Foreign currency inflows, outflows: India

This is a collection of articles archived for the excellence of their content. |

Contents |

Foreign borrowing

2008-19

From: July 31, 2019: The Times of India

See graphic, ‘Foreign borrowings by Indians, 2008-19 ’

Foreign currency inflows

2004-2014

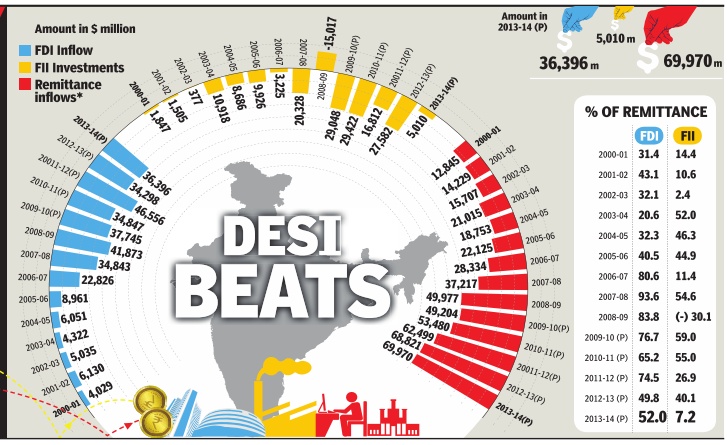

The Times of India Nov 28 2014

Talk about foreign money flowing into India largely centres around foreign direct investment (FDI), which gives a significant degree of control to investors, or foreign institutional investors (FII) -indirect investment in financial markets.Economists generally prefer FDI inflows to FII inflows, since the latter can exit suddenly, triggering a market crash and weakening the domestic currency. But FDI too involves some part of the profits being taken away to a foreign land. In India's case, both FDI and FII flows are dwarfed by remittances from Indians living abroad, the biggest source of foreign currency inflows.Source: World Bank, DIPP, *Remittance inflows are for calendar years

2017: Strong foreign inflows amid slowing economy

Strong foreign inflows amid slowing economy worry Sebi , September 7, 2017: The Times of India

Regulator Keeps Watch On Currency, Exports Impact

Markets regulator Sebi is concerned about the flow of foreign funds into India, its likely impact on the currency and also the country's export competitiveness at a time of slowing economic growth. Sebi whole-time member G Mahalingam, a former central banker, suggested on Wednesday a calibrated approach to managing foreign flows, which could be nondisruptive for the economy.

So far this year, foreign fund inflows have touched $27.2 billion (Rs 1.77 lakh crore), of which $20.1 billion has come through the debt route while the balance $7.1 billion through the equity route. In comparison, there was a net outflow of $3.9 billion in 2016 and $10.5 billion in 2015, according to CDSL data. Supported by India's record forex reserves of $395 billion as of August 25, the rupee has appreciated 5.6% against the dollar so far in the year. An appreciating rupee against major currencies -at a time when crude oil prices are almost stable -is leading to concerns about how this could impact India's export competitiveness.

“A huge amount of foreign inflows into the country at a time when the currency has been showing a substantial amount of appreciation is something which the regulator is going to be concerned about,“ Mahalingam said. “We need to be very careful as far as allowing foreign flows into the country is concerned. We can think of maybe different ways of allowing these inflows under a calibrated system,“ he added. The Sebi official also expressed concerns about masala bonds -the rupee-denominated corporate bonds -that are being sold to foreign investors. “Masala bonds don't hold any currency risk as far as the country is concerned. But at the same time, ex ternal liabilities of the country go up. This is something which we need to bear in mind,“ Mahalingam said.

Earlier in the day, Sebi chief Ajay Tyagi raised concerns about the high amount of buybacks in the market compared to earlier years. “We found that the capital that was returned back to shareholders in the form of buybacks and dividends was 1.5 times the equity capital raised in 2016-17. So the equity capital raised was pretty impressive last year, but the amount which went back...shows more money went back to investors against money being raised from them,“ Tyagi said.

The Sebi chief and also the whole-time member were speaking at industry trade body FICCI's annual capital market conference. The Sebi chief also warned companies to maintain high standards of corporate governance, disclosures and accountability of the board. He also warned statutory auditors about the sanctity of financial statements.

Foreign currency outflows

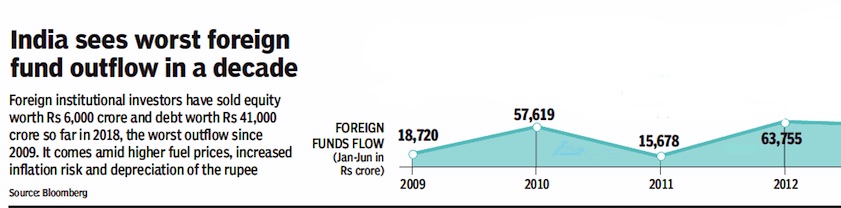

2009- 2018, July

From July 14, 2018: The Times of India

From July 14, 2018: The Times of India

See graphics :

Foreign currency outflows from India, 2009- 2012

Foreign currency outflows from India, 2013- 2018, July

See also

Financial Secrecy Index and India

Foreign currency inflows, outflows: India

Foreign Direct Investment (FDI): India

Foreign exchange reserves: India

Foreign Institutional Investment (FII): India