Drugs and Pharmaceuticals: India

This is a collection of articles archived for the excellence of their content. Readers will be able to edit existing articles and post new articles directly |

This is a collection of articles archived for the excellence of their content. |

Curbs by four EU nations

December 07 2014

Four European countries decided to suspend marketing authorization of 25 drugs, which had undergone tests at the GVK Biosciences facility European Medicines Agency (EMA) did say in a statement that it is reviewing the findings of non-compliance with good clinical practice at the GVK facility and determining its impact on medicines authorized on the basis of studies performed there. Germany , France, Luxembourg and Belgium have already decided to suspend marketing authorizations of these drugs. EMA's Committee for Medicinal Products for Human Use (CHMP) is now identifying, together with member states of the EU, the medicines covered by the inspection findings. French drug regulator ANSM has said on its website that Belgium, Germany , Luxembourg and France decided to suspend the marketing authorizations for the medicinal products concerned. “Although these documents are not essential to the demonstration of bioequivalence, the ANSM decided, as a precaution, to suspend the marketing authorization of 25 marketed generic drugs.

2008- 2014: Drug launches reduced by 80%

Dec 27 2014 New drug launches drop 80% in 6 yrs

Sushmi Dey

Launches of new medicines in India have come down by nearly 80% during 2008-2014 and drug manufacturers blame price regulations and policy uncertainty for making India an unattractive destination for both domestic as well as multinational pharmaceutical companies. In 2008, 270 new drugs were approved for sale in India, whereas it dropped to 44 and 35 in 2012 and 2013, respectively. In 2014, only 56 new medicines were approved till November, government data shows.

“Most of the big pharmaceutical companies have knocked out India from their list of key markets. The reason is stricter policy measures cutting down on margins, making it less attractive as a business proposition for future growth,” a senior executive in a leading domestic pharmaceutical company said.

A stricter regulatory regime, which not only brings down drug MRPs but also continuously expands span of price control, is cited as the main reason why drug manufacturers are losing their India focus. Industry of ficials also blames looming uncertainty in policy as another reason for companies to delay product launches. Apart from pricing, the pharma industry has been facing hiccups in foreign investment, new drug approvals, as well as clinical trials.

Government and regulators, however, brush aside such concerns. According to a senior official in the National Pharmaceutical Pricing Authority (NPPA), the price regulations are as per the policy and MRPs are fixed based on average price of medicines in that segment. “There is no reason for a particular company to find it unviable when others are making the same drug at a lower price,“ the official said, adding that market surveys show a huge disparity in pric es of similar medicines sold under different brands.

The number of drug approvals peaked in 2008, when as many as 270 new drugs were granted approval, followed by 217 in 2009, 224 in 2010, and 140 in 2011, the data shows.

However, since 2012, when the government released the ent released the National Pharmaceutical Pricing Policy bringing in 348 medicine formulations un der price control, the new drug launches started reducing drastically. “The role of NPPA is to implement the policy in letter and spirit and not create confusion leading to instability in the drug industry,“ another senior industry official said.

Recently, many medicines were also found missing from the market following stringent regulatory measures.

Limited rural reach inspite price control measures

The Times of India, Jul 15 2015

Sushmi Dey

Pharma price control has stunted innovation: Study

Lower cost but rural reach poorer

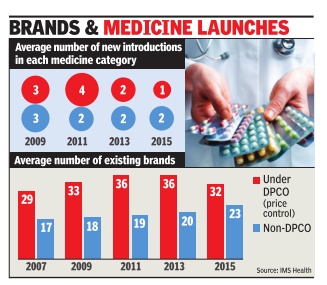

Consumers may be happy about a cut in medicine bills but the government's price control measures have forced many brands out of the “unviable“ pharmaceutical market, resulting in a drastic slowdown in launches over the last five years. From an average of four new drugs being launched in any specific category in 2011, it was down to a mere one in 2014-15, implying a 75% decline in launches, according to estimates by IMS Health -a leading healthcare market research agency .

Not just that, data collected since 2013, when the new pharmaceutical pricing policy came into place, show a sharp decline in consumption of price-controlled medicines. That's because of a growing push for alternative options outside price control.

With lower margins in price-controlled medicines, there is also less incentive to reach out to rural markets. “For low-income households that are reliant on the government system for healthcare, DPCO (Drugs Price Control Order) will not improve the patient's ability to purchase drugs. This is supported by the fact that no significant penetration of price-controlled molecules in rural markets is visi ble...,“ says a new report, Assessing the Impact of ` Price Control Measures on Access to Medicines in India' by IMS Health.

According to the report, consumption of price-controlled medicines in rural areas dropped by 7% in the past two years, whereas sales of other medicines increased by 5%. It says even in Tier-II and III cities, such medicines have witnessed a muted growth.

The industry argues that the move has failed to achieve the intended objectives of increased affordability and availability because policy measures have impacted tail-end brands more than the leading players.But public health experts brush aside such concerns saying companies manufacture one medicine under several brands with different compositions, and regulations are aimed at bringing them on a par in terms of pricing.