Direct taxes: India

(Created page with " = Interest liability on tax refunds= ''' CAG pulls up finmin on tax refunds ''' New Delhi: TIMES NEWS NETWORK [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&...") |

|||

| Line 1: | Line 1: | ||

| + | {| class="wikitable" | ||

| + | |- | ||

| + | |colspan="0"|<div style="font-size:100%"> | ||

| + | This is a collection of articles archived for the excellence of their content.</div> | ||

| + | |} | ||

= Interest liability on tax refunds= | = Interest liability on tax refunds= | ||

Revision as of 19:27, 5 August 2014

This is a collection of articles archived for the excellence of their content.

|

Interest liability on tax refunds

CAG pulls up finmin on tax refunds

New Delhi: TIMES NEWS NETWORK

The Times of India Aug 05 2014

Auditor Says I-T Department Refunded Rs6,700Cr Without House Nod

The finance ministry has been pulled up by the Comptroller & Auditor General (CAG) for making tax refunds of close to Rs 6,700 crore without Parliamentary authorization.

In its latest report, tabled in Parliament last week, CAG said, the Public Accounts Committee too had concurred with it and pointed out that “there was no valid ground as to why the department (of revenue) could not make broad estimates of expenditure on interest liability on tax refunds based on the studied trends of the past“.

It also said that the revenue department itself had admitted that in terms of Article 266 of the Constitution, it had no legal authority to withdraw the ‘interest' on excess tax collected and make refunds without getting it approved by Parliament.

Apart from CAG, even experts have argued that in the interest of transparency , the government should not hold back tax refunds and explicitly provide for it in the Budget.

But the finance ministry has refused to heed to this plea. has refused to heed to this plea. Typically, to meet the stiff tax targets set by the finance minister, tax officials push companies to cough up higher taxes, which are then refunded. The department also goes slow on refunds to ensure that the overall tax collection number looks healthy. Usually, the government has refunds of around Rs 1 lakh crore at the start of the financial year.

In fact, last year, the issue was also referred to the attorney general G E Vahanvati, who initially suggested that the CAG was right but later gave a different opinion when more facts were presented to him. Vahanvati and Sumit facts were presented to him. Vahanvati and Sumit Bose, then revenue secretary , had been summoned to the PAC for what it believed were “mutually contradictory opinions“ on the expenditure that the government incurred in paying interest on tax refunds.

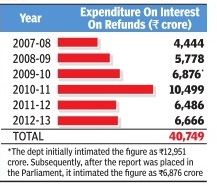

In its latest report, CAG has said that over the last six years, Central Board of Direct Taxes alone had made refunds of close to Rs 41,000 crore, without obtaining legislative approval. A similar practice is also followed on the indirect taxes front, although on a smaller scale. According to CAG's estimates, over the past four years, refund of indirect taxes added up to nearly Rs 45 crore.

See also

Direct taxes: India Income Tax India: Expert advice Income Tax India: Laws Income Tax India: NRIs Wealth tax: India