Investments: India

(→Mega projects, 2006-16) |

(→Gross fixed capital formation) |

||

| Line 30: | Line 30: | ||

3. ''i) Capacity utilisation of manufacturing companies (%), 2011-17; <br/> ii) its impact on growth of employment in 2017'' | 3. ''i) Capacity utilisation of manufacturing companies (%), 2011-17; <br/> ii) its impact on growth of employment in 2017'' | ||

| + | =Impact investments= | ||

| + | ==2017>2019== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F07%2F22&entity=Ar00200&sk=89524615&mode=text Digbijay Mishra, July 22, 2019: ''The Times of India''] | ||

| + | |||

| + | [[File: Impact investments in India in 2018, Sectors funded, sources of funds, Definition.jpg|Impact investments in India in 2018: <br/> Sectors funded, sources of funds, Definition <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F07%2F22&entity=Ar00200&sk=89524615&mode=text Digbijay Mishra, July 22, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | Impact investments, a pathway to achieve the seemingly divergent goals of financial returns and social good, are moving towards agriculture and healthcare in the country, according to the latest report of research organisation Brookings India. It’s a marked shift in trends from two years ago. Until 2017, these sectors saw muted interest from impact funds, receiving smaller infusions. | ||

| + | |||

| + | Energy and microfinance, however, continue to command the attention of funders the world over, as per the Global Impact Investing Network (GIIN). | ||

| + | |||

| + | Brookings, which interviewed 25 impact investors and industry stakeholders for its study, notes that the positive trend in agriculture and healthcare represents a deviation from microfinance and energy in India. About 67% of the respondents were interested in agriculture and education, while about 58% were excited about opportunities in healthcare and financial services, excluding microfinance. The respondents were given multiple options. Affordable housing, energy, and employability and skilling are other sectors on investors’ radar. | ||

| + | |||

| + | Greater interest in health and farming signals bigger opportunities, considering that large sections of the country’s population are underserved in these segments. | ||

| + | “While the reasons for this shift are unclear, policy uncertainty around the microfinance sector after the 2010 Andhra Pradesh ordinance and high capital requirements of the energy sector were noted as enablers for this shift,” the Brookings report states. In 2010, Andhra Pradesh introduced stringent conditions for microfinance firms after alleged coercive collection methods of some companies drove many borrowers to end their life. | ||

| + | |||

| + | Impact investment is being viewed as a potential gamechanger to address some of the world’s most complex problems that governments alone cannot handle because of budgetary constraints. The promise of returns on each investment draws funders who want to do public good. In the Union Budget, the government proposed a social stock exchange under Sebi to list social enterprises and voluntary organisations so they can raise capital. | ||

| + | |||

| + | Venture capital (VC) firms, according to investors, are increasingly looking to back impact firms as they see decent returns on such bets. Ankur Capital, which has exhausted its first fund of ₹50 crore, said 70% of portfolio companies had raised follow-on investments from VCs focused on strong financial returns instead of the social good metric. | ||

| + | |||

| + | Ritu Verma, co-founder and managing partner at Ankur Capital, sees this as a validation of startups trying to solve problems in priority sectors such as agriculture and healthcare. She is currently raising her second fund of ₹350 crore with a plan to back over a dozen new startups. | ||

| + | But even as Indian impact investors prepare to allocate more capital to startups in priority sectors, there are some challenges. Brookings India research director Shamika Ravi, who is on the Economic Advisory Council to Prime Minister Narendra Modi, told TOI that investors must innovate and measure the impact startups were creating for further help from the government. | ||

| + | |||

| + | “It’s very important to measure the impact. Right now, the industry is standing fundamentally on the back of financial returns. They are not putting in as much effort to showcase what is the impact,” Ravi said. “In the long term, this sector has to grow in India, and it requires investment. There is a huge investment gap and the government is looking for nonbudgetary allocations to help sectors like health, agriculture, and education.” | ||

| + | |||

| + | Typically, impact investors back startups early in their journey with smaller cheques, largely for seed stage to Series A funding. According to the study, funders see appropriate capital across the risk/return spectrum and suitable exits options as the biggest challenges. This is in line with global trends. Finding good quality investment is a challenge for about 32% of global impact investment firms. In India, 25% of firms face this issue. | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|I | ||

| + | INVESTMENTS: INDIA]] | ||

| + | [[Category:India|I | ||

| + | INVESTMENTS: INDIA]] | ||

| + | [[Category:Pages with broken file links|INVESTMENTS: INDIA]] | ||

=Investment by Indian corporations= | =Investment by Indian corporations= | ||

Revision as of 16:06, 13 January 2021

This is a collection of articles archived for the excellence of their content. |

Contents |

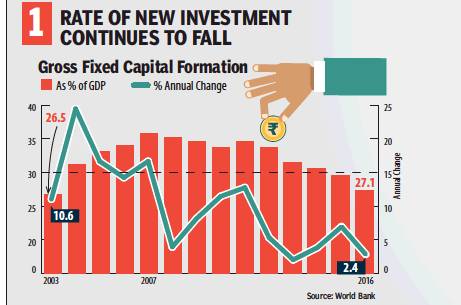

Gross fixed capital formation

2003-17

February 2, 2018: The Times of India

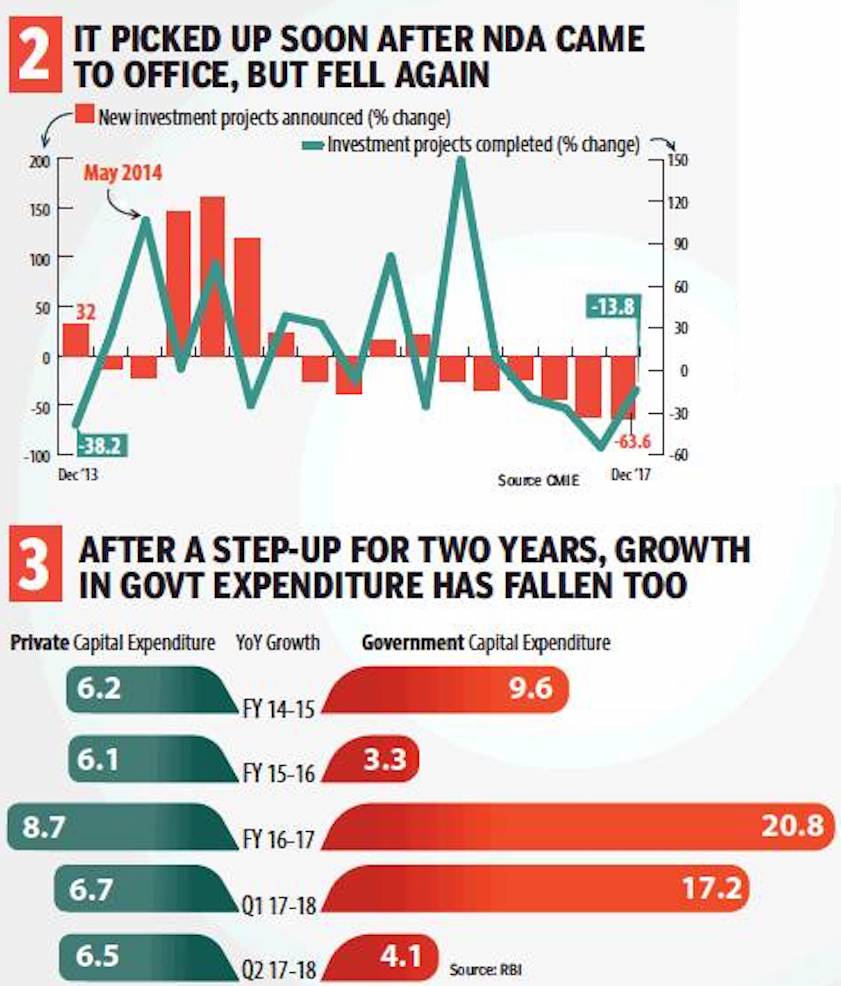

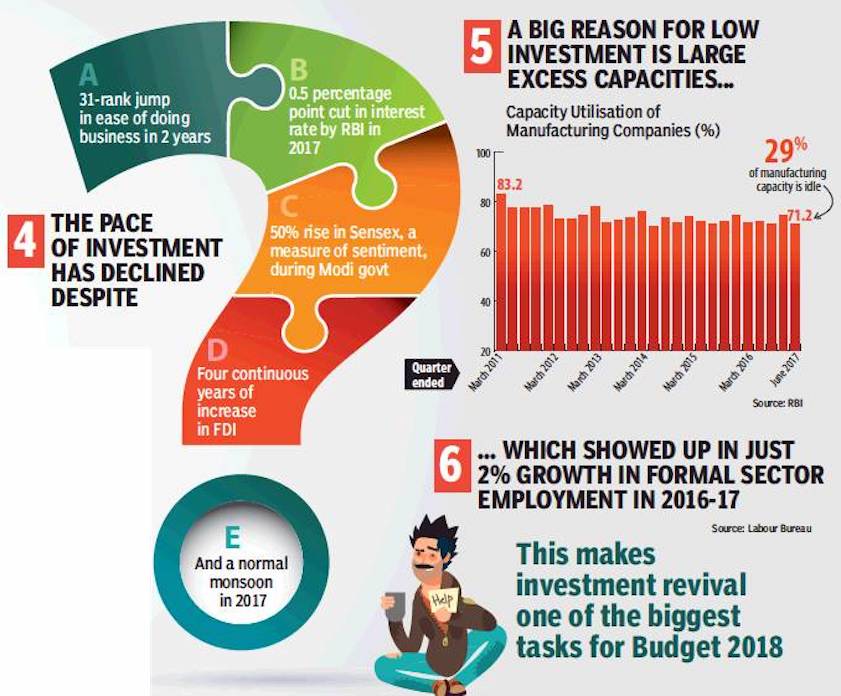

Soaring stock prices, pick-up in industrial production, stabilising GST regime and a projected upturn in GDP growth-there has been a raft of good economic news in the past few weeks. But the good times won’t roll on unless the rate of new investment, especially private investment, picks up soon. Here’s how severe the slowdown is and what’s causing it

ii) Government and private capital expenditure, 2014-18

From: February 2, 2018: The Times of India

ii) its impact on growth of employment in 2017

From: February 2, 2018: The Times of India

See graphics:

1. Gross fixed capital formation, 2003-16,

i) as percentage of GDP;

ii) annual change

2. i) The rise and fall of gross fixed capital formation, 2013-17,

ii) Government and private capital expenditure, 2014-18

3. i) Capacity utilisation of manufacturing companies (%), 2011-17;

ii) its impact on growth of employment in 2017

Impact investments

2017>2019

Digbijay Mishra, July 22, 2019: The Times of India

Sectors funded, sources of funds, Definition

From: Digbijay Mishra, July 22, 2019: The Times of India

Impact investments, a pathway to achieve the seemingly divergent goals of financial returns and social good, are moving towards agriculture and healthcare in the country, according to the latest report of research organisation Brookings India. It’s a marked shift in trends from two years ago. Until 2017, these sectors saw muted interest from impact funds, receiving smaller infusions.

Energy and microfinance, however, continue to command the attention of funders the world over, as per the Global Impact Investing Network (GIIN).

Brookings, which interviewed 25 impact investors and industry stakeholders for its study, notes that the positive trend in agriculture and healthcare represents a deviation from microfinance and energy in India. About 67% of the respondents were interested in agriculture and education, while about 58% were excited about opportunities in healthcare and financial services, excluding microfinance. The respondents were given multiple options. Affordable housing, energy, and employability and skilling are other sectors on investors’ radar.

Greater interest in health and farming signals bigger opportunities, considering that large sections of the country’s population are underserved in these segments. “While the reasons for this shift are unclear, policy uncertainty around the microfinance sector after the 2010 Andhra Pradesh ordinance and high capital requirements of the energy sector were noted as enablers for this shift,” the Brookings report states. In 2010, Andhra Pradesh introduced stringent conditions for microfinance firms after alleged coercive collection methods of some companies drove many borrowers to end their life.

Impact investment is being viewed as a potential gamechanger to address some of the world’s most complex problems that governments alone cannot handle because of budgetary constraints. The promise of returns on each investment draws funders who want to do public good. In the Union Budget, the government proposed a social stock exchange under Sebi to list social enterprises and voluntary organisations so they can raise capital.

Venture capital (VC) firms, according to investors, are increasingly looking to back impact firms as they see decent returns on such bets. Ankur Capital, which has exhausted its first fund of ₹50 crore, said 70% of portfolio companies had raised follow-on investments from VCs focused on strong financial returns instead of the social good metric.

Ritu Verma, co-founder and managing partner at Ankur Capital, sees this as a validation of startups trying to solve problems in priority sectors such as agriculture and healthcare. She is currently raising her second fund of ₹350 crore with a plan to back over a dozen new startups. But even as Indian impact investors prepare to allocate more capital to startups in priority sectors, there are some challenges. Brookings India research director Shamika Ravi, who is on the Economic Advisory Council to Prime Minister Narendra Modi, told TOI that investors must innovate and measure the impact startups were creating for further help from the government.

“It’s very important to measure the impact. Right now, the industry is standing fundamentally on the back of financial returns. They are not putting in as much effort to showcase what is the impact,” Ravi said. “In the long term, this sector has to grow in India, and it requires investment. There is a huge investment gap and the government is looking for nonbudgetary allocations to help sectors like health, agriculture, and education.”

Typically, impact investors back startups early in their journey with smaller cheques, largely for seed stage to Series A funding. According to the study, funders see appropriate capital across the risk/return spectrum and suitable exits options as the biggest challenges. This is in line with global trends. Finding good quality investment is a challenge for about 32% of global impact investment firms. In India, 25% of firms face this issue.

Investment by Indian corporations

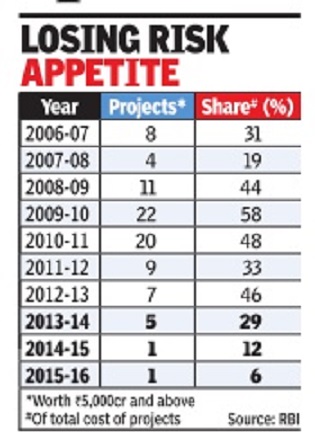

Mega projects, 2006-16

2013-16: a declining trend

India Inc is shying away from mega projects, which are defined as those with a value of Rs 5,000 crore and above. Their share in the total cost of all projects has fallen to a decade low of less than 6% in 2015-16 -the third consecutive year of the slide. The share of mega projects in the total cost of projects had hit a peak of 58% in 2009-10 (see graph).

Although the overall cost of projects has grown by nearly 10% in 2015-16, the increase has come only from small-value projects (which cost less than Rs 1,000 crore each), data with the RBI showed. “High-value projects financed by banks witnessed a repeated decline in the past few years and the same trend may be expected to continue for a couple of quarters. Due to the cleaning up of balance sheets undertaken by banks, they may not be able to lend aggressively in the near future,“ the RBI said.

The share of high-value projects (Rs 1,000 crore and above) also fell in 2015-16.Their share has come down to 45% in the total cost of all projects during the year compared to 60% in the previous year.

Capital expenditure (capex) by corporates, estimated at Rs 1.5 lakh crore in 2015-16, was nearly 25% lower than the revised estimate for 2014-15. “In order to maintain even this lower level of aggregate capex in 2016-17, about Rs 83,800 crore needs to be spent from the new projects to be sanctioned financial assistance in 2016-17,“ the RBI said.

The aggregate capex to be incurred in 2015-16 amounted to Rs 99,700 crore -a nearly 27% fall over the previous year, continuing the trend seen since 2011-12.

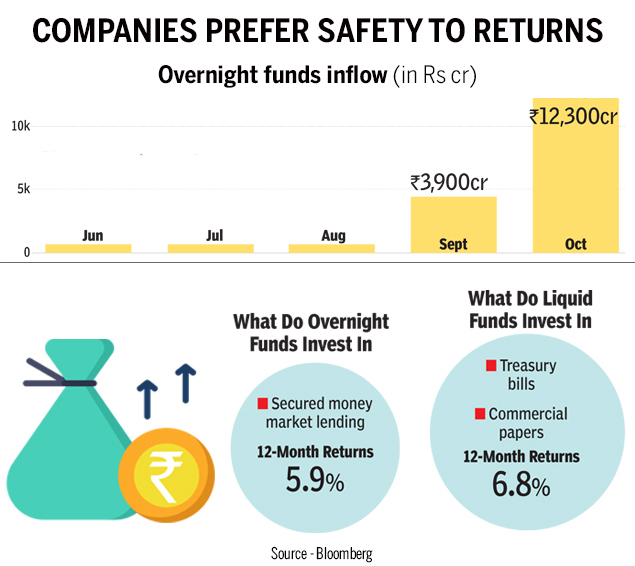

2018: parking cash in securities maturing overnight

December 5, 2018: The Times of India

From: December 5, 2018: The Times of India

Corporate treasury departments in India have become so concerned about credit risk that they are increasingly parking their cash in securities maturing overnight. Assets with overnight funds soared to Rs 12,300 crore ($1.8 billion) last month, from Rs 3,900 crore in September, as companies chose safety over returns in the wake of a rare debt default, by the IL&FS Group. Some liquid funds lost as much as 5% — or half a year’s worth of gains — in a single day. Short-term investments also reduce interest rate risks.

Investment intentions

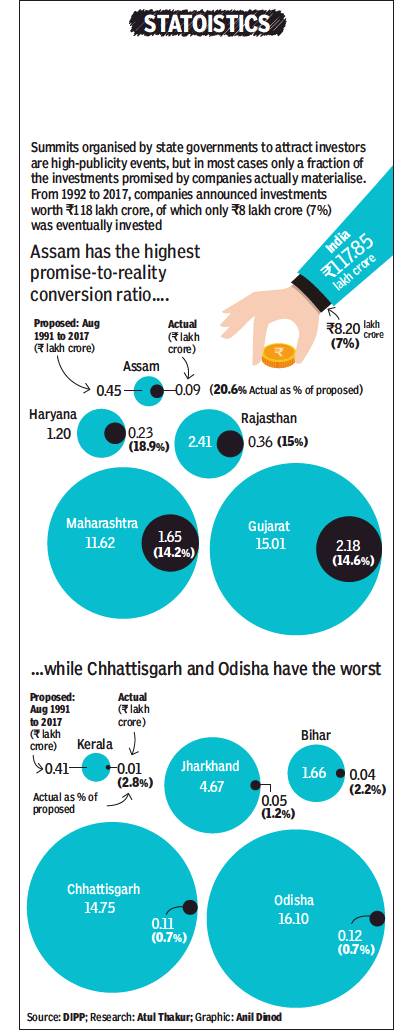

1991-2017: promise: reality ratio

From: March 21, 2018: The Times of India

See graphic:

1991-2017: the ratio of promises (of investment made at investor summits held by state governments): reality (actual investment)

2016, “investment intentions”, state-wise

The Hindu, August 7, 2016

Karnataka emerges as investors’ favourite

Gujarat, which was ranked first among all States in 2015 for attracting maximum ‘investment intentions’ in value terms, has lost its position to Karnataka halfway through 2016.

Gujarat received investment intentions worth only Rs.21,309 crore during January-June 2016, while Karnataka — which topped the list — received over thrice that amount, or Rs.67,757 crore, during the same period, government data showed.

The Centre, which is co-ordinating efforts to rank states on ‘ease of doing business’, also maintains a State-wise break-up of investment intentions in terms of Industrial Entrepreneur Memoranda filed for de-licensed sector, Letters of Intent issued and Direct Industrial Licences granted.

Interestingly, the Rs.67,757 crore worth investment intentions received by Karnataka in the first six months of 2016 was more than the Rs.64,733 crore that Gujarat had attracted in the whole of 2015, the year when it topped the all-India list in this regard.

The Rs.64,733 crore-worth investment intentions Gujarat got was 20.81 per cent of the total investment intentions worth Rs.3,11,031 crore that India received in 2015. However, out of the Rs.1,76,738 crore worth proposed investments that India received in January-June 2016, the share of Gujarat declined to 12.06 per cent — or Rs.21,309 crore. Meanwhile, Karnataka’s share jumped from 10.18 per cent (or Rs.31,668 crore) in 2015 to 38.34 per cent (or Rs.67,757 crore) in January-June 2016. Karnataka said ‘Invest Karnataka 2016’, an investors’ meet held during February 3-5 this year, concluded with 1,201 approved projects and MoUs valued at Rs.3.08 lakh crore.

Other leading States in terms of ‘investment intentions’ during January-June 2016 were Maharashtra (Rs.15,688 crore), Telengana (Rs.13,600 crore) and Chhattisgarh (Rs.8,514 crore). In 2015, the States in the top five after Gujarat were Chhattisgarh (Rs.36,511 crore), Maharashtra (Rs.33,277 crore), Karnataka (Rs.31,668 crore) and Odisha (Rs.24,524 crore).

Even in the ‘Business Reforms Action Plan’ index 2016 (or measures taken by states to improve ease of doing business), Gujarat was sixth with a score of 53.98 per cent. Uttarakhand topped that dynamic ‘implementation scorecard’ with 63.72 per cent, followed by Rajasthan, Telengana, Chhattisgarh and Andhra Pradesh. Gujarat government officials rejected apprehensions that incidents (which even led to changes at the Chief Minister-level) — including the Patidar agitation for reservation and more recently, Dalit protests after some of them were reportedly attacked for allegedly skinning cow carcasses — are leading to lower investor interest in Gujarat.

“These numbers (on investment intentions) keep going up and down. Some big announcements could come up soon and the situation can change,” a senior Gujarat government official said, indicating that some major decisions are likely in the run-up to the Vibrant Gujarat Global Investors’ Summit that is slated to be held during January 10-13 next year.

Most of the investment intentions that Gujarat has received are getting converted into amount that is actually being spent on the ground, the official said.