Banking, India: I

Note: The terms public sector banks (PSBs), PSU banks and nationalised banks have been used interchangeably on this page and mean the same thing.

This is a collection of articles archived for the excellence of their content. |

History

AD 1720

The Times of India, Aug 22 2016

The Times of India

India's first joint stock bank was established in 1720 in Mumbai. This was followed by the setting up of a similar bank in Kolkata in 1770 and, later, in many other cities. Because of the growing need for modern banking services, of uniform currency to streamline foreign trade and to manage the remittances of British Army personnel and civil servants, three Presidency Banks were established in Mumbai, Kolkata and Chennai. Apart from normal banking, these banks could also issue currency until 1861.During the same period, there was a significant increase in privately-owned commercial banks and, by 1913, there were 56 commercial banks operating in India. The First World War and the Great Depression exposed the flaws of banking in India as many banks failed and the need for a cent ral bank to ensure regulatory safeguards was felt.

1969: Nationalisation and political misuse

The Times of India, April 10, 2016

Banks will remain political fiefdoms till privatized

Public sector banks are losing huge sums and running up gargantuan bad debts. Defaulters like Vijay Mallya, once politically powerful, are fleeing abroad. India's banking crisis is fundamentally political, not financial.

The left, predictably, blames wicked busi nessmen, saying the banking system has become a fiefdom of big business. Rubbish! The banks were indeed fiefdoms of big business before 1969. Then Indira Gandhi nationalized them to make them the fiefdoms of politicians. That's the root of today's crisis.

Indira and her socialist acolytes claimed bank nationalization was essential for the state to capture the commanding heights of the economy , and channel bank lending to top social priorities.Actually , she could have ordered private banks to lend to favoured sectors (as is done today) without nationalization.

Her real aim was to control all big finance, emasculating the businessmen and maharajas leading the Swatantra Party , the main opposition party after the 1967 election. She nullified the treaties Sardar Patel had signed with the princes to persuade them to accede to India in 1947. She abolished their privy purses and made them taxable, bankrupting them.

She raised income-tax rates to 97.75%, added a wealth tax of 3.5%, nationalized several other industries, and made it clear to businessmen that dissenters would be crushed. The ploy succeeded. The Swatantra Party collapsed, and businessmen crawled.

However, the poverty ratio did not fall at all after 1947 till 1983. Meanwhile, the population doubled, so the absolute number of poor doubled. That terrible human cost exposes the fraudulent intent and outcome of Indira's Garibi Hatao policies, spearheaded by bank nationalization.

Did nationalization spur lending to “the people“? As Orwell said, in socialism all are equal, but some are more equal than others. Most equal of all was Sanjay Gandhi, Indira's son, who sought unending loans for his dud car project. Anyone opposing Sanjay -including R K Hazari, deputy RBI governor, and R K Talwar, chairman of the State Bank of India -got marching orders. After that, bank chiefs obediently followed orders (official or unofficial) from top politicians. That's the genesis of today's bank misgovernance and losses. The economy has grown 50 times since, so the misgovernance and losses have risen too. But in essence, Vijay Mallya is simply a new avatar of Sanjay Gandhi.

After Talwar's travails, pre-nationalization financial discipline was quickly destroyed. Loans were given to dud businesses and dud social projects (like loan melas to woo political vote banks). How many defaulters did nationalized banks remove from control of their businesses? Virtually none, since they had all bought political protection. Regional rural banks (RRBs) did indeed penetrate the countryside, a social plus. But they lost vast sums and had to be merged with the big banks.

By the early 1980s, the bad loans of banks exceeded their equity capital. Technically , they were bankrupt. But given government ownership, that was not even news. After all, public sector behemoths had always lost huge sums, and been replenished indefinitely by the taxpayer.

By the 1980s, nationalized banks were okaying highly inflated project costs that enabled promoters to skim off the excess. Banks “evergreened“ bad loans (renewing them indefinitely) instead of admitting they were unpayable, taking over the assets of borrowers and auctioning them. Unpaid and unpayable dues were listed as “receivables“. And all receivables, believe it or not, were classified as “income“, even though nothing was coming in.

Banking doyen Narayan Vaghul told me at the time that most bank profits were fictional, since they were based on receivables that were never received. On this fictional income the banks declared profits, and even paid corporate tax. And those that had no cash borrowed money to pay the taxes! That sad farce has continued ever since, in greater or lesser measure. Politicians have continued phoning bank managers.And at budget time finance ministers announce a host of schemes to be financed by the banks, a political diktat.

Governments have the right to lay down lending priorities.But bank funds are actually the resources of citizen savers, not the government. So, politicians should not force banks to hold loan melas for vote banks, or go easy on favoured borrowers.

Modi has brought in reforms aiming to provide more honest, independent bank chiefs and boards. This may improve matters.But the process is hardly foolproof, and can be reversed by a future government.

Private-sector banks (like ICICI Bank) have also been hit by bad loans in problem sectors like infrastructure and metals. But they avoided the worst loan proposals that nationalized banks happily accepted, with disastrous results. The private banks lent on commercial principles, not political orders. Probably bank privatization alone can ensure commercial discipline in future. But no political party wants that.

19 July 1969

Nationalised banks in 1969 and 2019

From: July 19, 2019: The Times of India

See graphic, ‘19 July 1969: the events of the day

Nationalised banks in 1969 and 2019. ’

When bank nationalisation law was ruled ‘unconstitutional’ over unfair compensation

OMKAR GOKHALE, June 5, 2025: The Indian Express

During an intimate dinner party hosted by Rustom Cavasjee Cooper, 47, in July 1969, a news development crackled over the radio: the government had nationalised 14 of India’s largest private commercial banks having deposits of over Rs 50 crore.

Recalling that dinner party in an article for Himmat, a weekly magazine, Cooper, a shareholder in several of these banks and a Swatantra Party leader, remembers spending the rest of the evening pacing and feeling agitated. Sensing his turmoil, a senior government official at the party remarked casually, “Why don’t you contest it in the Supreme Court?”

That casual suggestion would ignite one of the most important legal battles in India’s constitutional history, ending with the Supreme Court emphasising that actions made for public interest must ensure just compensation and reaffirming that Directive Principles of State Policy, the guiding principles in making policies that aim to create a welfare state, cannot override fundamental rights.

After the dinner party

The very next morning, Cooper boarded the first flight to Delhi. Fate, it seemed, had conspired in his favour. Nani Palkhivala, one of India’s brightest legal minds, happened to be in Delhi too. By that evening, the preparations for a constitutional challenge were underway.

Six months later, on February 10, 1970, an 11-judge Bench of the Supreme Court led by Justice J C Shah, while holding the Bank Nationalization Act, 1969, as “unconstitutional” since it violated the right to property, clarified that nationalisation of banks itself was not unconstitutional.

Striking down the law, the SC said the method of calculating compensation to the shareholders undervalued the banks’ assets by ignoring their goodwill and key properties.

Born on August 18, 1922, in a Mumbai-based Parsi family, Cooper, a chartered accountant, had completed his PhD in economics from the London School of Economics (LSE). He was also president of the Institute of Chartered Accountants of India (1963-64), the president of the Indian Merchants’ Chamber (IMC), and the treasurer and general-secretary of Swatantra Party.

The ordinance enabling bank nationalisation was promulgated on July 19, 1969, a few days before the Parliament session was to begin. Three days prior to the ordinance, then Prime Minister Indira Gandhi had divested Morarji Desai of his finance portfolio. Cooper’s opposition to bank nationalisation was not about personal financial loss. Besides holding shares in the Central Bank of India Ltd (of which he was a director), Bank of Baroda Ltd, Union Bank of India Ltd and Bank of India Ltd, he also had current and fixed deposit accounts in these banks. His shareholdings were modest, entitling him to cash compensation in any event.

Instead, Cooper’s grievance was rooted in principle: he believed the ordinance, promulgated in haste and without parliamentary debate, had trampled upon the Constitution’s sanctity since it violated his right to property under Articles 19 (1)(f) and 31 over the unfair compensation method.

Cooper challenged the Banking Companies (Acquisition and Transfer of Undertakings) Ordinance 8 of 1969. The ordinance transferred and vested the undertaking of 14 commercial banks that held over 80% of India’s bank deposits and had deposits of not less than Rs 50 crore, in the corresponding new nationalised banks set up under the decree.

Though pleas challenging the ordinance were lodged before the Supreme Court, before they were heard, Parliament enacted the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1969, replacing the ordinance with modifications.

The objective of the Act was to enable acquisition and transfer of the undertakings of certain banking companies so as to “better serve the needs of development of the economy, in conformity with national policy” and connected matters.

Filed under Article 32 (right to move to Supreme Court to enforce fundamental rights), Cooper, through Palkhivala, argued that the law impaired his rights guaranteed under Articles 14, 19 and 31 (right to property).

In his February 20, 1970, article for Himmat, Cooper wrote, “I thought that it (bank nationalisation) was done with unreasonable haste…a clear violation of the sanctity of the Constitution…I felt that not only political parties but individuals in the highest places had started regarding the Constitution as something which could easily be played with.”

While accusations later surfaced that big business interests were backing Cooper’s case, he steadfastly denied such claims.

“Insinuations were made to this effect before the Supreme Court during the hearings too. I would like to clarify that not only was there no interest in financing this petition, but every single person (lawyers, accountants and experts)…who assisted Mr Palkhivala and me in these proceedings, did …not charge any fees,…including a large amount of travelling expenses,” his article states, adding that “none of the Chairmen or members of the old boards of Directors of the nationalised banks or eminent businessmen and industrialists came forward to join us in this fight for democracy”.

Besides stating that the method of calculating compensation undervalued the banks’ assets by ignoring their goodwill and key properties, the Supreme Court’s February 10, 1970, verdict also held that forcing nationalised banks to cease both banking and non-banking activities was discriminatory and especially violative of equality before law under Article 14.

Denying the government’s submission that banks — and not the shareholders — were directly affected by the decision, the SC held that shareholders could independently move the top court if their fundamental rights were infringed upon.

This approach would later become the bedrock of public interest litigation (PILs) in the country, empowering citizens to seek justice not just for themselves, but for broader public causes.

The Supreme Court clarified that nationalisation of banks itself was not unconstitutional, while emphasising that actions made for public interest must ensure just compensation. The court also reaffirmed that Directive Principles of State Policy cannot override fundamental rights.

Justice A N Ray, who became the Chief Justice of India (CJI) in April 1973, superseding three of his Bench colleagues, Justices J M Shelat, A N Grover and K S Hegde, however, took a dissenting view. Upholding the Act, Justice Ray said it was “for development of the national economy with the aid of banks”.

Then CJI Mohammad Hidayatullah had recused himself from hearing the matter as he had given assent to the impugned law in capacity as then acting President of India.

Before 1970, constitutional law was still shaped by the judgment in the A K Gopalan v State of Madras (1950), where the Supreme Court had held that each fundamental right operated in isolation and that as long as a law adhered to one specific constitutional provision, its effects on other rights were irrelevant.

However, R C Cooper v Union of India shattered this view. The Supreme Court held that the impact of state action on individual rights determined constitutionality. “Impairment of the right of the individual and not the object of the State in taking the impugned action, is the measure of protection. To concentrate merely on power of the State and the object of the State action in exercising that power is therefore to ignore the true intent of the Constitution…,” stated the majority opinion, authored by Justice Shah on behalf of the nine other judges and him.

In his article, Cooper opined that the SC judgment was important for shareholders of nationalised banks, as well those of any industries that may be nationalised in future. “Parliament certainly has a right to legislate for nationalisation of certain aspects of economic activity…The second important principle which has emerged is that for assets which are taken over by the State there should be fair and reasonable compensation. And the third is that there should be no hostile discrimination against any particular concern or concerns in an industry,” he wrote.

Four days after the judgment, on February 14, 1970, then President V V Giri issued a new ordinance that stipulated compensation to shareholders of the 14 nationalised banks.

Cooper felt the new decree “was an improvement over the previous one” and sought to “undo illegalities” pointed out by the Constitution Bench. He added that the compensation offered to shareholders under the new ordinance was “more realistic” and “payable wholly in cash if so desired…in three years …, together with interest”.

The judgment paved the way for the apex court’s decision in the 1973 Kesavananda Bharati case, in which it laid down the “basic structure” doctrine that put limits on Parliament’s powers to amend the Constitution, along the verdict in the 1978 Maneka Gandhi vs Union of India. Cooper’s case is remembered not merely for challenging bank nationalisation, but for establishing that constitutional rights must be protected against the real impact of state action, not just its stated aims. While the right to property ceased to be a fundamental right in 1978, it is protected under Article 300A, which provides protection to citizens against arbitrary deprivation of their property by the state.

With the Swatantra Party dissolving in 1974 and Indira Gandhi imposing an Emergency in the country ini 1975, Cooper relocated to Singapore. where he set up a financial consultancy and also wrote two books, Job Sharing in Singapore (1986) and War on Waste (1991).

He died at the age of 90 while on a visit to London in June 2013. Nearly 55 years after the judgment, Cooper’s spirit — demanding fairness, reasonableness and accountability from the state — continues to guide judicial review.

Accounts, number of/ population covered

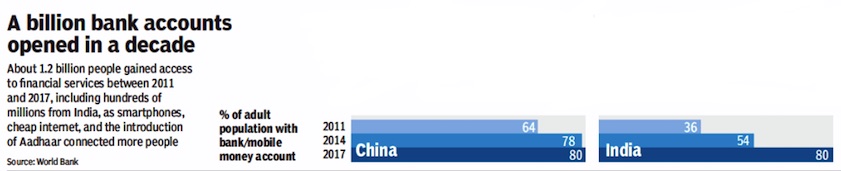

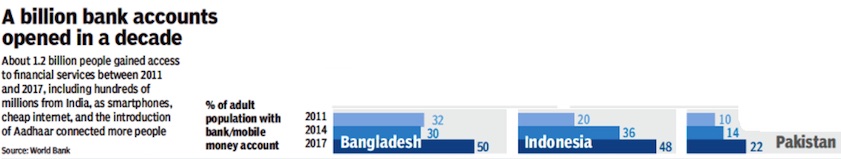

2011> 2017

From: April 24, 2018: The Times of India

From: April 24, 2018: The Times of India

See graphics:

Bangladesh, China, India, Indonesia and Pakistan: the percentage of the adult population with bank/ mobile bank accounts. In 2011, 2014 and 2017 (Part-I)

Bangladesh, China, India, Indonesia and Pakistan: the percentage of the adult population with bank/ mobile bank accounts. In 2011, 2014 and 2017 (Part-II)

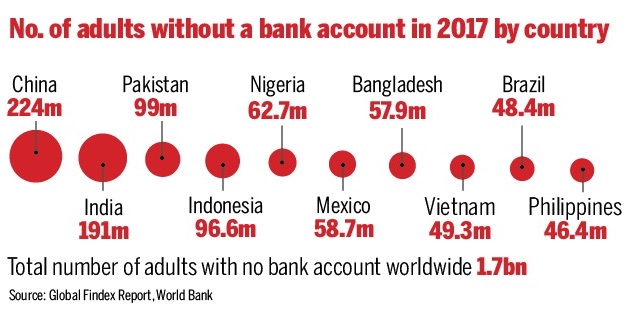

India has 2nd largest unbanked population

June 13, 2018: The Times of India

From: June 13, 2018: The Times of India

From: June 13, 2018: The Times of India

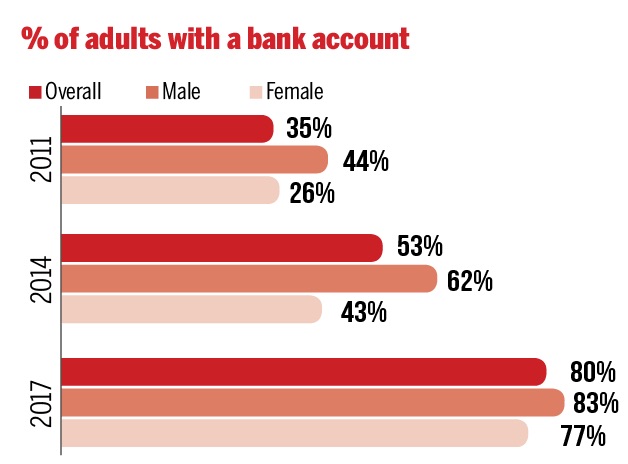

While India is quite proud about adding more individuals into the formal banking system -- the number of adults with bank accounts grew from 53% in 2014 to 80% in 2017 -- it is not enough. As many as 191 million Indian adults are still without a bank account. The figure places the country next only to China.

Bangladesh, China, India, Pakistan vis-à-vis the world/ 2017

i) The number of unbanked adults, and

ii) The percentage of unbanked population,

As in 2017

From: June 15, 2018: The Times of India

See graphic:

Bangladesh, China, India, Pakistan vis-à-vis the world:

i) The number of unbanked adults, and

ii) The percentage of unbanked population,

As in 2017

State-wise contribution to banking business: 2018

See graphic

The leading states’ contribution to the banking business in India, presumably as in 2018

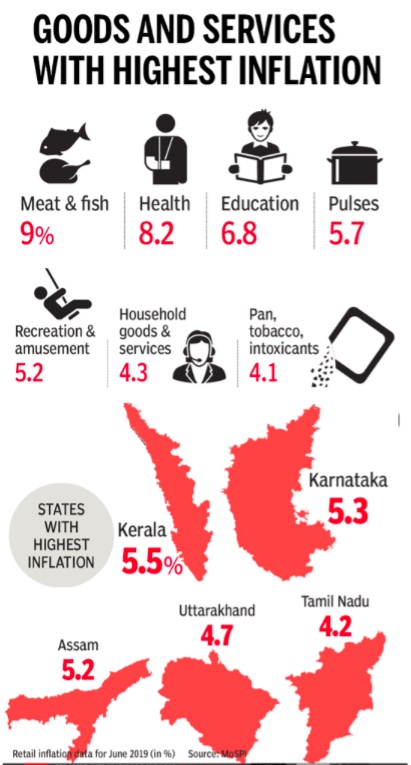

2019, June

States with highest inflation, 2019

From: July 19, 2019: The Times of India

See graphic:

2019, June- Goods and services with highest inflation

States with highest inflation, 2019

Additional Tier 1 (AT1) bonds

The basics, as in 2020 March

All you want to know about AT1 bonds, March 10, 2020: The Times of India

What are AT1 bonds?

Additional Tier 1 bonds, also called AT1in market parlance, are a kind of perpetual bonds without any expiry date that banks are allowed to issue to meet their longterm capital requirement. That’s why these bonds are treated as quasi-equity instruments under the law. RBI is the regulator for these bonds.

Do these bonds pay interest?

Yes. AT1 bonds are like any other bonds issued by banks and companies, which pay a fixed rate of interest at regular interval. Usually, these bonds pay a slightly higher rate of interest compared to similar, non-perpetual bonds. However, the issuing bank has no obligation to pay back the principal to investors.

Are these bonds traded in the market?

Yes. These bonds are listed and traded on the exchanges. So if an AT1 bond holder needs money, he can sell it in the market.

How are AT1 bonds redeemed?

Investors can not return these bonds to the issuing bank and get the money. This means there is no put option available to its holders. However, the issuing banks have the option to recall AT1 bonds issued by them (termed call option). They can go for a call option five years after these are issued and then every year at a pre-announced period. This way the issuing banks can give an exit option to AT1 bond holders.

At present, what’s the total value of AT1 bonds in the market?

According to a report by rating agency ICRA, nearly Rs 94,000 crore worth of AT1 bonds are currently issued by various banks. Of this, Rs 55,000 crore is from PSU banks, while the balance Rs 39,000 crore is by private lenders.

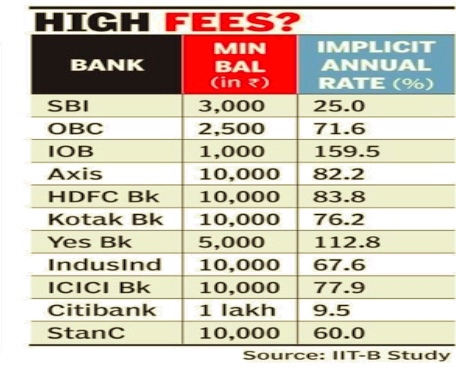

Administrative costs levied on customers

2015-18: Charges For ATM Withdrawals, low minimum Balance

PSU banks collected ₹10k cr from you in 3 and a half yrs, December 22, 2018: The Times of India

From: PSU banks collected ₹10k cr from you in 3 and a half yrs, December 22, 2018: The Times of India

Charged For ATM Withdrawals, Not Maintaining Min Balance

State-run banks have collected over Rs 10,000 crore from those who did not maintain minimum balance in their savings accounts and from charges levied on ATM withdrawals beyond the free transactions in the last nearly three and a half years, data submitted in Parliament showed.

According to a written reply to a Parliament question, the low monthly average balance was charged by SBI till 2012 but it stopped doing so till March 31, 2016 while other banks, including private banks, were charging as approved by their boards. SBI reintroduced the charge from April 1, 2017.

The minimum balance requirements were subsequently reduced from October 1, 2017. There is no minimum balance requirement for basic savings bank deposit accounts and Jan-Dhan accounts.

Apart from the over Rs 10,000 crore collected by staterun banks during the threeand-a-half-year period, private banks would also have collected a hefty amount. Data for private banks was not included in the numbers provided in the Parliament question.

The details emerged in a reply by the finance ministry to a question posed by Lok Sabha MP Dibyendu Adhikari on Tuesday. The ministry said the Reserve Bank of India (RBI) had permitted banks to fix charges on various services rendered by them, as approved by their boards. The banks are to ensure that the charges are reasonable and not out of line with the average cost of providing these services.

It also said, according to the RBI’s directions, a minimum of three free transactions at any other bank’s ATM at six metros — Mumbai, New Delhi, Chennai, Kolkata, Bengaluru and Hyderabad — and a minimum of five free ATM transactions at a bank’s own ATM at any other location is permitted during a month.

“Beyond this minimum number of free ATM transactions, banks have their boardapproved policy on charges from customers on ATM transactions subject to a cap of Rs 20 per transaction,” the ministry said in its reply.

The ministry also said public sector banks had informed that they do not have any plans to shut down their ATMs. This was in response to the question on whether the government proposes to withdraw 50% of total ATM services in the country by March 2019.

Administrative measures, initiatives, issues

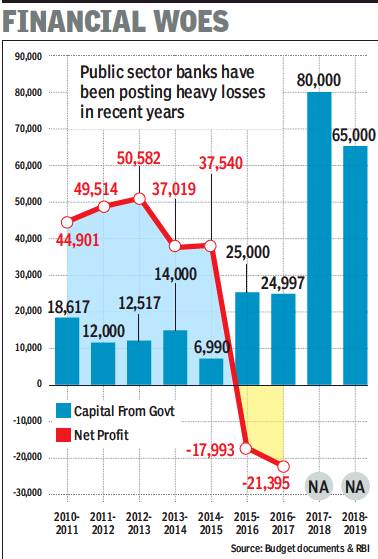

RBI’s asset quality review under Raghuram Rajan: 2015

The Times of India, June 19, 2016

A few years down the line several of the current bank chiefs would probably remember Raghuram Rajan for one thing eating into their annual bonuses. ICICI Bank has already announced that its top management won't receive performance bonus for 201516. PSU bank chiefs too are expected to miss the annual pay-out as soaring bad debts have hit the financial performance of lenders.

Just when data showed promise of the economy stabilising, the RBI started what's come to be known as asset quality review, a term that most bankers dread.While annual inspection of banks was the norm, RBI has now opted to ask banks to classify several loans as non-performing assets (NPA), which in normal course would have been treated as “standard“.

Classifying a loan as an NPA or a sub-standard asset means that banks have to set aside more funds to cover for potential losses due to nonpayment of dues. The result is for everyone to see: NPAs of Indian banks shot up to a little under Rs 6 lakh crore as each lender was handed a list of companies where funds had to be set aside, called provisioning in banking parlance. Even loans which were restructured were to be monitored strictly and funds set aside for a year.

As a result, against cumulative profits of close to Rs 31,000 crore in 2014-15, state-run lenders ran up losses of almost Rs 18,000 crore as bank after bank reported record losses. Some of the large private banks, such as ICICI Bank, man aged to stay profitable but saw a steep decline in profit.

But the hit is not just for banks, it also impacts India Inc. Companies that get the NPA tag would be choked of funding, a move that will impact economic revival as these entities would be unable to add more capacity to their factories.

Banks can't refuse faded, scribbled notes: RBI

Banks can't refuse scribbled notes, says RBI circular, April 29, 2017: The Times of India

The RBI has said banks cannot refuse to accept faded notes or those with scribbles. The central bank said such banknotes had to be treated as “soiled notes“ and dealt with according to the RBI's “clean note policy“.

The circular to banks was sent by the RBI after it received complaints that many branches were not accepting banknotes, specifically of 500 and 2,000 denominations, with anything written on them or those either smudged with colour or faded due to washing.

Bank branches have been rejecting such notes following rumours in social media that such notes were not acceptable.

The RBI drew attention to its December 2013 statement, issued in response to rumours that from 2017 onwards banks would not accept notes with anything written on them. The RBI had then stated that it had not issued any such instruction. The central bank clarified that its instructions on scribbling on notes was a directive for staffers not to write on banknotes. This was after the RBI had observed that bank officials themselves were in the habit of writing on banknotes, which went against the central bank's clean note policy.

The RBI has sought cooperation from all members of public, institutions and others in keeping banknotes clean by not scribbling on them.

Bank Board Bureau/ 2016

The Hindu, February 29, 2016

Prime Minister Narendra Modi approved the setting up of the Bank Board Bureau with former Comptroller and Auditor-General of India Vinod Rai as its first Chairman.

The Bureau is mandated to play a critical role in reforming the troubled public sector banks by recommending appointments to leadership positions and boards in those banks and advise them on ways to raise funds and how to go ahead with mergers and acquisitions.

“With a view to improve the governance of public sector banks, the government had decided to set up an autonomous Bank Board Bureau. The bureau will recommend for selection the heads of public sector banks and financial institutions and help banks in developing strategies and capital raising plans,” the government said in a release.

The bureau was announced in August 2015 as part of the seven-point Indradhanush plan to revamp these banks. It will constantly engage with the boards of all 22 public sector banks to formulate appropriate strategies for their growth and development.

The bureau, led by Mr Rai, will select the heads of public sector banks (even from the private sector, if need be) and aid them in formulating strategies to raise additional capital. It will select and appoint non-executive chairmen and non-official directors.

The non-performing assets of public sector banks are estimated at almost Rs. 4 lakh crore, and they need to raise capital of Rs. 2.4 lakh crore by 2018 to conform to Basel-III capital requirement norms, according to the government.

While some questions have been raised on Mr. Rai's appointment as a CAG cannot hold a government office post-retirement, former senior civil servants say the role is advisory in nature and a part-time position. The government release said the appointments have been made for a period of two years.

The bureau will have three ex-officio members and three expert members, in addition to the Chairman.

2016/ Selection process of Managing Directors of public-sector banks

The Indian Express, May 30, 2016

George Mathew

The Bank Board Bureau (BBB), set up by the government in February 2016, has kicked off the selection process of managing directors and CEOs of public sector banks.

The body has conducted its maiden interviews for appointments of MDs & CEOs at three state-run banks and met as many 10 candidates who are currently serving as executive directors in various PSU banks, according to sources. One of the interviewees was earlier shunted out by the government from a large PSU bank in connection with a dubious loan to Atlas group, a Gulf-based jewellery chain.

2018/ Asset Quality Review

The RBI has included several top business groups in the ongoing asset quality review which, based on the replies of the banks, could lead to bankruptcy proceedings in many cases.

The regulator has already sent letters to banks to gauge the level of action by lenders to clean up the banking system, said a banking source. Each bank is expected to clarify the position separately. “This could be the second major asset quality review after former RBI Governor Raghuram Rajan kicked off the first review in 2015,” said an official of a nationalised bank.

The RBI has included several top business groups in the ongoing asset quality review which, based on the replies of the banks, could lead to bankruptcy proceedings in many cases. Most of these accounts have already been declared as non-performing assets (NPAs) by banks. The RBI did not respond to emailed queries.

The RBI had initially sent a list of 12 defaulters for resolution under the Insolvency and Bankruptcy Code (IBC). Out of this, 11 accounts are in various stages of resolution at different benches of the National Company Law Tribunal (NCLT). Bankers are expecting over 50 per cent recovery from these accounts.

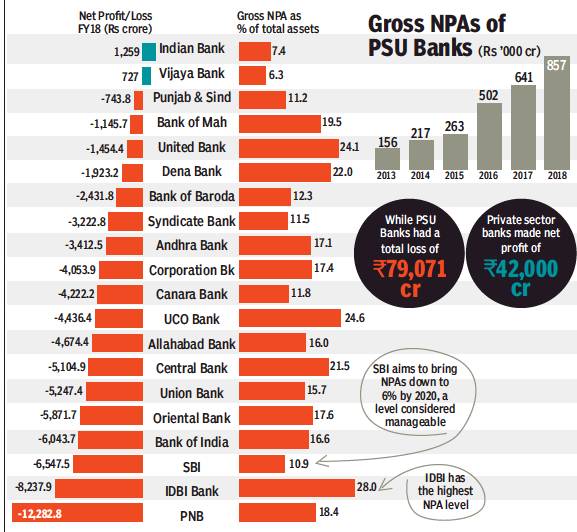

The regulator subsequently sent another list of 28 stressed accounts for resolution. However, banks don’t expect more than 25-30 per cent from these accounts. Some of these accounts were evergreened — or fresh loans disbursed to repay old loans — by banks to prevent them being classified as bad loans. The fresh exercise by the RBI comes at a time when gross non-performing assets in the banking system has risen to around Rs 10.3 lakh crore, or 11.2 per cent of advances compared with Rs 8 lakh crore, or 9.5 per cent of advances, as on March 31, 2017.

In FY18, the banking system reported a net loss of Rs 40,000 crore because of the sharp rise in NPAs and the resulting increase in provisioning costs. In the previous fiscal, as much as Rs 5 lakh crore of bank loans slipped into the NPAs category, taking the total slippages in the past three fiscals to Rs 13.6 lakh crore, Crisil has said.

In June, the RBI’s Financial Stability Report (FSR) warned that “the stress in the banking sector continues as gross NPA ratio rises further. Profitability of banks declined, partly reflecting increased provisioning”. RBI’s macro-stress tests indicated that under the baseline scenario of current macroeconomic outlook, gross NPA ratio of banks may rise from 11.6 per cent in March 2018 to 12.2 per cent by March 2019.

Nearly a dozen PSU banks are under the prompt corrective action (PCA) of the RBI.

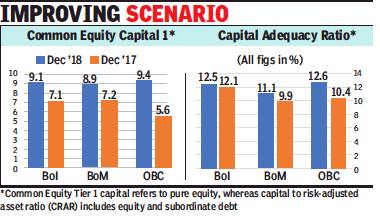

2019: RBI removes BOI, BOM, OBC from PCA framework

RBI lifts lending restrictions on three public sector banks, February 1, 2019: The Times of India

From: RBI lifts lending restrictions on three public sector banks, February 1, 2019: The Times of India

Bank of India, Bank of Maharashtra, OBC Exit PCA Framework

The Reserve Bank of India (RBI) has removed Bank of India, Bank of Maharashtra and Oriental Bank of Commerce from its prompt corrective action (PCA) framework — a watch list for weak banks that placed lending restrictions on them.

“The RBI’s decision to remove the three banks from the PCA framework is on expected lines, given the sizeable capital infusion in these three during December 2018,” said Anil Gupta, sector head (financial sector ratings) at Icra. “The balance of the budgeted capital can support the exit of one or two more banks from the PCA framework if the government allocates higher capital to some of these lenders, like Corporation Bank,” he added.

Responding to the RBI action, BoM MD & CEO A S Rajeev said that the recent capital infusion of Rs 4,498 crore helped the bank improve its capital adequacy ratio to 11.05%. At the same time, the bank reduced its non-performing assets (NPAs) by 50% year-on-year.

The decision is understood to have been taken following a meeting of the board for financial supervision on Thursday. The board, chaired by governor Shaktikanta Das, reviewed the performance of all the 11 banks on the PCA list.

According to Gupta, although the three banks have exited PCA, the question remains whether negative return on asset continues to remain a PCA criteria? Following the RBI announcement, finance secretary Rajeev Kumar said in a tweet that this was an outcome of the government’s ‘4R’ strategy — recognition of stressed loans as default, recapitalisation of banks, resolution of bad loans, and reform of public sector. “Banks need to be more responsible, adopt high underwriting and risk management standards to avoid recurrence,” Kumar added.

The RBI’s move comes two days after a review meeting of banks with interim finance minister Piyush Goyal. In the meeting, Goyal informed banks that if they maintained the trend of improvement in performance, they would exit the PCA soon.

2018/ Inter-Creditor Agreement

Sangita Mehta, July 11, 2018: The Economic Times

The Reserve Bank of India has started a review of over 200 stressed assets of top business groups in the banking system to assess the provisioning level and classification of assets.

Over the past few years, Indian banks have been forced by the Reserve Bank of India to recognise troubled assets on their books, but their resolution has remained a challenge. • Public sector, private sector and foreign banks signed an inter-creditor agreement to push for the speedy resolution of non-performing loans on their balance sheets.

• It is aimed at the resolution of loan accounts with a size of Rs 50 crore and above that are under the control of a group of lenders.

• It is a part of "Sashakt" plan approved by the government to address the problem of resolving bad loans.

As many as 56 lenders signed an inter-creditor agreement which will prohibit dissenting creditors from making an easy exit.

The agreement — based on a recommendation by the Sunil Mehta committee that looked into resolution of stressed assets — aims to deal with bad loans that banks must resolve before next month end under a February 12 RBI circular. Banks will have to refer unresolved loans to the bankruptcy court and they fear the asset value may erode if there are no buyers at bankruptcy court.

The agreement says if 66 per cent of lenders by value agree to a resolution plan, it would be binding on all lenders. The dissenting creditors will, however, have the option to sell their loans to other lenders at a discount of 15 per cent to the liquidation value, or buy the entire portfolio paying 125 per cent of the value agreed under the debt resolution plan by other lenders.

The agreement says each resolution plan would be submitted to an overseeing committee comprising experts from the banking industry. For dissenting creditors, the agreement says the “lead bank has the right, but not the obligation, to arrange the buyout of the loan facilities at a value that is equal to 85 per cent of the liquidation or the resolution value —whichever is lower.”

However, “if the lead bank does not arrange for a buyout, the dissenting lenders shall have the right, but not the obligation, to arrange for buyout of the facilities of all the other lenders at a value that is equal to 125 per cent of the liquidation value or the resolution value — whichever is higher.”

Dissenting creditors can also exit by selling their loans to any entity at a price mutually arrived at between the lender and buyer. The agreement has a standstill clause wherein all lenders are barred from enforcing any legal action against the borrower for recovery of dues. During the standstill period, lenders are barred from transferring or assigning their loans to anyone except a bank or finance company. But it is not clear if a loan can be sold to an asset reconstruction company during that period.

The standstill provision will be operative for 180 days from the reference date — the RBI had asked lenders to resolve their restructured loans within 180 days beginning March 1 or refer those to the bankruptcy court. However, the provision would not prevent lenders from acting against borrowers or directors for criminal offence. Lenders are in the process of getting this inter-creditor agreement approved by their boards.

Benefits:

• Such an agreement may persuade banks to embark more quickly on a resolution plan for stressed assets.

• It is an improvement over the earlier model, which replied solely on the joint lenders' forum to arrive at a consensus among creditors. It is, in fact, logical for joint lenders who want to avoid a deadlock to agree on the ground rules of debt resolution prior to lending to any borrower. But the obligation on the lead lender to come up with a time-bound resolution plan can have unintended consequences.

Challenges:

• The biggest obstacle to bad loan resolution is the absence of buyers who can purchase stressed assets from banks, and the unwillingness of banks to sell their loans at a deep discount to their face value. Unless the government can solve this problem, the bad loan problem is likely to remain unresolved for some time to come.

Elected directors

2019: RBI’s guidelines

August 3, 2019: The Times of India

PSBs can’t push people of choice on their boards

Mumbai:

Public sector banks (PSBs) will not be able to manoeuvre people of their choice into board positions with the Reserve Bank of India (RBI) tightening fit and proper guidelines for the position of elected directors. The central bank on Friday came out with new master directions on fit and proper guidelines for elected directors on the board of PSBs. Elected representatives such as members of Parliament, or state legislature or municipal corporation or local bodies cannot be shareholder representatives on bank boards.

The rules explicitly bar board members of the RBI or any bank, financial institution, insurance company or bank holding company. The new rule also requires that the candidate should not have served on the board of a bank, financial institution or insurance company for six years. Individuals who are connected with hire purchasing, financing, money lending, investment, leasing or para banking activity are also not considered eligible, as also are stock brokers.

Shareholders of PSU banks are required to elect two to three directors, depending on the level of public shareholding. Although there are directors by investors, these board members have typically been chartered accountants or other professionals with business contacts with the banks.

To keep out political appointees, RBI requires all PSBs to have a nomination and remuneration committee (NRC) with at least three non-executive directors. Of these, half should be independent and should include at least one member from the risk management committee of the board to determine the ‘fit and proper’ status of candidates for the board.

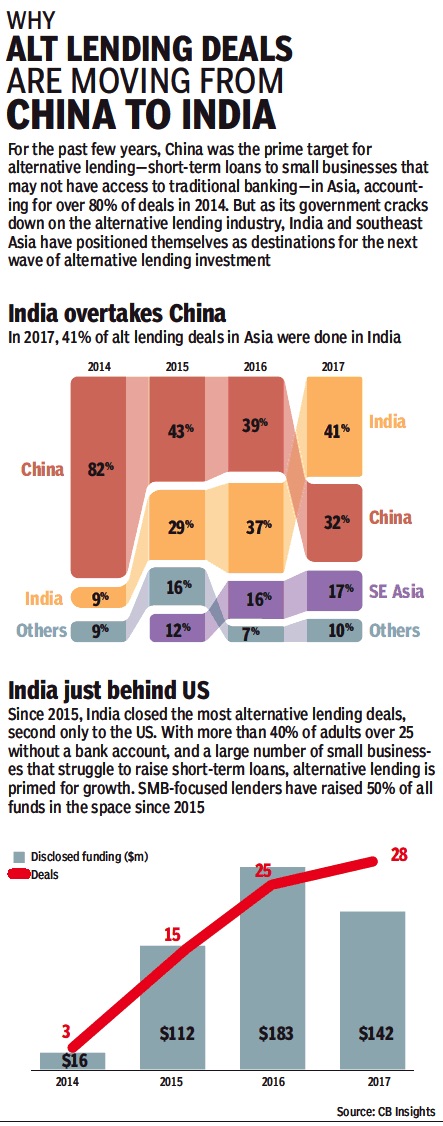

Alternative lending

2014-17

i) India overtakes China

ii) India just behind US

From: August 5, 2018: The Times of India

See graphic :

Alternative lending deals, 2014-17

i) India overtakes China

ii) India just behind US

Attrition rate among bankers

2023

From: August 14, 2024: The Times of India

See graphic:

The Attrition rate among bankers In India and other large economies, presumably as in 2023

Borrowers

Women borrowers/ 2021

Prabhakar Sinha, March 9, 2022: The Times of India

NEW DELHI: Women are proving to be better borrowers since they display higher credit consciousness and better credit scores as compared to their male counterparts, a study by TransUnion CIBIL revealed. As of 2021, 53% of the 54 million women borrowers had a CIBIL score in the prime category (with credit scores of 731-770) and above compared to 47% for men.

The delinquency rate for women borrowers was pegged at 5.2% across retail credit products, compared to 6.9% for their male counterparts.

Besides, the report pointed out that women borrowers were increasing at a faster pace in recent years — 29% annually. They accounted for 29% of the borrowers, compared with a quarter of the borrowers in 2016.

The outstanding loan amount also increased at 20% compounded annually (CAGR) to Rs 12.4 lakh crore which is 23% of total outstanding retail credit balances in 2021 from Rs 5 lakh crore or 21% in 2016.

Banks see women as a huge target segment as credit penetration, despite doubling to 12% between 2016 and 2021, remained low.

The report also said that the growth in women borrowers has remained strong during the pandemic, with women borrowers showing a stronger growth at 11% compared to the 6% of male borrowers through 2021. TransUnion CIBIL insights also indicated the expansion in the footprint of women borrowers in the semi-urban and rural locations, with a CAGR of 21% between 2016 and 2021 as compared to 16% growth in metro and urban regions.

Branches

Rural/ 2011-21

From: March 28, 2022: The Times of India

See graphic:

Private vis-à-vis PSU banks: Rural Branches/ 2011-21

CEOs’ turnover

2008-18

Govt banks see higher CEO churn than pvt sector peers, December 1, 2018: The Times of India

From: Govt banks see higher CEO churn than pvt sector peers, December 1, 2018: The Times of India

See graphic:

The turnover of the CEOs of selected public-sector and private banks, presumably as in 2008-18

PSU banks have a higher turnover of CEOs compared to their private sector peers. In the last decade, five PSU banks have had six CEOs, meaning that the average tenure has been less than two years. Analysts say such quick changes impact governance and the ability of a bank to take strategic long-term initiatives. Bank chiefs are also unwilling to take decisions on tricky issues and are happy to kick the can down the road.

CEOs’ salaries

2017

HIGHLIGHTS

SBI chief Arundhati Bhattacharya took home Rs 28.96 lakh in 2015-16.

In comparision, ICICI CEO Chanda Kochhar received a basic salary of Rs 2.66 crore in 2015-16.

Such high disparity in compensation impacts the motivation of public sector managers who have to fiercely compete with private sector peers.

SBI, one of the world's 50 largest banks, pays only a small fraction to its top management as compared to private sector players like ICICI Bank and HDFC Bank.

Former RBI governor Raghuram Rajan had flagged the low remuneration issue last August saying it makes difficult for state-owned banks to "attract top talent, especially a lateral entry".

SBI chairman Arundhati Bhattacharya took home Rs 28.96 lakh last fiscal, which is pittance when compared to remuneration of her counterparts in private banks receive, according to analysis of annual reports of various banks.

In comparison, ICICI Bank MD and CEO Chanda Kochhar received a basic salary of Rs 2.66 crore last fiscal besides Rs 2.2 crore performance bonus to be paid over the next few years. In addition, she received allowances and perquisites of over Rs 2.43 crore.

The total compensation received by Kochhar in FY17 stood at Rs 6.09 crore.

Similarly, Shikha Sharma, MD and CEO of Axis Bank, took home a basic salary of Rs 2.7 crore, and Rs 1.35 crore as variable pay, besides host of perks and allowances like Rs 90 lakh HRA.

Yes Bank MD and CEO Rana Kapoor, who also happens to be promoter of the bank, took home Rs 6.8 crore as salary in 2016-17.

HDFC Bank's managing director Aditya Puri saw his remuneration rise marginally to Rs 10 crore and exercised stock options worth over Rs 57 crore during the last fiscal.

Speaking about public sector banks at a banking conference in Mumbai, Rajan had said state-owned banks tended to overpay at the bottom but underpay their top executives.

He jokingly said he himself was underpaid and the disparity made it harder to attract talent from outside at the top level in public sector banks.

On the business front, SBI, after merger with its subsidiary banks, caters to 42.04 crore customers with a market share of 23.07 per cent and 21.16 per cent in deposits and advances, as opposed to 18.05 per cent and 17.02 per cent respectively, before the merger.

Punjab National Bank, the nearest rival of SBI among PSBs post merger, will have a market share of 5.96 per cent, and 7.04 per cent in deposits and advances.

Remuneration comprises various components, including basic salary, allowances and perquisite, PF, superannuation allowances, gratuity and performance bonus and payment of performance bonus is deferred over a multi-year period.

Not only such high disparity in compensation makes it difficult for the government to hire top managers laterally at public sector banks, as pointed out by Rajan, it also impacts the motivation of public sector managers who have to fiercely compete with their private sector peers.

2018

Highest-paid Indian banker Aditya Puri gets 4% pay cut, June 17, 2018: The Times of India

From: Highest-paid Indian banker Aditya Puri gets 4% pay cut, June 17, 2018: The Times of India

HDFC Bank CEO Aditya Puri, who has been the highest-paid Indian banker for years, has seen a small dip in overall remuneration to Rs 9.6 crore in FY18 from Rs 10 crore in FY17 despite the bank’s net profit rising 20% to Rs 17,487 crore.

The compensation could change if the central bank approves a higher performance bonus. According to information in the bank’s annual report, bonus for FY17 has not been paid out as it is pending RBI approval and therefore not disclosed. In FY17, he had received a performance bonus of Rs 92 lakh.

The ratio of Puri’s salary to that the median is 209:1. However, his salary has not increased in line with the 8.9% average percentage increase for key managerial personnel and non-managerial staff. Puri holds around 0.13% stake in the bank, which is worth about Rs 687 crore. Puri, who has led the bank for 24 years, is credited with creating the country’s most valuable financial institution, which is today worth nearly Rs 5.3 lakh crore.

Uday Kotak, founder and CEO of Kotak Bank, received compensation of Rs 2.92 crore in FY 18 (Rs 2.63cr last year), which is 48.44 times the median salary in the bank. However, despite the relatively modest salary, Kotak ranks 104 in the Bloomberg Billionaire Index with assets worth nearly Rs 76,000 crore because of his 29.75% holding in the bank.

Yes Bank CEO Rana Kapoor’s total remuneration for FY18 stood at Rs 5.35 crore compared to Rs 6.81 crore in FY17. This was despite the bank’s net profit rising nearly 27% to Rs 4,224 crore in FY18. His salary is 79 times the median salary in the bank. Kapoor’s individual shareholding in the bank is worth Rs 3,306 crore.

Shikha Sharma, MD & CEO of Axis Bank, has seen her salary dip marginally to Rs 2.90 crore from Rs 2.94 crore in the previous year. This does not include other perks such as HRA, deferred variable pay and company contribution to provident fund. Her remuneration is 77.6 times the median.

ICICI Bank is yet to publish its annual report for FY18. The bank’s CEO Chanda Kochhar received total remuneration of 5.54 crore in FY17 which was 112 times the median. As compared to the private sector, public sector bank chiefs receive modest salaries. For instance, the chairman of SBI, the country’s largest bank, received compensation of Rs 14.25 lakh for the second-half of FY18 after he took charge mid-year. However, analysts point out that public sector banks have a higher wage to income ratio because of higher entry level salaries and also because private sector banks score higher in terms of productivity.

2019: 50% of CEOs’ pay to be variable: RBI

Nov 5, 2019: The Times of India

50% of bank CEOs’ pay to be variable: RBI

TIMES NEWS NETWORK

Mumbai:

Top executives in banks will have to receive half their salary in the form of variable pay which will be linked to their bank’s performance, according to new rules announced by the RBI on Monday. The variable pay itself will be capped at 300% of the fixed pay and will include equity compensation.

The inclusion of equity in variable pay and the cap on variable pay would mean that bonuses will be limited, and will include non-cash compensation.

The new guidelines announced by the central bank will be effective from April 1, 2020. These guidelines apply to private sector banks, local area banks, small finance banks and payment banks. They will also apply to multinational banks that have incorporated locally as wholly owned subsidiaries.

Besides chief executives, the restriction on salaries will apply to senior executives, including whole-time directors, and other employees who are risk-takers such as bond traders. RBI has said that if bonuses are paid in cash, at least half of the cash bonus should be deferred if the total amount is over Rs 25 lakh.

If the variable pay is up to 200% of the fixed pay, at least 50% of it must be non-cash, and if the variable pay is above 200%, 67% of it should be paid via non-cash instruments.

In addition to deferring the bonuses, RBI has asked banks to have ‘clawback’ clauses which enable them to recover past bonuses if the executive’s actions result in losses for the bank. The policies determining compensation will have to be laid out by the board of each bank. “The policy should cover all aspects of the compensation structure such as fixed pay, perquisites, performance bonus, guaranteed bonus (joining/sign-on bonus), severance package, share-linked instruments such as employee stock option plan (ESOPs), pension plan and gratuity taking into account these guidelines,” said RBI.

“Banks shall identify a representative set of situations in their compensation policies, which require them to invoke the clawback clauses that may be applicable on entire variable pay,” RBI said.

“The compensation practices were one of the important factors which contributed to the global financial crisis in 2008. Employees were often rewarded for increasing short-term profit without adequate recognition of the risks and long-term consequences that their activities posed to the organisations,” RBI said in its note to banks announcing the new rules.

According to RBI, it was these perverse incentives that amplified excessive risk-taking that severely threatened the global financial system. “The compensation issue has, therefore, been at the centre stage of regulatory reforms,” RBI said.

2019

From: Nov 5, 2019: The Times of India

See graphic:

What bank CEOs earned in 2019

Cheque bouncing

Incidence

As of 2024

Dec 28, 2024: The Times of India

From: Dec 28, 2024: The Times of India

New Delhi : There are 43 lakh cases of cheque bounce pending in various courts across country as of Dec 18. Rajasthan tops all states and UTs with more than 6.4 lakh such cases pending, followed by Maharashtra, Gujarat, Delhi, UP and Bengal.

Traffic challans and cheque bounce cases together account for a large number of pending cases in courts across India. While govt has started the option of paying traffic challans through virtual courts, cheque-bounce cases are dealt in regular courts given the criminal nature of cases where evidence recording and witness submissions is involved.

Law minister Arjun Ram Meghwal recently informed in a written response in Parliament on Dec 20 that several factors lead to delay in dispos- al of cases related to cheque bounce, including frequent adjournments and lack of ad- equate arrangement to monitor, track and bunch cases for hearing, besides lack of prescribed time frame by respective courts for disposal of various kinds of cases.

“The disposal of cases in courts is contingent upon many factors, which include availability of physical infrastructure, supporting court staff, complexity of facts involved, nature of evidence, cooperation of stakeholders viz bar, investigation agencies, witnesses and litigants & proper application of rules and procedures,” he said.

Given the long delay in disposal of such cases, Supreme Court had in an order dated March 10, 2021, constituted a 10-member committee to study steps that must be taken to facilitate an early disposal of cases under Negotiable In- struments Act.

The committee suggested creation of de novo special negotiable instruments court. The amici curiae in the matter suggested a pilot study in five judicial districts with the highest pendency in five states (Maharashtra, Rajasthan, Gujarat, Delhi and UP) so that viability of the scheme can be examined.

In another order of May 19, 2022, the apex court directed that the pilot study shall be conducted in the manner indicated in the said order for a duration of one year in 25 special courts, one in each of the five judicial districts which have been identified as having the highest pendency by the respective five high courts. No further details were available on the progress of the court findings.

Court judgements

Cheque bounce convict can make deal, avoid jail: SC

AmitAnand Choudhary, Sep 3, 2025: The Times of India

New Delhi : A person can avoid a jail term after being convicted in a cheque bounce case if they reach a compromise with the complainant, Supreme Court said, holding that once a compromise deed is signed between the parties, conviction under Section 138 of Negotiable Instruments Act cannot be sustained.

A bench of justices Aravind Kumar and Sandeep Mehta said the offence of dishonour of cheque was mainly a civil wrong and had been made specifically compoundable. “This court referred the offence under Section 138 NI Act as a Civil Sheep in Criminal Wolf ’s Clothing which meant issues agitated by the parties under the said provision are of private nature which are brought within the sweep of criminality jurisdiction in order to strengthen the credibility of the negotiable instruments,” the bench said while referring to an earlier verdict of the apex court.

The court set aside a Punjab and Haryana HC ruling that had refused to quash conviction in a cheque dishonour case after settlement between the parties.

SC said when parties enter into an agreement and compound the offence, they do so to save themselves from the process of litigation. Hence, courts cannot override such compounding and impose its will, it said.

“Once the complainant has signed the compromise deed accepting the amount in full and final settlement of the default sum, the proceedings under Section 138 of the NI Act cannot hold water; therefore, the concurrent conviction rendered by the courts below has to be set aside,” SC said. “...The legislature by virtue of Section 147 of NI Act has made it compoundable notwithstanding provisions of Code of Criminal Procedure, 1973.”

Cheque usage

2019/ India lags most countries in reducing use

June 5, 2019: The Times of India

From: June 5, 2019: The Times of India

India lags most countries in reducing cheque use

Mumbai:

India lags other countries in the shift to a more efficient electronic payment system from a costly cheque clearance. One reason for this is that a relatively lower number of people use the direct debit option to make recurrent payments and instead issue cheques every month. A report by the RBI, which compares the country’s advancement in payment systems with others on various parameters, has identified several areas where India is in a weak spot. This includes per capita number of card swipe machines, the availability of a common card for transportation, share of debit and credit cards in payment systems. Despite having a high level of cash, the ATM penetration in India is still lower than in other countries.

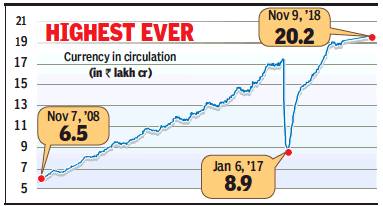

One area where the country has made progress is reducing dependency on cash. India had a high cash in circulation at 12% of gross domestic product (GDP) with only Japan and Hong Kong being higher. Demonetisation and an active growth in GDP brought down the active cash in circulation as a percentage of GDP to 8.7% in 2016 which increased to 10.7% in 2017.

The report said that in most countries cheques have disappeared or are dying a slow death. India’s cheque volume declined by 10.8% between 2012 and 2017 at a compounded annual growth rate of -2% — the second slowest after Turkey. The US and Brazil, which had a higher volume of cheques in 2012, showed a sharper decline. “In India, the year-on-year growth in 2016 was 10%, which can be attributed to demonetisation where all modes of payment showed an increase. However, 2017 saw a small decline of 2.9% over the previous year,” the RBI said.

Ironically, India’s failure to move people away from cheques is also attributed to its success in cheque handling. India has an efficient T+1 settlement system (cheques are cleared in a day) and cheques processing is mechanised. Standardisation of cheque forms and cheque truncation system (CTS) enable the clearing to be done using an image of the cheque rather than moving it physically. On the positive side, India is ahead of others in payment laws, regulation, customer safety and authentication standards.

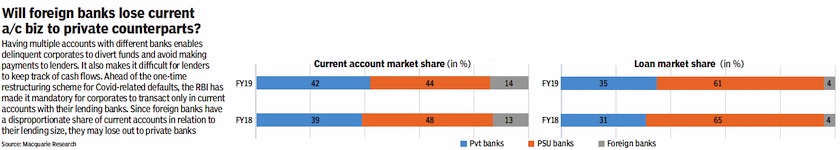

Corporate banking

2016-18: PSBs lose ground

July 11, 2019: The Times of India

From: July 11, 2019: The Times of India

Nationalised banks are losing market share to private banks not just in deposits and credit, they are also rapidly losing their position as lead bank — the lender which calls the shots in lending to businesses — in many corporate relationships. While most corporates have multiple banking relationships, they can have only one bank which sets the terms and conditions for credit facilities.

According to report by Greenwich associates, HDFC Bank and SBI top the list as lead bankers for corporates. Each of these two banks is used for corporate banking services by roughly three-quarters (75%) of large Indian companies. Close behind is ICICI Bank, with a market penetration score of 71%. These three banks also secure the top spots among middle-market banking companies, with HDFC Bank in first place and ICICI and SBI tied in the No. 2 spot.

The report said that weak balance sheets and other immediate challenges like bad loans are preventing PSU banks from making long-term IT investments, which are needed to compete for wholesale banking business in the future. This comes at a time when needs of businesses are getting more complex and they are looking for value-added services. The loss of lead bank status has implications for retail businesses as well as many private banks offer attractive ‘salary account’ schemes for corporates where they are lead banks.

Among foreign banks, Standard Chartered Bank and Citibank are tied with a market penetration of 51–54% among large Indian corporates, followed by HSBC at 50%. In the middle-market space, among foreign banks, HSBC ranks first, StanChart second and Citi a close third.

The nationalised banks (PSBs excluding SBI) have been losing marketshare because almost half of them were placed under prompt corrective action (PCA) by the RBI last year.

Corruption/ vigilance cases

2017-20

Six bank chiefs facing CBI, ED probe, says govt, February 11, 2020: The Times of India

From: Six bank chiefs facing CBI, ED probe, says govt, February 11, 2020: The Times of India

The CBI and ED are investigating cases against half-a-dozen managing directors and CEOs of commercial banks, although no arrests have been made so far, the government informed Parliament.

Separately, the CBI has sought prosecution of over 800 PSB staff, including presidential appointees such as chairmen, MDs and executive directors of state-run entities since 2017. In 139 cases, the government had declined request for prosecution, the finance ministry said in LS.

The ministry, however, was silent on whether the probe involved serving or former top bankers. Apart from former ICICI Bank CEO and MD Chanda Kochhar, ex-PNB chief Usha Ananthasubramanian, United Bank’s former CMD Archana Bhargava and ex-UCO Bank boss Arun Kaul are among those facing investigation. An inquiry need not translate into prosecution.

“Through extensive reforms, change in credit culture has been instituted and controls have been tightened for every stakeholder in the financial system, which has enabled a tighter check on corruption and decline in occurrence of frauds,” the government said in the House.

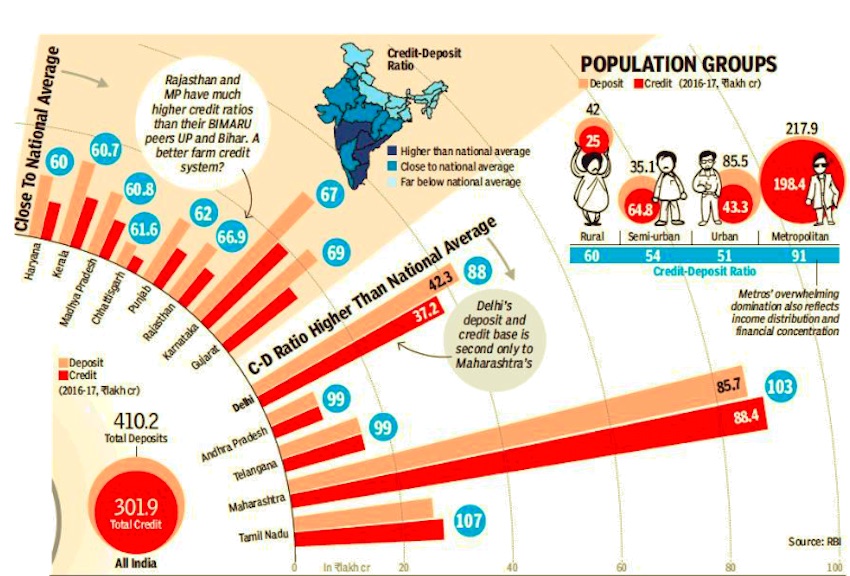

Credit-deposit ratio

2016-17

February 3, 2018: The Times of India

See graphics:

1. State-wise deposit and credit of scheduled commercial banks, 2016-17-I

2. State-wise deposit and credit of scheduled commercial banks, 2016-17-II

From: February 3, 2018: The Times of India

From: February 3, 2018: The Times of India

ARE BIHAR’S DEPOSITS FUNDING TAMIL NADU’S GROWTH?

Banks help convert people’s savings into investment, which in turn creates employment, income and assets. The process of conversion is called credit creation in which banks lend money to businessmen, farmers and consumers who need loans and are creditworthy. States with higher credit demand and more creditworthy people convert higher share of deposits into credit and have a high credit-deposit ratio. States with low credit-deposit ratios are those whose income, savings or both are higher than their investment needs — mostly the poor ones. India’s average credit-deposit ratio is 73.6

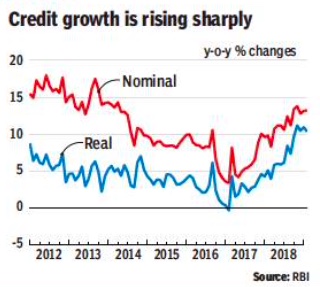

2008-18

August 20, 2019: The Times of India

From: August 20, 2019: The Times of India

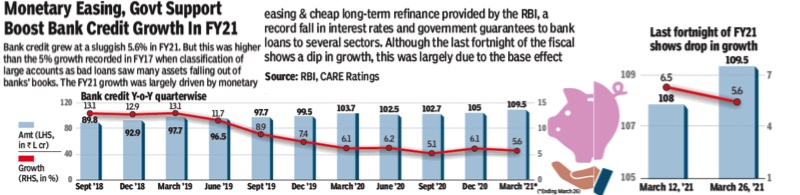

Credit has to expand 18-20% for India to become $5tn eco

Required Growth Rate Was Last Achieved In Fiscal 2010-11

TIMES NEWS NETWORK

Mumbai:

annual credit growth in the range of 18-20%. This kind of growth was last seen following the stimulus in FY11, when bank credit grew 21.5%.

In the case of new-to-credit borrowers, 59% of disbursement in these sectors came from NBFCs.

bankers say that there isn’t much of private investment demand and most of the credit demand is from retail and government investment in infrastructure.

According to Amitabh Chaudhry, MD & CEO of Axis Bank, all the high-frequency indicators point to things being tough. “Sales are down and working capital cycles are getting longer and bankers have to be cautious,” he said. The opportunities were largely among businesses that have managed to deleverage, he added.

In the last decade, credit growth ranged from a low of 8.2% in FY17 to 21.5% in FY11. The highest growth in bank credit after liberalisation was 37% in FY06. As on August 2, 2019, the year-on-year bank credit growth was 12%, while the year-to-date credit growth was negative.

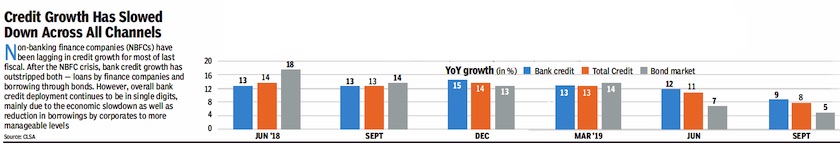

Credit growth

2000-16

`At 5.1%, credit growth slide reaching a point of no return', Jan 06 2017: The Times of India

Growth of bank credit fell to a multi-decade low of 5.1% for the fortnight ended December 23, as drying up of demand in the last two months of the year saw businesses cutting down on borrowing. Data released by RBI showed that as of December 23, bank lending to busines ses, individuals and the farm sector stood at Rs 73.48 lakh crore, an increase of 5.1% over the same period of last year.Going by readily available RBI data, this is the slowest rate of growth since 2000.

SBI chief economist Soumya Kanti Ghosh went further to say that credit growth was actually the lowest in over 60 years -since 1954-55 -when it had slowed to 1.7%. A slowdown to 5.1% in De cember seems to indi cate that credit growth is reaching a point of no return in this financial year.While there is marginal growth year-on-year, on a yearto-date basis (from April 2016) credit has declined in many sectors,“ said SBI chief economist Soumya Kanti Ghosh.Year-on-year credit growth in the previous fortnight ended December 9 was also a low 5.76%.

D K Joshi, chief economist at Crisil, the country's leading credit rating agency , attributed the drop in credit growth to the disruption caused by demonetisation. “Otherwise there was no reason for credit growth to fall. The economy was looking up, there was the pay commission hike, there were good rains, and some interest rate cuts were being passed on to borrowers, which would have created more demand for credit,“ he said.

The second half of the year is when banks advance the bulk of their loans. A slow down at this time will hurt growth targets, said economists. “Demonetisation has hurt activity across all corners of the economy . Purchasing Managers Index (PMI) data shows that both manufacturing and services have contracted in December. The PMI order-to-inventory ratio suggests that upcoming manufacturing activity will also remain weak. Input prices have been rising, but have not yet been passed on to final prices, suggesting that corporate margins have worsened,“ said Pranjul Bhandari, chief economist, HSBC India in a report.

According to Jefferies In dia, an investment bank, credit growth could slip to 6% in FY17. “Deleveraging of corporate balance sheets, halt in fresh capex, and increased access to corporate bond market have led to a negative growth in banks' credit to corporates.Given that 56% of bank loans and 88% of non-performing assets are with large borrowers, they hold the key to bank credit growth pick-up and asset quality improvement,“ the research firm said in a report.

RBI numbers show that corporate loans are shrinking.Since end-September bank loans have shrunk by Rs 1.72 lakh crore (2.3%). The sectors which saw a slowdown or drop in credit include infrastructure, food processing, chemical and chemical products, all engineering, textiles and basic metal and metal products.

Although very little fresh investment was taking place even before demonetisation, there was a consumption push. Crisil's Joshi expects consumption-led growth to return because of “some of the measures likely in the Budget, lower interest rates and if we have good rains. The next fiscal year will see a pick-up. But it will not happen in the January-March quarter.“

The silver lining appears to be the gains to the government from demonetisation.“We continue to expect the Income Disclosure Scheme II to net around Rs 1 lakh crore of tax. At the same time, we have cut our estimate of RBI dividend from black cash money not returned to banks to Rs 50,000 crore from Rs 95,000 crore earlier with the bulk (of demonetized currencies) depositedexchanged,“ said Bank of America Merrill Lynch in a report.

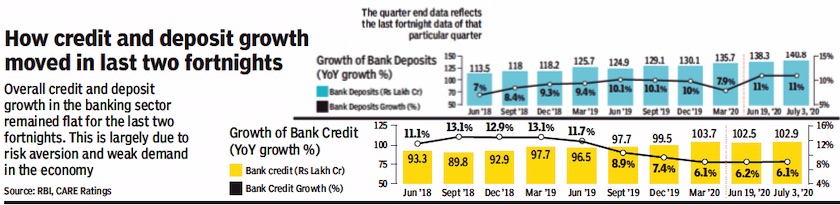

2000-2020

From: August 17, 2020: The Times of India

See graphic:

Credit and deposit growth in India, 2000-2020.

2012-18

From: May 22, 2019: The Times of India

See graphic:

Share of credit growth, 2012-18

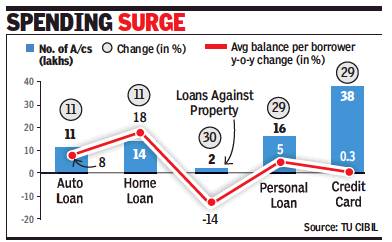

2017>2018: Consumer loan growth exceeds overall credit

Consumer loans beat overall credit, March 29, 2019: The Times of India

From: Consumer loans beat overall credit, March 29, 2019: The Times of India

Unsecured Loans Grow Twice As Fast As Total Borrowing

Unsecured personal loans, which are availed for consumption, have emerged the fastest growing segment in bank lending.

According to borrower data analysed by TransUnion CIBIL, loans outstanding under credit cards, personal and consumer durable loans grew

31.3% year-on-year as on December 2018. This is more than double the 15% year-on-year growth recorded by overall bank credit.

The TU CIBIL Industry Insights Report (IIR) shows consumer credit market continued to expand over the past year thanks to strong growth in these unsecured segments. As against this the secured lending category — loans against property (LAP), auto and housing — experienced more moderate total balance growth. But even these segments grew at a robust rate of 21.8%, 17.4% and 17.1%, respectively.

Also, while default rates remained relatively stable across most major consumer lending categories, loans against property have seen a 53-basis point rise in serious delinquencies. Auto loans have been an exception with serious delinquency rates dropping 116 basis points to 2.8%. Serious delinquency rates are measured as the percentage of loans that are overdue for 90 or more days.

“Consumer credit continues to be a key driver for the Indian economy. Although GDP growth has decelerated in recent quarters, the rate of overall consumer lending growth in India is still significantly higher than for most other major economies in the world,” said Yogendra Singh, vice-president of data science and analytics for TransUnion CIBIL. One reason for the sharp growth in this unsecured segment is the improved ability of lenders to provide loans for the non-salaried new-to-credit segment by using fresh data sources and analytical tools.

2015-18, Jan: high growth, though from low base (in 2018)

Mayur Shetty, Bank credit grows highest in 2 yrs, January 18, 2018: The Times of India

From: Mayur Shetty, Bank credit grows highest in 2 yrs, January 18, 2018: The Times of India

See graphic':

Bank credit growth rate (%), 2015- 2018, Jan

Outstanding bank credit has touched Rs 82.06 lakh crore, recording a yearon-year growth of 11.1% — the highest since February 2016. Bankers attribute the surge to a lower base following absence of credit offtake during demonetisation coupled with incipient recovery in demand for loans.

For the same period, nonfood credit growth has touched almost 12% — the highest since April 2015 — partly due to an increase in demonetisation. Non-food credit represents bank loans other than those advanced to Food Corporation of India for grain procurement.

Data released by the Reserve Bank of India showed that outstanding non-food bank credit stood at Rs 81.5 lakh crore, an increase of 11.96% over the last 12 months.

Compared to this, outstanding bank deposits of Rs 109.97 crore were up only 4.5% over the same period last year. The deposit growth rate was, however, higher than the preceding three fortnights.

According to SBI chief economist Soumya Kanti Ghosh, there are signs of a pickup in the economy.

“The latest IIP (index of industrial production) numbers confirm that few of the manufacturing sectors are pushing growth rate up. These are sugar, cement, steel, commercial vehicles, passenger vehicles and two-wheelers. Numbers suggest that some sectors are actually showing green shoots,” Ghosh pointed out.

“While some element of the base effect may be there, I believe that there is traction in terms of growth momentum. For instance, the SBI composite index shows that industrial production for December 2017 is also likely to come out strong,” said Ghosh.

Some bankers say that the surge in yields in end-December could have resulted in some corporates shifting to the loan market from money market instruments. In 2017, a large chunk of funding came from money market instruments like commercial paper and short-term bonds. The rise in bond yields is seen as a pointer to hardening interest rates.

Ghosh, however, rules out a rate hike by the central bank. “I don’t think that rate hike is an overarching feature. Economic growth is at an incipient stage and inflation is still under control,” he said.

2016-17: Lowest growth since 1953

From: Mayur Shetty, At 5.1%, FY17 bank credit growth lowest in over 60 yrs , April 15, 2017: The Times of India

Hit By Bad Loans, Sluggish Corporate Investments, DeMon

Growth in bank credit in FY17, at 5.1%, has turned out to be the slowest in over 60 years as state-owned banks burdened with bad loans struggled to find safe avenues to lend. The last time loans grew slower than this was in 1953-54 when bank credit growth had slowed down to 1.7%.

According to data released by the RBI, outstanding bank credit as on March 31, 2017 stood at Rs 78.82 lakh crore. A large part of the growth in lending has come in the last fortnight of the month when banks disbursed Rs 3.16 lakh crore. But even after this last-minute surge, loan growth for the whole year was 5.1% as against 10.3% last year.

Other than bad loans and corporate investment coming to a standstill, bank credit growth was also constrained by demonetisation. Between October and December 2016, bank credit contracted by 2.3% as against a 2.7% growth during the same period last year.

Besides bad loans, one of the biggest concerns for the RBI is managing the surplus liquidity with banks. While on the one hand banks are seeing lower credit growth, on the other their deposits continue to remain high, again thanks to demonetisation.

Banks have ended the year with an 11.8% growth in deposits, which now stand at more than Rs 108 lakh crore. Some bankers feel that the RBI is reluctant to intervene in the forex market as this would add to the surplus liquidity in the system.

According to a senior banker, of the total credit growth during the current fiscal, half has come from home loans and alarge part of the rest has been due to loans to the service sector. Most of the lenders are private banks and a few large private banks. Other than them, most public sector banks are likely to report flat credit growth for FY17.

One fallout of the slow down in credit is that banks will report a higher percentage of bad loans. Growth in credit helps to mask the level of bad loans. With bad loans at close to 10% of their total assets, many banks face a catch-22 situation. The RBI's prompt corrective action may make it difficult for banks to expand their balance sheet.The absence of fresh lending would, however, make it difficult for banks to generate revenues to clean up their books.

“With asset quality pressures, banks -especially the weaker public sector banks (PSBs) -have been reporting a continuous degrowth in their net interest income (NII) over the five consecutive quarters of Q3FY2016 to Q3FY2017, mainly on account of slower credit growth and reversal of interest income recognised on NPAs“ ratings agency ICRA said in a report.

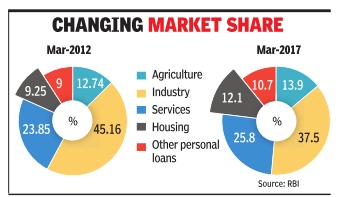

Credit growth, sector-wise: 2016-17

Mayur Shetty, Home loans biggest driver of credit growth, May 2, 2017: The Times of India

Grow 16% Over Five Years As Loans To Corp Slow To 6.7%

Over the last five years home loans have recorded the highest compounded annual growth rate (CAGR) of over 16% and now account for over 12% of all bank credit.Overall credit to industry during the same period has slowed to single digits at 6.7% after a negative growth this year.Though the share of loans to industry in March 2017 were still hight at 37.5%.

According to data on sector credit released by the RBI, bank credit to industry as on March 31, 2017 stood at Rs 26.77 lakh crore which is 2% lower than outstanding bank credit of Rs 27.30 lakh crore as on end-March 2016. This has resulted in the slowest growth in bank credit in decades.

The main driver of bank credit in 2016-17 has been home loans which stood at Rs 8.60 lakh crore, 15% higher than Rs 7.46 lakh crore as on endMarch 2016. The share of housing which was 9.26% on March 2012 has been rising over the years. The last time bank credit to housing was in double digits was in 2009, when the government introduced special schemes to boost demand in the wake of the global financial crisis. “Between FY12-FY16 bank credit registered double digit growth, barring in FY15 when credit grew by 9%. However, growth in bank credit slowed to 5% in FY17. The slowdown has mainly been on account of banks stressed with bad loans, stagnant corporate investment environment and some migra tion to the debt market,“ said Madan Sabnavis, chief economist, CARE Ratings.

The slowdown in lending to industry is largely because of PSBs which have reduced their exposure to corporates.After home loans, credit card outstandings are the fastest growing segment which have grown at a CAGR of 20% over the last five years. However, they account for less than 1% of bank credit and are one of the smallest components of lending to the personal segment -smaller than education and auto loans.

December 22, 2017: Bank credit growth in double digits

From: Mayur Shetty, Bank credit growth hits double digits for first time since Sept ’16, January 6, 2018: The Times of India

Bank credit has grown in double digits for the first time since September 2016 driven by home loans and advances to traders and finance companies.

According to RBI data, the loan book of the banking sector stood at Rs 80,967 crore as on December 22, 2017 — an increase of 10.7% from the same period a year ago. The last time bank credit was above 10% was on September 30, 2016 when year-on-year advances grew 11.83%. A month later the government announced demonetisation which led to a prolonged slump in credit growth. For the whole of 2017, bank credit growth was only in single digits.

On the commercial end, Banks have been lending to trade and to non-banking finance companies. Besides shrinking demand for credit, demonetisation also brought down interest rates sharply. This resulted in large corporates replacing loans with borrowings by issuing debt. While lenders do invest in debt, these investments are not reflected in credit numbers. Besides banks, mutual funds have also invested a significant amount in corporate bonds.

The growth in the loan book of banks during the current fiscal (up to December 22) has been Rs 2,55,260 crore. In the same period last year, it was Rs 67,780 crore. Overall bank credit stood at Rs 80,967 crore as on December 22.

A break-up of the sectoral deployment of bank credit up to November-end shows that 40% of the incremental loans went to services sector, which included loans to trade and non-banking finance companies. Almost half (47%) of the incremental bank loans went to the personal segment. Loans to the housing segment grew at 13.1% with the homeloan books of banks growing by Rs 10,680 lakh crore to Rs 9,22,210 crore. The highest growth was recorded by credit card advances which rose 37% to Rs 63,700 crore.

Although bank credit to industry accounts for 36% of the total loan book, it is only 4.5% of the incremental credit. Overall credit to industry has grown by only 1%.