at HAL with a formal complaint. But much to the shock of the couple, SBI allegedly closed the case in a few days, stating the transaction was correct and the customer got the money.

After running from pillar to post, the couple obtained CCTV footage that showed Kumar using the machine, but no cash being dispensed. They further lodged a complaint with the bank, following which an investigation committee ruled that Vandana, the cardholder, is not seen in the footage.

Meanwhile, Vandana, through an RTI, obtained a cash verification report of the ATM for November 16, 2013, which showed excess cash of Rs 25,000 in the machine. The report submitted in the court was later countered by the SBI counsel who produced a report showing no excess cash.

Before approaching the consumer forum, the couple made a final plea to the bank ombudsman who simply ruled, ‘PIN shared, case closed.’

The case went on for over three-and-a-half years. Vandana said SBI should refund her money which was lost due to an ATM flaw, but the bank stood its ground, citing the rule that sharing ATM PIN with someone else was a violation. Further, the bank produced documents, including log records, showing the stated ATM transaction was successful and technically correct.

In its verdict on May 29, 2018, the court ruled that Vandana should have given a self-cheque or an authorisation letter to her husband for withdrawal of Rs 25,000, instead sharing the PIN and making him withdraw the money. The court dismissed the case.