Direct taxes: India

(→Collection of direct tax) |

(→2023, 2024) |

||

| Line 44: | Line 44: | ||

=Contribution of states= | =Contribution of states= | ||

==2023, 2024== | ==2023, 2024== | ||

| − | [[File: State-wise collection of direct taxes in India | + | [[File: State-wise collection of direct taxes in India- 2023, 2024.jpg|State-wise collection of direct taxes in India: 2023, 2024 <br/> From: [https://epaper.indiatimes.com/article-share?article=09_11_2024_008_010_cap_TOI Nov 9, 2024: ''The Times of India'']|frame|500px]] |

'''See graphic''': | '''See graphic''': | ||

Latest revision as of 15:24, 16 December 2024

This is a collection of articles archived for the excellence of their content.

|

Contents |

[edit] Collection of direct tax

[edit] 2020: first fall in direct taxes

Reuters, Jan 24, 2020: Live Mint

The tax department managed to collect only ₹7.3 trillion as of 23 Jan, more than 5.5% below the amount collected in the year-ago period, said a senior tax official

Direct taxes typically account for about 80% of the government's projections for annual revenue

Mumbai: India's corporate and income tax collection for the current year is likely to fall for the first time in at least two decades, over half a dozen senior tax officials told Reuters, amid a sharp fall in economic growth and cut in corporate tax rates.

Prime Minister Narendra Modi's government was targetting direct tax collection of ₹13.5 trillion ($189 billion) for the year ending March 31 - a 17% increase over the prior fiscal year.

However, a sharp decline in demand has stung businesses, forcing companies to cut investment and jobs, denting tax collections and prompting the government to forecast 5% growth for this fiscal year - the slowest in 11 years.

The tax department had managed to collect only ₹7.3 trillion as of Jan. 23, more than 5.5% below the amount collected by the same point last year, said a senior tax official.

After collecting taxes from companies in advance for the first three quarters, officials typically garner about 30-35% of annual direct taxes in the final three months, data from the past three years shows.

But eight senior tax officials interviewed by Reuters said despite their best efforts direct tax collections this financial year were likely to fall below the ₹11.5 trillion collected in 2018-19.

"Forget the target. This will be the first time that we'll see a fall in direct tax collection ever," said a tax official in New Delhi.

He estimates that direct tax collections for this year could end up roughly 10% below fiscal 2019.

Direct taxes typically account for about 80% of the government's projections for annual revenue, and the shortfall may leave the government needing to boost borrowing to meet expenditure commitments.

The tax officials also say that a surprise cut in headline corporate tax rate last year aimed at wooing manufacturers and boosting investment in Asia's third-biggest economy is another key reason behind the sluggish tax collections.

"We'll be very happy if we can even breakeven with what we collected last year," said another senior tax official in the financial capital Mumbai, the biggest tax generator, accounting for about a third of revenues from direct taxes. "But given the state of the economy, I'm not too hopeful.”

This story has been published from a wire agency feed without modifications to the text. Only the headline has been changed.

[edit] Contribution of states

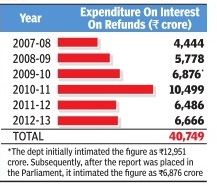

[edit] 2023, 2024

From: Nov 9, 2024: The Times of India

See graphic:

State-wise collection of direct taxes in India: 2023, 2024

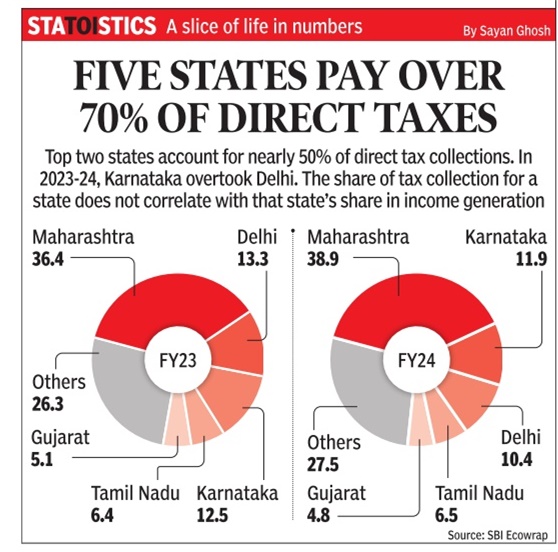

[edit] Interest liability on tax refunds

CAG pulls up finmin on tax refunds

New Delhi: TIMES NEWS NETWORK

The Times of India Aug 05 2014

Auditor Says I-T Department Refunded Rs6,700Cr Without House Nod

The finance ministry has been pulled up by the Comptroller & Auditor General (CAG) for making tax refunds of close to Rs 6,700 crore without Parliamentary authorization.

In its latest report, tabled in Parliament last week, CAG said, the Public Accounts Committee too had concurred with it and pointed out that “there was no valid ground as to why the department (of revenue) could not make broad estimates of expenditure on interest liability on tax refunds based on the studied trends of the past“.

It also said that the revenue department itself had admitted that in terms of Article 266 of the Constitution, it had no legal authority to withdraw the ‘interest' on excess tax collected and make refunds without getting it approved by Parliament.

Apart from CAG, even experts have argued that in the interest of transparency , the government should not hold back tax refunds and explicitly provide for it in the Budget.

But the finance ministry has refused to heed to this plea. has refused to heed to this plea. Typically, to meet the stiff tax targets set by the finance minister, tax officials push companies to cough up higher taxes, which are then refunded. The department also goes slow on refunds to ensure that the overall tax collection number looks healthy. Usually, the government has refunds of around Rs 1 lakh crore at the start of the financial year.

In fact, last year, the issue was also referred to the attorney general G E Vahanvati, who initially suggested that the CAG was right but later gave a different opinion when more facts were presented to him. Vahanvati and Sumit facts were presented to him. Vahanvati and Sumit Bose, then revenue secretary , had been summoned to the PAC for what it believed were “mutually contradictory opinions“ on the expenditure that the government incurred in paying interest on tax refunds.

In its latest report, CAG has said that over the last six years, Central Board of Direct Taxes alone had made refunds of close to Rs 41,000 crore, without obtaining legislative approval. A similar practice is also followed on the indirect taxes front, although on a smaller scale. According to CAG's estimates, over the past four years, refund of indirect taxes added up to nearly Rs 45 crore.

[edit]

Apr 22 2015

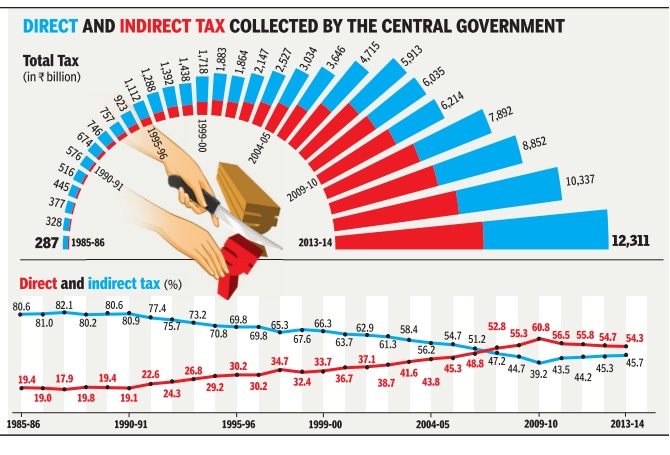

Unlike direct taxes like income tax which are paid only by the relatively well-off, whether an individual or a company, indirect taxes like sales tax, VAT, service tax are paid by everyone irrespective of their income levels. This is why higher collections of direct taxes are seen as a sign of a `progressive' tax regime. Data on the central government's tax revenues shows that from 1990-91 to 2009-10, the share of direct taxes in total tax revenue witnessed a steady increase. Since 2009-10, however, this share has been declining largely due to service tax emerging as a major source of revenue Research: Atul Thakur; Graphic: Sunil Singh; Source: Reserve Bank of India 1

[edit] Widening the direct taxpayer base

[edit] 1988-2018

June 25, 2019: The Times of India

From: June 25, 2019: The Times of India

India’s taxation has become more poor-friendly after Liberalisation

Thirty years ago, less than 20% of the Centre’s tax revenue came from income tax and other direct taxes. More than 80% came from indirect taxes like custom and excise duties that the rich and the poor pay equally on purchase of goods and services. Today, direct taxes that are imposed on the country’s relatively well-off population account for more than half of the Centre’s total tax revenue

[edit] 2013-2016

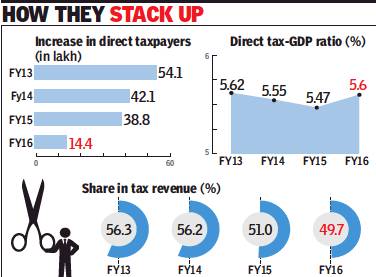

Direct taxpayer base growth slows in Modi govt’s first 2 yrs, December 21, 2017: The Times of India

ii) Direct tax-GDP ratio, FY13-16

From: Direct taxpayer base growth slows in Modi govt’s first 2 yrs, December 21, 2017: The Times of India

See graphic:

i) Increase in direct taxpayers, FY13-FY16

ii) Direct tax-GDP ratio, FY13-16

Hopes For Widening Net Alive With 91L Added After Note Ban

Tax concessions and moderate increments have slowed down the expansion of direct taxpayer base in the first two years of the Narendra Modi government, a trend that it expects to reverse post-demonetisation.

Data released by the tax department showed that the number of individual taxpayers filing returns has grown, but at a slower pace for four years in a row starting 2012-13, when there was an increase of 54 lakh. But ever since then, the numbers will not bring cheer as far as widening the base is concerned. In fact, in the first two years of the current regime, the number of individual taxpayers rose from 5.4 crore in 2013-14, the year before Modi swept to power, to 5.93 crore in 2015-16 — an increase of 53 lakh.

But with at least 91lakh taxpayers added-post demonetisation, the government is hoping to significantly widen the base.

Tax experts say part of the reason for the moderation in growth in the direct taxpayer base are the concessions offered by the Modi government.

For instance, in his first Budget after the elections, finance minister Arun Jaitley had increased personal income tax exemption limit by Rs 50,000, which was seen as a reward for the middle class. This move is seen to have pushed several individuals out of the net. In 2015, he followed it up with more deductions for health insurance and pension.

“The reduction in individual taxpayers could be a consequence of increase in basic ceiling of taxable income for individual taxpayers in 2014-15. The data of 2015-16 is prior to demonetisation — it not only has carry-over effect of reduction in basic taxable income but also marginal increase in income of salaried class,” said Samir Kanabar, partner at consulting firm Ernst & Young.

In 2015-16, the falling trend of direct taxes as a percentage of the Centre’s overall tax collection also continued as the share of service tax in overall kitty went up. In fact, for the first time since 2006-07, direct taxes accounted for less than half the tax collections, data released by the government on Wednesday showed.

But on the positive side, it was a year in which the trend of falling ratio of direct taxes to GDP was reversed.

[edit] 2016-19

The share of direct and indirect taxes in government revenues, and

The number of taxpayers

From: July 29, 2019: The Times of India

See graphic, ‘ 2016-19:

The share of direct and indirect taxes in government revenues, and

The number of taxpayers’

[edit] See also

Direct taxes: India

Income Tax India: Expert advice

Income Tax India: Expert advice, 2016-17