Wealth tax: India

| Line 1: | Line 1: | ||

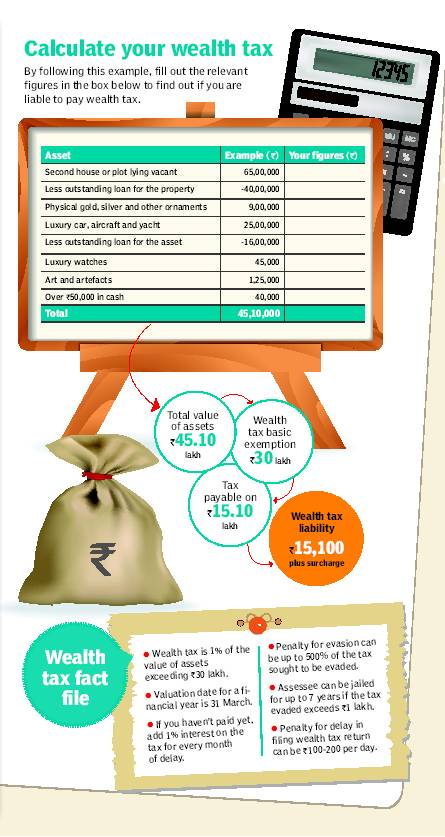

| − | [[File: wealth tax.jpg||frame|500px]] | + | [[File: wealth tax.jpg|Calculate your wealth tax. Chart: [http://epaper.timesofindia.com/Default/Client.asp?Daily=CAP&showST=true&login=default&pub=TOI&Enter=true&Skin=TOINEW The Times of India ] July 2013|frame|500px]] |

{| class="wikitable" | {| class="wikitable" | ||

|- | |- | ||

Revision as of 13:51, 12 August 2014

This is a collection of articles archived for the excellence of their content. Readers will be able to edit existing articles and post new articles directly |

Contents |

Wealth tax: India

Do you have to pay wealth tax?

Find out if you have to pay this little-known tax on certain assets you own

BABAR ZAIDI

The Times of India July 2013

Very few taxpayers have heard of it and fewer pay it. However, this is no reason for you to ignore wealth tax. This tax is payable if the market value of certain assets exceeds 30 lakh. The tax is 1% of the combined value of such assets.

Unproductive, non-essential and idle assets are targeted

Wealth tax targets unproductive, non-essential and idle assets. In the crosshairs are two of the biggest obsessions of Indian investors: property and gold. If you have bought a second house and not given it on rent, the value of the property will be included while computing your wealth tax liability. Of course, the outstanding loan taken to buy the property will be deducted from this. Gold and silver, whether bought, gifted or inherited, will also be included in the calculation. Even the cash you keep in your locker at home is liable to wealth tax.

However, productive and financial assets, such as commercial property, bonds, fixed deposits, stocks, Ulips, gold funds, mutual funds, your savings account bank balance and gold exchange traded funds (ETFs) are exempt from wealth tax.

This tax is not taken very seriously by taxpayers because the Central Board of Direct Taxes is busy with other, more important, ones, such as corporate tax, income tax, service tax and excise. Wealth tax accounts for less than 0.25% of total direct taxes and is minuscule in the total revenue collection. Last year, it contributed 866 crore to the total revenue collection of 1,038,036 crore.

The taxman’s disinterest is surprising because, although small, this is a regular stream of tax collection. Unlike income tax, which is levied on earnings just once, wealth tax is payable every year for the same assets. One would have thought that wealth tax collections would see an exponential rise as India’s rich became richer. Instead, these collections have witnessed a slow growth, rising 10% from 787 crore in 2011-12 to 866 crore in 2012-13.

Penalty for evading wealth tax

This doesn’t mean the taxman will not go after you for not paying it. Direct tax collections have been below the target set in the budget and the CBDT is under pressure to improve compliance. There is a stiff penalty for evading wealth tax. Incorrect declaration of wealth can invite a fine of up to 500% of the evaded tax. One can also be jailed for up to seven years if the tax due is over 1 lakh. Remember, wealth tax evasion is easy to detect because the assets are tangible and undervaluation is not difficult to prove.

Are you liable to pay wealth tax? Fill the table provided here to know if you are rich enough to fall in its ambit. If the total figure exceeds 30 lakh, you have to pay 1% wealth tax on that amount. This can be paid online or deposited at any designated bank branch. The wealth tax return is to be filed using form BA and the last date for doing so is 31 July. If the assessee is liable to audit, the last date is 30 September.

See also

See also Not filing wealth tax return’’ on the page Income Tax India: Expert advice

And also...

Direct taxes: India / Income Tax India: Expert advice / Income Tax India: Laws / Income Tax India: NRIs / Wealth tax: India