Automobile industry: India

This is a collection of articles archived for the excellence of their content. |

Contents |

2008: India 8th automaker in the world

From the archives of The Times of India: 2008 ‘India figures in top 15 automakers’

New Delhi: With a burgeoning auto industry to boast of, India has made it to the top 15 automakers of the world and occupies the fourth position in the leading developing countries' category of motor vehicle manufacturers, a UNIDO report has said.

According to the UNIDO International Yearbook of Industrial Statistics 2008, India ranks 12th in the list of world's top 15 automakers, which is led by Japan followed by the US and Germany. Other countries making it to list are Mexico, France, Korea, UK, Canada, Spain, Iran, Sweden, Brazil, Italy and Indonesia.

In the leading developing countries category, India ranks fourth. The list is topped by Mexico, followed by Korea, Iran. Brazil holds the fifth position followed by Indonesia, Turkey, Argentina, Thailand, Singapore, China, China (Taiwan Province), Malaysia, UAE and Columbia.

India also figures among the world's top 15 producers of chemicals and chemical products, electrical machinery and apparatus, basic metals, coke, refined petroleum products, nuclear fuel, non-metallic mineral products (glass and glass products, cement, lime and plaster, ceramic products), machinery and equipment, leather, leather products and footwear and textiles, the report said.

The country ranks fifth among the top 15 textile producers in the world. China has captured the top slot followed by the US, Italy, Japan, Mexico, Thailand, Indonesia, Pakistan, Germany, Korea, UK, Brazil, Turkey and Bangladesh.

The Yearbook is the 14th issue of UNIDO's annual publication and is based on 2006 data. It follows the International Standard for Industrial Classification that categorizes the automobile sector as manufacture of motor vehicles, bodies (coachwork) for motor vehicles, trailers and semi-trailers and manufacture of parts and accessories of motor vehicles and their engines.

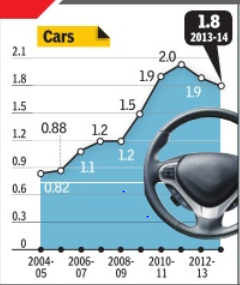

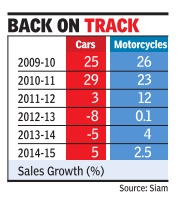

Automobile sales: 2009-15

Apr 11 2015

Pankaj Doval

Car sales up after 2 yrs of decline

After two successive years of decline, car sales registered a 5% growth in the last financial year (2014-15). But the revival may not be sustained in the current financial year due to an adverse impact on the rural economy after unseasonal rains. Car sales fell 5% in 2013-14 and 8% in 2012-13 as high interest rates and growing fuel prices had dampened buyer sentiment.

The car industry has started showing some positive traction after entry of the Narendra Modi government in May last year. Modi's entry , which revived hopes of an economic turnaround, also coincided with a cut in fuel prices and a marginal reduction in interest rates. These positive factors, coupled with a low base year, led to a growth in sales numbers.

But a weak rural economy may play spoilsport. The difficult journey of the rural economy started last year with a deficient monsoon. This year also, unseasonal rains have damaged rabi crops.

The impact of an affected rural economy is already visible on the sales of motorcy cles, which grew only 2.5% in 2014-15, lagging a 25% growth witnessed by scooters. Sales of bikes fell 6% during the last quarter of 2014-15. Analysts said with rural economy playing an increasingly bigger role in the sales of small cars and motorcycles, an adverse demand impact here could hit the overall sales momentum.

“We are already feeling the pressure of a slowdown in the rural economy ,“ Vishnu Mathur, DG of industry body Society of Indian Automobile Manufacturers (Siam), told TOI.“Sales in the rural regions are critical for growth in some of the important categories, especially motorcycles.“

According to some estimates, rural economy accounts for around 30% to total sales of car makers -especially in case of mass-market manufactur ers like Maruti and Hyundai, while in motorcycles, the share has reached nearly half.

“Market sentiment in some rural areas has been impacted due to various factors, including the curtailment of national rural employment guarantee act (NREGA) spends, poor crop realisation and moderating wages,“ an official at top twowheeler maker Hero MotoCorp said. “The industry has, therefore, felt some impact in retail off-take in markets such as Bihar and Madhya Pradesh and sugar cane-growing areas in Uttar Pradesh and Maharashtra.“

The scooter category , however, is somewhat insulated from the agri pressure as it has abig share of the urban market.

The weak trends in rural India are worrisome for car manufacturers, which had turned their focus on agri-led regions.

Sales: 2014, 2015

The Times of India, Jun 23 2015

Nandini Sengupta

Toyota Replaces Tata Motors As Fifth Largest Car Maker

M&M lone Indian auto co in top 5

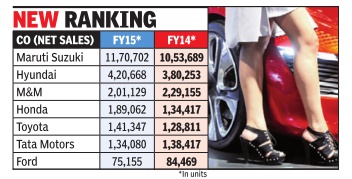

There has been a shift in the pecking order of car and SUV companies in India with the fourth, fifth and sixth spots showing significant changes. According to statistics from the Society of Indian Automobile Manufacturers (SIAM), the top five passenger vehicle companies in India by sale are Maruti, Hyundai, Mahindra & Mahindra, Honda and Toyota. Tata Motors, which was in fourth place in fiscal 2014, slipped to sixth place in FY2015. Ford India is the seventh company in the top sellers' list. As a result of this rejig, M&M is now the only Indian brand among the top five passenger vehicle companies in India.

Indeed, Maruti, Hyundai and M&M have retained their earlier positions in FY2015 as well. Maruti, with 11,70,702 units in sales, remains top seller in FY2015 as well, increasing its tally from 10,53,689 units the year before.

Hyundai, in second position with 4,20,668 units, has also increased its tally from 3,80,253 units in FY14. M&M in third position, though, is lower in terms of sales at 2,01,129 units, down from 2,29,155 units in FY14.

The real change though is in the fourth, fifth and sixth slots. Honda, with 1,89,062 units, is the biggest gainer in the fourth position. It was in the fifth position with 1,34,417 units in FY14. Toyota, at fifth position with 1,41,347 units, has also jumped a slot in FY15. The year before it was sixth with 1,28,811 units.

Tata Motors lost two slots in FY15. With 1,34,080 units, it is now in sixth place whereas in FY14 it was fourth with a nearly similar tally of 1,38,417 units. Ford has remained number seventh, though with a reduced tally -75,155 units in FY15 compared to 84,469 units in FY15.

Industry experts say the change in pecking order is part of a larger churn in the industry as India readies for new emission and safety regulations in two years. N Raja, senior VP & director sales & marketing, Toyota Kirloskar Motor, said, “Customers have started to appreciate and demand safety features in cars, which becomes an important buying parameter. At Toyota, we are happy to contribute to the globalization of the automobile products sold in the country rather than merely chase numbers.“

Others say that individual performances depend more upon the value proposition of the vehicle models and technology will not be market barrier for companies. Vishnu Mathur, director general, SIAM, said, “Once the mandatory regulations come in, the higher technology will be a benchmark for everybody with price-increase a possible small differentiator.“

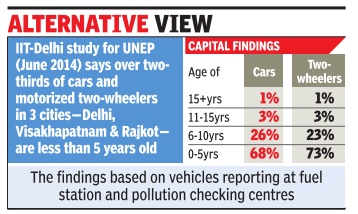

Average age of cars on road

Transport min says ban unfair on owners

Dipak Dash The Times of India Dec 03 2014

The findings of a study by IIT (Delhi) for UN Environment Programme showed that on average, less than one percent cars which are over 15 years old are plying on Delhi roads. The findings were same for two-wheelers. The findings were based on vehicles reporting at fuel stations and pollution checking centres. While the sample size for cars was 2,231, it was 1,570 in the case of two-wheelers. The survey found that the average age of cars on road was 4.4 years and the average age of two-wheelers was 4.7 years.

The study also covered two other cities Visakhapatnam and Rajkot and the findings were not much different.

Referring to a study conducted by central roads research institute (CRRI) in 2007, the report has mentioned how the vehicle registration date in Indian cities is an overestimation of the actual number of vehicles plying. This is because private vehicle owners pay a life time tax on the purchase of the vehicle and don't have to register their vehicle annually .

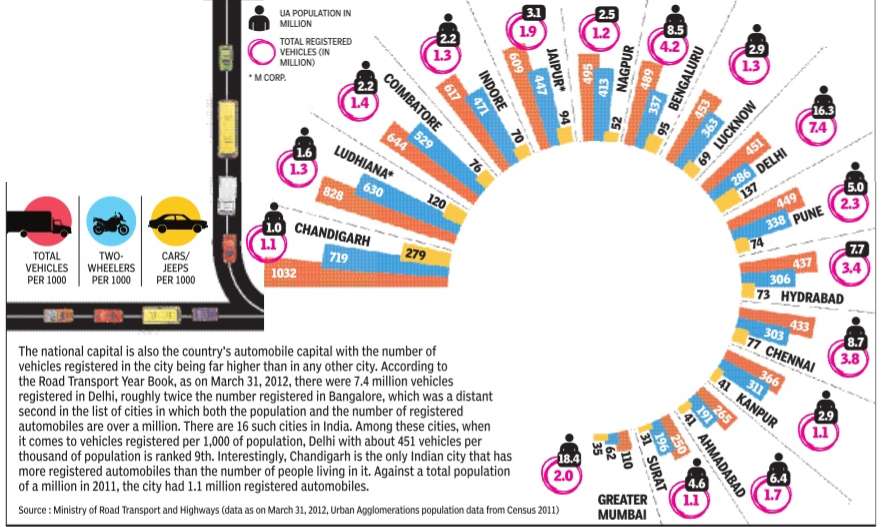

Number of vehicles, city-wise