Exports, imports (international trade): India

(→2018: 9% increase) |

(→Benefits of exports) |

||

| Line 32: | Line 32: | ||

Global trade is seen as a crucial element in the strategy to propel growth, given its link to the overall development. The Economic Survey cites the experience of garments where incentives helped push shipments | Global trade is seen as a crucial element in the strategy to propel growth, given its link to the overall development. The Economic Survey cites the experience of garments where incentives helped push shipments | ||

| + | |||

| + | =Export complexity= | ||

| + | ==India vis-à-vis the world == | ||

| + | ===2000> 2019=== | ||

| + | [[File: The complexity of India’s exports, vis-à-vis the world, 2000- 2019.jpg|The complexity of India’s exports, vis-à-vis the world, 2000> 2019 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL/2021/08/12&entity=Ar02201&sk=7ECE43FF&mode=image August 12, 2021: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | '' The complexity of India’s exports, vis-à-vis the world, 2000> 2019 '' | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|T EXPORTS, IMPORTS (INTERNATIONAL TRADE): INDIAEXPORTS, IMPORTS (INTERNATIONAL TRADE): INDIAEXTERNAL/ INTERNATIONAL TRADE (EXPORTS, IMPORTS): INDIA | ||

| + | EXTERNAL/ INTERNATIONAL TRADE (EXPORTS, IMPORTS): INDIA]] | ||

| + | [[Category:India|T EXPORTS, IMPORTS (INTERNATIONAL TRADE): INDIAEXPORTS, IMPORTS (INTERNATIONAL TRADE): INDIAEXTERNAL/ INTERNATIONAL TRADE (EXPORTS, IMPORTS): INDIA | ||

| + | EXTERNAL/ INTERNATIONAL TRADE (EXPORTS, IMPORTS): INDIA]] | ||

| + | [[Category:Pages with broken file links|EXPORTS, IMPORTS (INTERNATIONAL TRADE): INDIAEXTERNAL/ INTERNATIONAL TRADE (EXPORTS, IMPORTS): INDIA | ||

| + | EXTERNAL/ INTERNATIONAL TRADE (EXPORTS, IMPORTS): INDIA]] | ||

=Exports from India= | =Exports from India= | ||

Revision as of 05:08, 14 August 2021

This is a collection of articles archived for the excellence of their content. |

Benefits of exports

Benefits to states

January 30, 2018: The Times of India

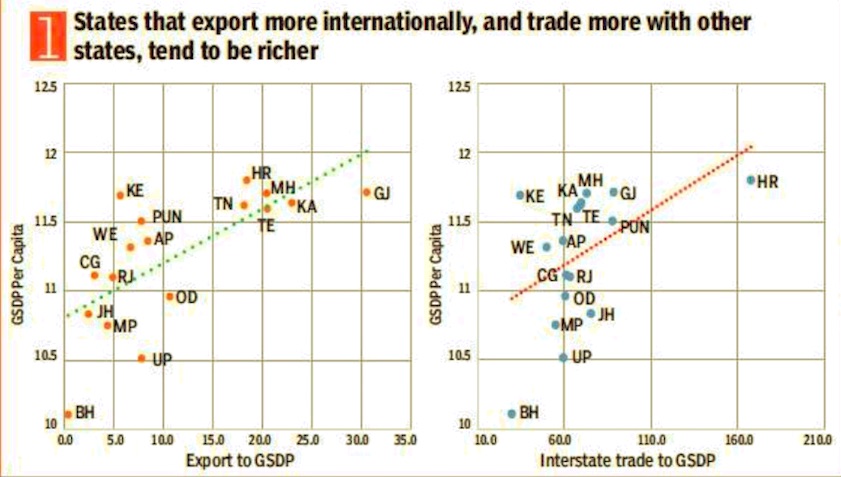

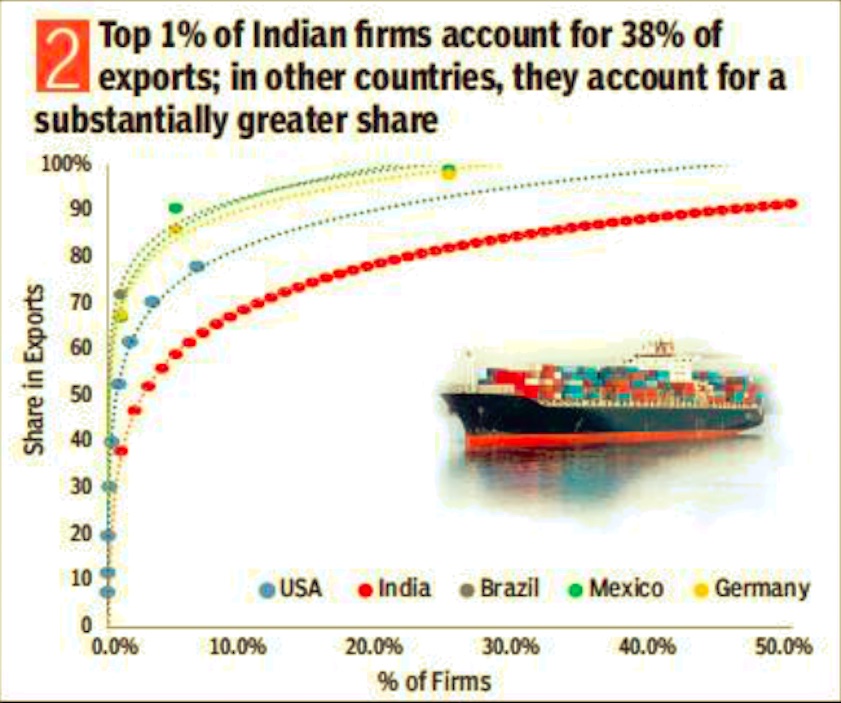

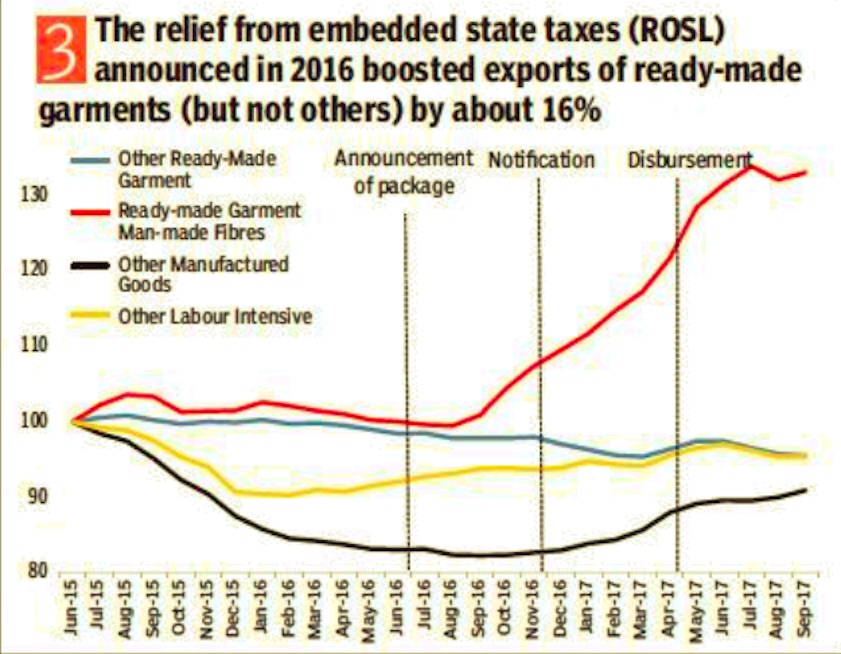

See graphic:

1. States that export more internationally, and trade more with other states, tend to be richer

2. Top 1% of Indian firms account for 38% of exports-in other countries, they account for a substatially greater share

3. The relief from embedded state taxes (ROSL) announced in 2016 boosted exports of ready-made garments (but not others) by about 16%

From: January 30, 2018: The Times of India

From: January 30, 2018: The Times of India

From: January 30, 2018: The Times of India

Global trade is seen as a crucial element in the strategy to propel growth, given its link to the overall development. The Economic Survey cites the experience of garments where incentives helped push shipments

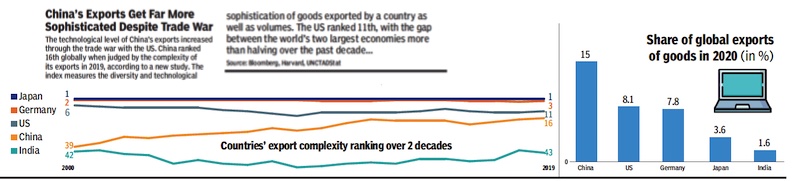

Export complexity

India vis-à-vis the world

2000> 2019

From: August 12, 2021: The Times of India

See graphic:

The complexity of India’s exports, vis-à-vis the world, 2000> 2019

Exports from India

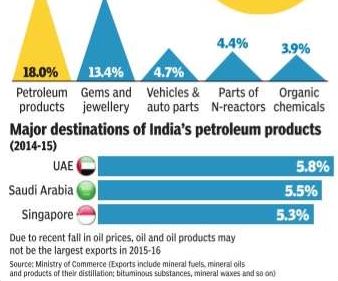

1991-2015, the Top 5

See graphic:

Top 5 exports from India, 1991-2015

Petroleum products, 2005-15

See graphic:

India’s export of petroleum products, 2005-15

2005-15: The main sectors that exported goods/ services

See graphic:

The sectors that contributed to Indian exports in 2005-15

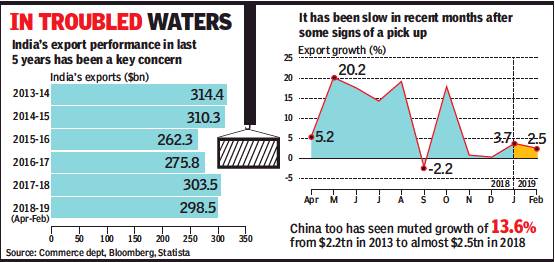

2013-19

India’s imports and trade deficit: 2017-19

From: April 16, 2019: The Times of India

See graphic:

India’s exports: 2013-19

India’s imports and trade deficit: 2017-19

2014> 2019: exports

Exports in 2018-19 set to finally scale 2013-14 level, March 16, 2019: The Times of India

From: Exports in 2018-19 set to finally scale 2013-14 level, March 16, 2019: The Times of India

Officials Blame Global Slowdown For Recent Sluggishness

Exports appear on course to finally cross the 2013-14 level during the current financial year despite the sluggishness seen in recent months.

Data released by the commerce department showed that exports inched up by 2.5% to $26.7 billion in February as several key sectors, such as engineering goods, chemicals, rice and cotton yarn and fabrics reported tepid growth, while oil product exports fell by 7.7%. And, with gold, electronics and crude imports shrinking in February, the overall import bill fell by over 5.4% to $36.3 billion, narrowing the trade deficit to $9.6 billion, compared to $12.3 billion in February last year. In fact, during February, 12 of the 30 closely watched segments showed a decline in the value of shipments.

During April-February, India’s exports are estimated to be 8.8% higher at $298.5 billion, while imports are up a shade under 10% at $464 billion.

Policymakers and trade experts are keeping close tabs on the export numbers, as the Modi government has so far fallen short of scaling the level of exports that it had inherited. Government officials blame it on the global export slowdown as well as growing protectionism across the world, especially in the US, which had been an advocate of free trade.

With March expected to see a year-end rush of shipments, the Modi administration expects to close the year with exports of around $330 billion, helping it scale the record $314 billion reached during UPA’s last year in office.

2015: exports decline

See graphic:

Exports value in US $ million; Year-on-year % change, 2015

2018: 9% increase

Exports rise 9% to touch record $331bn, April 16, 2019: The Times of India

Exports rose 9% to touch a record high of $331billion during 2018-19 as sectors such as petroleum and electronics drove the growth. But with imports too rising at nearly the same pace, the trade deficit widened to $176 billion, compared with $162 billion a year ago.

It was, however, the export numbers that were being cited as a major achievement in the wake of a global trade slowdown that has been attributed to protectionist policies, especially in the United States.

It will also come as a shot in the arm for policymakers as the NDA government’s track record on the export front had been poor. In fact, in the first two years, it had seen a contraction. A pickup in exports is seen to be crucial to revive the manufacturing sector, where growth has slowed down in recent months.

2019, H1: 'India gained $755m due to US-China trade war

Nov 6, 2019: The Times of India

Key Highlights

A study, conducted by the UN trade and investment body, puts the trade diversion effects of the US-China tariff war for the first half of 2019 at about $21 billion

The US tariffs on China have made other players more competitive in the US market and led to a trade diversion effect

UNITED NATIONS: India gained about $755 million in additional exports, mainly of chemicals, metals and ore, to the US in the first half of 2019 due to the trade diversion effects of Washington's tariff war with China, a study by the UN trade and investment body has said.

The study — Trade and trade diversion effects of United States tariffs on China — shows that the ongoing US-China trade war has resulted in a sharp decline in bilateral trade, higher prices for consumers and trade diversion effects - increased imports from countries not directly involved in the trade war.

The study puts the trade diversion effects of the US-China tariff war for the first half of 2019 at about $21 billion, implying that the amount of net trade losses corresponds to about $14 billion.

The US tariffs on China have made other players more competitive in the US market and led to a trade diversion effect. These trade diversion effects have brought substantial benefits for Taiwan (province of China), Mexico, and the European Union.

"Trade diversion benefits to Korea, Canada and India were smaller but still substantial, ranging from $0.9 billion to $1.5 billion," it said. The remainder of the benefits were largely to the advantage of other South East Asian countries.

The US tariffs on China resulted in India gaining $755 million in additional exports to the US in the first half of 2019 by selling more chemicals ($243 million), metals and ore ($181 million), electrical machinery ($83 million) and various machinery ($68 million) as well as increased exports in areas such as agri-food, furniture, office machinery, precision instruments, textiles and apparel and transport equipment, UNCTAD said.

While it does not consider the impact of Chinese tariffs on US imports, the study indicates that qualitative results are most likely to be analogous: higher prices for Chinese consumers, losses for US exporters and trade gains for other countries.

Of the $35 billion Chinese export losses in the US market, about $21 billion (or 62 per cent) was diverted to other countries, while the remainder of $14 billion was either lost or captured by the US producers.

The study found that tariffs imposed by the United States on China are economically hurting both countries and that consumers in the US are bearing the heaviest brunt of Washington's tariffs on Beijing, as their associated costs have largely been passed down to them and importing firms in the form of higher prices.

However, the study also finds that Chinese firms have recently started absorbing part of the costs of the tariffs by reducing the prices of their exports.

"The results of the study serve as a global warning. A lose-lose trade war is not only harming the main contenders, it also compromises the stability of the global economy and future growth," UNCTAD's director of international trade and commodities Pamela Coke Hamilton said. "We hope a potential trade agreement between the US and China can de-escalate trade tensions."

The analysis shows that US tariffs caused a 25 per cent export loss, inflicting a $35 billion blow to Chinese exports in the US market for tariffed goods in the first half of 2019. This figure also shows the competitiveness of Chinese firms which, despite the substantial tariffs, maintained 75 per cent of their exports to the US.

The office machinery and communication equipment sectors were hit the hardest, suffering a $15 billion reduction of US imports from China as trade in tariffed goods in those sectors fell by an average of 55 per cent.

Though the study does not examine the impact of the most recent phase of the trade war, it warns that the escalation in summer of 2019 is likely to have added to the existing losses, UNCTAD said.

"US consumers are paying for the tariffs … in terms of higher prices," said Alessandro Nicita, an economist at UNCTAD. "Not only final consumers like us, but importers of intermediate products – firms which import parts and components from China."

Since mid-2018, the US and China have been locked in a trade confrontation that has resulted in several rounds of retaliatory tariffs. Over the course of 2018, the US administration started implementing a series of trade measures to curtail imports, first targeting specific products (steel, aluminum, solar panels and washing machines) and then specifically targeting imports from China.

In the early summer 2018, US and China raised tariffs on about $50 billion worth of each other's goods. This escalated further in September 2018 when the US introduced an additional 10 per cent to cover $200 billion worth of Chinese imports, to which China retaliated by imposing tariffs on imports from the US worth an additional $60 billion.

In June 2019, the US increased the tariffs further, to 25 per cent. China responded by raising the tariffs on a subset of products that were already subject to tariffs. In September 2019, the US imposed 15 per cent tariffs on a large subset of the remaining $300 billion worth of imports from China not yet subject to tariffs.

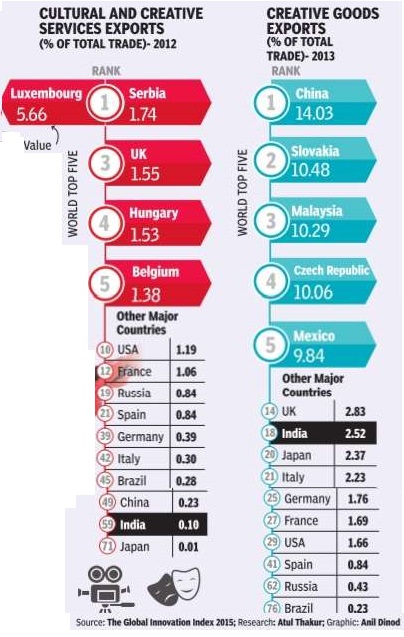

Export of creative goods and services

2012-13

The Times of India, September 25, 2015

India's soft power through the export of entertainment movies, music, television sitcoms and cricket -is indisputable. Data on the export of creative goods and services as a proportion of total exports, however, suggests it is a bit overrated. According to the recently released global innovation index, India was 59th in the world in the export of cultural and creative services (audio visual and other recreational services). In exports of creative goods (merchandise, processing and repairs of goods categorised as creative), India is ranked 18th.Interestingly, China is ranked above India in both these categories.

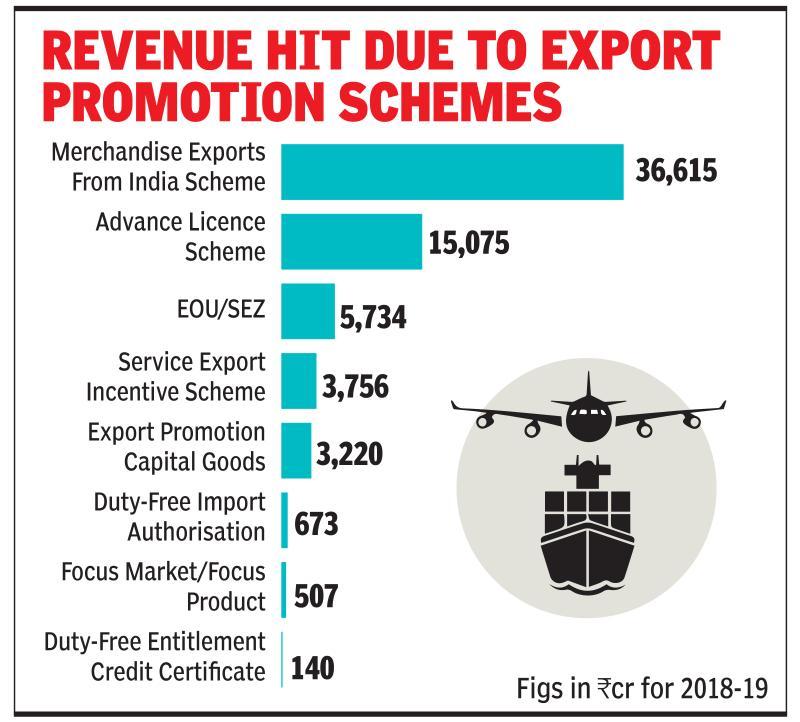

Export promotion programmes

2018-19: revenue loss; status

Sep 10, 2019: The Times of India

From: Sep 10, 2019: The Times of India

NEW DELHI: As the government works on an “export package”, the finance ministry has said that it may not be possible for the government to shift all exports to the Rebate of State and Central Taxes and Levies (RoSCTL) scheme, given the Budget constraints. Instead, it wants the commerce department to identify priority sectors which need more support. RoSCTL is a replacement for the existing Merchandise Exports from India Scheme (MEIS). The commerce department put together the new scheme after the US dragged India’s export promotion programmes to the World Trade Organization and is expected to be taken up by the Union Cabinet shortly. On an average, the government has estimated that the incidence of central and state levies added up to 4-5%, which needed to be refunded. With merchandise exports estimated at over $330 billion, refund of levies would add up to over $16 billion or more than Rs 1.1 lakh crore, sources said.

For the current fiscal year, the Centre has budgeted for a revenue impact of Rs 65,720 crore on account of all export-promotion schemes. Of this, MEIS is estimated to have an impact of Rs 36,615 crore. Already, some of the GST is refunded to exporters. The government recently released Rs 6,000 crore for the textiles industry, while insisting that some of the other sops for exporters should be dropped. While the rebate scheme for all exporters is being finalised, the government is also working on ways to improve access to loans for which commerce and industry minister Piyush Goyal has held several round of deliberations. Sources said that the scheme is almost ready and is expected to be announced shortly. In an interview last week, finance secretary Rajiv Kumar too had underlined the need to offer incentives to exporters. This, he said, will help use up idle capacity in the manufacturing sector and also result in import substitution.

Garments

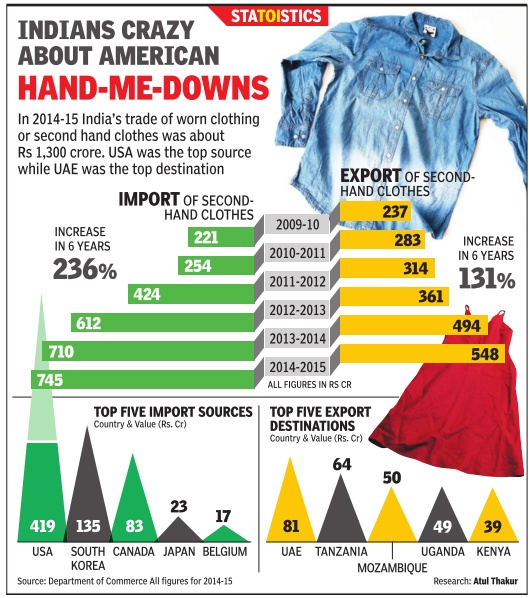

Second-hand clothes: import, export of

See graphic:

2014-15: The import and export of second-hand clothes

Imports into India

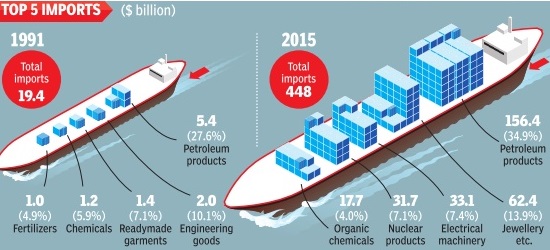

1991-2015, the Top 5

See graphic, ' Top 5 imports into India, 1991-2015 '

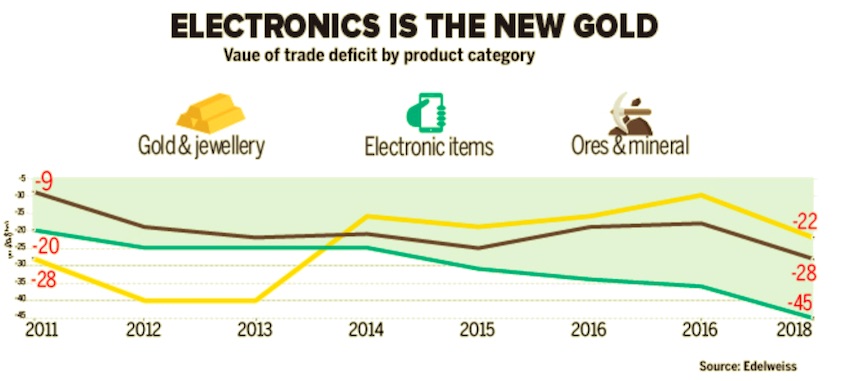

2011-18: the three main imports

October 9, 2018: The Times of India

From: October 9, 2018: The Times of India

See graphic:

2011-18: India’s three main imports

One of the triggers for the rupee’s weakness — both in 2013 and 2018 — has been the rising current account deficit (CAD). Imports of gold, which was one of the main reasons of the currency’s depreciation in 2013, have almost halved in five years. But electronic imports are the new gold, with the net deficit in electronics trade nearly doubling to $45 billion in 2018 from $25 billion in 2013.

2017-19: the Top 10 countries India imports from

From: June 15, 2019: The Times of India

See graphic, '2017-19: the Top 10 countries that India imports from '

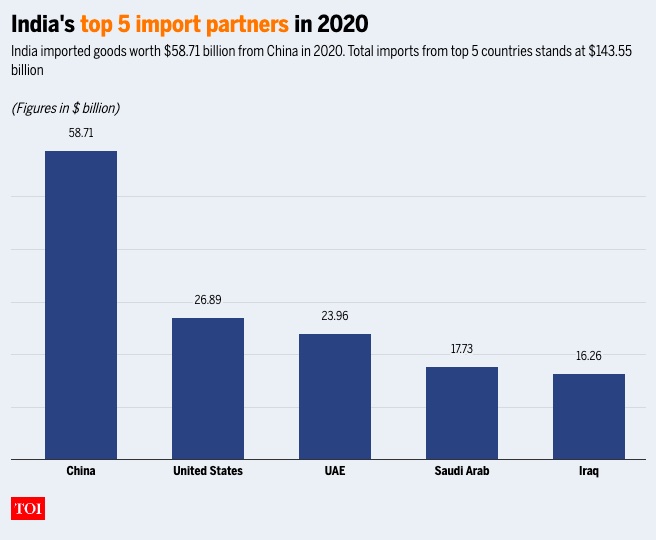

2020: the top 5 sources of imports

From: March 18, 2021: The Times of India

See graphic:

India's top 5 import partners, 2010-20

Perception of quality of Indian products

2018: Countries in which goods made in India are perceived positively, and negatively

March 22, 2018: The Times of India

From: March 22, 2018: The Times of India

HIGHLIGHTS

Are 'Made in India' products making the kind of wave across the globe that the Narendra Modi-government had envisaged? TOI brings to you data that shows which parts of the world think our products are 'slightly or very positive'

The Narendra Modi-government's flagship 'Make in India' project launched in 2014, has, so far, received mixed responses. While few doubt the government's intent behind pushing the manufacturing sector's agenda, experts have raised concerns on the implementation of the project.

A data set by Statista.com -- a statistics, market research and business intelligence portal-- shows that products manufactured under the 'Make in India' initiative are particularly valued in the middle-east. Respondents from United Arab Emirates (UAE), Bahrain and Saudi Arabia top the chart in opining that products made in India are 'slightly or very positive.'

38 per cent of Chinese and a quarter of respondents from the US and UK also believe the same.

The ranking displays the results of the worldwide Made-In-Country Index 2017, a survey conducted to show how positively products "made in..." are perceived in various countries all over the world. 43,034 respondents answered the question "On a lot of products you can find a label stating where the product was made. How do you feel about products labeled with…?" on a 5-level scale. The sample represents 90 per cent of the global population, according to Statista.

"Never was the volume of international goods transport higher than during this decade. Today, the meaning of the "made in" label is more important than ever," the research firm said. In the Economic Survey for the financial year 2017-18 released earlier this year, the government earmarked 10 sectors, including capital goods, auto, defence, pharma and renewable energy to push growth in manufacturing and generate job opportunities.

The other sectors are biotechnology, chemicals, electronic system design and manufacturing, leather, textiles, food processing, gems & jewellery, construction, shipping and railways.

Christening the initiative as 'Make in India 2.0', government identified these sectors as the ones which have potential to become global champions and drive double-digit growth in manufacturing.

Regional Comprehensive Economic Partnership (RCEP)

Why India did not join

Payal Bhattacharya, November 15, 2020: The Times of India

From: Payal Bhattacharya, November 15, 2020: The Times of India

From: Payal Bhattacharya, November 15, 2020: The Times of India

From: Payal Bhattacharya, November 15, 2020: The Times of India

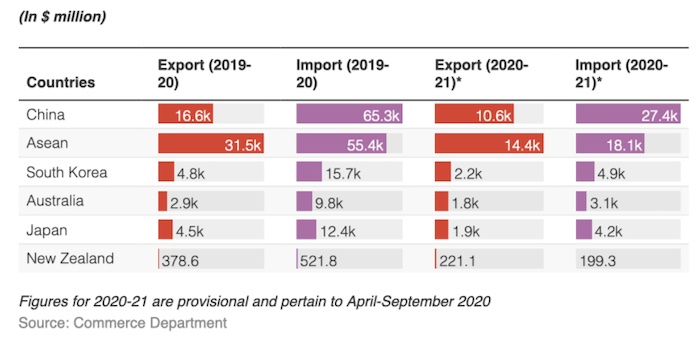

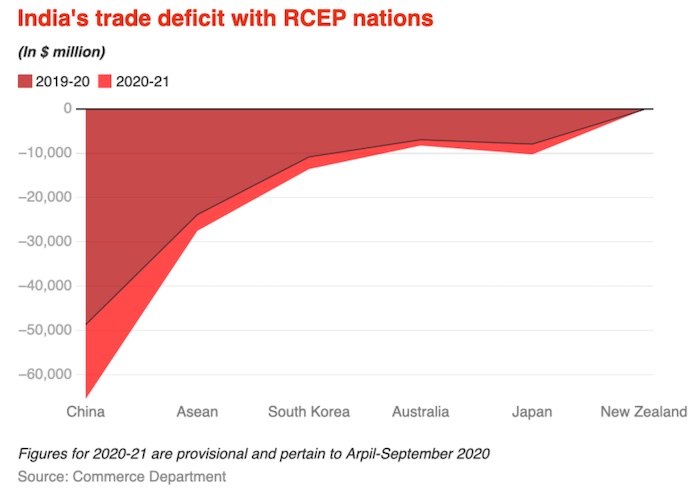

Why India opted out of world's biggest trade deal signed today

NEW DELHI: Fifteen Asia-Pacific countries — with a combined gross domestic product (GDP) of over $26 trillion and comprising nearly one-third of the world's population — signed the world's biggest trade deal at the 37th Association of Southeast Asian Nations (Asean) Summit on November 15.

The Regional Comprehensive Economic Partnership (RCEP) aims to achieve a modern, comprehensive, high-quality and mutually beneficial economic partnership agreement among the Asean member states and its FTA (free trade agreement) partners.

However, as negotiations to finalise the long-overdue agreement entered its final stages, in November 2019, Prime Minister Narendra Modi surprised fellow member nations by choosing to opt out of it.

Following India's withdrawal, the remaining 15 nations signed the RCEP on Sunday on the sidelines of the annual summit of the 10-nation Association of Southeast Asian Nations, which Vietnam was hosting virtually. However, many participating nations are also becoming too economically dependent on China with the pact seen as a coup for it in extending its influence across the region.

What is RCEP

The RCEP negotiations were launched by leaders from 10 Asean member states (Brunei Darussalam, Cambodia, Indonesia, Loas, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam) and six Asean FTA partners (Australia, China, India, Japan, Korea and New Zealand) during the 21st Asean summit in Phnom Penh in Cambodia in November 2012.

The agreement allows for common one set of rules of origin to qualify for tariffs reduction with other RCEP members. This means less procedures and easier movement of goods. That should encourage multinational firms to invest more in the region, including building supply chains and distribution hubs.

Since China is the key source of imports and is also the main export destination for most member nations, the deal is likely to it in a better position to shape the region's trade rules. The new tariff regime will kick in from 2022 and will see duties go back to 2014 levels.

India's exit from RCEP

India pulled out of the China-backed trade agreement as negotiations failed to address its core concerns. These were threat of circumvention of rules of origin due to tariff differential, inclusion of fair agreement to address the issues of trade deficits and opening of services.

The deal would have brought down import duties on 80% to 90% of the goods, along with easier service and investment rules. Some in Indian industry feared that reduced customs duty would result in a flood of imports, especially from China with which it has a massive trade deficit. India’s trade deficit with other RCEP countries were also rising.

In its negotiations, the government had also raised the issue of unavailability of MFN (Most Favoured Nation) obligations, where it would be forced to give similar benefits to RCEP countries that it gave to others. It had raised a red flag over the move to use 2014 as the base year for tariff reduction.

Prime Minister Narendra Modi said India's decision was guided by the impact it would have on the lives and livelihoods of all Indians, especially vulnerable sections of society. Despite its withdrawal, officials have said India could rejoin talks if it chooses to do so at a later date.

What it means for India

India would have the third biggest economy in the RCEP. Analysts believe that India might lose investments while its consumers may end up paying more than they should, especially when global trade, investment and supply chains face unprecedented challenges due to the Covid-19 pandemic.

Countries in the RCEP agreement would also lose out on an opportunity to access the Indian market that is notoriously hard to get into especially during the current global economic situation.

For India, it will be an opportunity to strengthen its domestic industries and move towards its dream of becoming self-reliant. A large number of sectors including dairy, agriculture, steel, plastics, copper, aluminium, machine tools, paper, automobiles, chemicals and others had expressed serious apprehensions on RCEP citing dominance of cheap foreign goods would dampen its businesses.

India-Asean relations and impact on RCEP

India's relationship with Asean is a key pillar of its foreign policy and the foundation of the Act East Policy. Its focus on a strengthened and multi-faceted relationship with Asean is an outcome of the significant changes in the world’s political and economic scenario since the early 1990s and India’s own march towards economic liberalisation.

In 2012, Asean and India had commemorated 20 years of dialogue partnership and 10 years of Summit level partnership with a Commemorative Summit held in New Delhi under the theme 'ASEAN-India Partnership for Peace and Shared Prosperity' on 20-21 December 2012.

India-Asean trade and investment relations have been growing steadily, with Asean being India's fourth largest trading partner. Its trade with Asean stands at $81.33 billion, which is approximately 10.6 per cent of India's overall trade. While, India's exports to Asean stand at 11.28 per cent of our total exports.

Investment flows are also substantial both ways, with Asean accounting for approximately 18.28 per cent of investment flows into India since 2000. FDI inflows into India from Asean between April 2000 to March 2018 was about $68.91 billion, while FDI outflows from India to Asean countries, from April 2007 to March 2015, as per data maintained by department of economic affairs (DEA), was about $38.672 billion.

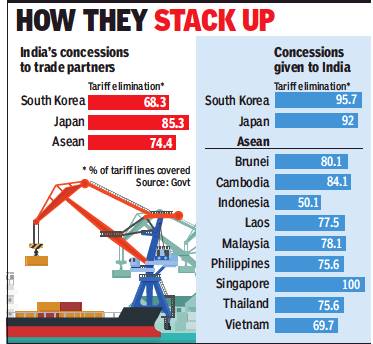

Under the UPA government, India had opened 74 per cent of its market to Asean countries but richer countries like Indonesia opened only 50 per cent of their markets for India. It also agreed to explore an India-China FTA in 2007 and join RCEP negotiations with China in 2011-12. However, the impact of these decisions resulted in increased trade deficit with RCEP nations - from $7 billion in 2004 to $78 billion in 2014.

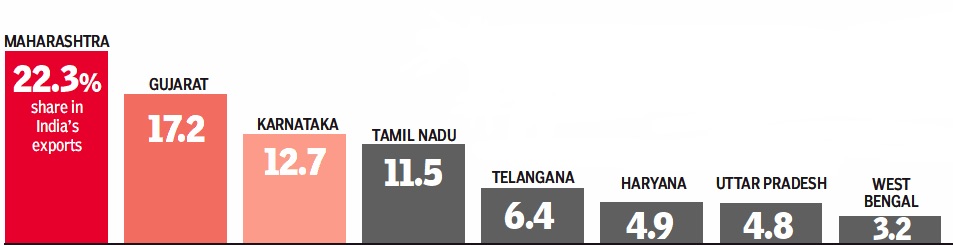

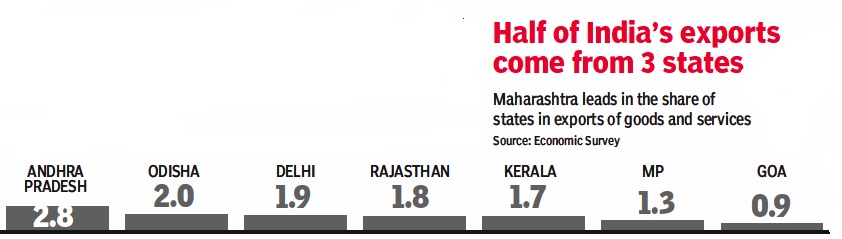

State-wise performance

2017

From: March 2, 2018: The Times of India

From: March 2, 2018: The Times of India

See graphics:

The share of India’s Top 8 exporting states in India’s exports, 2017- I

The share of India’s 9th-15th (rank-wise) exporting states in India’s exports, 2017- II

Trade agreements

As in 2019, Nov

From: Nov 6, 2019: The Times of India

See graphic:

India vis-à-vis countries included in the RCEP, concessions made by either side.

Trade deficit

2005-16

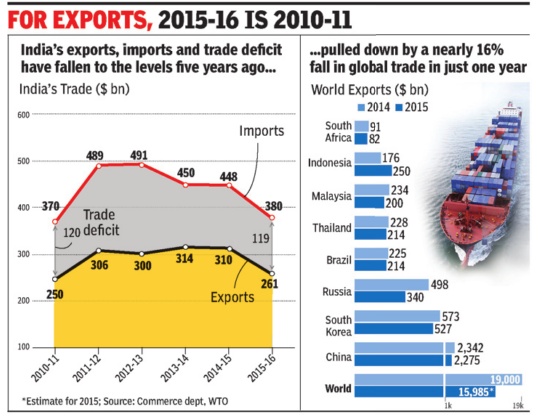

See graphic 'India's exports, imports and trade deficit levels in 2015-16...'

2013-16

The Times of India, May 10 2016

India has trade deficit with 27 countries

India has a trade deficit with as many as 27 major countries, in cluding China, Australia, Iraq and Iran, during the last three years. With these countries, India has trade deficit continuously during the last three years, commerce and industry minister Nirmala Sitharaman said in a written reply to the Lok Sabha.

She said India generally runs a deficit with those countries from which highdemand commodities are sourced. These include items like crude oil, gold, diamond and fertiliser.

In 2015-16, India's trade deficit fell 14% to $118.4 billion. Other countries with which India has a trade gap include Indonesia, Korea, Germany , Canada, Taiwan, Russia and Ukraine.

In a separate reply , she said India's exports have been adversely affected by recessionary trends across the globe, including in the EU and the US. India's agriculture exports during April-February 2016 worked out at $18.8 billion as against $18.7 billion in 2014-15, the minister said.

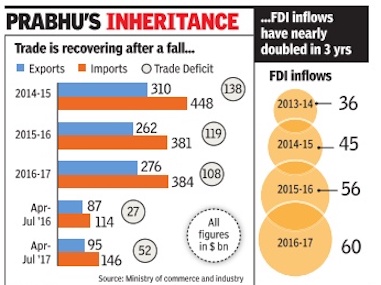

2014-17

ii) FDI inflows, 2013-17

From The Times of India, September 4, 2017

See graphic, ' India’s external trade, 2014-17'

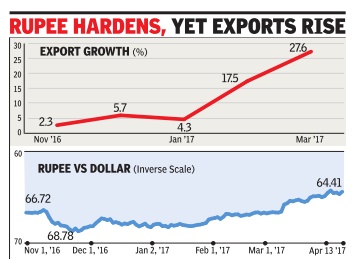

Nov 2016-April 2017

See graphic:

Nov 2016-April 2017: Indian exports rise despite the rupee appreciating in value

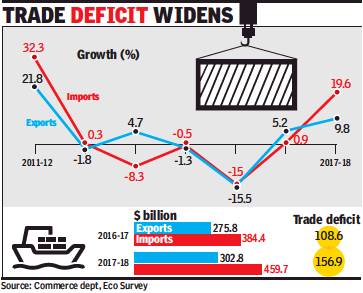

2017-18: Exports expand 9.8%, fastest in six years

Exports expand 9.8% in FY18, fastest in six years, April 14, 2018: The Times of India

From: Exports expand 9.8% in FY18, fastest in six years, April 14, 2018: The Times of India

India’s exports rose 9.8% during 2017-18, the highest growth rate in six years, while imports went up nearly 20% as commodity prices pushed up the value of shipments in and out of the country along with a pick-up in global trade.

But, exports dipped 0.7% in March to $29.1 billion, led by a decline in shipments of gems and jewellery and petroleum products from the country, latest data released by the commerce department on Friday showed. This was the first decline in four months as oil exports dropped 13%, while gems and jewellery exports fell nearly 17%. During March, import growth too slowed down, rising 7% to $42.8 billion, leaving a trade deficit of $13.7 billion.

In 2017-18, trade deficit was estimated to have widened to $157 billion, compared to $109 billion in 2016-17. “With the expansion in imports nearly twice as high as export growth in FY2018, the merchandise trade deficit widened by 44% in the just-concluded fiscal. ICRA expects the current account deficit to more than triple to $47-50 billion (around 1.9% of GDP) in FY2018 from $15 billion in FY2017,” said Aditi Nayar, principal economist at the ratings agency. While exporters’ lobby group Fieo said that the overall number was positive, it warned about the adverse impact of protectionism and geo-political uncertainty.

2018: August

From: September 17, 2018: The Times of India

See graphic:

India's top exports and imports- August 2018

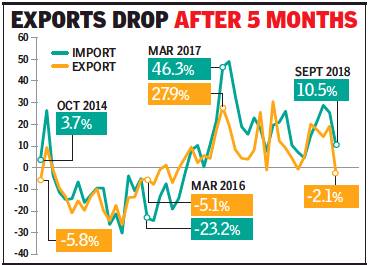

Sep: exports dip 2% despite ₹ depreciation/ Imports up

Exports dip 2% despite sharp Re depreciation, October 16, 2018: The Times of India

2018, Sep: exports dipped 2% despite ₹ depreciation; imports rose

From: Exports dip 2% despite sharp Re depreciation, October 16, 2018: The Times of India

India’s exports declined over 2% in September, despite a steep depreciation of the rupee, but the government dismissed it as a blip and blamed high base for the first fall in value of shipments in five months.

A late evening statement showed a decline across sectors — from gems and jewellery (down 22%) to readymade garments (-33.6%). On the other hand, gainers included oil products (26.8%) due to higher global prices, along with plastics and linoleum (28%) and chemicals (17%).

Typically, exports become more attractive due to a weakening currency. The rupee has depreciated over 15% since January, making it the worst performing Asian currency so far this year. But, exporters said they have gained little so far since the orders were booked before rupee’s free fall began. Besides, buyers are now demanding lower prices citing a weaker rupee.

In September 2018, exports were estimated at close to $28 billion, compared to $28.6 billion a year ago. Imports, however, rose 10.4% to $41.9 billion, resulting in a trade deficit of nearly $14 billion. Oil imports surged 33.6% to $10.9 billion, while gold shipments were 51% higher at $2.6 billion, mounting pressure on trade deficit.

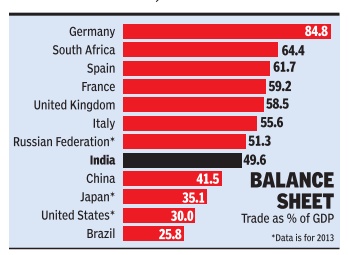

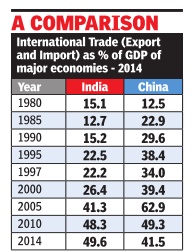

Trade-GDP ratio

Vulnerable India's trade-GDP ratio higher than US, China's

The Times of India, Aug 30 2015

Atul Thakur

India's trade-GDP ratio higher than US, China's Country

More vulnerable to global crises

Historically, India has been viewed as being far less vulnerable to global financial crises than other large economies because it was much less integrated with the global economy than countries like, say , the US or China. Today , however, at least as far as trade goes, the opposite is true. World Bank data shows that in 2014 India's total trade (exports plus imports) was equivalent to about 50% of its GDP. This was higher than the trade to GDP ratio of the US, Japan or China. Dur ing the 1997 Asian financial crisis, which India escaped relatively unscathed, total foreign trade was equivalent to only 22.2% of the country's GDP.

One way to measure the extent to which an economy is globally linked is by comparing its international trade with its GDP. By this yardstick, India's aggregate exports and imports of goods and services was 49.6% of the country's GDP in 2014, compared to China's trade to GDP ratio of 41.5% for the same year. In 2013, the year till when Bank data is available for the US and Japan, international trade was about 30% of GDP for America and 35.5% for the Japanese economy . Of course, the US, China and Japan are far larger economies than India at the nominal exchange rate and hence a lower trade ratio doesn't mean their trade volumes are lower than India's.

The data shows that among major economies, countries of Western Europe have the highest degree of integration with the global economy . For instance, the ratio was 84.8% for Germany , Europe's largest economy . For the UK, Italy , Spain and France, trade was about 60% of GDP .

Three decades ago, in 1984, China and India had a similar degree of globalization with the trade to GDP ratio 16.6% for China and 13.8% for India. The Chinese economy experienced exponential growth thereafter and it was reflected in the growth of its international trade as well.The trade to GDP ratio steadily increased to a peak of 64.8% in 2006. Since then it has been decreasing as China's domestic market has expanded with increased per capita incomes.

India, on the other hand, continues to be in a phase where its global trade expands at a faster pace than its economy , resulting in a steadily climbing trade to GDP ratio.

India and the world, 2019

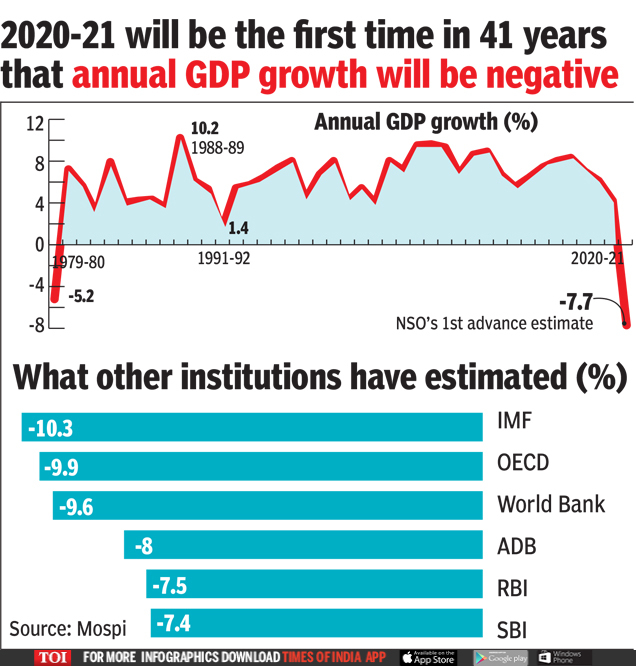

What other institutions have estimated (%)

From: GDP may contract by 7.7% in FY21: NSO data, January 8, 2021: The Times of India

See graphic:

Annual GDP growth, 1979-80- 2020-21;

What other institutions have estimated (%)

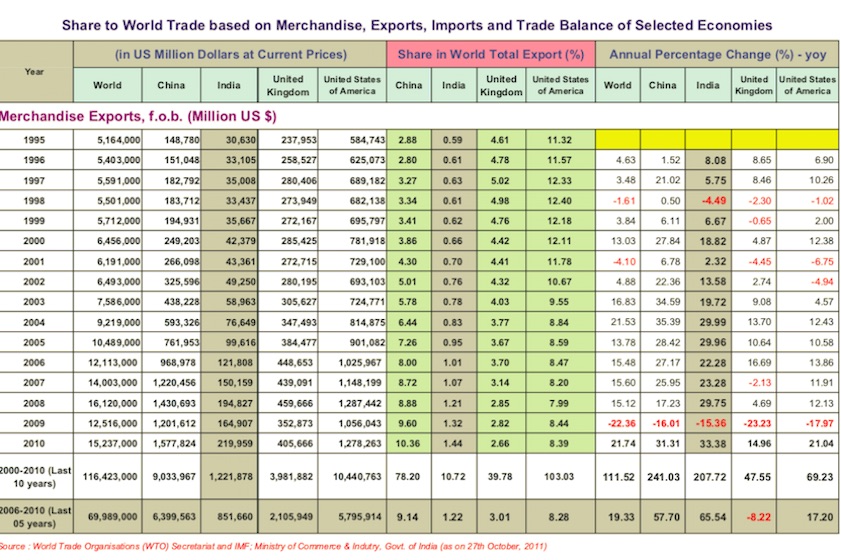

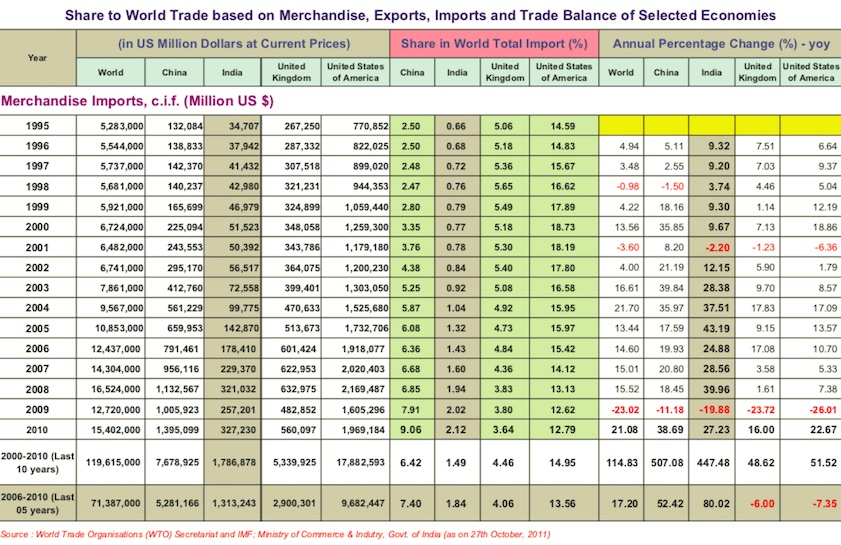

Trade, merchandise

From: December 22, 2014: The Planning Commission

From: December 22, 2014: The Planning Commission

See graphics:

1. Share to World Trade based on Merchandise, Exports, Imports & Trade Balance of Selected Economies - (1995-2010)- MERCHANDISE EXPORTS

2. Share to World Trade based on Merchandise, Exports, Imports & Trade Balance of Selected Economies - (1995-2010)- MERCHANDISE IMPORTS

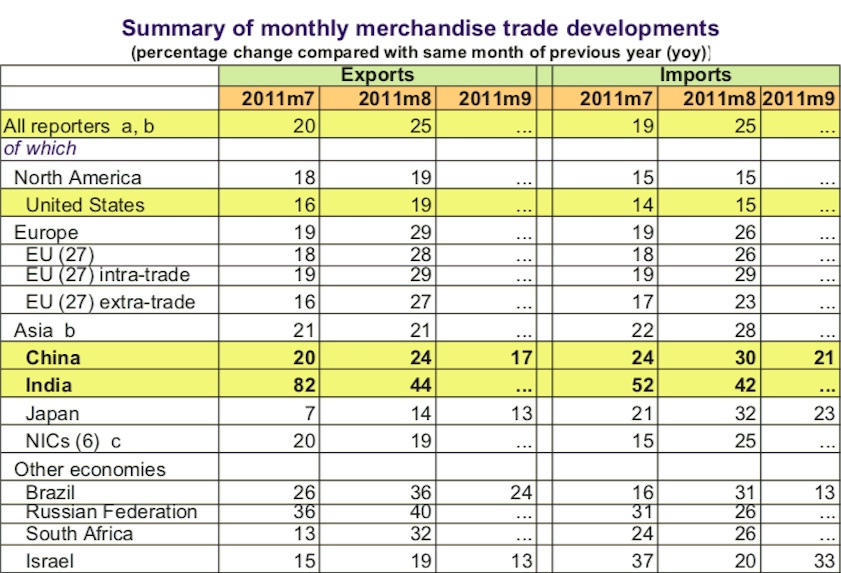

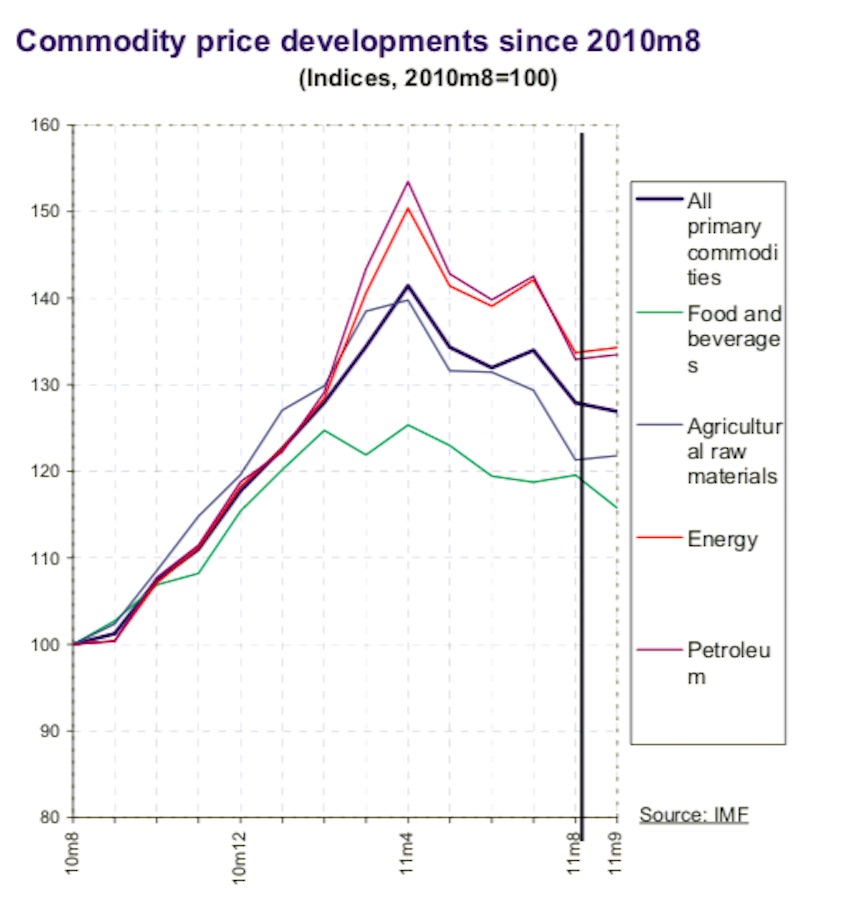

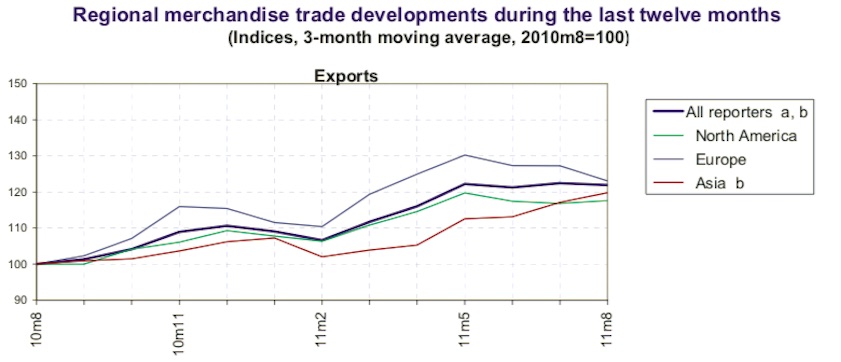

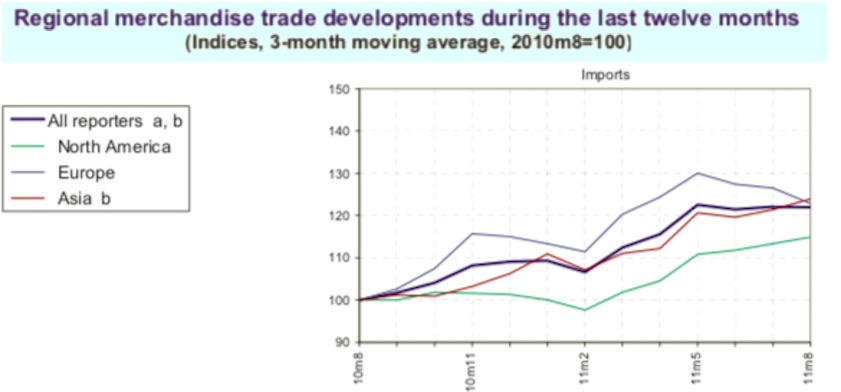

Summary of monthly merchandise trade developments

From: December 22, 2014: The Planning Commission

From: December 22, 2014: The Planning Commission

From: December 22, 2014: The Planning Commission

From: December 22, 2014: The Planning Commission

See graphics:

1. Summary of monthly merchandise trade developments- (percentage change compared with same month of previous year (yoy))

2. Commodity price developments since 2010m8

3. Regional merchandise trade developments during the last twelve months- (Indices, 3-month moving average, 2010m8=100)- EXPORTS

4. Regional merchandise trade developments during the last twelve months- (Indices, 3-month moving average, 2010m8=100)- IMPORTS

Trading partners, India’s main

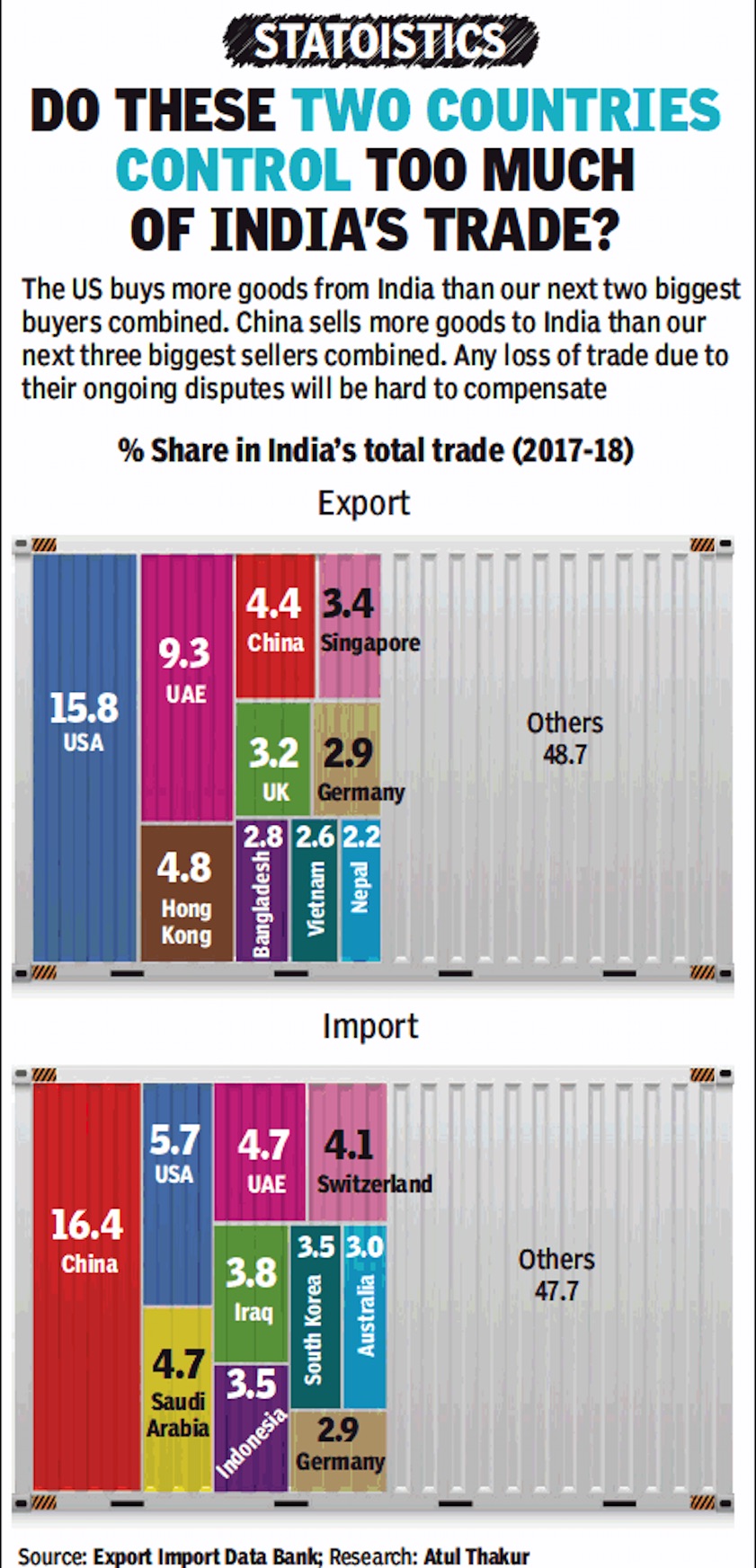

2017-18

ii) The main countries from which India imported their goods,

in 2017-18.

From: July 5, 2018: The Times of India

See graphic:

i) The main countries to which India exported its goods, and

ii) The main countries from which India imported their goods

2019-20: vis-à-vis the USA, China

July 12, 2020: The Times of India

NEW DELHI: The US remained India's top trading partner for the second consecutive fiscal in 2019-20, which shows increasing economic ties between the

two countries.

According to the data of the commerce ministry, in 2019-20, the bilateral trade between the US and India stood at $ 88.75 billion as against $87.96 billion in 2018-19.

The US is one of the few countries with which India has a trade surplus. The trade gap between the countries has increased to $17.42 billion in 2019-20 from $ 16.86 billion in 2018-19, the data showed.

In 2018-19, the US first surpassed China to become India's top trading partner.

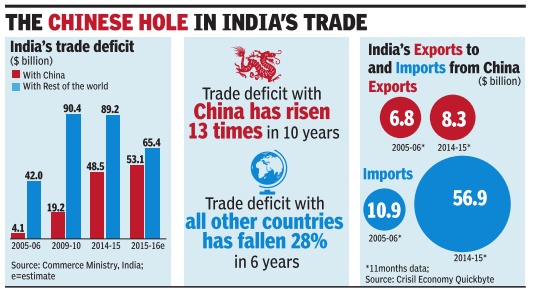

The bilateral trade between India and China has dipped to $81.87 billion in 2019-20 from $87.08 billion in 2018-19. Trade deficit between the two neighbours have declined to $48.66 billion in 2019-20 from $53.57 billion in the previous fiscal.

The data also showed that China was India's top trading partner since 2013-14 till 2017-18. Before China, UAE was the country's largest trading nation. Presence of Indian diaspora in the US is one of the main reasons for increasing bilateral trade, Biswajit Dhar, professor of economics at Jawaharlal Nehru University, said.

"Presence of Indian diaspora is creating demand for Indian goods such as consumer items and we are supplying that," Dhar said.

2020: vis-à-vis the USA, China

Bloomberg, February 23, 2021: The Times of India

From: February 23, 2021: Bloomberg

China returns as top India trade partner even as relations sour

NEW DELHI: China regained its position as India’s top trade partner in 2020, as New Delhi’s reliance on imported machines outweighed its efforts to curb commerce with Beijing after a bloody border conflict.

Two-way trade between the longstanding economic and strategic rivals stood at $77.7 billion last year, according to provisional data from the ministry of commerce.

Although that was lower than the previous year’s $85.5 billion total, it was enough to make China the largest commercial partner displacing the US -- bilateral trade with whom came in at $75.9 billion amid muted demand for goods in the middle of a pandemic.

While Prime Minister Narendra Modi banned hundreds of Chinese apps, slowed approvals for investments from the neighbor and called for self-reliance after a deadly clash along their disputed Himalayan border, India continues to rely heavily on Chinese-made heavy machinery, telecom equipment and home appliances.

As a result, the bilateral trade gap with China was at almost $40 billion in 2020, making it India’s largest.

Total imports from China at $58.7 billion were more than India’s combined purchases from the US and the UAE, which are its second- and third-largest trade partners, respectively.

That said, India did manage to lower imports from its Asian neighbor amid demand disruptions caused by the coronavirus pandemic.

The South Asian nation also managed to increase its exports to China by about 11% from a year ago to $19 billion last year, which makes any further worsening of ties with Beijing a threat to New Delhi’s export revenue.

The tense relations are already weighing on India’s ambitions to bolster its manufacturing capabilities. New Delhi has been slow to issue visas to Chinese engineers needed to help Taiwanese companies set up factories under a so-called production-linked incentive program, or PLI, to promote local manufacturing.

“Still a very long way to go” is how Amitendu Palit, an economist specializing in international trade and investment at the National University of Singapore, described New Delhi’s efforts to wean itself away from Beijing.

“The PLI schemes will take at least four-five years to create fresh capacities in specific sectors. Till then reliance on China would continue.”

See also

Agricultural produce marketing, sales, exports: India

Commerce: Indian government data

Exports, imports (international trade): India