Investments: India

m (Pdewan moved page Investment: India to Investments: India without leaving a redirect) |

|||

| Line 8: | Line 8: | ||

[[Category:India |I ]] | [[Category:India |I ]] | ||

[[Category:Economy-Industry-Resources |I ]] | [[Category:Economy-Industry-Resources |I ]] | ||

| + | |||

| + | =Gross fixed capital formation= | ||

| + | ==2003-17== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/PrintArticle.aspx?doc=TOIDEL%2F2018%2F02%2F02&entity=ar00903&ts=20180202013334&uq=20180126102801&mode=text February 2, 2018: ''The Times of India''] | ||

| + | |||

| + | |||

| + | Soaring stock prices, pick-up in industrial production, stabilising GST regime and a projected upturn in GDP growth-there has been a raft of good economic news in the past few weeks. But the good times won’t roll on unless the rate of new investment, especially private investment, picks up soon. Here’s how severe the slowdown is and what’s causing it | ||

| + | |||

| + | [[File: Gross fixed capital formation, 2003-16, i) as percentage of GDP; ii) annual change.jpg| <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/PrintArticle.aspx?doc=TOIDEL%2F2018%2F02%2F02&entity=ar00903&ts=20180202013334&uq=20180126102801&mode=text February 2, 2018: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | [[File: i) The rise and fall of gross fixed capital formation, 2013-17, ii) Government and private capital expenditure, 2014-18.jpg|i) The rise and fall of gross fixed capital formation, 2013-17, <br/> ii) Government and private capital expenditure, 2014-18 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/PrintArticle.aspx?doc=TOIDEL%2F2018%2F02%2F02&entity=ar00903&ts=20180202013334&uq=20180126102801&mode=text February 2, 2018: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | [[File: i) Capacity utilisation of manufacturing companies (%), 2011-17; ii) its impact on growth of employment in 2017.jpg|i) Capacity utilisation of manufacturing companies (%), 2011-17; <br/> ii) its impact on growth of employment in 2017 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/PrintArticle.aspx?doc=TOIDEL%2F2018%2F02%2F02&entity=ar00903&ts=20180202013334&uq=20180126102801&mode=text February 2, 2018: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphics''': | ||

| + | |||

| + | 1. ''Gross fixed capital formation, 2003-16, <br/> i) as percentage of GDP; <br/> ii) annual change'' | ||

| + | |||

| + | 2. ''i) The rise and fall of gross fixed capital formation, 2013-17, <br/> ii) Government and private capital expenditure, 2014-18'' | ||

| + | |||

| + | 3. ''i) Capacity utilisation of manufacturing companies (%), 2011-17; <br/> ii) its impact on growth of employment in 2017'' | ||

| + | |||

=Investment by Indian corporations= | =Investment by Indian corporations= | ||

Revision as of 18:30, 5 February 2018

This is a collection of articles archived for the excellence of their content. |

Contents |

Gross fixed capital formation

2003-17

February 2, 2018: The Times of India

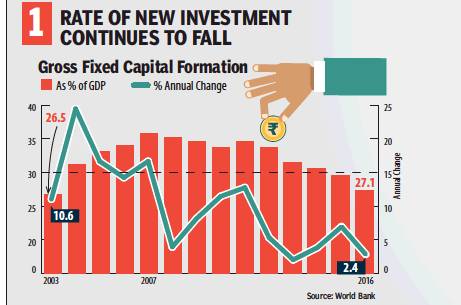

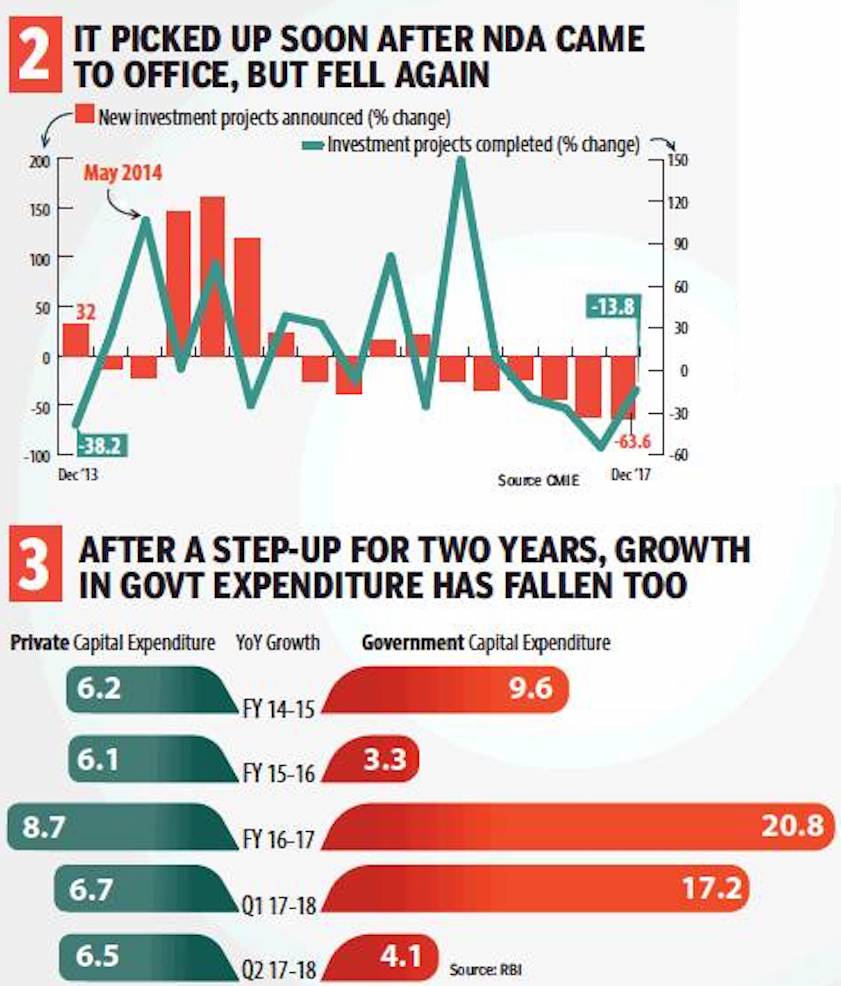

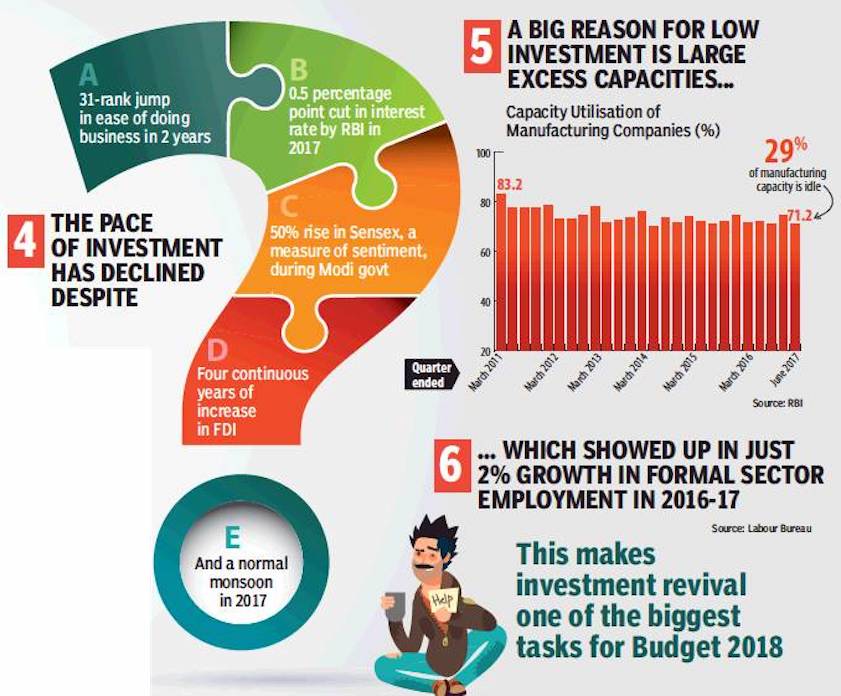

Soaring stock prices, pick-up in industrial production, stabilising GST regime and a projected upturn in GDP growth-there has been a raft of good economic news in the past few weeks. But the good times won’t roll on unless the rate of new investment, especially private investment, picks up soon. Here’s how severe the slowdown is and what’s causing it

ii) Government and private capital expenditure, 2014-18

From: February 2, 2018: The Times of India

ii) its impact on growth of employment in 2017

From: February 2, 2018: The Times of India

See graphics:

1. Gross fixed capital formation, 2003-16,

i) as percentage of GDP;

ii) annual change

2. i) The rise and fall of gross fixed capital formation, 2013-17,

ii) Government and private capital expenditure, 2014-18

3. i) Capacity utilisation of manufacturing companies (%), 2011-17;

ii) its impact on growth of employment in 2017

Investment by Indian corporations

Mega projects, 2006-16

2013-16: a declining trend

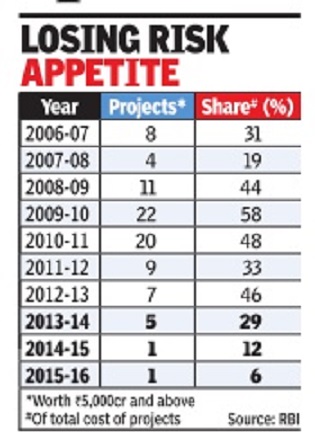

India Inc is shying away from mega projects, which are defined as those with a value of Rs 5,000 crore and above. Their share in the total cost of all projects has fallen to a decade low of less than 6% in 2015-16 -the third consecutive year of the slide. The share of mega projects in the total cost of projects had hit a peak of 58% in 2009-10 (see graph).

Although the overall cost of projects has grown by nearly 10% in 2015-16, the increase has come only from small-value projects (which cost less than Rs 1,000 crore each), data with the RBI showed. “High-value projects financed by banks witnessed a repeated decline in the past few years and the same trend may be expected to continue for a couple of quarters. Due to the cleaning up of balance sheets undertaken by banks, they may not be able to lend aggressively in the near future,“ the RBI said.

The share of high-value projects (Rs 1,000 crore and above) also fell in 2015-16.Their share has come down to 45% in the total cost of all projects during the year compared to 60% in the previous year.

Capital expenditure (capex) by corporates, estimated at Rs 1.5 lakh crore in 2015-16, was nearly 25% lower than the revised estimate for 2014-15. “In order to maintain even this lower level of aggregate capex in 2016-17, about Rs 83,800 crore needs to be spent from the new projects to be sanctioned financial assistance in 2016-17,“ the RBI said.

The aggregate capex to be incurred in 2015-16 amounted to Rs 99,700 crore -a nearly 27% fall over the previous year, continuing the trend seen since 2011-12.

Investment intentions

2016, “investment intentions”, state-wise

The Hindu, August 7, 2016

Karnataka emerges as investors’ favourite

Gujarat, which was ranked first among all States in 2015 for attracting maximum ‘investment intentions’ in value terms, has lost its position to Karnataka halfway through 2016.

Gujarat received investment intentions worth only Rs.21,309 crore during January-June 2016, while Karnataka — which topped the list — received over thrice that amount, or Rs.67,757 crore, during the same period, government data showed.

The Centre, which is co-ordinating efforts to rank states on ‘ease of doing business’, also maintains a State-wise break-up of investment intentions in terms of Industrial Entrepreneur Memoranda filed for de-licensed sector, Letters of Intent issued and Direct Industrial Licences granted.

Interestingly, the Rs.67,757 crore worth investment intentions received by Karnataka in the first six months of 2016 was more than the Rs.64,733 crore that Gujarat had attracted in the whole of 2015, the year when it topped the all-India list in this regard.

The Rs.64,733 crore-worth investment intentions Gujarat got was 20.81 per cent of the total investment intentions worth Rs.3,11,031 crore that India received in 2015. However, out of the Rs.1,76,738 crore worth proposed investments that India received in January-June 2016, the share of Gujarat declined to 12.06 per cent — or Rs.21,309 crore. Meanwhile, Karnataka’s share jumped from 10.18 per cent (or Rs.31,668 crore) in 2015 to 38.34 per cent (or Rs.67,757 crore) in January-June 2016. Karnataka said ‘Invest Karnataka 2016’, an investors’ meet held during February 3-5 this year, concluded with 1,201 approved projects and MoUs valued at Rs.3.08 lakh crore.

Other leading States in terms of ‘investment intentions’ during January-June 2016 were Maharashtra (Rs.15,688 crore), Telengana (Rs.13,600 crore) and Chhattisgarh (Rs.8,514 crore). In 2015, the States in the top five after Gujarat were Chhattisgarh (Rs.36,511 crore), Maharashtra (Rs.33,277 crore), Karnataka (Rs.31,668 crore) and Odisha (Rs.24,524 crore).

Even in the ‘Business Reforms Action Plan’ index 2016 (or measures taken by states to improve ease of doing business), Gujarat was sixth with a score of 53.98 per cent. Uttarakhand topped that dynamic ‘implementation scorecard’ with 63.72 per cent, followed by Rajasthan, Telengana, Chhattisgarh and Andhra Pradesh. Gujarat government officials rejected apprehensions that incidents (which even led to changes at the Chief Minister-level) — including the Patidar agitation for reservation and more recently, Dalit protests after some of them were reportedly attacked for allegedly skinning cow carcasses — are leading to lower investor interest in Gujarat.

“These numbers (on investment intentions) keep going up and down. Some big announcements could come up soon and the situation can change,” a senior Gujarat government official said, indicating that some major decisions are likely in the run-up to the Vibrant Gujarat Global Investors’ Summit that is slated to be held during January 10-13 next year.

Most of the investment intentions that Gujarat has received are getting converted into amount that is actually being spent on the ground, the official said.