Canada- India economic relations

This is a collection of articles archived for the excellence of their content. |

=Business relations

2019 – 2023

From: Sep 20, 2023: The Times of India

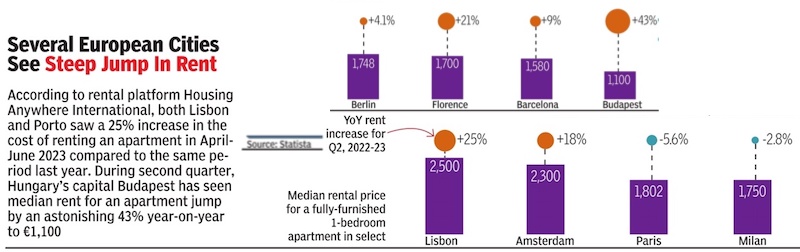

See graphic:

Canada – India business relations, 2019 – 2023

Trade, agriculture imports

2020-23

Harish Damodaran , Udit Misra, Sep 22, 2023: The Indian Express

India’s total trade with Canada in the last (2022-23) financial year was $8 billion — that’s 0.7% of India’s total trade ($1.1 trillion) with the world. The share has remained this way at least for the past five years, even though the export and import numbers have gone up and down, especially during the Covid year.

Bilateral trade has also been fairly evenly balanced; in 2022-23, for instance, roughly $4 bn of imports were matched by $4 billion of exports even though India enjoyed a tiny trade surplus of $58 million.

Among what India imports from Canada, three categories of goods dominate and account for 46% (that is, almost half) of the total import by value. These are:

1. Mineral fuels, mineral oils and products of their distillation; bituminous substances; mineral waxes.

2. Pulp of wood or of other fibrous cellulosic material; waste and scrap of paper or paperboard

3. Edible vegetables and certain roots and tubers

The top three exports, on the other hand, accounted for only 30% of the total exports. These were:

1. Pharmaceutical products

2. Articles of iron or steel

3. Nuclear reactors, boilers, machinery and mechanical appliances; parts thereof

The major agri imports from Canada

Canada is important to India as a supplier of two major agri-related commodities.

The first is muriate of potash (MOP), the third most consumed fertiliser in India after urea and di-ammonium phosphate. India’s MOP imports totalled 50.94 lakh tonnes (lt) in 2020-21, 29.06 lt in 2021-22 and 23.59 lt in 2022-23, valued at $1,212.67 million, $990.84 million and $1,405.31 million respectively. Canada’s share in these was 16.12 lt ($383.91 million) in 2020-21, 6.15 lt ($185.13 million) in 2021-22 and 11.43 lt ($680.40 million) in 2022-23. Canada was India’s largest MOP supplier last year, followed by Israel, Jordan, Belarus, Turkmenistan and Russia.

The second major item is masur or red lentil. India is a significant importer of pulses, with masur being the biggest after arhar/tur or pigeon-pea. India’s total masur imports stood at 11.16 lt in 2020-21, 6.67 lt in 2021-22 and 8.58 lt in 2022-23, valued at $622.40 million, $528.74 million and $655.48 million respectively. Canada is India’s largest masur supplier, followed by Australia. Masur imports from Canada stood at 9.09 lt ($505.39 million) in 2020-21, 5.23 lt ($408.89 million) in 2021-22 and 4.85 lt ($370.11 million) in 2022-23.

Dal millers and traders are currently keeping a close watch on the ongoing India-Canada standoff, especially in case of any spillover to masur imports.

Masur has, in recent times, emerged as a substitute for arhar/tur similar to yellow/white peas vis-a-vis chana. In many hotels, restaurants, canteens and even homes, red masur dal is being used in place of yellow arhar, including for making sambar. This makes economic sense, especially when masur dal is now retailing at about Rs 100/kg, as against an average of Rs 160-plus for arhar.

Geopolitical worries apart, there are concerns over even the size of the masur crop in Canada. The 2023 crop now being harvested is pegged at around 15.4 lt, down from last year’s 23 lt. It has already led to landed prices of imported masur climbing to $760-770 per tonne, a jump of $100 in the last one month.

Also, till 2017-18, India used to also be a heavy importer of yellow/white peas, which were a substitute for chana (chickpea). In 2015-16, 2016-17 and 2017-18, India imported 22.45 lt, 31.73 lt and 28.77 lt of yellow/white peas valued at $831.96 million, $1,205.58 million and $921.10 million respectively. Again, Canada was the top supplier at 13.69 lt ($503.20 million) in 2015-16, 17.29 lt ($657.71 million) in 2016-17 and 11.70 lt ($396.14 million) in 2017-18.