Two-wheeled automobiles: India

(→2018: ownership in the metros) |

(→2018: BMW Motorrad- 2,187 units sold) |

||

| Line 78: | Line 78: | ||

''Ownership of two-wheeled_automobiles in the Indian metros, presumably as in 2018'' | ''Ownership of two-wheeled_automobiles in the Indian metros, presumably as in 2018'' | ||

| − | ==2018: BMW Motorrad- | + | ==2018: BMW Motorrad- top 5 bestsellers for BMW== |

[https://timesofindia.indiatimes.com/auto/bikes/made-in-india-bikes-in-top-5-bestsellers-for-bmw-globally/articleshow/67598087.cms Nandini Sen Gupta, ‘Made in India’ bikes in top 5 bestsellers for BMW globally, January 19, 2019: ''The Times of India''] | [https://timesofindia.indiatimes.com/auto/bikes/made-in-india-bikes-in-top-5-bestsellers-for-bmw-globally/articleshow/67598087.cms Nandini Sen Gupta, ‘Made in India’ bikes in top 5 bestsellers for BMW globally, January 19, 2019: ''The Times of India''] | ||

Revision as of 15:23, 21 January 2019

This is a collection of articles archived for the excellence of their content.

|

Contents |

Sales

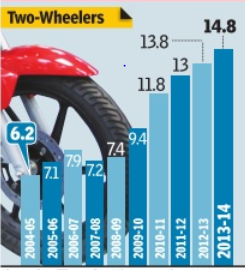

2004-14

See graphic:

Sale of two-wheelers in India, 2004-14

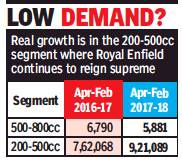

2016>18: High-end bike sales slow down

Nandini Sengupta, High-end bike sales hit slow lane, March 23, 2018: The Times of India

From: Nandini Sengupta, High-end bike sales hit slow lane, March 23, 2018: The Times of India

As leisure biking picks up speed in India, more and more global motorcycle brands are flocking to this market and new products and brands are rolling in thick and fast. But despite the excitement about the highend luxury motorcycle market, the latest SIAM data shows that the 500cc-plus segment is shrinking.

The real growth is in the 200-500cc segment where Royal Enfield continues to reign supreme. The higher end moto-market — where global brands like Harley Davidson, Triumph, Kawasaki and others play — is either flat or has turned negative.

Consider the stats: According to Siam, between April and February, sales in the 500cc-plus segment fell to 5,881 units from 6,790 a year ago. In contrast, the 200-500cc market is vrooming with sales up nearly 21% in the April-February period. This segment has gone from 7,62,068 units in the previous April-February to nearly a million units (9,21,089 units) now.

The segment immediately preceding this — the 150-200cc market — has clocked the highest growth in the motorcycle market at nearly 42% with Bajaj, Honda Motorcycle and Scooter India, Suzuki and TVS all clocking impressive growth.

Motorcycle marketers are betting big on this demand shift upwards as some of the more mass-market segments continue to shrink. The 125-150cc market, for instance, has shrunk from 11,93,426 units to 10,17,713 units this time round. “The demand shrink is happening in those commuter segments which focused on urban markets as demand there is moving towards 200cc and above,” said a senior motorcycle marketer. “But rural demand has ensured that the bottom end of the motorcycle market remains buoyant.”

Indeed, the 75-110cc entrylevel commuter segment has actually grown from 5.9 million units to 6.7 million units in the April-February period. The 110-125cc commuter segment has also grown from 1.7 million units to 2 million units in the same period. Both these segments were under pressure when rural demand was stuck in first gear due to poor rains, among other reasons.

2017, India: World’s biggest market for two-wheelers

India is now the world’s biggest two-wheeler market , Pankaj Doval, May 7, 2017: The Times of India

HIGHLIGHTS

17.7 million two-wheelers were sold in India in 2016, while China trailed at 16.8 million units

"The massive government spending in rural programmes and large road-construction projects is leading to a pick-up in volumes in smaller towns and villages," said a top official at Hero MotoCorp

NEW DELHI: India has overtaken China to emerge as the world's biggest market for two-wheelers. A total of 17.7 million two-wheelers were sold here last year, that's over 48,000 units every day.

Neighbouring China trailed with 16.8 million units sold, according to officials from industry body Society of Indian Automobile Manufacturers (Siam) as well as data from China Association of Automobile Manufacturers.

Besides rising incomes and growing infrastructure in rural areas, one big reason for the spurt in sales has been women commuters+ who like the ease of zipping in and out of chaotic city traffic on their gearless scooters. For Honda, which leads the scooter market, the share of women is at 35%.

The market in China has been on a decline over the past few years, perhaps due to the fast-paced growth in car sales there as well as the curbs on petrol two-wheelers in top cities. "The Chinese market has been coming down from the highs of 25 million or so, reached a few years back," says Sugato Sen, Deputy DG of Siam. However, the sales of electric two-wheelers have been on an upswing in China.

Indonesia is holding steady as the third-largest two-wheeler market with annual sales estimated at 6 million units. Here too, volumes have slipped from 6.5 million units sold in 2015.

So, what clicks for India when it comes to the two-wheeler market? "The need for mobility is very large in India, and we are one of the fastest developing economies in the world," says YS Guleria, Senior VP (Sales & Marketing) at Honda Motorcycle and Scooter India (HMSI), the country's second-biggest two-wheeler company.

Easier finance options, newer and more fuel-efficient models, rising incomes have only added to the push even as new business models, such as e-commerce, also help purchases.

A top official at Hero MotoCorp, the country's biggest company, said that the growth of infrastructure in smaller towns and non-urban areas is helping demand.

"The massive government spending in rural programmes and large road-construction projects is leading to a pick-up in volumes in smaller towns and villages," said the official, who did not wish to be identified.

In metros and the larger cities, the sales are also being aided by the choked infrastructure. "People are buying two-wheelers for shorter commute and errands, even if they have a car. It is difficult to move around in congested cities, and even more difficult to get a space to park. So, two-wheelers are increasingly becoming the second vehicles in the household," the official from Hero says.

Industry officials say that the market will continue to grow over the next few years. "We will grow at around 9-11% over the coming years," Honda's Guleria says.

The growth is not only being led by commuter vehicles, but even larger and expensive two-wheelers are being sold in good numbers. Royal Enfield, which sells bikes comfortably priced upwards of Rs 1 lakh, has seen sales grow by over 30% last year, and is now preparing to boost its production capacity.

"We have seen a massive demand in the past few years and are ramping up capacity," says Siddhartha Lal, CEO of Eicher Motors that sells the bikes. "India is a market where sales are only going to go up, and there is enormous potential here."

Premium bike makers (those selling products priced upwards of Rs 5 lakh) such as UK's Triumph Motorcycles and American Harley Davidson have also been upping their product portfolio and exposure in India.

Triumph, which entered India in 2013, has already sold over 4,000 bikes and now has portfolio of over 17 vehicles. "Triumph is the fastest-growing luxury motorcycle brand in India, and we hope to maintain the pace further," Vimal Sumbly, MD of Triumph in India, says.

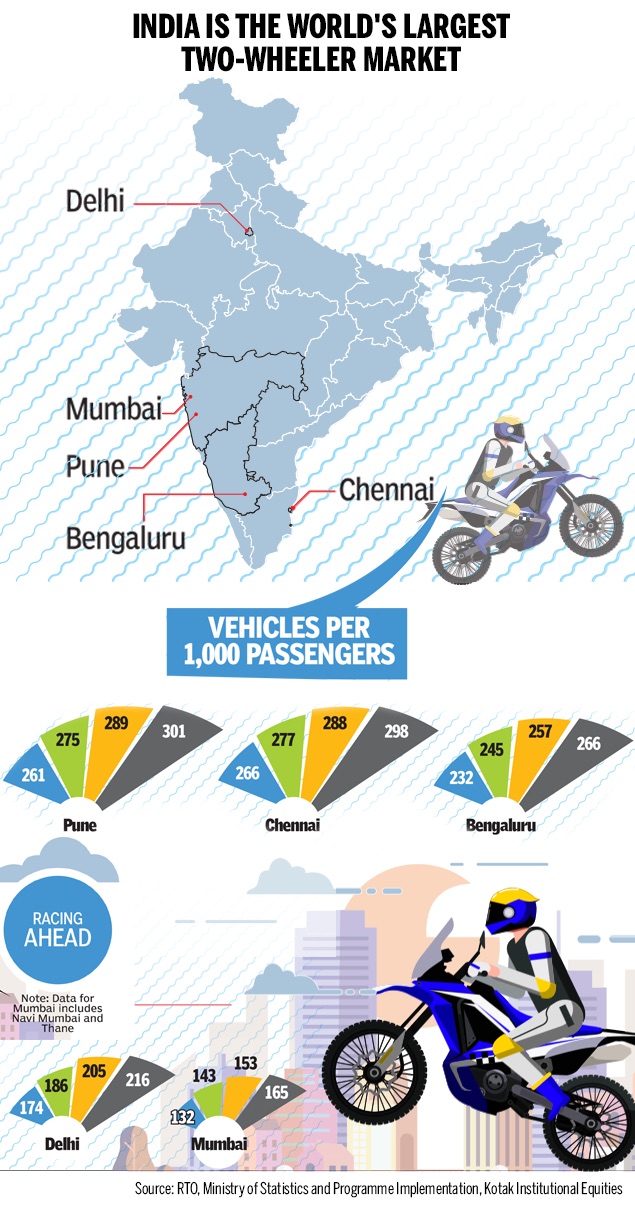

2018: ownership in the metros

From: January 10, 2019: The Times of India

See graphic:

Ownership of two-wheeled_automobiles in the Indian metros, presumably as in 2018

2018: BMW Motorrad- top 5 bestsellers for BMW

BMW Motorrad, the German luxury marque BMW’s motorcycle arm, has clocked an all-time sales high in 2018 — its 8th in a row — with its ‘Made in India’ G 310 R and G 310 GS featuring among the top-five models worldwide.

The company has reported “significant growth in India” even as its worldwide deliveries increased by 0.9 per cent to 1,65,566 vehicles. As many as 24,363 units of the G 310 R and G 310 GS models produced in India since 2017 have already been delivered to customers by the end of 2018.

“The two agile all-rounders are thus among the top five of the top-selling models in 2018 and are very popular all over the world,” said the company in a statement. BMW Motorrad also announced its focus on new markets and segments for 2019. The company sold 2,187 units in India in 2018 as “the BMW Group’s own sales subsidiary was successfully established sales of BMW motorcycles began following the start of business in 2017,” added the company statement.

In April 2013, TVS Motor Company and BMW Motorrad signed a long-term strategic partnership to manufacture sub-500cc motorcycles for the globe.

This collaboration has resulted in the launch of three products on the 310cc platform namely BMW G 310 R, BMW 310 GS and TVS Motor Company’s TVS Apache RR 310. Last month, the 50,000th unit of the BMW 310cc motorcycle rolled out from TVS Motor’s Hosur plant. The exports for BMW G 310 R and BMW 310 GS, commenced in December 2016 and are currently being offered in more than 90 countries.

The India growth comes alongside some top-gear performance in China and Brazil. With 7,561 BMW motorcycles and scooters sold and a growth rate of over 35 per cent, China together with Brazil (7,361 units, up 11 per cent) are among the markets with the strongest growth.

“With this sales record, BMW Motorrad takes another step towards reaching its planned target of 2,00,000 units in the year 2020,” said Markus Schramm, head of BMW Motorrad.

In India, BMW G 310 R has a starting price of Rs 2.99 lakh while the G 310 GS is latched at a price of Rs 3.49 lakh.

MOTORCYCLES

Honda Motorcycles & Scooters

2017: India the largest market

India is now the largest two wheeler market globally , by volume, for Japanese automobile major Honda. Honda Motorcycle & Scooter India's (HMSI) volume contribution globally hit 32% in the first quarter of this financial year -its highest ever so far.

According to top HMSI officials the company's two wheeler sales grew 20% in the AprilJuly period -compared to 9% growth clocked by the industry -with scooters growing 19% and motorcycles growing 20% including domestic sales and exports.

“India is also the biggest production hub now for Honda with a combined capacity of 6.4 million units compared to Indonesia which was earlier the largest at 5.8 million units,“ said YS Guleria senior VP marketing and sales HMSI.

With this India has become Honda's largest motorcycle market globally in FY16-17 dethroning Indonesia which however continues to be Hon da's biggest scooter market globally. In an effort to keep up that momentum the company is planning to enter the high growth 250 cc plus motorcycle market that is currently dominated by Royal Enfield.

“We have a strong intention to enter this segment in the near future. We have been considering how to enter it with the right product and compete from the cost and price point because competition enjoys high cost competitiveness,“ said M Kato president and CEO HMSI. Apart from the lifestyle segment Honda's also trying to expand the market for scooters to semi urban and rural segments. To that end the company on Monday launched the 110 cc Cliq at a price of Rs 44,524.

“Overall rural markets contribute around 28-30% of Honda's sales with 20% of scooter sales coming from these markets“ added Guleria.

Apart from rural markets, focus is also on the 5 southern markets which together account for 28% of two wheeler sales countrywide and 43% scooter sales.