Drugs and Pharmaceuticals: India

This is a collection of articles archived for the excellence of their content. Readers will be able to edit existing articles and post new articles directly |

This is a collection of articles archived for the excellence of their content. |

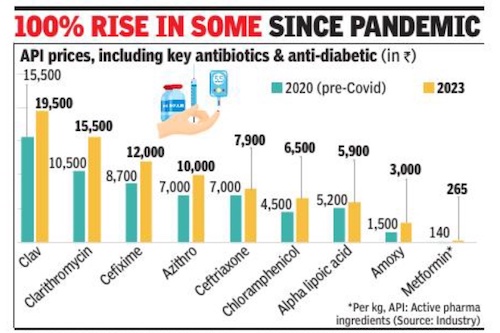

Active pharmaceutical ingredients’ (API) prices

Active pharmaceutical ingredients imported from China, 2016

The Times of India

See graphic, The dependence of the Indian pharmaceutical industry on ingredients imported from China Active pharmaceutical ingredients imported from China, 2016

2020- February 2023

Rupali Mukherjee, February 27, 2023: The Times of India

From: Rupali Mukherjee, February 27, 2023: The Times of India

Mumbai : A steep price increase of over 100% from prepandemic levels of certain raw materials for essential drugs — called active pharmaceutical ingredients (API) — has raised eyebrows in the industry. Interestingly, the sharp hike — which should have corrected by now with the improvement in supply chain and logistics — has been witnessed in high-volume key antibiotics including azithromycin and amoxicillin imported from China. These are also the products where India has near or complete dependence on China, industry experts told TOI . As against this, prices of most vitamins, including vitamin B and D, also imported from China, are at an all-time low.

Besides APIs for key antibiotics, anti-TB rifampicin and anti-diabetes metformin have also doubled from the pre-pandemic level, they added. Antibiotics including Azithro, Clav and Amoxicillin are high-volume products, the production of which is dependent on imports from the neighbouring country.

The dramatic increase is being attributed to multiple reasons like inflation, increase in prices of key starting materials and solvents due to crude, and the freight cost, experts added. Further, fewagents have been controlling the imports of certain products, which has led to a cartelisation of sorts. The government should break the monopoly and prevent sole agents from controlling the market, an executive with a firm manufacturing APIs said. A Mumbai-based trader stated, “It’s more about Chinese fleecing as we are dependent on them, coupled with some registration agents pushing themto form unholy cartels for their own benefits. ”

It may be noted that cost has gone up for only those drugs for which raw materials are imported from China. Once the pandemic spread, API prices of certain drugs like fever and pain relief medication, paracetamol, life-saving antibiotic Meropenem (also used for Covid), and antidiabetic metformin, jumped by over 200%, putting the spotlight back on India’s near total-dependence on China. Since 2020, prices have been increasing due to the pandemicinduced supply disruption and logistics challenges, pinching the industry hard. “API prices have remained inflated due to the lockdown in China for the past twothree years, logistics and high energy prices. So far, companies have been managing API prices by being efficient with operations. Also, the government had allowed some price revisions a couple of years ago,” said Sujay Shetty, global health industries advisory leader at PwC India.

According to pharma policy, for essential drugs, prices undergo a change — either increase or decrease — in line with the annual wholesale price index (WPI) in April each year. Non-scheduled drugs (those outside price control) are allowed an annual increase of 10% every year.

Advertisements, inappropriate

Non-enforcement of Rule 170 of Drugs and Cosmetics Act questioned by SC/ 2024

Anonna Dutt, Sep 2, 2024: The Indian Express

Justices Hima Kohli and Sandeep Mehta, while hearing the ongoing Supreme Court case against Patanjali Ayurved, pulled up the AYUSH ministry for its July 1 notification asking state licensing authorities “not to initiate/take any action under” Rule 170 of the Drugs and Cosmetics Act.

The rule, introduced in 2018, is designed to prevent misleading advertisements of AYUSH products. The AYUSH ministry’s July 1 notification reiterated its position made in a previous letter, dated August 29, 2023.

What is Rule 170?

In 2018, the government brought in Rule 170 to govern the manufacture, storage, and sale of medicines in the country, “specifically for controlling inappropriate advertisements of Ayurvedic, Siddha and Unani medicines”.

The rule prohibits AYUSH drug manufacturers from advertising their products without approval and allotment of a unique identification number from the state licensing authority. The manufacturers have to submit details such as textual references and rationale for the medicine from authoritative books, indication for use, evidence of safety, effectiveness, and quality of drugs.

The rule states that the application will be rejected if the manufacturer does not provide their contact details, if the contents of the advertisement are obscene or vulgar, products for enhancement of male or female sexual organs, depicts photographs or testimonials from celebrities or government officials, refers to any government organisation, gives false impression or makes misleading or exaggerated claims.

The rule was introduced after a parliamentary standing committee highlighted the problem of misleading claims, and the need for the AYUSH ministry to proactively pursue the issue.

What are challenges to regulate AYUSH drugs?

Like allopathic medicines, manufacturers of AYUSH drugs also have to seek a license from the drug controller. As per the Drugs and Cosmetics Act, phase I, II, and III trials for approval of new allopathic medicines or equivalence studies for generic versions have to be conducted before a drug is cleared for marketing.

However, such trials are not necessary for AYUSH drugs. According to the aforementioned act, most AYUSH drugs can be approved simply based on the rationale provided in authoritative texts of that particular stream. Safety trials have to be conducted only for formulations that use around 60 specific ingredients listed in the act, such as snake venom, snake head, heavy metals such as arsenic and mercury, and compounds such as copper sulphate.

For licensing of drugs containing these ingredients and traditional drugs used for new indications, proof of effectiveness has to be provided as per the Act.

Why did AYUSH ministry direct licensing authorities to ignore the rule?

The Ayurvedic, Siddha and Unani Drugs Technical Advisory Board (ASUDTAB), an expert body that recommends actions relating to regulation of AYUSH drugs, in a meeting in May 2023 said that Rule 170 could be omitted as amendments in Drugs and Magic Remedies Act — another law to govern such misleading advertisements — were also being taken up by the health and AYUSH ministries.

It is in this context that the AYUSH ministry made its recommendation to ignore the rule.

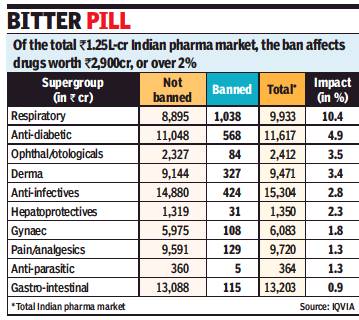

Banned drugs

Fixed-dose combinations/ proposed ban, 2018

Rupali Mukherjee, August 24, 2018: The Times of India

From: Rupali Mukherjee, August 24, 2018: The Times of India

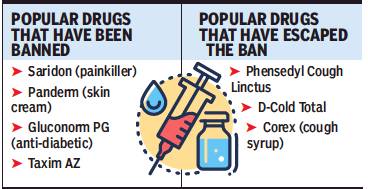

The proposed government ban on over 340 combination medicines (fixed-dose combinations, or FDCs) will impact over 2% — nearly Rs 2,900 crore — of the organised retail market, with popular cough syrups, painkillers and flu medicines — like Phensedyl, Saridon, Sumocold, and Vicks Action 500 — facing action. A final decision on the ban is expected soon by health ministry, even as an expert panel — the Drug Technical Advisory Board, or DTAB — earlier recommended these “irrational and “harmful” medicines should be taken off the shelves.

An FDC contains two or more drugs combined in a fixed ratio, and made available in a single dosage form. They comprise around 50% of the Rs 1.25-lakh-crore market (moving annual total, or MAT, June 2018), with only certain combinations being marketed “irrational” and “harmful”.

Last year, the Supreme Court (SC) had asked the DTAB to review the matter and recommend which FDCs should be regulated or banned, following a protracted legal battle between the government and drug companies over the issue.

The banned combinations on the proposed list belong to several therapeutic areas like cough and cold syrups, gastrointestinal and anti-infective formulations, and dermatological medicines. The respiratory portfolio will bear the highest impact of 10%, followed by antidiabetic and anti-infective drugs, data culled from IQVIA, a leading technology-driven healthcare service provider said.

Gastro-intestinal medicine Panderm+ (Macleods Pharma) is the most impacted brand at 8% or Rs 233 crore in value terms in the banned category, followed by cough preparation Phensedyl Cough (Abbott).

IQVIA general manager South Asia Amit Mookim said, “The popularity of combination drugs has been due to the convenience of reduced pill burden at an affordable cost. After the ban implementation, the doctors may now have to change their Rx (prescription) habit and prescribe multiple plain drugs, instead of writing one FDC, which may have a huge cost impact on the patients. Further, retail pharmacists dispense medicines based on doctors’ prescriptions that mention the brand names. The banned FDCs are sold under multiple brand names, and looking into the combination of each such brand is an extremely complex process. Each pharmacy may have hundreds of brands with the same combination, and it will be difficult to identify the banned FDCs — which are given in pharmacological names — and eventually may pose a risk to the patients. Therefore, the industry will have to educate and create awareness among pharmacists for effective and safe implementation of the ban.”

Govt bans Saridon, 327 other combination drugs

September 13, 2018: The Times of India

From: September 13, 2018: The Times of India

Among the roughly 6,000 brands estimated to be affected by the ban are popular drugs like the painkiller Saridon, the skin cream Panderm, combination diabetes drug Gluconorm PG, antibiotic Lupidiclox and antibacterial Taxim AZ.

The government had banned 344 FDCs on March 10, 2016 and later added five more to this list. However, manufacturers of these drugs contested the ban in various high courts and the Supreme Court. The SC on December 15, 2017 asked for the matter to be examined by the Drugs Technical Advisory Board. DTAB concluded that there was no therapeutic justification for the ingredients in 328 FDCs and that these could be a risk to people. The board recommended banning them.

In the case of six other FDCs, the board recommended restricted manufacture and sale subject to certain conditions based on their therapeutic justification. The SC ruled that the government could not use the DTAB report to prohibit 15 of the 344 drugs in the original list as these have been manufactured in India since before 1988. This exception covered several popular cough syrups, painkillers and cold medication with sales amounting to over Rs 740 crore annually. However, the court told the ministry that it could still look into the safety of these 15 drugs by initiating a fresh investigation if it wanted to ban them.

The All India Drug Action Network, one of the petitioners in the SC case, welcomed the ban and sought swift action on the 15 excluded FDCs.

‘Unsafe FDCs make up 25% of drug market’

The banned FDCs account for about Rs 2,500 crore and represent only the tip of the iceberg. In our estimate, the market for unsafe, problematic FDCs in India is at least onefourth of the total pharma market which is valued at Rs 1.3 trillion,” the All India Drug Action Network, a civil society group working on safety and access to medicines which was one of the petitioners in the Supreme Court case, said in a statement. It also sought a review of all FDCs in the market in the interest of patient safety as recommended by the Kokate Committee, constituted by the health ministry to examine FDCs.

Meanwhile, many large drug companies have claimed that over the last couple of years they have either phased out such drugs or changed the combination. The FDCs in question are less than 2%, they claim.

SC stays drug ban, allows Saridon, Piriton, Dart

SC stays drug ban, allows manufacture, sale of 3 FDCs, September 18, 2018: The Times of India

The Supreme Court allowed sale of Saridon, Piriton Expectorant and Dart — three fixed dose combination (FDCs) drugs — recently banned by the Centre along with 325 other drugs and permitted pharmaceutical companies to manufacture and sell the medicines.

A bench ofJustices R F Nariman and Indu Malhotra agreed to hear pleas from pharma majors challenging the Centre’s decision to ban the drugs.

The government took the decision on the recommendation of a panel constituted by the Centre on the SC’s direction to review safety, efficacy and therapeutic justification of FDCs. Hearing petitions challenging the Centre’s 2015 ban on some FDCs, the court in December referred the issue to the Drugs Technical Advisory Board (DTAB) for a fresh view before recommending action. FDCs are single dosage combinations of two or more drugs.

The review was ordered after the Centre challenged the Delhi high court order quashing its March 10, 2016, notification banning 344 FDC drugs citing health risks and lack of therapeutic justification. The ban on FDC drugs was enforced following a report by a six-member committee, which in January 2015 termed 963 FDCs as posing health threats. The court, however, said its Monday order will be applicable to FDCs given licence prior to 1988.

Challenging the Centre’s decision, manufacturing companies filed an application before the court saying contended the three FDCs were given licence before 1988 and the panel was not allowed to examine them.

Three drug manufacturers challenged the ban saying it was illegal and arbitrary, arguing their FDCs received licences before 1988 and the central panel was not allowed to examine them

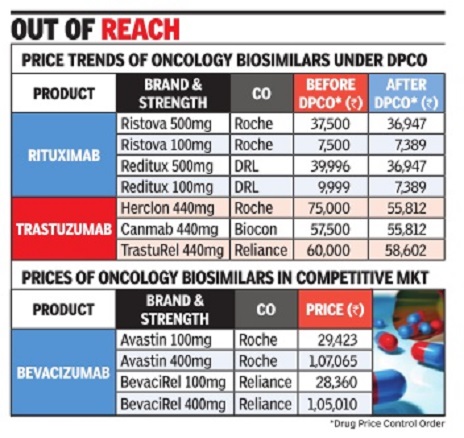

Biosimilars

2018: India no.1 in world

Rupali Mukherjee, Desi pharma cos top in biosimilars globally, October 29, 2018: The Times of India

From: Rupali Mukherjee, Desi pharma cos top in biosimilars globally, October 29, 2018: The Times of India

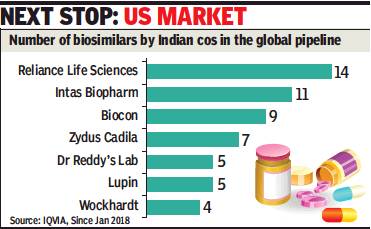

India is leading the global biosimilar pipeline, with the largest number of products launched in the country and emerging economies. Biosimilars, developed by innovators, are approved versions of biopharmaceuticals — complex medicines manufactured using live organisms, as against conventional drugs that are based on chemical composition.

At present, domestic companies are marketing their products only in emerging markets, but the largest and most lucrative market for all pharmaceuticals — the US — is the next stop. The development not only indicates that Indian pharma companies are moving up the value chain after decades of making copycat medicines, it has, more importantly, led to treatment costs getting slashed by 20-40% in chronic and life-threatening illnesses, like rheumatoid arthritis and cancers.

“Reliance Life Sciences has pursued a strategy of developing, in an integrated manner, a wide array of biosimilars at competitive prices to meet patient needs on a global basis. Being recognised as the top biosimilar player globally, in terms of number of products, is one testimony of this strategy in practice,” says company president and CEO K V S Subramaniam.

Significantly, the entry of biosimilars has helped bring down prices for patients. To illustrate, net prices to innovators have come down 18% from Rs 22,000 for bevacizumab (a 100mg vial), 45% to Rs 3,000 for interferon beta (30-microgram pre-filled syringe), and 14% to Rs 19,000 for rituximab (500mg vial). Indian companies are exporting biosimilars to developing countries, primarily South Asia, Southeast Asia, Africa and Latin America.

Intas VC and MD Binish Chudgar said, “The estimate of the global biosimilar market is $9.5-13 billion by 2022, despite the fact that over $90 billion worth of biotech-based medicines are expected to go off-patent in the next few years. Much of the activity in biosimilars is taking place in Europe, while the US, which is the largest pharmaceutical market in the world by a wide margin, has not really opened up to these products. On the domestic front, with a very supportive regulatory authority, biotechnological medicines are set to become an important part of future healthcare landscape.”

PwC India leader (pharmaceutical & life sciences) Sujay Shetty said, “There are emerging signs that partnerships (Biocon with Mylan) are beginning to bear fruit. However, their success in regulated markets will depend on skills of each JV partner. India can dominate rest of world. Going forward, there could be competition from Korean and Chinese companies in the emerging markets.”

Chemists

Regulations/ 2018-19

From: Rupali Mukherjee, Chemists may face legal action for violation of storage norms, November 25, 2018: The Times of India

Govt Plans Strict Guidelines To Prevent Drug Adulteration

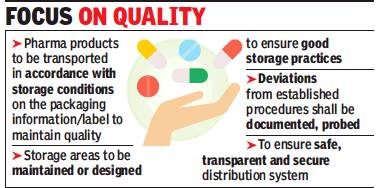

Consumers can now expect to get better bang for the pills they pop. The Centre is planning to introduce stringent guidelines on distribution practices for drug companies. The regulations — expected once the health ministry’s expert panel, Drugs Technical Advisory Board (DTAB), approves them this week — will prevent widelyprescribed antibiotics and pain-relievers, insulins and vaccines from getting adulterated or contaminated during transportation and distribution.

Once in force, stockists and chemists who fail to comply with the specified storage and distribution norms will face legal action. At present, there are standards laid down for manufacturing, but have been practically non-existent for storage, transportation and distribution once medicines leave the company’s plant — giving rise to contamination and sub-standard medication in certain cases. There have been instances when popular medicines, including pain-killers, vitamins, antibiotics, anti-allergics have disintegrated or were sub-standard, and insulins and vaccines did not have the desired therapeutic effect, or were not effective.

Such issues arise if certain medicines, are not transported from the manufacturer to pharmacy through a cold chain, where essentially temperature is controlled (2°C to 8°C), or these are stored without refrigeration.

“The practices will ensure quality of medicines and integrity of supply chain, while preventing entry of any spurious drugs into the distribution channel,” sources told TOI, adding these will be taken up at the DTAB meeting on November 29.

The guidelines are to ensure quality and identity of pharmaceutical products during all aspects of the distribution process from the manufacturing plant to medical stores. These include procurement, purchasing, storage, transportation, and documentation. These regulations will be applicable on all outlets involved in any aspect of the storage and distribution of pharmaceutical products from the premises of manufacturer to the person dispensing or providing pharmaceutical products directly to a patient, the draft says.

Transportation of drugs is carried out by third parties in most cases. Involvement of unauthorised entities in distribution chain is also a concern.

Clinical trials

Rules eased/ 2016

The Times of India, Aug 04 2016

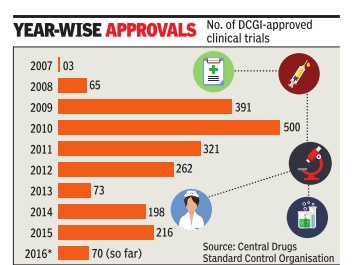

Sushmi Dey Clinical trials may rise as drug regulator eases rules The federal drug regulator has eased norms related to pharmaceutical research, a move that may boost the number of clinical trials but could also raise concerns on patient safety .

Drugs Controller General of India (DCGI) in a notification, said an investigator or researcher can undertake as many trials as approved by the ethics committee instead of the present cap of three. The regulator has also relaxed norms for hospitals or clinical sites undertaking such trials. Through a separate notification, the DCGI has revised the rule that prohibited any hospital with less than 50 beds to take up a trial.

Under the revised norms, the ethics committee has been empowered to decide whether asite is suitable for a trial irrespective of its bed capacity . It suggested the site should have “emergency rescue and care arrangements“.

The ethics committee is a panel of experts which examines the proposal of a pharmaceutical company or a researcher to conduct clinical trials or human experiments for new medicines.

Following random clinical trials and increasing number of deaths during such experiments, the government had earlier imposed a restriction of not more than three clinical trials to be conducted by an investigator.

The number of clinical trials in India went up rapidly around 2008-09. According to data available from the Central Drugs Standard Control Organisation (CDSCO), aro und 65 trials were approved in 2008, whereas it jumped to 391 in 2009 and 500 in 2010. However, following the Supreme Court's intervention, the approvals dropped drastically from 2011onwards.

The changes have cheered the industry . “Ultimately what this translates into is qualitatively better clinical trials as decisions will be guided by which investigator or site is best suited for a particular trial,“ Indian Society of Clinical Research president Suneela Thatte said.

Criticisms of/ allegations against Indian drugs

India says US report is an attack on cheap generic drugs/ 2019

Sushmi Dey, April 28, 2019: The Times of India

India trashes US report, calls it attack on cheap generic drugs

Govt: India Is Pharmacy Of The World

New Delhi:

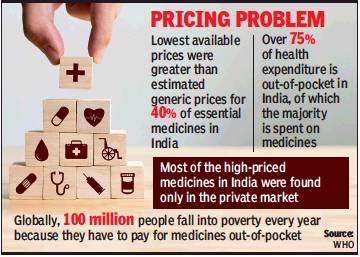

India has outrightly rejected allegations in a US report about the country being a chief source of counterfeit medicines to the world and said it is an attack on low cost generic drugs — crucial to make healthcare affordable.

The ‘Special 301 Report’ by United States Trade Representative (USTR) slammed India and China as leading sources of counterfeit medicines distributed globally with 20% of all pharmaceutical products sold in the Indian market estimated to be counterfeits. “We strongly disagree with the observations made by USTR. We do not know the genesis and methodology of their findings. Instead, we view this as opposition to low cost generics and the thriving Indian drug manufacturing industry which is the ‘Pharmacy of the world’,” health secretary Preeti Sudan told TOI.

The USTR report, an annual review of the state of IP protection and enforcement in US trading partners around the world, has again put India on the ‘priority watch list’ for violation of intellectual property rights.

“In particular, China and India are reportedly leading sources of counterfeit medicines distributed globally. While it may not be possible to determine an exact figure, studies have suggested that up to 20% of drugs sold in the Indian market are counterfeit and could represent a serious threat to patient health and safety,” the report said. It also claimed that India exports counterfeit drugs to Africa, Canada, the Caribbean, the EU, South America, and the US. However, emphasising that generic drugs are low cost but quality products, Sudan said only certified pharmaceutical products are exported from here. Locally, over 75% of sales come from generic medicines.

Not surprisingly, India is named in the report for the country’s patentability criteria, compulsory licensing criteria and absence of an additional intellectual property monopoly-data exclusivity. “At a time when medicine prices are soaring... the report undermines the efforts... seeking to make medicines more affordable domestically. USTR’s push for more protection and enforcement of IP policies would keep medicine prices high globally and place lifesaving treatments out of reach for longer in developing countries,” says MSF which advocates access to medicines.

The report also said inadequate protection for trade secrets in a number of countries, notably China and India, puts US trade secrets at risk.

Drugs and pharmaceuticals made in India

Curbs by four EU nations

December 07 2014

Four European countries decided to suspend marketing authorization of 25 drugs, which had undergone tests at the GVK Biosciences facility European Medicines Agency (EMA) did say in a statement that it is reviewing the findings of non-compliance with good clinical practice at the GVK facility and determining its impact on medicines authorized on the basis of studies performed there. Germany , France, Luxembourg and Belgium have already decided to suspend marketing authorizations of these drugs. EMA's Committee for Medicinal Products for Human Use (CHMP) is now identifying, together with member states of the EU, the medicines covered by the inspection findings. French drug regulator ANSM has said on its website that Belgium, Germany , Luxembourg and France decided to suspend the marketing authorizations for the medicinal products concerned. “Although these documents are not essential to the demonstration of bioequivalence, the ANSM decided, as a precaution, to suspend the marketing authorization of 25 marketed generic drugs.

Drugs and pharmaceuticals sold in India

2008- 2014: Drug launches reduced by 80%

Dec 27 2014

New drug launches drop 80% in 6 yrs

Sushmi Dey

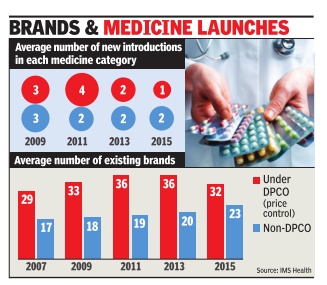

Launches of new medicines in India have come down by nearly 80% during 2008-2014 and drug manufacturers blame price regulations and policy uncertainty for making India an unattractive destination for both domestic as well as multinational pharmaceutical companies.

In 2008, 270 new drugs were approved for sale in India, whereas it dropped to 44 and 35 in 2012 and 2013, respectively. In 2014, only 56 new medicines were approved till November, government data shows.

“Most of the big pharmaceutical companies have knocked out India from their list of key markets. The reason is stricter policy measures cutting down on margins, making it less attractive as a business proposition for future growth,” a senior executive in a leading domestic pharmaceutical company said.

A stricter regulatory regime, which not only brings down drug MRPs but also continuously expands span of price control, is cited as the main reason why drug manufacturers are losing their India focus. Industry of ficials also blames looming uncertainty in policy as another reason for companies to delay product launches. Apart from pricing, the pharma industry has been facing hiccups in foreign investment, new drug approvals, as well as clinical trials.

Government and regulators, however, brush aside such concerns. According to a senior official in the National Pharmaceutical Pricing Authority (NPPA), the price regulations are as per the policy and MRPs are fixed based on average price of medicines in that segment. “There is no reason for a particular company to find it unviable when others are making the same drug at a lower price,“ the official said, adding that market surveys show a huge disparity in pric es of similar medicines sold under different brands.

The number of drug approvals peaked in 2008, when as many as 270 new drugs were granted approval, followed by 217 in 2009, 224 in 2010, and 140 in 2011, the data shows.

However, since 2012, when the government released the National Pharmaceutical Pricing Policy bringing in 348 medicine formulations un der price control, the new drug launches started reducing drastically. “The role of NPPA is to implement the policy in letter and spirit and not create confusion leading to instability in the drug industry,“ another senior industry official said.

Many medicines were also found missing from the market following stringent regulatory measures.

2018: domestic retail grows 10%

Rupali Mukherjee, January 16, 2019: The Times of India

From: Rupali Mukherjee, January 16, 2019: The Times of India

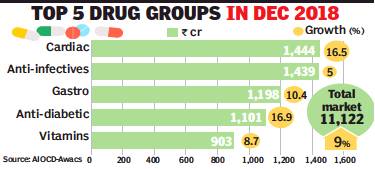

The domestic pharma retail market registered a robust growth rate of around 10% in 2018, nearly doubling year-on-year, buoyed by higher volumes and launch of new drugs. In 2017, the market was impacted by the introduction of GST, resulting in a meagre growth rate of 5.5% — the lowest in recent years.

Anti-diabetics, cardio-vascular, respiratory and derma medicines ended the year with strong double-digit growth, while overall drivers of the Rs 1.29-lakh-crore market include higher volumes (4.8%), price increase (2.2%) and new launches (2.4%), data from market research firm AIOCDAwacs said. For December alone, the market showed 9.8% growth, higher than in November. In fact, growth has been consistently above 9% over the last four quarters with Abbott, Lupin, Torrent and Intas growing at strong double-digit rates during the year, it said.

Anti-diabetic therapy human premix insulin Mixtard topped the pecking order, followed by anti-diabetes medicines including Glycomet GP, Lantus and Janumet for the year. Ayurvedic hepatic protector Liv 52 assumed the fifth slot. Anti-infectives is the largest therapy, followed by cardiac, gastro-intestinal and anti-diabetic. Expansion was driven by top domestic companies contributing close to 43%, and collectively outgrowing the market. The north and west zones in the country registered strong growth in double digits.

Glenmark Pharma president (India formulations, Middle East and Africa) Sujesh Vasudevan said, “The domestic pharmaceutical market saw good growth in 2018, driven by strong performance of anti-diabetic, cardiology and dermatology segments. In the current year, we expect doubledigit growth for the domestic pharma industry as companies continue to improve productivity and brand-building”.

MNCs grew 9% during December, while domestic companies recorded higher growth at 10%. Among the top MNCs, Boehringer Ingelheim was the fastest growing, followed by Bayer and Astra Zeneca. While anti-infectives grew 5%, respiratory segment slowed down at 2.7% during the month. As against this, dermatology grew faster at 10.5%, gastro-intestinal drugs posted double-digit sales growth (10.4%), while vitamins grew at 8.7%. Among the chronic therapies, anti-diabetic and cardio drugs posted robust sales growth at 16.9% and 16.5% respectively.

Sales of fixed-dose formulations, many of which have been banned and are facing regulatory glare, slumped, while the non-FDC (fixed dose combination) market grew 9.3% during December.

Types of medicines sold: 2018-19

Sushmi Dey , Oct 22, 2019: The Times of India

From: Sushmi Dey , Oct 22, 2019: The Times of India

Anti-infectives along with medicines for cardiac diseases, diabetes, gastro-intestinal and respiratory problems garnered the highest sales in the Indian pharmaceutical market in last one year, pointing to a rapidly growing burden of lifestyle-related ailments.

Indians spent over Rs 1,36,000 crore on medicines in last one year ending September 2019, of which 31% was spent on medicines for diabetes, heart disorders and other chronic ailments.

This is also the fastest growing segment at 13% as compared to acute therapies which accounted for 47% of the market but grew by 11.7% and sub-chronic segment at 10.7%, according to data released by All India Organisation of Chemists & Druggists (AIOCD).

While anti-infectives topped the list of medicines with highest sales value, those for cardiac problems, diabetes and gastro-intestinal disorders were among the top five, with only cardiac and anti-diabetes drugs registering double digit growth of 12.6% and 14.9%, respectively, for the year. The overall drug sales grew by 9.8% during the period.

People spent over Rs 17,000 crore on cardiac drugs, around Rs 15,400 crore for gastro-intestinal disorders and over Rs 13,360 crore on anti-diabetes medicines in the last 12 months. Anti-infectives accounted for the highest sales of over Rs 18,413 crore.

“Sales of anti-diabetic drugs has increased due to multiple factors like increased number of patients, more frequent diagnosis, increasing use of more expensive drugs and insulin. Importantly, use of conventional low cost drugs/insulin could help manage about 60-70% cases of diabetes in India, thus reducing out of pocket cost for patients,” says Dr Anoop Misra, Chairman Fortis C-Doc.

Maximum drug launches were in cardiovascular and respiratory segments. Around 78 new drugs were launched in September alone. Of these, 18 were to treat cardiovascular diseases, 17 were vitamins, minerals and nutrients and 14 were in in the respiratory segment.

Not just in terms of value but volume growth have also gained momentum, a senior industry executive said.

“Increasing disease burden, growing awareness, availability and affordability of treatment along with enhanced insurance penetration have all resulted in higher sales of medicines. Besides, there is no doubt that the NCD (non-communicable disease) segment is growing rapidly leading to higher growth in segments like cardiac and diabetes,” he said. The data also show the top ten corporates gradually increasing there market share in the chronic segment.

2022: The most popular drugs

DurgeshNandan Jha, June 17, 2023: The Times of India

From: DurgeshNandan Jha, June 17, 2023: The Times of India

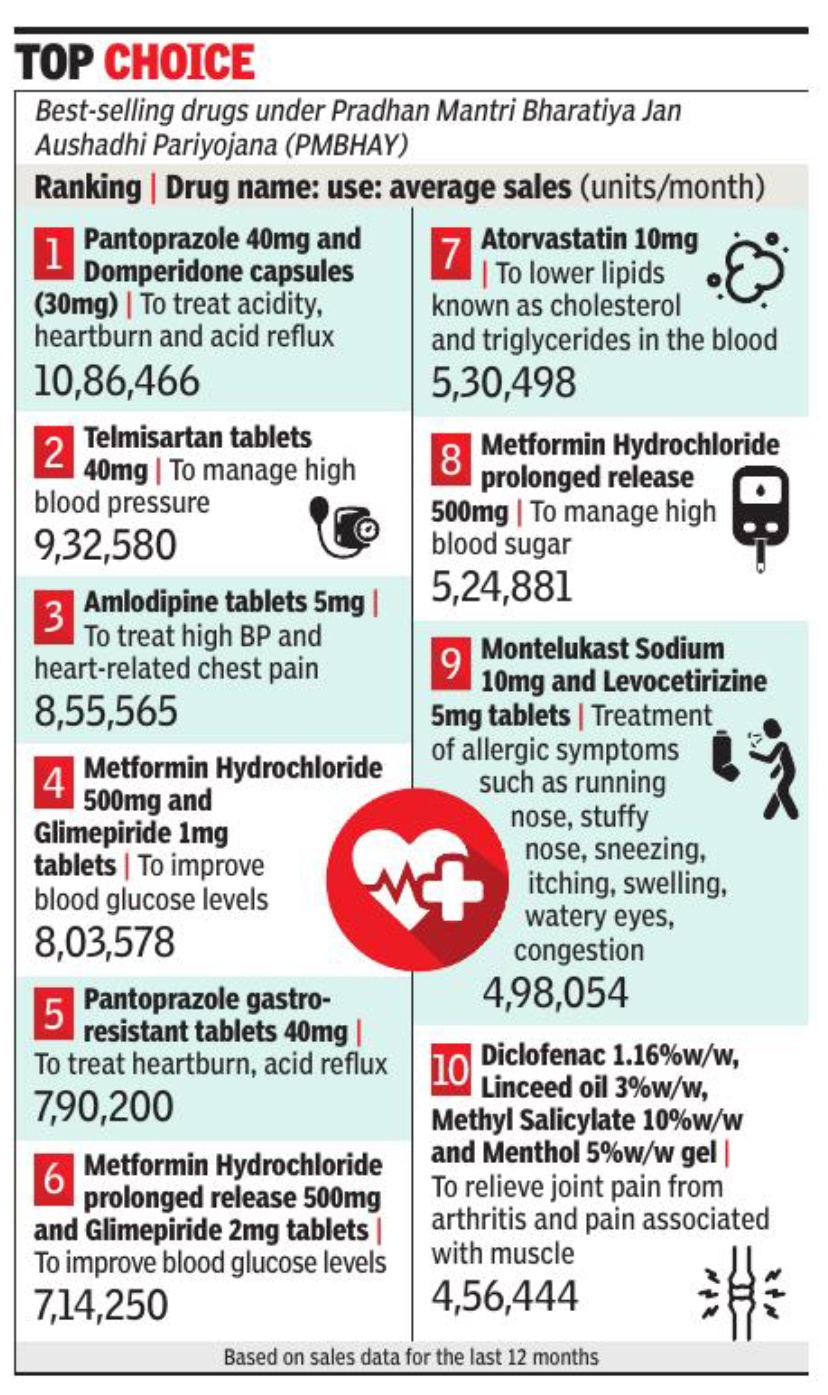

New Delhi : Pantoprazole (40 mg) and Domperidone (30 mg) capsules — a fixed-dose combination drug used for treating acidity-related problems — has emerged as the top selling product at Jan Aushadhi Kendras across the country.

India has 9,484 Jan Aushadhi Kendras which sell generic drugs at affordable prices to the public under the Pradhan Mantri Jan Aushadhi Pariyojana (PMBJP).

According to sales data of these stores for the last 12 months, an average of 10. 8 lakh units (each unit contains 10 capsules) of Pantoprazole (40 mg) and Domperidone (30 mg) capsules were sold at these stores on a monthly basis, the highest of all products sold by them. This was followed by Telmisartan (9. 3 lakh units monthly sales) and Amlodipine (8. 5 lakh units monthly sales), which are used to treat high blood pressure.

Ravi Dadhich, CEO, Pharmaceuticals and Medical Devices Bureau of India (PMBI), told TOIthat the generic drugs sold at the Jan Aushadhi Kendras are 50%-90% cheaper than the branded alternatives, which is why more and more people are opting to buy them. “Of the top 10 best-selling products at the Jan Aushadhi Kendras, 30% are products that are used to treat high blood pressure and diabetes. These are chronic conditions and treatment involves longterm medication. By opting for generic drugs, people can save a lot of money spent on drug purchase,” he said. The product basket of PMBJP comprises over 1800 drugs and 285 surgical equipment. Dadhich said that to ensure quality of products sold at the stores, all drugs are procured from World Health Organisation – Good Manufacturing Practices (WHO-GMP) certified suppliers. “Each batch of drug after its receipt at the warehouses is tested at laboratories accredited by ‘National Accreditation Board for Testing and Calibration Laboratories’ (NABL) for ensuring best quality,” the PMBI CEO said.

The major therapeuticgroup of medicines availableat the stores are: antibioticsand anti-infectives; cancerdrugs; cardiovascular drugs;and vitamins and mineralsamong others.

In 2019, thegovernment also startedselling sanitary napkins atRs 1 per pad. In 2014-15, there were only80 Jan Aushadhi Kendras andtheir sales value stood ataround Rs 7. 29 crore.

Earnings, profits

2012-18; exports to USA in 2018

From: Rupali Mukherjee, US-focused pharma cos see 30% drop in FY18 earnings, June 15, 2018: The Times of India

Regulatory clampdowns, increased competition and channel consolidation in the US have led to a drop of 30% — one of the worst — in earnings of USfocused Indian pharma companies in FY18. But the good news is there are signs of recovery with a strong doubledigit growth expected in FY19.

Analysts expect net profit of these companies to grow nearly 23% in fiscal 2019, fuelled by a rich and mature pipeline, a ramp-up in capacity, and a favourable base (GST and US tax impact).

Moreover, US revenues for the top 10 US-focused companies — Sun Pharma, Dr Reddy’s, Cipla, Lupin, Aurobindo, Glenmark, Cadila, Alkem, Torrent and Alembic — are expected to rebound, and grow in single digits in FY19, after the huge drop of nearly 12% witnessed in FY18.

Analysts believe fiscal 2019 may see a gradual comeback for large-cap pharma companies, driven by regulatory resolutions, and a moderating price erosion. Recently, beleaguered Sun Pharma resolved its regulatory issues at its Halol plant after a gap of over two years.

Most Indian pharma cos have scaled up US ops

Most companies were forced to go slow in US FDA (Food and Drug Administration) filings, as they were bogged down with their key plants being under the regulatory scanner. However, over last two years, companies have invested heavily to expand their capabilities — both in manufacturing and research and development.

Three years ago, a majority of US revenues of most Indian pharma majors was contributed by two plants. Since then, they have scaled up and diversified filings across multiple facilities. This has significantly reduced concentration risk with respect to future regulatory adversity, said an analyst from HDFC Securities in a note.

Glenmark Pharmaceuticals CMD Glenn Saldanha said, “We have had a good start to the new financial year with two good approvals, especially the approval of generic Welchol.

Though price erosion still remains a challenge in the US generic market, new product approvals will be key to growing the US business. We hope that we will be able to launch 10 to 15 new products in this year, which will augur well for our US generic business.”

For most companies, several product launches across generic and specialty categories are expected in the second half of FY19. With a rich pipeline, fiscal 2019 could be a breakthrough year in terms of niche product opportunities, the note says, including Sun Pharma’s (Tildra, Sceiera, Yonsa), Lupin (Solosec, Levothyroxine, generic Ranexa), and Dr Reddy’s (generic NuvaRing, generic Suboxone). Additionally, inhalers, bio-similars, trans-dermals and niche injectables are expected to be launched from FY20. A major reason for earnings having bottomed out is price erosion moderating in the US, experts say. Price erosion has been ever-present in the generics business. However, it has historically been in the range of 5-6%, while over 2016-18, there was a double-digit decline.

Most players have witnessed moderating price erosion during the fourth quarter FY18, and expect a stable singledigit price decline ahead.

2018-19

From: Sushmi Dey, April 28, 2019: The Times of India

See graphic:

Pharma exports rose 11% in FY19

Exports

Medical consumables: 2022-23

DurgeshNandan Jha, May 8, 2024: The Times of India

New Delhi: India, for the first time, has become a net exporter of medical consumables and disposables, reversing the earlier trend where overseas shipments of products such as needles and catheters completely dominated the market.

The country exported consumables and disposables worth $1.6 billion, while it imported products worth only about $1.1 billion in 2022-23, Union pharma secretary Arunish Chawla said. Exports went up 16% compared with the previous fiscal, while imports fell 33%.

Govt is seeking to replicate this success in other segments too, such as surgical instruments and electronic equipment, so that there is lower dependence on imports, Chawla said on the sidelines of an event by his department & CII.

Govt’s push for reducing import dependence for key pharma products and devices got a major thrust postCovid outbreak after China controlled supplies of everything from basic chemicals to PPEs and testing kits. India is known as pharmacy of the world because of its generic medicines and low-cost vaccines. In the medical devices sector, how- ever, the country remains heavily dependent on imports with nearly 70% of the products being sourced from other countries. China is among the major sources of imports.

Centre has further divided medical device sector into segments such as cancer therapy, imaging, critical care, assistive medical devices, body implants, surgical instruments and hospital equipment, consumables & disposables, and IV Dinstruments and reagents. The pharma secretary said deliberations are on to identify important medical devices from each segment, assess their import-export dynamics, examine duty structures, and their implications across the value chain.

“During Covid, demand for consumables and disposables increased tremendously which pushed the industry towards augmenting its manufacturing,” said Himanshu Baid, chairman of CII’s national medical technology forum.

Fixed dose combination (FDC) medicines

Health ministry bans 344 FDC drugs, HC lifts ban/ 2016

Sushmi Dey, Dec 5, 2016: The Times of India

`344 FDC drugs limit therapy choices'

Public health groups have expressed concerns over the Delhi high court order lifting the ban on 344 fixed dose combination (FDC) medicines, imposed by the government.

“This is a huge setback to efforts aimed at bringing a semblance of order into the absolute anarchy that exists in India's pharmaceutical market,“ said a statement from Jan Swasthya Abhiyan.

The health ministry had banned 344 FDC drugs terming them as irrational and raising concerns over their misuse. These included some of the popular pharmaceutical brands such as Pfizer's Corex and Abbott's Phensedyl. However, recently the Delhi HC overturned the government's ban providing a major relief to the pharmaceutical companies.

Public health and advocacy groups have asked the government to appeal against the HC order as it has the potential to impact healthcare cost as well as quality of medicines. Health groups said lifting of the ban seems to be predicated on “perceived procedural issues“ which fundamentally abrogate the right to life and healthcare.

Jan Swasthya Abhiyan said use of FDCs increase cost of medication, exposes populations to a larger array of adverse effects and limits the choice of therapy as they may combine drugs with different dosage schedules. Further, some of the cough syrups in the ban order are primarily being used as addictive substances and not as therapeutic agents.

FDCs include two or more active pharmaceutical ingredients combined in a single dosage form.

“The Delhi High Court order does not appear to address the issues of rationality of the FDCs and the resultant adverse effect on public health,“ it said, asking the government to plug legal and regulatory loopholes so that the ban order can be restored.

“It is of utmost importance that the government, as a custodian of public health, act decisively to de fend it and strengthen regulatory mechanisms,“ JSA said.

The HC verdict has come as a major set back to the government which was planning to ban more FDCs to eliminate irrational combination drugs causing anti-microbial resistance. In some cases the toxicity is so high that it can even lead to failure of organs, officials say. There are also concerns many of these FDCs being available over-the-counter without doctors' prescription, which is leading to their misuse.

While many of these products are sold at the chemists level, officials and health experts say often adverse events are not reported because patients do not come back to doctors unless these drugs are used repetitively , leading to severe problems.

Estimates show around FDCs comprise over 40% of the total Rs 1 lakh crore annual Indian pharmaceutical market. However, only around 16 FDCs are part of the National List of Essential Medicines.

Foreign countries’ approvals to sell Indian drugs

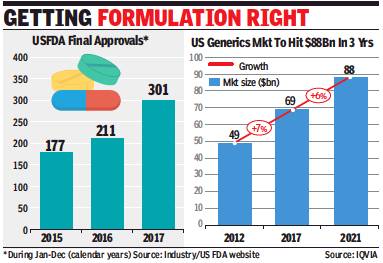

2018-19: USFDA approvals increase 9%

Rupali Mukherjee, May 6, 2019: The Times of India

From: Rupali Mukherjee, May 6, 2019: The Times of India

Domestic phar ma companies received 372 approvals to launch generic drugs in the US in fiscal 2019, up 8.6% from 340 in the previous year. The development comes even as India got 15 warning letters in calendar 2018, lower than the US with 19, and China which topped the list with 24 warning letters. As against this, India had the ignominious distinction of topping the list with 9 warning letters in 2015, and has since appeared to have cleaned up its act.

In terms of approvals, Zydus Cadila topped the list with 60, with Indian companies cornering nearly 40% volume share in the highly lucrative $60-billion-plus US generic market — a key driver of growth for the domestic industry. In an indication of having resolved data integrity issues by investing in skill sets, domestic companies grabbed the opportunity by the US Food and Drug Administration (USFDA) to speed up generic competition.

Indian generic filings have been rising year-on-year, unfazed by regulatory pressure from the USFDA, and a spate of warning letters issued to their facilities over the last couple of years. Over 2015-17, Indian companies faced intense regulatory glare from the US, with nearly all top companies having been issued warning letters over manufacturing violations at their plants. This seems to have changed last year with fewer warning letters for Indian companies, compared to other major countries.

Also, USFDA’s erstwhile chief Scott Gottlieb had last year announced a slew of policy measures to strengthen and streamline the generic drug-review process, setting record numbers for generic drug approvals.

Imports from China

Active pharmaceutical ingredients

2016-19

From: Sushmi Dey, June 23, 2020: The Times of India

See graphic:

The import of Active pharmaceutical ingredients (APIs) from China and other countries, 2016-19.

Import of ingredients

2017: 26% dip in import from China

Chethan Kumar, 26% dip in drug ingredient import from China, January 22, 2018: The Times of India

From: Chethan Kumar, 26% dip in drug ingredient import from China, January 22, 2018: The Times of India

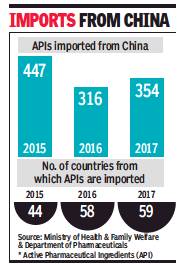

See graphic:

APIs imported from China to India, 2015-17

In 2017, India imported 354 Active Pharmaceutical Ingredients (APIs) from China, a 26% dip compared to 447 in 2015, largely achieved because the number of countries India imported such material from increased from 44 in 2015 to 58 in 2016 and 59 in 2017.

The number of APIs imported from China has grown slightly compared to 2016 (316) though. Also, import from China is still the highest in this category, accounting for 66% of all imports in 2017 — Rs 12,254.97 crore of the Rs 18,372.54 crore. The trend has remained similar in all the three years.

Many of these APIs go into 12 essential drugs listed by India — paracetamol, metformin, ranitidine, amoxicillin, ciprofloxacin, cefixime, acetylsalicylic acid, ascorbic acid, ofloxacin, ibuprofen, metronidazole and ampicillin — and 8 of which are also on WHO’s Model List of Essential Medicines.

Officials from the Department of Pharmaceuticals (DoP) and industry experts point out that the import of APIs is because of economic considerations, but experts also pointed out the issue of quality that comes with such over-dependence.

Earlier this month, India banned import of APIs from six Chinese firms claiming they did not meet the required quality standards.

Drugs Controller General of India Dr GN Singh said: “Our mandate is limited. We are concerned about the quality of imports and are always keeping a track of it. The ban on those firms is routine and should not been seen as targeting the Chinese companies.”

He said that India is also manufacturing APIs and there are more than 500 products, but most of them are being exported. Indian Pharmaceutical Association president Dr Rao VSV Valdlamudi said drug prices in the domestic market are controlled and while the APIs being exported command the price their quality demands, they do not fetch the same price domestically.

“The problem of over-dependence, however, is a much larger issue. If China stops importing from India, will India be able to turn all its exports to the domestic market? Over-dependence has to reduce. At present the government doesn’t take into consideration many variables and overheads in production and subsidies, as some argue, is not a longterm solution,” Rao said.

India has been putting in place some systems, but chemicals and fertilisers minister HN Ananth Kumar, while blaming legacy, concedes the Centre is not fully happy with the progress.

“Historically, there has been too much dependence on China and previous governments have done nothing about it. We took a twopronged approach.

First, from 0% customs duty on import of APIs from China, we made it 7.5% which is very good for domestic API makers. As per the Dr Katoch Committee report, we initiated having bulk drug parks and the first will come up near Hyderabad,” he said.

He said the Centre will provide up to Rs 500 crore for common facilities like power, water, effluent treatment, testing and trading facilities at such parks, which will reduce production cost by 30% making it globally competent, even compared to China.

The industry in India

Helping fight AIDS, Covid 19

SWAMINATHAN S ANKLESARIA AIYAR, January 3, 2021: The Times of India

Arguably, the most-hated industry in the world is the pharmaceutical industry. Since dying people will pay anything, the normal price resistance of consumers disappears. So, profit margins for new patented drugs can be humongous. When anti-AIDS drug cocktails were invented in the 1990s, US drug companies charged a whopping $15,000 per year. This created an uproar. To mollify critics, major US companies offered the drug “at cost” to poor countries — just $1,500, they said.

But Cipla, an Indian company, was already exporting the drugs at just $800. Cipla was lambasted by US companies as a “pirate” violating patents. Cipla retorted that the US companies were the real robbers and pirates. US President Bill Clinton ultimately sided with the activists.

Production shifted massively to countries like India, and prices kept falling. By 2010, the cost was just $200. No wonder activists denounced US drug companies as killers. Yet, ironically, these very companies had created the cures and saved millions.

The hated drug industry has just performed a miracle, producing several different vaccines against Covid in a few months. It had proved impossible to develop any vaccine at all for several viruses, including AIDS. When Covid struck, sober specialists noted that new vaccines took at least five years to be created, tested and approved. Bill Gates said we would be lucky to get an anti-Covid vaccine in 18 months. Yet in less than a year, vaccines galore have emerged. Russia and China were among the first to create and approve their own vaccines. Western experts cautioned that these countries had not followed all the usual safety protocols. However, it can make sense to shorten test procedures to expedite a vaccine that could save millions of lives.

Pfizer and Moderna in the US have produced vaccines following the usual protocols and are ready for mass vaccination. AstraZeneca and Oxford University have developed a different vaccine which — at the insistence of Oxford University — will be sold at just $3-4 per dose in poor countries. This vaccine can be stored at 2 to 7 degrees Celsius in ordinary refrigerators, making it suitable for poor countries like India lacking the super-cooling facilities required by the Pfizer and Moderna vaccines.

Maybe half the population of most countries will be vaccinated by late 2021, slashing further transmission of Covid. Gradually, people will resume travel, office meetings, social gatherings and tourism.

What lessons flow from this? First, the pharma industry is a saviour, not a killer. The international patent system is seriously flawed. To make up for huge R&D losses on drugs that fail tests, companies make enormous profits on the few that work. This can sound odious. But remember, the drug companies are the saviours that have doubled life expectancy in the last century, curing dozens of diseases once incurable, relieving the world of immense misery and death.

People have shown that they will happily give up their entire life savings for another year or two of life. By that standard, the life-extending services of drug companies make them among the greatest saviours in history.

What the Covid example shows is that government guarantees can make a huge difference. R&D is expensive. If governments are serious about health, they should offer significant funding for basic research, research on diseases of specific local interest, and for clinical trials.

For tackling tropical diseases, developing countries as well as aid consortia and institutions like the World Bank should guarantee to buy a large quantity of promising drugs even before expensive testing begins. This can be linked to price caps for drugs that clear testing.

In theory, all medical R&D could be done by governments and offered patent-free to all. However, the historical experience in this has been dismal. The Soviet Union and its Red empire stretching across Eastern Europe and Cuba boasted of good and free healthcare but failed to produce significant new drugs. Virtually all the hundreds of new medicines that saved millions of lives were created by profit-motivated R&D by drug companies. The social motivation of public sector research proved insufficient.

Drug companies have been found guilty of many sins: of cartelisation to raise prices or diminish competition; of fudging clinical trials; of promoting unsuitable or even bogus drugs; of bribing doctors to promote their particular medicines; of encouraging addictive opioids; and of enormous profits on some drugs. Yet the very same sinners have saved millions of lives through R&D. We must harness their skills while reducing the odium of super-profits on a few drugs.

Covid shows that we need new systems of government support for medical research. Public health is a public good that governments have a duty to improve. This does not mean just price controls and hospital subsidies but guarantees and funding for relevant R&D on diseases.

Influencing academies, research

Pharma industry influences Academy of Paediatrics

Rema Nagarajan, How pharma firms influence paediatricians' body, Mar 27, 2017: The Times of India

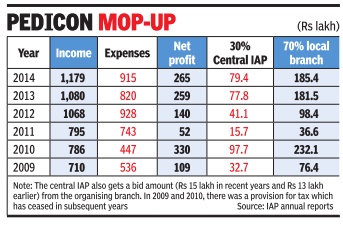

A Parliament question “regarding the influence of vaccine-makers on the immunisation plan“ has raised the issue of funding of the Indian Academy of Paediatrics (IAP), the body representing over 23,000 paediatricians in India. A look at its finances shows just how dependent the IAP is on funding from the pharma industry , especially vaccine manufacturers.

Most of the industry funding comes as sponsorship for IAP's annual conference, Pedicon, and funding for the association's activities under the Presidential Action Plan.

In 2016, IAP earned Rs 5.5 crore, of which almost 30% was combined income from Pedicon (55 lakh) and the Action Plan (Rs 1.1 crore). Pedicon's share is usually much larger, touching Rs 93 lakh and Rs 94 lakh in 2013 and 2014 respectively , including the bidding charge of Rs 15 lakh that the organising branch has to pay the central IAP (CIAP).

The growing dependence on industry was raised by IAP treasurer Pravin J Mehta in the 2013 annual report when he said: “Our expenditure per year is approximately 2.77 crores. Our fixed income... is approximately 1.77 crores.That means every year we are dependent on variable income of rupees one crore...Major chunk of this variable income is from Pedicon. This means that in unforeseen circumstances of Pedicon not doing well financially , it will be difficult to match income with rising expenditure.“

The “lead sponsor“ of Pedicon 2017 held in Bengaluru in January this year was Bharat Biotech, a leading vaccine company . According to the brochure, platinum sponsorship was Rs 5 crore. So was Bharat Biotech the platinum sponsor? Dr Govindaraj M, the chief organising chair man, claims he does not know.Other vaccine companies like Wyeth and Sanofi too got prominent mention at the venue, which could mean that they were diamond (Rs 4 crore), gold (Rs 3 crore) or silver (Rs 2 crore) sponsors. Judging by the sponsorship brochure, this conference could have raked in over Rs 15 crore.

Pedicon is supposed to be an academic conference, but the discussions regarding it seem to revolve primarily around the revenue it generates and sharing of the profits between the central IAP and the organising branch in a 30:70 ratio. The profits generated by some Pedicons have been over Rs 3 crore.

IAP's 2015 annual report talks about the escalating costs of the annual conference with per delegate costs rising from Rs 10,000 for four days to over Rs 20,000 in the past three years. Total expenses had more than doubled from about Rs 4.5 crore in 2010 to over Rs 9 crore by 2014.

The report noted that IAP had no mechanism for oversight of expenses and though the income from the conference has continued to rise, profits had remained almost static. There was a suggestion that the IAP should take complete charge of Pedicon finances. But that is being resisted.

In a critical note in the annual report, Dhananjay Shah, founder convenor of the first finance committee, wrote: “Pedicon organisers have been kindly making luxurious arrangements for the 50 odd group of newly elected EB members who are provided a five-star accommodation at a luxurious hotel for full five days during their Pedicon as an expense item of the Pedicon. The EB meeting is actually a CIAP (central IAP) function and has nothing to do with the Pedicon event.“

He also warned that the money available in IAP cof fers could be an “attractive bait for those with evil designs“ and that candidates were already spending sums of even Rs 50 lakh “to win the presidential crown“. IAP's academic role “will take a severe beating and thrashing“, he apprehended.

Gala cultural evenings and bar nights push up the cost of these so-called academic conferences. However these are not unique to IAP.Almost all doctors' associations organise these lavish sponsored conferences ostensibly to educate doctors. From the annual conference of national associations of specific specialties, to those organised by state or city branches, all are funded by pharma companies that shell out crores to oblige the doctors.

In 2014, the IAP alone had 27 state branches and 314 city district branches. The Cardiology Society of India has 26 state branches, not including the sub-specialty councils. Doctors insist they are never influenced by the generosity of these companies, but that begs the question of why for-profit companies would spend crores without expecting returns in the form of `prescription support' from the doctors.

Manufacturers

Ownership changes hands/ M&A

2010-23

Rupali Mukherjee, Oct 9, 2023: The Times of India

Mumbai: Multinationals’ drug portfolios are thinning. Consolidation is underway in the formulations business. Some Indian promoters are seeking an exit. These factors are heating up dealmaking activity in the domestic pharma sector.

Mergers and acquisitions in the pharma sector are expected to pick up as promoters of high leverage companies cash out amid rising compliance costs and pricing pressures in the domestic and the US market.

Indian strategic buyers are increasingly acquiring domestic assets, while private equity (PE) biggies like KKR, Caryle, and Advent are getting aggressive and building platforms in both high-growth domestic formulations and API businesses — as in the case of recent deals such as JB Chemicals and Suven Pharma. The PE activity that started just before the pandemic will accelerate over the next few years, industry experts say.

Over the years, promoters have been cashing out in the wake of increasing price control, higher regulatory scrutiny in the US, and the disappearing lucrative Para IV opportunities, leading to a tough business environment, said PwC India’s global health industries advisory leader Sujay Shetty.

Incidentally, some of these factors also triggered the sell-out of pharma biggie Ranbaxy by the Singh family in 2008. Ranbaxy's promoters, led by Malvinder Singh, decided to sell their entire family stake of nearly 35% to Japan’s Daiichi Sankyo for Rs 10,000 crore — one of the largest deals in Indian pharma.

Now, the promoters of Cipla — India’s third-largest drug firm — are planning to divest the family’s stake, with the second generation not keen to continue running the business. Recently, Mumbai-based Glenmark Pharma announced a divestment of 75% in its subsidiary, Glenmark Life Sciences, to Ahmedabad-based detergents-to-cement conglomerate Nirma for Rs 5,652 crore, and in another deal, US-based Viatris (erstwhile Mylan), is selling its active pharmaceutical ingredients and women’s healthcare businesses in India for a combined value of $1.2 billion (nearly Rs 10,000 crore), as part of a $3.6-billion global divestment. Further, large domestic players are doubling down on India as an attractive diversification from a US generics market beaten up heavily by price erosion. As a result, several deals were inked where Indian companies snapped up high-growth brands from local sellers at attractive valuations. For instance, last year, Mankind Pharma swooped on Panacea’s domestic formulations’ business while three years ago, Dr Reddy’s acquired some Wockardt brands, and Torrent Pharmaceuticals bought Unichem’s branded formulations assets in 2017 (see graphic).

As against this, a decade back, mainly foreign firms like Abbott, Daiichi Sankyo, Sanofi made headlines with sizeable buy-outs of domestic firms like Piramal Healthcare, Ranbaxy and Shantha Biotec, respectively.

“The pharma M&A landscape has changed over the last few years and has been mainly driven by how the markets (both domestic and international) have evolved competition, resource allocation and PE interest. On one hand, we have seen global Big Pharma pruning their branded generic portfolio to domestic companies, rationalising their portfolios by selling off their upstream businesses (read APIs, etc) and buying into mid-market brands (including prescription, OTC and consumer brands) to PE players doing buy-outs and roll-up plays across APIs, CDMOs and branded formulation,” said Sunil Thakur, partner and head of South Asia at Quadria Capital, a healthcare PE fund.

Medicines/ Pharmaceuticals that sold the most in...

2017-18

From: Rupali Mukherjee, In India, derma biz grows fastest in retail pharma, October 1, 2018: The Times of India

Skin-Related Issues Draw Most Concern

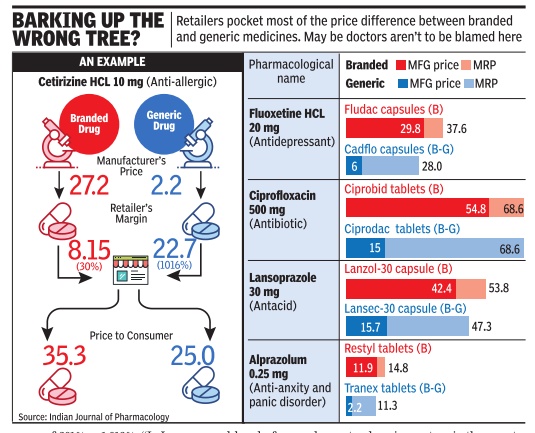

Indians are virtually turning the age-old adage that beauty is only skin deep on its head. Issues like cough or cold or even lifestyle problems such as diabetes and heart disease are not worrying us, but surprisingly, it’s skin-related ailments which are causing concern.

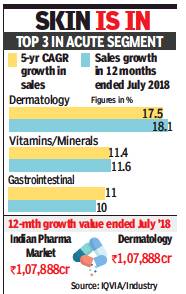

Dermatology is showing the fastest sales growth of 17.5% with a CAGR (compounded annual growth rate) of five years in the domestic pharma retail market. Interestingly, this is even higher than the sales growth witnessed in anti-diabetes (16.8%), or heartdisease pills (10.7%), over a CAGR of five years.

Increasing incidence of fungal infections, greater awareness of skin-related issues and skin care and a growing desire to look presentable are factors driving the growth, say experts.

Overall, the Indian pharmaceutical market (IPM) has witnessed a CAGR growth of 11.2% in last five years.

In the 12 months ended July 2018, IPM growth was 11.6% while its market is valued around Rs 1,07,888 crore. Dermatology, on the other hand, has witnessed CAGR growth of 18.1% in 12 months ended July 2018. The value of dermatology market is Rs 8636.3 crore.

Earlier, people just lived with a mole, white patches and pigmentation issues, or hair loss. Patients are more conscious of their appearance today and seek medical help for aesthetic problems, dermatologists told TOI. Nearly half of their practice now comprises of such cases, as against two to three patients earlier.

Sales within the derma category also mirror the trend, with skin-related medication driving the high growth. Overall, the largest category is anti-fungal topicals (43.8%) — medication applied on skin, followed by anti-fungal oral drugs (35.3%), data culled from healthcare service provider IQVIA said.

Sujesh Vasudevan, president India and MEA business of Glenmark Pharmaceuticals, said: “Prescription dermatology segment has witnessed strong growth in the antifungal space driven by general awareness among the population, and also due to pollution. Thus, most of the growth in the dermatology segment has been volume led. We continue to believe that that the dermatology segment will consistently grow at a rapid pace. This has also resulted in intense competition and new players constantly entering this segment”.

Industry experts point out that the huge growth in derma includes only those medication prescribed by doctors and not the exorbitant botox treatment done for cosmetic purposes to reduce facial wrinkles or fine lines.

For another industry player, GlaxoSmithKline Pharma, the topical antibiotic portfolio (used to cure infections caused by bacteria in wounds) is important. Managing director of GSK Pharma A Vaidheesh said, “Dermatology is one of the important focus segments for GSK India where we have a strong heritage and ambitious plans for patient access. We are focusing our efforts on key brands to drive growth in identified therapy areas where there is significant unmet patient need.”

However, indiscriminate use of harmful steroid-containing creams which are a combination of anti-fungal, anti-bacterial and anti-allergic, is a huge issue. “Use of unethical and unscientific combination creams (containing steroids) has risen substantially. They are increasingly prescribed by doctors (other than dermatologists), while a large percentage are bought over the counter, even though these should not be sold without a proper prescription,” said dermatologist Belinda Vaz.

Experts stated that over the last few years, sales of medicines for chronic ailments, like diabetes and hypertension, have seen strong growth in the Indian market while those in the acute segment have been stagnating.

2020-21

Rupali Mukherjee, May 11, 2021: The Times of India

Call it the Covid effect. Anti-viral drug Favipiravir, used for Covid-19 treatment, has rocketed to the rank of the largest-selling pharma brand in April for the first time ever in the domestic retail market, reports Rupali Mukherjee.

The drug, marketed by Mumbai-based Glenmark as Fabiflu, posted sales of Rs 352 crore in April alone, overtaking sales of drugs for lifestyle ailments such as diabetes, which have long dominated the market.

In April, Fabiflu overtook sales of other top-selling drugs being used in Covid-19 therapy, including health supplement Zincovit and pain-killer Dolo.

Early 2021

Fabiflu mops up ₹762cr sales in last 12 months

During the pandemic, the top pecking order witnessed a change with Zincovit becoming the largestselling pharma brand in October last year, while others like Monocef, Dolo and Betadine grew at a strong clip this year.

For the 12-month period ended April, Fabiflu mopped up Rs 762 crore sales, higher than anti-diabetic drug, Glycomet-GP’s Rs 564 crore, with around half coming in April alone, according to data culled from pharma research firm, AIOCD-Awacs.

In September, Glenmark touched its highest monthly sales of around Rs 60 crore, and thereafter tapered off, in line with the decrease in Covid-19 caseload. Sales witnessed an upswing post mid-March as cases started rising, while in February, there were insignificant sales.

“Our every effort from the beginning has been to provide doctors a safe and effective treatment option in an out-patient setting and reduce the burden on the country’s hospitals and healthcare system'’, Glenn Saldanha, chairman and MD Glenmark Pharmaceuticals told TOI.

Favipiravir is an early-use antiviral which showed promising results in certain countries including Japan, but it’s efficacy has been under a cloud in India. Irrespective, the drug is being prescribed and used widely in Covid-19 therapy across the country, with its sales seeing a massive surge during the second wave.

The antiviral drug was approved in June by India’s drug regulator under `restricted emergency authorisation’ under the accelerated approval process, for mild-tomoderate cases.

Over 30 companies are now producing Favipiravir, including Sun Pharma, Cipla, Abbott, Alkem, Dr Reddy’s, Hetero, Brinton, Jenburkt, Lasa Supergenerics, Delcure and Strides Pharma. Glenmark has also tweaked the strength of Fabiflu to reduce the pill burden, and is now offered in 400 and 800 mg options.

Online sales

2018: Banned by Delhi HC, for entire country

Abhinav Garg, HC bans online med sales across country, December 13, 2018: The Times of India

The Delhi high court ordered a ban on sale of online medicines by e-pharmacists across the country and directed the Centre and the AAP government to immediately implement the order.

A bench of Chief Justice Rajendra Menon and Justice V K Rao passed the order while acting on a PIL filed by Delhi-based dermatologist Zaheer Ahmed who complained that lakhs of medicines were being sold on the internet every day without much regulation, posing a huge risk to patients and doctors alike.

In the plea filed through advocate Nakul Mohta, Ahmed pointed out that online sale of medicines is not permitted under the Drugs and Cosmetics Act, 1940 and Pharmacy Act, 1948.

The petitioner highlighted that even though the Drug Controller General of India in 2015 clearly directed all state drug controllers to protect the interest of public health by restraining such sale online, lakhs of medicines continue to be sold online, often even without prescription.

Online sale of drugs can lead to misuse: PIL

Unable to supervise, the government has failed in its responsibility to protect public health which is its constitution obligation under Article 21, the PIL says.

“Unlike common items, drugs are highly potent and its misuse or abuse can have serious consequences on human health, not just for the person consuming it but for humanity at large as some drugs can be addictive, habit forming and harmful to the body. A large number of children/minor or people from uneducated rural background use internet and can be victims of wrong medication while ordering medicines online,” the PIL argues, seeking the court’s intervention.

Blaming the government for not doing enough, the plea says online pharmacies are operating without a drug licence and warns that “unregulated sale of medicines online will increase the risk of spurious, misbranded and substandard drugs being sold” adding that “Some drugs have psychotropic substances and can be easily ordered on internet and misused for criminal activities or drug abuse.”

The PIL states that Centre is well aware of the risks involved in sale of medicines on internet since a panel setup by it for this purpose cautioned as late as September this year about risks involved in the online sale of medicines, particularly, prescription, habit-forming and addictive medicines.

In September the Union health ministry had come out with draft rules on sale of drugs by e-pharmacies with an aim to regulate online sale of medicines across India and provide patients accessibility to genuine drugs from authentic online portals. The draft rules on “sale of drugs by e-pharmacy” state that no person will distribute or sell, stock, exhibit or offer for sale of drugs through e-pharmacy portal unless registered.

The plea said unregulated sale of medicines by online pharmacies would increase the risk of spurious, misbranded and substandard drugs being sold

Opioids

2025/ Govt. bans manufacture, export of 2 drugs ‘fuelling’ W Africa opioid crisis

Naomi Canton & Eshan Kalyanikar, TNN, February 24, 2025: The Times of India

From: Naomi Canton & Eshan Kalyanikar, TNN, February 24, 2025: The Times of India

London/Mumbai: A media exposé on a Maharashtra-based pharma company accused of illegally manufacturing unlicensed, addictive opioids and exporting them to West Africa led to a joint raid by state and central drug inspectors over the weekend and the announcement of curbs on the manufacturing and export of such products.

The raid on Aveo Pharmaceuticals Pvt Ltd’s facility and warehouse in Boisar under Palghar district followed a BBC World Service documentary titled ‘India’s Opioid Kings’. It examined the public health crisis caused by pills made of a deadly cocktail of tapentadol (a powerful opioid) and carisoprodol (an addictive muscle relaxant), packaged as legitimate licensed medicines, in countries such as Nigeria and Ghana.

This drug combination is not licensed for use anywhere in the world. “They are coming in from India and that has become a big menace in Nigeria,” a member of Nigeria’s drug enforcement agency told BBC.

Maharashtra FDA officials said the entire stock was seized, and further production was immediately halted. The company was also slapped with a showcause.

On Friday, the Centre issued directives to all states to revoke the no-objection certificate (NOC) for export and the manufacturing licences for tapentadol, carisoprodol, and other similar products.

Speaking to TOI, an FDA official said, “Aveo has been on our radar for the past few months. We served them notice in October for nonmatching of their manufacturing and distribution records. Central Drugs Standard Control Organization (CDSCO) is responsible for testing the exports as per their protocols, and the state does not play a role. Both the medicines have their use separately, but their combination is harmful, and it is already banned in India.” Monish Bhalla, former senior officer of India’s Nar- cotics Control Bureau, said, “The checks and balances on imports in India are far more stringent than for exports.”

Aveo is breaking Indian law because it is not meeting import requirements in Ghana, but “the Indian authorities pay little attention to pharma drugs not sold in India,” the documentary states.

An undercover BBC reporter went to Aveo Pharmaceuticals’ factory posing as a businessman looking to supply opioids to Nigeria and met the managing director Vinod Kumar Sharma. Whilst being plied with snacks and Bisleri, Sharma showed him the pills boxed under different brand names such as Taamdol 225mg and Taramaking 250, all made from the same dangerous cocktail.

Sharma told the reporter, “This is very harmful for their health, but the customer cannot understand that. He wants to relax. Any medicine can be misused. This is a very harmful product in their hands, but nowadays this is business. I can clear from our customs, means India. You can clear from your side.”

He told the reporter that he can ship them to Ghana and they can enter Nigeria from there. The drugs he shows are the same ones that have been seized by the police in West African nations because they are illegal. Sharma also boasted that his factory is “WHO certified”.

The documentary also focuses on a drug rehabilitation centre in Nigeria where patients addicted to these opioids live in appalling conditions with their legs chained together, sleeping on the floor with no running water. In Tamale, Ghana, local city chief Alhassan Maham has created a citizens’ task force of 100 volunteers whose mission is to raid and arrest the drug dealers and take these illegal opioids off the streets. But the problem is: India is manufacturing them faster than they can do that.

CDSCO told the BBC it has taken the matter up with countries in West Africa and will take immediate action against any pharmaceutical firm involved in malpractice.

While Sharma did not respond to TOI requests, the company in a statement said that the allegations against it were baseless and without merit. The company added that it adhered to the rules and regulations set by various regulatory authorities to manufacture and export its products.

Pharma GCCs

As of 2025

Swati Bharadwaj & Rupali Mukherjee, TNN, Sep 19, 2025: The Times of India

India is already called the ‘pharmacy of the world’ for manufacturing quality and affordable medicines. To be counted as a drugs powerhouse, it has to now find a way to move up the value chain. Whatever the approach, if pharma GCCs, or global capability centres, located in the country appear vital to the journey, it’s because they’ve come a long way themselves.

Over 55 healthcare & lifesciences (H&LS) GCCs are now present in India, operating over 95 centres spread across mainly Bengaluru, Hyderabad and Mumbai. Together, they represent millions of dollars in investment and lakhs of roles, including ones increasingly in research and drug development. Among those who’ve trooped in are as many as 23 of the world’s top 50 life sciences companies. While about half of these made their entry only over the last five years (according to a recent EY India report), it’s a story that begins almost a quarter century back.

Growth Momentum

2001. Just after the turn of the millennium, when India was basking in the success of its Y2K moment that heralded its arrival on the global IT stage, pharma giant Novartis planted the seed of what would become the next big offshoring story for India. The Swiss company put together a modest 20-member team in Mumbai to test the waters for building capabilities in data management, statistics and IT.

Cut to 2025, and Novartis Corporate Centre (NCC) India is the largest pharma GCC in the country. In between came a move to Hyderabad in 2007-08 and investments of more than $400 million. NCC India now houses over 8,500 employees, including around 2,800 people in development across Hyderabad and Mumbai. Ganpat Anchaliya, head of NCC India, says “foresight and conviction” led them to act “well ahead of peers”. But it didn’t take very long for others to follow.

As EY points out, what started as a trickle in the 2000s with pharma giants Novartis, Johnson & Johnson, and Novo Nordisk gathered pace in the mid-2010s as Eli Lilly, Merck KGaA and Bayer headed to Indian shores. Post Covid-19, this momentum has only accelerated, with pharma MNCs gearing up for a coming decade of uncertainty, high competition and increasing regulatory scrutiny.

Why India?