Foreign Direct Investment (FDI): India

This is a collection of articles archived for the excellence of their content. |

FDI in India: A timeline

1991-2016

The Hindu, June 21, 2016

Twenty-five years of changes in FDI policy: highlights

1991

July: New industrial policy of Narasimha Rao government as part of the Union Budget presented by Manmohan Singh, which led to a substantive opening up of the Indian economy.

August: FDI up to 51 per cent opened up in 47 high-priority sectors, including software (with 34 sectors under automatic route), with a condition that capital goods imports be financed by foreign equity. Export trading firms, hotels and tourism businesses also allowed 51 per cent FDI.

Foreign Investment Promotion Board (FIPB) set up in the PMO to vet FDI proposals, with a Finance Minister-headed panel deciding on investments taking a call on FDI over Rs 300 crore.

1992

April: FDI in software also put on automatic route.

May: Use of foreign brand names allowed.

June: Dividend balancing norms for FDI-backed firms, linking dividend payments to export income, scrapped for all but consumer goods firms.

1994

October: FDI in Pharma up to 51 per cent put on automatic approval route, except for recombinant DNA technologies.

1996

FIPB transferred to Department of Industrial Policy and Promotion (DIPP); approvals up to Rs. 600 crore by Industry Minister, Cabinet Committee for nods over Rs. 600 crore.

November: Condition linking import of capital goods to foreign equity investments scrapped.

1998

October: 49 per cent FDI allowed in mobile telephony by satellite.

1999

January: FDI in construction of highways, toll roads and ports raised from 74 per cent to 100 per cent.

March: Timeline for considering FDI proposals slashed from six weeks to 30 days.

2000

March: Eases norms for 100 per cent FDI in NBFCs.

October: 26 per cent FDI in insurance sector.

2001

May: 100 per cent FDI in drug manufacturing and pharma, airports, hotel, tourisms, 26 per cent FDI in defence, 74 per cent in select activities of telecom sector, 49 per cent FDI in banking sector.

2004

January: 100 per cent FDI in petroleum product marketing, oil exploration, petroleum production and natural gas pipelines.

March: 74 per cent FDI in private banks.

2005

March: 100 per cent FDI in townships.

November: 74 per cent FDIin telecom, 20 per cent FDI in radio broadcasting.

2006

February: 51 per cent FDI in single brand retail.

March: 74 per cent FDI in telecom.

2008

March: 100 per cent FDIin airports, 74 per cent FDI in non-scheduled air transport services.

2009

January: 100 per cent FDI in fax publication of foreign newspapers, 26 per cent FDI in publication of Indian versions of foreign publications.

2011

November: 100 per cent FDI in brownfield pharmaceutical projects (earlier only in greenfield).

2012

January: 100 per cent FDI in single brand retail.

September: 52 per cent FDI in multi-brand retail. 49 per cent FDI in aviation companies, power exchanges. 74 per cent FDI in teleports, mobile TV.

2014

August: 49 per cent FDI in defence sector, 100 per cent FDI in some aspects of rail infrastructure.

2015

March, April: 49 per cent FDI in insurance, pension sectors.

2016

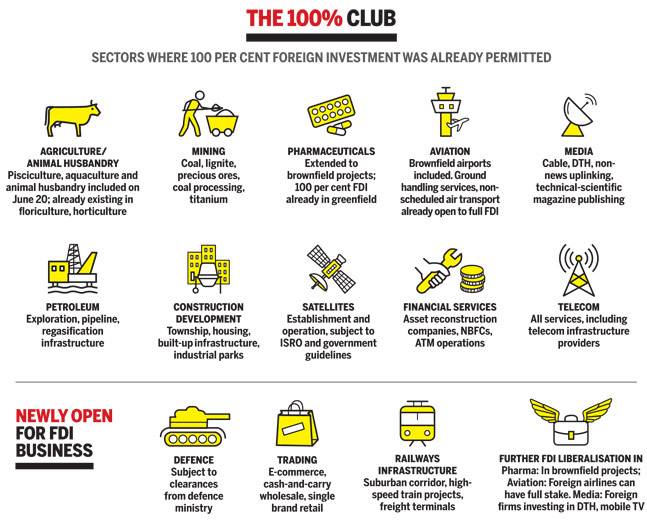

June: 100 per cent FDI in trading including through e-commerce, amendments to FDI in defence sector policy, 100 per cent FDI in teleports, DTH, mobile TV, 100 per cent FDI in brownfield aviation projects, 74 per cent FDI in private security agencies, amendments to FDI in animal husbandry policy, relaxing norms in single brand retail.

2004-16: FDI inflows into India

The Times of India, April 8, 2016

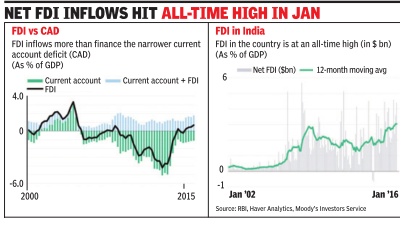

FDI Financing CAD First Time Since 2004

Ratings agency Moody's has said that net foreign direct investment (FDI) inflows have hit an all-time high in early 2016, highlighting the success of Narendra Modi's `Make in India' initiative. The ratings agency said that the FDI in flows have more than financed the current account deficit (CAD) for the first time since 2004. A country is known to be facing a CAD when the value of its imports is more than the value of its exports.

“The rise in FDI points to stronger investor interest in India on the back of ro bust economic growth. Higher inflows also suggest that recent government policies, such as efforts to liberalize foreign investment limits in several sectors and the `Make in India' initiative, are bearing fruit,“ said Moody's in a report released on Thursday .

Net FDI inflows into India hit an all-time high in January 2016 at $3 billion on a 12-month moving average basis. India's current account deficit is now more than covered by its FDI inflows. The basic balance (the sum of the current account balance and net FDI) returned to surplus in 2015 after being in deficit from 2003-2014.

This is good news for the do mestic currency whose value has been determined by capital flows due to the country's per manent trade deficit. The only dark cloud has been the drop in remittances. Money sent by overseas Indians dropped 30% year-on-year in the SeptemberDecember 2015 quarter due to turmoil in the Middle East economy . But Moody's said that In dia's external financing needs have diminished sharply over the last three years due to a crash in commodity prices.

On FDI, Moody's said that the development of industrial corridors, investment & manufacturing zones, and `smart cities' will further bolster investment inflows. “In particular, flows into the manufacturing sector are likely to accelerate as the government seeks to boost the sector's share of gross domestic product (GDP) to 25% by 2022.Government investment in infrastructure will help address some of India's deficiencies in this area and foster FDI,“ the report added.

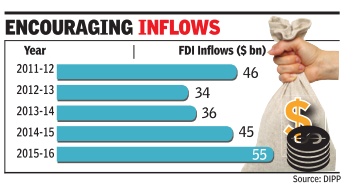

2011-16

See graphic, 'FDI inflows in India, year-wise, 2011-16'

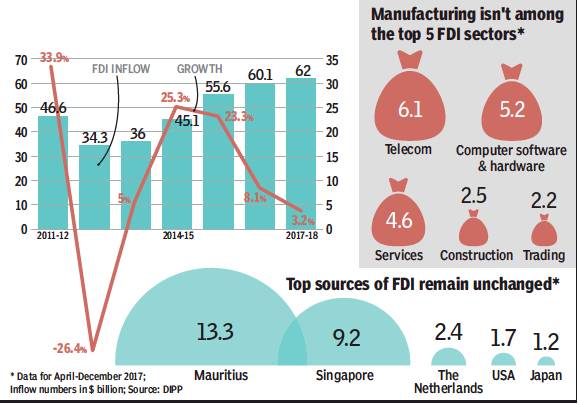

2011-18

ii) The main countries from which Foreign direct investment comes into India; and

iii) The five main sectors that attract Foreign direct investment into India

From: June 9, 2018: The Times of India

See graphic:

i) Foreign direct investment in India, 2011-18;

ii) The main countries from which Foreign direct investment comes into India; and

iii) The five main sectors that attract Foreign direct investment into India.

2011 – 2025

From: May 22, 2025: The Times of India

See graphic:

Gross foreign direct investment into India, 2011 – 2025

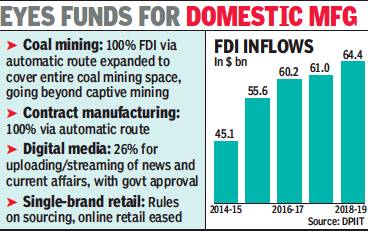

2014-19

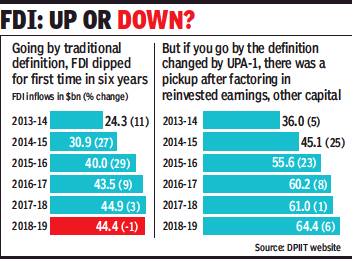

From: August 29, 2019: The Times of India

See graphic:

FDI inflows into India, year-wise, 2014-19

2017: inflows decreased 9%, outflows doubled

FDI into India slipped 9% to $40bn last year: UN report, June 8, 2018: The Times of India

Foreign Direct Investment (FDI) to India decreased 9% to $40 billion last year from $44 billion in 2016 while outflows from India, the main source of investment in South Asia, more than doubled, according to a new trade report by the UN.

According to the World Investment Report 2018 by the UN Conference on Trade and Development (UNCTAD) global foreign direct investment flows fell by 23% in 2017, to $1.4 trillion from $1.9 trillion in 2016. “Downward pressure on FDI and the slowdown in global value chains are a major concern for policymakers worldwide, and especially in developing countries,” UNCTAD secretarygeneral Mukhisa Kituyi said.

FDI to India decreased from $44 billion in 2016 to $40 billion in 2017. But outflows from India, the main source of FDI in South Asia, more than doubled to $11 billion, the report said.

The report cited India’s state-owned oil and gas company ONGC’s active investment in foreign assets in recent years. After acquiring a 26% stake in Vankorneft, an affiliate of Russia’s national oil company Rosneft PJSC, in 2016, ONGC bought a 15% stake in an offshore field in Namibia from Tullow Oil in 2017. By the end of 2017, ONGC had 39 projects in 18 countries, producing 285,000 barrels of oil and oilequivalent gas per day, the report said.

3% growth in FDI slowest in four years

June 8, 2018: The Times of India

Foreign direct inflows into India rose 3% to $62 billion during 2017-18, the slowest pace of expansion since the Narendra Modi government came to office four years ago. FDI inflows during the previous financial year were estimated at a shade over $60 billion.

The slowdown in growth in FDI flows comes even as domestic private investment has remained muted, which commerce and industry minister Suresh Prabhu said was on account of surplus production capacity now getting used up.

He said that during the four years of the Modi government, foreign inflows jumped to $223 billion from $152 billion in the previous four-year period.

2016

India: World's top greenfield FDI destination

India retains world's highest FDI recipient crown: Report, May 25, 2017: The Times of India

HIGHLIGHTS

India attracted USD 62.3 billion in 2016, says the FDI Report 2017

India has remained ahead of China and the US as far as FDI inflows were concerned in the last year, it states.

FDI by capital investment saw an increase of 2 per cent to USD 62.3 billion in 809 projects during 2016 in India

India retained its numero uno position of being the world's top most greenfield FDI investment destination for the second consecutive year, attracting US $62.3 billion in 2016, says a report.

India has remained ahead of China and the US as far as FDI inflows were concerned in the last year, said the fDi Report 2017 compiled by fDi Intelligence, a division of The Financial Times Ltd.

FDI by capital investment saw an increase of 2 per cent to US $62.3 billion in 809 projects during 2016 in India.

"India managed to keep the crown as the world's number one location for greenfield capital investment for the second year running - ahead of China and the US," the report said. The report said, global investment landscape has changed considerably in 2016 as FDI gravitated to locations experiencing the strongest economic growth, while locations in recession or facing high levels of uncertainty saw major declines.

In 2016, greenfield FDI continued to rise worldwide, with capital investment increasing by more than 6 per cent to US $776.2 billion, its highest since 2011, alongside an increase in job creation by 5 per cent to 2.02 million. The number of FDI projects, however, declined 3 per cent to 12,644. China has overtaken the US to become the second biggest country for FDI by capital investment, recording US $59 billion of announced FDI, compared with US $48 billion-worth in the US.

Globally, the real estate sector has claimed the top spot for capital investment, with US $157.5 billion of announced FDI recorded in 2016, following an increase of 58 per cent. In value terms, coal and natural gas witnessed an inflow of US $121 billion, followed by alternate and renewable energy at US $77 billion.

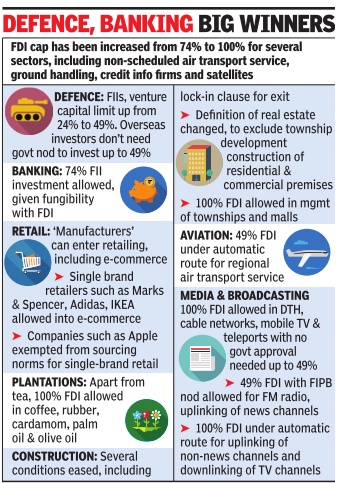

Defence

Shweta Punj Sandeep Unnithan MG Arun , The FDI big bang “India Today” 23 6 2016

Pharma

Shweta Punj Sandeep Unnithan MG Arun , The FDI big bang , 23/6/2016

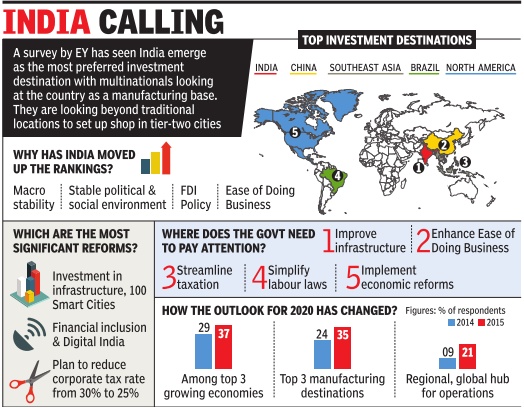

India at Global level

See graphic

Shweta Punj Sandeep Unnithan MG Arun , The FDI big bang “India Today” 4/7/2016

Retail

See graphic

Shweta Punj Sandeep Unnithan MG Arun , The FDI big bang “India Today” 4/7/2016

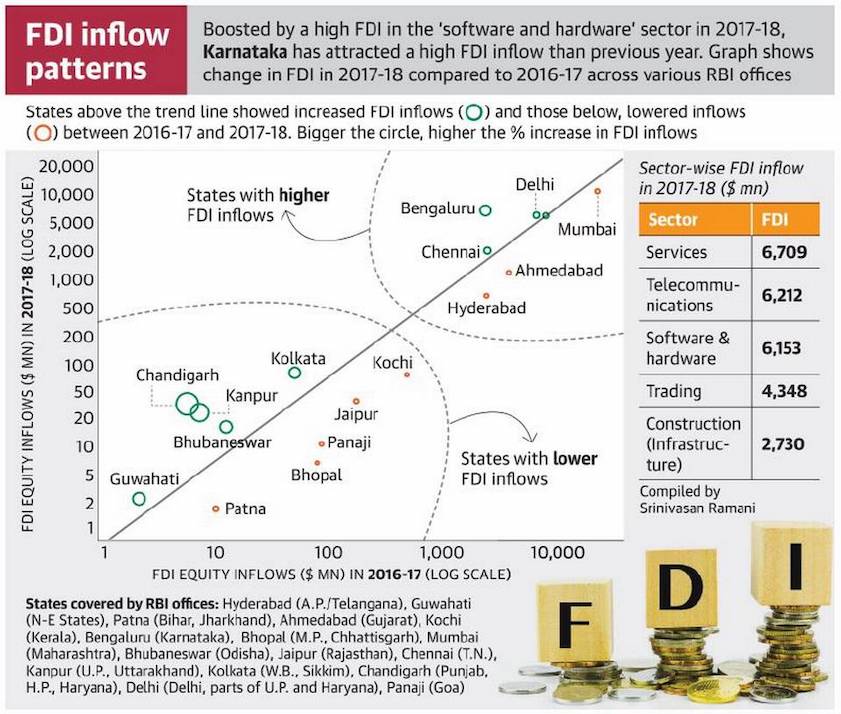

2017-Mar 2018, FDI inflow, state-wise

From: Sangeetha Kandavel and Sanjay Vijayakumar, Karnataka sees 300% jump in FDI inflows, T.N. rebounds, July 23, 2018: The Hindu

Services sector top recipient despite 23% drop

Karnataka registered the biggest increase in Foreign Direct Investment (FDI) last year, as inflows from overseas jumped 300% in the 12 months ended March 2018. Tamil Nadu too saw a rebound reversing a slowdown in the preceding period, while Gujarat, Maharashtra and Andhra Pradesh all saw a drop in FDI inflows, data from the Reserve Bank of India (RBI) presented in Parliament show.

While Karnataka received $8.58 billion in 2017/18, a sharp increase from the $2.13 billion in the previous fiscal, Tamil Nadu netted $3.47 billion, a 56% increase from the $2.22 billion in the prior period, as the State appeared to buck concerns about the investment climate. Investment had halved in 2016/17 from the previous 12 months ($4.53 billion) in an election year that also saw some political uncertainty in the wake of then Chief Minister J. Jayalalithaa’s hospitalisation and demise.

The data from the Chennai Regional Office of the RBI, covers Tamil Nadu and Puducherry.

Other major states Maharashtra, Gujarat and Andhra Pradesh saw a dip in FDI inflows, according to Minister of State for Commerce and Industry C.R. Chaudhary, in a written reply to the Lok Sabha on Monday.

Data from the Mumbai office of RBI, which covers Maharashtra, Dadra and Nagar Haveli, Daman and Diu, show inflows dropped to $13.4 billion in 2017/18 from $19.7 billion. FDI inflows into Gujarat fell almost 38% to $2.09 billion in 2017-18, from $3.37 billion.

Andhra Pradesh saw FDI inflows drop 43% to $1.25 billion in 2017/18.

Biswajit Dhar, Professor at Centre for Economic Studies and Planning in the School of Social Sciences at Jawaharlal Nehru University, pointed out that there was no way to assess whether the inflows were helping a State in its development efforts.

“When you look at the breakdown of FDI, it has a lot of components to it – firstly, you have long term inflows and then you have short term inflows like private equity,” he pointed out.

Overall, sector-wise investment data show that computer software and hardware gained from a 68% jump in FDI last year to $6.15 billion.

Interestingly, the services sector which comprises finance, banking, insurance and outsourcing among others, remained the top recipient of FDI despite seeing a 23% decline in inflows at $6.71 billion.

2018-22

From: May 21, 2022: The Times of India

See graphic:

FDI inflows into India, 2018-22

2019: India no. 5 in world

Press Trust of India, January 21, 2020: ‘'Business Standard

India was among the top 10 recipients of Foreign Direct Investment in 2019, attracting $49 billion in inflows, a 16 per cent increase from the previous year, driving the FDI growth in South Asia, according to a UN report.

The Global Investment Trend Monitor report compiled by United Nations Conference on Trade and Development (UNCTAD) states that the global foreign direct investment remained flat in 2019 at $1.39 trillion, a 1 per cent decline from a revised $1.41 trillion in 2018.

This is against the backdrop of weaker macroeconomic performance and policy uncertainty for investors, including trade tensions, it said.

Developing economies continue to absorb more than half of global FDI flows. South Asia recorded a 10 per cent increase in FDI to $60 billion and "this growth was driven by India, with a 16 per cent increase in inflows to an estimated $49 billion. The majority went into services industries, including information technology," the report said.

India attracted an estimated $49 billion of FDI in 2019, a 16 per cent increase from the $42 billion recorded in 2018, it said.

The FDI flows to developed countries remained at a historically low level, decreasing by a further 6 per cent to an estimated $643 billion.

The FDI to the European Union (EU) fell by 15 per cent to $305 billion, while there was zero-growth of flows to United States, which received $251 billion FDI in 2019, as compared to $254 billion in 2018, the report said.

Despite this, the United States remained the largest recipient of FDI, followed by China with flows of $140 billion and Singapore with $110 billion.

China also saw zero-growth in FDI inflows. Its FDI inflows in 2018 were $139 billion and stood at $140 billion in 2019. The FDI in the UK was down 6 per cent as Brexit unfolded.

The report added that cross-border M&As decreased by 40 per cent in 2019 to $490 billion – the lowest level since 2014.

Slowed down by sluggish Eurozone growth and Brexit, European M&A sales halved to $190 billion. Deals targeting United States companies remained significant – accounting for 31 per cent of total M&As.

The fall in global cross-border M&As sales was deepest in the services sector (a 56 per cent decline to $207 billion), followed by manufacturing (a 19 per cent decline to $249 billion) and primary sector (14 per cent decline to $34 billion), the report said.

In particular, sales of assets related to financial and insurance activities and chemicals fell sharply. The decline in M&A values was driven also by a lower number of megadeals. In 2019, there were 30 megadeals above $5 billion compared to 39 in 2018, it said.

Looking ahead, UNCTAD expects the FDI flows to rise moderately in 2020, as current projections show the global economy to improve somewhat from its weakest performance since the global financial crisis in 2009.

Corporate profits are expected to remain high and signs of waning trade tensions emerge. However, the decrease of announced greenfield projects by 22 per cent – an indicator of future trends, high geopolitical risks and concerns about a further shift towards protectionist policies temper expectations.

The report said that GDP growth, gross fixed capital formation and trade are projected to rise, both at the global level and, especially, in several large emerging markets.

Such an improvement in macroeconomic conditions could prompt MNEs to resume investments in productive assets, given also their easy access to cheap money, the fact that corporate profits are expected to remain solid in 2020, and hopes for waning trade tensions between the United States and China, it said.

However, significant risks persist, including high debt accumulation among emerging and developing economies, geopolitical risks and concerns about a further shift towards protectionist policies, it added.

2019-20: 18% growth

FDI inflows surge 18% in 2019-20 to record $74bn, May 29, 2020: The Times of India

From: FDI inflows surge 18% in 2019-20 to record $74bn, May 29, 2020: The Times of India

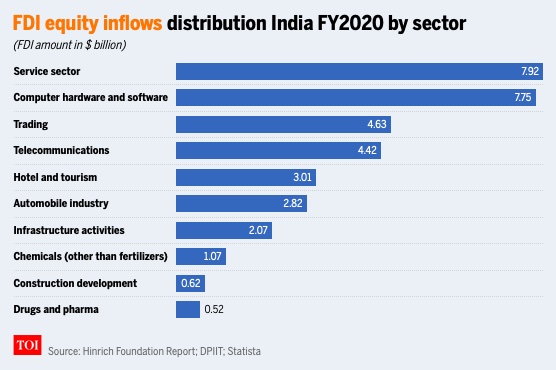

India’s FDI inflows, including reinvested earnings, rose 18% to a record $73.5 billion during 2019-20, buoyed by a spurt in inflows into computer hardware & software, telecom, and hotel & tourism, while services, the traditional mainstay, witnessed a decline.

Excluding reinvested earnings, inflows were 14% higher at just a shade under $50 billion, which is also an all-time high. In fact, the large flows acted as a counterweight to low FII inflows during the year, which were estimated at $247 million (on a net basis) during the last financial year.

The data naturally led to some celebration in government, given the overall gloomy economic situation and weak domestic investment. “In another strong vote of confidence in Make in India, total FDI into India grew 18% in 2019-20 to reach $73 billion. Total FDI has doubled from 13-14 when it was only $36 billion. This long-term investment will spur job creation,” commerce and industry minister Piyush Goyal tweeted.

The year saw several large deals, involving overseas, with large inflows expected during the current year as well, with Reliance Jio alone announcing several transactions so far. Besides, some of the earlier announcements such as Saudi Aramco’s stake acquisition in Reliance Industries and Brookfield’s proposed investment in the tower arm are pending.

While Maharashtra remained the top destination for overseas investors, Karnataka came second, although data for the October-March period was released by the department for promotion of industry and internal trade.

In terms of the countries, Singapore remained the top source for the second straight year, although inflows from the island nation dropped almost 10% to $14.7 billion. Mauritius was a distant second with investments of $8.2 billion routed via India’s close ally, with a sharp spike seen from the Netherlands, with inflows rising 1.7 times to $6.5 billion.

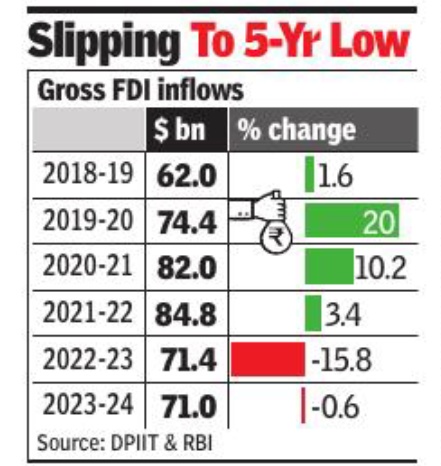

2019-24

See graphic:

FDI inflows, India: 2019-24

2020

January 26, 2021: The Times of India

From: January 26, 2021: The Times of India

From: March 30, 2021: The Times of India

See graphics:

India and the world, % change in FDI inflows in 2020

FDI equity inflows distribution India FY2020 by sector

FDI inflows into India jump by 13% to $57bn in 2020: UN

At $163Bn, China Pips US, Becomes Largest Global Recipient

New Delhi:

India witnessed a 13% rise in foreign direct investment (FDI) to $57 billion in 2020 compared to the previous year. The domestic figure was boosted by investments in the digital economy, while China overtook the US as the largest recipient of FDI globally, according to an UNCTAD report.

India and China were the only two countries which saw FDI rising in 2020, while the rest of the world, including developed economies such as the UK and the US, saw sharp declines. This was revealed by the UNCTAD’s investment trends monitor’s findings.

India’s FDI inflows were propped up by acquisitions in the digital economy. The report said cross-border M&A sales grew 83% to $27 billion, a notable deal being the acquisition of nearly 10% of Jio Platforms by Jaadhu — owned by Facebook — for $5.7 billion. It also said that infrastructure and energy propped up M&A deal values in the country. The Indian economy is staging a sharp recovery after plunging to record levels due to the impact of the strictest lockdown imposed to prevent the spread of the deadly Covid.

The report said China became the largest recipient of FDI, attracting an estimated $163 billion in inflows, followed by the US with $134 billion. It said that in relative terms, flows declined most strongly in the UK, Italy, Russia, Germany, Brazil and the US. FDI inflows to China increased by 4% compared to the previous year.

The pandemic triggered havoc across global economies and the report said global FDI collapsed in 2020, falling by 42% to an estimated $859 billion from $1.5 trillion in 2019. It said that FDI finished 2020 more than 30% below the trough after the global financial crisis. Flows to developed countries fell drastically by 69% to values last seen 25 years ago.

FDI in Asean — an engine of FDI growth throughout the last decade — was down by 31%.

UNCTAD said global FDI flows will remain weak in 2021. “The uncharacteristic immediacy of the FDI reaction to the crisis caused by the pandemic was due to physical lockdowns and other mitigation measures making the implementation of ongoing projects more difficult but the effects of the recession will linger and an FDI recovery is not expected to start before 2022. Investor uncertainty related to further waves of the pandemic and to developments in the global policy environment for investment will also continue to affect FDI,” the report cautioned.

2021

May 25, 2021: The Times of India

From: May 25, 2021: The Times of India

From: June 10, 2022: The Times of India

See graphics:

FDI inflows, 2018-21

FDI inflows: India and the world, 2021

FDI inflows rise 9.8% to record $82bn in FY21

Foreign direct investment (FDI) inflows into India rose 9.8% to a record $81.7 billion in 2020-21 on a gross basis on the back of record investment into companies such as Reliance Jio.

Fresh equity inflows are estimated to have increased by an impressive 19% to $59.6 billion, while reinvested earnings went up 14% to $16.2 billion. On the flip side, there was a 47% jump in repatriation to $27.1 billion. Data released by the commerce and industry ministry on Monday showed that Singapore was the top source, which is now followed by the United States with Mauritius — once the dominant source of FDI due to tax benefits under the tax avoidance treaty — pushed to the third spot.

In terms of growth, inflows from Saudi Arabia. jumped from $90 million in 2019-20 to $2.8 billion last year. And with e-commerce and IT being the major draw for overseas investors looking to tap into the India consumption story, computer software and hardware emerged as the most attractive sector to invest, cornering nearly 44% of the FDI equity inflows. Next was construction (infrastructure), which accounted for a 13% share. Among the states it was Gujarat that was the top recipient, according to the Centre’s data, accounting for 37% of the inflows, followed by Maharashtra (27%) and Karnataka (13%).

The government has been seeking to bolster FDI especially in the manufacturing sector and some of the investments are related to companies such as Apple’s vendors and Samsung pumping in funds to set up bigger production facilities for mobiles and electronics goods.

The government has identified close to 1,000 companies and is working with Invest India to tap companies that are seeking to diversify their production bases.

2022- 23: first dip in a decade, by 16% at that

From: May 24, 2023: The Times of India

See graphic:

Semiconductor industry value added by activity and region, 2011-23

2018- 2024

From: May 22, 2024: The Times of India

See graphic:

Foreign Direct Investment (FDI) in India, 2018- 2024

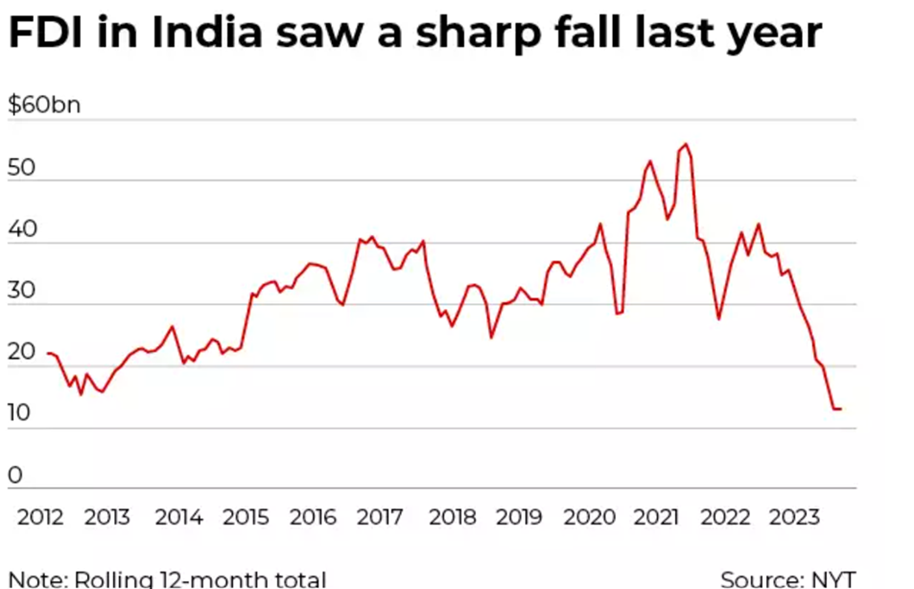

2012-2023

The New York Times cited by India Times- The Times of India

See graphic:

Foreign direct investment in India, 2012-2023

2018-25 Feb: Inflows and outflows

From: February 12, 2025: The Times of India

See graphic:

Foreign direct investment and India, Inflows and outflows: 2018-25 February

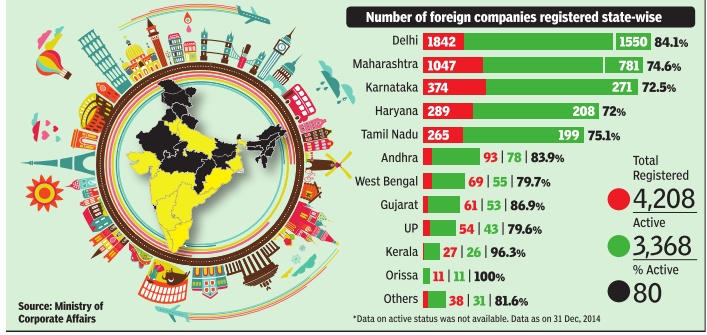

Foreign companies registered in India

Feb 09 2015

DESTINATION INDIA

As of December, 2014, there were over 4,000 foreign companies registered in the country. Of these, a little over 79% were active.Interestingly. the national capital had the highest number of such companies. It was followed by Maharashtra, Karnataka, Haryana and Tamil Nadu, usually perceived as some of the most industrialized states. The relatively large number of companies registered in Haryana seems to be linked to MNCs located in Gurgaon, one of the NCR's leading business hubs

Amount invested

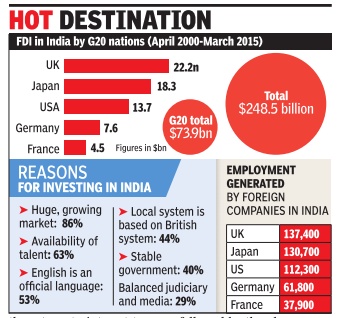

FDI by G20 nations: 2000-15

The Times of India ,Sep 02 2015

Kounteya Sinha

UK leads G20 nations flow to India in FDIHOT The latest data to confirm Britain's increasing interest in investing in India will make PM Narendra Modi happy a couple of months before he embarks on his maiden visit to the United Kingdom. The UK has become the largest investor in India among all G20 countries with a combined revenue of more than $54 billion in India.

Between the year 2000 and 2015, UK's FDI into India amounts to $22 billion -9% of all FDI in the country .

In total, G20 nations invested $ 73.9 billion in India between 2000-2015 with the UK being the single largest G20 investor into India followed by Japan ($ 18.3 bn), the US ($13.7bn), Germany ($ 7.6 bn) and France ($ 4.5 billion).

As India's largest employer, UK firms employ around 691,000 people across the country -5.5% of total organized private sector jobs in the country . Between 2000 and 2015, UK FDI generated around 138,000 direct jobs, 7% of the total 1.96 million jobs generated by FDI in India.

India's massive talent pool was the main reason for 63% of the British companies to believe in India's potential while India's recent growth story made 86% of them turn to interest towards the Asian giant. English being an official language has helped, too, with 53% of the companies relying on it while 40% said it was the country's stable government.

Confederation for British Industry's first Sterling Assets India report sponsored by PwC UK and brought out in association with the UK India Business Council says that Maharashtra and Delhi have attracted the bulk of Britain's FDI into India -26% and 20% respectively .

The chemicals sector attracts the lion's share of British investment in India, at $5.78 billion (26% of UK FDI), followed by the pharmaceutical sector at $3.76 billion (17% of UK FDI) and the food processing sector at $3.05 billion (14% of UK FDI).

Katja Hall, the confederation's deputy DG, said, “The economic relationship between India and the UK is in fine fettle. The UK has played a significant role in India's growth journey , investing more and creating more jobs than any other G20 nation.PM Modi's steps to improve the ease of doing business in India are a great boost and we look forward to the EU-India FTA talks resuming.“

60% increase, Oct 2014-Sept 2016

FDI jumps 60% in Oct 2014-Sept 2016, Nov 22 2016 : The Times of India

FDI went up 60% to $77.9 billion after the launch of `Make in India' initiative in September 2014, the government said on Monday.

Commerce and industry minister Nirmala Sitharaman said that after the launch of this initiative, there has been an “unprecedented“ increase in FDI into the country.

“During the period October 2014 to September 2016, total FDI equity inflows of $77.9 billion was recorded as against $48.5 billion received during the preceding 24 months with an increase of 60%,“ she said in a written reply to the Lok Sabha.

Make in India was launched with an aim to promote India as an important investment destination and a global hub for manufacturing. Replying to a separate question, she said a total of 19,666 comp laints were received by the National Consumer Helpline during April-October this year. In 2015-16, this number was 23,955.

“24 e-commerce companies were incorporated registered in India during the last two years (2014-15 and 2015-16),“ she added.

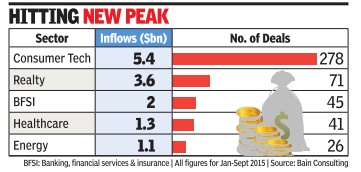

Private Equity (PE) investments: 2014, 2015

The Times of India, Oct 22 2015

Reeba Zachariah

PE inflows may hit record $20bn in 2015

If the last nine months of private equity (PE) activity are any indication, PE investments are poised for a strong finish in 2015. Bain Consulting, the leader in consulting to PE firms in India and globally , predicts that PE transactions will touch a record $20 billion this year, higher than the previous record of $17.1 billion in 2007.Heightened financing in consumer technology space and bigticket investments in real estate and financial services will propel PE activity to hit a new high this calendar. PE investments for the first nine months of 2015 have al ready hit $16.7 billion, outpacing 2014's total PE deal value of $15.2 billion. “The growth trend indicates that PE investment activity this year will surpass 2007, which was the best period so far,“ said Madhur Singhal, consulting principal, private equity practice, Bain Consulting.

The deal activity has been chiefly driven by the country's booming consumer technology sector, which attracted $5.4 billion of investments, followed by real estate and financial services with $3.6 billion and $2 billion, respectively , during the first nine months of 2015.

Bain Consulting's PE deals database doesn't include transactions where deal value is not disclosed. The three sectors accounted for 65% of the total deal value in the January-September period of 2015 and are expected to keep up the momentum in the October to December period too. “The consumer tech space needs more capital to scale up and will continue to attract more private equity ,“ Singhal said. Early-stage and growth investments dominated 85% of the deals in the first nine months of 2015.

PE funds such as Tiger Global, Blackstone, Temasek, Advent, SoftBank, Actis and GIC have invested about $125 billion in 5,400 deals between 2005 and September-end of 2015. However, exits from portfolio companies continue to remain challenging.Many funds have been forced to hold on to their investments for a longer number of years than originally envisaged.

Exits reached $4.5 billion in the first nine months of this year, driven by public market and secondary sales. Real estate, financial services and telecom witnessed the highest number of exits. The top 10 big-ticket exits, including TPG Capital selling its stake in Shriram City Union Finance for $386 million and New Silk Route offloading its interest in PNB Housing Finance for $257 million, constituted 40% of the total PE exit value in the first nine months of 2015.

Confusion over Financial Times figures

The Times of India, Oct 01 2015

Subodh Varma

RBI pegs fund flow at $20.6Bn in first half of 2015 against FT estimate of $31Bn

A recent report by a data consultancy owned by the FT of London created a stir by estimating that India is now the most favourite destination for foreign direct investment, beating China and the USA. The fine print indicates that they are talking about “estimated capital expenditures“ in greenfield, that is, new ventures. By this estimate, India attracted $31 billion compared to China's $28 billion in the first half of 2015. Reserve Bank of India (RBI) data for foreign investment flows does not appear to reflect this, causing much puzzlement in India. The total foreign direct investment that flowed into India between January and June 2015 is pegged at $20.6 billion. If you deduct the outflow from India in the form of outgoing FDI from India, this gets pared down to $19 billion.

Besides this inflow, there is also foreign portfolio investment mainly by institutional investors in the stock market. This was about $17 billion in the first half of 2015.

When put together, these two components of investment direct and portfolio yields about $31.5 billion for the same period. But this could hardly be what the FT report is talking about since much of this is neither greenfield nor capital investment.

The other puzzling aspect of the FT report is the com parison with China.

According to the National Statistical Bureau of China, foreign direct investment into China in the first half of 2015 was a whopping $68.4 billion, more than three times that of India's $20.6 billion, between January and June 2015.

A comparison of RBI data between the first halves of 2014 and 2015 shows that incoming FDI has increased by about 16% in 2015 but outgoing FDI has drastically declined, probably due to weakening economies around the world. Hence net FDI inflow to India has jumped up from $8.8 billion to $19 billion.

Analysis of this data by India's Department of Industrial Policy and Promotion (DIPP) indicates that most of the foreign direct investment has come into the IT sector followed by automobiles, trade and the financial sector. Major sources of FDI in India remain Singapore and Mauritius followed by the Netherlands, US and Germany .

Net portfolio investment has, however, sharply declined by about 23% from $21.7 billion in the first half of 2014 to $16.8 billion in the comparable period of 2015.

As a result of these opposing trends, the net foreign flows into India have shown only a marginal increase from $30.5 billion to $31.5 billion between the first halves of 2014 and 2015.

2013-19

From: Sidhartha, May 28, 2019: The Times of India

See graphic :

Foreign Direct Investment (FDI): India: 2013-19

Countries that invest most in India

2000-19

Sidhartha, May 29, 2019: The Times of India

From: Sidhartha, May 29, 2019: The Times of India

Foreign direct investment (FDI) inflows from Singapore were twice that from Mauritius during the last financial year as companies opted to route funds into the country via the southeast Asian city-state, instead of the island nation in the Indian Ocean, the most preferred route for overseas flows so far, after the tax treaty with both the countries was reworked.

In 2018-19, inflows from Singapore were estimated at $16.2 billion, compared with $8.1 billion from Mauritius, latest government data showed. This is only the third time inflows from Singapore have topped those from Mauritius, with investment advisers attributing the change to the revamped tax treaty. After 33 years, India and Mauritius had agreed to amend the tax treaty, allowing authorities there to tax capital gains on transfer of Indian shares acquired from April 2017.

‘PE investors in S’pore boost FDI into India’

A similar amendment was made in the tax treaty with Singapore, which also came into force from April 1, 2017. Unlike the tax treaty with Singapore, the original pact with Mauritius did not require “significant presence”.

As a result, since April 2000, 32% of the inflows have come through Mauritius because investors from the US, the UK and Germany too opted to route their investment via this window. Tax consultants said given the parity in tax treatment now, investors are preferring to route investments via Singapore.

“The choice of source of investment depends a lot on the bilateral tax agreement. Besides, Singapore offers other advantages on the ease of doing business front,” said Dhiraj Mathur, who was involved with FDI policy before turning a consultant.

Akash Gupt, partner and leader for regulatory practice at PwC India, said the presence of a large number of private equity investors in Singapore also helped boost inflows into India. “Now that there is tax neutrality, people are opting for Singapore as it is more accessible and approachable and offers tax incentives through lower tax rates if you locate your regional headquarters there,” added EY India’s Rajiv Chugh.

Besides, companies such as Walmart, which acquired Flipkart in a $14 billion deal, made the payments in the island nation as the e-tailer was registered in Singapore. As a result, the fresh investment of $2 billion came through Singapore. The change is significant since a decade ago, inflows from Mauritius were almost four times the investment from Singapore. The full year FDI data also showed FDI into the country went up 6% to top $64 billion.

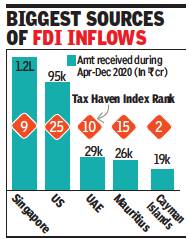

2020

From: March 10, 2021: The Times of India

See graphic:

Biggest sources of FDI inflows, April- December 2020

Tax havens: 2000-21

April 8, 2023: The Times of India

From: April 8, 2023: The Times of India

Nearly half of the world’s cross-border capital flows through offshore financial centres (OFCs), a 2017 study by the CORPNET research group found. Its report identified them as sink-OFCs, or countries with small economies that attract foreign capital with negligible or zero corporate taxes. The latest FDI data from IMF shows 19% of foreign capital has come to India through these sink-OFCs or tax havens, while the government pegs it at 32. 5%. It’s the same story across all large economies. Third Of India’s FDI From Tax Havens Government data shows 32. 5% of the FDI to India has come through tax havens, with Mauritius alone accounting for 26%. The Cayman Islands and Cyprus occupy the second and third positions. Between April 2000 and December 2022, India received more than $200 billion of FDI through these countries.

Why MNCs Park Funds In Tax Havens

Multinational corporations create a complex web of subsidiaries to store capital in tax havens, and redirect it. They rely on these small countries to shield their capital from unfavourable government decisions back home. Tax havens also help companies avoid corporate accountability and public scrutiny, while dodging corporate taxes.

Spotting A Capital Sink By Its ‘Sc Value’

The CORPNET research group was based at the University of Amsterdam (pictured) and funded by the European Research Council. It ran from 2015 to 2021 with the aim to understand global corporate control and financial flows, and was able to identify the world’s largest tax havens. It identified tax havens by comparing international capital inflows with the size of an economy, and assigned sink centrality (Sc) values to numerically express the disproportion. For example, an Sc value of 10 means a country’s foreign asset inflow is 10 timeshigher than the value that would correspond to its GDP. The British Virgin Islands have an Sc value of 5,235.

Among other things, CORPNET found that many opaque financial products that aggravated the 2008 crisis were created in these tax havens.

China Is Top Destination

China gets nearly three-fourths of its FDI from tax havens – the largest among major economies. The IMF says 74% of the $3. 6 trillion FDI that China received by end-2021 was routed through these havens. This might be because two of the 24 havens identified by the study – Hong Kong and Taiwan – are in the vicinity of China. Despite holding information on FDI from three tax havens, Germany is second on this list. Japan seems to have the most opaque FDI monitoring system as it held information on 18 of these tax havens.

Countries Invest Back In Proportion

IMF data shows while 74% of China’s FDI came through tax havens, 81% of its FDI outflow was to these countries. In India’s case, IMF says, nearly 19% of both the inflow and outflow of FDI was routed through these economies.

2014: India no.9 in the world

See graphic: 'India and the world, The 15 countries that received the highest FDI in 2014. India was no 9'

2015: India no. 1 destination

The Times of India, Sep 30 2015

India pips US, China as No. 1 FDI destination

Rises 16 llaces in ranking of competitiveness

India has emerged on top of the foreign direct investment (FDI) league table, overtaking China and the US, according to fDi Markets, the FT data service. A ranking of the top destinations for greenfield investment (measured by estimated capital expenditure) in the first half of 2015 shows India at number one, having attracted roughly $3 billion more than China and $4 billion more than the US.

India has also moved up on the World Economic Forum's Global Competitiveness Index by 16 places to 55th position from 71st.

The two reports come as a shot in the arm for the Modi government, which has taken several steps to attract foreign investment and has helped revive the mood of investors since it came to office in May 2014.

“Satisying, our efforts are paying off,“ finance minister Arun Jaitley tweeted.

The government has unveiled several initiatives like `Make in India' and `Digital India' to lure investors.

It has moved to ensure that the country moves up on the World Bank's Ease of Doing Business and states have also started their clean-up act on this parameter.

But experts say there are several areas where the government needs to step up reforms. The areas where investors want more reforms include tax policy, labour laws, cutting red tape and issues linked to land acquisition.

Investors have started taking interest in India and the recent visit of PM Modi to Silicon Valley triggered enormous interest from software and technology czars. India's growth is expected to be the fastest among large economies. Several multilateral agencies have also pointed out that India is a beacon of hope at a time when emerging economies are taking a hit and the Chinese stock market is witnessing volatility. Experts say India is expected to benefit from the slowdown in China and the overall sluggishness in global commodity prices including crude oil is expected to provide a cushion to the growth fortunes of Asia's third largest economy . The government is confident of achieving close to 8% growth in the current fiscal year. India has also moved up on Global Competitiveness Index by 16 places to 55th position.

The FT said that for the past several years, China and the US have vied for FDI supremacy and fought each other nearly to a draw last year, with the US ranking as the number one greenfield destination by number of projects and China coming in first by capital expenditure.

It said India ranked fifth last year for capital investment, after China, the US, the UK and Mexico. In a year when many other major FDI destinations posted declines, India experienced one of 2014's best FDI growth rates, increasing its number of projects by 47%, the article said.

“India is tracking well ahead of where it was at this time last year: it has more than doubled its midyear investment levels, attracting $30 billion by the end of June 2015 compared with $12 billion in the first half of last year,“ the newspaper said.

“Research from fDi Markets found 97 of 154 countries typically classed as emerging markets experiencing declines in capital expenditure on greenfield investment projects in the first six months of this year compared with the same time period last year,“ it said.

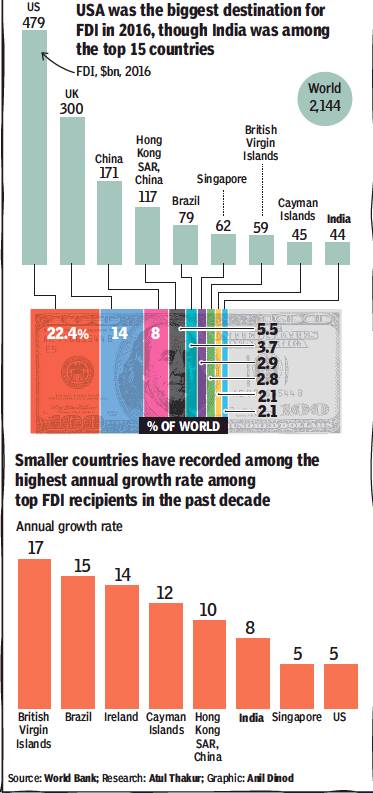

2016: India was among Top 15, but got 2% of global FDI

See graphic:

Biggest FDI destinations, 2016; Annual growth rate among top FDI recipients, 2006-16

From: November 23, 2017: The Times of India

FDI confidence: India 8th in 2017, 11th in 2018

India ranks 11th in FDI confidence, May 3, 2018: The Times of India

India was ranked 11th in A T Kearney’s FDI confidence index and retained its position as the second highest ranking emerging market.

But, India was down three notches in the overall ranking from last year. US topped the list, followed by Canada, while Germany dropped to the third place. Overall, India remains among the top investment destinations due to its market size and rapid economic growth.

“We are in a very exciting space of growth, opportunity and transformation. For long, India has been a very exciting destination for investors. Now, especially with the current political stability and positive reforms environment, India will only gain its attractiveness as an investment destination,” said Vikas Kaushal, MD and country head, A T Kearney India. The IMF projects India’s economy will grow by 7.4% in 2018, the fastest growth rate of any major economy. Inward FDI flows already increased to an estimated $45 billion in 2017, a record high.

2017: India moved to top 10 FDI-hosts

June 10, 2018: The Times of India

India has moved up a notch to enter the top 10 FDI host economies in 2017 despite the challenging condition of global foreign direct investment flows.

According to the World Investment Report 2018, global flows of FDI fell by 23% in 2017, largely due to contraction across developed economies. FDI flows across developing economies, especially in Asia have remained stable, even though the growth has been flat, according to the commerce ministry.

“2018 is slated to be a tough year with the slowing pace of international production and stagnation of growth in GVCs. Having said that, the Ministry of Commerce & Industry working on critical aspects such as modernising existing bilateral, multilateral and plurilateral treaties, and releasing the new industrial policy focussed on making the Indian industry future ready,” a statement from the ministry said.

Data showed FDI inflows into India rose 3% to $62 billion during 2017-18, the slowest pace of expansion since the Modi government came to office four years ago. FDI inflows during the previous fiscal were estimated at a shade over $60 billion.

2017: 11% dip in FDI for India

October 30, 2018: The Times of India

Change over 2016

From: October 30, 2018: The Times of India

From: October 30, 2018: The Times of India

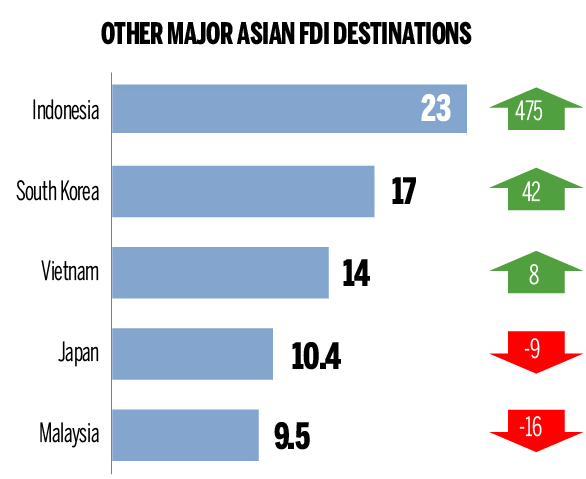

Despite a downturn in investment, Asia remained the largest recipient of foreign direct investment (FDI) in 2017, attracting over 36% of global FDI — up from nearly 28% in the previous year. The US retained the top slot, while China remained the favourite destination in Asia. India, however, saw an 11% dip in FDI flow to $40 billion.

See graphics:

India and other major economies: FDI received, and

Change over 2016

Other major Asian FDI destinations, 2017

2018: India, 5th most attractive investment destination

From: Sidhartha, Global CEOs see India as 5th most attractive investment destination, January 22, 2018: The Times of India

See graphic:

Top 10 investment destinations (2018)

India moved up a notch to overtake Japan as the fifth most attractive investment destination in a survey of global CEOs, even as the International Monetary Fund said that the country will once again emerge as fastest growing major economy in 2018 amid signs of an improvement in the overall economic environment.

In a survey conducted by consulting firm PricewaterhouseCoopers, chief executives said that excluding their home market they are most likely to invest in the US, followed by China with the world's largest economy expanding its gap as corporate chiefs expect more rapid growth in America. While China held on to its popularity, India moved a up slightly but still trailed Germany and the UK as an investment destination.

The survey will come as a booster for Prime Minister Narendra Modi who will court international investors+ on Monday and Tuesday in a bid to get more investment into the country, especially in the manufacturing sector, which has remained sluggish and is crucial to job creation.

"Backed by definitive structural reforms, the India story has been looking better in the past one year. Most of our clients are optimistic about their growth. The government has made efforts to address concerns around areas like infrastructure, manufacturing and skilling, although newer threats like cybersecurity and climate change are beginning to play on the minds of our clients," said Shyamal Mukherjee, chairman, PwC India.

Aided by opening up of several key sectors over the last few years, foreign direct investment in India surged 17% to over $25 billion during the first half of the current financial year, even as private investment has remained muted due to excess capacity and high financial stress. It had for the first time topped $60 billion in 2016-17 but remains less than half of China's $137 billion in 2017, which was an increase of around 8%.

But IMF on Monday reiterated its earlier estimate that India will grow 7.4% in 2018 and accelerate to 7.8% in 2019 from 6.7% last year. In contrast, China, which IMF estimates suggested grew 6.8%, a ad faster than India, is estimated to slow down to 6.6% in 2018 and further to 6.4% next year.

At a press conference, IMF chief Christine Lagarde urged global policymakers to "fix the roof" while the going was good, calling for a more inclusive development strategy as nearly one-fifth of developing and emerging economies saw their per capita income decline in 2017.

She also asked for structural or fiscal reforms and called upon leaders to put together a robust global collaboration to fight corruption, improve conditions for trade, stop tax evasion and prevent catastrophic climate change.

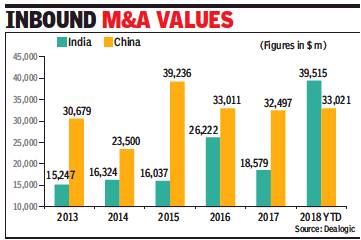

2018: India overtakes China

India pips China in attracting FDI in 2018, December 29, 2018: The Times of India

From: India pips China in attracting FDI in 2018, December 29, 2018: The Times of India

For the first time in years, annual foreign direct investment (FDI) into India has been more than that in China in 2018.

Riding on mega deals by Walmart’s buyout of online retail marketplace Flipkart, along with acquisitions by Unilver and Schneider Electric, the year that will end soon has recorded inbound M&A deals worth $39.5 billion in India, compared to $33 billion in China, data from Dealogic showed. In 2017, China’s inbound M&A deals aggregated at $32.5 billion, which was almost 80% more than India’s $18.6 billion.

For India, relatively stable economic fundamentals with low inflation rate, strict management of fiscal deficits and introduction of a bankruptcy code tilted the country among investment destinations among global investors. On other hand, for China, ensuing trade war with the US is keeping foreign investors on the back foot, market players said.

Going into 2019, foreign investors feel India will still remain an attractive investment destination.

2020: M&As push India to record no.5

June 22, 2021: The Times of India

From: June 22, 2021: The Times of India

Mergers and acquisitions (M&A), especially in the technology space, made India the fifth largest foreign direct investment (FDI) recipient in 2020, despite a19% fall in funds flowing into greenfield projects coming up in the country, latest data released by UNCTAD showed.

The latest World Investment Report showed that India’s FDI rose 25% to $64 billion in a year when global investment flows shrank 35% to $1 trillion (see graphic). India, China and Hong Kong were among the countries which saw a rise in 2020.

For the current year, the UN agency had a mixed outlook for India, which was the eighth largest FDI destination in 2019, due to the uncertainty caused by the second wave. It suggested investment in new ventures could be hit, but the production-linked incentive scheme and high-tech sectors could help drive a rebound. “India’s strong fundamentals provide optimism for the medium term. FDI to India has been on a long-term growth trend and its market size will continue to attract market-seeking investments,” the report said.

In 2020, cross-border M&As surged 83% to $27 billion. In contrast, FDI in greenfield ventures was down 19% to $24 billion. Apart from pandemic-driven investment resulting in inflows of around $1.8 billion from Amazon, investments in Jio Platforms, and those by Brookfield and GIC in telecom towers, and Unilever’s merger with GSK contributed to large amounts of inflows.

“Investment is about trust, about opportunity and about return on capital. There are a significant number of companies looking to relocate to India. The very encouraging response to the recent PLI initiatives bears testimony to global business perception of a promising new India,” said Deepak Bagla, who leads Invest India, the country’s investment promotion agency.

Regions that attract the most FDI

2017> 19: Top regions, sectors

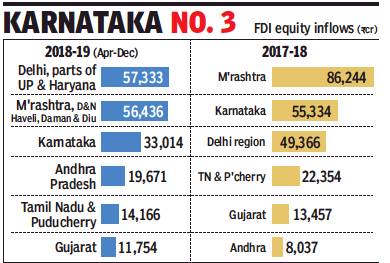

Allirajan M, NCR overtakes Maha as top destination for FDI equity, March 4, 2019: The Times of India

From: Allirajan M, NCR overtakes Maha as top destination for FDI equity, March 4, 2019: The Times of India

Share Of Inflows Rises From 14% To 25% In 3 Yrs

The National Capital Region has pipped long-standing leader Maharashtra in attracting FDI (foreign direct investment) equity inflows into the country.

A report by Department of Industrial Policy and Promotion (DIPP) mentions that the ‘New Delhi region’, covering the national capital and parts of UP and Haryana (which is broadly contiguous with NCR), received FDI equity inflows of Rs 57,333 crore ($8.3 billion) in the first nine months of 2018-19. FDI equity inflows aggregated about $33.5 billion in the first nine months of fiscal year 2018-19, a 7% decline compared with the same period in the previous fiscal year.

Maharashtra, which had the highest share of FDI in the first nine months of fiscal 2016-17 (49%), has witnessed a consistent drop in its share. Its share in total FDI flows fell to 32% during the corresponding period in fiscal 2017-18 and further to 24% in the same period in FY2018-19.

In contrast, NCR has seen a sustained increase in its share in total FDI equity inflows — from 14% in the first nine months of FY2016-17 to 17% in FY2017-18 and further to 25% in the same period in FY2018-19.

Maharashtra’s FDI inflows fell 30% year-on-year (y-o-y) to Rs 56,346 crore ($8 billion) in the first nine months of FY19 while that of Tamil Nadu contracted 26% y-o-y to Rs 14,166 crore ($2.1 billion).

Maharashtra, Delhi, Tamil Nadu, Karnataka and Gujarat received nearly 75% of the total FDI equity inflows into the country in the first nine months of FY2018-19.

Top five sectors account for 65% of FDI equity inflows

Tamil Nadu’s share in FDI inflows declined to 14% in the first nine months of FY2018-19 from 18% during the corresponding period in FY2017-18, but it was much higher than the 3% share in the same period in FY2016-17, data showed. FDI inflows into Karnataka also slumped 26% y-o-y to Rs 33,014 crore ($4.74 billion). Gujarat, however, saw higher inflows — from $787 million in the first nine months of FY2017-18 to about $1.7 billion in the same period in FY2018-19.

States that have been laggards in the past in attracting FDI, are also catching up fast. Andhra Pradesh, West Bengal, Kerala, Rajasthan, Punjab, Haryana and Himachal Pradesh collectively received nearly 15% of FDI equity inflows in the first nine months of FY2018-19.

They had only a 4% collective share in the comparable period the previous year. “Investments in emerging economies were lower partly due to uncertainty in the global markets,” said Rucha Ranadive, economist, CARE Ratings. “Foreign investments in emerging markets have mainly been adversely impacted by global headwinds such as the slowdown in the global economy, trade war between the US and China, concerns over Brexit, tightening of monetary policies by major global central banks, rupee depreciation and geo-political tensions among others.”

The top-5 sectors — services, computer hardware and software, chemicals, telecommunication and trading— accounted for nearly 65% of total FDI equity inflows. During the first nine months of FY2018-19, chemicals received highest FDI inflows of $6.07 billion, which was 18% of the total FDI equity inflows during this timeframe.

It was much higher than the 3% share of the sector in the comparable period last year and was five times more than the inflows amounting to $1.1 billion in the first nine months of FY2017-18. It was followed by services with nearly 17.7% share and by computer software and hardware (14% share). While inflows in the services sector grew by 28% y-o-y, it declined 8% in computer hardware and software.

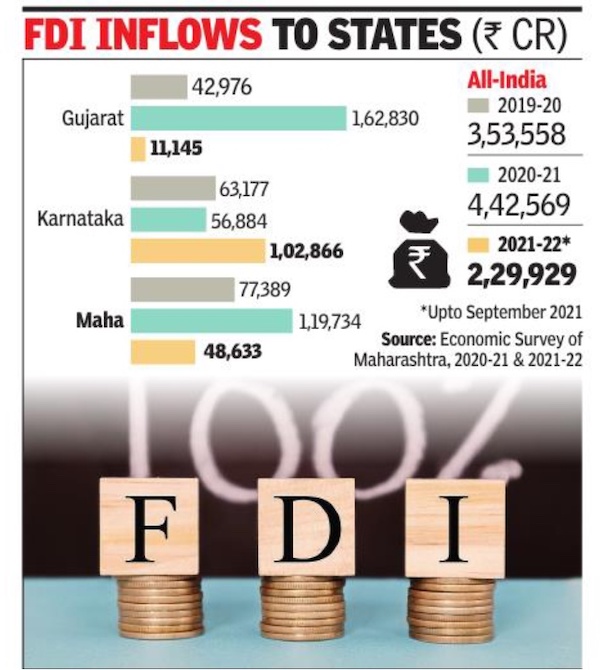

2019-21

Clara Lewis, March 19, 2022: The Times of India

From: Clara Lewis, March 19, 2022: The Times of India

Mumbai: The Mumbai Metropolitan Region and Pune's industrial clusters continue to be the favoured destinations for foreign direct investment (FDI) inflows to Maharashtra, industry minister Subhash Desai told TOI during the ongoing session of the legislature.

In the last two years of the Maha Vikas Aghadi government, of the 98 memoranda of understanding (MoUs) signed under Magnetic Maharashtra 2. 0 (June 2020 to December 2021), eight have been set aside for various reasons. Four have been set aside at the behest of the Union government (those that were signed with Chinese companies at the time of the Chinese incursion into Ladakh in 2020). Desai said that around 50 companies have been allotted land so far and 15 have started construction. “The MMR and Pune continue to be favoured destinations for FDI (in the state) but investments are coming to Solapur, Nandurbar, Yavatmal, Nagpur and Dhule as well," he said. The Aurangabad Industrial City (Auric), part of the Delhi-Mumbai Industrial Corridor, he said, has even been appreciated by the Centre as being the best industrial city on the corridor.

According to the Economic Survey of Maharashtra, between June 2020 and December 2021, the state attracted investment proposals of Rs 1. 9 lakh crore with expected employment generation of 3. 3 lakh under the Magnetic Maharashtra campaign. There were 10,785 startups in the state at the end of October 2021.

However, FDI inflows into Maharashtra seem to have slowed down. According to the Economic Survey, in 2021-22 till September the state received only Rs 48,633 crore in inflows as against around Rs 1. 2 lakh crore for the full year 2020-21. But this compares favourably with Gujarat that received only Rs 11,145 crore till September 2021, but unfavourably with Karnataka that received 1. 02 lakh crore in the same period.

Desai said that at the Dubai World Expo conference 2020, the state signed 25 MoUs worth Rs 15,260 crore in sectors such as automobile and components, logistics, electric vehicles, textiles, data centres, pharmaceuticals, bio-fuels and energy, and the estimated employment is over 11,000.

Rules, changes in

November 2015: Rules changed for 15 sectors

The Times of India, November 11, 2015

Govt tries to move beyond Bihar, goes for FDI reforms

The government announced a raft of changes in the foreign direct investment (FDI) rules for 15 sectors -including retail, defence, construction, banking and electronic media. The PM also was keen to ensure that the rules provide a boost to those manufacturing locally , with sources pointing to the decision to allow “Indian manufacturers“ to retail their goods, including on e-commerce plat forms -a move that will benefit the likes of Fabindia and Hidesign. Other “manufacturers“ too have been allowed to enter the retail arena without the government's approval. In a move that will make it easier for private banks to raise capital, the government has permitted full fungibility of foreign investment in private banks. This means that there will be no sub-limits for foreign portfolio investors (FPIs). While foreign direct investment of up to 74% was permitted until now, portfolio investment -investments by foreign institutional investors -was capped at 49%. Also, banks had to approach the foreign investment promotion board (FIPB) for any increase in foreign investment above 49%. The introduction of fungibility does not, however, mean that strategic investors get a free hand in picking up chunky stakes in banks. RBI regulations require that individual investor holding is capped at below 5%. Also, even promoters of banks are required to dilute their stake below 20% over a period of time. The relaxation of cap on sub-limits is in keeping with the government's proposal to announce composite caps for FDI in various sectors announced in July 2015. However, at the time of the announcement banks were kept out as they were considered `sensitive'.

2016: Liberalised FDI rules

The Times of India, Jun 21 2016

Foreigners can now hold 100% stake in food retail, airlines

The Modi government announced fresh liberalisation of foreign direct investment (FDI) rules by throwing open food retail, airlines and private security firms to higher overseas flows. In addition, rules were eased for those looking to invest in defence, DTH services and single-brand retail as the Modi administration sought to showcase India as the “most open“ FDI destination in the world with only a handful of sectors requiring government clearance.

“The Centre has radically liberalised the FDI regime, with the objective of providing major impetus to employment and job creation in India,“ the PMO tweeted.

The government suggested that the pitch will now change to how most sectors don't face FDI restrictions.“We will soon issue a negative list of sectors and all the others will be open to FDI,“ industrial policy and promotion (IPP) secretary Ramesh Abhishek told reporters after the changes were cleared at a high-level meeting chaired by the prime minister.

Although the finance ministry had kicked off discussions and the department of IPP had begun work on easing rules a few weeks ago, the decision came on the first working day after Raghuram Rajan's announcement to return to the US on completion of his term as RBI governor in September.

Government officials said too much should not be read into the announcements sin ce Modi had scheduled the meeting earlier. But the market saw in the decisions the government's determination to counter any slide in business and market confidence and a signal to the world that reforms would continue. In particular, they come amid fe ars of the rupee coming under renewed pressure on account of a possible withdrawal of some of the $20 billionplus foreign currency deposits that are due for redemption later this year. But the urgency could be gauged from the fact that the PM used special powers to announce the decisions and did not wait for a green light from the cabinet, which was scheduled to meet on Wednesday.Modi had used the powers for a similar liberalization initiative in November 2015.

For the government, this is at least the fourth round of major FDI changes since it took office two years ago and the second since last November when the rules for a number of sectors-aviation, construction and retail, among others--were eased. Earlier, the Modi government had raised FDI caps on insurance and defence while allowing overseas flows into railways, which had remained shut two decades after the 1991 reforms. The steps fuelled a 54% jump in FDI flows in the last financial year, to a record $55.5 billion.

This time, the focus has been on removing the stiff conditions that often came with opening up a sector and which tended to deter investors. The government has therefore eased rules for defence manufacturing companies where foreign ownership is in excess of 49%. Earlier, FDI was allowed only if foreign funds were accompanied with “state of the art“ technology. Now the rules say “modern technology“ will need to come, which is seen to be more flexible.“If the defence forces need some goods and it is produced using modern technology as opposed to state of the art, a local manufacturing facility can come up,“ said a senior government official.

Consultants acknowledged that rules had been simplified. “Defence is extremely technology-driven and OEMs (original equipment manufacturers) invest huge sums of money generating technology and intellectual property. The fact that there was no control permitted earlier was a major issue that was cited for not investing in India. That obstacle has now been removed and coupled with major simplification in the DPP (defence procurement procedure), OEMs should respond positively and proactively to these path-breaking reforms,“ said Dhiraj Mathur, a partner at global consulting firm PricewaterhouseCoopers.

Even in case of food retailing, the PM chose to ignore protests from the food processing ministry on mandating sourcing norms for retailers in a segment where 100% FDI has been permitted without riders, including in e-commerce.

The government also eased norms for setting up branch office, liaison office or project office. It also simplified rules for FDI in animal husbandry.

2016: Abolition of Foreign Investment Promotion Board (FIPB)

Pradeesh Chandran, Centre to abolish FIPB, Feb 1, 2017: The Hindu Business Line

Government has shown its clear intent towards fast-tracking inflow of Foreign Direct Investments

The Budget 2017-18 has given a clear indication of the government’s intent to further liberalise policies related to foreign direct investment. It also seeks to dismantle a two-decades-old body that was formed as a beacon of the economic liberalisation of 1993: the Foreign Investment Promotion Board (FIPB). The 1993 round of reforms under the P.V. Narasimha Rao regime, for the first time, threw the doors open to foreign investors.

One of the major announcements in Finance Minister Arun Jaitley’s Budget speech was the abolition of the FIPB.

The board has offered a single window clearance for applications of prospective foreign investors in sectors falling in the approval route. The board has handled investment proposals worth up to ₹5,000 crore.

Creation of FIPB

The FIPB was formed under the Prime Minister’s Office in the mid-1990s as part of the first round of Indian economic reforms. It was reconstituted in 1996 and transferred to the Department of Industrial Policy and Promotion. It was transferred to the Department of Economic Affairs under the Ministry of Finance in 2003, according to its website.

According to government rules, foreign investments in sectors under the automatic route do not require prior approval from the FIPB and are subject to sectoral rules.

“More than 90% of the total FDI inflows are now through the automatic route. The Foreign Investment Promotion Board has successfully implemented e-filing and online processing of FDI applications.”

“We have now reached a stage where FIPB can be phased out. We have therefore decided to abolish the FIPB in 2017-18,” Mr. Jaitley said.

“Government has shown its clear intent towards fast-tracking inflow of FDI, and the scrapping of FIPB is a notable step that would go a long way in supporting the objective of ease of doing business,” stated Glenn Saldanha, Chairman and Managing Director, Glenmark Pharmaceuticals.

Meanwhile, Mr. Jaitley also stated the government’s plan to pursue more radical liberalisation in Foreign Direct Investment norms.

Government scraps 25-year-old foreign investment advisory body: 10 key takeaways

Ramarko Sengupta, May 25, 2017: The Times of India

HIGHLIGHTS

The elimination of the decades-old panel is aimed at attracting more foreign direct investment.

1. The step follows Finance Minister Arun Jaitley's budget pledge in February to abolish the institution, which was set up soon after India embarked on its first market reforms in 1991, in a departure from decades of socialist planning

2. The FIPB currently vets FDI proposals requiring government's approval up to Rs 5,000 crore. Announcing the Cabinet's decision, Finance Minister Arun Jaitley said there are just 11 sectors left in which government's approval is needed for FDI.

3. The government has opened up most of the sectors to enable foreign companies to set up shop in the country, thus nearly eliminating the need for a dedicated panel.

4. Sectors that are under the approval route for FDI includes defence and retail trading. As per the proposed mechanism, respective ministries would take care of the FDI proposals.

5. In June 2016, the government had relaxed FDI norms in single-brand retail, civil aviation, airports, pharmaceuticals, animal husbandry and food products, which meant these sectors did not need FIPB's approval anymore.

6. FIPB was set up in the early 1990s; it was then under the Prime Minister's Office. In 1996, it was transferred to the commerce ministry's department of industrial policy and promotion, and to finance ministry's department of economic affairs in 2003. Economic Affairs Secretary Shaktikanta Das heads it currently.

7. Post the FIPB abolition, the government might ease FDI norms further in a few sectors. There could be an increase in the FDI limit in print news media to 49 per cent from the current 26 per cent and single-brand retail could be on the full automatic route.

8. Sectors where industry players have asked for further easing of rules include aviation, defence and pharmaceuticals.

9. The government had allowed full FDI in defence after approval; investors can pump in up to 49 per cent through automatic route. For brownfield projects in the pharmaceutical sector, automatic approval had been extended to 74 per cent.

10. The abolition of the FIPB is expected to facilitate easier capital inflows into India from foreign companies.

Retail, real-estate (100%); MHA security replaced

100% FDI Allowed In Single-Brand Retail Under Automatic Route, January 11, 2018: The Times of India

From: 100% FDI Allowed In Single-Brand Retail Under Automatic Route, January 11, 2018: The Times of India

In reforms push, foreign airlines allowed 49% in AI

The Union Cabinet unveiled a fresh round of liberalisation of the foreign direct investment (FDI) policy, allowing foreign airlines to invest up to 49% in Air India, and opening up 100% FDI in singlebrand retail under the automatic route. Similarly, 100% FDI has been allowed via the automatic route in real estate broking services.

Under the existing rules, foreign airlines can invest, with government approval, in Indian companies operating scheduled and non-scheduled air transport services, up to 49% of their paid-up capital. However, this provision was not applicable to Air India, implying that foreign airlines could not invest in the national carrier.

Foreign Cos Cannot Mandate Auditor Of Their Choice

Foreign Cos Cannot Mandate Auditor Of Their Choice

The government has quietly slipped in a swadeshi move while liberalising the foreign direct investment (FDI) rules by mandating that overseas auditors will have to undertake joint audit if an international investor insists on audit by a global firm, or its Indian affiliate.

This marks a major shift in India’s FDI regime, which was earlier silent on the issue and resulted in a situation where the shareholders’ agreement between a foreign investor and its Indian partner contained a clause specifying audit by Big Four firms such as KPMG, Ernst & Young, Deloitte or PricewaterhouseCoopers or Indian firms that are part of their network. The clause has been inserted to prevent this kind of an arrangement and the belief is that one global firm will not agree to a joint audit with an international rival and this will open the doors for standalone Indian firms which have been complaining of being left out. The foreign firms control a majority of the audit work in listed entities as well as large Indian companies, causing a lot of heartburn.

In fact, a group of Indian chartered accountants had lobbied hard with the government to insist on joint audit for all companies and had pitched for an amendment to the Companies Act. An expert committee headed by former finance secretary Ashok Chawla, however, rejected the proposal as it was seen to be adding to costs but recommended ways to strengthen Indian firms and work towards the development of some large Indian entities.

“It is a very good move from a corporate governance point of view. Instead of promoting Indian firms, the existing system prevented them from becoming global brands. This government move will help Indian firms,” said S Santhanakrishnan, an expert on corporate governance and law and an independent director on the boards of several large companies and banks.

“This move will help create large Indian firms and once international players get a taste of Indian firms, they will find it more worthwhile to work with them,” added Vinod Jain, president and founder of the All India Chartered Accountants Society. Sources, however, said that foreign investors can use another route to overcome the government directive. Instead of inserting a clause in the shareholders’ agreement, they may now get a resolution passed at the annual general meeting, something that is provided under the Companies Act. Jain, however, said that this may be tough to do.

Sectors invested in

Financial services

Emirates NBD to buy 60% stake in RBL for $3 Bn/ 2025

The Times of India

Dubai govt-controlled Emirates NBD will acquire a controlling stake of up to 60% in RBL Bank through a primary infusion of about $3 billion (Rs 26,850 crore), marking the largest FDI in India’s financial services sector and the biggest equity fundraise in the country’s banking industry.

The investment, to be made through a preferential issue, will be followed by a mandatory open offer to buy up to 26% from public shareholders under Sebi rules. The boards of both banks have also approved the merger of Emirates NBD’s India branches with RBL Bank after the preferential issue, in line with RBI guidelines. TNN

Sovereign bonds

2018>19: India, S. Korea, Asia receive investment

Sep 12, 2019: The Times of India

From: Sep 12, 2019: The Times of India

See graphic :

Investment by overseas investors in Indian, S. Korean and other Asian bonds, 2018>19

Asian bonds received a combined total inflow of about $1.8 billion, data from regional banks and bond market associations in Indonesia, Malaysia, Thailand, South Korea and India showed. Overseas investors purchased $1.7 billion worth of Indian bonds in August, the highest in the region, lured by its higher yield. South Korean bonds attracted the second highest, ahead of more expected interest rate cuts this year, after its central bank surprised investors by cutting its policy rate by 25 basis points in July.

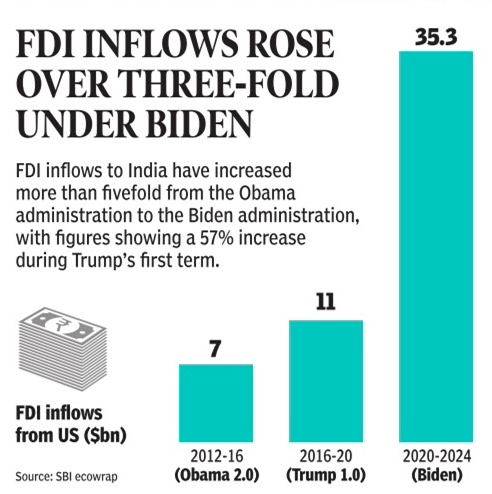

USA: inflows from

2012-24

From: Nov 14, 2024: The Times of India

See graphic:

FDI inflows from the USA to India, 2012-24

See also

Financial Secrecy Index and India

Foreign currency inflows, outflows: India

Foreign Direct Investment (FDI): India

Foreign exchange reserves: India

Foreign Institutional Investment (FII): India

Foreign Portfolio Investors (FPI): India

Private equity investments in India, this page includes statistics that club PE/ VC capital together