Real Estate (Regulation & Development) Act (RERA)

This is a collection of articles archived for the excellence of their content. |

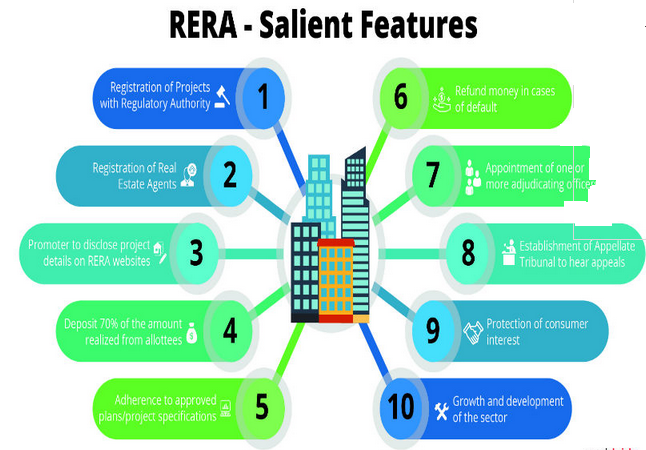

The evolution of the Real Estate (Regulation & Development) Act

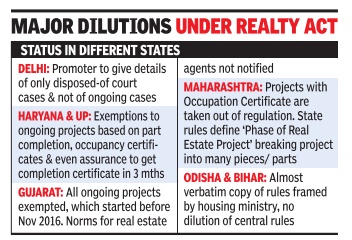

2016: Some states dilute provisions, give builders exemptions

Dipak Dash, UP, Gujarat dilute new realty law, Nov 04 2016 : The Times of India

Make It Builder-Friendly By Giving Exemptions To Ongoing Projects

States led by UP and Gujarat have begun diluting provisions of the Real Estate (Regulation & Development) Act, which notify the rules for regulation of the sector. Both states have let off most ongoing real estate projects which have been delayed for long and remain a worry for thousands of home buyers awaiting delivery .

While UP has come up with four exemptions to exclude incomplete projects from the category of “ongoing projects“, Gujarat has exempted all projects launched before notification of the rules. This means such projects won't have to be registered with the real estate regulator in these states.

On the contrary , the law enacted by the Centre earlier this year provides for manda tory registration of all “ongoing projects“ that have not received completion certificate. “The central law, which is binding on all states, does not differentiate between ongoing and future projects for registration. However, it provides for registration of incomplete projects within three months from the commencement of the Act,“ said an official here.

The norms notified by UP excluded projects in which services had been handed over to the local authority for maintenance, common areas and facilities that had been handed over to RWAs for maintenance and where development work had been completed and sale and lease deeds of 60% houses execu ted. “This dilutes norms laid down in the law and will help builders avoid the mandatory regulatory provisions,“ the central government official said.

Defending their move, a Gujarat government official said, “We have notified the rules primarily for setting up the regulator ahead of the October 31 deadline. Once the operative part of the law comes into effect, we may revisit the norms“.

But central government sources said states must notify specific rules in compliance with the law and it wouldn't take not more than a couple of days to make all provisions operative.

On its part, the Uttar Pradesh government has also provided a handle for developers to retain some land in their projects under the guise of commercial activity rather than hand over such land to house owners.

While the central law clearly says that all community and commercial facilities in a project will be treated as common areas, rules notified by UP says, “Community and commercial facilities shall include only those facilities, which have been provided as common areas.“

2017: States dilute rules

Dipak Dash, States & UTs dilute RERA to favour realtors, May 1, 2017: The Times of India

The Union housing ministry may claim that implementation of the real estate regulation law, popularly called RERA, will usher in a new era for home buyers, but the rules put forward by states have diluted many provisions, keeping most of the ongoing projects outside the ambit of the law that would come into effect.

States such as Odisha and Bihar have notified rules that are completely in sync with the one notified by the Union housing and poverty alleviation ministry . But in contrast, Haryana's draft rules, notified last week, have completely left out disclosures by builders on the sanctioned plan, layout and specifications at the time of booking with all subsequent changes till date.“This omission will give legal colour to all unilateral changes done by builders and will give them an escape route to avoid paying compensation to home buyers,“ said Abhay Upadhyay , president of Fight for RERA, the nationwide home buyers' body which campaigned for the law.

Similarly , in Maharashtra, a provision has been included to allow builders to ta ke out or divest from a project after occupancy certificate has been issued. This means, the builder can pull out its entire investment before completion of common areas, facilities and amenities.

In UP, the norms related to compounding of offences have been diluted as no specific amount has been mentioned. “There is provision for `up to' (a certain amount), which means it may even be zero. This will encourage corruption as quantum of money to be paid will be at the discretion of the authority,“ Upadhyay said.

Even the urban development ministry has allowed relaxation in Delhi, where rules specify that promoters need to provide details of only those court cases which have been disposed of during the last five years. This is despite the housing ministry clearly stating that builders need to provide details of all pending cases.

Till Saturday , 13 states and Union territories had notified their final rules. “With many states intentionally keeping most of the ongoing projects out of RERA's coverage, there will be little relief for lakhs of home buyers,“ Upadhyay said.

2018: 3 states do not roll out Rera, others dilute it

From: Prabhakar Sinha, 3 states yet to roll out Rera, others have diluted versions, August 17, 2018: The Times of India

West Bengal, Kerala and Assam are yet to implement the pro-consumer Real Estate regulation and Development Act (Rera) while states which have done so have rolled out watered down versions. What more, the proportion of unregistered projects are also very high.

In Maharshtra, Madhya Pradesh and Karnataka, where Rera is fully operational and are considered model states in term of Rera implementation, hundreds of under-implementation projects are not registered, piling hardship on thousands of homebuyers. States such as Haryana, Uttar Pradesh, Telangana, and Tamil Nadu among others where implementation of Rera is not up to the mark, the proportion of unregistered projects are very high.

Most of these unregistered projects are defaulters in term of delay in completing the project or not fulfilling all the obligations listed in the sales agreement with buyers, said a member of Rera authority, who wished to stay anonymous. These developers are trying to sidestep the act and the authority by not registering the project with authority. “It can be said that Rera has not been deployed in letter and spirit as was originally intended by the Centre,’’ said Anuj Puri, Chairman of property consulting firm ANAROCK.

A senior Rera official said the authority has the power to issue notices to s defaulter developers and can send notice to them suo-moto to get their projects registered. But most of the authorities are pro-active.

In Karnataka, the second most active state in implementing Rera, the authority has sent notices to 100-130 projects in Bengaluru for not registering under Rera in 2017 while 953 project applications are still under investigation, according to a report. In total, in Karnataka 2,982 projects are registered with Rera.

Delay in project execution because of dilution of Rera, and the signal such dilutions send to the market, will act as a dampener on buyers’ confidence. This will affect developers’ ability to sell, Puri said.

Rajiv Sabharwal MD and CEO of Tata Capital said the quality of implementation of Rera would depend on the caliber of people who would head the authority in its initial years of implementation.

RERA compliance: a checklist

“India Today”

The Real Estate (Regulation and Development) Act, 2016 (RERA) came into force on May 1, 2017 in the entire country. Since then there has been confusion and buyers find it difficult to make a decision. Many buyers are baffled on how to ascertain if their projects are RERA-compliant or not.

One such buyer Baladhitya wonders, "Will RERA bring any hope for home buyers? I am looking for properties for my own use, should I wait for some more time?"

On May 1, 2017 Maharashtra notified the Act. The state launched its website and uploaded all relevant details as per the state's RERA rules. The law mandates that once a project is registered, the developer will have to upload project details on the RERA website and provide updates on construction progress, commencement, occupation and other certificates before the flats are handed over to buyers.

"The situation is one where the positive aspects are apparent, and yet, there is an element of 'wait and watch' on the part of both home seekers as well as developers. RERA is a reality and has to be accepted. For stakeholders in real estate, the post-RERA necessary changes are being implemented. These are early days and we should see things firming up in the next few weeks," says Dr Niranjan Hiranandani, co-founder & chairman, Hiranandani Group.

If you are a confused buyer and want to know whether your project is RERA compliant or not then you can check the following before you park your hard-earned money.

Legal Title

You need to check that your developer has the legal title of the land on which the development is proposed, or has legally valid documents with authentication of the title if such a land is owned by another person. RERA has done away with the age-old practice where someone without having a legal title would sell to home buyers. Now buyers have to be cautious and see whether the project they are buying is RERA-compliant or not.

Detail of encumbrances

Is the land free from all encumbrances? Check the details of the encumbrances on such a land, including any rights, title, interest or name of any party in or over such land along with details.

Possession Date

RERA mandates that all projects have to be delivered as per the possession date mentioned by the developer. So, don't forget to check the time period within which he promises to complete the project or its phase. With RERA becoming a reality, it is important for developers to prepare for the changes promptly. "We believe that improved project planning will help developers avoid delays and manage project funds efficiently. It would be prudent to hire planning professionals to ensure timely project completion. Making such preparations early should give developers an edge over rivals and boost buyer's trust," said Surabhi Arora, Senior Associate Director, Research, Colliers International India.

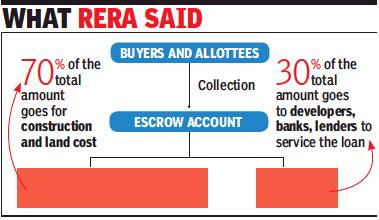

Escrow Account

Seventy per cent of the amounts realised for real estate projects from allottees, from time to time, shall be deposited in a separate account. This account has to be maintained in a scheduled bank to cover the cost of construction and other costs related to construction. This means that the developer has to use the money for the same project for which the funds have been collected. If your developer has deposited the money it means he is willing to complete and deliver the project on time.

Applicability of RERA

Rera is applicable to ongoing projects: HC

Builders Can Get More Time In Rare Cases

In a victory for home buyers, the Bombay high court has upheld the constitutional validity of the Real Estate (Regulation and Development) Act (Rera) and its applicability to ongoing projects across states. The law intends to make homebuying a transparent and speedy transaction with powers of redressal.

The judgment, however, offered a breather to builders too. It expanded powers under Rera to grant more time in exceptional cases to a builder to complete a project. The additional time is meant to be granted in compelling circumstances on a case-by-case basis.

A division bench of Justices Naresh Patil and R G Ketkar gave separate but concurrent findings. The extension would go beyond the statutory one-year extension after the deadline for completion, which the Act requires the project’s promoter to mention during registration.

The pronouncement is the first such verdict in the country on challenges raised by builders in various HCs. The Supreme Court had tasked the Bombay HC in September to set the path.

‘Haryana projects before Rera too come under it’

Ajay Sura, September 9, 2018: The Times of India

The Haryana Real Estate Regulatory Authority (HRera) has held that it has the power to adjudicate on projects that were ongoing before the Rera Act came into force and were, therefore, not registered with the regulatory authority.

The verdict will have wide ramifications on the real estate sector in Haryana as it will bring into Rera’s ambit even those projects where the builder had applied for an ‘occupation certificate’ before HRera rules were framed.

HRera’s Panchkula bench has ruled that a builder can’t escape its jurisdiction even if the completion certificate was issued before the rules were framed.

The bench, headed by chairman Rajan Gupta, passed these orders last week while hearing a bunch of petitions filed by Madhu Sarin and 23 others against the BPTP project in Faridabad.

H-Rera purview extends even to occupancy certs before Act: HC

Ajay Sura, May 4, 2022: The Times of India

Chandigarh:In a significant order having ramifications in the realty sector, the Punjab and Haryana high court has made it clear that merely obtaining of an occupancy certificate by builders pertaining to a housing project before the commencement of Rera Act, will not render them to be outside the purview of the jurisdiction of the state real estate regulatory authority (Rera).

The HC division bench passed these orders while hearing a petition filed by Experion Developers Private Limited.

The petitioner company had sought directions for setting aside the proceedings pending before the Haryana Real Estate Regulatory Authority (H-Rera), Gurugram. Further directions were also sought to restrain HRera from acting in contravention of the provisions of the Real Estate (Regulation and Development) Act, 2016.

The main contention of the petitioner was regarding the jurisdiction of the authority to pass the orders, with the contention being that the petitioner having received an occupancy certificate in respect of at least that part of the project on March 2, 2017, and the Rera Act having come into effect only from May 1, 2017, the project has to be treated to be a completed one and there was no requirement for even registration of the project with the authority in terms of the Rera Act.

Arbitration panels under RERA

2017: Maharashtra first to form conciliation committee

Nauzer Bharucha, Maha first state to form RERA arbitration panel, Sep 18, 2017: The Times of India

Maharashtra will be the first state in the country to form a conciliation committee under the new Real Estate (Regulation and Development) Act, comprising a panel representing builders and consumer groups to arbitrate complaints.

It will mediate between the two parties and help resolve issues so they can avoid taking the dispute before the housing regulator.Only in case the dispute is not settled can the party lodge a complaint with the state regulator.

“The panel should start functioning in the next three months,“ said state RERA chairman Gautam Chatterjee, adding that it would help build trust between purchasers and developers. Last week, leading developers and consumer activists met state RERA officials to iron out the committee's operations. “Talks have progressed very well,“ said consumer activist Shirish Deshpande of Mumbai Grahak Panchayat (MGP). “MGP is presently in consultation with organisations representing developers like Naredco and Credai-MCHI to work out the conciliation scheme on which an enabling provision exists in the RERA Act,“ he said.

Deshpande said the proposed scheme will be an Alternate Disputes Redressal mechanism to facilitate “settlements between aggrieved homebuyers and builders without having to resort to... litigation“. Officials said the conciliation can only be initiated when both the complainant and builder willingly agree to it.

Developer Rajan Bandelkar, vice-president of Nared kar, vice-president of Naredco, said majority of the disputes are minor and can be resolved through mediation.

The draft scheme envisages two panels of conciliators one will be of builders in which a total of ten persons will be nominated by Naredco, Credai-MCHI.On the other panel, MGP will nominate 10 members.

“Since it will be a mutual settlement and will be authenticated by MahaRERA, it will have sanctity , authenticity and finality,“ said Deshpande.Experts said this will reduce the pressure on MahaRERA as well as consumer courts.Officials said most of the over 13,300 projects registered in the state are ongoing ones and only 450 are new projects.

Challenging orders of Rera authorities

SC: First deposit full compensation or at least 30% of penalty

Dipak Dash, Nov 15, 2021: The Times of India

In what could be a relief for homebuyers and deter builders from the usual practice of resorting to long legal recourse by challenging orders of Rera authorities, the Supreme Court in a recent judgment has upheld a provision in the real estate law, which makes it mandatory for builders to deposit full compensation and interest ordered by the regulator or at least 30% of the penalty as a pre-condition for challenging any such order before the appellate authority. The court has also upheld the provision that the appellate authority has the freedom to increase the mandatory deposit beyond 30%.

While the penalty imposed by the Rera authorities goes to the Consolidated Fund of India or the state account, the refund is the entitlement of the customer. Homebuyers’ organisations said this judgment by a three-member bench, led by Justice U U Lalit on Thursday, will put an end to harassment of customers as builders found it a better option to challenge the Rera orders than paying the refund amount to the buyers.

The SC held that the condition of pre-deposit imposed on promoters for filing appeals under Section 43(5) of the Real Estate (Regulation and Development) Act is neither discriminatory nor a violation of constitutional provision. The court observed: “The intention of the legislature appears to be to ensure that the rights of the decree holder (the successful party) is to be protected and only genuine bona fide appeals are to be entertained…the intention of the instant legislation appears to be that the promoters ought to show their bona fides by depositing the amount so contemplated.”

Abhay Upadhyay, president of PFCE, an umbrella body of homebuyers, said, “This is a landmark judgment. We can now hope that this plugs all the loopholes and the builders must deposit the full refund ordered by the Rera authorities before going for any appeal. This will also filter the appeals which were intended only to harass homebuyers.” The pre-deposit provision was made to ensure that the money which has been computed by the authority must be safeguarded so that consumers don’t have to run from pillar to post to get their due, if the appellate authority passes order in favour of the buyer.

The SC also upheld the retroactive application of Rera to the real estate projects which were ongoing at the commencement of the Act. Earlier, the Bombay HC had passed a similar order when different builders had challenged the applicability of the law to projects which had already started by the time the law was notified.

Judgements/ orders of RERA benches, courts

‘Don’t use 70% of buyers’ funds to repay loans’/ 2019

From: Prabhakar Sinha & Rao Jaswant Singh, ‘Don’t use 70% of buyers’ funds to repay loans’, April 25, 2019: The Times of India

Gurgaon/Noida:

Developers should not repay loans taken from banks and financial institutions by using 70% of the total amount collected from buyers and allottees of a project, ordered Haryana Real Estate Regulatory Authority (HRera) and UP Real Estate Regulatory Authority (UPRera). This amount is meant to complete construction of the project and meet the land cost, the regulatory authorities said. In a case in Gurgaon, the local bench of HRera has directed the police commissioner to register a criminal case against Indiabulls Housing Finance Limited, Industrial Finance Corporation of India Limited and PNB Housing Finance Limited for using money from the 70% of the amount collected from buyers and allottees, which it said should be used to complete construction of the project as per the Rera Act.

HRera chief KK Khandelwal said it is probably the first-of-its-kind decision since the regulatory authority is constituted, in which it has asked the police to initiate action against the financers of the realty project.

The authority has taken a serious note of the fact that lending institutions “fraudulently and arbitrarily withdrew 100% of the receivable deposited in the Rera account in violation of Section 4(2)(l)(D) of Rera, 2016”.

According to the Rera provision, “70% of the amounts realised for the realty project from the allottees, from time to time, shall be deposited in a separate account to be maintained in a bank to cover the cost of construction and the land cost, and shall be used only for that purpose.”

The builder can use only 30% of the amount collected from allottees for other purposes, including creating charge in favour of lending institutions to repay loans.

In the normal course, lending banks and institutions get repayment of their loans from the escrow accounts opened by developers where all the receivables get deposited.

If the collection from allottees in a particular month is less than the installment supposed to be paid to lending banks and institutions, the entire amount in the escrow account goes to lenders. But this leaves the project high and dry owing to cash crunch, and the construction could be stalled.

Khandelwal said before making a provision for any purpose, 70% of the money collected from allottees must go to another escrow account, which should be called Rera account, to be maintained for the purpose of construction of the project and meet the land cost under the supervision of Rera.

Khandelwal said the developer “cannot create lien on the project” to raise money for a purpose other than completing construction of a project.

He also said the provision in law is to address the mischief, earlier being committed by unscrupulous builders to divert amount realised from the allottees to other projects or for different purposes other than the project, for which amount has been deposited by the allottees.

UP Rera in a letter to various banks said, “It is obligatory both for the promoter and the bank to ensure strict compliance of the above stated provisions of the Rera Act.”

UP Rera also pointed out that some of the banks, especially those which have sanctioned loan to promoters, arbitrarily adjust the entire amount deposited in the account against the outstanding loan of the promoter, instead of transferring 70% of the money collected to the escrow account for the purpose of construction and payment of land cost.’’ He also said HRera has issued strict directions to these financiers to deposit back the excess amount withdrawn by them in violation of the statutory provision of Rera, 2016. Also, a show cause notice has been issued to the developer, asking it why penal proceedings should not be initiated against it for violating the provisions of the Act and in particular section 4(2)(l)(D).

Possession date is binding on builder

Swati Deshpande, January 18, 2021: The Times of India

‘Possession’ of flat doesn’t mean ‘fit out possession’ under Real Estate (Regulation and Development) Act (RERA). Ruling on the sanctity of the ‘specified date’ of possession, Maharashtra Real Estate Appellate Tribunal directed a builder to refund with interest money paid by two buyers who withdrew from a project three months after delivery of their flats was due.

The tribunal held that the promoters of Palava Lakeside in Kalyan failed to hand over possession of two flats by February 28, 2018, as mentioned in the agreements for sale (AFS) and thus allottees were entitled to withdraw and get refund with interest. “Section 18 of RERA is absolute on the point of ‘specified date’ mentioned in the agreement for giving possession” and not on any “grace period” mentioned in the agreement, said the tribunal in its judgment. It added that permitting possession beyond the specified date “would lead to disastrous consequences rendering the agreed date of possession as specified in the AFS irrelevant”.

Two buyers had filed a complaint initially before MahaRERA. Their 2014 agreement promised possession for fit-outs by February 2017 and within a year the final possession with occupancy certificate (OC) but with a grace period of a year. Since the project was incomplete when the Real Estate (Regulation and Development) Act took effect on May1, 2017, the promoters registered the project under RERA. In May 2018, with no possession given, the buyers decided to withdraw and demanded refund with interest and compensation.

The tribunal noted that the builder offered possession with OC to the buyers, on June 21, 2018, hence there was a “delay in handing over possession”. The tribunal directed refund of amounts paid by the buyers with interest of 2% more than the SBI rate, as provided under RERA.

Judgments, judicial

Forfeiture clause

It exploits home buyers/ MahaRera 2020

Forfeiture clause exploits home buyers: MahaRera, August 20, 2020: The Times of India

Mumbai:

The Maharashtra Real Estate Regulatory Authority (MahaRera), Mumbai, has struck down a forfeiture clause in the sale agreements of two flats at The Trees, a Godrej Properties’ housing project in Vikhroli, observing that the clause is “most unjust and exploits flat purchasers”, reports Rosy Sequeira. It said the clause “to forfeit 20% of the amount of total consideration plus interest on delayed payment is one-sided. Therefore, it is unreasonable and unfair”.

Lability of promoters

Co- promoter also liable

Swati Deshpande, March 5, 2024: The Times of India

Mumbai: Bombay HC has held that the term ‘promoter’ covers a co-promoter even if he hasn’t got money from flat buyers and is jointly liable under Real Estate (Regulatory and Development) Act (Rera) to refund the amount, with interest, for delays.

It said under the 2016 Act, which came into effect in 2017, ‘promoter’ has “been so widely defined that it virtually includes every person associated with construction of the building”, and it is not necessary that there has to be an agreement between every promoter and a flat buyer. “Even a person who is merely an investor (along with promoter) in the project” and benefits from it falls within the ambit of ‘promoter’, it said while hearing an appeal by Wadhwa Group Housing Pvt Ltd against an Oct 2022 order of Rera appellate tribunal that had fastened it with the refund liability.

HC’s Feb 26 order has stirred real estate industry, said lawyers, as it answers a substantial question of law that many were tracking. It has ramifications for many redevelopment projects in the city, said legal experts.

Justice S V Marne focused on a legal issue — whether a promoter who has not received any payment from an allottee can be made liable for giving refund with interest under Section 18 of Rera.

Wadhwa Group Housing had challenged joint liability on it as a co-promoter for having joined in as co-developer in an SRA project in Andheri. In 2012, the two builders, in a joint development agreement, split among themselves the constructed area to be sold.

A flat buyer, Vijay Choksi, had complained to MahaRera and sought refund of Rs 1.2 crore part payment he made to co-developer, SSS Escatics, which failed to meet project deadline of 2019, said the appeal before HC.

Wadhwa Group Housing, through counsel Naushad Engineer, said the amount was paid by Choksi to Escatics, which alone can be directed to refund it with interest. Engineer argued that for monies received in a pre-Rera situation sans contract between a builder and a buyer, it will not stand to reason that the builder should be made liable post Rera. HC, which also heard Choksi’s counsel Ashish Kamat, held that “account in which monies are received by promoters is irrelevant for purpose of determining joint liability”.

Maintenance charge

Leviable only after occupancy certificate

AmitAnand Choudhary, January 31, 2022: The Times of India

New Delhi: In a relief to homebuyers who are forced to take possession and start living in their flats without occupancy certificate (OC) because of delay on the part of builders to get all clearances from the authority, the National Consumer Disputes Redressal Commission held that builders cannot demand maintenance charge from the buyers without OC. The apex consumer forum held that homebuyers will be liable to pay maintenance charge for their flats only after the builder gets Occupancy Certificate from the civic authority and it is not proper for builders to demand it even though the flat buyers start residing in their flats after taking over the possession. It said if the builder fails to get OC then it means that the project is not yet fully complete and it would be considered only as “paper possession” if the flat is handed over to the buyers.

The NCDRC allowed a plea of a batch of 15 homebuyers from Benguluru led by Harinder Singh who were compelled by a builder to pay maintenance charges after taking possession of their flats without OC. Their lawyer Chandrachur Bhattacharya contended before a bench of S M Kanitkar and Binoy Kumar that the buyers were forced to pay two year maintenance in advance while taking possession of the flats for which the builder failed to get OC despite a delay of six years.

Opposing homebuyers’ plea, the builder VDB Whitefield Development Private Ltd contended that maintenance charge was being charged as it was providing all facilities to those who have shifted to their flats. It said that delay in the project was caused because of Covid-19 pandemic and it was the buyers who had forced it to give them physical possession of their units without OC. The NCDRC, however, was not convinced with the submission of the builders and allowed the plea of homebuyers by relying upon a recent judgment delivered by the Supreme Court in January and an earlier verdict of the Commission.

“Regarding the issue of maintenance charges, it is a fact that the complainants have taken physical possession of their respective units. It would be logical that there would be an expense on the maintenance of certain common services. It is also a fact that the Occupancy Certificate has not been obtained yet. It means that the project is not yet fully complete and that not all services promised are being provided. No maintenance charge should be levied before obtaining the occupancy certificate,” it said.

Provisions/ benefits of RERA

Real Estate Regulation Law: 10% interest rate for delayed housing projects

Prabhakar Sinha, RERA pushes for 10% interest clause, May 5, 2017: The Times of India

No Registration Of Project Unless Builder Agrees To Pay Penalty At This Rate

Buyers of delayed housing projects will get interest on the invested amount for the delay period at the Real Estate Regulatory Authority's (RERA) prescribed rate as against Rs 5 per sq feet to Rs 10 per sq feet contracted in the sales agreement, said chairman of Madhya Pradesh RERA Anthony de Sa.RERA's prescribed rate comes out to be 10% at present.

Meanwhile, developers have not been barred from advertising and marketing existing projects, said regulators and officials of MP, Punjab, Haryana and Delhi. Dispelling builders' doubts, officials said they need to apply for registration for ongoing projects only by July 31.

Additional chief secretary of housing urban development, Punjab, Vini Mahajan, who has also been appointed as the interim regulatory authority under RERA, while addressing a conference organised by FICCI, clarified that the existing projects need not wait for registration to advertise. They can continue all their activities as usual. However, those projects for which application for registration is not made even by July 31 to the regulatory authority cannot market their projects. “So far, 14 states and UTs have implemented this law. There are 14 more states which are in process of notifying the rules. We hope that they will do it soon,“ said joint secretary of housing ministry Rajiv Ranjan Mishra at the FICCI conference.

Anthony de Sa said that delayed ongoing housing projects will be registered with RERA only if the deve loper is ready to pay the buyer interest at the authority's prescribed rate, which is 2 percentage points above SBI's MCLR (marginal cost of fund based lending rate), and not the contractual rates of Rs 5 per sq ft to Rs 10 per sq ft which builders had accepted to pay when the sales agreement was signed.

At present, as SBI's MCLR is 8%, developers will have to pay 10% interest on the paid amount to the buyers. At the same time, buyers will also pay the same interest at 10% on delayed pay ment of their dues and not the penal rates of 12% to 18% as mentioned in the sales agreement.

Member of RERA Haryana committee and chief town planner of Haryana government Dilbag Singh Sihag, who is entrusted with the responsibility of finalising the RERA Rules for the state, said justice demands for the same interest rate to be paid by developers as they are charging buyers on delayed payment on outstanding dues.

Normally , developers charge a high rate of 12% to 18% while they pay only Rs 5 per sq feet to Rs 10 per sq feet on a project which costs Rs 4,000 to Rs 5,000 per sq feet. Sihag said this mismatch can be resolved by asking both parties to pay the RERA prescribed rates. He, however, added that no final view has been taken so far.

Mahajan said that existing buyers will get respite under RERA, clarifying that the authority is bound by the act and rules while taking the decision.

So, it can only enforce the contract signed between buyers and developers in light of RERA rules, which cannot go beyond the act.

Developers of delayed ongoing projects will get one more chance to regularize them. Regulators said that while registering ongoing projects, developers can set their own deadline to complete them. The deadline, however, should be reasonable. Anthony de Sa said that if a project was launched eight years back and the developer returns for registration seeking another four years for completion, it cannot be granted. There is no hard or fast rule to fix the deadline, which will depend on the existing condition and stage of implementation of the project.

But once the developer has given the deadline to complete the project and is unable to meet it, the regulator will take a very harsh view -he will either have to return the money to the buyers with interest or face consequences, including even a jail term, said Sihag.

RERA will help facilitate completion of projects so that all buyers can be satisfied. Only if developers are unable to achieve this goal will the regulators take stern action.

No RERA relief in disputes with builders over redevelopment

Nauzer Bharucha, No Rera relief in redevelopment rows, January 17, 2018: The Times of India

Housing society members who have a dispute with their builder over redevelopment cannot seek relief under the Real Estate (Regulation and Development) Act (Rera). Last month, Maharashtra Rera dismissed a complaint filed by members of a housing society against a builder for failing to hand over their new flats for 11 years. They also accused the society’s managing committee of granting permission to the builder to add five floors without their approval.

In a December 2017 order, MahaRera chief Gautam Chatterjee said the authority was not the proper forum to resolve the society’s issues with the builder. The order has wide implications because over 85% of all construction in Mumbai involves redevelopment. Housing experts warned that thousands stranded for years because their redevelopment projects were stuck could not take recourse under Rera.

“The complainants have not been able to point out any contravention or violation of the provisions of Rera...,” said the order. The case pertains to a complaint filed by members of the Shanti Niketan cooperative housing society in Vikhroli (east) against Matrix Construction. “On May 10, 2007, we assigned our project ‘Shanti Niketan’ for redevelopment. But to date, we haven’t received possession of our flats although the building is ready,” they said. The 13-storey redeveloped building is ready, but the builder wants to add five more floors. The society said it would allow him to do so on the condition that he shared 25% of the profits from the sale of the flats. Another condition was that the builder hand over their new flats by June 2017 and give them a corpus of Rs 9 lakh per member. The developer was also to give them free open parking.

“On fulfilment of these pre-conditions, members agreed to give their NOC to construct five additional floors. However, the society’s managing committee manipulated the minutes and gave NOC to the developer without listing these conditions... ,” said the complaint.

The complainants said they discovered it only when they approached Maharashtra Housing and Area Development Authority, which told them the builder had already procured the NOC without these conditions.

A senior Rera official said a dispute between society members and the society had to be resolved under the Cooperative Society Act while one between a society and the builder was a civil dispute. “In a MahaRera registered project, an aggrieved party will have to point out which provision of Rera Act has been violated,” he said.

Activist Dharam Shettigar, who has brought many housing societies on a common platform, said: “This is a glaring lacunae in Rera. Dubious developers will exploit this loophole...” Added housing activist Chandrashekhar Prabhu: “Any law that does not protect rights of such people would be... useless.”

Last month, Maharashtra Rera dismissed a complaint stemming from a redevelopment bid, filed by members of a housing society in Mumbai against their builder

States’ RERAs

SC: Bengal’s version of Rera is unconstitutional

Dhananjay Mahapatra , May 5, 2021: The Times of India

The Trinamool Congress government’s attempt to run a parallel regime on regulating the real estate sector came unstuck on Tuesday as the Supreme Court quashed the West Bengal Housing Industry Regulation Act (WB-HIRA), 2017, as unconstitutional for copying from a central legislation, Real Estate (Regulation and Development) Act, 2016, and also because many provisions were in conflict with the central law.

Slamming the Bengal government’s attempt, a bench of Justices D Y Chandrachud and M R Shah said, “The state law fits, virtually on all fours, with the footprints of the law enacted by Parliament. This is constitutionally impermissible. What the West Bengal legislature has attempted to achieve is to set up its parallel legislation involving a parallel regime.”

After carrying out a clause-by-clause comparison between the two laws, the bench said not only was the state legislature barred from copying a central legislation to attempt a parallel regime but an additional reason why there was “repugnancy” between WB-HIRA and RERA was that many provisions of the state law were directly in conflict with the central enactment.

Writing the judgment, Justice Chandrachud said, “WB-HIRA has failed to incorporate valuable institutional safeguards and provisions intended to protect the interest of homebuyers. The silence of the state legislature in critical areas indicates that important safeguards which have been enacted by Parliament in the public interest have been omitted in the state enactment.”

YEAR-WISE DEVELOPMENTS

2016-2019: Disposal of cases

Dipak Dash, Nov 4, 2019: The Times of India

From: Dipak Dash, Nov 4, 2019: The Times of India

It’s not just homebuyers who are troubled by builders’ non-compliance with orders passed by Real Estate Regulatory Authorities (Reras), even regulators are concerned at the stubborn attitude of builders. Fed up, the regulators are likely to seek more authority under the law to empower them to attach unsold inventories of builders to make them fall in line and find ways to complete projects.

Real estate regulators from across states have gathered in Lucknow and sources said they would push for amendments in the Real Estate Regulation and Development Act (Rera) to give them more teeth, particularly to execute orders passed by them. They are also likely to flag emerging issues before the government including financing requirement for the sector, which is saddled with stuck projects across the country. “Our ultimate task is to see that stuck projects get completed and hence we have to look at liquidity issues,” said a regulator.

On Sunday, housing secretary Durga Shankar Mishra hinted that the government would consider amendments in the law. “He said government is considering to give more power to regulators so that they can take bold steps,” an official statement by UP Rera said.

A couple of Rera chiefs TOI spoke to said though the law had made an impact across states, there were some challenges to take it ahead. They said some legal issues needed to be resolved for effective functioning of regulators. “This is the first time that there is a concerted effort to identify issues, discuss them and make recommendations to the government. The main focus is how to strengthen the system,” one of them said.

See also

Housing and urban affairs: India

National Capital Region (India): Shelter

Buildings, building construction: India

Real Estate (Regulation & Development) Act (RERA)