Non-banking finance companies: India

This is a collection of articles archived for the excellence of their content. |

Contents |

Credit to NBFCs

2017, 18+ the 2019 policy

RBI eases bank loan norms for NBFCs with top rating, February 8, 2019: The Times of India

From: RBI eases bank loan norms for NBFCs with top rating, February 8, 2019: The Times of India

In Maiden Policy, RBI Guv Das Gives Cash Boost To Agri, Non-Banking Fin Biz

Links Exposure To Ratings Issued By Accredited Agencies

Better rated nonbanking finance companies (NBFCs) have improved chances of getting loans with the RBI relaxing capital requirements for banks that lend to them. “With a view to facilitating flow of credit to well-rated NBFCs, it has now been decided that rated exposure of banks to all NBFCs, excluding core investment companies, would be risk-weighted as per the ratings assigned by the accredited agencies, in a manner similar to corporates,” the RBI said in its statement. Loans to a core-investment company, which acts as a holding company for other businesses, would continue to attract a 100% risk weightage.

Current guidelines require that bank exposure to systemically important NBFCs (other than asset and infrastructure financiers) have to be uniformly risk-weighted at 100%. What this means is that 100% of the loan is deemed to be exposed to risk and banks have to provide capital for the whole loan. As against this, the risk weightage is around 50% for most home loans.

“The amount of borrowing from banking system, which, as per the new announcement would get rating benefit is Rs 2.52 lakh crore. The change of risk weights, as per rating distribution would lead to capital saving equivalent to 7.58% of the assets under consideration, thereby releasing an amount of Rs 19000 Cr of capital,” said Soumya Kanti Ghosh, chief economist, SBI.

According to RBI deputy governor N S Vishwanathan, “This was an aberration in the risk-weight system. So,

this was a harmonisation and aimed at reducing complexity in regulations.” Besides this, the RBI also announced harmonisation of NBFC categories. Henceforth, all NBFCs engaged in credit intermediation — asset finance companies (AFCs), loan companies, and investment companies — have been grouped into a single category to provide them flexibility in operations.

The relaxation by the central bank comes at a time when NBFCs are facing tight liquidity conditions. After IL&FS — an infrastructure financier promoted by top rated companies — defaulted on its loans, lenders have turned wary. Even as there was some confidence building up in the markets, DHFL’s stocks and bonds came under pressure following rumours and allegations by a news site.

Data released by the RBI shows that bank credit to NBFCs stood at Rs 5,70,900 crore — nearly 7% of overall bank credit of Rs 82.4 lakh crore as on December 21, 2018. This is an increase of 55% over Rs 3.6 lakh core in the previous year.

Making it easier for better-rated NBFCs to borrow could encourage consolidation as less creditworthy companies might sell their loans to those with better finances.

Financial crises

2018: Liquidity squeeze hurts NBFCs

Prashanth Perumal J., October 25, 2018: The Hindu

With concern over repayment of dues, shadow banks are caught in a vicious cycle

What’s up with NBFCs?

Shares of non-banking financial companies (NBFCs) have witnessed a steep fall in recent weeks after concerns over whether they can successfully meet their short-term dues. Housing finance companies (HFCs) in particular have seen their shares punished severely over fears of a severe liquidity crisis. Dewan Housing Finance has been the worst hit among HFCs. The current crisis began with the default of Infrastructure Leasing and Financial Services on several of its dues last month. The Union government subsequently decided to step in and assure lenders to the company that their money would be paid back safely without any default.

How did they get into trouble?

Many NBFCs use short-term loans borrowed from the money market to extend long-term loans to their customers. This leads to a mismatch in the duration of their assets and liabilities and exposes NBFCs to the substantial risk of being unable to pay back their lenders on time. NBFCs usually resort to rolling over, or refinancing, their old short-term debt with new short-term debt to compensate for the mismatch in duration. But even though NBFCs usually manage to roll over their short-term debt smoothly, there are times when they may fail to do so. Such risk is high particularly during times of crisis when lenders are affected by fear. In such cases, they may have to resort to sale of their assets at distress prices to meet their dues. This can turn a liquidity crisis into a more serious solvency crisis, wherein the total value of the assets of a company falls below the value of its total liabilities. Further, NBFCs also face the risk of having to pay higher interest rates each time they refinance their short-term debt. As interest rates rise across the globe, equity investors believe that the cost of borrowing of NBFCs will rise and affect their profit margins. This is seen as the primary reason behind the fall in the shares of many NBFCs. Investors may be pricing in the prospect of falling profits for NBFCs in the coming quarters.

What lies ahead?

It is estimated that NBFCs need to repay about Rs. 1.2 trillion of short-term debt in the current quarter. How they manage to meet these dues remains to be seen. It is hoped that banks will offer a helping hand to NBFCs to meet their short-term dues to lenders like mutual funds. Many further believe that a widespread financial panic may not be on the cards as the government will act as a lender of last resort. Such bailouts, however, create the risk of moral hazard in the wider financial system. NBFCs, for instance, may continue to borrow short-term to extend long-term loans to their customers because they expect the government to bail them out if they get into trouble. In fact, some believe that financial institutions in general have traditionally resorted to borrowing short-term to finance long-term loans simply because there is an implicit guarantee extended by the government. As the cost of borrowing funds rises, NBFCs may have to settle for lower profits unless they find a way to pass the burden of higher rates on to borrowers.

Ownership

As in 2019

November 24, 2020: The Times of India

From: November 24, 2020: The Times of India

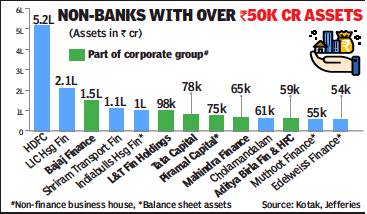

Half of NBFCs which qualify for bank licence are corporate-owned

Around half of the finance companies with assets of over Rs 50,000 crore that meet the RBI’s size criteria to get a bank licence are part of corporate groups, while two are already part of banking groups. Not many standalone nonbanking financial companies (NBFCs) are likely to qualify for the bank licence norms.

The RBI’s internal working group in its report had said that well-run NBFCs, with an asset size of above Rs 50,000 crore, including those which are owned by a corporate house, may be considered for conversion into banks.

Among the top 10 finance companies in terms of assets under management, Aditya Birla Capital, Bajaj Finance, L&T Finance Holdings, Mahindra Finance, Piramal, and Tata Capital are part of a corporate group. Of the remaining NBFCs, HDFC is already a promoter of a bank, while the Life Insurance Corporation, promoter of LIC Housing Finance, owns IDBI Bank. PNB Housing Finance, another large NBFC, is owned by Punjab National Bank. The RBI has said that companies have to wait till laws are changed to give the central bank powers to supervise corporate groups before giving them a bank licence.

However, it has left the door open for NBFCs that are owned by corporates if they have been around for 10 years.

The other standalone NBFCs that have a balance sheet size of over Rs 50,000 crore are Shriram Group finance companies, Indiabulls Housing, Cholamandalam Finance, Muthoot Finance, and Edelweiss Finance. IIFL and Sundaram Finance, although large established lenders, are likely to fall short of the target.

For Shriram Transport Finance, transferring its vehicle finance business into a bank would reduce efficiency. “A bank has to provide a very wide range of services, maintain SLR (statutory liquidity ratio) & CRR (cash reserve ratio) requirements and operates at a much higher cost structure compared to NBFCs. So, an NBFC will have to weigh the pros and cons after the final guidelines, and understand the impact for stakeholders (shareholders, employees, customers) before considering conversion into a bank,” said Shriram Transport Finance MD & CEO Umesh Revankar.

Another disincentive for Shriram is that the RBI has said that, upon conversion into a bank, any lending activity that can be undertaken within a bank has to be transferred to the bank. However, many lenders have NBFC arms. Indiabulls had made unsuccessful attempts to acquire a bank licence earlier. The last time was when it proposed to merge with Lakshmi Vilas Bank, which was rejected by the RBI. The group is likely to try again.

A big challenge for the NBFCs to convert into banks will be the cost of investment in technology and setting up a retail branch network. They will also have to face additional costs in complying with the SLR of 18% and the CRR of 4% and not all NBFCs can meet this cost of compliance.

Policies, trends

2019: housing, infra finance companies avoided

July 3, 2019: The Times of India

NBFCs delink themselves from hsg & infra fin cos

‘NOT STRESSED’

TIMES NEWS NETWORK

Mumbai:

Non-banking finance companies (NBFCs) have sought to distance themselves from housing finance companies (HFCs), which are facing stress, and infra lenders like the troubled IL&FS group. An industry body has said that the sector is neither overleveraged or stressed and nor does it have an asset-liability mismatch. The industry association has sought recognition for NBFCs as partners of banks, helping them lend to the priority sector.

Representatives of the NBFC sector from various finance groups — including Mahindra & Mahindra Finance, SREI, Shriram Transport Finance, Sundaram Finance and Muthoot Group — in a joint press conference under the aegis of Finance Industry Development Council (FIDC) said that the solvency issues

faced by some institutions were being hyped as a liquidity issue. FIDC chairman and SREI Equipment Finance senior vicepresident Raman Aggarwal said the defaults at IL&FS and DHFL were being made out to be representative of the NBFC sector, while NBFCs were distinct from HFCs, which were long-term financiers. IL&FS was a unique case as there are only eight infrafinancing NBFCs, of which five are government-owned.

“The bulk of NBFCs are short-term, small-ticket loan providers with average maturity of loans between two and five years. Nine months have passed since IL&FS defaulted without any NBFC defaulting. NBFCs have met their liabilities by restricting their lending. The current crisis is a growth-related issue and not a solvency issue.”

The international position

2013> 2018

From: November 25, 2020: The Times of India

See graphic:

Non-bank financial intermediation in India, Brazil, Canada, China, Italy, South Korea: 2013> 2018

Loan and advances

2014-17

From: October 10, 2018: The Times of India

See graphic:

Non-Banking Finance Co's loans and advances, 2014-17

See also

Non-banking finance companies: India