Homebuyers and the law: India

This is a collection of articles archived for the excellence of their content. |

Homebuyers’ interests and the law

2019/ Homebuyers given creditor status under IBC

AmitAnand Choudhary, July 10, 2019: The Times of India

Backing the homebuyers in their fight against builders, who duped them and are facing insolvency proceedings, the Centre on Tuesday told the Supreme Court that there was no illegality in amendment brought by it in the Insolvency and Bankruptcy Code (IBC) to give them a say in the proceedings by classifying them as financial creditors like banks.

Responding to a batch of more than 140 petitions filed by real estate companies challenging the constitutional validity of the amendment in IBC, the Centre filed its affidavit in the apex court and said the law was amended to protect the interests of lakhs of homebuyers who had paid money for flats but were cheated by the companies. It said the amendment was brought after the apex court itself had in 2017 expressed concern over the plight of homebuyers and had said that they should be represented in the Committee of Creditors under IBC.

The real estate companies have challenged the validity of Section 5(8)(f) of the IBC, 2016 which ensures inclusion of homebuyers as financial creditors. The Centre, however, said the amendment was brought to insert an explanation to the definition of financial debt to clear doubts on inclusion of homebuyers within the ambit of financial creditors. “It means that homebuyers and other financial creditors who have entered into purchase agreements having the commercial effect of borrowing were already covered under the code as it stood before the amendment. The explanation inserted under Section 5(8)(f) providing that the allottees under the real estate project are considered as financial creditors was only for the purpose of abundant clarity,” the affidavit said.

Countering the stand of companies that homebuyers should not be part of the proceedings under IBC as they can raise grievances before consumer courts and the authority under Real Estate (Regulation and Development) Act, the Centre said providing alternative remedy to them under a separate law does not violate any constitutional

provisions and sought dismissal of all the petitions.

“The amendment is only aimed at real estate developers who default in payment of financial debt owed to financial creditors, be it homebuyers or other financial creditors. The amendment has no effect of driving solvent and healthy real estate developers to insolvency,” it said.

Opposing the plea of companies, the homebuyers too filed a reply. “Objective of the instant legislation was never to liquidate the company but to restructure the company and come up with a resolution plan to correct the default committed. It is pertinent to mention here that homebuyers being the highest stakeholders in the project, their interests need to be safeguarded and the same is of paramount importance,” said advocate Aditya Parolia, who is representing a batch of homebuyers.

Jaypee: SC orders depositing of security against homebuyers’ investments

The Supreme Court assured that homebuyers' interest would be protected even if big creditors and realtors suffered, and ordered Jaiprakash Associates Ltd (JAL), the holding company of distressed Jaypee Infratech, to deposit Rs 2,000 crore in the apex court by October 27.

The SC told JAL's counsel, Rupinder Singh Suri, that the company could sell its land with the apex court's consent to generate Rs 2,000 crore, which would serve as security for the investments made by homebuyers in Jaypee Infratech's housing projects. The court directed JAL to deposit the money even though Jaypee Infratech (JIL), through P S Patwalia, said it had no money .

The court ordered the MD and directors of Jaypee Infratech and JAL not to leave India without its permission. Any person who was a director or managing director of JIL or JAL on the date of institution of insolvency proceedings (on August 9) against JIL as well as the present directorsmanaging director shall also not leave the country without prior permission of this court. The foregoing restraint shall not apply to nominee directors of lending institutions (IDBIICICISBI),“ a bench of Chief Justice Dipak Misra and Justices A M Khanwilkar and D Y Chandrachud said.

The court, right from the beginning, made it clear that homebuyers' interest was paramount and that it would do everything possible within the law to protect it.“We are not concerned whether the companies sink in Bay of Bengal or in Pacific Ocean. Homebuyers' interest must get protected at all costs,“ it said.

The Centre, through attorney general K K Venugopal, the interim resolution professional (IRP) appointed by the National Company Law Tribunal (NCLT) through additional solicitor general Tushar Mehta and IDBI Ltd through A M Singhvi said the SC's September 4 order staying the NCLT's in solvency proceedings amounted to handing over assets to Jaypee Infratech, the defaulter company .

Venugopal sought revival of the IRP to take control of Jaypee Infratech's assets and said the IRP alone could devise a plan in consultation with the committee of creditors to resuscitate the realtor and provide a mechanism for recovery of dues owed to creditors.

“Since we have a practical problem as the Insolvency and Bankruptcy Code, 2016 did not provide for homebuyers, the court could permit representative of homebuyers to be present in the meeting of the committee of creditors,“ he said.

The SC accepted the pro posal and nominated Shekhar Naphade and Shubhangi Tuli to be present in the meeting of the committee of creditors to safeguard the interest of homebuyers. It asked the IRP to submit an interim resolution scheme to the court in 45 days which shall include the interest of homebuyers apart from those of secured creditors like IDBI, SBI and other banking institutions.

“The IRP shall forthwith take over the management of JIL. The IRP shall formulate and submit an interim resolution plan within 45 days before this court. The interim resolution plan shall make all necessary provisions to protect the interests of homebuyers,“ it said.

Financial creditor status upheld by SC

August 9, 2019: The Times of India

SC upholds homebuyers’ status on par with lenders

NEW DELHI: In a big relief to home-buyers, the Supreme Court on Friday upheld amendment in Insolvency and Bankruptcy Code (IBC) that gives them the status of financial creditors on par with lender banks and rejected the plea of around 200 real estate companies which had challenged its constitutional validity. A bench of Justices R F Nariman, Sanjiv Khanna and Surya Kant said IBC is a beneficial legislation to protect the interest of home-buyers who had invested their money to realise their dream of a house and there was no illegality in giving them a say in insolvency proceedings against a builder which failed to discharge its obligation to hand over possession of flats on time.

The court held that IBC provided an additional forum for aggrieved home-buyers to take action against builders and if that status is taken away, they will not get anything in liquidation process against a defaulting company. It said there is no conflict between Real Estate (Regulation and Development ) Act and IBC and home-buyers could pursue parallel proceedings against builders under both the laws in addition to approaching consumer forum.

“RERA is to be read harmoniously with the Code, as amended by the Amendment Act. It is only in the event of conflict that the Code will prevail over RERA. Remedies that are given to allottees of flats/apartments are therefore concurrent remedies, such allottees of flats/apartments being in a position to avail of remedies under the Consumer Protection Act, 1986, RERA as well as the triggering of the Code,” the bench said.

The court noted that the threshold limit to trigger the Code is purposely kept low — at only one lakh rupees — so that small individuals may also trigger the Code as financial creditors along with banks and financial institutions to whom crores of rupees may be due. “The Code is thus a beneficial legislation which can be triggered to put the corporate debtor back on its feet in the interest of unsecured creditors like allottees, who are vitally interested in the financial health of the corporate debtor, so that a replaced management may then carry out the real estate project as originally envisaged and deliver the flat/apartment as soon as possible and/or pay compensation in the event of late delivery, or non-delivery, or refund amounts advanced together with interest,” it said.

Allaying fears of the real estate firms that the law can be used as a tool of blackmail by speculative investors, the court said the builders can also point out in the proceedings that the insolvency resolution process under the Code has been invoked fraudulently and with malicious intent.

“This the real estate developer may do by pointing out, for example, that the allottee who has knocked at the doors of NCLT is a speculative investor and not a person who is genuinely interested in purchasing a flat/apartment,” it said.

Refund when buyer opts out

Can Retain Just Earnest Money: Consumer Body

New Delhi:

A home-buyer will have to forfeit only the earnest money paid at the time of booking a flat and the builder has to refund the rest of the amount if the buyer decides not to take possession of a flat, the National Consumer Disputes Redressal Commission (NCDRC) has ruled. It also said one-year delay in completion of a housing project is reasonable and a buyer cannot seek refund of money on that ground. While adjudicating a dispute between real estate company Emmar MGF and a home-buyer who refused to take possession of a flat in its housing project in Gurgaon and sought refund of money, a bench of Justice V K Jain said the company cannot enforce its agreement as per which it was allowed to define the forfeit money and deduct other charges while refunding the amount. The NCDRC said such agreement was not enforceable as it was “one-sided” in favour of the builder at the cost of the interest of homebuyers. It held that only the amount paid at the time of booking should be non-refundable and the builder has to refund the rest of the amount.

In this case, a couple had booked a flat worth around Rs 1.68 crore and paid Rs 10 lakh at the time of booking in 2013. They subsequently paid over Rs one crore through bank loan, but decided to get the money refunded when the builder offered possession in 2018 after a delay of 14 months.

“The complainants paid an initial amount of Rs 10 lakh to the builder for booking a residential flat allotted to them. The said amount being the initial deposit made by them would constitute earnest money despite definition to the contrary given in the buyer agreement executed between the parties. The builder, in my opinion, should deduct only a sum of Rs 10 lakh out of the total amount received by it,” Jain said in his order.

“As regards the terms of the agreement executed between the complainant and the builder, such agreements being wholly one-sided constitutes an unfair trade practice and, therefore, cannot bind the flat buyer,” it said.

It, however, rejected the plea of the home-buyer who sought refund with interest for delay of around 14 months in completion of the project.

Builders call will decide your GST rate

May 9, 2019: The Times of India

Builder's call will decide your GST rate

NEW DELHI: Your GST liability will only come down to 5% on the remaining instalments of your under-construction apartment, if your builder decides to move to the new mechanism.

Under the revised regime, the GST Council has lowered the levy from 12% to 5% (and from 8% to 1% for affordable housing) but taken away the benefit of tax credit on inputs such as cement, paints and steel as builders were seen to be pocketing it and charging 12% flat GST.

In a set of FAQs, the government has clarified that you can hope to move to a 5% or 1% rate for the remaining portion of the under-construction flat. So, if you had paid 40% of the value of the flat up to March 31 and your builder decides to move to the new regime, you can opt for the new rate. But in case the builder sticks to the one with ITC (input tax credit), make sure that the benefits of tax credit accrue, which will mean a lower than the 12% rate.

The government also said that a one-time option has been given to builders to move to the revamped structure but those who do not submit their option by Friday, will automatically move to the 5% rate without ITC, and 1% for affordable homes.

It has also reiterated that 80% of the value of goods and services have to be sourced from registered suppliers. "For calculating this threshold, the value of services by way of grant of development rights, long term lease of land, floor space index, or the value of electricity, high speed diesel, motor spirit and natural gas used in construction of residential apartments in a project shall be excluded," the 16-page FAQs said.

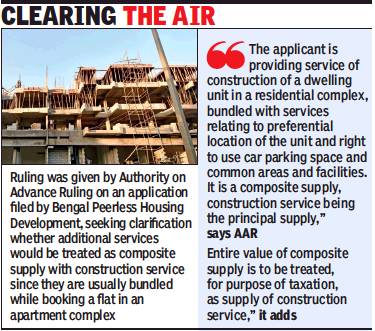

Builder can’t charge higher GST for location, parking

May 4, 2019: The Times of India

From: May 4, 2019: The Times of India

Builder can’t charge higher GST for location, parking

Ruling To Ensure Tax Parity With Construction Services

New Delhi:

There may be further GST (goods and services tax) relief for home buyers with the Authority on Advance Ruling (AAR) in West Bengal concluding that services such as preferential location and facilities like car parking in apartments should be treated as “composite construction service” and attract the same levy as construction. After the ruling, builders will now have to charge 5% GST on services bundled with affordable homes and 8% on others. Several builders, including some of the top players, were charging 18% GST on these services, while the government had lowered the rate for under construction apartments. The government allows onethird abatement or rebate on the value of land, that results in the actual levy coming to 8% for non-affordable category residential units when the GST rate is 12%.

“Taxability of ancillary charges recovered by builders like preferential location charges (PLC), parking charges, transfer fees, external development charges, internal development charges (IDC), document charges etc has been a matter of dispute even under the erstwhile service tax regime. With this ruling, it is likely that diverse practices adopted by builders on taxability of PLC and parking charges end, and such services henceforth are made liable to tax at the lower rate as applicable to construction services.” said Harpreet Singh, partner at consulting firm KPMG.

“The real estate sector was in a conundrum on the taxability of preferential charges, right to use car parking, etc; the essential reason being as to whether some of these qualified as under construction service on which the lower GST rate of 12% or 5% would be available or they would be taxed at 18%. In this ruling, the West Bengal AAR has upheld that the lower rate would be available as it qualifies as a composite supply, with construction service being the principal supply,” added Abhishek Jain, a partner at EY.

Buyer can’t be forced to accept delayed flat’

AmitAnand Choudhary, August 4, 2019: The Times of India

It is the choice of a homebuyer whether to take possession of his/her flat in a delayed housing project or seek refund of his/her money and a builder cannot refuse to return the amount on the ground that the flat is ready, the National Consumer Disputes Redressal Commission has ruled.

A bench of Justice V K Jain directed a Delhi-based builder, Pioneer Urban Land and Infrastructure, to refund an amount of Rs 4.43 crore to a homebuyer who had invested the money in 2012 for a flat in Gurgaon. The flat was to be delivered in 2015 but the builder failed to fulfil its promise and the homebuyer approached NCDRC in 2018 for refund of the amount.

Although the builder had constructed the flat and got an occupation certificate from the authority concerned just a fortnight before the homebuyer filed the complaint, the commission directed the builder to refund the money as there was a delay of more than two years.

REALTY BITE

Builder ordered to refund flat money with interest

Referring to the judgments of the Supreme Court, the commission said that the builder had to refund the money as it failed to fulfil its contractual obligation of obtaining the occupancy certificate and offering possession to the buyer within the time stipulated in the agreement or within a reasonable time thereafter. It said the flat purchaser could not be compelled to take possession of the flat as it was offered more than two years after the grace period under the agreement expired.

“More than two years and four months from the stipulated date had already expired by the time the occupancy certificate was obtained. Therefore, in this case as well the complainants were justified in terminating the agreement by instituting the consumer complaint... the complainants are justified in insisting upon refund of the amount paid by them to the opposite party,” Justice Jain said.

The builder contended that the buyer had no justification for refusing to take possession and insisting on a refund, and alleged that the buyer had booked the flat for a “speculative purpose”. The commission, however, refused to give credence to its allegation as no evidence was placed before it to prove that the flat was not booked for residential purpose. It accepted with the contention of the homebuyer’s advocate Adity Parolia, who submitted that in case of unreasonable delay, the choice will be with the buyer whether to take a belated possession or to seek refund with appropriate compensation.

The commission directed the builder to refund the amount with a simple interest at the rate of 10.65% per annum.

House delayed, buyer can’t be forced to take possession: SC

Dipak Dash, August 5, 2019: The Times of India

A builder cannot “impose” upon a buyer to take possession of a ready house if it is delayed, and the customer is justified in seeking a refund, the Supreme Court has ordered.

Upholding an order of the National Consumer Disputes Redressal Commission to a Pune-based builder, an SC bench comprising Justices U U Lalit and Vineet Saran said, “Even assuming that the villa is now ready for occupation (as asserted by the appellants), the delay of almost five years is a crucial factor and the bargain cannot now be imposed upon the respondents. The respondents were, therefore, justified in seeking refund of the amounts that they had deposited with reasonable interest on said deposited amount. The findings rendered by the commission cannot, therefore, be said to be incorrect or unreasonable on any count.”

TOI had reported another case on Sunday where the NCDRC had said that a homebuyer had full freedom on whether to take possession of his/her flat in a delayed housing project or seek refund and a builder could not refuse to return the amount on the ground that the flat was ready. This order was passed in a case involving a project in Gurgaon.

The SC order came on Tuesday with regard to a project in Pune, Marvel Selva Ridge Estate. The developer, Marvel Omega Builders, had sold a villa to one Shrihari Gokhale in July 2012 and the builder had promised to hand over the villa by December 31, 2014. Gokhale had filed a complaint with the NCDRC in 2016 seeking a refund of Rs 13.24 crore.

The builder had challenged the NCDRC order in the SC to refund Rs 8.14 crore principal amount with 10% annual interest to Gokhale. When the matter came up for hearing, the builder’s counsel said the villa was ready and the completion certificate would be obtained within 21 days. Observing that there was total failure on the builder’s part and deficiency in rendering services, the SC directed the builder not to sell the villa that Gokhale had booked nor create any third party rights till the order was executed. It also said the villa shall be under attachment till the order was fully complied with.

Agreement is valid till full refund paid

Mumbai:

The national consumer commission has ruled that even if a flat buyer had initially sought refund due to delayed possession, in case the entire amount is not returned with reasonable interest and within time, the builder cannot say the agreement stands cancelled and avoid handing over the flat, reports Rebecca Samervel.

Upholding a state forum’s order, the national forum ordered a city builder to hand over a flat in Malad to a woman who had booked it almost 20 years ago. “We specifically note that in 2003, the complainant (Anita Lewis) had requested for refund of the entire amount paid by her, but the party (Square One Enterprises) did not refund it with or without interest, within reasonable time.” ‘Flat buyer can’t be made to wait indefinitely’

It refuted the builder’s contention that the agreement had no mention of date of delivery of possession. Observing that a flat buyer cannot be made to wait for an indefinite period, the national consumer commission said, “We find that the said contention of the opposite party cannot go in its favour as it was its duty to mention the date of delivery of possession in the agreement, and the failure to do so necessarily requires to be read against it.”

When the builder did not hand over possession even two years after Lewis paid Rs 16 lakh in 2001, she sought a refund. She said that the letter was ignored. The total cost of the flat was Rs 21 lakh and it was understood that she would get possession by December 2002. Lewis further submitted that in October 2006, about 3 years and 5 months after she had sent the refund letter, she received a letter from the builder stating that since she had cancelled the agreement and paid only Rs 11 lakh, she could collect it with interest. The builder did not acknowledge Rs 4.5 lakh she had paid in cash. Lewis refused to take the money and in 2007, she learned that the builder was attempting to dispose of the flat through a broker. She moved the state commission that year.

In 2015, the state commission directed the builder to hand over possession after receiving the remaining payment of Rs 5.5 lakh. Lewis was also awarded a compensation of Rs 1.25 lakh towards mental agony and costs. Aggrieved, the builder moved the National Consumer Disputes Redressal Commission in 2015. “It is also pertinent that even after filing of the consumer complaint, the opposite party initiated legal proceedings in the civil court with respect to the agreement, which was dismissed. Clearly, this conduct has a bad air,” the national commission said.

Rules, state-wise

Delhi: Builders to face separate trials in cases filed by buyers

Abhinav Garg, July 11, 2019: The Times of India

Builders who dupe thousands of homebuyers, or those accused of Ponzi schemes to defraud investors will now face multiple prosecutions in Delhi — based on complaints of individual victims — and can be awarded long and consecutive prison terms.

The Delhi HC ended the current practice of Delhi Police (mostly EOW and crime branch) of lodging a single FIR in cases of cheating of a large number of investors/ depositors where, for instance, a lone homebuyer is treated as the complainant while the others are shown as witnesses in a criminal case.

In such cases, many are left in the lurch if the sole complainant withdraws the case or reaches a settlement with the builder/accused.

A bench of Justices Vipin Sanghi and I S Mehta termed as “erroneous and not sustainable in law” the practice “of registering a single FIR on the basis of the complaint of one of the complainants/victims, and of treating the other complainants merely as witnesses.”

HC makes punishment for errant builders rigorous

Trial Courts Can Now Give Consecutive Prison Terms The court said it “raises very serious issues with regard to deprivation of rights of such complainants to pursue their complaints, and to ensure that the culprits are brought to justice”.

Spelling out the law in this regard, HC was categorical that in a case of inducement, allurement and cheating of a large number of investors/ depositors, “each deposit by an investor constitutes a separate and individual transaction” and noted that “all such transactions cannot be amalgamated and clubbed into a single FIR by showing one investor as the complainant, and others as witnesses.”

“In respect of each such transaction, it is imperative for the state to register a separate FIR if the complainant discloses commission of a cognisable offence,” the court observed.

The court rejected the police’s stand that only a single FIR is required in cases where all investors/depositors were cheated in pursuance of a single conspiracy. The EOW argued that commission of multiple acts did not require the registration of separate FIRs for each victim.

In its ruling, the court highlighted how such a procedure denies other victims the right to “oppose, or to seek cancellation of bail that the accused may seek in relation to their particular transaction.”

The high court’s answer came on a reference sent to it by additional district and sessions judge Kamini Lau while dealing with a case involving 1,852 different victims cheated in a ponzi scheme.

In the process, the high court also made it clear that police or any investigating agency probing such an economic offence “cannot amalgamate the separate offences investigated under separate FIRs, into one chargesheet”, as is the current practice.

The high court also held that a limit on the quantum of sentence imposed by the CrPC (where courts award concurrent jail terms in a single trial for more than one IPC section) won’t apply in these cases, where an economic offender faces multiple trials that result in more than one conviction. This means trial courts can now give consecutive prison terms where the second term starts only once the first sentence ends, making the punishment much more rigorous.

See also

Homebuyers and the law: India